Capst Courier 7 Round

Capst Courier 7 Round

Uploaded by

kuala singhCopyright:

Available Formats

Capst Courier 7 Round

Capst Courier 7 Round

Uploaded by

kuala singhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Capst Courier 7 Round

Capst Courier 7 Round

Uploaded by

kuala singhCopyright:

Available Formats

Round: 6

Dec. 31, C116353

2026

Andrews Baldwin Chester

Pranav Gupta jatin bagla Shweta Rohra

Abhishek Gupta Suprey Bharambe Shubham Mahajan

Adarsh IR Harshad Bobade Ahmad Rab

Himanshi Jain Vishakha Bukalsaria Shubhang Rao

Divya Jaiwar SOMYA KESHRI Namisha Sharma

Nikhil Malik omkar Lalage Nilima Singh

Digby Erie Ferris

Khaji Mohammad Atah SANJIT ANAND Surya Jain

Shubham Choudhary Sumi Hamilton Dhaval Jain

Nishi Mallika Krishak Khandelwal Priyal Jain

Bharadwaj Paravastu Ayush Kothari Prity Malani

Prachi Singhal Shivam Sethi Arjun Mehera

Akilesh Sonaji Harsh Swarnkar Danish Mittal

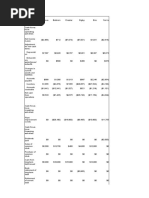

Selected Financial Statistics

Andrews Baldwin Chester Digby Erie Ferris

ROS 6.8% 14.0% 1.4% 7.7% 3.6% 8.4%

Asset Turnover 2.12 0.94 2.03 1.56 1.68 1.30

ROA 14.5% 13.2% 2.9% 12.0% 6.1% 11.0%

Leverage 2.2 3.5 6.7 2.0 1.7 1.7

ROE 32.4% 45.6% 19.3% 23.8% 10.6% 18.8%

Emergency Loan $0 $0 $0 $0 $0 $0

Sales $204,612,356 $82,052,662 $219,116,058 $243,943,796 $251,064,076 $213,623,832

EBIT $27,745,623 $26,497,926 $13,610,900 $37,926,089 $20,612,981 $35,225,695

Profits $13,964,818 $11,464,100 $3,105,830 $18,785,465 $9,086,943 $18,043,094

Cumulative Profit ($11,431,288) ($18,830,813) ($31,089,274) $25,794,740 $13,625,628 $23,986,060

SG&A / Sales 10.0% 11.9% 8.1% 8.5% 6.3% 7.1%

Contrib. Margin % 31.8% 44.6% 20.2% 34.1% 21.8% 34.4%

CAPSTONE ® COURIER Page 1

Round: 6

Stock & Bonds C116353 Dec. 31, 2026

Stock Market Summary

MarketCap Book Value

Company Close Change Shares EPS Dividend Yield P/E

($M) Per Share

Andrews $32.33 $18.85 2,986,905 $97 $14.43 $4.68 $0.00 0.0% 6.9

Baldwin $22.00 $21.00 2,200,000 $48 $11.42 $5.21 $0.00 0.0% 4.2

Chester $7.78 $6.34 2,862,345 $22 $5.64 $1.09 $0.00 0.0% 7.2

Digby $61.02 $25.36 2,449,337 $149 $32.22 $7.67 $0.50 0.8% 8.0

Erie $36.31 $7.12 3,413,925 $124 $25.14 $2.66 $0.00 0.0% 13.6

Ferris $57.23 $17.04 3,027,922 $173 $31.66 $5.96 $0.00 0.0% 9.6

Bond Market Summary

Company Series# Face Yield Close$ S&P Company Series# Face Yield Close$ S&P

Andrews Digby

13.2S2032 $15,000,000 14.1% 93.91 CCC 11.3S2031 $13,000,000 12.5% 90.09 B

14.0S2033 $6,126,000 14.5% 96.65 CCC 13.3S2032 $15,000,000 13.8% 96.52 B

14.6S2034 $8,000,000 14.7% 99.10 CCC 13.7S2033 $750,000 14.0% 97.87 B

Baldwin 13.8S2034 $5,000,000 14.1% 98.16 B

11.3S2031 $3,200,000 13.3% 84.90 DDD 14.1S2036 $10,000,000 14.2% 99.48 B

13.9S2033 $17,000,000 15.1% 91.90 DDD Erie

14.5S2034 $2,000,000 15.4% 93.90 DDD 11.3S2031 $11,000,000 12.2% 92.69 BB

15.2S2035 $500,000 15.7% 96.76 DDD 12.4S2032 $9,600,000 12.9% 96.05 BB

15.7S2036 $15,000,000 15.9% 99.03 DDD 13.6S2035 $18,300,000 13.5% 101.01 BB

Chester Ferris

11.3S2031 $4,500,000 13.5% 83.74 DDD 12.1S2032 $22,500,000 12.7% 95.24 BBB

13.2S2032 $18,000,000 14.9% 88.67 DDD

14.2S2033 $15,367,000 15.5% 91.59 DDD

14.8S2034 $4,400,000 15.8% 93.55 DDD

Next Year's Prime Rate10.00%

CAPSTONE ® COURIER Page 2

Round: 6

Financial Summary C116353 Dec. 31, 2026

Cash Flow Statement Survey Andrews Baldwin Chester Digby Erie Ferris

CashFlows from operating activities

Net Income(Loss) $13,965 $11,464 $3,106 $18,785 $9,087 $18,043

Adjustment for non-cash items:

Depreciation $8,840 $6,273 $10,582 $11,587 $11,558 $12,653

Extraordinary gains/losses/writeoffs ($1,217) ($9,680) $0 $0 $0 $0

Changes in current assets and liablilities

Accounts payable $2,468 ($1,828) $9,137 $4,053 ($2,442) ($187)

Inventory $938 $9,501 $0 $1,198 $2,590 ($2,259)

Accounts Receivable ($3,482) $416 ($4,900) ($5,577) $223 ($1,595)

Net cash from operations $21,511 $16,146 $17,925 $30,046 $21,017 $26,655

Cash flows from investing activities

Plant improvements(net) ($11,680) $794 ($12,016) ($19,440) ($40,654) ($29,170)

Cash flows from financing activities

Dividends paid $0 $0 $0 ($1,225) $0 $0

Sales of common stock $0 $0 $250 $5,000 $0 $7,000

Purchase of common stock ($2,000) $0 $0 $0 $0 $0

Cash from long term debt issued $0 $15,000 $0 $10,000 $0 $0

Early retirement of long term debt ($8,000) $0 $0 $0 ($10,000) $0

Retirement of current debt $0 ($3,588) $0 $0 ($6,400) ($7,000)

Cash from current debt borrowing $0 $0 $0 $0 $0 $13,000

Cash from emergency loan $0 $0 $0 $0 $0 $0

Net cash from financing activities ($10,000) $11,412 $250 $13,775 ($16,400) $13,000

Net change in cash position ($169) $28,352 $6,159 $24,382 ($36,037) $10,485

Balance Sheet Survey Andrews Baldwin Chester Digby Erie Ferris

Cash $23,237 $28,352 $17,518 $58,420 $6,768 $38,106

Accounts Receivable $16,817 $4,496 $18,010 $20,050 $26,826 $17,558

Inventory $1,108 $0 $0 $325 $16,687 $13,563

Total Current Assets $41,163 $32,848 $35,528 $78,794 $50,281 $69,227

Plant and equipment $132,600 $94,100 $158,736 $173,800 $173,376 $189,800

Accumulated Depreciation ($77,373) ($40,147) ($86,286) ($95,955) ($73,908) ($95,242)

Total Fixed Assets $55,227 $53,953 $72,450 $77,845 $99,468 $94,558

Total Assets $96,389 $86,802 $107,977 $156,640 $149,749 $163,785

Accounts Payable $11,383 $3,129 $28,726 $13,121 $14,175 $11,569

Current Debt $12,773 $20,850 $20,850 $20,850 $10,850 $33,850

Total Current Liabilities $24,156 $23,979 $49,576 $33,971 $25,025 $45,419

Long Term Debt $29,126 $37,700 $42,267 $43,750 $38,900 $22,500

Total Liabilities $53,282 $61,679 $91,843 $77,721 $63,925 $67,919

Common Stock $29,131 $18,560 $21,830 $30,110 $46,862 $46,487

Retained Earnings $13,976 $6,563 ($5,696) $48,809 $38,962 $49,380

Total Equity $43,107 $25,123 $16,134 $78,919 $85,824 $95,866

Total Liabilities & Owners Equity $96,389 $86,802 $107,977 $156,640 $149,749 $163,785

Income Statement Survey Andrews Baldwin Chester Digby Erie Ferris

Sales $204,612 $82,053 $219,116 $243,944 $251,064 $213,624

Variable Costs(Labor,Material,Carry) $139,569 $45,481 $174,752 $160,875 $196,223 $140,122

Contribution Margin $65,043 $36,572 $44,364 $83,069 $54,841 $73,502

Depreciation $8,840 $6,273 $10,582 $11,587 $11,558 $12,653

SGA(R&D,Promo,Sales,Admin) $20,524 $9,731 $17,658 $20,806 $15,720 $15,273

Other(Fees,Writeoffs,TQM,Bonuses) $7,933 ($5,930) $2,513 $12,750 $6,950 $10,350

EBIT $27,746 $26,498 $13,611 $37,926 $20,613 $35,226

Interest(Short term,Long term) $5,756 $8,427 $8,720 $8,315 $6,289 $6,785

Taxes $7,697 $6,325 $1,712 $10,364 $5,013 $9,954

Profit Sharing $329 $282 $73 $462 $223 $444

Net Profit $13,965 $11,464 $3,106 $18,785 $9,087 $18,043

CAPSTONE ® COURIER Page 3

Round: 6

Production Analysis C116353 Dec. 31, 2026

2nd

Shift Auto

Unit & mation Capacity

Primary Units Inven Revision Age Pfmn Size Material Labor Contr. Over- Next Next Plant

Name Segment Sold tory Date Dec.31 MTBF Coord Coord Price

Cost

Cost Marg. time Round Round Utiliz.

Able Trad 2,405 0 7/23/2026 1.5 14500 8.6 11.0 $23.89 $7.96 $8.08 33% 53% 6.0 1,500 152%

Acre Low 2,555 0 8/16/2024 6.5 12000 3.8 16.3 $16.09 $3.97 $7.83 26% 84% 6.5 1,400 182%

Adam High 1,261 46 9/24/2026 1.3 23500 13.3 6.8 $36.99 $13.34 $10.93 35% 65% 4.0 800 163%

Agape Size 1,109 0 6/23/2026 1.5 16000 7.8 5.6 $31.49 $10.28 $12.31 28% 87% 4.5 600 185%

Air High 654 0 8/9/2026 1.4 23500 13.0 7.5 $37.50 $13.01 $10.80 37% 89% 4.5 450 187%

Baker Low 1,970 0 6/2/2026 1.5 14300 7.9 13.5 $26.50 $6.80 $3.87 57% 0% 8.0 2,100 87%

Bold Pfmn 891 0 6/21/2026 1.4 27000 14.7 12.5 $33.49 $13.19 $12.80 23% 100% 4.0 650 198%

Cake Trad 3,409 0 9/6/2026 1.6 17500 8.2 11.8 $23.50 $9.05 $10.33 18% 100% 5.7 1,950 184%

Cedar Low 2,764 0 8/10/2026 2.6 14000 4.1 15.9 $17.30 $5.12 $7.60 26% 100% 7.1 1,590 184%

Coat Pfmn 1,216 0 8/18/2026 1.5 27000 13.6 12.9 $32.50 $13.83 $11.69 22% 100% 5.2 700 184%

Cure Size 1,106 0 8/14/2026 1.5 21000 7.1 7.3 $32.49 $11.65 $13.25 24% 100% 4.2 650 184%

Coffee Low 829 0 5/24/2026 1.5 14000 4.2 15.8 $19.00 $5.19 $13.35 2% 80% 4.0 650 166%

Daze Trad 1,943 19 6/28/2026 1.5 19000 9.2 10.8 $28.00 $9.32 $7.57 39% 0% 5.2 2,100 90%

Dell Low 2,376 0 4/26/2024 6.6 16000 3.1 17.0 $18.50 $4.54 $7.04 37% 71% 6.5 1,400 170%

Dixie High 1,337 0 8/5/2026 1.4 25000 14.0 6.7 $38.70 $13.81 $12.10 34% 50% 3.0 1,100 149%

Dot Pfmn 1,089 0 7/22/2026 1.4 27500 14.7 12.8 $34.00 $13.26 $10.80 30% 83% 4.2 900 182%

Dune Size 990 0 7/9/2026 1.5 21000 7.2 5.8 $34.49 $11.29 $12.43 32% 67% 4.0 900 165%

Droom Trad 792 0 6/3/2026 1.5 19000 9.3 10.7 $28.60 $9.38 $11.06 29% 14% 3.0 700 113%

Eat Trad 1,697 530 4/1/2027 3.1 19000 8.5 11.5 $26.99 $9.83 $7.73 30% 25% 5.7 1,200 124%

Ebb Low 2,780 0 2/10/2026 6.4 13000 3.8 16.1 $17.49 $4.71 $8.74 22% 100% 5.7 1,400 199%

Echo High 816 256 9/5/2026 1.3 25000 12.8 6.9 $37.99 $14.80 $13.03 24% 100% 3.1 740 199%

Edge Pfmn 1,291 0 5/15/2026 1.5 27000 14.4 12.5 $32.49 $14.47 $13.19 14% 100% 5.0 875 199%

Egg Size 1,072 0 6/25/2026 1.5 19000 7.6 5.9 $32.99 $11.95 $13.03 23% 100% 5.0 765 199%

EBB2 Low 1,104 0 2/10/2026 4.9 13000 4.5 15.5 $19.49 $5.17 $9.32 21% 0% 4.5 985 99%

EGO Trad 993 0 3/11/2026 2.3 17000 9.2 10.8 $26.99 $9.73 $13.19 15% 100% 4.7 750 199%

Fast Trad 1,735 66 6/25/2026 1.6 14000 8.9 11.0 $26.00 $7.78 $9.13 35% 0% 4.0 1,800 95%

Feat Low 2,282 0 5/11/2025 4.1 12000 4.0 16.0 $17.50 $4.06 $7.82 30% 0% 5.0 2,300 79%

Fist High 1,774 503 7/25/2026 1.4 25000 14.3 5.7 $39.00 $14.17 $10.64 35% 53% 4.0 2,500 152%

Foam Pfmn 594 0 6/15/2026 1.5 27000 15.0 12.0 $35.00 $13.34 $9.13 36% 0% 4.0 600 99%

Fume Size 594 0 6/11/2026 1.5 19000 7.9 5.0 $35.00 $11.17 $10.43 38% 0% 4.0 600 99%

Fruit High 445 0 7/7/2026 1.0 25000 13.9 6.2 $40.00 $13.88 $11.51 37% 28% 3.0 500 126%

CAPSTONE ® COURIER Page 4

Traditional Segment Analysis C116353 Round: 6

Dec. 31, 2026

Traditional Statistics

Total Industry Unit Demand 12,526

Actual Industry Unit Sales |12,526

Segment % of Total Industry |26.5%

Next Year's Segment Growth Rate |9.2%

Traditional Customer Buying Criteria

Expectations Importance

1. Age Ideal Age = 2.0 47%

2. Price $17.00 - 27.00 23%

3. Ideal Position Pfmn 9.2 Size 10.8 21%

4. Reliability MTBF 14000-19000 9%

Top Products in Traditional Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Able 18% 2,273 7/23/2026 YES 8.6 11.0 $23.89 14500 1.52 $1,800 90% $1,700 81% 50

Cake 18% 2,200 9/6/2026 YES 8.2 11.8 $23.50 17500 1.58 $1,150 81% $1,759 85% 44

Daze 16% 1,943 6/28/2026 9.2 10.8 $28.00 19000 1.47 $1,550 89% $1,643 83% 41

Fast 14% 1,732 6/25/2026 8.9 11.0 $26.00 14000 1.57 $1,000 79% $791 65% 37

Eat 14% 1,697 4/1/2027 8.5 11.5 $26.99 19000 3.12 $500 56% $1,260 85% 20

EGO 8% 993 3/11/2026 YES 9.2 10.8 $26.99 17000 2.30 $400 46% $819 85% 37

Baker 7% 895 6/2/2026 YES 7.9 13.5 $26.50 14300 1.54 $1,300 86% $2,050 88% 15

Droom 6% 792 6/3/2026 YES 9.3 10.7 $28.60 19000 1.45 $600 25% $365 83% 22

CAPSTONE ® COURIER Page 5

Low End Segment Analysis C116353 Round: 6

Dec. 31, 2026

Low End Statistics

Total Industry Unit Demand 17,404

Actual Industry Unit Sales |17,108

Segment % of Total Industry |36.8%

Next Year's Segment Growth Rate |11.7%

Low End Customer Buying Criteria

Expectations Importance

1. Price $12.00 - 22.00 53%

2. Age Ideal Age = 7.0 24%

3. Ideal Position Pfmn 4.7 Size 15.3 16%

4. Reliability MTBF 12000-17000 7%

Top Products in Low End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Ebb 16% 2,780 2/10/2026 YES 3.8 16.1 $17.49 13000 6.39 $400 56% $819 77% 26

Cedar 16% 2,764 8/10/2026 YES 4.1 15.9 $17.30 14000 2.58 $1,100 76% $1,508 90% 21

Acre 15% 2,555 8/16/2024 YES 3.8 16.3 $16.09 12000 6.48 $1,700 85% $1,530 90% 43

Dell 14% 2,376 4/26/2024 YES 3.1 17.0 $18.50 16000 6.64 $1,550 87% $1,916 75% 10

Feat 13% 2,282 5/11/2025 YES 4.0 16.0 $17.50 12000 4.13 $1,400 84% $1,319 79% 25

Cake 7% 1,209 9/6/2026 YES 8.2 11.8 $23.50 17500 1.58 $1,150 45% $1,759 90% 0

EBB2 6% 1,104 2/10/2026 YES 4.5 15.5 $19.49 13000 4.87 $150 28% $756 77% 15

Baker 6% 1,075 6/2/2026 YES 7.9 13.5 $26.50 14300 1.54 $1,300 45% $2,050 64% 0

Coffee 5% 829 5/24/2026 YES 4.2 15.8 $19.00 14000 1.53 $1,150 42% $1,926 90% 11

Able 1% 131 7/23/2026 YES 8.6 11.0 $23.89 14500 1.52 $1,800 45% $1,700 90% 0

Fast 0% 2 6/25/2026 8.9 11.0 $26.00 14000 1.57 $1,000 45% $791 79% 0

CAPSTONE ® COURIER Page 6

High End Segment Analysis C116353 Round: 6

Dec. 31, 2026

High End Statistics

Total Industry Unit Demand 6,286

Actual Industry Unit Sales |6,286

Segment % of Total Industry |13.3%

Next Year's Segment Growth Rate |16.2%

High End Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 14.3 Size 5.7 43%

2. Age Ideal Age = 0.0 29%

3. Reliability MTBF 20000-25000 19%

4. Price $27.00 - 37.00 9%

Top Products in High End Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Fist 28% 1,774 7/25/2026 14.3 5.7 $39.00 25000 1.38 $1,500 91% $1,583 77% 38

Dixie 21% 1,337 8/5/2026 YES 14.0 6.7 $38.70 25000 1.36 $1,500 87% $1,825 75% 34

Adam 20% 1,261 9/24/2026 13.3 6.8 $36.99 23500 1.35 $1,520 85% $1,870 90% 41

Echo 13% 816 9/5/2026 12.8 6.9 $37.99 25000 1.31 $340 60% $1,071 54% 20

Air 10% 654 8/9/2026 YES 13.0 7.5 $37.50 23500 1.41 $1,500 72% $1,870 90% 24

Fruit 7% 445 7/7/2026 YES 13.9 6.2 $40.00 25000 1.02 $1,500 63% $528 77% 21

CAPSTONE ® COURIER Page 7

Performance Segment Analysis C116353 Round: 6

Dec. 31, 2026

Performance Statistics

Total Industry Unit Demand 5,662

Actual Industry Unit Sales |5,081

Segment % of Total Industry |12.0%

Next Year's Segment Growth Rate |19.8%

Performance Customer Buying Criteria

Expectations Importance

1. Reliability MTBF 22000-27000 43%

2. Ideal Position Pfmn 15.4 Size 11.8 29%

3. Price $22.00 - 32.00 19%

4. Age Ideal Age = 1.0 9%

Top Products in Performance Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Edge 25% 1,291 5/15/2026 YES 14.4 12.5 $32.49 27000 1.55 $500 61% $819 63% 34

Coat 24% 1,216 8/18/2026 YES 13.6 12.9 $32.50 27000 1.48 $800 80% $1,591 87% 36

Dot 21% 1,089 7/22/2026 YES 14.7 12.8 $34.00 27500 1.40 $1,300 85% $1,643 66% 31

Bold 18% 891 6/21/2026 YES 14.7 12.5 $33.49 27000 1.45 $1,600 95% $2,050 89% 41

Foam 12% 594 6/15/2026 YES 15.0 12.0 $35.00 27000 1.50 $500 68% $528 38% 17

CAPSTONE ® COURIER Page 8

Size Segment Analysis C116353 Round: 6

Dec. 31, 2026

Size Statistics

Total Industry Unit Demand 5,437

Actual Industry Unit Sales |4,871

Segment % of Total Industry |11.5%

Next Year's Segment Growth Rate |18.3%

Size Customer Buying Criteria

Expectations Importance

1. Ideal Position Pfmn 8.2 Size 4.6 43%

2. Age Ideal Age = 1.5 29%

3. Reliability MTBF 16000-21000 19%

4. Price $22.00 - 32.00 9%

Top Products in Size Segment

Units Cust. Cust. Dec.

Market Sold to Revision Stock Pfmn Size List Age Promo A

ware- Sales A

ccess-

Cust

Name Share Seg Date Out Coord Coord Price MTBF Dec.31 Budget n

ess Budget ibility

Survey

Agape 23% 1,109 6/23/2026 YES 7.8 5.6 $31.49 16000 1.51 $1,700 86% $1,530 71% 31

Cure 23% 1,106 8/14/2026 YES 7.1 7.3 $32.49 21000 1.54 $650 74% $1,591 83% 21

Egg 22% 1,072 6/25/2026 YES 7.6 5.9 $32.99 19000 1.49 $400 57% $756 57% 18

Dune 20% 990 7/9/2026 YES 7.2 5.8 $34.49 21000 1.45 $1,500 87% $1,734 70% 19

Fume 12% 594 6/11/2026 YES 7.9 5.0 $35.00 19000 1.52 $500 68% $528 39% 16

CAPSTONE ® COURIER Page 9

Round: 6

Market Share C116353 Dec. 31, 2026

Actual Market Share in Units Potential Market Share in Units

Trad Low High Pfmn Size Total Trad Low High Pfmn Size Total

Industry Unit Sales 12,526 17,108 6,286 5,081 4,871 45,873 Units Demanded 12,526 17,404 6,286 5,662 5,437 47,315

% of Market 27.3% 37.3% 13.7% 11.1% 10.6% 100.0% % of Market 26.5% 36.8% 13.3% 12.0% 11.5% 100.0%

Able 18.1% 0.8% 5.2% Able 17.4% 4.6%

Acre 14.9% 5.6% Acre 27.3% 10.0%

Adam 20.1% 2.8% Adam 17.6% 2.3%

Agape 22.8% 2.4% Agape 28.0% 3.2%

Air 10.4% 1.4% Air 12.8% 1.7%

Total 18.1% 15.7% 30.4% 22.8% 17.4% Total 17.4% 27.4% 30.4% 28.0% 21.9%

Baker 7.1% 6.3% 4.3% Baker 6.6% 1.8%

Bold 17.5% 1.9% Bold 25.2% 3.0%

Total 7.1% 6.3% 17.5% 6.2% Total 6.6% 25.2% 4.8%

Cake 17.6% 7.1% 7.4% Cake 16.2% 0.4% 4.4%

Cedar 16.2% 6.0% Cedar 14.8% 5.4%

Coat 23.9% 2.6% Coat 22.4% 2.7%

Cure 22.7% 2.4% Cure 18.9% 2.2%

Coffee 4.9% 1.8% Coffee 7.0% 2.6%

Total 17.6% 28.1% 23.9% 22.7% 20.3% Total 16.2% 22.2% 22.4% 18.9% 17.3%

Daze 15.5% 4.2% Daze 14.3% 3.8%

Dell 13.9% 5.2% Dell 9.6% 3.5%

Dixie 21.3% 2.9% Dixie 19.5% 2.6%

Dot 21.4% 2.4% Dot 18.5% 2.2%

Dune 20.3% 2.2% Dune 17.1% 2.0%

Droom 6.3% 1.7% Droom 7.3% 1.9%

Total 21.8% 13.9% 21.3% 21.4% 20.3% 18.6% Total 21.6% 9.6% 19.5% 18.5% 17.1% 16.0%

Eat 13.6% 3.7% Eat 12.5% 3.3%

Ebb 16.3% 6.1% Ebb 16.6% 6.1%

Echo 13.0% 1.8% Echo 11.4% 1.5%

Edge 25.4% 2.8% Edge 23.4% 2.8%

Egg 22.0% 2.3% Egg 21.5% 2.5%

EBB2 6.5% 2.4% EBB2 8.8% 3.3%

EGO 7.9% 2.2% EGO 13.0% 3.4%

Total 21.5% 22.7% 13.0% 25.4% 22.0% 21.3% Total 25.5% 25.5% 11.4% 23.4% 21.5% 22.9%

Fast 13.8% 3.8% Fast 12.7% 3.4%

Feat 13.3% 5.0% Feat 15.3% 5.6%

Fist 28.2% 3.9% Fist 24.4% 3.2%

Foam 11.7% 1.3% Foam 10.4% 1.2%

Fume 12.2% 1.3% Fume 14.5% 1.7%

Fruit 7.1% 1.0% Fruit 14.3% 1.9%

Total 13.8% 13.4% 35.3% 11.7% 12.2% 16.2% Total 12.7% 15.3% 38.7% 10.4% 14.5% 17.0%

CAPSTONE ® COURIER Page 10

Round: 6

Perceptual Map C116353 Dec. 31, 2026

Andrews Baldwin Chester

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Able 8.6 11.0 7/23/2026 Baker 7.9 13.5 6/2/2026 Cake 8.2 11.8 9/6/2026

Acre 3.8 16.3 8/16/2024 Bold 14.7 12.5 6/21/2026 Cedar 4.1 15.9 8/10/2026

Adam 13.3 6.8 9/24/2026 Coat 13.6 12.9 8/18/2026

Agape 7.8 5.6 6/23/2026 Cure 7.1 7.3 8/14/2026

Air 13.0 7.5 8/9/2026 Coffee 4.2 15.8 5/24/2026

Digby Erie Ferris

Name Pfmn Size Revised Name Pfmn Size Revised Name Pfmn Size Revised

Daze 9.2 10.8 6/28/2026 Eat 8.5 11.5 4/1/2027 Fast 8.9 11.0 6/25/2026

Dell 3.1 17.0 4/26/2024 Ebb 3.8 16.1 2/10/2026 Feat 4.0 16.0 5/11/2025

Dixie 14.0 6.7 8/5/2026 Echo 12.8 6.9 9/5/2026 Fist 14.3 5.7 7/25/2026

Dot 14.7 12.8 7/22/2026 Edge 14.4 12.5 5/15/2026 Foam 15.0 12.0 6/15/2026

Dune 7.2 5.8 7/9/2026 Egg 7.6 5.9 6/25/2026 Fume 7.9 5.0 6/11/2026

Droom 9.3 10.7 6/3/2026 EBB2 4.5 15.5 2/10/2026 Fruit 13.9 6.2 7/7/2026

EGO 9.2 10.8 3/11/2026

CAPSTONE ® COURIER Page 11

Round: 6

HR/TQM Report C116353 Dec. 31, 2026

HUMAN RESOURCES SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Needed Complement 1,028 243 1,274 1,153 1,455 1,068

Complement 1,028 243 1,274 1,153 1,455 1,068

1st Shift Complement 597 166 645 825 845 939

2nd Shift Complement 431 77 629 328 610 129

Overtime Percent 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Turnover Rate 11.2% 9.1% 10.2% 10.2% 9.1% 10.0%

New Employees 275 22 484 352 133 107

Separated Employees 0 266 0 0 79 81

Recruiting Spend $0 $1,500 $0 $0 $3,000 $0

Training Hours 0 30 0 0 40 0

Productivity Index 100.0% 102.4% 100.0% 100.0% 110.2% 100.0%

Recruiting Cost $275 $55 $484 $352 $530 $107

Separation Cost $0 $1,330 $0 $0 $395 $405

Training Cost $0 $146 $0 $0 $1,164 $0

Total HR Admin Cost $275 $1,531 $484 $352 $2,089 $512

Labor Contract Next Year

Wages $28.77 $29.46 $29.56 $29.56 $28.48 $29.62

Benefits 2,678 2,678 2,728 2,702 2,752 2,755

Profit Sharing 2.3% 2.4% 2.3% 2.4% 2.4% 2.4%

Annual Raise 5.3% 5.4% 5.4% 5.4% 5.3% 5.4%

Starting Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Ceiling Negotiation Position

Wages

Benefits

Profit Sharing

Annual Raise

Adjusted Labor Demands

Wages

Benefits

Profit Sharing

Annual Raise

Strike Days

TQM SUMMARY

Andrews Baldwin Chester Digby Erie Ferris

Process Mgt Budgets Last Year

CPI Systems $1,500 $0 $0 $1,200 $500 $1,000

VendorJIT $1,000 $0 $1,000 $1,200 $500 $1,000

Quality Initiative Training $1,000 $0 $0 $1,200 $500 $1,000

Channel Support Systems $1,000 $1,000 $0 $1,200 $500 $1,000

Concurrent Engineering $500 $1,000 $0 $1,200 $800 $1,000

UNEP Green Programs $1,000 $0 $0 $1,200 $800 $1,000

TQM Budgets Last Year

Benchmarking $500 $0 $0 $1,200 $800 $1,000

Quality Function Deployment Effort $1,000 $1,000 $1,000 $1,200 $800 $1,000

CCE/6 Sigma Training $1,000 $0 $500 $1,200 $800 $1,000

GEMI TQEM Sustainability Initiatives $500 $0 $0 $1,200 $800 $1,000

Total Expenditures $9,000 $3,000 $2,500 $12,000 $6,800 $10,000

Cumulative Impacts

Material Cost Reduction 8.79% 10.04% 1.64% 10.11% 0.35% 10.45%

Labor Cost Reduction 12.81% 12.59% 1.27% 11.98% 0.33% 12.28%

Reduction R&D Cycle Time 39.46% 39.47% 0.96% 38.16% 5.30% 40.01%

Reduction Admin Costs 21.17% 47.85% 36.12% 58.10% 4.98% 60.02%

Demand Increase 14.01% 6.97% 2.49% 12.77% 0.48% 13.14%

CAPSTONE ® COURIER Page 12

Round: 6

Ethics Report C116353 Dec. 31, 2026

ETHICS SUMMARY

Other (Fees, Writeoffs, etc.) The actual dollar impact. Example, $120 means Other increased by $120.

Demand Factor The % of normal. 98% means demand fell 2%.

Material Cost Impact The % of normal. 104% means matieral costs rose 4%.

Admin Cost Impact The % of normal. 103% means admin costs rose 3%.

Productivity Impact The % of normal. 104% means productivity increased by 4%.

Awareness Impact The % of normal. 105% means normal awareness was multiplied by 1.05.

Accessibility Impact The % of normal. 98% means normal accessiblity was multiplied by 0.98.

Normal means the value that would have been produced if the problem had not been presented.

No Impact Andrews Baldwin Chester Digby Erie Ferris

Total

Other (Fees, Writeoffs, etc.) $0 $0 $0 $0 $0 $0 $0

Demand Factor 100% 100% 100% 100% 100% 100% 100%

Material Cost Impact 100% 100% 100% 100% 100% 100% 100%

Admin Cost Impact 100% 100% 100% 100% 100% 100% 100%

Productivity Impact 100% 100% 100% 100% 100% 100% 100%

Awareness Impact 100% 100% 100% 100% 100% 100% 100%

Accessibility Impact 100% 100% 100% 100% 100% 100% 100%

CAPSTONE ® COURIER Page 13

Annual Report

Round: 6

Annual Report Erie C116353

Dec. 31, 2026

Balance Sheet

DEFINITIONS: Common Size: The common size column

simply represents each item as a percentage of total ASSETS 2026 2025

assets for that year. Cash: Your end-of-year cash Common

position. Accounts Receivable: Reflects the lag between

Size

delivery and payment of your products. Inventories: The Cash $6,768 4.5% $42,805

current value of your inventory across all products. A zero

Account Receivable $26,826 17.9% $27,049

indicates your company stocked out. Unmet demand

would, of course, fall to your competitors. Plant & Inventory $16,687 11.1% $19,277

Equipment: The current value of your plant. Accum Total Current Assets $50,281 33.6% $89,131

Deprec: The total accumulated depreciation from your

plant. Accts Payable: What the company currently owes

Plant & Equipment $173,376 116.0% $132,722

suppliers for materials and services. Current Debt: The

debt the company is obligated to pay during the next year Accumulated Depreciation ($73,908) -49.4% ($62,350)

of operations. It includes emergency loans used to keep Total Fixed Assets $99,468 66.4% $70,372

your company solvent should you run out of cash during Total Assets $149,749 100.0% $159,504

the year. Long Term Debt: The companys long term debt

is in the form of bonds, and this represents the total value LIABILITIES & OWNERS

of your bonds. Common Stock: The amount of capital

EQUITY

invested by shareholders in the company. Retained

Earnings: The profits that the company chose to keep Accounts Payable $14,175 9.5% $16,617

instead of paying to shareholders as dividends.

Current Debt $10,850 7.2% $6,400

Long Term Debt $38,900 26.0% $59,750

Total Liabilities $63,925 42.7% $82,767

Common Stock $46,862 31.3% $46,862

Retained Earnings $38,962 26.0% $29,875

Total Equity $85,824 57.3% $76,737

Total Liab. & O. Equity $149,749 100.0% $159,504

Cash Flow Statement

The Cash Flow Statement examines what happened in the Cash Account Cash Flows from Operating Activities 2026 2025

during the year. Cash injections appear as positive numbers and cash Net Income(Loss) $9,087 $5,437

withdrawals as negative numbers. The Cash Flow Statement is an excellent Depreciation $11,558 $8,848

tool for diagnosing emergency loans. When negative cash flows exceed Extraordinary gains/losses/writeoffs $0 $0

positives, you are forced to seek emergency funding. For example, if sales Accounts Payable ($2,442) $4,798

are bad and you find yourself carrying an abundance of excess inventory,

Inventory $2,590 ($2,209)

the report would show the increase in inventory as a huge negative cash

Accounts Receivable $223 ($5,778)

flow. Too much unexpected inventory could outstrip your inflows, exhaust

your starting cash and force you to beg for money to keep your company Net cash from operation $21,017 $11,097

afloat. Cash Flows from Investing Activities

Plant Improvements ($40,654) ($4,500)

Cash Flows from Financing Activities

Dividends paid $0 $0

Sales of common stock $0 $13,700

Purchase of common stock $0 $0

Cash from long term debt $0 $18,300

Retirement of long term debt ($20,850) $0

Change in current debt(net) $4,450 ($5,482)

Net cash from financing activities ($16,400) $26,518

Net change in cash position ($36,037) $33,115

Closing cash position $6,768 $42,805

Annual Report Page 14

Round: 6

Annual Report Erie C116353

Dec. 31, 2026

2026 Income Statement

2026 Common

(Product Name) Eat Ebb Echo Edge Egg EBB2 EGO

Total

Size

Sales $45,810 $48,621 $31,013 $41,934 $35,374 $21,516 $26,796 $0 $251,064 100.0%

Variable Costs:

Direct Labor $13,496 $24,294 $10,634 $17,026 $13,968 $10,459 $13,097 $0 $102,973 41.0%

Direct Material $17,218 $13,800 $11,977 $18,840 $13,183 $6,503 $9,727 $0 $91,248 36.3%

Inventory Carry $1,152 $0 $851 $0 $0 $0 $0 $0 $2,002 0.8%

Total Variable $31,866 $38,094 $23,461 $35,866 $27,150 $16,961 $22,824 $0 $196,223 78.2%

Contribution Margin $13,944 $10,526 $7,552 $6,068 $8,223 $4,555 $3,972 $0 $54,841 21.8%

Period Costs:

Depreciation $2,304 $2,688 $908 $1,517 $1,326 $1,576 $1,240 $0 $11,558 4.6%

SG&A: R&D $1,000 $114 $689 $374 $488 $114 $193 $0 $2,970 1.2%

Promotions $500 $400 $340 $500 $400 $150 $400 $0 $2,690 1.1%

Sales $1,260 $819 $1,071 $819 $756 $756 $819 $0 $6,300 2.5%

Admin $686 $728 $464 $628 $530 $322 $401 $0 $3,759 1.5%

Total Period $5,750 $4,749 $3,472 $3,837 $3,499 $2,918 $3,053 $0 $27,278 10.9%

Net Margin $8,194 $5,778 $4,080 $2,231 $4,724 $1,637 $919 $0 $27,563 11.0%

Definitions: Sales: Unit Sales times list price. Direct Labor: Labor costs incurred to produce the product Other $6,950 2.8%

that was sold. Inventory Carry Cost: the cost unsold goods in inventory. Depreciation: Calculated on EBIT $20,613 8.2%

straight-line. 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each Short Term Interest $1,367 0.5%

product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget Long Term Interest $4,922 2.0%

for each product. Sales: The sales force budget for each product. Other: Chargs not included in other Taxes $5,013 2.0%

categories such as Fees, Write offs, and TQM. The fees include money paid to investment bankers and Profit Sharing $223 0.1%

brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs Net Profit $9,087 3.6%

include the loss you might experience when you sell capacity or liquidate inventory as the result of

eliminating a production line. If the amount appears as a negative amount, then you actually made money

on the liquidation of capacity or inventory. EBIT: Earnings Before Interest and Taxes. Short Term Interest:

Interest expense based on last years current debt, including short term debt, long term notes that have

become due, and emergency loans, Long Term Interest: Interest paid on outstanding bonds. Taxes:

Income tax based upon a 35% tax rate. Profit Sharing: Profits shared with employees under the labor

contract. Net Profit: EBIT minus interest, taxes, and profit sharing.

Annual Report Page 15

You might also like

- Lady M DCF TemplateDocument4 pagesLady M DCF Templatednesudhudh100% (1)

- Questions For IFRS HighlightedDocument28 pagesQuestions For IFRS HighlightedWowee Cruz100% (1)

- Addressing ExerciseDocument5 pagesAddressing ExerciseKaranveer Singh GahuniaNo ratings yet

- Capstone Courier Round 5 ResultsDocument15 pagesCapstone Courier Round 5 ResultsSanyam GulatiNo ratings yet

- CapitalDocument10 pagesCapitalSamantha Dela Cruz0% (1)

- Payday Loan Business Plan ExampleDocument23 pagesPayday Loan Business Plan ExampleJoseph Bwalya Mucheleka100% (1)

- Capsim Round 1Document14 pagesCapsim Round 1AjitNo ratings yet

- Comp-Xm® Inquirer WordDocument37 pagesComp-Xm® Inquirer WordAnonymous TAV9RvNo ratings yet

- Courier - Capstone Round 1Document14 pagesCourier - Capstone Round 1Khanh MaiNo ratings yet

- The Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94Document3 pagesThe Discounted Cash Flow (DCF) Estimate of Snap Stock's Fair Market Value On Per Share Is 27.94NarinderNo ratings yet

- The Garden Place - SemifinalDocument4 pagesThe Garden Place - SemifinalKrish Hegde0% (1)

- IAS 1 Presentation of Financial StatementsDocument23 pagesIAS 1 Presentation of Financial StatementsMinahilNo ratings yet

- Capstone Round 3 CourierDocument15 pagesCapstone Round 3 CourierKitarpNo ratings yet

- Round 5Document15 pagesRound 5AMIT REBALANo ratings yet

- Courier C151036 R8 TFK0 CADocument15 pagesCourier C151036 R8 TFK0 CAVishalNo ratings yet

- Round: 6 Dec. 31, 2027: Selected Financial StatisticsDocument15 pagesRound: 6 Dec. 31, 2027: Selected Financial StatisticsVrajesh IyengarNo ratings yet

- Courier 4Document14 pagesCourier 4vivek singhNo ratings yet

- Shikhar CourierDocument13 pagesShikhar CourierKESHAV JAINNo ratings yet

- Round: 5 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 5 Dec. 31, 2024: Selected Financial StatisticsYadandla AdityaNo ratings yet

- Round: 4 Dec. 31, 2023: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2023: Selected Financial StatisticsUjjawal MittalNo ratings yet

- Courier Round 7 (2028)Document15 pagesCourier Round 7 (2028)G H O S TNo ratings yet

- Round: 1 Dec. 31, 2021: Selected Financial StatisticsDocument15 pagesRound: 1 Dec. 31, 2021: Selected Financial StatisticsParas DhamaNo ratings yet

- Round 6 - CompetitionDocument12 pagesRound 6 - Competitiondianagamboa.bloomNo ratings yet

- Round: 2 Dec. 31, 2022: Selected Financial StatisticsDocument15 pagesRound: 2 Dec. 31, 2022: Selected Financial StatisticsAshesh DasNo ratings yet

- Courier C102348 R6 TDK0 CADocument15 pagesCourier C102348 R6 TDK0 CAOscar Gabriel FernándezNo ratings yet

- Round: 4 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2024: Selected Financial StatisticsCRNo ratings yet

- Practice ExamDocument20 pagesPractice ExamCammy BritoNo ratings yet

- Summer 23 Fastrack Assign 1Document21 pagesSummer 23 Fastrack Assign 1Jihane RezkiNo ratings yet

- Round: 0 Dec. 31, 2018: Selected Financial StatisticsDocument15 pagesRound: 0 Dec. 31, 2018: Selected Financial StatisticsCapsimNo ratings yet

- Cap Sim Round 1 ExcelDocument17 pagesCap Sim Round 1 ExcelPrashant NarulaNo ratings yet

- Round: 0 Dec. 31, 2016: Selected Financial StatisticsDocument13 pagesRound: 0 Dec. 31, 2016: Selected Financial StatisticsHimanshu KriplaniNo ratings yet

- Round: 0 Dec. 31, 2017 Andrews Baldwin ChesterDocument19 pagesRound: 0 Dec. 31, 2017 Andrews Baldwin ChesterPetraNo ratings yet

- Cap Sim Round 7Document17 pagesCap Sim Round 7Prashant NarulaNo ratings yet

- Capxm Final RoundDocument21 pagesCapxm Final RoundManoj KuchipudiNo ratings yet

- Cap Sim Round 6 ExcelDocument17 pagesCap Sim Round 6 ExcelPrashant NarulaNo ratings yet

- CpasimCourier Round 0Document14 pagesCpasimCourier Round 0AjitNo ratings yet

- Titan ValuationDocument67 pagesTitan ValuationmuthurajaNo ratings yet

- Infosys - ForecastDocument69 pagesInfosys - ForecastmuthurajaNo ratings yet

- Harris Wisconsin SmurfsDocument1 pageHarris Wisconsin SmurfstipsNo ratings yet

- BNI 111709 v2Document2 pagesBNI 111709 v2fcfroicNo ratings yet

- COMP-XM® INQUIRER Round 0Document21 pagesCOMP-XM® INQUIRER Round 0Joshua MoyNo ratings yet

- Round: 0 Dec. 31, 2016: Selected Financial StatisticsDocument11 pagesRound: 0 Dec. 31, 2016: Selected Financial Statisticsredditor1276No ratings yet

- UST Debt Policy Spreadsheet (Reduced)Document9 pagesUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNo ratings yet

- Apple TTMDocument25 pagesApple TTMQuofi SeliNo ratings yet

- Customer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedDocument64 pagesCustomer Email Total Amount Amount Paid Next Bill Next Bill Pay Status Comish Payment CompletedhamzaNo ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- Solution SlidesDocument8 pagesSolution Slidesshubham solankiNo ratings yet

- Courier - Capstone WebApp Round 1Document15 pagesCourier - Capstone WebApp Round 1Natália GuglielmiNo ratings yet

- Phương trình hồi quy - CorrelationDocument1 pagePhương trình hồi quy - CorrelationThục Anh LêNo ratings yet

- NetflixDocument13 pagesNetflixRamesh SinghNo ratings yet

- Planilha ZEEkDocument84 pagesPlanilha ZEEkisabelashimazakisouza10No ratings yet

- Assignment - Session 8Document20 pagesAssignment - Session 8Aditya JandialNo ratings yet

- Case 8 - Pacific Grove Spice CompanyDocument29 pagesCase 8 - Pacific Grove Spice CompanyMorten LassenNo ratings yet

- Mortgage CalculatorDocument17 pagesMortgage CalculatorRams VuyyuruNo ratings yet

- Comp-Xm® Inquirer0Document21 pagesComp-Xm® Inquirer0Jasleen Kaur (Ms)No ratings yet

- Ocean Carriers FinalDocument3 pagesOcean Carriers FinalGiorgi MeskhishviliNo ratings yet

- Ryan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Document3 pagesRyan D. Seelke Ocean Carriers Case: Forcasted Operating Cash Flow For New Capesize Vessel (25 Year Life) Discount Rate 9%Giorgi MeskhishviliNo ratings yet

- Ch 17 Corporate Financial Planning - Completed and Answers (2)Document17 pagesCh 17 Corporate Financial Planning - Completed and Answers (2)yara.fayadNo ratings yet

- Shonae Carrington Project 6Document8 pagesShonae Carrington Project 6api-325533351No ratings yet

- Ahorro (1)Document2 pagesAhorro (1)ramosnathaly64No ratings yet

- The Return of The Loan - Solution1Document20 pagesThe Return of The Loan - Solution1unveiledtopicsNo ratings yet

- Apple Case StudyDocument2 pagesApple Case StudyPrakhar MorchhaleNo ratings yet

- HDFC Life InsuranceDocument83 pagesHDFC Life InsuranceSanket AndhareNo ratings yet

- Auditing Problem For Shareholder's EquityDocument14 pagesAuditing Problem For Shareholder's Equityblack hudieNo ratings yet

- Valuation of Goodwill and SharesDocument40 pagesValuation of Goodwill and Sharesakshata100% (2)

- Accounting WorksheetDocument6 pagesAccounting WorksheetRaff LesiaaNo ratings yet

- The Friends Fry Co. Business Plan FinalDocument33 pagesThe Friends Fry Co. Business Plan FinalQueen Naisa AndangNo ratings yet

- Advanced Financial Accounting FIN-611: Mian Ahmad Farhan Lecture-3 Single Entry (Conversion Method)Document26 pagesAdvanced Financial Accounting FIN-611: Mian Ahmad Farhan Lecture-3 Single Entry (Conversion Method)Muhammad Salim Ullah KhanNo ratings yet

- Ch.10 - The Statement of Cash Flows - MHDocument59 pagesCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- Snowman LogisticDocument18 pagesSnowman LogisticVishalPandeyNo ratings yet

- 11th Annual Benedict's PDFDocument15 pages11th Annual Benedict's PDFYugam RathiNo ratings yet

- Solution Chapter 15Document32 pagesSolution Chapter 15xxxxxxxxx75% (4)

- Tica Manajemen KeuanganDocument25 pagesTica Manajemen KeuanganArif GantengNo ratings yet

- Jimat Chapter 8 Accounting TheoryDocument9 pagesJimat Chapter 8 Accounting TheoryYusuf RaharjaNo ratings yet

- Retirement QuestionDocument2 pagesRetirement QuestionshubhamsundraniNo ratings yet

- Less Than Book Value! What A Bargain?Document25 pagesLess Than Book Value! What A Bargain?xotom990No ratings yet

- FAR 1 AssetsDocument15 pagesFAR 1 AssetsSky LeeNo ratings yet

- Zainab AFS Chapter 1, 2, 3 SummaryDocument22 pagesZainab AFS Chapter 1, 2, 3 SummaryZainab Aftab 5221-FMS/BBA/S18No ratings yet

- SChedule VIDocument88 pagesSChedule VIbhushan2011No ratings yet

- Week 5 C35 - MFRS 138 IntangiblesDocument26 pagesWeek 5 C35 - MFRS 138 IntangiblesYong Arifin0% (1)

- Problem 9-15 (60 Minutes) : © The Mcgraw-Hill Companies, Inc., 2008. All Rights Reserved. Solutions Manual, Chapter 9 1Document14 pagesProblem 9-15 (60 Minutes) : © The Mcgraw-Hill Companies, Inc., 2008. All Rights Reserved. Solutions Manual, Chapter 9 1Tanvir AhmedNo ratings yet

- Module Number 6 (Ppe Revalution) Question No. 1Document4 pagesModule Number 6 (Ppe Revalution) Question No. 1ARISNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Financial Accounting I Revision NotesDocument1 pageFinancial Accounting I Revision Notessrajaratnam25No ratings yet

- Reviewer in Legal AccountingDocument7 pagesReviewer in Legal AccountingPrincess Cruz MacalingaNo ratings yet

- Financial Accounting MGT101 Power Point Slides Lecture 30Document13 pagesFinancial Accounting MGT101 Power Point Slides Lecture 30Waqar AhmedNo ratings yet

- Assignment 2 Far110Document4 pagesAssignment 2 Far110AisyahNo ratings yet

- A4 - Annuity AmortizationDocument27 pagesA4 - Annuity AmortizationNoel GatbontonNo ratings yet