Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Uploaded by

Quang NhựtCopyright:

Available Formats

Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Uploaded by

Quang NhựtOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Financial Control - 2 - Flexible Budgets and Variances - Webb Company With Solution

Uploaded by

Quang NhựtCopyright:

Available Formats

Flexible Budgets and Variances Case Study: Webb Company

Consider Webb Company, a firm that manufactures and sells jackets. The

jackets require tailoring and many other hand operations. Webb sells

exclusively to distributors, who in turn sell to independent clothing stores

and retail chains. For simplicity, we assume that Webb’s only costs are in

the manufacturing function; Webb incurs no costs in other value-chain

functions, such as marketing and distribution. We also assume that all

units manufactured in April N are sold in April N. Therefore, all direct

materials are purchased and used in the same budget period, and there is

no direct materials inventory at either the beginning or the end of the

period. No work-in-process or finished goods inventories exist at either

the beginning or the end of the period.

Webb has three variable-cost categories. The budgeted variable cost per

jacket for each category is as follows:

Variable costs information:

DM per unit 60

DL per unit 16

Man ovh per unit 12

Var cost per unit 88

The number of units manufactured is the cost driver for direct materials,

direct manufacturing labor, and variable manufacturing overhead. The

relevant range for the cost driver is from 0 to 12,000 jackets. Budgeted

and actual data for April N follow:

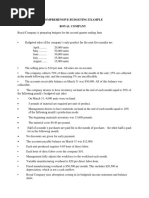

Budgeted and actual data

Budgeted fixed costs ($) 276 000

Budgeted selling price per unit ($) 120

Budgeted production and sales (in jackets) 12 000

Actual production and sales (in jackets) 10 000

© Pearson Edition – Olivier Greusard for Financial Control 1

Level 1 Analysis – Present the static Budget and the static Budget

variances using the templates provided.

© Pearson Edition – Olivier Greusard for Financial Control 2

You are now asked to prepare the flexible budget of Webb Company for

April N. The flexible budget is prepared at the end of the period (April N),

after the actual output of 10,000 jackets is known. The flexible budget is

the hypothetical budget that Webb would have prepared at the start of the

budget period if it had correctly forecast the actual output of 10,000

jackets.

Level 2 Analysis – Present the Flexible Budget and the Flexible

Budget and Sales Volume variances using the templates provided.

© Pearson Edition – Olivier Greusard for Financial Control 3

To calculate price and efficiency variances, Webb needs to obtain

budgeted input prices and budgeted input quantities. Webb’s three main

sources for this information are past data, data from similar companies,

and standards.

You gathered the following information to be able to detail the price and

efficiency variances for April N:

Standard direct material cost per jacket: 2 square yards of cloth input

allowed per output unit (jacket) manufactured, at $30 standard price per

square yard.

Standard direct manufacturing labor cost per jacket: 0.8 manufacturing

labor-hour of input allowed per output unit manufactured, at $20 standard

price per hour.

Actual direct material cost: 22,200 square yards of cloth input have been

purchased and used.

Actual direct manufacturing labor cost: 9,000 manufacturing labor-hours

of input have been incurred.

Level 3 Analysis – Calculate the price and efficiency variances both

for Direct Material and Direct using the templates provided.

© Pearson Edition – Olivier Greusard for Financial Control 4

Webb estimates a rate of $30 per standard machine-hour for allocating its

variable overhead costs.

Additional information about Overhead for Webb Company is given as

followed:

Calculate the variable and fixed overhead variances

© Pearson Edition – Olivier Greusard for Financial Control 5

You might also like

- Chapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisNo ratings yetChapter 12 Factory Over Head Planned Actual and Applied Variance Analysis29 pages

- Financial Control - 2 - Variances - Additional Exercises With Solution100% (1)Financial Control - 2 - Variances - Additional Exercises With Solution9 pages

- Questions On Relevant Information and Decision Making100% (2)Questions On Relevant Information and Decision Making3 pages

- Flexible Budgets, Standard Costs, and Variance Analysis100% (1)Flexible Budgets, Standard Costs, and Variance Analysis121 pages

- Royal Company Budgeting - With Additional Details100% (1)Royal Company Budgeting - With Additional Details3 pages

- ACCT-312:: Exercises For Home Study (From Chapter 6)No ratings yetACCT-312:: Exercises For Home Study (From Chapter 6)5 pages

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsNo ratings yetCH 5 Relevant Information For Decision Making With A Focus On Pricing Decisions10 pages

- Exercises For The Course Cost and Management Accounting IINo ratings yetExercises For The Course Cost and Management Accounting II8 pages

- Review Questions Principles of Cost Accounting - 070850No ratings yetReview Questions Principles of Cost Accounting - 0708507 pages

- Discuss Briefly The Historical Developments of That Contributed For The Development of Operations ManagementNo ratings yetDiscuss Briefly The Historical Developments of That Contributed For The Development of Operations Management7 pages

- Activity-Based Costing: Learning ObjectivesNo ratings yetActivity-Based Costing: Learning Objectives39 pages

- Group Assignment On Fundamentals of Accounting INo ratings yetGroup Assignment On Fundamentals of Accounting I6 pages

- # 2 Assignment On Financial and Managerial Accounting For MBA StudentsNo ratings yet# 2 Assignment On Financial and Managerial Accounting For MBA Students7 pages

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1No ratings yetFinal Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 17 pages

- # FM I Chapter 3 - Time Value of MoneyNo ratings yet# FM I Chapter 3 - Time Value of Money46 pages

- Chapter - One Cost-Volume-Profit AnalysisNo ratings yetChapter - One Cost-Volume-Profit Analysis13 pages

- CHAPTER Four Standard Costing, Flexible Budgeting and Variance AnalysisNo ratings yetCHAPTER Four Standard Costing, Flexible Budgeting and Variance Analysis23 pages

- Chapter 6 Flexible Budgets and Variance AnalysisNo ratings yetChapter 6 Flexible Budgets and Variance Analysis16 pages

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionNo ratings yetFinancial Control-1-Master Budgeting CS-Gordon Com. - Solution3 pages

- Financial Control - Individual Assignment 1 - Work To DoNo ratings yetFinancial Control - Individual Assignment 1 - Work To Do5 pages

- FC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionNo ratings yetFC - 1 - Master Budgeting CS - Stylistic 2021 - With Solution18 pages

- Startup Fundraising - Financial Model For Sales and MarketingNo ratings yetStartup Fundraising - Financial Model For Sales and Marketing6 pages

- Proforma Invoice Dinas Pendidikan Kota TangerangNo ratings yetProforma Invoice Dinas Pendidikan Kota Tangerang1 page

- Cepep Regional Programme Coordinator Job DescriptionNo ratings yetCepep Regional Programme Coordinator Job Description2 pages

- Taller de Reuniones de Negocios INGLES GESTION LOGISTICANo ratings yetTaller de Reuniones de Negocios INGLES GESTION LOGISTICA13 pages

- Banarsidas Chandiwala Institute of Professional Studies MBA-III Sem (Section A) Batch 2018-20 Presentation ScheduleNo ratings yetBanarsidas Chandiwala Institute of Professional Studies MBA-III Sem (Section A) Batch 2018-20 Presentation Schedule5 pages

- Head Office: Purchasing Department: Export Office:: Jeddah Madinah YanbuNo ratings yetHead Office: Purchasing Department: Export Office:: Jeddah Madinah Yanbu6 pages

- XYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextNo ratings yetXYLYS: Exploring Consumer Perception About Premium Watches in The Indian Context8 pages

- Ujmg 2004 Communication Research-PresentationNo ratings yetUjmg 2004 Communication Research-Presentation9 pages

- Chapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisChapter 12 Factory Over Head Planned Actual and Applied Variance Analysis

- Financial Control - 2 - Variances - Additional Exercises With SolutionFinancial Control - 2 - Variances - Additional Exercises With Solution

- Questions On Relevant Information and Decision MakingQuestions On Relevant Information and Decision Making

- Flexible Budgets, Standard Costs, and Variance AnalysisFlexible Budgets, Standard Costs, and Variance Analysis

- ACCT-312:: Exercises For Home Study (From Chapter 6)ACCT-312:: Exercises For Home Study (From Chapter 6)

- CH 5 Relevant Information For Decision Making With A Focus On Pricing DecisionsCH 5 Relevant Information For Decision Making With A Focus On Pricing Decisions

- Exercises For The Course Cost and Management Accounting IIExercises For The Course Cost and Management Accounting II

- Review Questions Principles of Cost Accounting - 070850Review Questions Principles of Cost Accounting - 070850

- Discuss Briefly The Historical Developments of That Contributed For The Development of Operations ManagementDiscuss Briefly The Historical Developments of That Contributed For The Development of Operations Management

- # 2 Assignment On Financial and Managerial Accounting For MBA Students# 2 Assignment On Financial and Managerial Accounting For MBA Students

- Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Final Exam Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1

- CHAPTER Four Standard Costing, Flexible Budgeting and Variance AnalysisCHAPTER Four Standard Costing, Flexible Budgeting and Variance Analysis

- Financial Control-1-Master Budgeting CS-Gordon Com. - SolutionFinancial Control-1-Master Budgeting CS-Gordon Com. - Solution

- Financial Control - Individual Assignment 1 - Work To DoFinancial Control - Individual Assignment 1 - Work To Do

- FC - 1 - Master Budgeting CS - Stylistic 2021 - With SolutionFC - 1 - Master Budgeting CS - Stylistic 2021 - With Solution

- Startup Fundraising - Financial Model For Sales and MarketingStartup Fundraising - Financial Model For Sales and Marketing

- Cepep Regional Programme Coordinator Job DescriptionCepep Regional Programme Coordinator Job Description

- Taller de Reuniones de Negocios INGLES GESTION LOGISTICATaller de Reuniones de Negocios INGLES GESTION LOGISTICA

- Banarsidas Chandiwala Institute of Professional Studies MBA-III Sem (Section A) Batch 2018-20 Presentation ScheduleBanarsidas Chandiwala Institute of Professional Studies MBA-III Sem (Section A) Batch 2018-20 Presentation Schedule

- Head Office: Purchasing Department: Export Office:: Jeddah Madinah YanbuHead Office: Purchasing Department: Export Office:: Jeddah Madinah Yanbu

- XYLYS: Exploring Consumer Perception About Premium Watches in The Indian ContextXYLYS: Exploring Consumer Perception About Premium Watches in The Indian Context