Q5. Adhere To The Norms Laid by Rbi

Q5. Adhere To The Norms Laid by Rbi

Uploaded by

Kushal MpvsCopyright:

Available Formats

Q5. Adhere To The Norms Laid by Rbi

Q5. Adhere To The Norms Laid by Rbi

Uploaded by

Kushal MpvsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Q5. Adhere To The Norms Laid by Rbi

Q5. Adhere To The Norms Laid by Rbi

Uploaded by

Kushal MpvsCopyright:

Available Formats

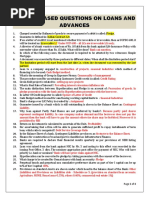

Q5.

ADHERE TO THE NORMS LAID BY RBI:

Accordingly, Bank has framed an OTS Scheme keeping in view of the guidelines

communicated by RBI. (i) Coverage of accounts: a) All loan accounts with original advance/

sanctioned limits up to Rs. 25,000/- which became doubtful and loss assets as on 30.9.2005.

b) All accounts, including Suit filed and Decreed Debts c) Accounts in all sectors irrespective

of the nature of the business /purpose. d) Cases of fraud, malfeasance are not covered.

(ii) Settlement formula: The amount that should be recovered as settlement amount under

these guidelines would be arrived at on the basis of holistic approach taking in to account the

age of the loan, nature of security available, present financial position of the borrower,

recovery received so far in the account, final impact on P& L account etc. However branches

shall make efforts to recover maximum possible in these accounts.

(iii) Payment: The amount of settlement arrived at as above, should normally be paid in one

lumpsum immediately i.e, within one month from the date of sanction. However, in deserving

cases, Branches may consider recovering the settlement amount in installments with a down

payment of at least 10% to be received at the time of settlement. The balance Syndicate Bank

amount should be recovered within one year from the date of sanction of OTS along with

DPI.

(iv) Scheme Period The Scheme will be in operation up to 31.12.2006.

(v) Fresh Loans: The borrowers whose loans are closed under this scheme would be eligible

for fresh loans. The respective authorities to take decision on fresh loan as per the delegated

powers keeping in view the viability of the proposed activity, income generation to meet the

loan installments and interest, borrower’s experience in the line etc. Bank’s Rights under the

provisions of SARFAESI Act: “The Securitisation and Reconstruction of Financial Assets

and Enforcement of Security interest Act 2002”(54/2002) has been effective from 21.6.2002,

the date on which the first Ordinance was promulgated and has received the President’s

assent on 17.12.2002.

You might also like

- Lgscas-Operational Guidelines - 17 08 2022Document5 pagesLgscas-Operational Guidelines - 17 08 2022Akhtar HussainNo ratings yet

- 28 March 2024 - DEA Fund Scheme - Finance 360Document17 pages28 March 2024 - DEA Fund Scheme - Finance 360Aniket RathoreNo ratings yet

- Letter No 864 Dated 03.03.2022 - Invocation of Education NCGTC & Skill Loan NPA AccountsDocument2 pagesLetter No 864 Dated 03.03.2022 - Invocation of Education NCGTC & Skill Loan NPA AccountsLkstoNo ratings yet

- Policy On Restructuring of Stressed AssetsDocument3 pagesPolicy On Restructuring of Stressed AssetsShantanuNo ratings yet

- It Can Be Identified 4 Basic Scenarios When Rescheduling A LoanDocument4 pagesIt Can Be Identified 4 Basic Scenarios When Rescheduling A LoanMd Salah Uddin100% (1)

- BRPD Circular No. 04 Large Loan Restructuring - 29.01.15Document5 pagesBRPD Circular No. 04 Large Loan Restructuring - 29.01.15M Tariqul Islam MishuNo ratings yet

- Special Accounts For Banking Firm - M.com (BM) II Sem. - DR - Rajeshri DesaiDocument5 pagesSpecial Accounts For Banking Firm - M.com (BM) II Sem. - DR - Rajeshri DesaiOMARA BMF-2024100% (1)

- Guideline On Computation of Debt-To-Income Ratio For Residential Property Loans 17 06 2021 0Document6 pagesGuideline On Computation of Debt-To-Income Ratio For Residential Property Loans 17 06 2021 0Bipin GooriahNo ratings yet

- Management of Credit Portfolio COVID Emergency Line of Credit SchemeDocument12 pagesManagement of Credit Portfolio COVID Emergency Line of Credit SchemeshaantnuNo ratings yet

- Model PolicyDocument18 pagesModel PolicyVaibhav DeoreNo ratings yet

- Credit Guarantee Scheme For Startups (CGSS)Document7 pagesCredit Guarantee Scheme For Startups (CGSS)narendar.1No ratings yet

- OTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDocument7 pagesOTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDigbalaya SamantarayNo ratings yet

- Philippine Deposit Insurance Corporation Act (RA 3591)Document35 pagesPhilippine Deposit Insurance Corporation Act (RA 3591)NHASSER PASANDALANNo ratings yet

- Uco BankDocument27 pagesUco BankLiji Jayan100% (2)

- RBI GUIDELINES ON Working CapitalDocument57 pagesRBI GUIDELINES ON Working Capitalashwini.krs80No ratings yet

- Sarfaesi ActDocument14 pagesSarfaesi ActAnup SinghNo ratings yet

- Revised Standard Operating ProcedureDocument6 pagesRevised Standard Operating ProcedureManmatha SahooNo ratings yet

- 'The Deposit Insurance and Credit Guarantee Corporation' (DICGC-India)Document5 pages'The Deposit Insurance and Credit Guarantee Corporation' (DICGC-India)Veeraswamy AmaraNo ratings yet

- Recovery Management CDR Bifr Oct, 13Document9 pagesRecovery Management CDR Bifr Oct, 13Amit GiriNo ratings yet

- Policy On Bank DepositsDocument6 pagesPolicy On Bank DepositsprojectbmsNo ratings yet

- Philippine Deposit Insurance Corporation: I. ObjectiveDocument5 pagesPhilippine Deposit Insurance Corporation: I. ObjectiveBilog Ang MundoNo ratings yet

- Rbi Circular Banning SDRDocument20 pagesRbi Circular Banning SDRRakesh SahuNo ratings yet

- SIB's Policy On Bank Deposits: PreambleDocument8 pagesSIB's Policy On Bank Deposits: PreamblenithiananthiNo ratings yet

- SFI Restructuring PolicyDocument3 pagesSFI Restructuring PolicygandhinagarsabarirajNo ratings yet

- Pricing of Liability Products Dec2021Document9 pagesPricing of Liability Products Dec2021Aditya SharmaNo ratings yet

- QuestionnaireDocument2 pagesQuestionnaireRudrakhya barikNo ratings yet

- OTS Scheme 2012Document6 pagesOTS Scheme 2012Neir KrNo ratings yet

- 17ubmn02 43490933Document4 pages17ubmn02 43490933Sethu RNo ratings yet

- Chapter - 9 Opening and Operating Bank AccountsDocument12 pagesChapter - 9 Opening and Operating Bank AccountsMd Mohsin Ali100% (1)

- Role of Commercial BanksDocument16 pagesRole of Commercial BanksJayant MishraNo ratings yet

- Overdraft Against Property Loan AgreementDocument56 pagesOverdraft Against Property Loan Agreementkirubaharan2022No ratings yet

- MFD Ots 07 Scheme Term LoanDocument19 pagesMFD Ots 07 Scheme Term LoansarojbagNo ratings yet

- 3 Credit Guarantee Scheme of Cgtmse and How It Is Implemented by Bank of BarodaDocument19 pages3 Credit Guarantee Scheme of Cgtmse and How It Is Implemented by Bank of BarodaAkshayNo ratings yet

- Memory Based Questions On Loans and AdvancesDocument4 pagesMemory Based Questions On Loans and AdvancesRadha KrishnaNo ratings yet

- Pakistan Credit Gurantee FacilityDocument8 pagesPakistan Credit Gurantee FacilityRatnesh JhaNo ratings yet

- Fixed Deposit Advice: M/S Nirmala P Ratchagar B 1, New Kothangudi Flats, - Annamalai Nagar-Tamil Nadu 608002Document1 pageFixed Deposit Advice: M/S Nirmala P Ratchagar B 1, New Kothangudi Flats, - Annamalai Nagar-Tamil Nadu 608002ratchagar aNo ratings yet

- Prudential Norms IracDocument26 pagesPrudential Norms IracsgjatharNo ratings yet

- COVIDDocument11 pagesCOVIDSatishNo ratings yet

- August 06, 2020 Notification.Document5 pagesAugust 06, 2020 Notification.Rashi JainNo ratings yet

- Assignment OF Management OF Working Capital: (Credit Authorization System)Document6 pagesAssignment OF Management OF Working Capital: (Credit Authorization System)Neeraj GuptaNo ratings yet

- Nahar Demand Loan PolicyDocument4 pagesNahar Demand Loan PolicyManav MahajanNo ratings yet

- PDIC Law - Lecture NotesDocument4 pagesPDIC Law - Lecture NotesJolina Ayngan100% (2)

- HDFC FD Policy DownloadDocument14 pagesHDFC FD Policy DownloadYogeshNo ratings yet

- Prudential Regulations For Microfinance BanksDocument40 pagesPrudential Regulations For Microfinance BanksSajid Ali MaariNo ratings yet

- Terms and ConditionsDocument3 pagesTerms and ConditionsGhulam AbbasNo ratings yet

- Tncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22Document4 pagesTncs Preferred Starsaver Bonus Interest Profit Acquisition Promo22HuatNo ratings yet

- Amended RBPF PolicyDocument2 pagesAmended RBPF Policynfk roeNo ratings yet

- UntitledDocument5 pagesUntitledPrabaNo ratings yet

- HarajDocument6 pagesHarajCrestine Jarah LacorteNo ratings yet

- Terms and Conditions Personal Loan 1734244895709Document19 pagesTerms and Conditions Personal Loan 1734244895709biplabdas0408No ratings yet

- General GuidelinesDocument385 pagesGeneral GuidelinesRuchi SharmaNo ratings yet

- Final-Sarfaesi Act 2002Document41 pagesFinal-Sarfaesi Act 2002ninpra50% (2)

- Fair Practice CodeDocument4 pagesFair Practice CodeShashi Bhushan PrinceNo ratings yet

- Scheme For Sustainable Structuring of Stressed AssetsDocument9 pagesScheme For Sustainable Structuring of Stressed Assetssumit pamechaNo ratings yet

- Cgtmse MDocument82 pagesCgtmse MAnonymous EtnhrRvz0% (1)

- Terms and Conditions Personal Loan 1735899855238Document22 pagesTerms and Conditions Personal Loan 1735899855238DevNo ratings yet

- Prom 158Document158 pagesProm 158Bibin PHNo ratings yet

- General Banking: Chapter-03Document15 pagesGeneral Banking: Chapter-03Rkbl SlmNo ratings yet

- Bank RD Interest Rates (General Public) Senior Citizen RD RatesDocument3 pagesBank RD Interest Rates (General Public) Senior Citizen RD RatesKushal MpvsNo ratings yet

- Frsa Module 4 Problems SolutionsDocument12 pagesFrsa Module 4 Problems SolutionsKushal MpvsNo ratings yet

- NUSDocument11 pagesNUSKushal MpvsNo ratings yet

- 1194Document6 pages1194Kushal MpvsNo ratings yet

- CR SaitejaTalluri PDFDocument1 pageCR SaitejaTalluri PDFKushal MpvsNo ratings yet

- R C M S: Calendar of Events & Holidays For The Academic Year 2018 (1st Semester)Document4 pagesR C M S: Calendar of Events & Holidays For The Academic Year 2018 (1st Semester)Kushal MpvsNo ratings yet

- ValuesBeliefs PDFDocument1 pageValuesBeliefs PDFKushal MpvsNo ratings yet

- Leadership For Good Starts Here: Calendar KeyDocument1 pageLeadership For Good Starts Here: Calendar KeyKushal MpvsNo ratings yet

- MPMC Unit 1Document69 pagesMPMC Unit 1Kushal MpvsNo ratings yet

- Business Communication Presentation Skill Assessment-1: N J M KishoreDocument4 pagesBusiness Communication Presentation Skill Assessment-1: N J M KishoreKushal MpvsNo ratings yet

- EC2403 RF and Microwave EngineeringDocument152 pagesEC2403 RF and Microwave EngineeringKushal MpvsNo ratings yet