0 ratings0% found this document useful (0 votes)

44 viewsCashflow Format

Cashflow Format

Uploaded by

Shubham BawkarThe document outlines the format of a cash flow statement, which tracks cash inflows and outflows under three categories: operating, investing, and financing activities. It lists line items including net profit before tax, depreciation, interest paid and received, purchase and sale of assets, share capital proceeds, borrowing and repayments, dividends paid, and beginning and ending cash and cash equivalents. It also provides an alternative calculation of net profit before tax using balances from the profit and loss account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Cashflow Format

Cashflow Format

Uploaded by

Shubham Bawkar0 ratings0% found this document useful (0 votes)

44 views2 pagesThe document outlines the format of a cash flow statement, which tracks cash inflows and outflows under three categories: operating, investing, and financing activities. It lists line items including net profit before tax, depreciation, interest paid and received, purchase and sale of assets, share capital proceeds, borrowing and repayments, dividends paid, and beginning and ending cash and cash equivalents. It also provides an alternative calculation of net profit before tax using balances from the profit and loss account.

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document outlines the format of a cash flow statement, which tracks cash inflows and outflows under three categories: operating, investing, and financing activities. It lists line items including net profit before tax, depreciation, interest paid and received, purchase and sale of assets, share capital proceeds, borrowing and repayments, dividends paid, and beginning and ending cash and cash equivalents. It also provides an alternative calculation of net profit before tax using balances from the profit and loss account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

44 views2 pagesCashflow Format

Cashflow Format

Uploaded by

Shubham BawkarThe document outlines the format of a cash flow statement, which tracks cash inflows and outflows under three categories: operating, investing, and financing activities. It lists line items including net profit before tax, depreciation, interest paid and received, purchase and sale of assets, share capital proceeds, borrowing and repayments, dividends paid, and beginning and ending cash and cash equivalents. It also provides an alternative calculation of net profit before tax using balances from the profit and loss account.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

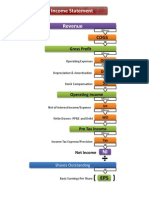

Format of a cash flow statement

Amt (Rs.) Amt (Rs.)

Cash flows from operating activities

Net profit before tax

Add: (non-cash and non- operating expenses)

Depreciation

Loss on sale of fixed assets

Loss on sale of investments

Goodwill w/off

Preliminary expenses w/off

Interest paid

Less: (non-cash incomes and non-operating

income)

Profit on sale of fixed assets

Profit on sale of investments

Interest received

Dividend received

Operating profit before working capital

changes

Add: decrease in working capital

OR

Less: Increase in working capital

Cash generated from operations

Income tax paid

Net cash flows from operating activities

Cash flows from investing activities

Purchase of fixed assets and investments

Sale of fixed assets and investments

Interest received

Dividend received

Net cash flows from investing activities

Cash flows from financing activities

Proceeds of issue of share capital

Proceeds from long term borrowings

Repayment of long-term borrowings

Issue of debentures

Redemption of debentures

Redemption of preference shares

Interest paid

Dividend paid

Net cash flows from financing activities

Net increase /decrease in cash and cash

equivalents

Cash and cash equivalents at the beginning

of the period

Cash and cash equivalents at the end of the

year

In case net profit before tax is not readily available then it can be worked

out as follows:

Amount Amount

(Rs.) (Rs.)

Profit & loss a/c bal. as per balance sheet at the

end of the year

Less:

Profit & loss a/c bal as per balance sheet at the

beginning of the year

Net profit after appropriations

Add: appropriations

Proposed dividends

Transfers to various reserves

Net profit after tax

Add: Provision for tax

Net profit before tax

You might also like

- Colgate-Financial-Model-unsolved-wallstreetmojo.com_.xlsxDocument33 pagesColgate-Financial-Model-unsolved-wallstreetmojo.com_.xlsxFarin KaziNo ratings yet

- Appropriations Dividend To Shareholders of Parent CompanyDocument30 pagesAppropriations Dividend To Shareholders of Parent Companyavinashtiwari201745No ratings yet

- Proforma Statement of Cash Flow 3Document1 pageProforma Statement of Cash Flow 3Praveena RavishankerNo ratings yet

- Equity ValuationDocument2,424 pagesEquity ValuationMuteeb Raina0% (1)

- Cash Flow Cheat SheetsDocument2 pagesCash Flow Cheat SheetsSarah SafiraNo ratings yet

- Format of Cash Flow StatementDocument5 pagesFormat of Cash Flow Statementilyas2sapNo ratings yet

- 19 - Cash Flow StatementDocument2 pages19 - Cash Flow StatementShreyansh Sanat JoshiNo ratings yet

- IAS Changes2Document3 pagesIAS Changes2johnny458No ratings yet

- Cash Flow STMTDocument2 pagesCash Flow STMTpadmanabha1979No ratings yet

- Industry Analysis of Nestle SA: ParticularDocument4 pagesIndustry Analysis of Nestle SA: ParticularCfhunSaatNo ratings yet

- Consolidated Statement of Earnings (Usd $)Document68 pagesConsolidated Statement of Earnings (Usd $)fivehoursNo ratings yet

- Cash Flow FormatDocument2 pagesCash Flow Formatrajesh shekarNo ratings yet

- Funds From Operation Net Sales - Cost of Goods Sold - Operating ExpensesDocument1 pageFunds From Operation Net Sales - Cost of Goods Sold - Operating ExpensesChris RessoNo ratings yet

- Cash Flow Statemen IndirectDocument2 pagesCash Flow Statemen IndirectSakshi GuptaNo ratings yet

- 10 Year Model - ADVFN - New FormatDocument144 pages10 Year Model - ADVFN - New Formattalibkw4li8035No ratings yet

- CASHFLOW TemplateDocument6 pagesCASHFLOW Templatemilabol100% (1)

- Particulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing ActivitiesDocument3 pagesParticulars Amt Amt Amt: Net Cash From Operating Activities II) Cash Flow From Investing Activitiesrohan_jangid8No ratings yet

- Statement of Cash FLowsDocument44 pagesStatement of Cash FLowsNeerunjun HurlollNo ratings yet

- Assets Non-Current AssetsDocument11 pagesAssets Non-Current AssetsPeter LetlhakeNo ratings yet

- Classification of Accounts PDFDocument3 pagesClassification of Accounts PDFLuzz Landicho100% (1)

- Cash Flow From Operating ActivitiesDocument10 pagesCash Flow From Operating ActivitiesFatihahZainalLimNo ratings yet

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarNo ratings yet

- Financial Statements, Cash Flows, and TaxesDocument31 pagesFinancial Statements, Cash Flows, and Taxesjoanabud100% (1)

- Fsap Template in EnglishDocument34 pagesFsap Template in EnglishDo Hoang HungNo ratings yet

- Financial Analysis For Managers Class PresentationDocument217 pagesFinancial Analysis For Managers Class PresentationAkanksha RajanNo ratings yet

- Statement of Change in Financial Position-5Document32 pagesStatement of Change in Financial Position-5Amit SinghNo ratings yet

- Fiscal Year Is January-December. All Values ZAR MillionsDocument14 pagesFiscal Year Is January-December. All Values ZAR MillionsRavi JainNo ratings yet

- K P I T Cummins Infosystems Limited: Financials (Standalone)Document8 pagesK P I T Cummins Infosystems Limited: Financials (Standalone)Surabhi RajNo ratings yet

- Exhibit 6.3 Margin Money For Working CapitalDocument12 pagesExhibit 6.3 Margin Money For Working Capitalanon_285857320No ratings yet

- Lecture 5Document4 pagesLecture 5zehratmuzaffarNo ratings yet

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (3)

- Cash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedDocument9 pagesCash Flow Statement: Transfer To Reserves: Any Transfer of Profit From P & L A/c To Reserves Will Be AddedKhalid MahmoodNo ratings yet

- 220Ch13-Cash Flow StatementDocument17 pages220Ch13-Cash Flow Statementsurachai_chotiNo ratings yet

- Format of Profit and Loss and Other Comprehensive StatementDocument5 pagesFormat of Profit and Loss and Other Comprehensive StatementIleo AliNo ratings yet

- Cash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business ManagementDocument20 pagesCash Flow: Dadasaheb Narale Roll No.10 Sinhgad Institute of Business Managementaftabkhan21No ratings yet

- Cash Flow Statement Classification of ActivitiesDocument4 pagesCash Flow Statement Classification of ActivitiesAanchal MahajanNo ratings yet

- List of Company's BankersDocument22 pagesList of Company's BankersMega_ImranNo ratings yet

- Hand Outs AccountingDocument5 pagesHand Outs AccountingFinance TutorNo ratings yet

- Format of Cash Flow StatementDocument3 pagesFormat of Cash Flow StatementMoses Fernandes100% (1)

- Financial StatementsDocument8 pagesFinancial Statementsmanthansaini8923No ratings yet

- Financial Projection Template - NewDocument5 pagesFinancial Projection Template - NewNorhisham DaudNo ratings yet

- Rupali Bank DataDocument40 pagesRupali Bank DataAAM26No ratings yet

- Unit V: Financial AccountingDocument31 pagesUnit V: Financial AccountingAbhishek Bose100% (2)

- Ratio AnalysisDocument27 pagesRatio AnalysisPratik Thorat100% (1)

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Cash Flow Mechanics ProjectionsDocument56 pagesCash Flow Mechanics Projectionskarimhisham0% (1)

- BAV Model v4.7Document27 pagesBAV Model v4.7Missouri Soufiane100% (2)

- Ak Hotel Sap 4Document7 pagesAk Hotel Sap 4aniNo ratings yet

- Cash FlowsDocument17 pagesCash FlowsvyahutsupriyaNo ratings yet

- Final Accounts/ Financial StatementsDocument53 pagesFinal Accounts/ Financial Statementsrachealll100% (2)

- Chapter 6: Non Profit OrganizationDocument25 pagesChapter 6: Non Profit Organizationmariyam_aziz_1100% (2)

- Financial Statements, Cash Flow, and TaxesDocument19 pagesFinancial Statements, Cash Flow, and TaxesAnna StoychevaNo ratings yet

- Jawaban Cash FlowDocument1 pageJawaban Cash FlowChoiru IbadilhaqNo ratings yet

- FormatDocument4 pagesFormatAshmitNo ratings yet

- Cash Flow Statement Review SheetDocument3 pagesCash Flow Statement Review SheetSarah WinzenriedNo ratings yet

- Auditors' Report (Continued) : 1.establishmentDocument1 pageAuditors' Report (Continued) : 1.establishmenttekalignyohannesNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Lecture 3 Week 3 PPT 3Document39 pagesLecture 3 Week 3 PPT 3Li Lin100% (1)

- Simple Cash Flow Statement TemplateDocument4 pagesSimple Cash Flow Statement TemplateSudeep KulkarniNo ratings yet

- Satyam 3Document1 pageSatyam 3Shubham BawkarNo ratings yet

- ScamDocument10 pagesScamShubham BawkarNo ratings yet

- International ScamDocument14 pagesInternational ScamShubham BawkarNo ratings yet

- Is It Okay To Cry at WorkDocument2 pagesIs It Okay To Cry at WorkShubham BawkarNo ratings yet

- Marketing Strategies of Banking Industry & Recent TrendsDocument40 pagesMarketing Strategies of Banking Industry & Recent TrendsShubham BawkarNo ratings yet

- Segmentation, Targeting and PositioningDocument77 pagesSegmentation, Targeting and PositioningShubham BawkarNo ratings yet

- Case Study On Nirma & Surfexcel DetergentDocument12 pagesCase Study On Nirma & Surfexcel DetergentShubham BawkarNo ratings yet

- A PROJECT On Technical and Fundamental Analysis of Equity Market On Cement SectorDocument49 pagesA PROJECT On Technical and Fundamental Analysis of Equity Market On Cement SectorShubham BawkarNo ratings yet

- Background: List of 2022 Indian Premier League Personnel ChangesDocument2 pagesBackground: List of 2022 Indian Premier League Personnel ChangesShubham BawkarNo ratings yet

- A PROJECT On Technical and Fundamental Analysis of Equity Market On Cement SectorDocument21 pagesA PROJECT On Technical and Fundamental Analysis of Equity Market On Cement SectorShubham BawkarNo ratings yet

- JK Cement: Valuations Factor in Positive Downgrade To HOLDDocument9 pagesJK Cement: Valuations Factor in Positive Downgrade To HOLDShubham BawkarNo ratings yet

- ADVANCED ACCOUNTING NewDocument72 pagesADVANCED ACCOUNTING NewShubham BawkarNo ratings yet