0 ratings0% found this document useful (0 votes)

148 viewsAfar Solution

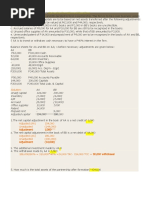

The document shows the profit allocation for partner A in a partnership. It details that A earned Rs. 30,000 in interest on capital, Rs. 160,000 in salary, and Rs. 150,000 bonus. A's equal share in remaining profit was Rs. 200,000, bringing their total profit share to Rs. 540,000. The partnership profit for the year was Rs. 1,050,000, of which Rs. 300,000 was used for interest and salary. The remaining Rs. 750,000 was subject to A's 20% bonus of Rs. 150,000.

Uploaded by

Tk KimCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0 ratings0% found this document useful (0 votes)

148 viewsAfar Solution

The document shows the profit allocation for partner A in a partnership. It details that A earned Rs. 30,000 in interest on capital, Rs. 160,000 in salary, and Rs. 150,000 bonus. A's equal share in remaining profit was Rs. 200,000, bringing their total profit share to Rs. 540,000. The partnership profit for the year was Rs. 1,050,000, of which Rs. 300,000 was used for interest and salary. The remaining Rs. 750,000 was subject to A's 20% bonus of Rs. 150,000.

Uploaded by

Tk KimCopyright

© © All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

You are on page 1/ 2

Interest on capital (10% x 300,000) 30,000

Salary (40,000 x 4) 160,000

Bonus to A 150,000

Equal share in remaining profit (600,000 / 3) 200,000

Total share of A in partnership profit 540,000

Partnership profit for the year ended December 31, 2018 1,050,000

Less: Total interest and salary (100,000 + 200,000) (300,000)

Net profit after salary and interest but before bonus to managing partner 750,000

Multiply by Bonus percentage x 20%

Bonus to A as managing partner 150,000

Number 7 Answer B

Interest on capital (10% x 500,000) 50,000

Salary (10,000 x 4) 40,000

Equal share in remaining profit 200,000

Total share of B in partnership profit 290,000

Number 8 Answer B

Capital Balance of B before the admission of D 800,000

Less: Capital to be transferred to D (P800,000 x 40%) ( 320,000)

Capital Balance of B after the admission of D 480,000

Number 9 Answer D

Capital Balance of A before the retirement of C 500,000

Add: Share of A in asset revaluation (250,000 x 10%) 25,000

Capital Balance of A after the retirement of C 525,000

Cash received by C upon retirement 300,000

Capital of C before retirement 200,000

Share of C asset revaluation 150,000

Total asset revaluation (150,000 / 60%) 250,000

Number 10 Answer C

Capital Balance of B before the retirement of C 300,000

Add: Share of B from Bonus given by C (P20,000 x 4/5) 16,000

Capital Balance of B after the retirement of C 316,000

Capital balance of C before retirement 100,000

Cash received by C upon retirement 80,000

Bonus given by C 20,000

You might also like

- Fibergigaband Internet Service Agreement: Residential Package InclusionsNo ratings yetFibergigaband Internet Service Agreement: Residential Package Inclusions1 page

- Assignment 11 Partnership Dissolution Part 2No ratings yetAssignment 11 Partnership Dissolution Part 223 pages

- Quiz 1 Answers and Solutions (Partnership Formation and Operation)No ratings yetQuiz 1 Answers and Solutions (Partnership Formation and Operation)6 pages

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021100% (1)Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-202115 pages

- Lesson 5 Partnership Dissolution ExercisesNo ratings yetLesson 5 Partnership Dissolution Exercises7 pages

- Question 1 Answer:A: Partnership OperationsNo ratings yetQuestion 1 Answer:A: Partnership Operations7 pages

- Question 1 Answer: B: Partnership DissolutionNo ratings yetQuestion 1 Answer: B: Partnership Dissolution9 pages

- Partnership Operations Name: Date: Professor: Section: Score: Quiz50% (2)Partnership Operations Name: Date: Professor: Section: Score: Quiz8 pages

- SOLUTION TO ASSIGNMENT FOR DISCUSSION (Chapters 1,2,3 and 4)No ratings yetSOLUTION TO ASSIGNMENT FOR DISCUSSION (Chapters 1,2,3 and 4)17 pages

- Prelimexamacct1103withanswerandsolutiondocx PDF Free0% (1)Prelimexamacct1103withanswerandsolutiondocx PDF Free14 pages

- Afar 2 Quizzes Acgsbdjxjcudhdh - CompressNo ratings yetAfar 2 Quizzes Acgsbdjxjcudhdh - Compress26 pages

- Review Materials 1 - Partnership Formation (Concised)No ratings yetReview Materials 1 - Partnership Formation (Concised)5 pages

- Quiz Chapter-2 Partnership-Operations 2020-EditionNo ratings yetQuiz Chapter-2 Partnership-Operations 2020-Edition7 pages

- Solution: Merlin, Capital Withdrawal 2,600,000 Property 500,000 900,000 1,200,000No ratings yetSolution: Merlin, Capital Withdrawal 2,600,000 Property 500,000 900,000 1,200,00019 pages

- Colegio de San Gabriel Arcangel: Lesson ModuleNo ratings yetColegio de San Gabriel Arcangel: Lesson Module35 pages

- Partnership Operations: 1. False 6. True 2. True 7. False 3. True 8. False 4. True 9. False 5. False 10. TRUENo ratings yetPartnership Operations: 1. False 6. True 2. True 7. False 3. True 8. False 4. True 9. False 5. False 10. TRUE9 pages

- Partnership Dissolution - Practice Exercises0% (2)Partnership Dissolution - Practice Exercises5 pages

- 01 Quiz Partnership Formation and OPerationNo ratings yet01 Quiz Partnership Formation and OPeration3 pages

- Jordan Pippen Total: Multiple Choice Answers and SolutionsNo ratings yetJordan Pippen Total: Multiple Choice Answers and Solutions26 pages

- Chapter 2 Partnership Operations 2021 EditionNo ratings yetChapter 2 Partnership Operations 2021 Edition17 pages

- Accounting For Special Transactions - (Problems)No ratings yetAccounting For Special Transactions - (Problems)44 pages

- Marks: Taxation (Pakistan) and Marking SchemeNo ratings yetMarks: Taxation (Pakistan) and Marking Scheme2 pages

- General Overview of Accounting Research: Teresa P. Gordon and Jason C. PorterNo ratings yetGeneral Overview of Accounting Research: Teresa P. Gordon and Jason C. Porter8 pages

- Chapter Review: I. Unit-Based Product CostingNo ratings yetChapter Review: I. Unit-Based Product Costing6 pages

- (Ebook) The Kingdom of Matthias : A Story of Sex and Salvation in 19th-Century America by Paul E. Johnson, Sean Wilentz ISBN 9780199892495, 9780199917594, 0199892490, 0199917590 all chapter instant download100% (4)(Ebook) The Kingdom of Matthias : A Story of Sex and Salvation in 19th-Century America by Paul E. Johnson, Sean Wilentz ISBN 9780199892495, 9780199917594, 0199892490, 0199917590 all chapter instant download71 pages

- Budget Motivation Speech For Prison ServicesNo ratings yetBudget Motivation Speech For Prison Services9 pages

- The Originals The Resurrection - Julie PlecNo ratings yetThe Originals The Resurrection - Julie Plec183 pages

- Fabships: Off-Grid Maker Spaces For A Better WorldNo ratings yetFabships: Off-Grid Maker Spaces For A Better World4 pages

- The Casualties in The Caraga Region. (2 PTS)No ratings yetThe Casualties in The Caraga Region. (2 PTS)2 pages

- An Act Proposing The Creation of Dr. Juan C. Angara MunicipalityNo ratings yetAn Act Proposing The Creation of Dr. Juan C. Angara Municipality3 pages

- Hartono Silalahi C/O. Perum. Nusa Batam Block I No. 38 Batuajibatam Mobile: + 62 81372125428No ratings yetHartono Silalahi C/O. Perum. Nusa Batam Block I No. 38 Batuajibatam Mobile: + 62 8137212542826 pages

- The "Big Picture" of The Curriculum at Key Stage 3No ratings yetThe "Big Picture" of The Curriculum at Key Stage 31 page

- Edelweiss Passive Equity Deck - Edelweiss MFNo ratings yetEdelweiss Passive Equity Deck - Edelweiss MF75 pages