Part 3333

Part 3333

Uploaded by

RhoizCopyright:

Available Formats

Part 3333

Part 3333

Uploaded by

RhoizOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Part 3333

Part 3333

Uploaded by

RhoizCopyright:

Available Formats

36.

WW and RR share profits and losses equally, WW and RR receive salary allowances of P20 000 and P30 000

respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are

calculated at the beginning of each month regardless of when the capital contributions and capital withdrawals

were made, and partners drawings are not used in determining the average capital balances. Total net income for

20x5 is P120 000.

WW RR

January 1 Capital Balances ……………………………..............P100 000 P120 000

Yearly Drawings (P1500 a month) ……………………………… 18 000 18 000

Permanent withdrawals of capital:

June 3 ……………………………………………. (12 000)

May 2 ……………………………………………. (15 000)

Additional investments of capital:

July 3 …………………………………………….. 40 000

October 2 ………………………………………… 50 000

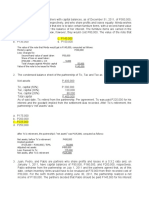

What is the weighted average capital for WW and RR respectively for 20x5?

Answer: A. P110 667 and P119 5853

37. HH, MM, and AA formed a partnership on January 1 20x5, and contributed P150 000, P200 000, and P250 000,

respectively. Their articles of co-partnership provide that the operating income be shared among the partners as

follows: as salary, P24 00 for HH, P18 000 for MM, and P12 000 for AA; interest of 12% on the average capital

during 20x5 of the three partners: and the remainder in the ratio of 2:4:4 respectively.

The operating income for the year ending December 31 20x5 amounted to P176 000. HH contributed additional

capital of P30 000 on July 1 and made a drawing of P10 000 on October 1; MM contributed additional capital of

P20 000 on August 1 and made a drawing of P10 000 on October1; AA made a drawing of P30 000 on

November 1.

The partners’ capital balances on December 20x5 are:

Answer: D. HH, P223 180; MM, P272 060; AA, P280 760

38. Merlin, a partner in the Camelot Partnership, has a 30% participation in partnership profits and losses. Merlin’s

capital account has a net decrease of P1 200 000 during the calendar year 20x5. During 20x5, Merlin withdrew

P2 600 000 (charged against his capital account) and contributed property valued at P500 000 to the partnership.

What was the net income of the Camelot Partnership for year 20x5?

Answer: A. P3 000 000

39. On January 2 20x5, BB and PP formed a partnership. BB contributed capital of P175 000 and PP, P25 000. They

agreed to share profits and losses 80% and 20%, respectively. PP is the general manager and works in the

partnership full time and is given a salary of P5 000 a month; an interest of 5% of the beginning capital (of both

partner) and a bonus of 15% of net income before the salary, interest and the bonus.

The profit and loss statement of the partnership for the year ended December 31 20x5 is as follows:

Net sales ……………………………………………………… …………………… P875 000

Cost of goods sold …………………………………………………………………. 700 000

Gross Profit ………………………………………………………………………… P175 000

Expenses (including the salary, interest and the bonus)…………………………… 143 000

Net income …………………………………………………………………………. P 32 000

The amount of bonus to PP in 20x5 amounted to:

Answer: C. P18 000

40. On January 1 20x5, A, B, C, and D formed Bakya Trading Co., a partnership, with capital contributions as follows:

A, P50 000; B, P25 000; C, P25 000; and D, P20 000. The partnership contract provided that each partner shall

receive a 5% interest on contributed capital, and that A and B shall receive salaries of P5 000 and P3 000,

respectively. The contract also provided that C shall receive a minimum of P2 500 per annum, and D a minimum

of P6 000 per annum, which is inclusive of amounts representing interest and share of remaining profits. The

balance of the profits shall be distributed to A, B, C, and D in a 3:3:2:2 ratio.

What amount must be earned by the partnership, before any change for interest and salaries, so that A may receive

an aggregate of P12 500 including interest, salary and share of profits?

Answer: D. P32 333

You might also like

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocument77 pagesSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- Partnership Formation111Document6 pagesPartnership Formation111Rhoiz75% (8)

- Quiz Liquidation and DissolutionDocument30 pagesQuiz Liquidation and DissolutionIan RanilopaNo ratings yet

- Partnership Formation111Document6 pagesPartnership Formation111Rhoiz75% (8)

- Partnership Formation111Document6 pagesPartnership Formation111Rhoiz75% (8)

- Southwest Airlines Generating Competitive Advantage Through Human Resources ManagementDocument13 pagesSouthwest Airlines Generating Competitive Advantage Through Human Resources ManagementGonçalo RodriguesNo ratings yet

- Partnership Operations Enabling AssessmentDocument6 pagesPartnership Operations Enabling AssessmentVon Andrei MedinaNo ratings yet

- B.) CC, P25,000: PP, P21,000 Aa, P38,000Document22 pagesB.) CC, P25,000: PP, P21,000 Aa, P38,000Wendelyn TutorNo ratings yet

- Parcor CompuDocument14 pagesParcor CompuErika delos Santos100% (3)

- Chapter 1&2Document34 pagesChapter 1&2iptrcrmlNo ratings yet

- Comprehensive Quiz 1Document11 pagesComprehensive Quiz 1Ken PioNo ratings yet

- Ansay, Allyson Charissa T - Activity 4Document14 pagesAnsay, Allyson Charissa T - Activity 4Allyson Charissa AnsayNo ratings yet

- Afar ParcorDocument271 pagesAfar Parcorawesome bloggers50% (2)

- Part 5555Document2 pagesPart 5555Rhoiz80% (5)

- Partnership 2222Document2 pagesPartnership 2222Rhoiz71% (7)

- Partnership ContinuationDocument3 pagesPartnership ContinuationRhoiz100% (2)

- PracticeProblems Set1withAnswersDocument5 pagesPracticeProblems Set1withAnswersRoselle Jane LanabanNo ratings yet

- Problems: Volume IDocument6 pagesProblems: Volume IMigs MigsyNo ratings yet

- ActivityDocument14 pagesActivityKeith Joshua GabiasonNo ratings yet

- Lecture NotesDocument25 pagesLecture NotesPrecious Diarez Pureza67% (3)

- Partnership FormationDocument51 pagesPartnership FormationGarp BarrocaNo ratings yet

- Jordan Pippen Total: Multiple Choice Answers and SolutionsDocument26 pagesJordan Pippen Total: Multiple Choice Answers and SolutionsJOEMAR LEGRESONo ratings yet

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Ac Far Quiz7Document4 pagesAc Far Quiz7Kristine Joy Cutillar100% (1)

- 139Document9 pages139Allynna JoyNo ratings yet

- Quiz AccountingDocument11 pagesQuiz Accountingsino ako100% (1)

- Eric &philipDocument4 pagesEric &philipKing MacunatNo ratings yet

- Chapter 1 OperationsDocument9 pagesChapter 1 Operationsrietzhel22100% (1)

- PartnershipDocument9 pagesPartnershipGrace A. ManaloNo ratings yet

- 001 Partnership Formation ActivityDocument9 pages001 Partnership Formation ActivityKenncy100% (1)

- Ac Far Quiz6Document2 pagesAc Far Quiz6Kristine Joy Cutillar0% (1)

- Quiz in PartnershipDocument13 pagesQuiz in PartnershipDonalyn BannagaoNo ratings yet

- Partnership DissolutionDocument5 pagesPartnership DissolutionJayhan PalmonesNo ratings yet

- Parcor CaseletsDocument13 pagesParcor CaseletsErika delos Santos100% (2)

- 03-Partnership Liquidation Quiz2Document6 pages03-Partnership Liquidation Quiz2JiddahNo ratings yet

- HahahahaDocument3 pagesHahahahaTyrelle Dela Cruz100% (1)

- Reduction of Partner by RetirementDocument4 pagesReduction of Partner by RetirementsunshineNo ratings yet

- P2Document20 pagesP2Jemson YandugNo ratings yet

- NSBZDocument6 pagesNSBZKenncy100% (4)

- Lesson 5 Partnership Dissolution ExercisesDocument7 pagesLesson 5 Partnership Dissolution ExercisesMonicaNo ratings yet

- ActivityDocument9 pagesActivityKimberlie Jane GableNo ratings yet

- Advacc 1 Quiz 1 With AnswersDocument9 pagesAdvacc 1 Quiz 1 With AnswersGround ZeroNo ratings yet

- PracticeDocument2 pagesPracticesppNo ratings yet

- MSJG Chap 1 10 QuestionsDocument6 pagesMSJG Chap 1 10 QuestionsMar Sean Jan Gabiosa100% (2)

- AuditingDocument4 pagesAuditingMaria Carmela MoraudaNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- Practical Accounting 2 - RMYCDocument10 pagesPractical Accounting 2 - RMYCZadharie Abby Gail BurataNo ratings yet

- 1 PartnershipDocument9 pages1 PartnershipLJBernardo100% (1)

- Finals Quiz Dissolution To LiquidationDocument6 pagesFinals Quiz Dissolution To LiquidationJeane Mae Boo75% (4)

- Partnership Reviewer 2021Document78 pagesPartnership Reviewer 2021Miquel Villamarin100% (1)

- MC6Document5 pagesMC6shudayeNo ratings yet

- Ac Far Quiz9Document5 pagesAc Far Quiz9Kristine Joy CutillarNo ratings yet

- Advanced AccountingDocument4 pagesAdvanced AccountingGennia Mae MartinezNo ratings yet

- Parcor 002Document17 pagesParcor 002Vincent Larrie MoldezNo ratings yet

- Items 71 95Document8 pagesItems 71 95Ice Voltaire Buban GuiangNo ratings yet

- Part3333Document2 pagesPart3333Vince Raeden AmaranteNo ratings yet

- Jeremeh V Querol Bachelor of Science in Tourism ManagementDocument8 pagesJeremeh V Querol Bachelor of Science in Tourism ManagementJasmine ActaNo ratings yet

- Partnership Operations (Additional Sample Problems)Document5 pagesPartnership Operations (Additional Sample Problems)Pauline Anne LopezNo ratings yet

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Additional ProblemsDocument3 pagesAdditional Problems가 푸 레멜 린 메No ratings yet

- Partnership Operation Part 1 PDFDocument2 pagesPartnership Operation Part 1 PDFazzenethfaye.delacruz.mnlNo ratings yet

- 1ST GRADING EXAM For StudentsDocument12 pages1ST GRADING EXAM For StudentsAndrea Florence Guy VidalNo ratings yet

- 2 Partnership OperationsDocument3 pages2 Partnership OperationsKIARA ANDREA TULIONo ratings yet

- Partnership Operations: QuizDocument8 pagesPartnership Operations: QuizLee SuarezNo ratings yet

- Slide Presentation - Lesson 1Document17 pagesSlide Presentation - Lesson 1RhoizNo ratings yet

- Five Basic Skills of BasketballDocument10 pagesFive Basic Skills of BasketballRhoiz100% (4)

- Part 5555Document2 pagesPart 5555RhoizNo ratings yet

- Tax Assignment 4Document5 pagesTax Assignment 4pfungwaNo ratings yet

- PadgettDocument15 pagesPadgettDonna RespondekNo ratings yet

- Como Exportar para o BrasilDocument113 pagesComo Exportar para o BrasilFabio Alexander de PauliNo ratings yet

- General Mariano Alvarez Executive Summary 2014Document7 pagesGeneral Mariano Alvarez Executive Summary 2014Andrea Dela CruzNo ratings yet

- ENSM - Comparative and Superlative - Pie Charts - Part 2Document30 pagesENSM - Comparative and Superlative - Pie Charts - Part 2med27919No ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- Advacc 1 Answer Key Set ADocument3 pagesAdvacc 1 Answer Key Set AA BNo ratings yet

- NEF Application Form 28nov2022Document9 pagesNEF Application Form 28nov2022NicolasNo ratings yet

- Gross Compensation IncomeDocument4 pagesGross Compensation IncomeAngeline LicuanNo ratings yet

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDocument19 pagesIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeAngellina. ANo ratings yet

- BookDocument98 pagesBookmuthulakshmiNo ratings yet

- FBMINT T1 EBITDA - EBIT - EBT - EAT EngDocument11 pagesFBMINT T1 EBITDA - EBIT - EBT - EAT EngTamer BAKICIOLNo ratings yet

- CFA L1 GlossaryDocument35 pagesCFA L1 Glossaryanindita.nag68No ratings yet

- Financial Litercy 1Document13 pagesFinancial Litercy 1balanivalshcaNo ratings yet

- Verimatrix - Q4 - 2020 - Transcript FileDocument24 pagesVerimatrix - Q4 - 2020 - Transcript FileGirish MamtaniNo ratings yet

- Bhel P&LDocument2 pagesBhel P&LRutvik HNo ratings yet

- Art Center Business Plan FINAL 5-4-09Document42 pagesArt Center Business Plan FINAL 5-4-09Hue PhamNo ratings yet

- Module 2 - TaxationDocument69 pagesModule 2 - TaxationAnik KararNo ratings yet

- 2019-2020 Associations Income Tax Return - 2dec - 3PMDocument10 pages2019-2020 Associations Income Tax Return - 2dec - 3PMMYO KO KONo ratings yet

- PDF Installment Sales Reviewer Problems - CompressDocument43 pagesPDF Installment Sales Reviewer Problems - CompressMischievous Mae0% (1)

- Preliminary Exams Problems Income TaxationDocument12 pagesPreliminary Exams Problems Income TaxationTrixie JeramieNo ratings yet

- Continuing ProblemDocument7 pagesContinuing ProblemKavya GopakumarNo ratings yet

- 2020 Valix Answer Key Acounting 3 - CompressDocument19 pages2020 Valix Answer Key Acounting 3 - Compressrandomfinds864No ratings yet

- Activity 5 Gross IncomeDocument6 pagesActivity 5 Gross IncomeRussel Jay CardeñoNo ratings yet

- Sanjib Ghosh Assessment Year: 2023-2024 PAN: AFZPG0468EDocument1 pageSanjib Ghosh Assessment Year: 2023-2024 PAN: AFZPG0468Ejdas7061No ratings yet

- FIN301 Term-Paper Sec02 Spring-2019Document20 pagesFIN301 Term-Paper Sec02 Spring-2019Sadab Rahaman RidamNo ratings yet

- 2022 Cost of Living Report (Portland Business Alliance)Document4 pages2022 Cost of Living Report (Portland Business Alliance)KGW NewsNo ratings yet

- 12 Topmach Corporation 2022 Leads ScheduleDocument216 pages12 Topmach Corporation 2022 Leads ScheduleArvin TejonesNo ratings yet

- Agricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerDocument20 pagesAgricultural Economics and Marketing - Review Exam Set 1 Select The Best AnswerSean HooeksNo ratings yet