0 ratings0% found this document useful (0 votes)

232 viewsSlip

Slip

Uploaded by

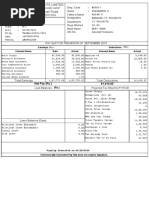

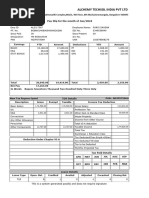

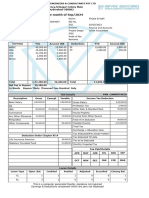

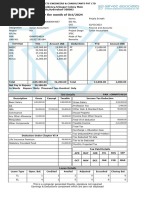

PratikDuttaThis pay slip summarizes Anshuman Sahoo's earnings and deductions for August 2019. He works as a Customer Services Representative and earns a basic salary of Rs. 11,247 with additional earnings of Rs. 10,512 for house rent, Rs. 734 in bonuses, and Rs. 1,950 for car allowance, totaling Rs. 24,443 in gross pay. Provident fund contributions of Rs. 1,393 were deducted, leaving a net pay of Rs. 23,776. An income tax worksheet provides details of earnings, exemptions, deductions, and tax calculations for the period of April 2019 to March 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Slip

Slip

Uploaded by

PratikDutta0 ratings0% found this document useful (0 votes)

232 views1 pageThis pay slip summarizes Anshuman Sahoo's earnings and deductions for August 2019. He works as a Customer Services Representative and earns a basic salary of Rs. 11,247 with additional earnings of Rs. 10,512 for house rent, Rs. 734 in bonuses, and Rs. 1,950 for car allowance, totaling Rs. 24,443 in gross pay. Provident fund contributions of Rs. 1,393 were deducted, leaving a net pay of Rs. 23,776. An income tax worksheet provides details of earnings, exemptions, deductions, and tax calculations for the period of April 2019 to March 2020.

Original Description:

Salary Slip of March

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This pay slip summarizes Anshuman Sahoo's earnings and deductions for August 2019. He works as a Customer Services Representative and earns a basic salary of Rs. 11,247 with additional earnings of Rs. 10,512 for house rent, Rs. 734 in bonuses, and Rs. 1,950 for car allowance, totaling Rs. 24,443 in gross pay. Provident fund contributions of Rs. 1,393 were deducted, leaving a net pay of Rs. 23,776. An income tax worksheet provides details of earnings, exemptions, deductions, and tax calculations for the period of April 2019 to March 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

232 views1 pageSlip

Slip

Uploaded by

PratikDuttaThis pay slip summarizes Anshuman Sahoo's earnings and deductions for August 2019. He works as a Customer Services Representative and earns a basic salary of Rs. 11,247 with additional earnings of Rs. 10,512 for house rent, Rs. 734 in bonuses, and Rs. 1,950 for car allowance, totaling Rs. 24,443 in gross pay. Provident fund contributions of Rs. 1,393 were deducted, leaving a net pay of Rs. 23,776. An income tax worksheet provides details of earnings, exemptions, deductions, and tax calculations for the period of April 2019 to March 2020.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

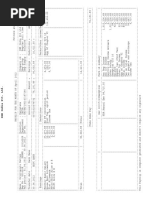

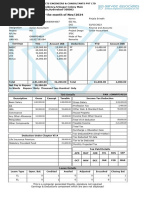

ISON BPO INDIA PRIVATE LIMITED.

A 14-15 SEC-16 NOIDA-201301

Pay Slip for the month of August 2019

Name ANSHUMAN SAHOO Emp. Code ISNG00146

Designation CUSTOMER SERVICES REPRESENTIVE Date of Joining 13/07/2017

Department OPERATIONS :Payment Mode HDFC BANK

Payable Days : 31.00

Gender Male Bank A/c No. 50100294632841

Location NOIDA UAN No: 101148877755 PF No. GNGGN00333140000031814

Process GOIBIBO ESI No : 6716779391 PAN FFLPS8591R

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic Salary 11,247 11,247.00 363.00 11,610.00 Provident Fund 1,393

House Rent 10,512 10,512.00 339.00 10,851.00

Bonus_Allo 734.00 24.00 758.00

ERN_CARALL 1,950.00 1,950.00

GROSS PAY 24,443.00 726.00 25,169.00 GROSS DEDUCTION 1,393

NET PAY : 23,776.00

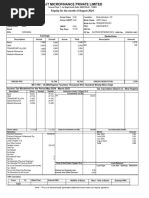

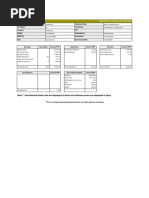

Income Tax Worksheet for the Period April 2019 - March 2020

Description Gross Exempt Taxable Deduction Under Chapter VI-A HRA Calculation

Basic Salary 135,327 135,327 Investments u/s 80C Rent Paid (For Non-Metro )

HRA 128,685 128,685 PF+VPF 16,544 From

PRJ_CARALL 3,975 3,975 To

Other Earnings 3,300 3,300 1. Actual HRA 128,685

BONUS_ALLO 6,630 6,630 2. 40% or 50% of Basic

3. Rent > 10% Basic

Least of above is exempt

Taxable HRA 128,685

Gross Salary 277,917 277,917 Total of Investment u/s 80C 16,544

Standard Deduction 50,000.00 DEDU 80CCD Tax Deducted Till Date

Professional Tax Month Amount

Any Other Income April 2019 0

Under Chapter VI-A 16,544 May 2019 0

Taxable Income 211,370 June 2019 0

Total Tax July 2019 0

Tax Rebate 0.00 Total 0

Balance Tax 0.00

Surcharge

Educational Cess 0

Net Tax

Tax Deducted (Previous Employer)

Tax Deducted Till Date

Tax to be Deducted

Additional Tax Total of Ded Under Chapter VI-A

Average Tax / Month

Tax Deduction for this month

General Note :This is computer generated pay slip no need for signature.

You might also like

- IBM Payslip April 2012 PDFDocument1 pageIBM Payslip April 2012 PDFtaraivanNo ratings yet

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (2)

- This Study Resource Was: de La Salle UniversityDocument7 pagesThis Study Resource Was: de La Salle UniversityMuhammad Imran Bhatti100% (1)

- Razorpay Software P.L: Pay Slip For The Month of April 2021Document1 pageRazorpay Software P.L: Pay Slip For The Month of April 2021ARSHU . SNo ratings yet

- Salary Slip AprilDocument1 pageSalary Slip AprilDaya Shankar100% (3)

- SalaryDocument1 pageSalarypankajNo ratings yet

- Sap RmcaDocument4 pagesSap RmcanonameeegmailNo ratings yet

- Case Study PDFDocument3 pagesCase Study PDFLinh Bảo Bảo100% (1)

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- March PDFDocument1 pageMarch PDFRNo ratings yet

- Dimension Data India PVT LTD: Pay Slip For The Month of August 2019Document1 pageDimension Data India PVT LTD: Pay Slip For The Month of August 2019Ashok ChauhanNo ratings yet

- PavanDocument1 pagePavanPavan KumarNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- Pay Slip For The Month of February 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of February 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Aug PDFDocument1 pageAug PDFRNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- HTMLReports (7)Document1 pageHTMLReports (7)Jyoti SharmaNo ratings yet

- HTMLReports (2)Document1 pageHTMLReports (2)Jyoti SharmaNo ratings yet

- April'24 Salary SilpDocument1 pageApril'24 Salary Silpayanbhargav3100% (1)

- Gebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Document1 pageGebr. Pfeiffer (India) Pvt. LTD.: Pay Slip For The Month of February 2018Abhijeet SahuNo ratings yet

- SlipDocument1 pageSlipak986984No ratings yet

- HTMLReportsDocument1 pageHTMLReportssaurabhupadhyay215No ratings yet

- PDFDocument2 pagesPDFkumar Ranjan 22No ratings yet

- Payslip For The Month of May 2020: Earnings DeductionsDocument1 pagePayslip For The Month of May 2020: Earnings DeductionsRNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Aapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022Document1 pageAapt Outsourcing Solutions Pvt. LTD.: Payslip For The Month of April 2022ayush bhatnagarNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- PayslipDocument1 pagePayslipLmj Copy HubNo ratings yet

- FIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Document1 pageFIS Global Solutions Philippines Payslip For: 01 Apr 2019 To 15 Apr 2019Zyrha ZelrineNo ratings yet

- Dec Payslip - Rekrut IndiaDocument1 pageDec Payslip - Rekrut IndiafkadirNo ratings yet

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Document1 pageEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerNo ratings yet

- decemberDocument1 pagedecember20IF012 Shruti Dhote IFNo ratings yet

- CTC Breakup 12 2023Document2 pagesCTC Breakup 12 2023n17mahey09No ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument1 pagePayslip: Employee Details Payment & Leave DetailsKushal MalhotraNo ratings yet

- NOV PAYSLIPDocument1 pageNOV PAYSLIPlilekag335No ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 91,610.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 91,610.00Prashanth IyerNo ratings yet

- April Payment SleepDocument1 pageApril Payment Sleepizajahamed1No ratings yet

- June PayslipDocument1 pageJune PayslipPurvi SaxenaNo ratings yet

- Dec'18_PaySlip_OxigenDocument1 pageDec'18_PaySlip_Oxigenparik.p88No ratings yet

- SEP PAYSLIPDocument1 pageSEP PAYSLIPlilekag335No ratings yet

- Tata Business Support Services LTD: 00150785 Amir KhanDocument2 pagesTata Business Support Services LTD: 00150785 Amir KhanAamir KhanNo ratings yet

- Payslip Tax 7 2024Document2 pagesPayslip Tax 7 2024kannojuupendharNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Apr 2023Document1 pageApr 2023gaurav sharmaNo ratings yet

- STEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Document1 pageSTEAG Energy Services (India) Pvt. LTD: Provisional Pay Slip For The Month of March 2019Amaresh NayakNo ratings yet

- HTMLReportsDocument1 pageHTMLReportskhambhatijagrutiNo ratings yet

- HTMLReportsDocument3 pagesHTMLReportspriyangamarimuthu15No ratings yet

- 1519732537814Document1 page1519732537814vinod kumarNo ratings yet

- Atul Pandey (EEA1546)Document1 pageAtul Pandey (EEA1546)atulpandey15marchNo ratings yet

- OCT PAYSLIPDocument1 pageOCT PAYSLIPlilekag335No ratings yet

- Salary SlipsDocument2 pagesSalary SlipsshailNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Payslip July 2019 CP Payslip 024612 PDFDocument2 pagesPayslip July 2019 CP Payslip 024612 PDFhari bcaNo ratings yet

- Earnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedDocument1 pageEarnings Deductions MTH - Rate Arrears Total Earned Arrears Total DedShubham GargNo ratings yet

- 4.April_2022Document1 page4.April_2022Bhargava UpadrastaNo ratings yet

- Payslip - Manoj(October'2024)Document1 pagePayslip - Manoj(October'2024)djn8w8qwxdNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- 1001template Unit2 - 1213813822Document13 pages1001template Unit2 - 1213813822Abdu KarimovNo ratings yet

- Apml Bosmp222315505Document2 pagesApml Bosmp222315505Ridha GuptaNo ratings yet

- BUDGET CIRCULAR 2025-26_1Document4 pagesBUDGET CIRCULAR 2025-26_1iassunnysharmaNo ratings yet

- Schedule of Charges Branchless Banking Apr To Jun 2019 EnglishDocument2 pagesSchedule of Charges Branchless Banking Apr To Jun 2019 EnglishJahangirNo ratings yet

- Fact-Sheet SyngeneDocument4 pagesFact-Sheet SyngeneRahul SharmaNo ratings yet

- Lembar Kerja Jurnal Ud Moro SenengDocument11 pagesLembar Kerja Jurnal Ud Moro SenengIbnuHamid100% (1)

- TOPIC Practice Questions: Question: MayDocument13 pagesTOPIC Practice Questions: Question: MayPines MacapagalNo ratings yet

- Economics: PAPER 1 Multiple ChoiceDocument12 pagesEconomics: PAPER 1 Multiple ChoiceigcsepapersNo ratings yet

- Jayati Agarwal.Document1 pageJayati Agarwal.Appu NairNo ratings yet

- Gamechanger AgendaDocument5 pagesGamechanger AgendaaxfNo ratings yet

- Georgia Fruit and Vegetable Survey Analysis - Preliminary Report - 10-6-2011Document6 pagesGeorgia Fruit and Vegetable Survey Analysis - Preliminary Report - 10-6-2011Rebecca BeitschNo ratings yet

- Shivansh: Terms and ConditionsDocument2 pagesShivansh: Terms and ConditionsShivansh HR ServicesNo ratings yet

- Zerodha Streak Algo Trading PDF PDFDocument13 pagesZerodha Streak Algo Trading PDF PDFsaubhik chattopadhyayNo ratings yet

- Mathematical Literacy-FINANCE (1) - Removed - RemovedDocument53 pagesMathematical Literacy-FINANCE (1) - Removed - RemovedshahirashuhadaNo ratings yet

- Lesson 21 Global CitiesDocument4 pagesLesson 21 Global CitiesSUASE GEMMALYNNo ratings yet

- SHRM Employee Benefits Survey - Executive Summary - FINALDocument9 pagesSHRM Employee Benefits Survey - Executive Summary - FINALAriella HotasiNo ratings yet

- SMMT - LT 2020Document236 pagesSMMT - LT 2020Zaidan FaridNo ratings yet

- Project Employee EngagementDocument34 pagesProject Employee EngagementSuruchi Goyal86% (7)

- IENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate IsDocument1 pageIENG 577 Homework 3: and Payables To Be 10% of The Cost of Goods Sold. Billingham's Marginal Corporate Tax Rate IsAbdu AbdoulayeNo ratings yet

- 21 AravenaDocument3 pages21 AravenaanneguineyNo ratings yet

- Marc - Environment Scanning & Opportunity IdentificationDocument24 pagesMarc - Environment Scanning & Opportunity Identificationmkharish24No ratings yet

- Lending ProcessDocument13 pagesLending Processsagar kaleNo ratings yet

- Annual Report 2016 - PT Inti Agri (TTD) - CPDocument115 pagesAnnual Report 2016 - PT Inti Agri (TTD) - CPSri Zahara Dewi SNo ratings yet

- Ge S Two E28093 Decade TransformationDocument24 pagesGe S Two E28093 Decade TransformationSouvik DeyNo ratings yet

- Akpi Ratio PDFDocument3 pagesAkpi Ratio PDFFaznikNo ratings yet

- Summer by Gagan - 2Document63 pagesSummer by Gagan - 2gaganNo ratings yet