Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Uploaded by

RaviJhaCopyright:

Available Formats

Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Uploaded by

RaviJhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Fatca/Crs Self Certification / Declaration For Individuals: Documents As Mentioned Below

Uploaded by

RaviJhaCopyright:

Available Formats

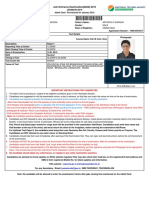

FATCA/CRS SELF CERTIFICATION / DECLARATION FOR INDIVIDUALS

FATCA/CRS INSTRUCTIONS

If you have any questions about your tax residency, please contact your tax advisor. If you

are a US citizen or resident or green card holder, please include United States in the

foreign country information field along with your US Tax Identification Number. $It is

mandatory to supply a TIN or functional equivalent if the country in which you are tax resident

issues such identifiers. If no TIN is yet available or has not yet been issued, please provide

an explanation and attach this to the form.

In case customer has the following Indicia pertaining to a foreign country and yet declares

self to be non-tax resident in the respective country, customer to provide relevant Curing

Documents as mentioned below:

Documentation required for Cure of FATCA/ CRS

FATCA/ CRS Indicia observed (ticked)

indicia

If customer does not agree to be Specified U.S. person/ reportable

person status

• U.S. place of 1. Self-certification (in attached format) that the account holder is neither

birth a citizen of United States of America nor a resident for tax purposes;

2. Non-US passport or any non-US government issued document

evidencing nationality or citizenship (refer list below); AND

3. Any one of the following documents:

a. Certified Copy of “Certificate of Loss of Nationality or

b. Reasonable explanation of why the customer does not have such

a certificate despite renouncing US citizenship; or Reason the

customer did not obtain U.S. citizenship at birth

Residence/mailing address in a country other than India or 1. Self-certification that the

Telephone number in a country other than India (and no account holder is not

telephone number in India provided) or resident for tax purposes in

that country; and

Standing instructions to transfer funds to an account

maintained in a country other than India 2. Documentary evidence

(refer list below)

List of acceptable documentary evidence needed to establish the residence(s) for tax purposes:

1. Certificate of residence issued by an authorized government body*

2. Valid identification issued by an authorized government body*(e.g. Passport, National

Identity card, etc.)

*Government or agency thereof or a municipality of the country or territory in which the

applicant claims to be a resident.

PNB - 1227B

Page 1 of 2

FATCA/CRS SELF CERTIFICATION / DECLARATION FOR INDIVIDUALS:

(If you are a tax resident of any country other than India, then please fill the details below)

(a) Please indicate all countries in which you are resident for tax purposes and associated details

1.Country/ ISO 3166 Tax Identification Identification Residence Address Type:

(ies) of Tax Country code of Number (TIN)% or Type (TIN or Address for

residency # jurisdiction of Equivalent Other%, please Tax purpose 1- Residential or

residence* specify) (including City, Business,

State, Country 2- Residential,

and Pin code) 3- Business,

4- Registered Office

1st Applicant

2nd Applicant

3rd Applicant

Place/City of Birth* ISO 3166

Country code

of Birth

1st Applicant

2nd Applicant

3rd Applicant

#

To also include USA, where the individual is a citizen/ green card holder of USA

%

In case Tax Identification Number is not available, kindly provide functional equivalent$

(b) Certification

Under penalty of perjury, I/we certify that: I understand that Punjab National Bank is relying on

this information for the purpose of determining the status of the account holder named above

in compliance with FATCA/CRS. Punjab National Bank is not able to offer any tax advice on

FATCA or CRS or its impact on the account holder. I shall seek advice from professional tax

advisor for any tax questions.

I agree to submit a new form within 30 days if any information or certification on this form

becomes incorrect.

I agree that as may be required by domestic regulators/tax authorities, Punjab National Bank

may also be required to report, reportable details to CBDT or other authorities/agencies or

close or suspend my account, as appropriate.

I have understood the information requirements of this Form (read along with the FATCA/

CRS Instructions) and hereby confirm that the information provided by me on this Form

including the taxpayer identification number is true, correct, and complete. I also confirm that

I have read and understood the FATCA/CRS Terms and Conditions and hereby accept the

same.

........................., ........................., .........................,

Signature(s) / Thumb Impression of Applicant

Page 2 of 2

You might also like

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- (VIDA Company Profile) This Is VIDA 202212Document26 pages(VIDA Company Profile) This Is VIDA 202212Artemis SimetraNo ratings yet

- Tab Banking Form With Income Undertaking11111Document5 pagesTab Banking Form With Income Undertaking11111Mahakaal Digital Point100% (1)

- FATCA/CRS Self-Certification - Individual: Tata Aia Life Insurance Company LimitedDocument2 pagesFATCA/CRS Self-Certification - Individual: Tata Aia Life Insurance Company Limitedvirjog33% (3)

- CVL Kra Kyc Change Individual FormDocument2 pagesCVL Kra Kyc Change Individual FormM. Sadiq. A. PachapuriNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- FATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSDocument2 pagesFATCA-CRS Annexure For Individual Accounts (Including Sole Proprietor) Details Under FATCA and CRSOws AnishNo ratings yet

- Fatca Crs Declaration Individuals PDFDocument2 pagesFatca Crs Declaration Individuals PDFfujstructuralNo ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- FATCA CRS Individual Declaration FormDocument2 pagesFATCA CRS Individual Declaration FormSrigandh's WealthNo ratings yet

- FATCA Self Certification For Individual July 23Document2 pagesFATCA Self Certification For Individual July 23ramachandraadirajuNo ratings yet

- FATCA Declaration For All Accounts D1Document2 pagesFATCA Declaration For All Accounts D1erehz143No ratings yet

- FATCA Declaration For Individual Investors FormDocument2 pagesFATCA Declaration For Individual Investors FormnithiyNo ratings yet

- FATCA Declaration Individual FINALDocument3 pagesFATCA Declaration Individual FINALadvaitNo ratings yet

- Foreign Account Tax Compliance Act - 140119Document2 pagesForeign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- FATCA/CRS Declaration Form - (Individual)Document3 pagesFATCA/CRS Declaration Form - (Individual)ansfaridNo ratings yet

- SIGNED-Foreign Account Tax Compliance Act - 140119Document2 pagesSIGNED-Foreign Account Tax Compliance Act - 140119skn bharatNo ratings yet

- Consolidated AnnexuresDocument7 pagesConsolidated AnnexuresKunalNo ratings yet

- FATCA Form Individual 061015 V1Document2 pagesFATCA Form Individual 061015 V1sanjay901No ratings yet

- Extended KYC Annexure IndividualsDocument2 pagesExtended KYC Annexure IndividualsNarendra Reddy BhumaNo ratings yet

- Self-Certification For Individual - FATCA/CRS Declaration FormDocument3 pagesSelf-Certification For Individual - FATCA/CRS Declaration FormSean MayNo ratings yet

- FATCA Individual PDFDocument2 pagesFATCA Individual PDFPrathik NamakalNo ratings yet

- CRS Self Certification Form IndividualDocument5 pagesCRS Self Certification Form IndividualSalman ArshadNo ratings yet

- 8-FATCA Declaration - IndividualDocument2 pages8-FATCA Declaration - IndividualNeeraj KumarNo ratings yet

- CRS Self-Certification Form For Individual CustomersDocument2 pagesCRS Self-Certification Form For Individual CustomersBenNo ratings yet

- NCB Self Certification of ResidencyDocument2 pagesNCB Self Certification of Residencygeeman9787No ratings yet

- FATCA CRS DeclarationDocument4 pagesFATCA CRS Declarationashokdas test5No ratings yet

- Self-Certification For Individual: FATCA/CRS Declaration FormDocument2 pagesSelf-Certification For Individual: FATCA/CRS Declaration FormLeo DennisNo ratings yet

- FATCA Individuals PDFDocument2 pagesFATCA Individuals PDFfordd greenNo ratings yet

- NM Substitute W9Document2 pagesNM Substitute W9marcelNo ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Jamaica FATCA Individual Self Certification - 2022Document2 pagesJamaica FATCA Individual Self Certification - 2022FandENo ratings yet

- Edoc Profile Apr092021Document2 pagesEdoc Profile Apr092021Ryan ReidNo ratings yet

- FATCA/CRS - Self Declaration Form For Non-Resident Clients - IndividualDocument2 pagesFATCA/CRS - Self Declaration Form For Non-Resident Clients - IndividualthomasNo ratings yet

- FATCA Application Form AnnexureDocument3 pagesFATCA Application Form AnnexureblossomkdcNo ratings yet

- FATCADocument1 pageFATCAjeryjosephNo ratings yet

- FRM W8DM HRDocument2 pagesFRM W8DM HRmiscribeNo ratings yet

- ZerodhaFormfortrading AccountDocument20 pagesZerodhaFormfortrading AccountChinmay RaikarNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormJennifer LeetNo ratings yet

- FATCA Individual Form 21012016Document2 pagesFATCA Individual Form 21012016Aakash SharmaNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Supplementary Fatca Kyc Crs Form PLTVFDocument2 pagesSupplementary Fatca Kyc Crs Form PLTVFmohandidymus.vNo ratings yet

- For Re-KYC Nredocument NRI - 18.5Document4 pagesFor Re-KYC Nredocument NRI - 18.5rajucbit_2000No ratings yet

- Fatca-Crs - Icici BankDocument8 pagesFatca-Crs - Icici BankSankaram Kasturi100% (1)

- Aviva Crs FormDocument2 pagesAviva Crs FormAstroSunilNo ratings yet

- FM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)Document3 pagesFM105W - SLR - CRS - SELFCERT - IND - JUL20 - 002 (Writable)HKRRL HKRRLNo ratings yet

- CRS Form V3.0Document2 pagesCRS Form V3.0bansal book storeNo ratings yet

- t1261 Fill 23eDocument2 pagest1261 Fill 23eVladimirNo ratings yet

- Transmission Request FormDocument4 pagesTransmission Request FormVinayak SavanurNo ratings yet

- FATCA Declaration For Individual FinalDocument2 pagesFATCA Declaration For Individual Finalmmiimc@gmail.comNo ratings yet

- Fatca FormDocument1 pageFatca FormGarv BhayanaNo ratings yet

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalNo ratings yet

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoNo ratings yet

- Re-KYC Diligence of NRE or NRO or FCNR (B) AccountDocument4 pagesRe-KYC Diligence of NRE or NRO or FCNR (B) AccountMahendran KuppusamyNo ratings yet

- PNB 1249 A2 Annexure IDocument1 pagePNB 1249 A2 Annexure IShilpy SinhaNo ratings yet

- RBL Fatca Crs Declaration EntitiesDocument2 pagesRBL Fatca Crs Declaration EntitiesAyush BankaNo ratings yet

- Entrepreneur's Guide to U.S. Credit: Building a Solid Foundation for Business SuccessFrom EverandEntrepreneur's Guide to U.S. Credit: Building a Solid Foundation for Business SuccessNo ratings yet

- Fu. +e't/: No - UlDocument2 pagesFu. +e't/: No - UlRaviJhaNo ratings yet

- The Oriental Insurance Company LimitedDocument5 pagesThe Oriental Insurance Company LimitedRaviJhaNo ratings yet

- Request For Outward Remittance From NRO AccountDocument4 pagesRequest For Outward Remittance From NRO AccountRaviJhaNo ratings yet

- Publication List 2019Document6 pagesPublication List 2019RaviJhaNo ratings yet

- Kccy PDFDocument4 pagesKccy PDFRaviJhaNo ratings yet

- IDWorks v6b PDFDocument326 pagesIDWorks v6b PDFCarlos Zúñiga0% (1)

- PrintoutDocument3 pagesPrintoutlakshmi computerNo ratings yet

- New Joiner Kit - August 2022Document33 pagesNew Joiner Kit - August 2022Elboy Son DecanoNo ratings yet

- Birth Certificate ApplicationDocument4 pagesBirth Certificate Applicationabnmarriott4560No ratings yet

- Click To Download IELTS Application FormDocument2 pagesClick To Download IELTS Application Formapi-3712408No ratings yet

- PDOSDocument8 pagesPDOSresurgumNo ratings yet

- Instructions / Checklist For Filling KYC FormDocument20 pagesInstructions / Checklist For Filling KYC FormamerNo ratings yet

- Saira: Page 1 of 3Document3 pagesSaira: Page 1 of 3ali baqarNo ratings yet

- CoaljunctionDocument3 pagesCoaljunctionuttamksrNo ratings yet

- 190 Applicant ChecklistDocument3 pages190 Applicant Checklistpriya_psalmsNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip: ImportantDocument2 pagesIrctcs E-Ticketing Service Electronic Reservation Slip: ImportantzaheerbcNo ratings yet

- High Commission of India: Visa Application FormDocument2 pagesHigh Commission of India: Visa Application FormJames AmirNo ratings yet

- Chapter 3 - CUSTOMERS AND ACCOUNT HOLDERDocument10 pagesChapter 3 - CUSTOMERS AND ACCOUNT HOLDERShreekanth GuttedarNo ratings yet

- AdmitCard 190310464060Document1 pageAdmitCard 190310464060Lavanya VenkateshNo ratings yet

- Canada Check List Imm5881eDocument7 pagesCanada Check List Imm5881ebhagavathamhNo ratings yet

- List of Crosscore ServicesDocument4 pagesList of Crosscore ServicesAmit SinghNo ratings yet

- 07051/HYB RXL SPL Third Ac (3A)Document2 pages07051/HYB RXL SPL Third Ac (3A)Sumit MishraNo ratings yet

- 1 CIS Individual FrontDocument1 page1 CIS Individual FrontCarlie MaeNo ratings yet

- Ar1 en Residence Permit Salaried WorkDocument17 pagesAr1 en Residence Permit Salaried WorkMONA100% (1)

- Https WWW - Irctc.co - in Nget Print-TicketDocument3 pagesHttps WWW - Irctc.co - in Nget Print-Ticketnagaraj baddiNo ratings yet

- AADHAAR - A Unique Identification Number: Opportunities and Challenges AheadDocument10 pagesAADHAAR - A Unique Identification Number: Opportunities and Challenges AheadResearch Cell: An International Journal of Engineering SciencesNo ratings yet

- Waqf BoardDocument4 pagesWaqf Boardaslamdongre28No ratings yet

- Tnstc. 3Document2 pagesTnstc. 3Manish GounderNo ratings yet

- Visa For Family Reunion With Non-Eu Spouse Visa DDocument2 pagesVisa For Family Reunion With Non-Eu Spouse Visa DJannie AntallanNo ratings yet

- Haryana Cet 2022 New NotificationDocument65 pagesHaryana Cet 2022 New NotificationVarun PathakNo ratings yet

- Judicial Council Notice To Appear RequirementsDocument45 pagesJudicial Council Notice To Appear RequirementsR W0% (1)

- AdmitCard 190310534317Document1 pageAdmitCard 190310534317Yashodhar KapadiaNo ratings yet

- Sabong Sample Page DesignDocument3 pagesSabong Sample Page DesignRossrival BendilloNo ratings yet

- Transfertaxform Apv9t Form (072010)Document2 pagesTransfertaxform Apv9t Form (072010)Karma Pema DorjeNo ratings yet