0 ratings0% found this document useful (0 votes)

108 views04 Long Term Construction Contracts PDF

04 Long Term Construction Contracts PDF

Uploaded by

Kyla Valencia Ngo1) The document outlines different types of construction contract costs and how they are treated, including directly attributable costs that are expensed and indirect costs that are expensed.

2) It provides formulas and journal entries for tracking construction in progress under the percentage of completion and cost recovery methods using a balance sheet approach.

3) Revenue is recognized over time based on the percentage of completion, calculated using cost-to-cost or engineering estimates, with progress billings and contract retentions also factored in.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

04 Long Term Construction Contracts PDF

04 Long Term Construction Contracts PDF

Uploaded by

Kyla Valencia Ngo0 ratings0% found this document useful (0 votes)

108 views2 pages1) The document outlines different types of construction contract costs and how they are treated, including directly attributable costs that are expensed and indirect costs that are expensed.

2) It provides formulas and journal entries for tracking construction in progress under the percentage of completion and cost recovery methods using a balance sheet approach.

3) Revenue is recognized over time based on the percentage of completion, calculated using cost-to-cost or engineering estimates, with progress billings and contract retentions also factored in.

Original Title

04-Long-term-Construction-Contracts.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1) The document outlines different types of construction contract costs and how they are treated, including directly attributable costs that are expensed and indirect costs that are expensed.

2) It provides formulas and journal entries for tracking construction in progress under the percentage of completion and cost recovery methods using a balance sheet approach.

3) Revenue is recognized over time based on the percentage of completion, calculated using cost-to-cost or engineering estimates, with progress billings and contract retentions also factored in.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

108 views2 pages04 Long Term Construction Contracts PDF

04 Long Term Construction Contracts PDF

Uploaded by

Kyla Valencia Ngo1) The document outlines different types of construction contract costs and how they are treated, including directly attributable costs that are expensed and indirect costs that are expensed.

2) It provides formulas and journal entries for tracking construction in progress under the percentage of completion and cost recovery methods using a balance sheet approach.

3) Revenue is recognized over time based on the percentage of completion, calculated using cost-to-cost or engineering estimates, with progress billings and contract retentions also factored in.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

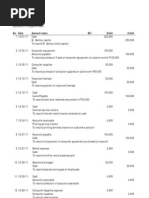

Kind of costs EXCLUDED Note: TCITD is cumulative.

Directly • Selling costs →

attributable expense • Is the outcome profit or loss?

Indirectly • General and o POC

attributable administrative costs ▪ If profit, use POC

• Depreciation of idle ▪ If loss, use 100%

assets o Zero-profit

• R&D costs → ▪ Profit = 0

expense ▪ Loss = 100%

• Advances to • Data: per year or as of?

Reimbursable subcontracted → o Income statement -> nominal -> cost

receivable incurred each year

• Materials delivered o Balance sheet -> real -> cost incurred to

but not yet utilized date

except specialized

materials BALANCE SHEET APPROACH

FORMULAS Construction in Progress

• Percentage of completion Costs incurred to Cumulative RGL

o Costs incurred to date / total costs date (CI) (L)

▪ Costs incurred to date will be reduced by Cumulative RGP

gain on disposal of excess and scrap (P)

materials Ending balance

(CIP)

METHODS OF REVENUE RECOGNITION

• Cost recovery (zero-profit) Progress Billings

o No profit is recognized until construction Beginning

contract is completed Additional billings

o Outcome cannot be estimated reliably Ending balance

o Revenue is recognized only to the extent of

contract costs that are probable (If POC is Accounts Receivable

not yet 100%, CR = CC → RGP = 0) Progress billings to Collections

o Contract costs are recognized as an date

expense in the period in which they are Ending balance

incurred

▪ Very similar to the recognition of COGS CIP XX

Progress billings (XX)

• Percentage of completion Net XX

o Used when the problem is silent • Net is positive -> current asset (due from

o Used when the outcome can be estimated customer)

reliably • Net is negative -> current liability (due to

Difference Formulas customer)

Input Cost to cost TCITD / ETCC

Output Engineering or

estimate TCITD / (TCITD

+ ETCC)

JOURNAL ENTRIES • Does not have an income element

o Ignore this when solving for RGP and net

1.1. Incurrence of cost income. See, no effect on net income

Raw materials XX • Think of it as contractors’ protection

Salaries XX

Utilities XX JOURNAL ENTRIES

Cash XX

Cash XX

1.2. Transfer to WIP or CIP Contract retention XX

Construction in progress XX Accounts receivable XX

Raw materials XX

Salaries XX Cash XX

Utilities XX Contract retention XX

But hassle ‘yan, so— MOBILIZATION FEE

1. Incurrence of cost • Liability

Construction in progress XX • Deducted from bills of contractors in equal

Cash XX installment covering the project period

o Just check whatever’s given in the problem

2. Progress billings • Does not have an income element, so ignore

Accounts receivable XX again when solving for RGP and NI

Progress billings XX • Does not affect progress billing, but affects

accounts receivable

3. Collection on progress billings

Cash If profit If loss

Accounts receivable Construction Always (CIP > (CIP <

CI) CI)

4. Profit recognition – POC method CIP + (1

CIP (profit) XX Revenue POC x

CIP – POC) x

Construction costs (bal) XX (as of) TCR

loss

CR XX

CR – CI + (1 –

Cost to

Cost (as of) RGP to POC) x

Construction costs (bal) XX date

date loss

CR XX

CIP (loss) XX

PERCENTAGE OF COMPLETION

5. Settlement

COST-TO-COST METHOD

Building XX

Contract price XX

CIP XX

Total estimated costs

Progress billings XX Costs incurred to date XX

CIP XX Estimated costs to complete XX XX

Total estimated gross profit (A XX

Note: CIP in the year of completion = 0 to D)

Multiply by: POC %

CONSTRUCTION REVENUE USING (R)Gross profit to date XX

PERCENTAGE OF COMPLETION METHOD (R)GP – previous year (XX)

(R)GP – current year XX

• First year • Contract price is affected by

o CR = contract price x POC + escalation clause (increase in certain costs)

• Second/subsequent years - de-escalation clause (opposite)

o CR = contract price x change in POC - penalty clause

- incentive payment

+/- modifications or variations or adjustments

CONTRACT RETENTION Add if: increase in cost

• May be part of billing, but not paid to contractor Deduct if: decrease in cost

You might also like

- 2021 Turbo Tax ReturnDocument10 pages2021 Turbo Tax ReturnIvette Hoffman75% (4)

- Payslip Dec 2022Document1 pagePayslip Dec 2022VickySaravananNo ratings yet

- L11 Mmi Bma 19 Financing and ValuationDocument28 pagesL11 Mmi Bma 19 Financing and ValuationchooisinNo ratings yet

- General Journal SampleDocument2 pagesGeneral Journal SampleBusinessTips.Ph89% (19)

- 1.2.1 MC - Exercises On Property RelationsDocument3 pages1.2.1 MC - Exercises On Property RelationsJem ValmonteNo ratings yet

- AFAR UNIT 4-LTCC-Google-SheetsDocument2 pagesAFAR UNIT 4-LTCC-Google-SheetschelseaalvarezNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingakrmehta8No ratings yet

- LTCC Work BookDocument49 pagesLTCC Work BookHannah NolongNo ratings yet

- Topic 8.1 - Macro and The Circular Flow Model-775Document4 pagesTopic 8.1 - Macro and The Circular Flow Model-775mwattooNo ratings yet

- Revenue-from-Contracts-with-Customers (1)Document20 pagesRevenue-from-Contracts-with-Customers (1)Xenia AveryNo ratings yet

- Topic 8Document25 pagesTopic 8Bosco ChanNo ratings yet

- HO LTCC-StudentsDocument4 pagesHO LTCC-StudentsYasminNo ratings yet

- LTCCDocument2 pagesLTCCN JoNo ratings yet

- Capital BudgetingDocument27 pagesCapital BudgetingDilu - SNo ratings yet

- 6 - Budgect CashflowDocument12 pages6 - Budgect CashflowH. DaasNo ratings yet

- International Capital Budgeting and Cost of CapitalDocument50 pagesInternational Capital Budgeting and Cost of CapitalGaurav Kumar100% (2)

- Long Term Construction ContractsDocument2 pagesLong Term Construction ContractsRes GosanNo ratings yet

- IAS 11 - Construction ContractsDocument2 pagesIAS 11 - Construction ContractsPatricia Ann TamposNo ratings yet

- Net Present Value (NPV)Document28 pagesNet Present Value (NPV)Subhan UllahNo ratings yet

- Acctg For LTCC - IllustrationsDocument13 pagesAcctg For LTCC - IllustrationsGalang, Princess T.No ratings yet

- Consider CGT When There Is A Disposal of An Asset That Is Capital in NatureDocument6 pagesConsider CGT When There Is A Disposal of An Asset That Is Capital in Naturekatelynnewson07No ratings yet

- Finance T3 2017 - w8Document39 pagesFinance T3 2017 - w8aabubNo ratings yet

- Revenue RecognitionDocument8 pagesRevenue RecognitionSedrick ChiongNo ratings yet

- Capital Budgeting - Evaluation TechniquesDocument42 pagesCapital Budgeting - Evaluation TechniquesShubham KhuranaNo ratings yet

- Capital Project Evaluation: - Overview and "Vocabulary" - MethodsDocument30 pagesCapital Project Evaluation: - Overview and "Vocabulary" - Methodsmarco961No ratings yet

- Costs or Cash OutflowsDocument4 pagesCosts or Cash OutflowsLau RencéNo ratings yet

- Notes For L3Document11 pagesNotes For L3yuyin.gohyyNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- Statement of Profitloss OciDocument1 pageStatement of Profitloss Ocigummydummy5678No ratings yet

- Long-Term Construction Contracts & FranchiseDocument6 pagesLong-Term Construction Contracts & FranchiseBryan ReyesNo ratings yet

- Revenue Recognition: Long Term ConstructionDocument3 pagesRevenue Recognition: Long Term ConstructionLee SuarezNo ratings yet

- CIVE629 Chapter+02Document106 pagesCIVE629 Chapter+02Jimmy hkNo ratings yet

- Project Evaluation Criteria 2009Document10 pagesProject Evaluation Criteria 2009kunalsaini8890601632No ratings yet

- BA 2 Short NotesDocument20 pagesBA 2 Short NotesNivneth PeirisNo ratings yet

- 3 Capital BudgetingDocument6 pages3 Capital BudgetingAshNor RandyNo ratings yet

- ch.6: Making Capital Investment DecisionsDocument44 pagesch.6: Making Capital Investment DecisionsMahmoud SakkaryNo ratings yet

- Henry Ngwira FM Materials 2022Document57 pagesHenry Ngwira FM Materials 2022Unanimous OneNo ratings yet

- Chapter 6 Capital Allowance Industrial Building AllowanceDocument57 pagesChapter 6 Capital Allowance Industrial Building AllowancePatricia TangNo ratings yet

- Accounting Standards AS 7, 9 and 3: DTRTI LucknowDocument44 pagesAccounting Standards AS 7, 9 and 3: DTRTI LucknowvivekNo ratings yet

- Chapter Three Project ManagementDocument67 pagesChapter Three Project ManagementIsuu JobsNo ratings yet

- Lecture Note TOCDocument53 pagesLecture Note TOCactuallyarkkaNo ratings yet

- Grade 12 Income Statement AdjustmentsDocument51 pagesGrade 12 Income Statement Adjustmentsrefilwemagolego34No ratings yet

- Unit 3 Long Term Construction ContractDocument20 pagesUnit 3 Long Term Construction ContractTrixie Hicalde0% (1)

- Financial Management and Strategic Management 02 - Class NotesDocument63 pagesFinancial Management and Strategic Management 02 - Class NotesSANJEEWANI KUMARINo ratings yet

- MBA32-Corporate Finance SharingDocument23 pagesMBA32-Corporate Finance SharingPhươngAnhNo ratings yet

- Vsa Taxation Incometaxation Part4.2Document14 pagesVsa Taxation Incometaxation Part4.2lopa.palis.uiNo ratings yet

- Chapter 7 - Construction ContractsDocument17 pagesChapter 7 - Construction ContractsMikael James VillanuevaNo ratings yet

- CAPBUDGETINGfinalDocument68 pagesCAPBUDGETINGfinalmeowgiduthegreatNo ratings yet

- Reviewer Financial ManagementDocument39 pagesReviewer Financial ManagementDerek Dale Vizconde NuñezNo ratings yet

- (IE) Chapter 4 - Investment EfficiencyDocument76 pages(IE) Chapter 4 - Investment Efficiencypkh310803No ratings yet

- Module 6 Deductions General 2024Document56 pagesModule 6 Deductions General 2024boitumeloditebohoNo ratings yet

- 13 - Advanced Capital Bud Class NotesDocument88 pages13 - Advanced Capital Bud Class NotesRemaining lifeNo ratings yet

- Chapter 6 Capital AllowanceDocument59 pagesChapter 6 Capital AllowanceKailing KhowNo ratings yet

- IAS-12 (First 15 Points)Document4 pagesIAS-12 (First 15 Points)Hafeez HaidriNo ratings yet

- P2 Construction Contract - GuerreroDocument22 pagesP2 Construction Contract - GuerreroCelen Ochoco100% (1)

- Special Deductions SlidesDocument73 pagesSpecial Deductions SlidesboitumeloditebohoNo ratings yet

- Lecture 8 Construction Contracts Ias 11 Revision Notes PDFDocument6 pagesLecture 8 Construction Contracts Ias 11 Revision Notes PDFKim Nicole ReyesNo ratings yet

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Document3 pagesDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- CH 7-11Document319 pagesCH 7-11anynameNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Managing County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesFrom EverandManaging County Assets and Liabilities in Kenya: Postdevolution Challenges and ResponsesNo ratings yet

- BVPS and Eps Exercises PDFDocument9 pagesBVPS and Eps Exercises PDFKyla Valencia NgoNo ratings yet

- Pledge and Mortgage PDFDocument43 pagesPledge and Mortgage PDFKyla Valencia NgoNo ratings yet

- Revenue From Contracts With Customers: Ifrs 15Document64 pagesRevenue From Contracts With Customers: Ifrs 15Kyla Valencia NgoNo ratings yet

- Adv2 KahootDocument3 pagesAdv2 KahootKyla Valencia NgoNo ratings yet

- Answer: Wrong Wrong WrongDocument2 pagesAnswer: Wrong Wrong WrongKyla Valencia NgoNo ratings yet

- Guaranty, Loan, DepositDocument15 pagesGuaranty, Loan, DepositKyla Valencia Ngo100% (1)

- Txmwi 2018 Dec Q PDFDocument15 pagesTxmwi 2018 Dec Q PDFangaNo ratings yet

- AOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Document3 pagesAOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Basavaraj KorishettarNo ratings yet

- Prepare A Set of Financial StatementsDocument5 pagesPrepare A Set of Financial Statementskenshi ihsnekNo ratings yet

- ScanDocument1 pageScanlovetksmNo ratings yet

- Chapter 4 FinaccDocument4 pagesChapter 4 Finaccv l100% (1)

- Income From Capital GainsDocument31 pagesIncome From Capital GainsMEGHENDRA DEV SHARMA100% (1)

- Pay Slip PDFDocument1 pagePay Slip PDFasif MehmoodNo ratings yet

- Laporan Arus Kas: Pt. Shakti BandungDocument2 pagesLaporan Arus Kas: Pt. Shakti BandungNiken SalsabilaNo ratings yet

- Examination Question and Answers, Set A (Problem Solving), Chapter 2 - Analyzing TransactionsDocument2 pagesExamination Question and Answers, Set A (Problem Solving), Chapter 2 - Analyzing TransactionsJohn Carlos DoringoNo ratings yet

- CRQSDocument79 pagesCRQSAtka FahimNo ratings yet

- Form F.C 8: Last Pay Certificate Gazetted and Non-Gazetted OfficersDocument2 pagesForm F.C 8: Last Pay Certificate Gazetted and Non-Gazetted Officersgirlprincipal04No ratings yet

- Bus Com 7Document5 pagesBus Com 7Chabelita MijaresNo ratings yet

- Floating Rate Saving BondDocument6 pagesFloating Rate Saving Bondmanoj barokaNo ratings yet

- Indirect Taxes Smart WorkDocument8 pagesIndirect Taxes Smart WorkmaacmampadNo ratings yet

- Freshtex Orient Craft LTD: Request For Payment of Expenses / ImprestDocument6 pagesFreshtex Orient Craft LTD: Request For Payment of Expenses / ImprestsameershedgeNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument3 pages1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsLLYOD FRANCIS LAYLAYNo ratings yet

- Dizon Lands Realty and Development Corporation - 2.17.2022Document6 pagesDizon Lands Realty and Development Corporation - 2.17.2022Kervin GalangNo ratings yet

- 2024 Rev-413fDocument7 pages2024 Rev-413fMarty WebbNo ratings yet

- Tax.3609-2 Discussion QuestionsDocument5 pagesTax.3609-2 Discussion QuestionsJulienne CaitNo ratings yet

- Auditing ProblemsDocument37 pagesAuditing ProblemsApple estolonioNo ratings yet

- Docu StampDocument2 pagesDocu Stampmijareschabelita2No ratings yet

- 60) CIR v. AlgueDocument2 pages60) CIR v. Alguemaximum jicaNo ratings yet

- Model Exam Question Paper StatutoryDocument7 pagesModel Exam Question Paper Statutoryshibin cpNo ratings yet

- Srinivasan COMPUTATIONDocument3 pagesSrinivasan COMPUTATIONgeo38vvtNo ratings yet

- BAS Template PDFDocument2 pagesBAS Template PDFrajkrishna03No ratings yet

- Slides 8Document31 pagesSlides 8Erico MatosNo ratings yet