Health Products ITGI

Health Products ITGI

Uploaded by

Soumitra PaulCopyright:

Available Formats

Health Products ITGI

Health Products ITGI

Uploaded by

Soumitra PaulOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Health Products ITGI

Health Products ITGI

Uploaded by

Soumitra PaulCopyright:

Available Formats

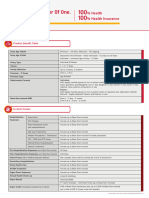

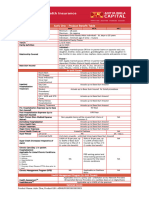

INDIVIDUAL HEALTH PROTECTOR FAMILY HEALTH PROTECTOR HEALTH PROTECTOR PLUS CRITICAL ILLNESS BENEFIT SWASTHYA RAKSHA BIMA

HEALTH PROTECTOR PLUS CRITICAL ILLNESS BENEFIT SWASTHYA RAKSHA BIMA SWASTHYA KAVACH POLICY

Proposer’s Age: Min.18 years to Max.65 years

Min Entry Age Max Entry Agea.

Other Insured Members: Min.90 days to Max.65 years

Entry Age The maximum entry age is 65 years Maximum entry age is 65 years. Maximum entry age is 65 years Child – 3 years Child – 23 years Adult The maximum entry age is 65 years

(Children up to 23 years)

– 18 years Adult - 65 years

2 lacs SA with 1 lac deductible to 25 lacs SA with 5

Sum Insured options 50000 to 20 lacs 1.5 Lacs to 30 lacs Rs 1 lac to 1 crore 1lac, 2lac, 3lac, 4lac, 5lac 1 Lac to 5 lacs

lacs deductible

Normal room 1.0% of Basic Sum Insured per day.

Renewability Life Long Life Long High coverage at low premium 25 critical illnesses are covered: Life Long

ICU/ITU 2.0% of Basic Sum Insured per day.

Pre-Hospitalization for 30 days , Actual subject to

ILNESSES : Cancer of specified severity, Kidney failure

Room Rent (including Boarding and Nursing expense overall limit of Sum Insured No Room Rent Capping on Sum Insured 3 Lakh and

No Room Rent capping on Sum Insured 5 lacs above Daily allowance up to a maximum of Rs. 1,000 per day requiring regular dialysis, Multiple Sclerosis with

etc. above

persisting symptoms,

Post Hospitalization Up to 7% of Hospitalization

ILNESSES : Motor Neuron Disease with Permanent

Daily Cash Benefit equivalent to 0.20% of the sum Ambulance charges are covered up to 0.75% of the expenses (excluding Room Rent) incurred during Renewability: There is no age limit for renewal of the

Medical Practitioner/ Anesthetist, Consultant fees. Symptoms, End Stage Lung Failure, End Stage Liver

insured per day, for the duration of hospitalization. sum insured or Rs. 2500, whichever is lower. period up to 30 days after Hospitalization subject to policy.

Failure, Primary (Idiopathic) Pulmonary Hypertension,

maximum of Rs.7500/-

AYUSH Cover Alternative Treatments such as

Ambulance charges, subject to a limit of 1% of the Option to convert to standard health policy with ILNESSES : Benign Brain Tumor, Parkinson’s Disease

Pre-hospitalization and post-hospitalization of 45 days ‘Ayurveda, Yoga and Naturopathy, Unani, Siddha and

sum insured or Rs. 2500/- whichever is less for each continuity of benefits after 04 continuous years with Before The Age Of 50 Years, Alzheimer's Disease No medical checkup required up to 60 years.

and for a period of 60 days. Homeopathy systems covered up to SI including Pre &

hospitalization. us. Before The Age Of 50 Years

Post Hospitalization Expenses

SURGERIES : Major Organ (Heart/ Lung/ Liver/ Kidney Daily allowance – Policyholders are liable to receive a

Pre and Post Hospitalization expenses for maximum Day care surgeries for 161 surgical procedures are

Waiver of Deductible in case of change/loss of job /Pancreas) or Human Bone Marrow Transplant, Open Day Care Procedures 161 Listed day care procedures daily allowance of up to ₹150 for the duration of their

period of 45 & 60 days respectively. covered without 24 hours of hospitalization.

heart replacement or repair of heart valves hospitalization.

Ayurveda and/or Homeopathy and/or Unani

Health Check up expenses - once at the end of 4 claim Cost of health checkups up to 1% of the basic sum hospitalization expenses incurred in Government Daily Allowance ₹ 150 per day for the entire duration

SURGERIES : Open chest CABG, Surgery Of Aorta Domiciliary hospitalization expenses

free years block @ 1.0% of average Basic Sum Insured. insured during the block of 4 claim free policies. recognized hospitals. Coverage also includes pre- of Hospitalization

hospitalization and post hospitalization expenses.

MEDICAL EVENT : Stroke resulting in permanent

Pre and Post Hospitalization expenses for maximum

Ayurvedic and Homeopathic hospitalization Ambulance Charges as per actual or Rs.3000/- (Three symptoms, Permanent Paralysis of Limbs, Myocardial Ambulance Charges ₹ 750 per claim or the actual;

Vaccination expenses are covered. period of 30 & 30 days for basic and 60 days for wider

treatments covered up to Sum Insured Thousand) per claim; whichever is less. Infarction (First Heart Attack of specified severity), whichever is lower

plan for respectively.

Third Degree Burns

An additional Daily Allowance amount equivalent to

Cumulative bonus increased by 5% of the basic sum Emergency assistance services to insured persons MEDICAL EVENT : Loss of Speech, Blindness, Loss of

0.10% of the Sum Insured for the duration of Donor Expenses Donor expenses excluding

insured subject to a max of 50% for each claim free during travel. It provides this service at no additional Limbs, Deafness, Coma of Specified Severity, Major Emergency Assistance Services at no additional cost

Hospitalization towards defraying of miscellaneous Ambulance, Pre & Post hospitalization expenses

year of insurance. cost. Head Trauma, Muscular Dystrophy

expenses.

The critical illness, medical event and surgical Domiciliary Hospitalization Reasonable and

Hospitalization more than 12 hrs but less than 24 hrs Income tax benefits under section 80D of the Indian Income tax benefits under section 80D of the Indian

Room rent expenses are covered. procedure first commenced atleast 30 days after the Customary Charges subject to a maximum 20% of SI

covered (Up to 50% of entitled room rent/day). Tax Act, 1961 Tax Act, 1961.

commencement of the policy period. (excludes Daily Allowance, Ambulance Charges etc.)

SALIENT FEATURES Reinstatement (optional) After occurrence of a claim,

Emergency Assistance Service Medical consultation, the basic sum insured will be reinstated by the

Cost of vaccination at the end of every block of two evaluation and referral, Emergency medical amount of the claim after charging appropriate

policy period of 365 (three hundred & sixty five) days, Hospital registration and service charges during evacuation, Emergency cash coordination, Medical Insured person survives for a minimum of 28 days premium. So that full basic sum insured is available

No medical checkup required up to 60 years.

subject to a maximum of 10% of the total premium hospitalization are covered. repatriation, Transportation to join patient, Care from the date of diagnosis. for the policy period

paid. and/or transportation of minor children, Emergency Reinstatement of Basic Sum Insured will be to the

message transmission, Return of mortal remains extent of claim amount paid.

Emergency Assistance Service Medical consultation,

evaluation and referral, Emergency medical

Ayurveda, Homoeopathy, Unani and Sidha

No medical check-up upto 50 years, subject to evacuation, Emergency cash coordination, Medical Income tax benefits under section 80D of the Indian

161 listed Day care medical surgeries. hospitalization expenses are covered up to a specified

proposal form having no adverse medical declaration. repatriation, Transportation to join patient, Care Tax Act, 1961.

limits.

and/or transportation of minor children, Emergency

message transmission, Return of mortal remains

Sublimit

(Refer policywordings) Applicable for Cataract, Piles,

Domiciliary hospitalization is covered up to a Fistula, Fissure, Tonsillitis, Sinusitis

Emergency Assistance Services at no additional cost maximum aggregate sub-limit of 20% of the basic Benign Prostatic Hypertrophy, Hernia, Knee/Hip Joint

sum insured. replacement, Cancer, renal failure, Appendicitis, Gall

Bladder stones and Hysterectomy

Co-payment : Zone A Cities-South

Bonus: cumulative bonus of 5% of the basic sum 35 % in Chennai, Bangalore, Hyderabad,

Lifelong Renewal

insured at each renewal following a claim free year. Visakhapatnam, Vijaywada

Reinstatement of Sum Insured The basic sum insured

Sum Insured for listed Critical illnesses can be

in the policy can be restored or reinstated by paying

doubled at a very competitive rate.

appropriate premiums to the insurance provider.

No medical checkup required up to 60 years. No medical checkup required up to 60 years.

Income tax benefits under section 80D of the Indian Income tax benefits under section 80D of the Indian

Tax Act, 1961. Tax Act, 1961.

You might also like

- Gallbladder Natural Therapy PDFDocument14 pagesGallbladder Natural Therapy PDFSoumitra Paul100% (2)

- AROGYA SHIELD Brochure NEW 28-10-2021 V09Document28 pagesAROGYA SHIELD Brochure NEW 28-10-2021 V09Eureka InfosysNo ratings yet

- CARE V2 Detailed PRESENTATIONDocument33 pagesCARE V2 Detailed PRESENTATIONPritam PatilNo ratings yet

- Arogya Shield Single Pager - V05Document2 pagesArogya Shield Single Pager - V05Yogesh SharmaNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureAarti A BhardwajNo ratings yet

- Module 2 Know Your TRADsDocument11 pagesModule 2 Know Your TRADsJun Reyes RamirezNo ratings yet

- Care Freedom For DiabtiesDocument25 pagesCare Freedom For DiabtiesAgile ServicesNo ratings yet

- Annexure III - Product Benefit Table - Activ One - VYTL-V1Document2 pagesAnnexure III - Product Benefit Table - Activ One - VYTL-V1vaibhavp23101993No ratings yet

- ReAssure 2.0 - Product NoteDocument5 pagesReAssure 2.0 - Product Notearindamta1211010No ratings yet

- Activ One Max Product Benefit TableDocument11 pagesActiv One Max Product Benefit Tablesaisuraj.arNo ratings yet

- Care Supreme-Senior Citizen UpdatedDocument9 pagesCare Supreme-Senior Citizen Updateddimplemakwana28No ratings yet

- Revised Super Health - Quick Reference - 03012024-V3Document5 pagesRevised Super Health - Quick Reference - 03012024-V3mangalam.vastu20No ratings yet

- Product Summary by DerekDocument6 pagesProduct Summary by Derekarief shah amranNo ratings yet

- HEALTH INFINITY Plan ONE PagerDocument3 pagesHEALTH INFINITY Plan ONE PagerVikas SharmaNo ratings yet

- Star Fho One Page Feb 2020Document2 pagesStar Fho One Page Feb 2020suryaNo ratings yet

- MMP LeafletDocument5 pagesMMP LeafletGyanesh BhujadeNo ratings yet

- FHO One Pager Version 1.5 September 2021Document1 pageFHO One Pager Version 1.5 September 2021manu.vm1990No ratings yet

- Care Supreme One PagerDocument3 pagesCare Supreme One PagersamsunggranddousromNo ratings yet

- Comparison Sheet 23-05-2023Document6 pagesComparison Sheet 23-05-2023jyotishivkaniNo ratings yet

- Comparision 11-09-2024Document3 pagesComparision 11-09-2024reezarajuNo ratings yet

- Young Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Document1 pageYoung Star Insurance Policy - One Pager - Version - 1.0 - (Apr) - (2021)Manjunatha GayakwadNo ratings yet

- Copression Between Comprhensive & Care PDFDocument1 pageCopression Between Comprhensive & Care PDFsatishlad1288No ratings yet

- Brochure With PolicyDocument2 pagesBrochure With Policysanthoshreddyb986No ratings yet

- POS Young Star Insurance PolicyDocument1 pagePOS Young Star Insurance Policysaisandeep9967No ratings yet

- Comparison Quote - GPADocument7 pagesComparison Quote - GPAvisheshNo ratings yet

- Young Star - One Pager - Version 1.2 - August 2021Document1 pageYoung Star - One Pager - Version 1.2 - August 2021Satya ArchangelNo ratings yet

- Care Supreme - BrochureDocument4 pagesCare Supreme - BrochureVivek HamseNo ratings yet

- RB Health Plan One PagerDocument2 pagesRB Health Plan One PagersoniNo ratings yet

- One Pager Super StarDocument2 pagesOne Pager Super Starpixel gamingNo ratings yet

- YSI One Pager Version 1.0 Feb 21Document2 pagesYSI One Pager Version 1.0 Feb 21Prasad.MNo ratings yet

- Young Star PolicyDocument1 pageYoung Star PolicyStar HealthNo ratings yet

- Young Star - One Pager - Version 1.4 - September 2021Document1 pageYoung Star - One Pager - Version 1.4 - September 2021ShihbNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithursvinciNo ratings yet

- One Pager For YOUNG STARDocument1 pageOne Pager For YOUNG STARVivek Sharma100% (1)

- Star Health Assure - One Pager - Version 1.0 - April - 2022Document2 pagesStar Health Assure - One Pager - Version 1.0 - April - 2022Rohit kanyal0% (1)

- Care Freedom One Pager-1Document2 pagesCare Freedom One Pager-1kkNo ratings yet

- L2-Care Global-1Document18 pagesL2-Care Global-1Become CreatorNo ratings yet

- Bandhan Bank Health Plus Portability 050723Document2 pagesBandhan Bank Health Plus Portability 050723goelrajivgNo ratings yet

- Benefits Silver GoldDocument4 pagesBenefits Silver GoldMitra LalNo ratings yet

- KHP - One Pager - Edge - 05112018-2-1Document2 pagesKHP - One Pager - Edge - 05112018-2-1Ashok JhamerNo ratings yet

- PNBGroup CareDocument2 pagesPNBGroup CareviktaconsultantNo ratings yet

- SBI General Arogya Plus Policy BrochureDocument8 pagesSBI General Arogya Plus Policy Brochureyashmpanchal3330% (1)

- Arogya Sanjeevani - One PagerDocument1 pageArogya Sanjeevani - One Pagernaval7301070% (1)

- Arogya Sanjeevani - One PagerDocument1 pageArogya Sanjeevani - One Pagernaval730107No ratings yet

- Care Senior Leaflet PDFDocument4 pagesCare Senior Leaflet PDFTejinderNo ratings yet

- Care Supreme PDFDocument23 pagesCare Supreme PDFVijay Kumar NandagiriNo ratings yet

- Star One Pager All ProductsDocument30 pagesStar One Pager All Productschalk.duster4learningNo ratings yet

- Prime Senior One Pager-1Document1 pagePrime Senior One Pager-1rizzbizzincNo ratings yet

- FHO One Pager Version 1.0 Oct 2020Document2 pagesFHO One Pager Version 1.0 Oct 2020Darsh TalwadiaNo ratings yet

- Arogya Sanjeevani - One Pager PDFDocument1 pageArogya Sanjeevani - One Pager PDFstar health Vadavalli50% (2)

- Arogya Sanjeevani - One Pager PDFDocument1 pageArogya Sanjeevani - One Pager PDFstar health Vadavalli50% (2)

- Arogya - One Pager - Version 1.0 April 2020Document1 pageArogya - One Pager - Version 1.0 April 2020Ari BanerjeeNo ratings yet

- HAAP QuoteDocument5 pagesHAAP QuoteRakesh VermaNo ratings yet

- ABHI Active OneDocument2 pagesABHI Active Onedevayani.inNo ratings yet

- Secure Your Family Against Uncertainties, With A Plan That Adjusts To Your NeedsDocument25 pagesSecure Your Family Against Uncertainties, With A Plan That Adjusts To Your Needsroxcox216No ratings yet

- HDFC Click2protectlife BrochureDocument25 pagesHDFC Click2protectlife BrochureaaaNo ratings yet

- Click 2 Protect Optima Secure BrochureDocument30 pagesClick 2 Protect Optima Secure Brochureabhiu1991No ratings yet

- Apollo Munich VS Icici LombardDocument12 pagesApollo Munich VS Icici LombardNavendu ShekharNo ratings yet

- Abhishek Kumar PPT Roll No 62Document28 pagesAbhishek Kumar PPT Roll No 62aksjsimrNo ratings yet

- Toroidal Ferrite Core TutorialsDocument12 pagesToroidal Ferrite Core TutorialsSoumitra PaulNo ratings yet

- Specialty Lubricants: Molykote HP-500 GreaseDocument2 pagesSpecialty Lubricants: Molykote HP-500 GreaseSoumitra PaulNo ratings yet

- Single Transistor LED FlasherDocument3 pagesSingle Transistor LED FlasherSoumitra PaulNo ratings yet

- Ashampoo LicensesDocument1 pageAshampoo LicensesSoumitra PaulNo ratings yet

- Lower Limb Trauma: Cast Application For Common FracturesDocument58 pagesLower Limb Trauma: Cast Application For Common FracturesdrusmanjamilhcmdNo ratings yet

- Care Map Template - FinalDocument6 pagesCare Map Template - FinalOcholi AttahNo ratings yet

- Modi Ed Percutaneous Kirschner Wire With Mutual Linking Technique in Proximal Humeral Fracture: A Technique Note and Preliminary ResultsDocument14 pagesModi Ed Percutaneous Kirschner Wire With Mutual Linking Technique in Proximal Humeral Fracture: A Technique Note and Preliminary ResultsRahul ReddyNo ratings yet

- CATHETERIZATIONDocument18 pagesCATHETERIZATIONZechariah NicholasNo ratings yet

- A Retrospect of The Special Issue Advances in OralDocument2 pagesA Retrospect of The Special Issue Advances in OralSalem RawashdahNo ratings yet

- Obesidad Cirugia EpilepsiaDocument7 pagesObesidad Cirugia Epilepsiacepdep orgNo ratings yet

- Guideline of Guidelines: A Review of Urological Trauma GuidelinesDocument9 pagesGuideline of Guidelines: A Review of Urological Trauma GuidelinesGamer MadaNo ratings yet

- Clinical Innovation CANT Identification Device in Orthodontics - Enabling Early Detection of Occlusal CANTDocument3 pagesClinical Innovation CANT Identification Device in Orthodontics - Enabling Early Detection of Occlusal CANTInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Quiz 2 - Healthcare Quality and Patient SafetyDocument2 pagesQuiz 2 - Healthcare Quality and Patient SafetySantosh JSENo ratings yet

- Jrsocmed00158 0011 PDFDocument6 pagesJrsocmed00158 0011 PDFWahyu SutrisnaNo ratings yet

- KOCH Benefits Manual AgnityDocument50 pagesKOCH Benefits Manual AgnitymayankNo ratings yet

- Impression Techniques For Occular Prosthesis - ReviewDocument9 pagesImpression Techniques For Occular Prosthesis - ReviewIJAR JOURNALNo ratings yet

- A Study of Patient Satisfaction Level in Inpatient Spine Department of A Tertiary Care Multi-Speciality HospitalDocument6 pagesA Study of Patient Satisfaction Level in Inpatient Spine Department of A Tertiary Care Multi-Speciality Hospitalimran_chaudhryNo ratings yet

- Kardex SituationsDocument6 pagesKardex Situationssara hamoudNo ratings yet

- 3-Cv Jan 2023Document2 pages3-Cv Jan 2023epc.techindiaNo ratings yet

- copaSKY - The Ultra ShortDocument16 pagescopaSKY - The Ultra ShortDan MunteanuNo ratings yet

- Ready Stock HRM CatalogueDocument4 pagesReady Stock HRM CatalogueAliabdulghaniNo ratings yet

- The Clerkship Guide 2020 Final Version PDFDocument263 pagesThe Clerkship Guide 2020 Final Version PDFأبو عبد الرحمن المحموديNo ratings yet

- Estimated Blood Loss in Craniotomy: Diana Sitohang, Rachmawati AM, Mansyur ArifDocument3 pagesEstimated Blood Loss in Craniotomy: Diana Sitohang, Rachmawati AM, Mansyur ArifJihadatul KholilahNo ratings yet

- Conservative Adult Treatment For Severe Class IIIDocument14 pagesConservative Adult Treatment For Severe Class IIIJULIAN ANDRES CAICEDO RIVERANo ratings yet

- Vital Root Resection in Severely Furcation-Involved Maxillary Molars: Outcomes After Up To 7 YearsDocument10 pagesVital Root Resection in Severely Furcation-Involved Maxillary Molars: Outcomes After Up To 7 YearshinanaimNo ratings yet

- Colostomy CareDocument34 pagesColostomy CareTolemre Emre100% (1)

- Surgical Approaches For Condylar Fractures Related To Facial Nerve Injury: Deep Versus Superficial DissectionDocument8 pagesSurgical Approaches For Condylar Fractures Related To Facial Nerve Injury: Deep Versus Superficial DissectionSaskia ParamitaNo ratings yet

- AEON Endostapler Technical Brochure - August 2020Document20 pagesAEON Endostapler Technical Brochure - August 2020Mohamed Ibrahim mansyNo ratings yet

- Anchorage of Partial Avulsion of The Heel Pad With Use of Multiple Kirschner WiresDocument4 pagesAnchorage of Partial Avulsion of The Heel Pad With Use of Multiple Kirschner WiresPrabhjeet singhNo ratings yet

- Gynacology Oncology Glubran2Document5 pagesGynacology Oncology Glubran2atheer gemitalyNo ratings yet

- NERVES StudyDocument10 pagesNERVES StudymohNo ratings yet

- Mathis Et. Al. Intraoperative MV & PPCDocument17 pagesMathis Et. Al. Intraoperative MV & PPCJun HungNo ratings yet

- Le Fort II Osteotomy and Modified Technique Presentation: Riginal RticleDocument6 pagesLe Fort II Osteotomy and Modified Technique Presentation: Riginal RticleSamuel SuazaNo ratings yet

- PRC-Cases Form 02Document5 pagesPRC-Cases Form 02Kceey CruzNo ratings yet