0 ratings0% found this document useful (0 votes)

39 viewsIndian Ctc-Breakup

Indian Ctc-Breakup

Uploaded by

Vasanth Kumar VThe document outlines the breakdown of various components that make up the total cost to company (CTC) for metro and non-metro employees. The CTC for both is Rs. 475,000 and includes allowances such as basic pay, house rent allowance, special allowance, education allowance, conveyance allowance, medical allowance, additional allowance, leave travel allowance, bonus/variable pay, provident fund, and gratuity. The document notes that companies can add or delete any allowance based on their income tax practices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Indian Ctc-Breakup

Indian Ctc-Breakup

Uploaded by

Vasanth Kumar V0 ratings0% found this document useful (0 votes)

39 views1 pageThe document outlines the breakdown of various components that make up the total cost to company (CTC) for metro and non-metro employees. The CTC for both is Rs. 475,000 and includes allowances such as basic pay, house rent allowance, special allowance, education allowance, conveyance allowance, medical allowance, additional allowance, leave travel allowance, bonus/variable pay, provident fund, and gratuity. The document notes that companies can add or delete any allowance based on their income tax practices.

Original Title

Indian ctc-breakup

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document outlines the breakdown of various components that make up the total cost to company (CTC) for metro and non-metro employees. The CTC for both is Rs. 475,000 and includes allowances such as basic pay, house rent allowance, special allowance, education allowance, conveyance allowance, medical allowance, additional allowance, leave travel allowance, bonus/variable pay, provident fund, and gratuity. The document notes that companies can add or delete any allowance based on their income tax practices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

39 views1 pageIndian Ctc-Breakup

Indian Ctc-Breakup

Uploaded by

Vasanth Kumar VThe document outlines the breakdown of various components that make up the total cost to company (CTC) for metro and non-metro employees. The CTC for both is Rs. 475,000 and includes allowances such as basic pay, house rent allowance, special allowance, education allowance, conveyance allowance, medical allowance, additional allowance, leave travel allowance, bonus/variable pay, provident fund, and gratuity. The document notes that companies can add or delete any allowance based on their income tax practices.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 1

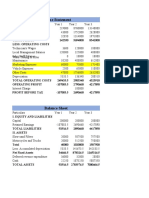

CTC BREAKUP METRO NON-Metro

Basic 166250 166250

HRA 83125 66500

Special Allowance 49875 49875

Education Allowance 2400 2400

Conveyance Allowance 9600 9600

Medical Allowance 15000 15000

Additional Allowance 70928 87553

LTA 16625 16625

Bonus / Variable Pay 33250 33250

PF 19950 19950

Gratutiy 7997 7997

TOTAL 475000 475000

You can add or delete any allowance based on the

income tax practices of the company.

You might also like

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- Indian CTC FormatDocument3 pagesIndian CTC FormatVasanth Kumar V0% (1)

- Solar PV Installer (Suryamitra)Document23 pagesSolar PV Installer (Suryamitra)Vasanth Kumar VNo ratings yet

- Corporation TaxDocument3 pagesCorporation TaxADITHYA KOVILINo ratings yet

- Airtel Case STUDYDocument5 pagesAirtel Case STUDYSrutiNo ratings yet

- Consolidated Steels LTD As On 31/12/1982: Balance Sheet ofDocument9 pagesConsolidated Steels LTD As On 31/12/1982: Balance Sheet oftrivedinaveenNo ratings yet

- Cogs 3. P&L A/c: Particulars Amount RevenueDocument1 pageCogs 3. P&L A/c: Particulars Amount RevenueMaryNo ratings yet

- Equity 2020-2021Document1 pageEquity 2020-2021saurav rajNo ratings yet

- BlankDocument3 pagesBlankcs.yashvee12No ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Pension CaclulatorDocument3 pagesPension CaclulatorKhizer HayatNo ratings yet

- Service Conditions Part 1Document38 pagesService Conditions Part 1Vincent VIJAY RAJ KNo ratings yet

- Ytd Tax CertificateDocument1 pageYtd Tax CertificateN'nodi jenniferNo ratings yet

- Muhammadkhairulridha - 071.018.076 - Tugas Ekomig3Document3 pagesMuhammadkhairulridha - 071.018.076 - Tugas Ekomig3Fahrul mahanggiNo ratings yet

- SLMPD 2018 Proposed BudgetDocument91 pagesSLMPD 2018 Proposed BudgetGRAMNo ratings yet

- BAV AssignmentDocument8 pagesBAV AssignmentTanisha GuptaNo ratings yet

- 90 Paul and Palu LTDDocument3 pages90 Paul and Palu LTDSumaiya Iqbal78No ratings yet

- 12222Document9 pages12222Alexander QuemadaNo ratings yet

- Template M/S Laxmi Enterprises Dabur: Gross Profit (Income)Document10 pagesTemplate M/S Laxmi Enterprises Dabur: Gross Profit (Income)trisanka banikNo ratings yet

- Northwestern Lehigh School District Revenue Budget ComparisonDocument6 pagesNorthwestern Lehigh School District Revenue Budget ComparisonNorthwesternCARESNo ratings yet

- Sub Total: ID Name Designation DepartmentDocument6 pagesSub Total: ID Name Designation DepartmentMd.Amir hossain khanNo ratings yet

- Vibrant Admission GuidanceDocument3 pagesVibrant Admission Guidancebunnycrazy338No ratings yet

- ROI CALCULATION - MBA MKT 1 - Shivam JadhavDocument4 pagesROI CALCULATION - MBA MKT 1 - Shivam JadhavShivam JadhavNo ratings yet

- Provision For Fringe Benefit Tax Provision For Fradulent EncashmentDocument20 pagesProvision For Fringe Benefit Tax Provision For Fradulent EncashmentSwapnil GadewarNo ratings yet

- A Arumugam SCRDocument5 pagesA Arumugam SCRFCI DONo ratings yet

- CTC Details With Present Employer: SR - No Component Monthly Amount TotalDocument1 pageCTC Details With Present Employer: SR - No Component Monthly Amount TotalRavi Shankar ChakravortyNo ratings yet

- Indigo-Leverage AnalysisDocument3 pagesIndigo-Leverage Analysisgokul9rovNo ratings yet

- Offer Letter Faizan (RT)Document2 pagesOffer Letter Faizan (RT)mfa_786No ratings yet

- EEV ANALYSIS BVDocument10 pagesEEV ANALYSIS BVcyics TabNo ratings yet

- Profit & Loss Detail: DescriptionDocument18 pagesProfit & Loss Detail: DescriptionAde PardedeNo ratings yet

- SchoolsandSchool BasedDetailbyFundDocument236 pagesSchoolsandSchool BasedDetailbyFundValerie F. LeonardNo ratings yet

- Fathom Example Import FileDocument4 pagesFathom Example Import FileSaravananNo ratings yet

- Tax Ek Prem KathaDocument267 pagesTax Ek Prem Kathasahil lathiNo ratings yet

- Give GeniousDocument7 pagesGive Geniousdamof62802No ratings yet

- Prabhat Cables 2024Document4 pagesPrabhat Cables 2024jagraj SinghNo ratings yet

- HO Maintenance OPEX 2025BP Vs 2024RE Dd.11.15Document60 pagesHO Maintenance OPEX 2025BP Vs 2024RE Dd.11.15Vhic EstefaniNo ratings yet

- CTC CalculatorDocument2 pagesCTC CalculatorPiyush Kundra100% (2)

- Name: Priya Sharma Client Code: 56644553 Pan No: Dlips5003K Pin: 226005Document1 pageName: Priya Sharma Client Code: 56644553 Pan No: Dlips5003K Pin: 226005Aditya SharmaNo ratings yet

- Quikchex 2019 Tax Comparison PDFDocument5 pagesQuikchex 2019 Tax Comparison PDFGMFL MumbaiNo ratings yet

- Audi Prices of Q5 AttyDocument1 pageAudi Prices of Q5 AttyjohnynellickalNo ratings yet

- Balance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsDocument4 pagesBalance Sheet As at 31St March, 2010 Amount Amount 2009-2010 2008-2009 Rs. P. Rs. P. Sources of FundsCA Saurav Kumar AgrawalNo ratings yet

- Cash Flow and RatiosDocument8 pagesCash Flow and RatiosAnindya BasuNo ratings yet

- budget of education instituteDocument3 pagesbudget of education instituteHassan JavedNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Schoolwide Budget Ead 510Document11 pagesSchoolwide Budget Ead 510api-515615857100% (1)

- Business Plan For Biofuel Industry (Briquette)Document7 pagesBusiness Plan For Biofuel Industry (Briquette)Sudarshan GovindarajanNo ratings yet

- WK1 - MTTI Budgets Pack ExcelDocument7 pagesWK1 - MTTI Budgets Pack ExcelBinay BhandariNo ratings yet

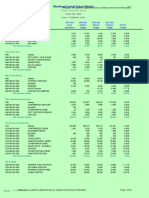

- Schedules To Profit and Loss Account For The Year Ended 31.03.2007Document20 pagesSchedules To Profit and Loss Account For The Year Ended 31.03.2007api-3708931100% (2)

- Salary Annexure-For CandidatesDocument3 pagesSalary Annexure-For CandidatesDuke RVSNo ratings yet

- Shashaank Industries LTD - Session 3Document6 pagesShashaank Industries LTD - Session 3Srijan SaxenaNo ratings yet

- Book1 (Version 1) .XLSBDocument3 pagesBook1 (Version 1) .XLSBNajmul HussainNo ratings yet

- Renu NDocument1 pageRenu NRenu AmbaniNo ratings yet

- Worksheet Chemalite (B)Document3 pagesWorksheet Chemalite (B)Rupak RajaramanNo ratings yet

- Mileston 3 - FinancialDocument7 pagesMileston 3 - FinancialCANTELA, MENCHIE L.No ratings yet

- Pay Scales of Medical DoctorsDocument5 pagesPay Scales of Medical DoctorsCol K D Menon0% (2)

- Riverhead Central School District 2021-2022 Proposed BudgetDocument16 pagesRiverhead Central School District 2021-2022 Proposed BudgetRiverheadLOCALNo ratings yet

- Om - Monthly ReportDocument81 pagesOm - Monthly ReportRajeshbabhu Rajeshbabhu100% (1)

- Shares Working SheetDocument12 pagesShares Working SheetMudassar PatelNo ratings yet

- Less: Variable Less: Variable Less: VariableDocument16 pagesLess: Variable Less: Variable Less: VariableHarshithaNo ratings yet

- Problem 1 Trekker Company: Qa7 Installment SalesDocument7 pagesProblem 1 Trekker Company: Qa7 Installment SalesCiarwena PangcogaNo ratings yet

- Tasl - TBDocument9 pagesTasl - TBcmakuldeepNo ratings yet

- John Rhoton's Finance Excel Notes - 2010Document18 pagesJohn Rhoton's Finance Excel Notes - 2010MoatasemMadianNo ratings yet

- Quickie Load Estimate Form: Project NameDocument1 pageQuickie Load Estimate Form: Project NameVasanth Kumar VNo ratings yet

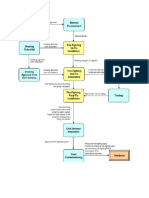

- FPS Project Flow DiagramDocument1 pageFPS Project Flow DiagramVasanth Kumar VNo ratings yet

- Solar Power Generating System Calculation - ChennaiDocument1 pageSolar Power Generating System Calculation - ChennaiVasanth Kumar VNo ratings yet

- LED Savings Calculator v1bDocument3 pagesLED Savings Calculator v1bVasanth Kumar VNo ratings yet

- Depreciation Calculation in ExcelDocument8 pagesDepreciation Calculation in ExcelVasanth Kumar VNo ratings yet

- LPG GAS Bank Calculation SampleDocument1 pageLPG GAS Bank Calculation SampleVasanth Kumar VNo ratings yet

- Basics of Rooftop SolarDocument6 pagesBasics of Rooftop SolarVasanth Kumar VNo ratings yet

- Organization Chart - SampleDocument1 pageOrganization Chart - SampleVasanth Kumar VNo ratings yet

- 3kw OffDocument11 pages3kw OffVasanth Kumar VNo ratings yet

- Total Volatile Organic CompoundsDocument6 pagesTotal Volatile Organic CompoundsVasanth Kumar VNo ratings yet

- Big Bang: N Solar Single Line DiagramDocument1 pageBig Bang: N Solar Single Line DiagramVasanth Kumar V0% (1)

- Monthly Personal BudgetDocument12 pagesMonthly Personal BudgetVasanth Kumar VNo ratings yet