Accounting 315 - Quiz Business Combination

Accounting 315 - Quiz Business Combination

Uploaded by

AlexCopyright:

Available Formats

Accounting 315 - Quiz Business Combination

Accounting 315 - Quiz Business Combination

Uploaded by

AlexOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Accounting 315 - Quiz Business Combination

Accounting 315 - Quiz Business Combination

Uploaded by

AlexCopyright:

Available Formats

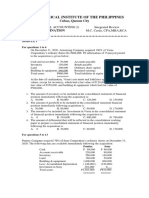

ACCOUNTING 315 – QUIZ BUSINESS COMBINATION

NAME : LEYROS, FE C. CLASS TIME: 3:00-4:30 PM DATE: 10/01/2020

Instructions: Solve the following problems. Show supporting computation with proper label.

Problem A

A merger was effected on June 1 whereby the Corona Corporation took over the assets and

assumed the liabilities of the Dino Company in exchange for 8,000 shares of its own stock. A

Statement of Financial Position for the Corona Corporation just prior to the merger shows the

following:

Cash, receivables, Current liabilities 105,000

inventories 365,000 Long-term debt 180,000

Investments 120,000 Preference shares, P100 par 100,000

Plant & equipment 400,000 Ordinary shares, P5 par 250,000

Goodwill & other Paid-in capital in excess of par 90,000

intangibles 100,000 Retained earnings 260,000

Total assets 985,000 Total liabilities & SHE 985,000

====== ======

The Dino Company’s Statement of Financial Position consists of the following:

Cash, receivable, Current liabilities 40,000

Inventories 80,800 Long-term debt 60,000

Plant and equipment (net) 140,000 Ordinary shares, P5 par 100,000

Goodwill 40,000 Paid-in capital in excess of par 30,000

Appraisal capital 50,000

Deficit (19,200)

Total assets 260,800 Total Liabilities & SHE 260,800

====== ======

The Corona Corporation records the assets of the Dino Company at appraised values as follows:

cash, receivables, and inventories, P56,000; plant and equipment, P120,000. Liabilities are

understated by certain accrued items totaling P1,200. The stock of the Corona Corporation is

selling at P12 per share, and this figure is used in recording the purchase of the Company’s net

assets.

Required:

1. Give the entries that would appear on the books of the Corona Corporation as a result of

the merger. (5 pts.)

Cash, receivable, Inventories 56, 000

Plant and equipment (net) 120,000

Goodwill 21, 000

Current Liabilities 41,200

Long-term debt 60,000

Cash (8000 shares x 12) 96,000

#

2. Give the entries on the books of Dino Company. (5 pts.)

Investment in Corona Corporation (8000 shares x 12) 96,000

Current Liabilities 40,000

Long-term debt 60,000

Loss on sale of business 64,800

Cash, Receivable, Inventories 80,800

Plant and equipment (net) 140,000

Goodwill 40, 000

#

3. Compute the amount of the following on the books of Corona Corporation after the merger.

(3 pts. each)

a. Total assets P 1,182,200

b. Total liabilities P 386,200

c. Total shareholders’ equity P 796,000

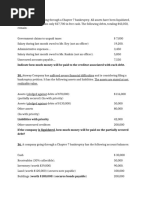

Problem B

Stockholders of Companies D, E, and F agree to the following plan in effecting a consolidation:

The new Company, DEF, Inc., shall acquire all of the assets of Companies D, E, and F and shall

assume all of the liabilities, issuing 6% preference shares, P100 par value, in an amount equal to

the net assets transferred excluding intangible assets. Assets are to be valued at current market

or reproduction costs. Average profits for 2017, 2018, and 2019 in excess of 6% of net tangible

assets after revaluation are to be capitalized at 25% in determining the valuation to be placed on

goodwill; 150,000 shares of no-par ordinary are to be issued in payment of goodwill.

Balance sheets on March 31, 2020, when the consolidation is to be made effective, follow:

Company D Company E Company F

Cash 120,000 100,000 30,000

Receivables 280,000 160,000 220,000

Inventories 700,000 400,000 650,000

Plant and equipment (net) 2,200,000 1,000,000 1,500,000

Goodwill 200,000 100,000 ________

Total assets 3,500,000 1,760,000 2,400,000

======== ======== ========

Accounts payable 350,000 310,000 300,000

Long-term note payable 1,500,000 500,000

Ordinary shares, P100 par 1,000,000 500,000 2,000,000

Retained earnings (Deficit) 650,000 950,000 (400,000)

Total liabilities & SHE 3,500,000 1,760,000 2,400,000

======== ======== ========

Current market values:

Inventories 950,000 500,000 800,000

Plant and equipment (net) 3,000,000 1,300,000 1,750,000

Average earnings for the three-year period ended Dec. 31, 2019, were as follows: Company D,

P160,000; Company E, P120,000; and Company F, P125,000.

Required:

1. Prepare the entries on the books of DEF to record the consolidation. (5 pts.)

2. Calculate the number of shares to be issued by DEF. (3 pts. each)

a. Preference shares __________________

b. Ordinary shares __________________

3. Calculate the total assets of the new company after the consolidation. ________________ ( 3

pts.)

4. Calculate the total shareholders’ equity of the new company. __________________ (3 pts.)

Problem C

Shareholders of Algo Company, Bay Company, and Cosio Company agree to a merger. Bay

Company and Cosio Company are to accept shares of Algo Company in exchange for all of their

assets and liabilities on the basis of 1 share for every P125 of net assets transferred. On Dec. 31,

2019, the date of the transfer, balances on the books of the separate companies are as follows:

Algo Co. Bay Co. Cosio Co.

Assets:

Current assets 230,000 200,000 230,000

Plant and equipment (net) 450,000 250,000 370,000

Goodwill 20,000 50,000

Total assets 700,000 450,000 650,000

====== ====== ======

Liabilities & Stockholders’ Equity:

Current liabilities 175,000 120,000 190,000

Bonds payable 100,000 200,000

Ordinary shares, P100 500,000 150,000 200,000

Additional paid-in capital 45,000 90,000

Retained earnings (deficit) (20,000) (10,000) 60,000

Total liabilities & SHE 700,000 450,000 650,000

====== ====== ======

The following adjustments are to be made in arriving at the net asset contributions of Bay

Company and Cosio Company for purposes of the merger:

a. The inventory of the Bay Company is presently stated on a LIFO basis at P100,000; the

inventory is to be recognized at P160,000, representing cost calculated on a FIFO basis

consistent with the costing procedures of the other companies.

b. All other assets and liabilities are already stated at their fair values.

Required:

1. Prepare the entries on the books of Algo Co. (5 pts.)

Current asset 490,000

Property and Equipment 620,000

Current Liability 310,000

Bonds Payable 300,000

Ordinary Shares 500,000

2. Prepare the entries on the books of Bay Co. and Cosio Co. (10 pts.)

Bay Co

Investment on Alco Co. 290,000

Current Liability 120,000

Bonds Payable 100,000

Current Assets 200,000

Plant and Equipment (net) 250,000

Ordinary Shares 60,000

#

Cosio Co

Investment on Algo Cop. 210,000

Current Liabilities 190,000

Bonds Payable 200,000

Ordinary Shares 200,000

Current Assets 230,000

Plant and Equipment 370,000

Goodwill 50,000

#

3. Calculate the amount of the following on the books of Algo Co. after the merger. (3 pts.

each)

a. Increase in total assets P 1,110,000

b. Increase in total liabilities P 610,000

c. Increase in total shareholders’ equity P 1 025,000

You might also like

- AFAR C1 MC AnswersDocument39 pagesAFAR C1 MC Answersheyhey85% (20)

- 2 - BuscomDocument9 pages2 - BuscomDeryl GalveNo ratings yet

- Business CombinationDocument8 pagesBusiness CombinationCharla SuanNo ratings yet

- Module 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDocument4 pagesModule 2: Corporate Liquidation: Integrated Review Ii: Advanced Financial Accounting and ReportingDarren Joy CoronaNo ratings yet

- Bodie, Kane, Marcus, Perrakis and Ryan, Chapter 7: Answers To Selected ProblemsDocument12 pagesBodie, Kane, Marcus, Perrakis and Ryan, Chapter 7: Answers To Selected ProblemsForhad AhmadNo ratings yet

- Pricing Strategy of AppleDocument35 pagesPricing Strategy of Appledevika100% (1)

- Accounting 315 - Quiz Business CombinationDocument3 pagesAccounting 315 - Quiz Business CombinationJoshua HongNo ratings yet

- Module 2 - Business CombinationsDocument4 pagesModule 2 - Business Combinations수지No ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Mas M 1404 Financial Statements AnalysisDocument22 pagesMas M 1404 Financial Statements Analysisxxx101xxxNo ratings yet

- Accounting For Business Combination - PRELIMDocument5 pagesAccounting For Business Combination - PRELIMAnonymouslyNo ratings yet

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosNo ratings yet

- Problems Week 1 2Document6 pagesProblems Week 1 2Maria Jessa HernaezNo ratings yet

- More Problem SolutionDocument16 pagesMore Problem SolutionAlaur RahmanNo ratings yet

- Problem 1 Adv. Acct. IIDocument4 pagesProblem 1 Adv. Acct. IISamuel DebebeNo ratings yet

- Business Combi PDF FreeDocument13 pagesBusiness Combi PDF FreeEricka RedoñaNo ratings yet

- Module 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)Document3 pagesModule 4 - Consolidation Subsequent To The Date of Acquisition (Hand - Outs 1)ariannealcaraz6No ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationlov3m3No ratings yet

- Chapter 5Document17 pagesChapter 5Belay MekonenNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- ABC PracticeSet1 2020-2Document5 pagesABC PracticeSet1 2020-2heyheyNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Advanced Accounting Chapter 1 PDF FreeDocument11 pagesAdvanced Accounting Chapter 1 PDF FreeSitiNo ratings yet

- Quiz in Safe Payment and Cash Priority Program With Answer Keys Part 2Document4 pagesQuiz in Safe Payment and Cash Priority Program With Answer Keys Part 2caraaatbongNo ratings yet

- Chap 14 1-2Document4 pagesChap 14 1-2Buenaventura, Lara Jane T.No ratings yet

- Latihan Soal Kombis (Answered)Document6 pagesLatihan Soal Kombis (Answered)Fajar IskandarNo ratings yet

- Case 1: Acquisition Equal To Book ValueDocument6 pagesCase 1: Acquisition Equal To Book ValueMaurice AgbayaniNo ratings yet

- Additional Problems On MergerDocument6 pagesAdditional Problems On MergerkakeguruiNo ratings yet

- TeDocument8 pagesTeRaja JulianNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- HO5 Business Combination at Acquisition DateDocument4 pagesHO5 Business Combination at Acquisition Dateitzadizazta01No ratings yet

- Josie B. Aguila, Mbmba: Financial Accounting For IeDocument6 pagesJosie B. Aguila, Mbmba: Financial Accounting For IeCATHERINE FRANCE LALUCISNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Net Asset AcquisitionDocument2 pagesNet Asset AcquisitionRafael BarbinNo ratings yet

- Beams Aa13e SM 01Document14 pagesBeams Aa13e SM 01jiajiaNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocument4 pagesPROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNo ratings yet

- 26 30problemsDocument5 pages26 30problemsJanesa Maxcen CabilloNo ratings yet

- Chapter 46 Cash Flow ComprehensiveDocument8 pagesChapter 46 Cash Flow ComprehensiveCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- FRFSA Mock Test Paper-2Document6 pagesFRFSA Mock Test Paper-2vandisdiprojitNo ratings yet

- Mergers and Inv in SubsDocument4 pagesMergers and Inv in Subsmartinfaith958No ratings yet

- Books of PDocument13 pagesBooks of PicadeliciafebNo ratings yet

- TUT 13 AFADocument5 pagesTUT 13 AFALương Phương ThảoNo ratings yet

- Practical Accounting 2 (P2)Document12 pagesPractical Accounting 2 (P2)Nico evansNo ratings yet

- Financial Analysis TestsDocument25 pagesFinancial Analysis Teststheodor_munteanuNo ratings yet

- Jan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Document5 pagesJan. 1, 20x1 Abc Co. XYZ, Inc.: Total Assets 670,000 160,000Nathaniel IgotNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Chap 13 - ProblemsDocument5 pagesChap 13 - ProblemsBuenaventura, Lara Jane T.No ratings yet

- Assignment 3Document3 pagesAssignment 3zhoudong910105No ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- 1Document4 pages1NURHAM SUMLAYNo ratings yet

- Far Quiz 2 Final W AnswersDocument4 pagesFar Quiz 2 Final W AnswersMarriz Bustaliño Tan78% (9)

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Relax CompanyDocument7 pagesRelax CompanyRegine CalipusanNo ratings yet

- P2 Bus Com.O2016Document9 pagesP2 Bus Com.O2016Paulo Miguel100% (2)

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- Act201 AssignmentDocument4 pagesAct201 Assignmentmahmud100% (1)

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

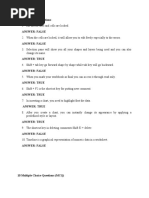

- Answer: True: Adding Graphics To A PresentationDocument1 pageAnswer: True: Adding Graphics To A PresentationAlexNo ratings yet

- Answer: True 2. Answer: True 3. Answer: False: Using Animation and MultimediaDocument1 pageAnswer: True 2. Answer: True 3. Answer: False: Using Animation and MultimediaAlexNo ratings yet

- Securing and Sharing A PresentationDocument1 pageSecuring and Sharing A PresentationAlexNo ratings yet

- 10Document1 page10AlexNo ratings yet

- Securing and Sharing A PresentationDocument1 pageSecuring and Sharing A PresentationAlexNo ratings yet

- Adding Graphics To A PresentationDocument1 pageAdding Graphics To A PresentationAlexNo ratings yet

- Percentage of Completion 33.33%Document6 pagesPercentage of Completion 33.33%AlexNo ratings yet

- Problem 4Document1 pageProblem 4AlexNo ratings yet

- True/FalseDocument1 pageTrue/FalseAlexNo ratings yet

- Name: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1Document7 pagesName: Fe C. Leyros Bsa 2 Acctg TTH 3:00-4:30 PM Solutions: Problem 1AlexNo ratings yet

- QuizDocument3 pagesQuizAlex100% (3)

- 10Document2 pages10AlexNo ratings yet

- 10 True or False QuestionsDocument8 pages10 True or False QuestionsAlexNo ratings yet

- B. Determining The Contribution Margin Per Unit and Projected Profits at Various Levels of ProductionDocument1 pageB. Determining The Contribution Margin Per Unit and Projected Profits at Various Levels of ProductionAlexNo ratings yet

- Part (B) SolutionDocument1 pagePart (B) SolutionAlexNo ratings yet

- Part (B) SolutionDocument1 pagePart (B) SolutionAlexNo ratings yet

- Arbitrage Trading Making Money Risk FreeDocument22 pagesArbitrage Trading Making Money Risk FreeJermaine WeissNo ratings yet

- The Economic Times Wealth 08.15.2022Document24 pagesThe Economic Times Wealth 08.15.2022Natasa MilanovicNo ratings yet

- Cost Benefit Analysis in Malaysian Education: Husaina Banu KenayathullaDocument18 pagesCost Benefit Analysis in Malaysian Education: Husaina Banu KenayathullaMusrilNo ratings yet

- Fall 2008 - FIN630 - 2Document2 pagesFall 2008 - FIN630 - 2sunny_fzNo ratings yet

- Mit Commercial Real Estate Analysis and Investment Online Short Program BrochureDocument9 pagesMit Commercial Real Estate Analysis and Investment Online Short Program BrochureJennifer LeeNo ratings yet

- Times Interest Earned Ratio: Compare Interest Payments With Income Available To Pay ThemDocument13 pagesTimes Interest Earned Ratio: Compare Interest Payments With Income Available To Pay Themfrank_grimesNo ratings yet

- International BusinessDocument7 pagesInternational Businessfarooq ahmadNo ratings yet

- Mixed Use JK PDFDocument9 pagesMixed Use JK PDFAnkit ChaudhariNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Vice President Marketing in Dallas FT Worth TX Resume Pete BosseDocument2 pagesVice President Marketing in Dallas FT Worth TX Resume Pete BossePeteBosseNo ratings yet

- Tata Group Is An Indian Multinational Conglomerate Company Headquartered in MumbaiDocument46 pagesTata Group Is An Indian Multinational Conglomerate Company Headquartered in MumbaiAnita VarmaNo ratings yet

- Chapter 3 MBF Financial SysDocument24 pagesChapter 3 MBF Financial SysDuy Anh NguyễnNo ratings yet

- 2017 11 Economics Sample Paper 02 Ans Ot8ebDocument5 pages2017 11 Economics Sample Paper 02 Ans Ot8ebramukolakiNo ratings yet

- Exam Reports3Document67 pagesExam Reports3Rishav Shiv RanjanNo ratings yet

- Sun Silk 1Document22 pagesSun Silk 1Nikhil Vijay ChavanNo ratings yet

- The - Hollywood - R Magazine - 06 - 05 - 2020Document60 pagesThe - Hollywood - R Magazine - 06 - 05 - 2020Mat davvNo ratings yet

- COB2Document12 pagesCOB203.Diễm Chinh 11a1No ratings yet

- Afar FCDocument2 pagesAfar FCRyan Julius RullanNo ratings yet

- Q2 July 2021Document4 pagesQ2 July 2021aisyahinafaryanis14No ratings yet

- Factsheet Nifty Consumer DurablesDocument2 pagesFactsheet Nifty Consumer Durablesdohare41No ratings yet

- Taxationlaw BarlisDocument11 pagesTaxationlaw Barlisitatchi regenciaNo ratings yet

- Materi 2Document12 pagesMateri 2Edi DarmawanNo ratings yet

- 1 PBDocument12 pages1 PBHaregewoyn DeyuNo ratings yet

- Objectives of SezDocument48 pagesObjectives of Sezasandilya100% (1)

- Key Performance IndicatorsDocument12 pagesKey Performance IndicatorsomegistosNo ratings yet

- The King of Pentacles Tarot CardDocument2 pagesThe King of Pentacles Tarot CardnaziboysNo ratings yet

- Fin Model Class5 Debt Schedule SlidesDocument10 pagesFin Model Class5 Debt Schedule SlidesGel viraNo ratings yet

- Term SheetDocument4 pagesTerm SheetSangeetSindanNo ratings yet