Business Combination Subsequent To Date of Acquisition

Business Combination Subsequent To Date of Acquisition

Uploaded by

Adrian MontemayorCopyright:

Available Formats

Business Combination Subsequent To Date of Acquisition

Business Combination Subsequent To Date of Acquisition

Uploaded by

Adrian MontemayorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Business Combination Subsequent To Date of Acquisition

Business Combination Subsequent To Date of Acquisition

Uploaded by

Adrian MontemayorCopyright:

Available Formats

BUSINESS COMBINATION SUBSEQUENT TO DATE OF ACQUISITION (FULL PFRS AND SMEs)

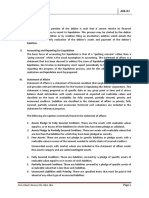

Adjustments to Net Income – Subsidiary, Impairment or amortization of Goodwill, Eliminating Dividend Income excluding Intercompany Sale of Assets

PROBLEM I.

P Corporation acquired an 80% interest in S Company on January 1, 2020 for P425,000. On this date, the share capital

and retained earnings of two companies were as follows:

P Corporation S Company

Share Capital P530,000 P175,000

Retained Earnings 380,000 35,000

The assets and liabilities of S Company were stated at their fair values when P acquired its 80% interest and the fair

value method was used to initially measure the NCI. Net income and dividends for 2020 for the affiliated companies were:

P Corporation S Company

Net Income P105,000 P31,500

Dividends Declared 63,000 17,500

End of the year valuation indicates P2,400 impairment in goodwill (partial).

1. Consolidated retained earnings at December 31, 2020.

2. Goodwill in the consolidated balance sheet at December 31, 2020.

PROBLEM II.

P Company paid P3,600,000 for 80% interest in S Company on January 2, 2020. The book values and fair values of S

Company’s assets and liabilities on this date are as follows:

Book Value Fair Value

Current Assets P2,300,000 P2,500,000

Noncurrent Assets 3,600,000 3,800,000

Liabilities 2,000,000 2,100,000

The increase in the value of the current assets is attributable to inventories which were all sold in 2020 whereas the

increase in value of noncurrent assets is attributable to a depreciable asset with 5 years remaining useful life. The parent

opted to measure NCI proportionate to its share of subsidiary’s identifiable net assets.

1. If S reported net income of P450,000 and declared dividends of P320,000, compute for the NCINIS.

2. Using data in #1, compute for the NCINAS.

PROBLEM III.

On January 1, 2020, P Corporation purchase 80% of S Company’s ordinary share for P810,000. P37,500 of the excess is

attributable to goodwill and the balance to depreciable asset with economic life of ten years. NCI is measured at fair value

on the date of acquisition. On this date, shareholders’ equity of the two companies were as follows:

P Corporation S Company

Ordinary share P1,312,500 P300,000

Retained earnings 1,950,000 525,000

On December 31, 2020, S Company reported net income of P131,250 and paid dividends of P45,000 to Party. Party

reported earnings from its own operations of 356,250 and paid dividends of P172,500. Goodwill has been impaired and

should be reported at P7,500 on December 31, 2020.

1. Net income attributable to parent

2. NCINIS

3. NCINAS

4. Consolidated retained earnings

5. Consolidated Shareholders’ Equity

You might also like

- PQ2Document2 pagesPQ2alellieNo ratings yet

- Consolidated BS - Date of AcquisitionDocument2 pagesConsolidated BS - Date of AcquisitionKharen Valdez0% (1)

- QUIZ REVIEW Homework Tutorial Chapter 5Document5 pagesQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNo ratings yet

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Answer Key For EmpleoDocument17 pagesAnswer Key For EmpleoAdrian Montemayor100% (2)

- Longchen NyingthigDocument53 pagesLongchen NyingthigSherab Sengye100% (4)

- Subsequent To Acquisition (Handouts)Document4 pagesSubsequent To Acquisition (Handouts)Ma Hadassa O. FolienteNo ratings yet

- M36 - Quizzer 1 PDFDocument8 pagesM36 - Quizzer 1 PDFJoshua DaarolNo ratings yet

- Solutionchapter 15Document36 pagesSolutionchapter 15Ken Jomel PeñadaNo ratings yet

- Chapter 15-Financial Planning: Multiple ChoiceDocument22 pagesChapter 15-Financial Planning: Multiple ChoiceadssdasdsadNo ratings yet

- Rmbe Afar For PrintingDocument18 pagesRmbe Afar For PrintingjxnNo ratings yet

- CONSOLIDATION FOR SMEsDocument1 pageCONSOLIDATION FOR SMEsvictoriaNo ratings yet

- Audprob Final Exam 1Document26 pagesAudprob Final Exam 1Joody CatacutanNo ratings yet

- The Following Information Will Be Used For Question Nos. 8 and 9Document5 pagesThe Following Information Will Be Used For Question Nos. 8 and 9jenieNo ratings yet

- How Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Document8 pagesHow Much Is The Adjusted Book Disbursements For September?: Part Ii: Practical Problems Problem No.1Raenessa FranciscoNo ratings yet

- TB ch01 9eDocument12 pagesTB ch01 9eRadizaJisiNo ratings yet

- Additional Data For The Period Were ProvidedDocument3 pagesAdditional Data For The Period Were Providedmoncarla lagon100% (1)

- Intercompany Sale of PPE ActivityDocument2 pagesIntercompany Sale of PPE Activitybea kullin0% (1)

- AC - Acctg Gov Quiz 01Document2 pagesAC - Acctg Gov Quiz 01Erjohn PapaNo ratings yet

- Toa Basic ConceptsDocument44 pagesToa Basic ConceptsKristine WaliNo ratings yet

- BusCom AssetAcquisitionDocument5 pagesBusCom AssetAcquisitionDanna Claire0% (1)

- HOBA QuestionsDocument7 pagesHOBA QuestionsKristine CorporalNo ratings yet

- Unmodified ReportDocument2 pagesUnmodified ReportErica CaliuagNo ratings yet

- Mid PS3Document8 pagesMid PS3heyNo ratings yet

- Consignment Sales ProblemsDocument1 pageConsignment Sales ProblemsAkako MatsumotoNo ratings yet

- Afar 02 P'ship Operation QuizDocument4 pagesAfar 02 P'ship Operation QuizJohn Laurence LoplopNo ratings yet

- Answer KEY PPEDocument6 pagesAnswer KEY PPExjammerNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Ale Aubrey - Bsma 3 1.exercise123Document28 pagesAle Aubrey - Bsma 3 1.exercise123Astrid XiNo ratings yet

- Derivatives Qs PDFDocument5 pagesDerivatives Qs PDFLara Camille CelestialNo ratings yet

- Lyceum First Preboard 2020Document3 pagesLyceum First Preboard 2020Jordan Tobiagon100% (1)

- Review QuestionairesDocument18 pagesReview QuestionairesAngelica DuarteNo ratings yet

- Chap 003Document37 pagesChap 003ChuyuZhang100% (2)

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaNo ratings yet

- Activity - Chapter 4Document2 pagesActivity - Chapter 4Greta DuqueNo ratings yet

- LTCC FormulaDocument2 pagesLTCC FormulaReginald ValenciaNo ratings yet

- Module 1 Home Office and Branch Accounting General ProceduresDocument4 pagesModule 1 Home Office and Branch Accounting General ProceduresDaenielle EspinozaNo ratings yet

- Chapter 14 Other SolutionDocument18 pagesChapter 14 Other SolutionChristine BaguioNo ratings yet

- B. Cost, Being The Purchase PriceDocument5 pagesB. Cost, Being The Purchase Priceaj dumpNo ratings yet

- ACC16 - HO 1 - Corporate LiquidationDocument5 pagesACC16 - HO 1 - Corporate LiquidationAubrey DacirNo ratings yet

- 9 Chapter6Document2 pages9 Chapter6Keanne ArmstrongNo ratings yet

- Palmones, Jayhan Grace M. QuizDocument6 pagesPalmones, Jayhan Grace M. QuizjayhandarwinNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- AFAR Review Midterm ExamDocument10 pagesAFAR Review Midterm ExamZyrah Mae SaezNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Quiz Number 3Document3 pagesQuiz Number 3Lopez, Azzia M.No ratings yet

- Quiz FinalDocument6 pagesQuiz FinalChriztel Joy Manansala100% (1)

- ACCOUNTING 3 PPE ProblemsDocument4 pagesACCOUNTING 3 PPE ProblemsMina ChouNo ratings yet

- Asia Pacific College of Advanced Studies Prelims Exam MGMT Acctg 2 Management Accounting 2Document7 pagesAsia Pacific College of Advanced Studies Prelims Exam MGMT Acctg 2 Management Accounting 2geminailnaNo ratings yet

- Midterm ExamDocument9 pagesMidterm ExamElla TuratoNo ratings yet

- PRTC Olympiad Reg 12Document14 pagesPRTC Olympiad Reg 12Vincent Larrie MoldezNo ratings yet

- Chapter 09Document16 pagesChapter 09FireBNo ratings yet

- Lesson 10 Assignment 4Document4 pagesLesson 10 Assignment 4marcied357No ratings yet

- m2.3d Diy-Exercises (Answer Key)Document28 pagesm2.3d Diy-Exercises (Answer Key)May RamosNo ratings yet

- Business Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Document1 pageBusiness Combination Subsequent To Date of Acquisition (Full Pfrs and Smes)Akako MatsumotoNo ratings yet

- Lesson 2-ACCOUNTS RECEIVABLES-2021NADocument5 pagesLesson 2-ACCOUNTS RECEIVABLES-2021NAandreaNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- Quiz - 3 ABC Problem SolvingDocument6 pagesQuiz - 3 ABC Problem SolvingAngelito Mamersonal0% (1)

- AFAR 3 (Test Questions)Document4 pagesAFAR 3 (Test Questions)Lalaine BeatrizNo ratings yet

- Financial Statement Analysis Current RatioDocument8 pagesFinancial Statement Analysis Current RatioAdrian MontemayorNo ratings yet

- BFINMAX Handout - Gross Profit Variance AnalysisDocument6 pagesBFINMAX Handout - Gross Profit Variance AnalysisAdrian MontemayorNo ratings yet

- Week 10 CorporationssDocument9 pagesWeek 10 CorporationssAdrian MontemayorNo ratings yet

- Chapter 10 - Responsibility AcctgDocument40 pagesChapter 10 - Responsibility AcctgAdrian MontemayorNo ratings yet

- Sample Problems Variance Analysis PDFDocument1 pageSample Problems Variance Analysis PDFAdrian MontemayorNo ratings yet

- Process Costing 1Document57 pagesProcess Costing 1Adrian Montemayor100% (1)

- Ra 6732 Reconstitution of Destroyed or Missing TitlesDocument5 pagesRa 6732 Reconstitution of Destroyed or Missing TitlesVernon BacangNo ratings yet

- 22 Simple Tips To Make A Guy Fall Crazily in Love With YouDocument27 pages22 Simple Tips To Make A Guy Fall Crazily in Love With Yousakshi agarwal100% (2)

- Design Recommendations For Seismically Isolated Buildings: Architectural Institute of JapanDocument10 pagesDesign Recommendations For Seismically Isolated Buildings: Architectural Institute of JapanYonny Pacompìa YucraNo ratings yet

- Mazuri 5E5L StudyDocument9 pagesMazuri 5E5L StudyLawrence TancincoNo ratings yet

- Letter Tanner 2018Document2 pagesLetter Tanner 2018api-209945054No ratings yet

- Staffing: Management of Human Resources at INFOSYSDocument32 pagesStaffing: Management of Human Resources at INFOSYSADITHYANo ratings yet

- Assignement 1: Exercise 1Document2 pagesAssignement 1: Exercise 1Arbi Chaima100% (1)

- Chapter 3 Motor CortexDocument1 pageChapter 3 Motor CortexDeena Al NuaimiNo ratings yet

- The Cowboy ChroniclesDocument60 pagesThe Cowboy ChroniclesChristain PakozdiNo ratings yet

- Design and Implementation of An Intruder Detector in Homes With Audio and Sms Alert Using GSM ModuleDocument65 pagesDesign and Implementation of An Intruder Detector in Homes With Audio and Sms Alert Using GSM ModuleLANGATNo ratings yet

- Data Collection & Questionnaire DesigningDocument24 pagesData Collection & Questionnaire DesigningDr. V. Vaidehi PriyalNo ratings yet

- Econ 620 SyllabusDocument3 pagesEcon 620 SyllabusTOM ZACHARIASNo ratings yet

- Department of Education: Republic of The PhilippinesDocument2 pagesDepartment of Education: Republic of The PhilippinesDrazen Emir Lim-Barraca Bernardo-LegaspiNo ratings yet

- Daniel's EnglishDocument3 pagesDaniel's Englishalondraelizabeth037No ratings yet

- ORGS 1136 - Week 3, Chapter 3 Notes ORGS 1136 - Week 3, Chapter 3 NotesDocument3 pagesORGS 1136 - Week 3, Chapter 3 Notes ORGS 1136 - Week 3, Chapter 3 NotesTara FGNo ratings yet

- Syllabus Vtu EntranceDocument32 pagesSyllabus Vtu EntranceHarish RamasastryNo ratings yet

- Limitations of FaithDocument13 pagesLimitations of FaithngungiladNo ratings yet

- Science 7Document13 pagesScience 7Miles SantosNo ratings yet

- Addyman S. Construction Project Organising 2022Document299 pagesAddyman S. Construction Project Organising 2022josimarNo ratings yet

- Group AttunementDocument8 pagesGroup Attunementdeepak_goyal198674No ratings yet

- Samarin Bana by WWW - Dlhausanovels.com - NGDocument256 pagesSamarin Bana by WWW - Dlhausanovels.com - NGFalmata Bukar koloNo ratings yet

- Languagecert Expert C1 Level 2 International Esol (Speaking) Practice Paper 3Document7 pagesLanguagecert Expert C1 Level 2 International Esol (Speaking) Practice Paper 3maria muela bravoNo ratings yet

- Osirion Tierra de FaraonesDocument36 pagesOsirion Tierra de Faraonesegurra100% (1)

- In H 1701964312 The Mughal Empire Mind Map - Ver - 1Document1 pageIn H 1701964312 The Mughal Empire Mind Map - Ver - 1Zehra ZuhairNo ratings yet

- Nursing 3Document48 pagesNursing 3Ranjitha MohanNo ratings yet

- Purgatorio (Lecture Notes)Document4 pagesPurgatorio (Lecture Notes)CRISTOPER LOPEZNo ratings yet

- Also Known As Bill Gates of Pakistan'Document4 pagesAlso Known As Bill Gates of Pakistan'Farhan KhanNo ratings yet

- NetiquettesDocument9 pagesNetiquettesdesimarieenriquez0311No ratings yet

- IMTGT Transformation To Digital Economy?: Unicorns, Transformation and The Internet of ThingsDocument5 pagesIMTGT Transformation To Digital Economy?: Unicorns, Transformation and The Internet of ThingsWilliam AnthonyNo ratings yet