Insurance

Insurance

Uploaded by

Mohammed Abdul Mutalib QureshiCopyright:

Available Formats

Insurance

Insurance

Uploaded by

Mohammed Abdul Mutalib QureshiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Insurance

Insurance

Uploaded by

Mohammed Abdul Mutalib QureshiCopyright:

Available Formats

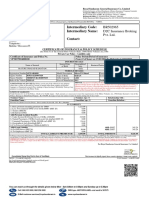

TWO WHEELER VEHICLE PACKAGE POLICY

Certificate Cum Policy Schedule

Certificate cum Policy No :3005/W-1673304/00/000

For CLAIMS : Call 1800-209-8888 (Toll free from all phones)

For RENEWALS : Visit www.icicilombard.com or call 1800-209-8888

DETAILS OF THE POLICY HOLDER POLICY DETAILS

Insured Name BALASUBRAMANYAM PINGALI Policy Issuing Office Zenith House, Keshav Rao Khadye Marg, Mahalaxmi,

Mumbai - 400034

Insured Address 501, A2 BLOCK, ALAKNANDA CHS, SECTOR

19A NERUL,NAVI MUMBAI-400706

Period of Insurance From 00:00 hrs 23-Apr-2010 to 22-Apr-2011 midnight

Contact No (s) 9619608758(Mobile No.) 91(Telephone No.)

Email Address bpingali@gmail.com Policy Issued On 23-Apr-2010 12:00:00

Cover Note No W-1673304

RTO Location MAHARASHTRA-MUMBAI

Hypothecated to

Category 0

VEHICLE DETAILS

Registration Number Make Model Type of body CC Mfg. Year Seating capacity

MH03AP7774 HONDA MOTORCYCLE UNICORN Saloon 150 2008 2

Chassis Number Engine Vehicle IDV Side Car Additional Acc Non-Electrical Elec/ Electronic CNG / LPG Total Value

Number (in Rs.) (in Rs.) (in Rs.) Acc.(in Rs.) Acc.(in Rs.) Unit (in Rs.) (in Rs.)

ME4KC098B88074080 KC09E4076546 46351 0 0 0 0 0 46351

SCHEDULE OF PREMIUM (IN RS.)

Own Damage(A) Liability (B)

Basic Own Damage 633.00 Basic Third Party Liability 300.00

Total 633.00 PA Cover for Owner-Driver of Rs. 1,00,000 50.00

Sub Total (Additions): 0.00 Total 350.00

Less Add

Sub Total (Deductions) 0.00 Sub Total (Additions) 0.00

Bonus Percent 20 % 127.00

Total - 127.00

Total Own Damage Premium 506.00 Total Liability Premium 350.00

Total package Premium(A+B) 856.00

Service Tax(Incl Edu.Cess And Higher Edu.Cess) 88.00

Total Premium Payable (in Rs.) 944.00

Geographical Area : India Compulsory deductibles : Rs. 50

LIMITS OF LIABILITY: (a) Under Section II - 1 (i) of the policy -> Death of or bodily injury : Such amount as is necessary to meet there requirements of the

motor vehicles Act.1988.

(b) Under Section II - 1 (i) of the policy -> Damage to Third Party Property Rs 100,000; PA Cover for Owner-Driver under section III-CSI Rs 100,000 ;Voluntary

Deductible Rs.0

LIMITATIONS AS TO USE: The policy covers use of the vehicle for any purpose other than : Hire or reward,Carriage of goods(other than samples or personal

luggage), Organized racing, Pace making, Speed testing,Reliability trials,Any purpose in connection with Motor Trade.

DRIVER'S CLAUSES : Any person including the insured : Provided that a person driving holds an effective Driving License at the time of the accident and is not

disqualified from holding or obtaining such a license. Provided also that the person holding an effective Learner's License may also drive the vehicle and that

such a person satisfies the requirements of Rule 3 of the Central Motor Vehicles Rules, 1989.

IMPORTANT NOTICE : The Insured is not indemnified if the vehicle is used or driven otherwise than in accordance with this schedule. Any payment made by

the company by reason of wider terms appearing in the certificate in order to comply with the Motor Vehicle Act,1988 is recoverable from the insured. See the

clause headed 'AVOIDANCE OF CERTAIN TERMS AND RIGHT OF RECOVERY'.For legal interpretation, English version will hold good.

Subject to IMT Endorsement Nos. & Memorandum printed herein / attached hereto :22,28

Premium Collection Details :-[Collection No/Amount/ReceiptDate] 422101717/Rs.944 / 22/04/2010

DISCLAIMER: Please visit www.icicilombard.com for the policy wordings for complete details on terms and conditions governing the coverage and NCB. This

document is to be read with the policy wordings.

Policy is valid subject to realization of cheque. We accept premium only via legally recognized modes except for cash. If our representative

request you to pay in cash, kindly report it to us.

For information on ombudsman you may visit our website www.icicilombard.com

I/We here by certify that the policy to which the certificate relates as well as the certificate of insurance are issued in For ICICI Lombard

accordance with the provision of chapter X,XI of M.V Act 1988 General Insurance Company

Service Tax Registration No. :GIS/ MUMBAI-I /1528 /2001, Service Tax Code Number.:AAACI7904GST001 Ltd

Category: - General Insurance Business Services 00440005

In Witness whereof this policy has been signed at Mumbai this 23 day of April of 2010 in lieu of covernote No W-1673304

The stamp duty of Rs. 0.5 paid in cash or by demand draft or by pay order,vide Receipt/Challan no. 30155 dated 14/12/2009

Duly Constituted Attorney(s)

Copy of policy

ICICI Lombard General Insurance Company Ltd.

Mailing Add. Office: ICICI Lombard General Insurance Company Ltd.Zenith House, Keshavrao Khadye Marg, 2nd

Floor, Mahalaxmi, Mumbai - 400 034

Corporate Office: ICICI Lombard General Insurance Company Ltd.Zenith House, Keshavrao Khadye Marg, 2nd

Floor, Mahalaxmi, Mumbai - 400 034

ICICI Lombard

Two Wheeler PA Proposal Form

Vehicle details

Registration location :

MUMBAI Registration number : MH03AP7774

(RTO)

: HONDA

Manufacturer Engine number : KC09E4076546

MOTORCYCLE

Model : UNICORN Chassis number : ME4KC098B88074080

: Purchase / Registration

Manufacturing year 2008 : 20/3/2008

date

Color : Registration type : Individual

Current showroom price :

66216

(Rs.)

Details of discounts & additional covers

Electrical accessories (Rs.) :0 Voluntary deductible (Rs.) :0

Non-electrical accessories : ARAI approved anti-theft

0 : No

(Rs.) device

Automobile association

:

membership

Value of LPG / CNG kit if

:0

any (Rs.)

Insured details

Name of the Insured : BALASUBRAMANYAM PINGALI Relationship : SELF

Address of Two Wheeler : 501, A2 Block, Alaknanda Chs,

Owner Sector 19a nerul City : NAVI MUMBAI

(Policy will be sent here)

Pincode : 400706

New policy details

Insurance value (IDV) (Rs.) : 46351 No Claim Bonus (%) : 20

Policy start date : 23-Apr-2010 Policy end date : 22-Apr-2011

Total Premium Amount : 944

ICICI Lombard

I. Own Damage

This product protects you against loss or damage to your motor vehicle and/or accessories due to *Fire *Self

Ignition *Explosion *Lightning *Theft * Burglary *Housebreaking *Riot *Strike *Earthquake *Flood and allied perils

*Accidental external means *Malicious acts *Terrorist activity *Transit *Landslide / rockslide

II. Third Party Liability

In addition to the coverage noted above, this product covers you against legal liability towards third party, in

respect of the following: *Death of or bodily injury to any person *damage to property as per the provisions of

Motor Vehicle Act. We are pleased to inform you that in addition, the product also includes the following:

l Personal accident benefits for owner driver upto a value of Rs.200,000.

l Legal liability towards the paid driver.

l Cover for Rs. 7.5 Lacs third party property damage.

l PA cover for Un-named passengers.

Significant Exclusions:

We would like you to know that the policy does not cover consequential loss, depreciation, normal wear and tear,

mechanical or electrical breakdown failures or breakages. The vehicle is not held covered if used for commercial

purposes or if driven by an unauthorized driver. Note: The foregoing is only an indication of the cover offered. For

details please refer to the policy. It is our endeavor to provide consistent quality service to all our customers. We

would like to let you know that insurance is a contract of Utmost Good Faith requiring the customer to disclose all

material facts. If in your opinion any fact is material and is not covered by the information sought in the application

form, we request you to disclose it.

It is important to note that our liability will commence only after we have accepted your proposal and the premium

has been received in full.

Declaration:

I/We hereby declare that the statements made by me/us in this Proposal Form are true to the best of my/our

knowledge and belief and no material information, which may be relevant, has been withheld or not disclosed I/We

hereby agree that this declaration shall form the basis of the contract between me/us and the "ICICI Lombard

General Insurance Co. Ltd."

I/We also declare that any additions or alterations are carried out after the submission of this proposal form then

the same would be conveyed to the insurers immediately.

I/We agree that the Policy shall become void able at the option of the Insurer, in the event of any untrue or

incorrect statement, misrepresentation, non-description or non-disclosure in any material particular in the proposal

form / personal statement, declaration and connected documents, or any material information has been withheld

by me or anyone acting on my behalf to obtain any benefit under this policy.

I/We hereby declare and warrant that the above statements are true, accurate and complete. I/We desire to effect

an insurance as described herein with the Company and I/We agree that this proposal and declarations shall be the

basis of contract between me/us and the Company and I/We agree to accept a policy subject to the conditions

prescribed by the Company.

INSURANCE ACT 1938, SECTION 41 - PROHIBITION OF REBATES

1. No person shall allow or offer to allow, either directly or indirectly as an inducement to any person to take out or

renew or continue an insurance in respect of any kind or risk relating to lives or property in India, any rebate of the

whole or part of the commission payable or any rebate of the premium shown on the policy, nor shall any person

taking out or renewing or continuing a policy accept any rebate except such rebate as may be allowed in

accordance with the prospectus or tables of the Insurer.

2. Any person making default in complying with the provisions of this section shall be punishable with fine, which

may extend to five hundred rupees.

SCHEDULE OF DEPRECIATION FOR ARRIVING AT IDV

AGE OF THE VEHICLE % OF DEPRECIATION FOR FIXING IDV

Not exceeding 6 months 5%

Exceeding 6 months but not exceeding 1 year 15%

Exceeding 1 year but not exceeding 2 years 20%

Exceeding 2 years but not exceeding 3 years 30%

Exceeding 3 years but not exceeding 4 years 40%

Exceeding 4 years but not exceeding 5 years 50%

Note. IDV of obsolete models of vehicles (ie. Models which the manufacturers have discontinued to manufacture)

and vehicles beyond 5 years of age will be determined on the basis of and understanding understanding between

the insurer and the insured.

You might also like

- PolicyDocument 702487456Document9 pagesPolicyDocument 702487456vipen5285No ratings yet

- Deployment Letter - SampleDocument1 pageDeployment Letter - SampleChino Cabrera33% (3)

- Bike Insurance Papers PDFDocument1 pageBike Insurance Papers PDFRajesh chowdaryNo ratings yet

- AckoPolicy-DBCR00117227928 00Document1 pageAckoPolicy-DBCR00117227928 00Rahul SrivastavaNo ratings yet

- Speed and VelocityDocument3 pagesSpeed and Velocityteja eashanNo ratings yet

- Regents Homeostasis and EnzymesDocument5 pagesRegents Homeostasis and Enzymesapi-3031203990% (1)

- Smith Adam Edi Ielts Writing Task 2Document130 pagesSmith Adam Edi Ielts Writing Task 2Nhung Le85% (34)

- Suzuki Access InsuranceDocument2 pagesSuzuki Access InsuranceRaki GowdaNo ratings yet

- Policy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerDocument2 pagesPolicy No 26020531196210020451 Proposal No. & Date Policy Issued On Period of Insurance Insured Name Previous Policy No. Insured Add Previous InsurerSanjay SharmaNo ratings yet

- Motor Insurance - Two Wheeler Comprehensi PDFDocument2 pagesMotor Insurance - Two Wheeler Comprehensi PDFVijay MaskarNo ratings yet

- Two Wheeler Insurance Certificate 2020-2021Document2 pagesTwo Wheeler Insurance Certificate 2020-2021vipin jainNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsMUSHAM217No ratings yet

- 0951809Document2 pages0951809vaughnNo ratings yet

- Riyaz Raja Hussain PDFDocument5 pagesRiyaz Raja Hussain PDFShaikh sanaNo ratings yet

- Bike Insurance 06 July '11 To '12Document1 pageBike Insurance 06 July '11 To '12Ankit Bansal0% (2)

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-BundledDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy-Bundledu want some then come and get someNo ratings yet

- Two Wheeler Insurance Package Policy (1) - Insurance - ChequeDocument5 pagesTwo Wheeler Insurance Package Policy (1) - Insurance - ChequepriyanshNo ratings yet

- W Hero Scooty InsuranceDocument3 pagesW Hero Scooty InsuranceVivek Kümär RNo ratings yet

- ISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedDocument1 pageISHRAT AFZA National Insurance Certificate of Insurance Cum Policy Shedule Ok TestedAnil SharmaNo ratings yet

- PolicySoftCopy 509109346Document1 pagePolicySoftCopy 509109346Zishan100% (2)

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDocument2 pagesThe Oriental Insurance Company Limited: Particulars of Insured VehicleijustyadavNo ratings yet

- Iffco - Tokio General Insurance Co. LTD: Regd. Office: IFFCO SADAN, C1 Distt Centre, Saket, New Delhi-110017Document1 pageIffco - Tokio General Insurance Co. LTD: Regd. Office: IFFCO SADAN, C1 Distt Centre, Saket, New Delhi-110017Gireesh Kumar AllaNo ratings yet

- Iffco-Tokio General Co - LTD: Signature Not VerifiedDocument4 pagesIffco-Tokio General Co - LTD: Signature Not VerifiedPulkit ChawlaNo ratings yet

- Reliance Activa Insurance PolicyDocument6 pagesReliance Activa Insurance PolicydsethiaimtnNo ratings yet

- E Shared PDFFILES 3151 PolicySchedule 202205250021019 PolicyScheduleDocument2 pagesE Shared PDFFILES 3151 PolicySchedule 202205250021019 PolicyScheduleLalit bhardwajNo ratings yet

- Pulsar 150 InsuranceDocument2 pagesPulsar 150 Insurancesunny rocky100% (1)

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsSanchit GoyalNo ratings yet

- Harbir 0382 PypDocument1 pageHarbir 0382 Pypcommission sompoNo ratings yet

- Your Policy Is Due For Renewal On 27/06/2017: Royal Sundaram General Insurance Co. LimitedDocument3 pagesYour Policy Is Due For Renewal On 27/06/2017: Royal Sundaram General Insurance Co. LimitedPrachi BhosaleNo ratings yet

- Cvi MX329537Document3 pagesCvi MX329537akrambasha095No ratings yet

- Final Motor Insurance Claim FormDocument1 pageFinal Motor Insurance Claim FormPrateek PatelNo ratings yet

- Two Wheeler PolicyDocument2 pagesTwo Wheeler Policykomal bhosaleNo ratings yet

- Bike InsuranceDocument3 pagesBike InsurancePartha Sarathi MandalNo ratings yet

- Bike Insurance Policy Till 2018Document5 pagesBike Insurance Policy Till 2018Leela KrishnaNo ratings yet

- Createds PDFDocument1 pageCreateds PDFROHIT KUMARNo ratings yet

- LTA Form Block Year 2022-2025 - KeysightDocument2 pagesLTA Form Block Year 2022-2025 - KeysightTarun JainNo ratings yet

- CreateDS PDF PDFDocument2 pagesCreateDS PDF PDFsubir kumar AdhikaryNo ratings yet

- PL 1018 203008 M05 003014 PDFDocument2 pagesPL 1018 203008 M05 003014 PDFAnonymous 1YmFJf7A7No ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleArora ParasNo ratings yet

- Your Vehicle Details: Additional CoverDocument1 pageYour Vehicle Details: Additional CoverchetanNo ratings yet

- Motor Insurance Policy - OICLDocument3 pagesMotor Insurance Policy - OICLAman DeepNo ratings yet

- Motor Insurance - Private Car Liability Only PolicyDocument2 pagesMotor Insurance - Private Car Liability Only PolicyOm Prakash SharmaNo ratings yet

- Motor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleDocument3 pagesMotor Insurance - Two Wheeler Liability Only: Certificate of Insurance Cum Policy ScheduleHeart RockNo ratings yet

- Intermediary Code: Intermediary Name: Contact:: BR502965 D2C Insurance Broking Pvt. Ltd.Document2 pagesIntermediary Code: Intermediary Name: Contact:: BR502965 D2C Insurance Broking Pvt. Ltd.Zakir SzaNo ratings yet

- Gokul Bike Insurance PDFDocument3 pagesGokul Bike Insurance PDFArun GokulNo ratings yet

- Car InsuranceDocument3 pagesCar InsurancesmgkinduriNo ratings yet

- Car InsuranceDocument5 pagesCar InsuranceGokulNath AravindNo ratings yet

- The Oriental Insurance Company Limited: Particulars of Insured VehicleDocument3 pagesThe Oriental Insurance Company Limited: Particulars of Insured Vehiclecarlos monteaNo ratings yet

- Car Policy 2023-24Document1 pageCar Policy 2023-24jamunapariiNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2320 1005 1515 2200 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2320 1005 1515 2200 000SiddhantPatelNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2311 2012 4730 4402 000Document2 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2311 2012 4730 4402 000Abhishek PatraNo ratings yet

- CH Nagamani PDFDocument3 pagesCH Nagamani PDFAnonymous LaXcfb0% (2)

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing OfficeAnonymous pKsr5vNo ratings yet

- Motor Insurance Certificate Cum Policy Schedule Motorised-Two Wheelers Liability Only Policy - Zone BDocument4 pagesMotor Insurance Certificate Cum Policy Schedule Motorised-Two Wheelers Liability Only Policy - Zone BRaghunandan R'dyNo ratings yet

- Insured Motor Vehicle Details Insured Declared Value (Idv) (In RS.)Document2 pagesInsured Motor Vehicle Details Insured Declared Value (Idv) (In RS.)Zakir SzaNo ratings yet

- Sub: Risk Assumption Letter: Insured & Vehicle DetailsDocument3 pagesSub: Risk Assumption Letter: Insured & Vehicle DetailsHIMANSHU MEHTANo ratings yet

- Star CityDocument1 pageStar CityAjai K0% (1)

- Mahinra Alfa Chi - RemovedDocument1 pageMahinra Alfa Chi - Removedsarath potnuri100% (1)

- Bike Insurance - 2013 PDFDocument3 pagesBike Insurance - 2013 PDFRupinder SinghNo ratings yet

- Reliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - ScheduleDocument6 pagesReliance General Insurance Company Limited: Reliance Two Wheeler Package Policy - Scheduleraj2364uNo ratings yet

- Ka32z4948 EndoDocument3 pagesKa32z4948 EndoIFFCO TOKIO100% (1)

- Claim FormDocument3 pagesClaim FormRandy OrtonNo ratings yet

- ASSDDocument3 pagesASSDSai ChNo ratings yet

- Pol 4232643Document3 pagesPol 4232643Ramanuja GanguNo ratings yet

- Diha - Chapter 2 Example For SLD & EoqDocument16 pagesDiha - Chapter 2 Example For SLD & EoqMohammad Amalil IVNo ratings yet

- Powder Flow CalcDocument2 pagesPowder Flow CalcIndra BRNo ratings yet

- The Essential Guide To ReinsuranceDocument51 pagesThe Essential Guide To Reinsurancefireblastrer100% (1)

- 014 Model F1FR 56 Quick Response SprinklersDocument8 pages014 Model F1FR 56 Quick Response SprinklersLeonardo Gabriel Angelino LeiteNo ratings yet

- Module 6Document26 pagesModule 6xtnreyesNo ratings yet

- 2020 Rove Concepts - Lookbook UpdateDocument198 pages2020 Rove Concepts - Lookbook UpdateTulaNo ratings yet

- Top Unesco World Heritage SitesDocument2 pagesTop Unesco World Heritage Sitesapi-473615378No ratings yet

- B.tech (LEET) Admission Brochure For The Session 2015-16Document140 pagesB.tech (LEET) Admission Brochure For The Session 2015-16Sarika AggarwalNo ratings yet

- Specification of CAT 330D CaterpillarDocument24 pagesSpecification of CAT 330D CaterpillarBassel AmmarNo ratings yet

- Lab-Density and Solids-Student GuideDocument8 pagesLab-Density and Solids-Student GuideDevontay SheelyNo ratings yet

- Toshiba T2110 T2110CS T2115CS T2130 T2130CS T2130CT T2135 - Maintenance ManualDocument183 pagesToshiba T2110 T2110CS T2115CS T2130 T2130CS T2130CT T2135 - Maintenance ManualAngel Chans SabrojoNo ratings yet

- Cetus x12, Cetus x15, Cetus XL ManualDocument163 pagesCetus x12, Cetus x15, Cetus XL ManualTan BuiNo ratings yet

- Hyperbaric Oxygen TherapyDocument30 pagesHyperbaric Oxygen TherapychaiNo ratings yet

- ProceedingDocument7 pagesProceedingnoor hafizzatul izzahNo ratings yet

- Indonesian Hotel Annual ReviewDocument34 pagesIndonesian Hotel Annual ReviewSPHM HospitalityNo ratings yet

- Special Program in The ArtsDocument30 pagesSpecial Program in The Artsnestor castanos jrNo ratings yet

- IIPA Indian Institute of Public AdministrationDocument1 pageIIPA Indian Institute of Public AdministrationvidyachandaragiNo ratings yet

- TectonicsDocument32 pagesTectonicsFlavyus06No ratings yet

- Bajko Paul Adela 1977 Poland ECCDocument20 pagesBajko Paul Adela 1977 Poland ECCthe missions networkNo ratings yet

- MNTG Textbook PDFDocument379 pagesMNTG Textbook PDFJustice MachiwanaNo ratings yet

- Complete Clinical Guide To Cardiology 1st Edition Christian Fielder Camm PDF For All ChaptersDocument62 pagesComplete Clinical Guide To Cardiology 1st Edition Christian Fielder Camm PDF For All Chaptersarrianadife100% (4)

- Savage Worlds - JustifiersDocument19 pagesSavage Worlds - JustifiersShannon Russell (necron99)No ratings yet

- Document 1904073.1Document4 pagesDocument 1904073.1Isa Sarreira Mendes100% (1)

- Vacon NX Brake Resistor User ManualDocument38 pagesVacon NX Brake Resistor User Manualclaudir.calazansNo ratings yet

- B. Proportionate Sharing of Costs and Profit.: EngageDocument2 pagesB. Proportionate Sharing of Costs and Profit.: EngageOliver TalipNo ratings yet

- Router DynexDocument196 pagesRouter DynexEduardo Jose Fernandez PedrozaNo ratings yet