A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

Uploaded by

Vandita KhudiaCopyright:

Available Formats

A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

Uploaded by

Vandita KhudiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

A Study On Investment Pattern of Investor in Mutual Funds: Mr. Ismayil Paisal Khan

Uploaded by

Vandita KhudiaCopyright:

Available Formats

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

A STUDY ON INVESTMENT PATTERN OF INVESTOR

IN MUTUAL FUNDS

MR. ISMAYIL PAISAL KHAN

Saveetha School of Management, Chennai, India. Email: paisalkhan@gmail.com

MR. WILLIAM ROBERT P.

Assistant Professor, Saveetha School of Management, Chennai, India.

Email: willaim29robert@gamil.com

ABSTRACT:

The research is focusing an investment pattern of investor in mutual funds. The aim of the study is to

know about the awareness of mutual fund among investor. The objective of the study is to know about

the awareness of mutual fund among investor. The research design is taken through primary data of 120

respondents was collected through a close-ended questionnaire and the results were analyzed. The

investor is the respondents to know their perception regarding the awareness and investment pattern.

The tools used for analysis were frequency test. The research finds that the investors have high level of

awareness in the mutual funds. The study concludes from the research that the investment pattern of

investors in mutual funds required improving the awareness about the schemes and future benefits to the

investors.

INTRODUCTION:

Common Fund is advanced by a support and kept running by an assume that pools the

investment funds of various retail speculators who share a typical budgetary objective.

The cash gathered by offering units of common assets is put by the reserve

administrator in various kinds of securities depending as indicated by the target of the

plan. These could extend from offers to debentures to cash advertise instruments. For

206 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

singular speculators a Mutual Fund offers enhanced, professionally Overseen

portfolio at a moderately minimal effort. Anyone with an investible excess of as

meager as a scarcely any thousand rupees can put resources into Mutual Funds. Each

Mutual Fund plot has a characterized venture target and procedure.

From its initiation the development of Indian shared assets industry was moderate

and it took truly long a very long time to develop the cutting edge common assets.

Essential rationale behind shared reserve a venture is to convey a type of broadened

speculation arrangement. Throughout the years the thought created and individuals

got an ever increasing number of decisions of broadened speculation portfolio through

the shared assets. The credit goes to unit trust of India (UTI) for presenting the first

common reserve in India. Late years, Indian cash and capital market has indicated

colossal development and extended its range to more extensive land limits. Indian

controllers in cash and capital market have effectively taken an interest in confining

controls which offers certainty to both individual and institutional Institutions for

cooperation. Dynamic changes have occurred with the activity of Security Exchange

Board of India (SEBI), capital market controller in India which encourages funds. As

a money related mediator common store has assumed a huge part in the advancement

and development of capital markets in India. As per the different studies, directed in

India by SEBI, National Council of Applied Economic Research (NCAER) and

resource administration organizations (AMCs), little salaried financial specialists by

and large goes for bank stores, government supported little investment funds plans or

blessing life strategies for impose sparing reason, which don't give support against

swelling and regularly arrive up acquiring negative genuine returns. With the

progression of time, India has seen numerous new and inventive common assets.

Nonetheless, there has been a change in outlook in the techniques and methods for

offering these assets additionally changed with time. It is proceeding to advance to a

superior future, where the financial specialists will get more current openings. In this

period of globalization and rivalry, the accomplishment of this industry is dictated by

the market execution of its stock. Amid the time of this examination, execution of

shared store industry was not according to the desire, in view of the underperformance

of the optional market and inconvenience of roof on the cost proportion and passage

207 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

stack charges by capital market controller. With recovered joined endeavors of the

business houses and the finance administrators and with the support of market

controllers, and broad mindfulness program for financial specialists, interests in

shared assets plans bound to get support.

NEED FOR THE STUDY:

To know about the awareness of mutual fund among investor.

To provide knowledge about mutual fund among investor.

It increases customer lifetime value.

It reduces negative word of mouth.

To bring new investment & increase it.

OBJECTIVES OF THE STUDY:

To study the Investment Pattern of investor in Mutual Fund

To study the investment decisions of different social class investor (in term of

Age group, Gender, Income level etc.)

To determine the preference of Investors in Mutual Fund.

To determine the factor influencing the preference of investment.

To study the amount of money invested in Mutual Fund.

To study the benefit of investing in Mutual Fund.

SCOPES OF THE STUDY:

This research will show the percentage of investors awareness about the

Mutual Funds.

Helps to find out where there they want to improve to get more investors.

This study gives idea to the mutual fund company to know about the different

investors mind set of customers.

LIMITATIONS OF THE STUD:

The investment pattern analysis has been limited to only 120 investor

208 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

This study is conducted to analyze their pattern not all those factors that really

matter while investing.

An interpretation of this study is based on the assumption that the respondents

have given correct information.

The economy and industry are so wide and comprehensive than it is difficult

to encompass all the likely influencing the investors investment pattern in the

given period of time.

REVIEW OF LITERATURE:

Gruber, M.J.(2011) have identified the Shared assets speak to one of the quickest

developing sort of budgetary middle person in the American economy. The inquiry

stays concerning why common assets and specifically effectively oversaw shared

assets have developed so quick, when their execution by and large has been

substandard compared to that of record stores. One conceivable clarification of why

financial specialists purchase effectively oversaw open end reserves lies in the way

that they are purchased and sold at net resource esteem, and therefore administration

capacity may not be evaluated. On the off chance that administration capacity exists

and it is excluded in the cost of open end stores, at that point execution ought to be

unsurprising. On the off chance that execution is unsurprising and at any rate a few

financial specialists know about this, at that point money streams into and out of

assets ought to be unsurprising by the plain same measurements that anticipate

execution. At long last, if indicators exist and in any event a few financial specialists

follow up on these indicators in putting resources into common subsidizes, the arrival

on new money streams ought to be superior to the normal return for all speculators in

these assets. This article presents exact confirmation on these issues and demonstrates

that financial specialists in effectively oversaw shared assets may have been more

balanced than we have accepted.

Adams, J.C., Mansi, S.A., & Nishikawa, T.(2009) has stated the new confirmation

connecting board qualities and execution. Utilizing physically gathered administration

information from the common reserve industry, we locate a backwards connection

between board size and store execution. We likewise discover confirm that

209 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

authoritative shape assumes a vital part in deciding operational execution. Generally

speaking, the outcomes are steady with the thought that there may not be a solitary

ideal board structure that is relevant to all supports, that endeavors to control board

properties ought to be considered with alert, and that support level components are

essential board structure contemplations.

Bergstresser, D., Chalmers, J.M.,& Tufano, P.(2008) have identified the numerous

speculators buy common finances through intermediated channels, paying

intermediaries or monetary consultants for finance choice and exhortation. This article

endeavors to evaluate the advantages that financial specialists appreciate in return for

the expenses of these administrations. We consider merchant sold and coordinate sold

assets from 1996 to 2004, and neglect to find that representatives convey significant

substantial advantages. In respect to coordinate sold assets, specialist sold assets

convey bring down hazard balanced returns, even before subtracting appropriation

costs. These outcomes hold crosswise over store goals, except for remote value

reserves. Further, agent sold assets display no more ability at total level resource

distribution than do stores sold through the immediate channel. Our outcomes are

predictable with two speculations: that agents convey considerable elusive advantages

that we don't watch and that there are material irreconcilable circumstances amongst

intermediaries and their customers.

Kempf, A., & Ruenzi, S.(2007) have analyzed the process of inspect intrafirm

rivalry in the common store industry. We test the theory that reserve directors inside

common store families contend with each other in a competition. Our exact

investigation of the US value common store advertise demonstrates that they alter the

hazard they take contingent upon the relative position inside their reserve family. The

bearing of the modification relies upon the focused circumstance in that family.

Hazard alterations are especially articulated among administrators of assets with high

cost proportions, which are overseen by a solitary supervisor and which have a place

with huge families.

210 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

Khorana, A., servaes, H., & Tufano, P.(2005) have analyzed the paper

contemplates the shared reserve industry in 56 nations and looks at where this money

related advancement has prospered. The store business is bigger in nations with more

grounded tenets, laws, and directions, and particularly where common reserve

speculators' rights are better secured. The business is likewise bigger in nations with

wealthier and more taught populaces, where the business is more seasoned,

exchanging costs are lower and in which characterized commitment benefits designs

are more common. The business is littler in nations where hindrances to passage are

higher. These outcomes show that laws and directions, supply-side and request side

factors all the while influence the span of the store business.

Shu, P.G.,Yeh,Y.H., & Yamada, T.(2002) stated that we look at the venture stream

of open-end value shared assets. With an exceptional information from Taiwan, we

can explore the purchase and offer conduct of common speculators independently. We

locate that most financial specialists that put resources into vast shared assets are little

sum speculators, while those that put resources into little subsidizes contribute a

considerably bigger sum. Little sum financial specialists of expansive assets tend to

pursue past victors and reclaim shares once subsidize execution makes strides. They

will probably maintain a strategic distance from effectively oversaw reserves with

high turnover. Then again, huge sum financial specialists of little subsidizes seem, by

all accounts, to be impartial purchasers whose buys are not amazingly influenced by

here and now execution. They will probably keep execution enhancing reserves,

reclaim the failures, and pay higher administration charges.

Kiron, K., & Bander, K. S (2000) said that shared store securitization process

allowing the exchanging of open end common subsidizes and connected subordinate

securities on or off the floor of a National Securities Exchange. The focused on

singular open end common store or gathering of open end shared assets, chose

through a screening procedure is securitized through the making of another, different

security. This new security is ideally a "shut end reserve of assets" and connect

subordinate securities, which artificially duplicate the factual relationship of the

characterized individual or gathering of open end shared assets. The upkeep of

budgetary records for the new security is kept up by electronically putting away

211 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

profit, capital increases and wage got from the open end stores which have been put

resources into, and ascertaining master forma money related proclamations to scatter

to investors and every single applicable gathering.

Sirri, E.R., & Tufano, P.(1998) have identified the paper contemplates the streams

of assets into and out of value common assets. Customers construct their reserve buy

choices with respect to earlier execution data, however do as such lopsidedly, putting

excessively more in stores that performed exceptionally well the earlier period.

Inquiry costs appear to be an essential determinant of store streams. Superior has all

the earmarks of being most remarkable for reserves that apply higher advertising

exertion, as estimated by higher expenses. Streams are straightforwardly identified

with the measure of the store's mind boggling and in addition the ebb and flow media

consideration gotten by the reserve, which bring down buyers' hunt costs.

Alexander, G.J., Jones, J.D., & Nigro, P.J.(1998) have analyzed the paper

looks at reactions from an overview of 2,000 haphazardly chose common reserve

financial specialists who acquired offers from six distinctive circulation channels. The

study gives information on the statistic, money related, and finance proprietorship

qualities of common reserve speculators. It additionally gives information on

speculators' information of the expenses and venture dangers of common assets and

the data sources these financial specialists use to find out about these expenses and

dangers. Our review results firmly recommend there is opportunity to get better in the

level of money related education of common reserve financial specialists.

Carhart, M.M.(1997) Utilizing an example free of survivor predisposition, I show

that regular factors in stock returns and venture costs totally clarify steadiness in value

common assets' mean and risk‐ adjusted returns. Hendricks, Patel and Zeckhauser's

(1993) "hot hands" result is generally determined by the one‐ year energy impact of

Jegadeesh and Titman (1993), however singular assets don't acquire higher comes

back from following the force system in stocks. The main critical industriousness not

clarified is gathered in solid underperformance by the worst‐ return shared assets. The

212 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

outcomes don't bolster the presence of gifted or educated shared reserve portfolio

supervisors.

Dibartolomeo, D., & witkowski, E.(1997) has stated an iterative utilization of

William Sharpe's technique for style investigation is connected to the grouping of

value common assets. Another technique for making purged shared store style records

is utilized to confirm existing groupings. Results recommend that 9 percent of all

value reserves are genuinely misclassified and another 31 percent are to some degree

misclassified. Two variables develop as the no doubt purposes behind

misclassification: (1) the uncertainty of the present arrangement framework and (2)

focused weights in the common reserve industry and remuneration structures that

reward relative execution. Monte Carlo recreations on out-of-test information

demonstrate that this misclassification significantly affects financial specialists'

capacity to fabricate broadened arrangement of shared assets.

Droms, W.G., & Walker, D. A.(1996) have analyzed the pooled cross-segment/time

arrangement examination is utilized to evaluate the long-run connection between

hazard balanced execution of value common assets and resource estimate, cost

proportions, portfolio turnover, and load/no-heap status. The information base

comprises of venture aftereffects of 151 value shared supports in ceaseless task over

the 20-year time frame from 1971 to 1990. Varieties of the cross-segment/time

arrangement show are utilized to investigate the connections among the idea of the

assets (stack or no-heap) with resource size and cost proportions. Venture execution

isn't identified with resource estimate, turnover rate, or load/no-heap status, and

higher costs are related with higher returns.

Elton, E.J., Gruber, M.J., & Blake, C.R.(1996) have started the consistency for

stock shared assets utilizing hazard balanced returns. We locate that past execution is

prescient of future hazard balanced execution. Applying present day portfolio

hypothesis strategies to past information enhances choice and enables us to build an

arrangement of assets that fundamentally beats a lead in light of past rank alone.

What's more, we can frame a blend of effectively oversaw portfolios with

213 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

indistinguishable hazard from a portfólio of file finances yet with higher mean return.

The portfolios chose have little yet factually huge positive hazard balanced returns

amid a period where common finances by and large had negative hazard balanced

returns.

Malkiel, B.G.(1995) have analyzed the numerous people buy partakes in common

supports as ventures. With an absence of proof supporting execution ingenuity in

finance returns, speculators ought to consider costs as a fund‐ selection device since

finance costs negatively affect subsidize returns. One of the biggest costs brought

about by subsidize speculators is appropriation costs, which incorporate both load

charges and yearly expenses. Near two‐ thirds of all value stores charge financial

specialists for finance appropriation. The genuine cost of these dispersion expenses to

speculators is difficult to quantify on the grounds that a bunch of circulation courses

of action have developed that shift both the planning and greatness of conveyance

charges. We determine a straightforward philosophy that communicates the present

estimation of conveyance costs as a level of the first interest in subsidize shares for

any normal holding period. This philosophy permits coordinate correlation of the

impact on financial specialists of dissemination expenses for common assets with

various kinds of offers plans.

Coggin, T.D., Fabozzi, F.J., & Rahman, S.(1993) have analyzed the paper

exhibits an observational examination of the selectivity and market timing execution

of an example of U.S. value annuity finance directors. Notwithstanding the decision

of benchmark portfolio or estimation demonstrate, the normal selectivity measure is

sure and the normal planning measure is negative. Anyway both selectivity and

timing give off an impression of being fairly delicate to the decision of a benchmark

when chiefs are grouped by venture style. Meta‐ analysis uncovered some genuine

variety around the mean qualities for each measure. The 80 percent likelihood

interims for selectivity uncovered that the best supervisors created considerable

risk‐ adjusted overabundance returns. We additionally found a negative relationship

amongst's selectivity and timing, however we contend that the watched negative

214 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

connection in our information is to a great extent an ancient rarity of adversely

corresponded examining blunders for the two appraisals.

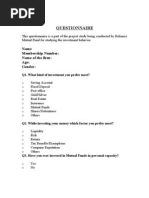

RESEARCH METHODOLOGY

RESEARCH DESIGH

Descriptive research seeks to certain magnitude by making complete the study of the

topic is the investor’s perception towards mutual funds. The present study used

primary data. The data is collected from through the questionnaire provided to the

customer and get the respondents. It is collected from the interactions with analysis in

the company during the live interaction to the investors. It is collected from the

company websites, old record, magazines & textbooks. Respondent Inside of the

organization is 80, and investors from the outside are 40. The overall population size

of this study is 120. Sampling is a procedure to draw conclusion about the large

group of respondents by studying a sample of the total number investing mutual fund

.sample is the segment of the investor. 120 Samples.

DATA ANALYSIS AND INTERPRETATION

Frequency Analysis

Table 4.1 Analysis of Age of the Investors

Age Frequency Percent

20-30 37 30.8

31-40 38 31.7

41-50 34 28.3

ABOVE 51 11 9.2

Total 120 100.0

Interpretation: From the table 4.1 it is found that 20-30 age of the investor

are invested in 30.8% , 31-40 age of the investor are invested in 31.7%, 41-50 age of

the investor are invested in 28.3%, above 51 age of the investor are invested in 9.2%.

So, it can be concluded that majority is 31-40 age of the investor.

215 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

Table 4.2 Analysis of Gender

Gender Frequency Percent

MALE 105 87.5

FEMALE 15 12.5

Total 120 100.0

Interpretation: From the table 4.2 it is found that 87.5% are Male and 12.5 % are

Female. So, it can be concluded than majority of the customer are male candidate.

Table 4.3 Analysis of Employment of the Investor

Employment Frequency Percent

PUBLIC 25 20.8

PRIVATE 56 46.7

BUSINESS 26 21.7

OTHERS 13 10.8

Total 120 100.0

Interpretation: From the table 4.3 it is found that 20.8%, of the investors are

public employee, 46.7% of the investors are private employee, 21.7% of the investors

are business, and remaining 10.8% of the investors are others. So, it can be concluded

that majority of the investor are private employee.

Table 4.4 Analysis of Monthly Income of the Investor

Monthly Income Frequency Percent

BELOW 20000 17 14.2

20001-50000 66 55.0

50001-100000 30 25.0

ABOVE100001 7 5.8

Total 120 100.0

216 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

Interpretation: From the table 4.4 it is found that 14.2% of the investors income is

below 20000, 55% of the investors income is below 50000, 25% of the investor

income below100000, and remaining 5.8% of the investor income is above 100001.

So, it can be concluded that majority of the investor income is below 50000.

Table 4.5 Analysis of Monthly Savings of the Investors

Monthly Saving Frequency Percent

LESS THEN 10% 34 28.3

11-25% 66 55.0

26-50% 16 13.3

MORE THEN 51 4 3.3

Total 120 100.0

Interpretation: From the table 4.5 it is found that 28.3% of the investors

savings is less then 10%, 55% of the investors are savings 11-25%, 13.3% of the

investors are savings 26-50%, and remaining 3.3% of the investors are savings more

then 51%. So, it can be concluded than majority of the investor savings is 11-25%.

Table 4.6 Analysis of Preferred Investment

Preferred Investment Frequency Percent

BANK DEPOSITS 18 15.0

STOCK MARKET 58 48.3

INSURANCE 6 5.0

MUTUAL FUND 38 31.7

Total 120 100.0

Interpretation: From the table 4.6 it is found that 15% of the investor are

invest in bank deposits, 48.3% of the investor are invest in stockmarket,5% of the

investor are invest in insurance, and remaining 31.7% of the investor are invest in

217 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

mutual fund. So, it can be concluded that majority of the investor are preferred stock

market.

Table 4.7 Analysis of Which Preference of Factor in Investment

FACTOR Frequency Percent

LIQUIDITY 23 19.2

LOW RISK 48 40.0

HIGH RETURN 38 31.7

COMPANY REPUTATION 11 9.2

Total 120 100.0

Interpretation: From the table 4.7 it is found that 19.2% of the investor are

preferred in liquidity, 40% of the investor preferred in low risk, 31.7% of the investor

are preferred in high return, and remaining 9.2% of the investor are preferred in

company reputation. So, it can be concluded than majority of the investor are

preferred low risk.

Table 4.8 Analysis of Level of Awareness of Mutual Fund

Awareness level Frequency Percent

YES 91 75.8

NO 29 24.2

Total 120 100.0

Interpretation: From the table 4.8 it is found that 75.8% of the investor are

said yes, and remaining 24.2% of the investor are said no. So, it can be concluded that

majority of the investor are said yes.

Table 4.9 Analysis of Causes of Investing in Mutual Fund

Purpose for Investment Frequency Percent

218 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

MORE RETURNS 42 35.0

GOAL ORIENTED 34 28.3

MANAGED RISK 22 18.3

CAPITAL APPRECIATION 3 2.5

SYSTEMATIC INVESTMENT 19 15.8

Total 120 100.0

Interpretation: From the table 4.9 it is found that 35% all the respondents

invest for the purpose of more return, 28.3% all the respondents invest for the purpose

of goal oriented, 18.3 all the respondents for the purpose of managed risk, 2.5% all

the respondents invest for the purpose of capital appreciation, 15.8% all the

respondents invest for the purpose of systematic investment. So, it can be concluded

that majority of respondents more returns.

Table 4.10 Analysis of Amount of Money Investing in Mutual Fund

Investing level Frequency Percent

1000-4000 41 34.2

4001-7000 49 40.8

7001-10000 25 20.8

MORE THEN 10001 5 4.2

Total 120 100.0

Interpretation: From the table 4.10 it is found that 34.2% of the investor are

said below 4000, 40.8% of the investor are said below 7000, 20.8% of the investor are

said below 10000 and remaining 4.2% of the investor are said more then 10001. So, it

can be concluded that majority of the investor said below 7000.

Table 4.14 Analysis of Invested Scheme

Schemes Frequency Percent

OPEN ENDED 26 21.7

219 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

CLOSED ENDED 24 20.0

LIQUID 13 10.8

GROWTH 13 10.8

LONG CAP 14 11.7

MID CAP 9 7.5

REGULAR INCOME 13 10.8

SECTOR FUND 8 6.7

Total 120 100.0

Interpretation: From the table 4.14 it is found that21.7% of the investor are

said open ended, 20% of the investor are said closed ended, 10.8% of the investor are

said liquid, 10.8% of the investor are said growth, 11.7% of the investor are said long

cap, 7.5% of the investor are said mid cap, 10.8% of the investor are said regular

income, and remaining 6.7% of the investor are said for sector fund. So, it can be

concluded that majority of the investor are said open ended.

Table 4.15 Analysis of most Attractive Mutual fund

Attractive level Frequency Percent

SYSTEMATIC INVESTMENT PLAN(SIP) 44 36.7

LIMITED INVESTMENT 41 34.2

COMPOUNDING RETURNS 9 7.5

BETTER ASSET ALLOCATION 22 18.3

DIVERSIFICATION 3 2.5

Total 119 99.2

Interpretation: From the table 4.15 it is found that36.7% of the investor are said

(SIP), 34.2% of the investor are said limited investment, 7.5% of the investor are said

compounding returns, 18.3% of the investor are said better asset allocation, and

remaining 2.5% of the investor are said diversification. So, it can be concluded that

majority of the investor are said systematic investment plan(SIP).

220 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

Table 4.16 Analysis about type of Mutual fund

Types Frequency Percent

EQUITY FUND 46 38.3

DEBT FUND 59 49.2

BALANCED FUND 15 12.5

Total 120 100.0

Interpretation: From the table 4.16 it is found that 38.3% of the investor are

said equity fund, 49.2% of the investor are said debt fund, and remaining 12.5% of the

investor are said balanced fund. So, it can be concluded that majority of the investor

said debt fund.

Table 4.17 Analysis of Investment in any other Mutual Fund

Other Mutual Fund Frequency Percent

YES 63 52.5

NO 57 47.5

Total 120 100.0

Interpretation: From the table 4.17 it is found that 52.5% of the investor are

said yes, and remaining 47.5% of the investor are said no. So, it can be concluded that

majority of the investor are said yes.

Table 4.18 Analysis about have Invested in Mutual Fund & which

Mutual Fund

Investor level Frequency Percent

PRUDENTIAL ICICI MUTUAL FUND 42 35.0

RELIANCE MUTUAL FUND 31 25.8

BIRLA SUN LIFE MUTUAL FUND 3 2.5

SHAREKHAN MUTUAL FUND 14 11.7

SBI MUTUAL FUND 25 20.8

OTHERS 5 4.2

Total 120 100.0

221 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

Interpretation: From the table 4.18 it is found that35% of the investor are said

prudential icici mutual fund, 25.8% of the investor are said reliance mutual fund,

2.5% of the investor are said biria sun life mutual fund, 11.7% of the investor are said

sharekhan mutual fund, 20.8% of the investor are said sbi mutual fund, and remaining

4.2% of the investor are said others. So, it can be concluded that majority of the

investor are said prudential icici mutual fund.

FINDINGS

The majority is 30-40 age of the investor. The majority of the investors are male

candidate. The most of the investors are private employee. The over all of the

investors income is 20000-50000. The majority of monthly savings 10-25% from

their income. The most of the investors are preferred stock market. The major of the

investors are preferred low risk. The majority of the investors are awareness about

mutual fund. The most of the mutual fund investors are investment purpose of more

returns. The majority of the investors are investing levels is below 7000. Maximum

investor choosing a scheme opens ended. Investors was attracts by systematic

investment plan. Investors would invest more in debt equity fund. Investors are

doing other mutual fund. Investor’s maximum invested in prudential ICICI mutual

fund.

SUGGESTION

Percentage of investing the age of above 51 is very low so, try to cover all type of age

customers. Improve the female investors in mutual funds; make more interaction with

them help to make investment more. Focus on other type of employment mainly,

public and Business because they get more money, if they know about mutual funds

definitely they will invest. Awareness about the mutual fund to the investor is very

high (75.8) but the problem is investment amount is very low, so better to explain the

future benefits to investor and advantage of investment in mutual fund give more idea

to them. Increase the marketing and promotional activities make the awareness about

the mutual fund. Improve the investors in mutual fund as much as possible the level in

the stock market. Explain the type and benefit of investing mutual funds and future

returns also. Good Customer relationship make the investors feel free to ask the

queries directly and come to know about all the schemes in mutual funds.

222 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

CONCLUSION

The success of a mutual fund depends upon the awareness level of the investors.

The investment pattern varies with age, gender, occupation etc, Even after seeing the

market crash in May 2006 people still thinks that mutual fund is much reliable way

to invest in stock market. So investors are not going for redemption during crash

& were ready to wait. In fact during the crash time many people were ready to invest

in mutual fund. The study observed high level of awareness about mutual fund

among the investors. It also observed significant difference in the awareness level

the investors belonging to different employment background, gender and age. The

amount of investment rate very low needs more marketing and promotional

strategies to improve the investors in mutual funds. They always want high return

low risk for that investors need to wait for the particular time period. Try to explain

all the benefits and future returns to the investors properly. Hence it can be

concluded from the above research that investment pattern of investors in mutual

funds required to improve the awareness about the schemes and future benefits to

the investors.

REFERENCE

1. Gruber, M. J. (2011). Another puzzle: The growth in actively managed mutual

funds. In Investments And Portfolio Performance (pp. 117-144).

2. Adams, J. C., Mansi, S. A., & Nishikawa, T. (2009). Internal governance

mechanisms and operational performance: Evidence from index mutual funds. The

Review of Financial Studies, 23(3), 1261-1286.

3. Bergstresser, D., Chalmers, J. M., &Tufano, P. (2008). Assessing the costs and

benefits of brokers in the mutual fund industry. The Review of Financial

Studies, 22(10), 4129-4156.

4. Kempf, A., &Ruenzi, S. (2007). Tournaments in mutual-fund families. The

Review of Financial Studies, 21(2), 1013-1036.

5. Khorana, A., Servaes, H., &Tufano, P. (2005). Explaining the size of the

mutual fund industry around the world. Journal of Financial Economics, 78(1), 145-

185.

223 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

Indo-Iranian Journal of Scientific Research (IIJSR)

(Peer Reviewed International Journal), Volume 2, Issue 3, Pages 206-224, July-September 2018

6. Shu, P. G., Yeh, Y. H., & Yamada, T. (2002). The behavior of Taiwan mutual

fund investors—performance and fund flows. Pacific-basin finance journal, 10(5),

583-600.

7. Kiron, K., & Bander, K. S. (2000). U.S. Patent No. 6,088,685. Washington,

DC: U.S. Patent and Trademark Office.

8. Sirri, E. R., &Tufano, P. (1998). Costly search and mutual fund flows. The

journal of finance, 53(5), 1589-1622

9. Alexander, G. J., Jones, J. D., &Nigro, P. J. (1998). Mutual fund shareholders:

Characteristics, investor knowledge, and sources of information. Financial Services

Review, 7(4), 301-316

10. Carhart, M. M. (1997). On persistence in mutual fund performance. The

Journal of finance, 52(1), 57-82.

11. DiBartolomeo, D., &Witkowski, E. (1997). Mutual fund misclassification:

Evidence based on style analysis. Financial Analysts Journal, 53(5), 32-43.

12. Droms, W. G., & Walker, D. A. (1996). Mutual fund investment

performance. The Quarterly Review of Economics and Finance, 36(3), 347-363.

13. Elton, E. J., Gruber, M. J., & Blake, C. R. (1996). The persistence of risk-

adjusted mutual fund performance. Journal of business, 133-157.

14. Malkiel, B. G. (1995). Returns from investing in equity mutual funds 1971 to

1991. The Journal of finance, 50(2), 549-572

15. Coggin, T. D., Fabozzi, F. J., & Rahman, S. (1993). The investment

performance of US equity pension fund managers: An empirical investigation. The

Journal of Finance, 48(3), 1039-1055.

.

224 | P a g e ISSN: 2581-4362 Website: www.iijsr.com

You might also like

- Task 2.1 Plan To Meet Internal and External Customer RequirementsDocument6 pagesTask 2.1 Plan To Meet Internal and External Customer RequirementsPahn PanrutaiNo ratings yet

- 4308 Thiei David V Research Methods For Engineers Metodi Issledovaniy Dlya Injenerov PDFDocument304 pages4308 Thiei David V Research Methods For Engineers Metodi Issledovaniy Dlya Injenerov PDFGosai Mohamed100% (1)

- A Project Report On "Why Mutual Fund Is The Better Investment Plan"Document71 pagesA Project Report On "Why Mutual Fund Is The Better Investment Plan"Sandeep Mahasuar80% (5)

- A Study To Assess The Perception of Mutual Fund Investors-Vijay 4sem MbaDocument7 pagesA Study To Assess The Perception of Mutual Fund Investors-Vijay 4sem Mbaviji videz100% (2)

- Theoritical FrameworkDocument4 pagesTheoritical FrameworkManisha ChaudhariNo ratings yet

- Mutual Fund As An Investment AvenueDocument62 pagesMutual Fund As An Investment Avenueamangarg13100% (8)

- Performance Evaluation of Mutual Funds in IndiaDocument40 pagesPerformance Evaluation of Mutual Funds in IndiafathimathabasumNo ratings yet

- Questioner On Investment Habits of PeopleDocument2 pagesQuestioner On Investment Habits of Peoplemaulik_mike7100% (5)

- Study The Awareness of Mutual Fund in MumbaiDocument48 pagesStudy The Awareness of Mutual Fund in MumbaiPrianca Kadam67% (3)

- Literature Review OriginalDocument7 pagesLiterature Review OriginalJagjeet Singh82% (11)

- Icici Prudential ReportDocument70 pagesIcici Prudential Reportrahulsogani123No ratings yet

- Questionnaire On Mutual FundsDocument5 pagesQuestionnaire On Mutual Fundsriteshjindal19875008No ratings yet

- Questionnaire On Mutual Fund of RelianceDocument3 pagesQuestionnaire On Mutual Fund of Reliancegaganhungama007No ratings yet

- Risk & Return Analysis in Mutual Fund IndustryDocument3 pagesRisk & Return Analysis in Mutual Fund IndustrySubrat Patnaik67% (3)

- Data Analysis & Its InterpretationDocument23 pagesData Analysis & Its InterpretationBharat MahajanNo ratings yet

- QuestionnaireDocument5 pagesQuestionnaireridimakhijaNo ratings yet

- Comparative Analysis Reliance and SbiDocument69 pagesComparative Analysis Reliance and SbiPreet Singh0% (1)

- Mutual Fund Project OutlineDocument6 pagesMutual Fund Project OutlineAnto PremNo ratings yet

- Investors Awareness and Perception Towards Mutual Fund Investment:an Exploratory StudyDocument11 pagesInvestors Awareness and Perception Towards Mutual Fund Investment:an Exploratory StudyIJAR JOURNALNo ratings yet

- A Study of Mutual Fund Investment Awareness of People of Kalyan Dombivli Municipal Corporation RegionDocument8 pagesA Study of Mutual Fund Investment Awareness of People of Kalyan Dombivli Municipal Corporation RegionVaibhav GawandeNo ratings yet

- Presentation of Summer Training Project Report On Mutual FundDocument31 pagesPresentation of Summer Training Project Report On Mutual FundAnkit ChhabraNo ratings yet

- A Project Report ON Consumer Behaviour AT: Masters of Business Administration (MBA)Document79 pagesA Project Report ON Consumer Behaviour AT: Masters of Business Administration (MBA)Anjali Kathuria100% (8)

- A Project Report On Mutual Funds - UTIDocument57 pagesA Project Report On Mutual Funds - UTIsidd0830100% (1)

- Literature Review of Mutual Funds in IndiaDocument4 pagesLiterature Review of Mutual Funds in Indiaanu0% (2)

- A PROJECT REPORT On Mutual Fund A Safer InvestmentDocument56 pagesA PROJECT REPORT On Mutual Fund A Safer InvestmentBabasab Patil (Karrisatte)100% (1)

- Study of Mutual FundDocument106 pagesStudy of Mutual Fundmadhumaddy20096958No ratings yet

- "Systematic Investment Plan: Sbi Mutual FundDocument60 pages"Systematic Investment Plan: Sbi Mutual Fundy2810No ratings yet

- A Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementDocument50 pagesA Study On Changing Investment Pattern Among Youth: G.H.Patel Post Graduate Institute of Business ManagementNaveen SahaNo ratings yet

- Mutual Fund InvstDocument109 pagesMutual Fund Invstdhwaniganger24No ratings yet

- Project On NJ India Invest PVT LTDDocument77 pagesProject On NJ India Invest PVT LTDrajveerpatidar69% (26)

- Executive SummaryDocument41 pagesExecutive SummaryArchana SinghNo ratings yet

- Mutual Fund ProjectDocument90 pagesMutual Fund ProjectAgnel Fernandes100% (1)

- BLack BookDocument65 pagesBLack Bookabhishek mohite100% (1)

- A Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionDocument17 pagesA Study On Awareness of Mutual Fund in Bachelor Students of Navsari RegionPriyanka PandeyNo ratings yet

- A Study On Portfolio Management at Motilal Oswal Financial Services LTD SubmittedDocument11 pagesA Study On Portfolio Management at Motilal Oswal Financial Services LTD Submittedv raviNo ratings yet

- Project of Mutual FundsDocument41 pagesProject of Mutual FundsNeha Shah100% (1)

- Comparison of Mutual Funds With Other Investment OptionsDocument56 pagesComparison of Mutual Funds With Other Investment OptionsDiiivya87% (15)

- Performance Evaluation of Public and Private Sector Mutual Funds Mba ProjectDocument50 pagesPerformance Evaluation of Public and Private Sector Mutual Funds Mba ProjectRishabh GoelNo ratings yet

- Comparative Analysis On Mutual Fund Scheme MBA ProjectDocument83 pagesComparative Analysis On Mutual Fund Scheme MBA Projectvivek kumar100% (1)

- 16 BibliographyDocument10 pages16 BibliographyBinayKPNo ratings yet

- Findings SuggestionsDocument4 pagesFindings SuggestionsWilfred DsouzaNo ratings yet

- Systematic Investment PlanDocument13 pagesSystematic Investment PlanPranika jain100% (1)

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathNo ratings yet

- A Mutual Fund Preference Survey - Google FormsDocument7 pagesA Mutual Fund Preference Survey - Google FormsADITYA SINGH RAJAWAT 1923605No ratings yet

- Questionnaire For InvestorsDocument4 pagesQuestionnaire For InvestorsVikas AhujaNo ratings yet

- Questionnaire On Mutual Fund InvetmentDocument4 pagesQuestionnaire On Mutual Fund InvetmentSafwan mansuriNo ratings yet

- Investor Perception On Investing in The Stock Market With Reference To Young Professionals in JMARATHON ADVISORY SERVICES PVTDocument50 pagesInvestor Perception On Investing in The Stock Market With Reference To Young Professionals in JMARATHON ADVISORY SERVICES PVTArafath50% (2)

- Systematic Investment Plan (SIP)Document3 pagesSystematic Investment Plan (SIP)rupesh_kanabar160486% (7)

- Project Report On Study of Mutual Fund and Its Comparison With Other Investment OptionsDocument70 pagesProject Report On Study of Mutual Fund and Its Comparison With Other Investment Optionsnsdhillon4380% (10)

- Religare ProjectDocument109 pagesReligare Projectjagrutisolanki01No ratings yet

- A Comparative Analysis of Public and Private Sector MutualDocument17 pagesA Comparative Analysis of Public and Private Sector Mutualprincess100% (1)

- Questionnaire For Customer Satisfaction at SBI Mutual FundDocument1 pageQuestionnaire For Customer Satisfaction at SBI Mutual FundSalman Syed MohdNo ratings yet

- Swot Analysis of Sbi MFDocument3 pagesSwot Analysis of Sbi MFKrishna Prasad Gadde33% (6)

- Project On Investor Preference in Mutual FundsDocument52 pagesProject On Investor Preference in Mutual FundsKevin Iyc100% (1)

- SBI Mutual FundDocument57 pagesSBI Mutual Fundpavan kumar100% (1)

- Demat Project ReportDocument91 pagesDemat Project ReportVeronica VaghelaNo ratings yet

- Mutual Fund SynopsisDocument8 pagesMutual Fund SynopsisAamit Bhardwaj50% (2)

- MF QuestionnaireDocument5 pagesMF QuestionnaireVINEETA KAPOORNo ratings yet

- EvolutionofMFinIndia PaperDocument22 pagesEvolutionofMFinIndia PaperSindhuNo ratings yet

- EvolutionofMFinIndia PaperDocument22 pagesEvolutionofMFinIndia PaperrodpalkarNo ratings yet

- A Study On Investor Behavior Towards Investment Pattern PortfoliosDocument12 pagesA Study On Investor Behavior Towards Investment Pattern PortfoliosKavitha KavithaNo ratings yet

- Comparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth FundsDocument9 pagesComparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth Fundsparmeen singhNo ratings yet

- Sapm 1 & 2Document73 pagesSapm 1 & 2Vandita KhudiaNo ratings yet

- Summer Internship Project ReportDocument12 pagesSummer Internship Project ReportVandita KhudiaNo ratings yet

- Above-Average Returns: Returns in Excess of What An Investor Expects To Earn From Other Investments With A Similar Amount of RiskDocument43 pagesAbove-Average Returns: Returns in Excess of What An Investor Expects To Earn From Other Investments With A Similar Amount of RiskVandita KhudiaNo ratings yet

- How Many Percentages of Your Savings You Invest in Mutual Funds?Document18 pagesHow Many Percentages of Your Savings You Invest in Mutual Funds?Vandita KhudiaNo ratings yet

- Percentage of Savings You Invest in Mutual FundsDocument8 pagesPercentage of Savings You Invest in Mutual FundsVandita KhudiaNo ratings yet

- Hypothesis Testing: Kruskal-Wallis TestDocument11 pagesHypothesis Testing: Kruskal-Wallis TestVandita KhudiaNo ratings yet

- FindingsDocument3 pagesFindingsVandita KhudiaNo ratings yet

- Mutual FundDocument4 pagesMutual FundVandita KhudiaNo ratings yet

- LR SipDocument9 pagesLR SipVandita KhudiaNo ratings yet

- Percentage of Savings You Invest in Mutual FundsDocument15 pagesPercentage of Savings You Invest in Mutual FundsVandita KhudiaNo ratings yet

- S Anupriya (2019) ::) : Ayurvedic and Herbal Remedies Are Available in All PatanjaliDocument4 pagesS Anupriya (2019) ::) : Ayurvedic and Herbal Remedies Are Available in All PatanjaliVandita KhudiaNo ratings yet

- Sumul District Co Operative Milk PDFDocument151 pagesSumul District Co Operative Milk PDFVandita Khudia100% (1)

- Question 1: The Logistics Functions and Various Objectives of The LogisticsDocument10 pagesQuestion 1: The Logistics Functions and Various Objectives of The LogisticsVandita KhudiaNo ratings yet

- Investment Patterns and Its Strategic Implications For Fund Managers: An Empirical Study of Indian Mutual Funds IndustryDocument34 pagesInvestment Patterns and Its Strategic Implications For Fund Managers: An Empirical Study of Indian Mutual Funds IndustryVandita KhudiaNo ratings yet

- Insurance Contracts: Insurance Contracts, Since Only Valid Contracts Are Legally EnforceableDocument5 pagesInsurance Contracts: Insurance Contracts, Since Only Valid Contracts Are Legally EnforceableVandita KhudiaNo ratings yet

- Principles of InsuranceDocument4 pagesPrinciples of InsuranceVandita KhudiaNo ratings yet

- Investment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandDocument16 pagesInvestment Pattern: A Psychographic Study of Investors' of Garhwal Region of UttrakhandVandita KhudiaNo ratings yet

- Investment PreferenceDocument20 pagesInvestment PreferenceVandita KhudiaNo ratings yet

- Analysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaDocument23 pagesAnalysis of Investment Pattern of Mutual Funds Investors - An Empirical Study in OrissaVandita KhudiaNo ratings yet

- Investors Socio Economic Profile and Their Investment PatternDocument15 pagesInvestors Socio Economic Profile and Their Investment PatternVandita KhudiaNo ratings yet

- An Empirical Study On An Investment Pattern of Individual Investors in Pune CityDocument13 pagesAn Empirical Study On An Investment Pattern of Individual Investors in Pune CityVandita KhudiaNo ratings yet

- Case Processing SummaryDocument3 pagesCase Processing SummaryVandita KhudiaNo ratings yet

- Analysis of Investment Pattern of Different Class of People: A ReviewDocument7 pagesAnalysis of Investment Pattern of Different Class of People: A ReviewVandita KhudiaNo ratings yet

- Final Reflection Essay2Document4 pagesFinal Reflection Essay2api-708296201No ratings yet

- The Management of Change in Public Organisations: A Literature ReviewDocument46 pagesThe Management of Change in Public Organisations: A Literature ReviewKibet KiptooNo ratings yet

- Research in The School of Architecture Dalhousie UniversityDocument4 pagesResearch in The School of Architecture Dalhousie UniversityRick LeBrasseurNo ratings yet

- GUID-1900 Peer Review GuidelinesDocument60 pagesGUID-1900 Peer Review GuidelinesangaNo ratings yet

- Journal Review ArticlesDocument11 pagesJournal Review Articlesibodduhjf100% (1)

- Activity 1 in CHN Module 2Document4 pagesActivity 1 in CHN Module 2Anonymous h2EnKyDbNo ratings yet

- System Approaches To Water, Sanitation, and Hygiene A Systematic Literature ReviewDocument18 pagesSystem Approaches To Water, Sanitation, and Hygiene A Systematic Literature ReviewDicky Estosius TariganNo ratings yet

- Policy and Procedures On Academic Staff AppointmentsDocument39 pagesPolicy and Procedures On Academic Staff AppointmentsNaftal NyakundiNo ratings yet

- Munandar, V., Morningstar, M. E., & Carlson, S. R. (2020) - A Systematic Literature Review of Video-Based InterventionsDocument13 pagesMunandar, V., Morningstar, M. E., & Carlson, S. R. (2020) - A Systematic Literature Review of Video-Based InterventionsTomislav CvrtnjakNo ratings yet

- University of Pittsburgh School of Medicine Curriculum Vitae FormatDocument8 pagesUniversity of Pittsburgh School of Medicine Curriculum Vitae FormatArshed Jawad Al-mansoriNo ratings yet

- Lesson PlanDocument3 pagesLesson Planapi-738758225No ratings yet

- L06 Understanding Journal ArticlesDocument7 pagesL06 Understanding Journal ArticleswiNo ratings yet

- Communicate Astronomy With PublicDocument36 pagesCommunicate Astronomy With PublicsulhafNo ratings yet

- CARES Peer Review Feedback FormDocument2 pagesCARES Peer Review Feedback Formpriya shahNo ratings yet

- Hijacked Journals - Beall's List of Predatory - Journals and PublishersDocument7 pagesHijacked Journals - Beall's List of Predatory - Journals and PublishersVaalu SivaNo ratings yet

- Credibility:: Evaluating Credibility of SourcesDocument2 pagesCredibility:: Evaluating Credibility of Sourcesgodofwar5601No ratings yet

- PSY 2174 Research Methods and Ethics - Fall 2021Document12 pagesPSY 2174 Research Methods and Ethics - Fall 2021jesselove15No ratings yet

- Digital Competencies - A Review of The Literature and Applications in The Workplace - Oberländer, M., Beinicke, A., & Bipp, T. (2019)Document37 pagesDigital Competencies - A Review of The Literature and Applications in The Workplace - Oberländer, M., Beinicke, A., & Bipp, T. (2019)vogonsoupNo ratings yet

- Research Methods in Public HealthDocument35 pagesResearch Methods in Public HealthJerry WangNo ratings yet

- Stetzer The Heart To NursingDocument5 pagesStetzer The Heart To Nursingapi-655937636No ratings yet

- Volume9 Issue9 (7) 2020 1Document253 pagesVolume9 Issue9 (7) 2020 1Brunda PsycheNo ratings yet

- NURS 250 Assessment Overview January 2020Document5 pagesNURS 250 Assessment Overview January 2020guneet cheemaNo ratings yet

- A Measure of Originality The Elements of ScienceDocument12 pagesA Measure of Originality The Elements of ScienceFernandoLacerdaNo ratings yet

- Draft UGC PHD Regulations 2022Document18 pagesDraft UGC PHD Regulations 2022Head Dept. of PhysicsNo ratings yet

- Instant Download The Impact of Feedback in Higher Education: Improving Assessment Outcomes For Learners Michael Henderson PDF All ChaptersDocument52 pagesInstant Download The Impact of Feedback in Higher Education: Improving Assessment Outcomes For Learners Michael Henderson PDF All Chapterskufuorturku100% (3)

- Testing Maturity ModelDocument2 pagesTesting Maturity ModelSwathy NairNo ratings yet

- Ijias - 0039 - 003 (5) (Livre D'article)Document415 pagesIjias - 0039 - 003 (5) (Livre D'article)ivankeli1234No ratings yet