W-2 Form George PDF

W-2 Form George PDF

Uploaded by

George LucasCopyright:

Available Formats

W-2 Form George PDF

W-2 Form George PDF

Uploaded by

George LucasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

W-2 Form George PDF

W-2 Form George PDF

Uploaded by

George LucasCopyright:

Available Formats

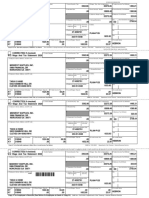

2019 W-2 and EARNINGS SUMMARY

Employee Reference Copy This blue section is your Earnings Summary which provides more detailed

W-2 Wage and Tax

Statement

Copy C for employee’srecords.

OMB No.

2019 1545-0008

information on the generation of your W-2 statement and W-4 profile. The

reverse side includes instructions and other general information.

d Control number Dept. Corp. Employer use only

290288 CHIC/5EZ 201050 T 203

c Employer’s name, address, and ZIP code

GREAT LAKES SERVICES 1

LLC

1255 FOURIER DRIVE # 201

MADISON WI 53717

1. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch #03110

Wages, Tips, other Social Security Medicare OH. State Wages,

e/f Employee’s name, address, and ZIP code Compensation Wages Wages Tips, Etc.

Box 1 of W-2 Box 3 of W-2 Box 5 of W-2 Box 16 of W-2

LUCAS L GEORGE RAUL

4600 MILAN ROAD Gross Pay 4,778.55 4,778.55 4,778.55 4,778.55

SANDUKSY OH 44870 Less Exempt Wages N/A 4,778.55 4,778.55 N/A

Reported W-2 Wages 4,778.55 0.00 0.00 4,778.55

b Employer’s FED ID number a Employee’s SSA number

27-1371313 APPLIED FOR

1 Wages, tips, other comp. 2 Federal income tax withheld

4778.55 360.35

3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld

7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 2. Employee Current W-4 Profile. To make changes, file a new W-4 with your payroll department.

11 Nonqualified plans 12a See instructionsfor box 12

12b

LUCAS L GEORGE RAUL Social Security Number: APPLIED FOR

14 Other

12c 4600 MILAN ROAD Taxable Marital Status: SINGLE

12d SANDUKSY OH 44870 Exemptions/Allowances:

____________________

13 Stat emp. Ret. plan 3rd party sick pay FEDERAL: 1

STATE: 1

15 State Employer’s state ID no. 16 State wages, tips, etc.

OH 52-7599690 4778.55

17 State income tax 18 Local wages, tips, etc.

93.28

19 Local income tax 20 Locality name 2019 ADP, LLC

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

4778.55 360.35 4778.55 360.35 4778.55 360.35

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

290288 CHIC/5EZ 201050 T 203 290288 CHIC/5EZ 201050 T 203 290288 CHIC/5EZ 201050 T 203

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

GREAT LAKES SERVICES GREAT LAKES SERVICES GREAT LAKES SERVICES

LLC LLC LLC

1255 FOURIER DRIVE # 201 1255 FOURIER DRIVE # 201 1255 FOURIER DRIVE # 201

MADISON WI 53717 MADISON WI 53717 MADISON WI 53717

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

27-1371313 APPLIED FOR 27-1371313 APPLIED FOR 27-1371313 APPLIED FOR

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 9 10 Dependent care benefits 9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

14 Other 12b 14 Other 12b 14 Other 12b

12c 12c 12c

12d 12d 12d

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

LUCAS L GEORGE RAUL LUCAS L GEORGE RAUL LUCAS L GEORGE RAUL

4600 MILAN ROAD 4600 MILAN ROAD 4600 MILAN ROAD

SANDUKSY OH 44870 SANDUKSY OH 44870 SANDUKSY OH 44870

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

OH 52-7599690 4778.55 OH 52-7599690 4778.55 OH 52-7599690 4778.55

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

93.28 93.28 93.28

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

Federal Filing Copy OH.State Reference Copy OH.State Filing Copy

W-2 Wage and Tax

Statement

Copy B to be filed with employee’s

OMB

2019 W-2

No. 1545-0008

Federal IncomeTax Return.

Wage and Tax

Statement

Copy 2 to be filed with employee’sState IncomeTax Return.

2019 W-2

OMB No. 1545-0008

Wage and Tax

Statement OMB

2019

Copy 2 to be filed with employee’sState IncomeTax Return.

No. 1545-0008

You might also like

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- IRS Form W2Document1 pageIRS Form W2nurulamin00023No ratings yet

- W 2Document3 pagesW 2lysprr33% (3)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- 2019 W2 2020120235817 PDFDocument3 pages2019 W2 2020120235817 PDFJamyia Nowlin Kirts100% (3)

- MyPay PDFDocument1 pageMyPay PDFPaul BeznerNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (3)

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- W-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceDocument2 pagesW-2 Wage and Tax Statement: This Information Is Being Furnished To The Internal Revenue ServiceJunk BoxNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- StubsDocument2 pagesStubsAnonymous 8C2bCutL0100% (2)

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (2)

- AjaxDocument2 pagesAjaxaccount.enquiry6770No ratings yet

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Javier A Valdez 2107 BAMBOO ST. Mesquite TX 75150Document2 pagesJavier A Valdez 2107 BAMBOO ST. Mesquite TX 75150javiercreatesNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Think Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Document1 pageThink Together 2101 E 4Th ST B Suite 200 Santa Ana, Ca 92705Humayon MalekNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- TranscriptDocument6 pagesTranscriptjohn doeNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document4 pagesWage and Tax Statement: OMB No. 1545-0008jgoldson235100% (1)

- W-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument1 pageW-2 Wage and Tax Statement: Copy B-To Be Filed With Employee's FEDERAL Tax ReturnjeminaNo ratings yet

- Filename PDFDocument3 pagesFilename PDFIvette PizarroNo ratings yet

- Nolasco W2Document2 pagesNolasco W2MARCOS NOLASCONo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008SuheilNo ratings yet

- Elina Shinkar w2 2014Document2 pagesElina Shinkar w2 2014api-318948819No ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- W 2Document3 pagesW 2Bar ChenNo ratings yet

- 2021 Turbo Tax ReturnDocument10 pages2021 Turbo Tax ReturnIvette Hoffman75% (4)

- 2020 TaxReturnDocument12 pages2020 TaxReturnAdam Mason67% (3)

- Harvey Metabank Jan22Document1 pageHarvey Metabank Jan22Mark Dewey0% (1)

- Wage and Tax Statement: OMB No. 1545-0008Document7 pagesWage and Tax Statement: OMB No. 1545-0008LUZILLE MEDINANo ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Profit Or: Loss From BusinessDocument2 pagesProfit Or: Loss From BusinessBryan Pasqueci100% (2)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Notice To Employee: WWW - Irs.gov/efileDocument2 pagesNotice To Employee: WWW - Irs.gov/efileRODRIGO GRIJALBA CABREJOSNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin75% (4)

- File by Mail Instructions For Your 2019 Federal Tax ReturnDocument7 pagesFile by Mail Instructions For Your 2019 Federal Tax ReturnKevin Osorio100% (2)

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocument2 pagesU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- Tax FormsDocument2 pagesTax Formswilliam schwartz50% (2)

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- Wage and Tax Statement: OMB No. 1545-0008Document6 pagesWage and Tax Statement: OMB No. 1545-0008jacqueline corral0% (1)

- W2 Taco BellDocument3 pagesW2 Taco BellJuan Diego Velandia DuarteNo ratings yet

- File by Mail Instructions For Your Federal Amended Tax ReturnDocument14 pagesFile by Mail Instructions For Your Federal Amended Tax ReturnRyan Mayle100% (1)

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronNo ratings yet

- Attention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerDocument11 pagesAttention:: Employer W-2 Filing Instructions and Information WWW - Socialsecurity.gov/employerhossain ronyNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- WCEihh 05607 H 434910223005072219102Document2 pagesWCEihh 05607 H 434910223005072219102whitneydemetria007No ratings yet

- Adp w2 2019 TemplateDocument1 pageAdp w2 2019 Templatetokahontas85No ratings yet

- J0 Pihh 184 H 254120213617160102202Document2 pagesJ0 Pihh 184 H 254120213617160102202swhb5b6pthNo ratings yet

- Consent of Directors in Lieu of MeetingDocument1 pageConsent of Directors in Lieu of MeetingLegal FormsNo ratings yet

- Deccan Corporate: GSTIN: 36BRGPB7443E1Z0Document1 pageDeccan Corporate: GSTIN: 36BRGPB7443E1Z0alrehaan xeroxNo ratings yet

- Fairdale Farms, Inc., Plaintiff-Appellant-Cross-Appellee v. Yankee Milk, Inc. and Regional Cooperative Marketing Agency, Inc., Defendants-Appellees-Cross-Appellants, 635 F.2d 1037, 2d Cir. (1980)Document13 pagesFairdale Farms, Inc., Plaintiff-Appellant-Cross-Appellee v. Yankee Milk, Inc. and Regional Cooperative Marketing Agency, Inc., Defendants-Appellees-Cross-Appellants, 635 F.2d 1037, 2d Cir. (1980)Scribd Government DocsNo ratings yet

- DFDFDocument2 pagesDFDFVel JuneNo ratings yet

- 13 Improper-Venue-Is-Not-JurisdictionalDocument5 pages13 Improper-Venue-Is-Not-JurisdictionalTien BernabeNo ratings yet

- Supreme Court Decision WP 1049Document32 pagesSupreme Court Decision WP 1049HS100% (1)

- 1993-G.O.Ms - No.23 dt.10.02.1993Document8 pages1993-G.O.Ms - No.23 dt.10.02.1993kamalgk100% (1)

- 684 RudyDocument1 page684 RudyBeverlyHillsWeeklyNo ratings yet

- Sale by A Nonowner or by One Having Voidable TitleDocument3 pagesSale by A Nonowner or by One Having Voidable TitleKristine Allen CabralesNo ratings yet

- Katarungang BarangayDocument3 pagesKatarungang BarangayCharina May Lagunde-SabadoNo ratings yet

- Adr NotesDocument7 pagesAdr NotesMa. Princess CongzonNo ratings yet

- Caneda vs. CADocument8 pagesCaneda vs. CAShiela PilarNo ratings yet

- Nazareth v. VillarDocument27 pagesNazareth v. VillarErin GamerNo ratings yet

- Case 125,127&132Document6 pagesCase 125,127&132Davenry AtgabNo ratings yet

- Philippine National Police: Id Application Form (PNP Dependent)Document1 pagePhilippine National Police: Id Application Form (PNP Dependent)SpineClarmenNo ratings yet

- Instructions For Form 8962Document20 pagesInstructions For Form 8962HNo ratings yet

- Villanueva vs. Philippine Daily Inquirer PDFDocument7 pagesVillanueva vs. Philippine Daily Inquirer PDFMia CudalNo ratings yet

- C. Bloomberry Resorts and Hotels Inc. vs. Bureau of Internal RevenueDocument2 pagesC. Bloomberry Resorts and Hotels Inc. vs. Bureau of Internal RevenueJoieNo ratings yet

- The Seeds Act, 1988Document6 pagesThe Seeds Act, 1988Raj K AdhikariNo ratings yet

- Family Code Art. 73-80Document19 pagesFamily Code Art. 73-80Jade Palace TribezNo ratings yet

- Ramos Vs CA 108 Scra 728Document3 pagesRamos Vs CA 108 Scra 728Nic NalpenNo ratings yet

- Controlling Time and Costs ReportDocument20 pagesControlling Time and Costs ReportErnesto Gastón De MarsilioNo ratings yet

- Bolos v. BolosDocument6 pagesBolos v. BolosRostum AgapitoNo ratings yet

- Peoples Bank & Trust Co. v. Tambunting, 42 SCRA 119Document3 pagesPeoples Bank & Trust Co. v. Tambunting, 42 SCRA 119Emil BautistaNo ratings yet

- Cred 1Document20 pagesCred 1It'sRalph MondayNo ratings yet

- 5 MAJOR GENERAL CARLOS F. GARCIA, AFP (RET.) vs. THE EXECUTIVE SECRETARY, Representing The OFFICE OF THE PRESIDENT THE SECRETARY OF NATIONALDocument2 pages5 MAJOR GENERAL CARLOS F. GARCIA, AFP (RET.) vs. THE EXECUTIVE SECRETARY, Representing The OFFICE OF THE PRESIDENT THE SECRETARY OF NATIONALNorbert DiazNo ratings yet

- Employees' Provident FundDocument17 pagesEmployees' Provident FundSūPërvv BâJpàï100% (1)

- 03 - de Guzman Vs de DiosDocument1 page03 - de Guzman Vs de DiosMary Grace Baynosa-CoNo ratings yet

- Project On Consumer ProtectionDocument10 pagesProject On Consumer ProtectionPramod YadavNo ratings yet

- Atelier Luxury Group LLC v. Zara USA, Inc.Document25 pagesAtelier Luxury Group LLC v. Zara USA, Inc.The Fashion LawNo ratings yet