0 ratings0% found this document useful (0 votes)

26 viewsCash Flow Format

Cash Flow Format

Uploaded by

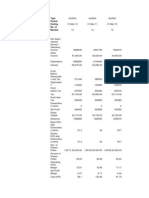

rajesh shekarThe document outlines two methods for preparing a cash flow statement. The indirect method calculates cash flow from operating activities by adjusting net profit for non-cash items and changes in current assets and liabilities. Cash flow from investing and financing activities is also shown. The direct method reports the actual cash amounts received and paid for operating, investing and financing activities without adjustments to net income. Both methods calculate total cash flow for the period and reconcile to the cash balance at the beginning and end of the year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Cash Flow Format

Cash Flow Format

Uploaded by

rajesh shekar0 ratings0% found this document useful (0 votes)

26 views2 pagesThe document outlines two methods for preparing a cash flow statement. The indirect method calculates cash flow from operating activities by adjusting net profit for non-cash items and changes in current assets and liabilities. Cash flow from investing and financing activities is also shown. The direct method reports the actual cash amounts received and paid for operating, investing and financing activities without adjustments to net income. Both methods calculate total cash flow for the period and reconcile to the cash balance at the beginning and end of the year.

Original Title

Cash Flow Format-.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document outlines two methods for preparing a cash flow statement. The indirect method calculates cash flow from operating activities by adjusting net profit for non-cash items and changes in current assets and liabilities. Cash flow from investing and financing activities is also shown. The direct method reports the actual cash amounts received and paid for operating, investing and financing activities without adjustments to net income. Both methods calculate total cash flow for the period and reconcile to the cash balance at the beginning and end of the year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

26 views2 pagesCash Flow Format

Cash Flow Format

Uploaded by

rajesh shekarThe document outlines two methods for preparing a cash flow statement. The indirect method calculates cash flow from operating activities by adjusting net profit for non-cash items and changes in current assets and liabilities. Cash flow from investing and financing activities is also shown. The direct method reports the actual cash amounts received and paid for operating, investing and financing activities without adjustments to net income. Both methods calculate total cash flow for the period and reconcile to the cash balance at the beginning and end of the year.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Cash Flow Statement (Indirect Method)

Cash Flow from Operating activities

Net Profit before taxation

ADD non-operating exp/non-cash expenses

Less non-operating income/non-cash income

Add Decrease in current assets

Add Increase in current liabilities

less Increase in current assets

Less decrease in current liabilities

Total (A)

Cash Flow from Investing activities

Less Purchase of fixed assets/investment

ADD Sale of fixed assets/investment

ADD interest received/divided received/rent received

Total (B)

Cash Flow from financing activities

ADD Issue of share/debenture/loan

Less Redemption of share/debenture/loan

Less dividend paid/interest paid

Total (C)

Total Cash flow during the year (A+B+C)

Add Cash and Cash equivalent at the opening of the year

= Cash and Cash equivalent at the end of the year

Cash Flow Statement (Direct Method)

Cash Flow from Operating activities

Cash received from Customer

Less Cash Paid for Purchase/ Merchandise

Less Cash Paid to employees

Less Income Tax

Total (A)

Cash Flow from Investing activities

Less Purchase of fixed assets/investment

ADD Sale of fixed assets/investment

ADD interest received/divided received/rent received

Total (B)

Cash Flow from financing activities

ADD Issue of share/debenture/loan

Less Redemption of share/debenture/loan

Less dividend paid/interest paid

Total (C)

Total Cash flow during the year (A+B+C)

Add Cash and Cash equivalent at the opening of the year

You might also like

- Accounting Cheat SheetDocument2 pagesAccounting Cheat Sheetanoushes1100% (2)

- Accounts of Non Trading OrganisationDocument13 pagesAccounts of Non Trading OrganisationMahesh Kumar100% (2)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Trading and Profit and Loss AccountDocument5 pagesTrading and Profit and Loss AccountDanish Azmi100% (1)

- Format of Cash Flow StatementDocument5 pagesFormat of Cash Flow Statementilyas2sapNo ratings yet

- Cashflow FormatDocument2 pagesCashflow FormatShubham BawkarNo ratings yet

- Cash Flow STMTDocument2 pagesCash Flow STMTpadmanabha1979No ratings yet

- 19 - Cash Flow StatementDocument2 pages19 - Cash Flow StatementShreyansh Sanat JoshiNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Titan Industries Consolidated Balance Sheet ASAT31 MARCH 2010Document4 pagesTitan Industries Consolidated Balance Sheet ASAT31 MARCH 2010Shrey VermaNo ratings yet

- Cash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedDocument9 pagesCash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedKhalid MahmoodNo ratings yet

- Proforma Statement of Cash Flow 3Document1 pageProforma Statement of Cash Flow 3Praveena RavishankerNo ratings yet

- 093 M 1 SolutionsDocument9 pages093 M 1 SolutionsJackie Zhangwen ChenNo ratings yet

- Chapter 6: Non Profit OrganizationDocument25 pagesChapter 6: Non Profit Organizationmariyam_aziz_1100% (2)

- Hand Outs AccountingDocument5 pagesHand Outs AccountingFinance TutorNo ratings yet

- Industry Analysis of Nestle SA: ParticularDocument4 pagesIndustry Analysis of Nestle SA: ParticularCfhunSaatNo ratings yet

- Cash Flow - Fund Flow - Cash ForecastsDocument22 pagesCash Flow - Fund Flow - Cash ForecastsAkhil Vashishtha100% (1)

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21No ratings yet

- Cash InflowsDocument2 pagesCash InflowsManik SharmaNo ratings yet

- 220Ch13-Cash Flow StatementDocument17 pages220Ch13-Cash Flow Statementsurachai_chotiNo ratings yet

- Particulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing ActivitiesDocument3 pagesParticulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing Activitiesrohan_jangid8No ratings yet

- Commencing: Insert Date HereDocument67 pagesCommencing: Insert Date HereMichael AthertonNo ratings yet

- Case Study Three: Anandam: Professor: Victor GoodmanDocument6 pagesCase Study Three: Anandam: Professor: Victor GoodmanYuki IsawaNo ratings yet

- Auditors' Report (Continued) : 1.establishmentDocument1 pageAuditors' Report (Continued) : 1.establishmenttekalignyohannesNo ratings yet

- Financial Analysis For Managers Class PresentationDocument217 pagesFinancial Analysis For Managers Class PresentationAkanksha RajanNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Cash FlowsDocument17 pagesCash FlowsvyahutsupriyaNo ratings yet

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- Cash Flow StatementDocument28 pagesCash Flow StatementJaan Sonu100% (2)

- Cash Flow Statemen IndirectDocument2 pagesCash Flow Statemen IndirectSakshi GuptaNo ratings yet

- Cash Flows DirectDocument2 pagesCash Flows DirectAleck CondesNo ratings yet

- Cashflowstatement IMPDocument30 pagesCashflowstatement IMPAshish SinghalNo ratings yet

- IAS Changes2Document3 pagesIAS Changes2johnny458No ratings yet

- Balanceco's Balance Sheets (OOO) : Assets Last Year This Year Sources UsesDocument4 pagesBalanceco's Balance Sheets (OOO) : Assets Last Year This Year Sources UsesMarvin TongNo ratings yet

- For Balance Sheet and Retained Earnings Statement - Follow The Format in The BookDocument7 pagesFor Balance Sheet and Retained Earnings Statement - Follow The Format in The Booknhtsng123No ratings yet

- Tally Ledger List in Excel Format TeachooDocument12 pagesTally Ledger List in Excel Format TeachooDINESH CHANCHALANINo ratings yet

- Tax PresentationDocument39 pagesTax Presentationtap4awhileNo ratings yet

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Methods For Preparing SCF: - Direct MethodDocument7 pagesMethods For Preparing SCF: - Direct MethodVen KatNo ratings yet

- Lecture 3 Week 3 PPT 3Document39 pagesLecture 3 Week 3 PPT 3Li Lin100% (1)

- Consolidated Balance Sheet: Equity and LiabilitiesDocument49 pagesConsolidated Balance Sheet: Equity and LiabilitiesmsssinghNo ratings yet

- Small Business Cash Flow Projection: (Company Name)Document1 pageSmall Business Cash Flow Projection: (Company Name)MrbudakbaekNo ratings yet

- Tally Ledger List in Excel Format - TeachooDocument12 pagesTally Ledger List in Excel Format - TeachooGaurav RawatNo ratings yet

- CummingmDocument259 pagesCummingmfasanoj5211No ratings yet

- Fund Flow Statement For The Year Ended 31st Mar'09: YellowDocument1 pageFund Flow Statement For The Year Ended 31st Mar'09: YellowChetan BramhankarNo ratings yet

- Final Accounts/ Financial StatementsDocument53 pagesFinal Accounts/ Financial Statementsrachealll100% (2)

- Cash Flow Statement Classification of ActivitiesDocument4 pagesCash Flow Statement Classification of ActivitiesAanchal MahajanNo ratings yet

- Basic Accounting Concepts: Financial AccountingDocument16 pagesBasic Accounting Concepts: Financial AccountinggusneriNo ratings yet

- Cash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareDocument135 pagesCash Flow Analysis, Gross Profit Analysis, Basic Earnings Per Share and Diluted Earnings Per ShareMariel de Lara100% (2)

- Statement of Cash FLowsDocument44 pagesStatement of Cash FLowsNeerunjun HurlollNo ratings yet

- Master Chart of AccountsDocument8 pagesMaster Chart of AccountsNandan SapaleNo ratings yet

- Vertical Analysis For Att and VerizonDocument4 pagesVertical Analysis For Att and Verizonapi-299644289No ratings yet

- FABM 2 Lesson 6 CFSDocument28 pagesFABM 2 Lesson 6 CFSKia MorenoNo ratings yet

- Ratio Analysis of M&M and Eicher MotorsDocument16 pagesRatio Analysis of M&M and Eicher MotorsGs AbhilashNo ratings yet

- Financial Projection Template - NewDocument5 pagesFinancial Projection Template - NewNorhisham DaudNo ratings yet

- AFS - Cash FlowDocument5 pagesAFS - Cash FlowSadia AltafNo ratings yet

- Session 9-10 PDFDocument26 pagesSession 9-10 PDFrajesh shekarNo ratings yet

- JSW Steel LTD - Section 3 - R2 PDFDocument21 pagesJSW Steel LTD - Section 3 - R2 PDFrajesh shekarNo ratings yet

- Session 11-12 PDFDocument31 pagesSession 11-12 PDFrajesh shekarNo ratings yet

- The Cost of Production - Chapter 7Document18 pagesThe Cost of Production - Chapter 7rajesh shekarNo ratings yet

- Course outline-ACT 5001Document5 pagesCourse outline-ACT 5001rajesh shekarNo ratings yet

- Financial Statement AnalysisDocument61 pagesFinancial Statement Analysisrajesh shekarNo ratings yet

- Session 18Document26 pagesSession 18rajesh shekarNo ratings yet

- Session 14-15 PDFDocument38 pagesSession 14-15 PDFrajesh shekarNo ratings yet

- Determining System RequirementsDocument46 pagesDetermining System Requirementsrajesh shekarNo ratings yet

- BCPC Internet Strategy: DebriefDocument21 pagesBCPC Internet Strategy: Debriefrajesh shekarNo ratings yet

- Identifying and Selecting Systems Development Projects (Pre-Project Planning)Document48 pagesIdentifying and Selecting Systems Development Projects (Pre-Project Planning)rajesh shekarNo ratings yet

- Consumer ChoiceDocument17 pagesConsumer Choicerajesh shekarNo ratings yet

- Session 1 2 3Document65 pagesSession 1 2 3rajesh shekarNo ratings yet

- Requirements Analysis and DesignDocument21 pagesRequirements Analysis and Designrajesh shekarNo ratings yet

- Session 19Document21 pagesSession 19rajesh shekarNo ratings yet

- Lessons Learnt: CASES 1&2Document24 pagesLessons Learnt: CASES 1&2rajesh shekarNo ratings yet

- Exercises On Tradeoffs and Conflicting Objectives: HBS CaseDocument14 pagesExercises On Tradeoffs and Conflicting Objectives: HBS Caserajesh shekar100% (1)

- Session 2Document8 pagesSession 2rajesh shekarNo ratings yet

- Request For Proposal (RFP) : Choosing The Right Consultant/consultancy ServicesDocument33 pagesRequest For Proposal (RFP) : Choosing The Right Consultant/consultancy Servicesrajesh shekarNo ratings yet

- Requiremen Ts AnalysisDocument42 pagesRequiremen Ts Analysisrajesh shekarNo ratings yet

- Sherif Metiyas at A. T - Kearney: Negotiating A Client Service PredicamentDocument12 pagesSherif Metiyas at A. T - Kearney: Negotiating A Client Service Predicamentrajesh shekarNo ratings yet

- Consulti NG ProcessDocument27 pagesConsulti NG Processrajesh shekarNo ratings yet

- Session 11Document15 pagesSession 11rajesh shekarNo ratings yet

- Requirements: Tools & TechniquesDocument31 pagesRequirements: Tools & Techniquesrajesh shekarNo ratings yet

- Business Analysis Planning and Monitoring: Cbap/Ccba (Babok)Document28 pagesBusiness Analysis Planning and Monitoring: Cbap/Ccba (Babok)rajesh shekarNo ratings yet

- Bain & Co. It Practice: Case AnalysisDocument21 pagesBain & Co. It Practice: Case Analysisrajesh shekarNo ratings yet

- Business Analysis: FoundationsDocument19 pagesBusiness Analysis: Foundationsrajesh shekarNo ratings yet

- Q2) List Out Problems Regarding: (A) Product Features and Benefits (B) Package (Material, DesignDocument4 pagesQ2) List Out Problems Regarding: (A) Product Features and Benefits (B) Package (Material, Designrajesh shekarNo ratings yet