Instructions For Form 990 Return of Organization Exempt From Income Tax

Instructions For Form 990 Return of Organization Exempt From Income Tax

Uploaded by

ms tnrcCopyright:

Available Formats

Instructions For Form 990 Return of Organization Exempt From Income Tax

Instructions For Form 990 Return of Organization Exempt From Income Tax

Uploaded by

ms tnrcOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Instructions For Form 990 Return of Organization Exempt From Income Tax

Instructions For Form 990 Return of Organization Exempt From Income Tax

Uploaded by

ms tnrcCopyright:

Available Formats

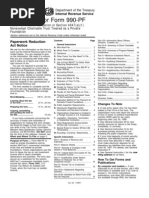

2019 Department of the Treasury

Internal Revenue Service

Instructions for Form 990

Return of Organization

Exempt From Income Tax

Under section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code

(except private foundations)

(For use with 2019 Form 990 (Rev. January 2020))

Section references are to the Internal Revenue Code unless Contents Page

otherwise noted. Appendix of Special Instructions to Form 990

Contents Page Contents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 76

Purpose of Form . . . . . . . . . . . . . . . . . . . . . . . . . ... 2 Appendix A. Exempt Organizations Reference

Phone Help . . . . . . . . . . . . . . . . . . . . . . . . . . . . ... 2 Chart . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 77

Email Subscription . . . . . . . . . . . . . . . . . . . . . . . ... 2 Appendix B. How To Determine Whether an

Organization's Gross Receipts Are Normally

General Instructions . . . . . . . . . . . . . . . . . . . . . . ... 2

$50,000 (or $5,000) or Less . . . . . . . . . . . . . . . . 78

A. Who Must File . . . . . . . . . . . . . . . . . . . . . ... 2

Appendix C. Special Gross Receipts Tests for

B. Organizations Not Required To File Form Determining Exempt Status of Section 501(c)

990 or 990-EZ . . . . . . . . . . . . . . . . . . . . .... 4 (7) and 501(c)(15) Organizations . . . . . . . . . . . . 78

C. Sequencing List To Complete the Form Appendix D. Public Inspection of Returns . . . . . . . . . 79

and Schedules . . . . . . . . . . . . . . . . . . . . . . . . 4

Appendix E. Group Returns—Reporting

D. Accounting Periods and Methods . . . . . . . . . . 5 Information on Behalf of the Group . . . . . . . . . . . 83

E. When, Where, and How To File . . . . . . . . . . . . 6 Appendix F. Disregarded Entities and Joint

F. Extension of Time To File . . . . . . . . . . . . . . . . 6 Ventures—Inclusion of Activities and Items . . . . . 84

G. Amended Return/Final Return . . . . . . . . . . . . . 6 Appendix G. Section 4958 Excess Benefit

H. Failure-to-File Penalties . . . . . . . . . . . . . . . . . 7 Transactions . . . . . . . . . . . . . . . . . . . . . . . . . . 86

I. Group Return . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Appendix H. Forms and Publications To File or

J. Requirements for a Properly Completed Use . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 91

Form 990 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 Appendix I. Use of Form 990 or 990-EZ To Satisfy

Specific Instructions . . . . . . . . . . . . . . . . . . . . . . . . . 8 State Reporting Requirements . . . . . . . . . . . . . . 93

Heading. Items A–M . . . . . . . . . . . . . . . . . . . . . . 8 Appendix J. Contributions . . . . . . . . . . . . . . . . . . . . 94

Part I. Summary . . . . . . . . . . . . . . . . . . . . . . . . 10 Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 98

Part II. Signature Block . . . . . . . . . . . . . . . . . . . 10 Future Developments

Part III. Statement of Program Service For the latest information about developments related to Form

Accomplishments . . . . . . . . . . . . . . . . . . . . . 11 990 and its instructions, such as legislation enacted after they

Part IV. Checklist of Required Schedules . . . . . . 12 were published, go to IRS.gov/Form990.

Part V. Statements Regarding Other IRS

Filings and Tax Compliance . . . . . . . . . . . . . 15

What’s New

Part VI. Governance, Management, and Required electronic filing by exempt organizations. For tax

Disclosure . . . . . . . . . . . . . . . . . . . . . . . . . . 19 years beginning on or after July 2, 2019, section 3101 of P.L.

Part VII. Compensation of Officers, Directors, 116-25 requires that returns by exempt organizations be filed

electronically. If you are filing Form 990 for a tax year beginning

Trustees, Key Employees, Highest

on or after July 2, 2019, you must file the return electronically.

Compensated Employees, and Limited exceptions apply. See When, Where, and How To File,

Independent Contractors . . . . . . . . . . . . . . . . 26 later, for more information.

Part VIII. Statement of Revenue . . . . . . . . . . . . . 38 Electronic filing requirements have not changed for Form 990

Part IX. Statement of Functional Expenses . . . . . 43 filers with tax years beginning before July 2, 2019 (which

Part X. Balance Sheet . . . . . . . . . . . . . . . . . . . . 48 includes calendar year 2019 Forms 990). Required electronic

Part XI. Reconciliation of Net Assets . . . . . . . . . 51 filing for calendar year filers will apply for tax years beginning in

2020 and later.

Part XII. Financial Statements and Reporting . . . 51

Business Activity Codes . . . . . . . . . . . . . . . . . . . . . 53 Reminders

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 54 Excise tax on executive compensation, Part V. New section

4960 imposes an excise tax on an organization that pays to any

Jan 15, 2020 Cat. No. 11283J

covered employee more than $1 million in remuneration or pays section 501(a), and certain political organizations and

an excess parachute payment during the year starting in 2018. nonexempt charitable trusts. Parts I through XII of the form

See section 4960 and Form 4720, Return of Certain Excise must be completed by all filing organizations and require

Taxes Under Chapters 41 and 42 of the Internal Revenue Code, reporting on the organization's exempt and other activities,

and IRS Notice 2019-09, for more information. finances, governance, compliance with certain federal tax filings

and requirements, and compensation paid to certain persons.

Excise tax on net investment income of certain colleges Additional schedules are required to be completed depending

and universities, Part V. New section 4968 imposes an excise upon the activities and type of the organization. By completing

tax on the net investment income of certain private colleges and Part IV, the organization determines which schedules are

universities. See section 4968 and Form 4720, Return of Certain required. The entire completed Form 990 filed with the IRS,

Excise Taxes Under Chapters 41 and 42 of the Internal Revenue except for certain contributor information on Schedule B (Form

Code, and the interim guidance listed in IRS Notice 2019-09, for 990, 990-EZ, or 990-PF), is required to be made available to the

more information. public by the IRS and the filing organization (see Appendix D.

FASB changes, Part X. Instructions to Form 990 reflect the Public Inspection of Returns), and can be required to be filed

financial statement reporting changes under the Accounting with state governments to satisfy state reporting requirements.

Standards Update (ASU) 2016-14 (ASU 2016-14), Presentation See Appendix I. Use of Form 990 and 990-EZ to Satisfy State

of Financial Statements of Not-for-Profit Entities, issued by the Reporting Requirements.

Financial Accounting Standards Board (FASB). ASU 2016-14 Reminder: Don't Include Social Security Numbers

changes the way not-for-profit organizations classify net assets. on Publicly Disclosed Forms. Because the filing

!

CAUTION organization and the IRS are required to publicly

Purpose of Form disclose the organization's annual information returns, social

Forms 990 and 990-EZ are used by tax-exempt organizations, security numbers shouldn't be included on this form. By law, with

nonexempt charitable trusts, and section 527 political limited exceptions, neither the organization nor the IRS may

organizations to provide the IRS with the information required by remove that information before making the form publicly

section 6033. available. Documents subject to disclosure include statements

An organization's completed Form 990 or 990-EZ, and a and attachments filed with the form. For more information, see

section 501(c)(3) organization's Form 990-T, Exempt Appendix D. Public Inspection of Returns.

Organization Business Income Tax Return, generally are

Helpful hints. The following hints can help you more efficiently

available for public inspection as required by section 6104.

review these instructions and complete the form.

Schedule B (Form 990, 990-EZ, or 990-PF), Schedule of

Contributors, is available for public inspection for section 527 • See General Instructions, Section C. Sequencing List to

Complete the Form and Schedules, later, which provides

organizations filing Form 990 or 990-EZ. For other organizations

guidance on the recommended order for completing the form

that file Form 990 or Form 990-EZ, parts of Schedule B (Form

and applicable statements.

990, 990-EZ, or 990-PF), can be open to public inspection. See

Appendix D and the Instructions for Schedule B (Form 990, • Throughout these instructions, “the organization” and the

“filing organization” both refer to the organization filing Form 990.

990-EZ, or 990-PF) for more details.

• Unless otherwise specified, information should be provided

Some members of the public rely on Form 990 or Form for the organization's tax year. For instance, an organization

990-EZ as their primary or sole source of information about a should answer “Yes” to a question asking whether it conducted a

particular organization. How the public perceives an organization certain type of activity only if it conducted that activity during the

in such cases can be determined by information presented on its tax year.

return. • The examples appearing throughout the instructions on Form

990 are illustrative only. They are for the purpose of completing

Phone Help this form and aren't all-inclusive.

If you have questions and/or need help completing Form 990, • Instructions to the Form 990 schedules are published

please call 877-829-5500. This toll-free telephone service is separately from these instructions.

available Monday through Friday. Organizations that have $1,000 or more for the tax year

Email Subscription ! of total gross income from all unrelated trades or

CAUTION businesses must file Form 990-T, to report and pay tax

The IRS has established a subscription-based email service for on the resulting UBTI, in addition to any required Form 990,

tax professionals and representatives of tax-exempt 990-EZ, or 990-N.

organizations. Subscribers will receive periodic updates from the

IRS regarding exempt organization tax law and regulations,

available services, and other information. To subscribe, visit

A. Who Must File

IRS.gov/Charities-&-Non-Profits/Subscribe-to-Exempt- Most organizations exempt from income tax under section

Organization-Update. 501(a) must file an annual information return (Form 990 or

990-EZ) or submit an annual electronic notice (Form 990-N),

General Instructions

depending upon the organization's gross receipts and total

assets.

Overview of Form 990 An organization may not file a “consolidated” Form 990

TIP to aggregate information from another organization that

Note. Terms in bold are defined in the Glossary of the has a different EIN, unless it is filing a group return and

Instructions for Form 990. reporting information from a subordinate organization or

Certain Form 990 filers must file electronically. See organizations, reporting information from a joint venture or

General Instructions, Section E. When, Where, and How disregarded entity (see Appendices E and F, later), or as

!

CAUTION to File, later, for who must file electronically. otherwise provided for in the Code, regulations, or official IRS

guidance. A parent-exempt organization of a section 501(c)(2)

Form 990 is an annual information return required to be filed with title-holding company may file a consolidated Form 990-T with

the IRS by most organizations exempt from income tax under

-2- Instructions for Form 990

the section 501(c)(2) organization, but not a consolidated Form Section 509(a)(3) supporting organizations. A section

990. 509(a)(3) supporting organization must file Form 990 or

990-EZ, even if its gross receipts are normally $50,000 or less,

Form 990 must be filed by an organization exempt from

and even if it is described in Rev. Proc. 96-10, 1996-1 C.B. 577,

income tax under section 501(a) (including an organization that

or is an affiliate of a governmental unit described in Rev. Proc.

hasn't applied for recognition of exemption) if it has either (1)

95-48, unless it qualifies as one of the following:

gross receipts greater than or equal to $200,000 or (2) total

assets greater than or equal to $500,000 at the end of the tax 1. An integrated auxiliary of a church described in

year (with exceptions described below for organizations eligible Regulations section 1.6033-2(h),

to submit Form 990-N and for certain organizations described in 2. The exclusively religious activities of a religious order,

Section B. Organizations Not Required to File Form 990 or or

990-EZ, later). This includes: 3. An organization, the gross receipts of which are normally

• Organizations described in section 501(c)(3) (other than not more than $5,000, that supports a section 501(c)(3) religious

private foundations), and organization.

• Organizations described in other 501(c) subsections (other

than black lung benefit trusts). If the organization is described in (3) but not in (1) or (2), then it

Gross receipts are the total amounts the organization must submit Form 990-N unless it voluntarily files Form 990 or

received from all sources during its tax year, without subtracting 990-EZ.

any costs or expenses. See Appendix B for a discussion of Section 501(c)(7) and 501(c)(15) organizations. Section

gross receipts. 501(c)(7) and 501(c)(15) organizations apply the same gross

For purposes of Form 990 reporting, the term section 501(c) receipts test as other organizations to determine whether they

(3) includes organizations exempt under sections 501(e) and (f) must file Form 990, but use a different definition of gross receipts

(cooperative service organizations), 501(j) (amateur sports to determine whether they qualify as tax-exempt for the tax year.

organizations), 501(k) (child care organizations), and 501(n) See Appendix C for more information.

(charitable risk pools). In addition, any organization described in Section 527 political organizations. A tax-exempt political

one of these sections is also subject to section 4958 if it obtains organization must file Form 990 or 990-EZ if it had $25,000 or

a determination letter from the IRS stating that it is described in more in gross receipts during its tax year, even if its gross

section 501(c)(3). receipts are normally $50,000 or less, unless it meets one of the

Form 990-N. If an organization normally has gross receipts of exceptions for certain political organizations under Section B.

$50,000 or less, it must submit Form 990-N, Electronic Notice Organizations Not Required To File Form 990 or 990-EZ, later. A

(e-Postcard) for Tax-Exempt Organizations Not Required To File qualified state or local political organization must file Form 990 or

Form 990 or 990-EZ, if it chooses not to file Form 990 or Form 990-EZ only if it has gross receipts of $100,000 or more. Political

990-EZ (with exceptions described below for certain section organizations aren't required to submit Form 990-N.

509(a)(3) supporting organizations and for certain Section 4947(a)(1) nonexempt charitable trusts. A

organizations described in Section B. Organizations Not nonexempt charitable trust described under section 4947(a)

Required To File Form 990 or 990-EZ, later). See Appendix B for (1) (if it isn't treated as a private foundation) is required to file

a discussion of gross receipts. Form 990 or 990-EZ, unless excepted under Section B.

Form 990-EZ. If an organization has gross receipts less than Organizations Not Required To File Form 990 or 990-EZ, later.

$200,000 and total assets at the end of the tax year less than Such a trust is treated like an exempt section 501(c)(3)

$500,000, it can choose to file Form 990-EZ, Short Form Return organization for purposes of completing the form. Section

of Organization Exempt From Income Tax, instead of Form 990. 4947(a)(1) trusts must complete all sections of the Form 990 and

See the Instructions for Form 990-EZ for more information. See schedules that section 501(c)(3) organizations must complete.

the special rules below regarding controlling organizations All references to a section 501(c)(3) organization in the Form

under section 512(b)(13) and sponsoring organizations of 990, schedules, and instructions include a section 4947(a)(1)

donor advised funds. trust (for instance, such a trust must complete Schedule A (Form

If an organization eligible to submit the Form 990-N or file the 990 or 990-EZ)), unless otherwise specified. If such a trust

Form 990-EZ chooses to file the Form 990, it must file a doesn't have any taxable income under Subtitle A of the Code, it

complete return. can file Form 990 or 990-EZ to meet its section 6012 filing

requirement and doesn't have to file Form 1041, U.S. Income

Foreign and U.S. possession organizations. Foreign Tax Return for Estates and Trusts.

organizations and U.S. possession organizations as well as

domestic organizations must file Form 990 or 990-EZ unless Returns when exempt status not yet established. An

specifically excepted under Section B. Organizations Not organization is required to file Form 990 under these instructions

Required To File Form 990 or 990-EZ, later. Report amounts in if the organization claims exempt status under section 501(a) but

U.S. dollars and state what conversion rate the organization hasn't established such exempt status by filing Form 1023,

uses. Combine amounts from inside and outside the United Application for Recognition of Exemption Under Section 501(c)

States and report the total for each item. All information must be (3) of the Internal Revenue Code, Form 1023-EZ, Streamlined

written in English. Application for Recognition of Exemption Under Section 501(c)

(3) of the Internal Revenue Code, Form 1024, Application for

Sponsoring organizations of donor advised funds. If Recognition of Exemption Under Section 501(a), or Form

required to file an annual information return for the year, 1024-A, Application for Recognition of Exemption under Section

sponsoring organizations of donor advised funds must file 501(c)(4) of the Internal Revenue Code, and receiving an IRS

Form 990 and not Form 990-EZ. determination letter recognizing tax-exempt status. In such a

Controlling organizations described in section 512(b)(13). case, the organization must check the “Application pending”

A controlling organization of one or more controlled entities, checkbox on Form 990, Item B, Heading, page 1 (whether or not

as described in section 512(b)(13), must file Form 990 and not a Form 1023, 1023-EZ, 1024, or 1024-A, has been filed) to

Form 990-EZ if it is required to file an annual information return indicate that Form 990 is being filed in the belief that the

for the year and if there was any transfer of funds between the organization is exempt under section 501(a), but that the IRS

controlling organization and any controlled entity during the year. hasn't yet recognized such exemption.

Instructions for Form 990 -3-

To be recognized as exempt retroactive to the date of its Certain organizations with limited gross receipts.

organization or formation, an organization claiming tax-exempt 10. An organization whose gross receipts are normally

status under section 501(c) (other than 501(c)(29)) generally $50,000 or less. Such organizations generally are required to

must file an application for recognition of exemption (Form 1023, submit Form 990-N if they choose not to file Form 990 or Form

1023-EZ, 1024, or 1024-A) within 27 months of the end of the 990-EZ. To determine what an organization's gross receipts

month in which it was legally organized or formed. “normally” are, see Appendix B. How To Determine Whether an

An organization that has filed a letter application for Organization's Gross Receipts Are Normally $50,000 (or $5,000)

recognition of exemption as a qualified nonprofit health or Less.

!

CAUTION insurance issuer under section 501(c)(29), or plans to do 11. Foreign organizations and organizations located in U.S.

so, but hasn't yet received an IRS determination letter possessions, whose gross receipts from sources within the

recognizing exempt status, must check the “Application United States are normally $50,000 or less and which didn't

pending” checkbox on the Form 990, Heading, Item B. engage in significant activity in the United States (other than

investment activity). Such organizations, if they claim U.S. tax

B. Organizations Not Required To File exemption or are recognized by the IRS as tax-exempt,

generally are required to submit Form 990-N if they choose not

Form 990 or 990-EZ to file Form 990 or 990-EZ.

An organization doesn't have to file Form 990 or 990-EZ even if it

has at least $200,000 of gross receipts for the tax year or If a foreign organization or U.S. possession organization is

$500,000 of total assets at the end of the tax year if it is required to file Form 990 or Form 990-EZ, then its worldwide

described below (except for section 509(a)(3) supporting gross receipts, as well as assets, are taken into account in

organizations, which are described earlier). See Section A. Who determining whether it qualifies to file Form 990-EZ.

Must File to determine if the organization can file Form 990-EZ Certain organizations that file different kinds of annual

instead of Form 990. An organization described in paragraph 10, information returns.

11, or 13 of this Section B is required to submit Form 990-N 12. A private foundation (including a private operating

unless it voluntarily files Form 990, 990-EZ, or 990-BL, as foundation) exempt under section 501(c)(3) and described in

applicable. section 509(a). Use Form 990-PF, Return of Private Foundation.

Also use Form 990-PF for a taxable private foundation, a section

Certain religious organizations.

4947(a)(1) nonexempt charitable trust treated as a private

1. A church, an interchurch organization of local units of a foundation, and a private foundation terminating its status by

church, a convention or association of churches, or an becoming a public charity under section 507(b)(1)(B) (for tax

integrated auxiliary of a church as described in Regulations years within its 60-month termination period). If the organization

section 1.6033-2(h) (such as a men's or women's organization, successfully terminates, then it files Form 990 or 990-EZ in its

religious school, mission society, or youth group). final year of termination.

2. A church-affiliated organization that is exclusively 13. A black lung benefit trust described in section 501(c)(21).

engaged in managing funds or maintaining retirement programs Use Form 990-BL, Information and Initial Excise Tax Return for

and is described in Rev. Proc. 96-10, 1996-1 C.B. 577. But see Black Lung Benefit Trusts and Certain Related Persons.

the filing requirements for section 509(a)(3) supporting

14. A religious or apostolic organization described in section

organizations in A. Who Must File.

501(d). Use Form 1065, U.S. Return of Partnership Income.

3. A school below college level affiliated with a church or

15. A stock bonus, pension, or profit-sharing trust that

operated by a religious order described in Regulations section

qualifies under section 401. Use Form 5500, Annual Return/

1.6033-2(g)(1)(vii).

Report of Employee Benefit Plan.

4. A mission society sponsored by, or affiliated with, one or

more churches or church denominations, if more than half of the Subordinate organizations in a group exemption

society's activities are conducted in, or directed at, persons in TIP which are included in a group return filed by the

foreign countries. central organization for the tax year shouldn't file a

separate Form 990, Form 990-EZ, or Form 990–N for the tax

5. An exclusively religious activity of any religious order

year.

described in Rev. Proc. 91-20, 1991-1 C.B. 524.

Certain governmental organizations.

C. Sequencing List To Complete the

6. A state institution whose income is excluded from gross

income under section 115. Form and Schedules

7. A governmental unit or affiliate of a governmental unit You may find the following list helpful. It limits jumping from one

described in Rev. Proc. 95-48, 1995-2 C.B. 418. But see the part of the form to another to make a calculation or determination

filing requirements for section 509(a)(3) supporting needed to complete an earlier part. Certain later parts of the

organizations in A. Who Must File. form must first be completed in order to complete earlier parts. In

8. An organization described in section 501(c)(1). A section general, first complete the core form, and then complete

501(c)(1) organization is a corporation organized under an Act of alphabetically Schedules A–N and Schedule R, except as

Congress that is an instrumentality of the United States, and provided below. Schedule O (Form 990 or 990-EZ),

exempt from federal income taxes. Supplemental Information to Form 990, should be completed as

the core form and schedules are completed. Note that all

Certain political organizations. organizations filing Form 990 must file Schedule O.

9. A political organization that is:

A public charity described in section 170(b)(1)(A)(iv),

• A state or local committee of a political party;

• A political committee of a state or local candidate; TIP 170(b)(1)(A)(vi), or 509(a)(2) that isn't within its initial 5

years of existence should first complete Part II or III of

• A caucus or association of state or local officials; or Schedule A (Form 990 or 990-EZ) to ensure that it continues to

• Required to report under the Federal Election Campaign Act qualify as a public charity for the tax year. If it fails to qualify as a

of 1971 as a political committee (as defined in section 301(4) of

public charity, then it must file Form 990-PF rather than Form

such Act).

-4- Instructions for Form 990

990 or Form 990-EZ, and check the box for “Initial return of a is an initial return for which the “Initial return” box is checked in

former public charity” on page 1 of Form 990-PF. Item B of the Heading or a final return for which the “Final return/

terminated” box is checked in Item B of the Heading.

1. Complete Items A through F and H(a) through M in the

Accounting period change. If the organization changes its

Heading of Form 990, on page 1.

accounting period, it must file a Form 990 for the short period

2. See the instructions for definitions of related resulting from the change. Write “Change of Accounting Period”

organization and control and determine the organization's at the top of this short-period return.

related organizations required to be listed on Schedule R (Form

If the organization has previously changed its annual

990).

accounting period at any time within the 10-calendar-year period

3. Determine the organization's officers, directors, trustees, that includes the beginning of the short period resulting from

key employees, and five highest compensated employees the current change in accounting period, and it had a Form

required to be listed on Form 990, Part VII, Section A. 990-series filing requirement or income tax return filing

4. Complete Parts VIII, IX, and X of Form 990. requirement at any time during that 10-year period, it must also

5. Complete Item G in the Heading section of Form 990, on file a Form 1128, Application To Adopt, Change, or Retain a Tax

page 1. Year, with the short-period return. See Rev. Proc. 85-58, 1985-2

C.B. 740.

6. Complete Parts III, V, VII, XI, and XII of Form 990.

If an organization that submits Form 990-N changes its

7. See the Instructions for Schedule L (Form 990 or accounting period, it must report this change on Form 990, Form

990-EZ), Transactions With Interested Persons, and complete 990-EZ, or Form 1128, or by sending a letter to Internal Revenue

Schedule L (Form 990 or 990-EZ) (if required). Service, 1973 Rulon White Blvd., Ogden, UT 84201.

8. Complete Part VI of Form 990. Transactions reported on

Schedule L (Form 990 or 990-EZ) are relevant to determining Accounting Methods

independence of members of the governing body under Form Unless instructed otherwise, the organization generally should

990, Part VI, line 1b. use the same accounting method on the return (including the

9. Complete Part I of Form 990 based on information Form 990 and all schedules) to report revenue and expenses

derived from other parts of the form. that it regularly uses to keep its books and records. To be

10. Complete Part IV of Form 990 to determine which acceptable for Form 990 reporting purposes, however, the

schedules must be completed by the organization. method of accounting must clearly reflect income.

11. Complete Schedule O (Form 990 or 990-EZ) and any Accounting method change. Generally, the organization must

other applicable schedules (for “Yes” boxes that were checked file Form 3115, Application for Change in Accounting Method, to

in Part IV). Use Schedule O (Form 990 or 990-EZ) to provide change its accounting method. An exception applies where a

required supplemental information and other narrative section 501(c) organization changes its accounting method to

explanations for questions on the core Form 990. For questions comply with the Financial Accounting Standards Board (FASB)

on Form 990 schedules, use the narrative part of each schedule Accounting Standards Codification 958, Not-for-Profit Entities

to provide supplemental narrative. (ASC 958). See Notice 96-30, 1996-1 C.B. 378. An organization

12. Complete Part II, Signature Block, of Form 990. that makes a change in accounting method, regardless of

whether it files Form 3115, must report any adjustment required

D. Accounting Periods and Methods by section 481(a) in Parts VIII through XI and on Schedule D

(Form 990), Supplemental Financial Statements, Parts XI and

These are the accounting periods covered under the law. XII, as applicable.

Accounting Periods State reporting. Many states that accept Form 990 in place of

their own forms require that all amounts be reported based on

Calendar year. Use the 2019 Form 990 to report on the 2019 the accrual method of accounting. If the organization prepares

calendar year accounting period. A calendar year accounting Form 990 for state reporting purposes, it can file an identical

period begins on January 1 and ends on December 31. return with the IRS even though the return doesn't agree with the

Fiscal year. If the organization has established a fiscal year books of account, unless the way one or more items are

accounting period, use the 2019 Form 990 to report on the reported on the state return conflicts with the instructions for

organization's fiscal year that began in 2019 and ended 12 preparing Form 990 for filing with the IRS.

months later. A fiscal year accounting period should normally Example 1. The organization maintains its books on the

coincide with the natural operating cycle of the organization. Be cash receipts and disbursements method of accounting but

certain to indicate in Item A of the Heading of Form 990 the date prepares a Form 990 return for the state based on the accrual

the organization's fiscal year began in 2019 and the date the method. It could use that return for reporting to the IRS.

fiscal year ended in 2020.

Example 2. A state reporting requirement requires the

Short period. A short accounting period is a period of less than organization to report certain revenue, expense, or balance

12 months, which exists when an organization first commences sheet items differently from the way it normally accounts for

operations, changes its accounting period, or terminates. If the them on its books. A Form 990 prepared for that state is

organization's short year began in 2019, and ended before acceptable for the IRS reporting purposes if the state reporting

December 31, 2019 (not on or after December 31, 2019), it may requirement doesn't conflict with the Instructions for Form 990.

use either 2018 Form 990 or 2019 Form 990 to file for the short

year. The 2019 form also may be used for a short period An organization should keep a reconciliation of any

beginning in 2020 and ending before December 31, 2020 (not differences between its books of account and the Form 990 that

on or after December 31, 2020). When doing so, provide the is filed. Organizations with audited financial statements are

information for designated years listed on the return, other than required to provide such reconciliations on Schedule D (Form

the tax year being reported, as if they were updated on the 2020 990), Parts XI through XII.

form. For example, provide the information on Schedule A, Part

II, for the tax years 2016–2020, rather than for tax years 2015–

2019. A short period return can't be filed electronically unless it

Instructions for Form 990 -5-

See Pub. 538, Accounting Periods and Methods, and hardship. For information on filing a waiver, see Notice 2010-13,

TIP the Instructions for Forms 1128 and 3115, about 2010-4 I.R.B. 327, available at

reporting changes to accounting periods and methods. IRS.gov/irb/2010-04_IRB/ar14.html.

Electronic filing for tax years beginning on or after July 2,

E. When, Where, and How To File 2019. If you are filing a 2019 Form 990 for a tax year beginning

File Form 990 by the 15th day of the 5th month after the on or after July 2, 2019, you are required to file electronically

organization's accounting period ends (May 15th for a unless one or more of the following exceptions apply.

calendar-year filer). If the due date falls on a Saturday, Sunday, 1. The name of the organization has changed, the new

or legal holiday, file on the next business day. A business day is name is entered on Form 990, and the “Name change” box is

any day that isn't a Saturday, Sunday, or legal holiday. checked in Item B.

If the organization is liquidated, dissolved, or terminated, file 2. Form 990 is for a short period because of an accounting

the return by the 15th day of the 5th month after liquidation, period change. This does not apply if (a) the short period is an

dissolution, or termination. initial return and the “Initial return” box is checked in Item B; or

(b) the short period is for a final return, and the “Final return/

If the return isn't filed by the due date (including any extension terminated” box is checked in Item B.

granted), explain in a separate attachment, giving the reasons

3. An application for exemption is pending, and the

for not filing on time.

“Application pending” box is checked in Item B.

Send the return to: 4. Form 990 is being filed before the end of the tax year.

This does not apply if the return is a final return, and the “Final

Department of the Treasury return/terminated” box is checked in Item B.

Internal Revenue Service Center

Ogden, UT 84201-0027 5. You attempted to file Form 990 electronically, but the

return was rejected (even after you contacted your e-file

provider).

Foreign and U.S. possession organizations. If the

organization's principal business, office, or agency is located in a For exceptions 1 through 4 above, file a paper Form 990. For

foreign country or U.S. possession, send the return to: exception 5, file a paper Form 990 as prescribed in section 5.7 of

Publication 4163, Modernized e-File (MeF) Information for

Department of the Treasury Authorized IRS e-File Providers for Business Returns.

Internal Revenue Service Center For additional information on the electronic filing requirement,

P.O. Box 409101 visit IRS.gov/Filing.

Ogden, UT 84409

F. Extension of Time To File

Private delivery services. Tax-exempt organizations can use Use Form 8868, Application for Automatic Extension of Time To

certain private delivery services (PDS) designated by the IRS to File an Exempt Organization Return, to request an automatic

meet the “timely mailing as timely filing” rule for tax returns. Go to extension of time to file.

IRS.gov/PDS for the current list of designated services.

The PDS can tell you how to get written proof of the mailing

G. Amended Return/Final Return

date. To amend the organization's return for any year, file a new return

including any required schedules. Use the version of Form 990

For the IRS mailing address to use if you’re using PDS, go to applicable to the year being amended. The amended return

IRS.gov/PDSstreetAddresses. must provide all the information called for by the form and

Private delivery services can't deliver items to P.O. instructions, not just the new or corrected information. Check the

! boxes. You must use the U.S. Postal Service to mail any “Amended return” box in Item B of the Heading of the return on

CAUTION item to an IRS P.O. box address. page 1 of the form. Also, enter in Schedule O (Form 990 or

990-EZ) which parts and schedules of the Form 990 were

Electronic filing for tax years beginning before July 2, amended and describe the amendments.

2019. The organization can file Form 990 and related forms, The organization can file an amended return at any time to

schedules, and attachments electronically. However, if an change or add to the information reported on a previously filed

organization files at least 250 returns of any type during the return for the same period. It must make the amended return

calendar year ending with or within the organization's tax year available for inspection for 3 years from the date of filing or 3

and has total assets of $10 million or more at the end of the tax years from the date the original return was due, whichever is

year, it must file Form 990 electronically. “Returns” for this later.

purpose include information returns (for example, Forms W-2

and Forms 1099), income tax returns, employment tax returns If the organization needs a complete copy of its previously

(including quarterly Forms 941, Employer's Quarterly Federal filed return, it can file Form 4506, Request for Copy of Tax

Tax Return), and excise tax returns. Return.

If an organization is required to file a return electronically but If the return is a final return, the organization must check the

doesn't, the organization is considered not to have filed its “Final return/terminated” box in Item B of the Heading on page 1

return, even if a paper return is submitted, unless it is reporting a of the form, and complete Schedule N (Form 990 or 990-EZ),

name change, in which case it must file by paper and attach the Liquidation, Termination, Dissolution, or Significant Disposition

documents described in Specific Instructions, Item B. of Assets.

Checkboxes, later. See Regulations section 301.6033-4 for

more information on mandatory electronic filing of Form 990. Amended returns and state filing considerations. State law

may require that the organization send a copy of an amended

For additional information on the electronic filing requirement, Form 990 return (or information provided to the IRS

visit IRS.gov/Filing. supplementing the return) to the state with which it filed a copy of

For tax years beginning before July 2, 2019, the IRS may Form 990 to meet that state's reporting requirement. A state may

waive the requirements to file electronically in cases of undue require an organization to file an amended Form 990 to satisfy

-6- Instructions for Form 990

state reporting requirements, even if the original return was • Exempt from tax under a group exemption letter that is still

accepted by the IRS. in effect, and

• Using the same tax year as the central organization.

H. Failure-to-File Penalties

The central organization can't use a Form 990-EZ for the

Against the organization. Under section 6652(c)(1)(A), a group return.

penalty of $20 a day, not to exceed the lesser of $10,500 or 5%

of the gross receipts of the organization for the year, can be A subordinate organization may choose to file a separate

charged when a return is filed late, unless the organization annual information return instead of being included in the group

shows that the late filing was due to reasonable cause. return.

Organizations with annual gross receipts exceeding

$1,067,000 are subject to a penalty of $105 for each day failure If the central organization is required to file a return for

continues (with a maximum penalty for any one return of itself, it must file a separate return and can't be included in the

$53,000). The penalty applies on each day after the due date group return. See Regulations section 1.6033-2(d)(1). See

that the return isn't filed. Section B. Organizations Not Required To File Form 990 or

990-EZ, earlier, for a list of organizations not required to file.

Tax-exempt organizations that are required to file

electronically but don't are deemed to have failed to file the Every year, each subordinate organization must authorize the

return. This is true even if a paper return is submitted, unless the central organization in writing to include it in the group return and

organization files by paper to report a name change. must declare, under penalties of perjury, that the authorization

The penalty also can be charged if the organization files an and the information it submits to be included in the group return

incomplete return, such as by failing to complete a required line are true and complete.

item or a required part of a schedule. To avoid penalties and

having to supply missing information later: The central organization should send the annual information

• Complete all applicable line items, update required to maintain a group exemption ruling (a

• Unless instructed to skip a line, answer each question on the separate requirement from the annual return) to:

return,

Department of the Treasury

• Make an entry (including a zero when appropriate) on all lines Internal Revenue Service Center

requiring an amount or other information to be reported, and

Ogden, UT 84201-0027

• Provide required explanations as instructed.

Also, this penalty can be imposed if the organization's return For special instructions regarding answering certain Form

contains incorrect information. For example, an organization that 990 questions about parts or schedules in the context of a group

reports contributions net of related fundraising expenses can be return, see Appendix E. Group Returns–Reporting Information

subject to this penalty. on Behalf of the Group.

Use of a paid preparer doesn't relieve the organization of its

responsibility to file a complete and accurate return. J. Requirements for a Properly

Against responsible person(s). If the organization doesn't file Completed Form 990

a complete return or doesn't furnish correct information, the IRS All organizations filing Form 990 must complete Parts I through

will send the organization a letter that includes a fixed time to XII, Schedule O (Form 990 or 990-EZ), and any schedules for

fulfill these requirements. After that period expires, the person which a “Yes” response is indicated in Part IV. If an organization

failing to comply will be charged a penalty of $10 a day. The isn't required to file Form 990 but chooses to do so, it must file a

maximum penalty on all persons for failures for any one return complete return and provide all of the information requested,

shall not exceed $5,000. including the required schedules.

There are also penalties (fines and imprisonment) for willfully

not filing returns and for filing fraudulent returns and statements Public inspection. In general, all information the organization

with the IRS (see sections 7203, 7206, and 7207). States can reports on or with its Form 990, including schedules and

impose additional penalties for failure to meet their separate attachments, will be available for public inspection. Note,

filing requirements. however, the special rules for Schedule B (Form 990, 990-EZ, or

990-PF), Schedule of Contributors, a required schedule for

Automatic revocation for nonfiling for three consecutive certain organizations that file Form 990. Make sure the forms

years. The law requires most tax-exempt organizations, other and schedules are clear enough to photocopy legibly. For more

than churches, to file an annual Form 990, 990-EZ, or 990-PF information on public inspection requirements, see Appendix D.

with the IRS, or to submit a Form 990-N e-Postcard to the IRS. If Public Inspection of Returns, and Pub. 557, Tax-Exempt Status

an organization fails to file an annual return or submit a notice as for Your Organization.

required for 3 consecutive years, its tax-exempt status is

automatically revoked on and after the due date for filing its third Signature. A Form 990 isn't complete without a proper

annual return or notice. Organizations that lose their tax-exempt signature. For details, see the instructions for Part II, Signature

status may need to file income tax returns and pay income tax, Block, later.

but may apply for reinstatement of exemption. For details, go to Recordkeeping. The organization's records should be kept for

IRS.gov/EO. as long as they may be needed for the administration of any

provision of the Internal Revenue Code. Usually, records that

I. Group Return support an item of income, deduction, or credit must be kept for

A central, parent, or similar organization can file a group return a minimum of 3 years from the date the return is due or filed,

on Form 990 for two or more subordinate or local organizations whichever is later. Keep records that verify the organization's

that are: basis in property for as long as they are needed to figure the

• Affiliated with the central organization at the time its tax year basis of the original or replacement property. Applicable law and

ends, an organization's policies can require that the organization retain

• Subject to the central organization's general supervision or records longer than 3 years. Form 990, Part VI, line 14, asks

control, whether the organization has a document retention and

destruction policy.

Instructions for Form 990 -7-

The organization also should keep copies of any returns it it should file Form(s) 8868 to request a filing extension. See

has filed. They help in preparing future returns and in making Section F. Extension of Time To File, earlier. If the organization

computations when filing an amended return. is unable to obtain this information by the extended due date

after making reasonable efforts, and isn't certain of the answer to

Rounding off to whole dollars. The organization must round

a particular question, it may make a reasonable estimate, where

off cents to whole dollars on the returns and schedules, unless

applicable, and explain in Schedule O.

otherwise noted for particular questions. To round, drop

amounts under 50 cents and increase amounts from 50 to 99

cents to the next dollar. For example, $1.49 becomes $1 and

Assembling Form 990, Schedules, and

$2.50 becomes $3. If the organization has to add two or more Attachments

amounts to figure the amount to enter on a line, include cents Before filing Form 990, assemble the package of forms,

when adding the amounts and round off only the total. schedules, and attachments in the following order.

Completing all lines. Make an entry (including -0- when 1. Core form with Parts I through XII completed, filed in

appropriate) on all lines requiring an amount or other information numerical order.

to be reported. Don't leave any applicable lines blank, unless 2. Schedules, completed as applicable, filed in alphabetical

expressly instructed to skip that line. If answering a line is order (see Form 990, Part IV, for required schedules). All pages

predicated on a “Yes” answer to the preceding line, and if the of a required schedule must be submitted by Form 990 paper

organization's answer to the preceding line was “No,” then leave filers, even if the filer is only required to complete certain parts

the “If Yes” line blank. but not all of the schedule.

All filers must file Schedule O (Form 990 or 990-EZ). Certain 3. Attachments, completed as applicable. These include (a)

questions require all filers to provide an explanation in name change amendment to organizing document required by

Schedule O (Form 990 or 990-EZ). In general, answers can be Item B under Heading; (b) list of subordinate organizations

explained or supplemented in Schedule O (Form 990 or 990-EZ) included in a group return required by Item H under Heading;

if the allotted space in the form or other schedule is insufficient, (c) articles of merger or dissolution, resolutions, and plans of

or if a “Yes” or “No” answer is required but the organization liquidation or merger required by Schedule N (Form 990 or

wishes to explain its answer. 990-EZ); (d) reasonable cause explanation for a late-filed return;

Missing or incomplete parts of the form and/or required and (e) for hospital organizations only, a copy of the most

schedules may result in the IRS contacting you to obtain the recent audited financial statements.

missing information. Failure to supply the information may result Don't attach materials not authorized in the instructions or not

in a penalty being assessed to your account. For tips on filing otherwise authorized by the IRS.

complete returns, go to IRS.gov/Charities.

To facilitate the processing of your return, don't

Reporting proper amounts. Some lines request information password protect or encrypt PDF attachments.

reported on other forms filed by the organization (such as Forms !

CAUTION Password protecting or encrypting a PDF file that is

W-2, 1099, and 990-T). If the organization is aware that the attached to an e-filed return prevents the IRS from opening the

amount actually reported on the other form is incorrect, it must attachment.

report on Form 990 the information that should have been

reported on the other form (in addition to filing an amended form

with the proper amount).

In general, don't report negative numbers, but use -0- instead

Specific Instructions

of a negative number, unless the instructions otherwise provide.

Report revenue and expenses separately and don't net related

items, unless otherwise provided. Heading. Items A–M

Inclusion of activities and items of disregarded entities Complete items A through M.

and joint ventures. An organization must report on its Form Item A. Accounting period. File the 2019 return for calendar

990 all of the revenues, expenses, assets, liabilities, and net year 2019 and fiscal years that began in 2019 and ended in

assets or funds of a disregarded entity of which it is the sole 2020. For a fiscal year return, fill in the tax year space at the top

member, and must report on its Form 990 its share of all such of page 1. See General Instructions, Section D. Accounting

items of a joint venture or other investment or arrangement Periods and Methods, earlier, for additional information about

treated as a partnership for federal income tax purposes. This accounting periods.

includes passive investments. In addition, the organization

generally must report activities of a disregarded entity or a joint Item B. Checkboxes. The following checkboxes are under

venture on the appropriate parts or schedules of Form 990. For Item B.

special instructions about the treatment of disregarded entities Address change. Check this box if the organization changed

and joint ventures for various parts of the form, see Appendix F. its address and hasn't reported the change on its most recently

Disregarded Entities and Joint Ventures—Inclusion of Activities filed Form 990, 990-EZ, 990-N, or 8822-B or in correspondence

and Items. to the IRS.

Reporting information from third parties. Some lines If a change in address occurs after the return is filed, use

request information that the organization may need to obtain TIP Form 8822-B, Change of Address or Responsible

from third parties, such as compensation paid by related Party—Business, to notify the IRS of the new address.

organizations; family and business relationships between

officers, directors, trustees, key employees, and certain Name change. Check this box if the organization changed its

businesses they own or control; the organization's share of the legal name (not its “doing business as” name) and if the

income and assets of a partnership or joint venture in which it organization hasn't reported the change on its most recently filed

has an ownership interest; and certain transactions between the Form 990 or 990-EZ or in correspondence to the IRS. If the

organization and interested persons. The organization should organization changed its name, file Form 990 by paper and

make reasonable efforts to obtain this information. If it is unable attach the following documents:

to obtain certain information by the due date for filing the return,

-8- Instructions for Form 990

IF the organization is . . . THEN attach . . .

operates under a name different from its legal name, enter the

alternate name on the “Doing Business As” (DBA) line. If multiple

A corporation A copy of the amendment to the DBA names won't fit on the line, enter one on the line and enter

articles of incorporation and proof of the others on Schedule O (Form 990 or 990-EZ).

filing with the appropriate state

authority.

If the organization receives its mail in care of a third party

(such as an accountant or an attorney), enter on the street

A trust A copy of the amendment to the trust address line “C/O” followed by the third party's name and street

instrument, or a resolution to amend address or P.O. box.

the trust instrument, showing the

effective date of the change of name Include the suite, room, or other unit number after the street

and signed by at least one trustee. address. If the Post Office doesn’t deliver mail to the street

address and the organization has a P.O. box, enter the box

An unincorporated association A copy of the amendment to the

articles of association, constitution, or

number instead of the street address.

other organizing document, showing For foreign addresses, enter the information in the following

the effective date of the change of order: city or town, state or province, the name of the country,

name and signed by at least two and the postal code. Don't abbreviate the country name.

officers, trustees, or members.

If a change of address occurs after the return is filed, use

Form 8822-B, Change of Address or Responsible

Initial return. Check this box if this is the first time the Party—Business, to notify the IRS of the new address.

organization is filing a Form 990 and it hasn't previously filed a Item D. Employer identification number (EIN). Each

Form 990-EZ, 990-PF, 990-T, or 990-N. organization (including a subordinate of a central organization)

Final return/terminated. Check this box if the organization must have its own EIN. Use the EIN provided to the organization

has terminated its existence or ceased to be a section 501(a) or for filing its Form 990 and federal tax returns. An organization

section 527 organization and is filing its final return as an exempt should never use the EIN issued to another organization, even if

organization or section 4947(a)(1) trust. For example, an the organizations are related. The organization must have only

organization should check this box when it has ceased one EIN. If it has more than one and hasn't been advised which

operations and dissolved, merged into another organization, or to use, notify the:

has had its exemption revoked by the IRS. An organization that

checks this box because it has liquidated, terminated, or Department of the Treasury

dissolved during the tax year must also attach Schedule N (Form Internal Revenue Service Center

990 or 990-EZ). Ogden, UT 84201-0027

An organization must support any claim to have

liquidated, terminated, dissolved, or merged by State the numbers the organization has, the name and

!

CAUTION attaching a certified copy of its articles of dissolution or

address to which each EIN was assigned, and the address of

merger approved by the appropriate state authority. If a certified the organization's principal office. The IRS will advise the

copy of its articles of dissolution or merger isn't available, the organization which number to use.

organization must submit a copy of a resolution or resolutions of A subordinate organization that files a separate Form

its governing body approving plans of liquidation, termination, TIP 990 instead of being included in a group return must use

dissolution, or merger. its own EIN, and not that of the central organization.

Amended return. Check this box if the organization

A section 501(c)(9) voluntary employees' beneficiary

previously filed a return with the IRS for a tax year and is now

filing another return for the same tax year to amend the TIP association must use its own EIN and not the EIN of its

sponsor.

previously filed return. Enter on Schedule O (Form 990 or

990-EZ) the parts and schedules of the Form 990 that were

Item E. Telephone number. Enter a telephone number of the

amended and describe the amendments. See General

organization that members of the public and government

Instructions, Section G. Amended Return/Final Return, earlier,

personnel can use during normal business hours to obtain

for more information.

information about the organization's finances and activities. If the

Application pending. Check this box if the organization organization doesn’t have a telephone number, enter the

either has filed a Form 1023, 1023-EZ, 1024, or 1024-A, with the telephone number of an organization official who can provide

IRS and is awaiting a response, or claims tax-exempt status such information.

under section 501(a) but hasn't filed Form 1023, 1023-EZ, 1024,

or 1024-A, to be recognized by the IRS as tax-exempt. If this box Item F. Name and address of principal officer. The address

is checked, the organization must complete all parts of Form 990 provided must be a complete mailing address to enable the IRS

and any required schedules. An organization that is required to to communicate with the organization's current (as of the date

file an annual information return (Form 990 or Form 990-EZ) or this return is filed) principal officer, if necessary. If the officer

submit an annual electronic notice (Form 990-N) for a tax year prefers to be contacted at the organization's address listed in

(see General Instructions, Section A. Who Must File, earlier) Item C, enter “same as C above.” For purposes of this item,

must do so even if it hasn't yet filed a Form 1023, 1023-EZ, “principal officer” means an officer of the organization who,

1024, or 1024-A with the IRS, if it claims tax-exempt status. regardless of title, has ultimate responsibility for implementing

the decisions of the organization's governing body, or for

To qualify for tax exemption retroactive to the date of its

supervising the management, administration, or operation of the

organization or formation, an organization claiming tax-exempt

organization.

status under section 501(c) (other than 501(c)(29)) generally

must file an application for recognition of exemption (Form 1023, If a change in responsible party occurs after the return is

1023-EZ, 1024, or 1024-A) within 27 months of the end of the TIP filed, use Form 8822-B, Change of Address or

month in which it was legally organized or formed. Responsible Party—Business, to notify the IRS of the

new responsible party.

Item C. Name and address. Enter the organization's legal

name on the “Name of organization” line. If the organization

Instructions for Form 990 -9-

Item G. Gross receipts. On Form 990, Part VIII, column A, add Line 1. Describe the organization's mission or its most

line 6b (both columns (i) and (ii)), line 7b (both columns (i) and significant activities for the year, whichever the organization

(ii)), line 8b, line 9b, line 10b, and line 12, and enter the total wishes to highlight, on the summary page.

here. See the exceptions from filing Form 990 based on gross

Line 2. Check this box if the organization answered “Yes,” on

receipts and total assets as described in General Instructions,

Part IV, line 31 or 32, and complete Schedule N (Form 990 or

Sections A and B, earlier.

990-EZ), Part I or Part II.

Item H. Group returns. If the organization answers “No” to line

Line 6. Enter the number of volunteers, full-time and part-time,

H(a), it shouldn't check a box in line H(b). If the organization

including volunteer members of the organization's governing

answers “Yes” on line H(a) but “No” to line H(b), attach a list (not

body, who provided volunteer services to the organization during

on Schedule O (Form 990 or 990-EZ)) showing the name,

the reporting year. Organizations that don't keep track of this

address, and EIN of each local or subordinate organization

information in their books and records or report this information

included in the group return. Additionally, attach a list (not on

elsewhere (such as in annual reports or grant proposals) can

Schedule O) showing the name, address, and EIN of each

provide a reasonable estimate, and can use any reasonable

subordinate organization not included in the group return. See

basis for determining this estimate. Organizations can, but aren't

Regulations section 1.6033-2(d)(2)(ii). If the organization

required to, provide an explanation on Schedule O (Form 990 or

answers “Yes” on line H(a) and “Yes” to line H(b), attach a list

990-EZ) of how this number was determined, the number of

(not on Schedule O) showing the name, address, and EIN of

hours those volunteers served during the tax year, and the types

each subordinate organization included in the group return. See

of services or benefits provided by the organization's volunteers.

Regulations section 1.6033-2(d)(2)(ii). A central or subordinate

organization filing an individual return should not attach such a Line 7b. If the organization isn't required to file a Form 990-T for

list. Enter on line H(c) the four-digit group exemption number the tax year, enter “0.” If the organization hasn't yet filed Form

(GEN) if the organization is filing a group return, or if the 990-T for the tax year, provide an estimate of the amount it

organization is a central or subordinate organization in a group expects to report on Form 990-T, line 39, when it is filed.

exemption and is filing a separate return. Don't confuse the

Lines 8–19. If this is an initial return, or if the organization filed

four-digit GEN number with the nine-digit EIN number reported

Form 990-EZ or 990-PF in the prior year, leave the “Prior Year”

on Item D of the form's Heading. A central organization filing a

column blank. Use the same lines from the 2018 Form 990 to

group return must not report its own EIN in Item D, but report the

determine what to report for prior year revenue and expense

special EIN issued for use with the group return.

amounts.

If attaching a list:

• Enter the form number (“Form 990”) and tax year, Line 16a. Enter the total of (i) the fees for professional

• Enter the group exemption name and EIN, fundraising services reported in Part IX, column (A), line 11e,

• Enter the four-digit group exemption number (GEN), and and (ii) the portion of the amount reported in Part IX, column (A),

• Use the same size paper as the form. lines 5 and 6, that comprises fees for professional fundraising

services paid to officers, directors, trustees, key employees, and

Item I. Tax-exempt status. Check the applicable box. If the disqualified persons, whether or not such persons are

organization is exempt under section 501(c) (other than section employees of the organization. Exclude the latter amount from

501(c)(3)), check the second box and insert the appropriate Part I, line 15.

subsection number within the parentheses (for example, “4” for a

501(c)(4) organization). Part II. Signature Block

Item J. Website. Enter the organization's current address for its The return must be signed by the current president, vice

primary website, as of the date of filing this return. If the president, treasurer, assistant treasurer, chief accounting officer,

organization doesn’t maintain a website, enter “N/A” (not or other corporate officer (such as a tax officer) who is

applicable). authorized to sign as of the date this return is filed. A receiver,

trustee, or assignee must sign any return he or she files for a

Item K. Form of organization. Check the box describing the corporation or association. See Regulations section 1.6012-3(b)

organization's legal entity form or status under state law in its (4). For a trust, the authorized trustee(s) must sign. The

state of legal domicile. These include corporations, trusts, definition of “officer” for purposes of Part II is different from the

unincorporated associations, and other entities (for example, definition of officer (see Glossary) used to determine which

partnerships and limited liability companies). officers to report elsewhere on the form and schedules, and from

Item L. Year of formation. Enter the year in which the the definition of principal officer for purposes of the Form 990

organization was legally created under state or foreign law. If a Heading (see Glossary).

corporation, enter the year of incorporation.

Paid Preparer

Item M. State of legal domicile. For a corporation, enter the

state of incorporation (country of incorporation for a foreign Generally, anyone who is paid to prepare the return must sign

corporation formed outside the United States). For a trust or the return, list the preparer's taxpayer identification number

other entity, enter the state whose law governs the (PTIN), and fill in the other blanks in the Paid Preparer Use Only

organization's internal affairs (or the foreign country whose law area. An employee of the filing organization isn't a paid preparer.

governs for a foreign organization other than a corporation). The paid preparer must:

• Sign the return in the space provided for the preparer's

Part I. Summary signature,

Because Part I generally reports information reported • Enter the preparer information, including the preparer's PTIN,

TIP elsewhere on the form, complete Part I after the other and

parts of the form are completed. See General • Give a copy of the return to the organization.

Instructions, Section C. Sequencing List to Complete the Form Any paid preparer can apply for and obtain a PTIN online at

and Schedules, earlier. IRS.gov/PTIN or by filing Form W-12, IRS Paid Preparer Tax

Complete lines 3–5 and 7–22 by using applicable references Identification Number (PTIN) Application and Renewal.

made in Part I to other items.

-10- Instructions for Form 990

Enter the paid preparer's PTIN, not his or her social governing body, if applicable. If the organization doesn’t have

! security number (SSN), in the “PTIN” box in the paid a mission that has been adopted or ratified by its governing

CAUTION preparer's block. The IRS won't redact the paid body, enter “None.”

preparer's SSN if such SSN is entered on the paid preparer's

Line 2. Answer “Yes,” if the organization undertook any new

block. Because Form 990 is a publicly disclosable document,

significant program services prior to the end of the tax year that

any information entered in this block will be publicly disclosed

it didn’t describe in a prior year's Form 990 or 990-EZ. Describe

(see Appendix D). For more information about applying for a

these items on Schedule O (Form 990 or 990-EZ). If any are

PTIN online, visit the IRS website at IRS.gov/Taxpros.

among the activities described on Form 990, Part III, line 4, the

organization can reference the detailed description on line 4. If

Note. A paid preparer may sign original or amended returns by the organization has never filed a Form 990 or 990-EZ, answer

rubber stamp, mechanical device, or computer software “No.”

program.

Line 3. Answer “Yes,” if the organization made any significant

Paid Preparer Authorization changes prior to the end of the tax year in how it conducts its

program services to further its exempt purposes, or if the

On the last line of Part II, check “Yes” if the IRS can contact the organization ceased conducting significant program services

paid preparer who signed the return to discuss the return. This that had been conducted in a prior year. Describe these items on

authorization applies only to the individual whose signature Schedule O (Form 990 or 990-EZ).

appears in the Paid Preparer Use Only section of Form 990. It

doesn’t apply to the firm, if any, shown in that section. An organization must report new, significant program

TIP services, or significant changes in how it conducts

By checking “Yes,” to this box, the organization is authorizing program services on its Form 990, Part III, rather than in

the IRS to contact the paid preparer to answer any questions a letter to IRS Exempt Organizations Determinations (“EO

that arise during the processing of the return. The organization is Determinations”). EO Determinations no longer issues letters

also authorizing the paid preparer to: confirming the tax-exempt status of organizations that report

• Give the IRS any information missing from the return, such new services or significant changes.

• Call the IRS for information about processing the return, and

• Respond to certain IRS notices about math errors, offsets, Lines 4a–4c. All organizations must describe their

and return preparation. accomplishments for each of their three largest program

services, as measured by total expenses incurred (not including

The organization isn't authorizing the paid preparer to bind

donated services or the donated use of materials, equipment, or

the organization to anything or otherwise represent the

facilities). If there were three or fewer of such activities, describe

organization before the IRS.

each program service activity. The organization can report on

The authorization will automatically end no later than the due Schedule O (Form 990 or 990-EZ) additional activities that it

date (excluding extensions) for filing of the organization's 2020 considers of comparable or greater importance, although

Form 990. If the organization wants to expand the paid smaller in terms of expenses incurred (such as activities

preparer's authorization or revoke it before it ends, see Pub. 947, conducted with volunteer labor).

Practice Before the IRS and Power of Attorney. Code. For the 2019 tax year, leave this blank.

Expenses and grants. For each program service reported

Check “No” if the IRS should contact the organization or its

on lines 4a–4c, section 501(c)(3) and 501(c)(4) organizations

principal officer listed in Item F of the Heading rather than the

must enter total expenses included on Part IX, column (B),

paid preparer.

line 25, and total grants and allocations (if any) included within

Part III. Statement of Program Service such total expenses that were reported on Part IX, on column

(B), lines 1–3. For all other organizations, entering these

Accomplishments amounts is optional.

Check the box in the heading of Part III if Schedule O (Form 990 Revenue. For each program service, section 501(c)(3) and

or 990-EZ) contains any information pertaining to this part. Part 501(c)(4) organizations must report any revenue derived directly

III requires reporting regarding the organization's program from the activity, such as fees for services or from the sale of

service accomplishments. A program service is an activity of an goods that directly relate to the listed activity. This revenue

organization that accomplishes its exempt purpose. Examples of includes program service revenue reported on Part VIII, column

program service accomplishments can include: (A), line 2, and includes other amounts reported on Part VIII,

• A section 501(c)(3) organization's charitable activities such as lines 3–11, as related or exempt function revenue. Also include

a hospital's provision of charity care under its charity care policy, unrelated business income from a business that exploits an

a college's provision of higher education to students under a exempt function, such as advertising in a journal. For this

degree program, a disaster relief organization's provision of purpose, charitable contributions and grants (including the

grants or assistance to victims of a natural disaster, or a nursing charitable contribution portion, if any, of membership dues)

home's provision of rehabilitation services to residents; reported on Part VIII, line 1, aren't considered revenue derived

• A section 501(c)(5) labor union's conduct of collective from program services. For organizations other than section

bargaining on behalf of its members; 501(c)(3) and 501(c)(4) organizations, entering these amounts is

• A section 501(c)(6) business league's conduct of meetings for optional.

members to discuss business issues; or Description of program services. For each program

• A section 501(c)(7) social club's operation of recreational and service reported, include the following.

dining facilities for its members. • Describe program service accomplishments through specific

measurements such as clients served, days of care provided,

Don't report a fundraising activity as a program service number of sessions or events held, or publications issued.

accomplishment unless it is substantially related to the • Describe the activity's objective, for both this time period and

accomplishment of the organization's exempt purposes (other the longer-term goal, if the output is intangible, such as in a

than by raising funds). research activity.

Line 1. Describe the organization's mission as articulated in its

mission statement or as otherwise adopted by the organization's

Instructions for Form 990 -11-

• Give reasonable estimates for any statistical information if during the year, contributions of the greater of $5,000 (in

exact figures aren't readily available. Indicate that this money or property) or 2% of the amount on Form 990, Part VIII,

information is estimated. line 1h. An organization filing Schedule B can limit the

• Be clear, concise, and complete in the description. Use contributors it reports on Schedule B using this

Schedule O (Form 990 or 990-EZ) if additional space is needed. greater-than-$5,000/2% threshold only if it checks the box on