Job Costing: 1. Whether Actual or Estimated Costs Are Used

Job Costing: 1. Whether Actual or Estimated Costs Are Used

Uploaded by

alemayehuCopyright:

Available Formats

Job Costing: 1. Whether Actual or Estimated Costs Are Used

Job Costing: 1. Whether Actual or Estimated Costs Are Used

Uploaded by

alemayehuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Job Costing: 1. Whether Actual or Estimated Costs Are Used

Job Costing: 1. Whether Actual or Estimated Costs Are Used

Uploaded by

alemayehuCopyright:

Available Formats

CHAPTER 2

JOB COSTING

- Product costing is the process of accumulating and classifying costs and then assigning those

costs to products.

- Product cost information is used for various purposes.

- The choice of a product -costing system depends on many factors, including the type of

industry, the needs of management, and the nature of the product or service. Three basic

characteristics distinguish product-costing and service costing system

1. Whether actual or estimated costs are used:

• Actual costing― assigns actual DL, DM and FOH to cost objects.

• Normal costing― assigns actual DM, DL and estimated FOH to cost objects.

• Standard costing―assigns estimated cost of DM, DL, & FOH to cost objects

2. The treatment of fixed-overhead costs

• Absorption costing― all manufacturing costs are inventoried.

• Variable costing― only variable mfg costs are inventoried. Fixed FOH period cost.

3. The procedures by which costs are accumulated and assigned.

• Job-order costing― costs are accumulated and assigned individually on a per-job basis.

• Process costing―accumulates costs by department and processes.

From these points you can see that there are twelve possible costing systems

{actual, normal, standard} {absorption, variable} {job order, process }

3 × 2 × 2 = 12

Operation Costing is a hybrid-costing system. It is used in situations where products have

some common as well as individual characteristics. TVs, for example, have some common

characteristics in that all models must be assembled and tested following the same basic

steps. However, each model has different components with different costs. The costs of the

components (materials) would be charged to a batch of a particular model individually, as in

job-order costing, but the conversion costs may be assigned using process costing.

Cost Systems

- The two extremes of product costing are usually termed job costing and process costing

1. Job Costing

- It is used by entities that make relatively small quantities or distinct batches of identifiable

unique products (services).

- Businesses using job costing include: Printing jobs at a printing Co., Ship-builders, Custom

furniture manufacturers, Construction companies, Film-producing companies, Accounting

and law firms, Advertising agencies, Medical clinics, etc

- Here an individual job is considered as a cost object. Sometimes a job consists of an

individual product, and sometimes it consists of a batch of products.

Cost Accounting AAUCC 2009 Page 1 of 16

- Job cost information is used (a) to determine the profitability of individual jobs, (b) to assist

in bidding on future jobs, and (c) to evaluate professionals who are in charge of managing

individual jobs.

- Service organizations would most likely use job-order costing to assign and track costs to

each client’s job.

2. Process Costing

- Process costing is used for production processes that produce mass quantities of identical

units that use the same amounts and types of direct labor, direct materials, and overhead.

- All costs are accumulated by departments, operations, or processes. The accumulated costs

can be averaged over the entire production since each unit is essentially identical.

- Businesses using Process Costing: Chemical plants, Food processors, Household appliance

manufacturers, Textile companies, Petroleum products manufacturers, Paper, Lumber and

pulp mills, Glass factories, soft-drink industries, beverage companies, cement factories, food

processing, ceramics, oil, etc

Building–Block Concepts of Costing Systems

- Cost object (cost objective) - anything for which a measurement of cost is desired

e.g. product, department , branch ,a service, a job, a customer etc

- Cost Accumulation

• The collection of cost data in some organized way by means of an accounting system.

• We may collect costs by some natural classification such as materials or labor or by

activities performed such as order processing or machine processing costs.

- Cost Pool

• A group of individual costs that is allocated to cost objects using a single cost driver.

• Cost pools can range from broad, such as all costs of the manufacturing plant, to narrow,

such as the cost of operating metal-cutting machine.

- Cost Allocation

• The assignment of indirect costs to a cost object.

- Cost Allocation Base

• Indirect mfg costs are assigned to cost objects by allocation. Cost allocation base is the

factor that links in a systematic way an indirect cost or group of indirect costs to a cost

object.

• Companies often use the cost driver of indirect costs because of the existence of cause

and effect link.

• A cost allocation base can be financial (DL cost, material costs) or nonfinancial (number

of machine hours, DL hours, units of production). But it has to be one that can easily be

measured for each cost object.

• In machine intensive operations a large part of the FOH cost is associated with operating

the machinery making probably machine hour a proper base. For similarly reason, in

labor intensive operations the proper base is probably DL cost or DL hours. If OH is

mainly material oriented, dominated by costs associated with procuring and handling

material, then materials cost may be a suitable base.

Cost Accounting AAUCC 2009 Page 2 of 16

Job Costing in Manufacturing Firms

- Let us examine the basic records (documents) used in a job costing system.

Job-cost sheet

- It is a document that records and accumulates all costs assigned to a specific job, starting

when work begins. The job may be a product, service, or batch of products.

- The job-cost sheet can be in paper or electronic form. A simplified job-cost sheet follows:

ABC Co. Job Cost Record

Job No. 160 Customer: X Co.

Date Started: May5,09 Date Finished: May 9, 09

Description: Office Eqt.

Machining Assembly Total

DM xx xx xxx

DL xx xx xxx

FOH xx xx xxx

Total xxx xxx xxx

- DM and DL costs are

traced to the job, and FOH costs are allocated to the job.

- A file of job cost sheets for partially completed jobs makes up the subsidiary ledger for the

WIP control.

- The output of a job can be a single unit or multiple similar or dissimilar units. With multiple

outputs, a unit cost can be computed only if the units are similar or if costs are accumulated

for each separate unit (such as through an ID no.).

- Costs entered onto the job cost sheet are obtained from:

Materials Requisition:

• It is a form which enables each department to take the material they want from stores and

is the basis for recording the amount of material used by each department for a job.

• This form identifies the job to which the materials are to be charged. Care must be taken

when charging materials to distinguish between direct and indirect materials. An example

of a materials requisition form is shown below.

Time Cards and Time Tickets

• Time cards collects data on how many hours have been worked by each hourly rate

employee. Manual system requires a time card for each individual, who would manually

record time. Electronic system uses magnetic cards, swiped through a card reader

• Each employee records the amount of time he or she spends on each job and each task on

a time ticket (time sheet).

• Periodically (e.g every week) an analysis (summary) of the time tickets is prepared. The

time spent on a particular job is considered direct labor and its cost is traced to that job.

The cost of time spent on other tasks, not traceable to any particular job, is usually

considered part of manufacturing overhead. Any time spent in nonmanufacturing areas is

charged to marketing or adm. Expense. An example of an employee time ticket is shown

below.

Cost Accounting AAUCC 2009 Page 3 of 16

Job No.160 DMs Requisition No. ___

Job No. 160 Date ___

Name ________________

Dept _____

Department ___________

Wage rate ___________ Description Quantity Unit cost Amount

Time started _________

Time finished ________

Departmental Overhead Analysis Sheet

• FOH cost is accumulated, without distinction as to job, for each department in

departmental OH analysis sheet. Then, departmental OH costs are allocated to each job

using a cost allocation base.

Departmental Overhead Analysis Sheet

Department ___________

Date Ind. Mater. Ind. Labor Prop. Tax Depr. Rep.&Maint Utilities Insurance Others Total

• Departmentalizing FOH allows departments to have different FOH rate resulting in

improved product costing. It also facilities responsibility accounting and control of OH

costs in a department.

General Approaches to Job costing

- There are seven steps to assigning costs to an individual job. They are equally applicable to

assigning costs to a job in manufacturing, merchandising and service sectors.

Step1. Identify the cost object which is a job.

Step2. Identify the direct costs. DMs and DLs can be traced to each job using materials

requisition and time tickets respectively and entered on the job-cost sheet.

Step3. Identify the indirect cost pools

• Overhead costs are accumulated in one or more cost pools. Accountants use

judgment in choosing the number and type of overhead cost pools for a given

organization.

• Some organizations use a single cost pool for all fixed and variable overhead

costs. Other organizations use separate cost pools for fixed and variable overhead

costs.

• If work is performed in separate departments or work areas, separate overhead

cost pools may be designated for each department or activity. All FOH are

determined for each department using departmental overhead analysis sheet.

Step 4. Select the cost allocation base

• The crucial quality of an allocation base is that it be a cost driver of the costs in the

pool to be allocated. The base must be easily measurable for each job.

Cost Accounting AAUCC 2009 Page 4 of 16

• Direct labor costs and hours are the two most popular allocation bases because this

information is already captured by the payroll system.

• In a job order cost system, the units produced cannot serve as the allocation base

because each unit, or group of units, tends to be different(i.e., there is lack cause-

and-effect relationship)

Step 5. Develop allocation rate

• The overhead allocation rate expresses the relationship between overhead costs and

some activity base that can be traced directly to specific cost objects(job)

Actual costing Actual OH Actual indirect cost rate

Actual allocation base

Normal costing Budgeted OH Budgeted indirect cost rate

Budgeted allocation base (predetermined OH rate)

• Some companies use separate rate for fixed and variable FOH. Variable factory

overhead per unit of the allocation base is assumed to be constant within the

relevant range of activity. However, fixed factory overhead is assumed to be

constant in total over the relevant range.

Level of complexity in OH allocation rate:

Plant-wide OH rate: the simplest form of OH allocation is to use a single OH rate

throughout all departments of a company. Here, we treat all annual OH for the company as a

single costs pool, and allocate is based on one allocation base.

Departmental OH rate: after OH costs have been departmentalized, a different OH

allocation rate for each department may be used to have a more accurate OH cost allocation

to each cost object in each department. Multiple OH rates should be used, for example, in

sanitations where on department is machine intensive and another department is labor

intensive.

Activity Based Costing (ABC Costing): it is a more complex OH allocation system. It

recognizes that many activities within a department drive OH costs and uses multiple cost

pools and multiple cost drivers within a department. For example, a portion of the

departmental costs may be allocated on the basis of direct labor hours, another portion on the

basis of machine hours, and the remainder on the basis of the number of machine setups. This

method results in more accurate product cost information.

Step 6. Compute indirect costs allocated to the job

Actual costing Actual indirect cost rate × Actual quantity of the

cost allocation base used

Normal costing Budgeted indirect cost rate × Actual quantity of the

cost allocation base used

Step 7. Compute total cost of the job

Actual costing = DM + DL + OH(actual)

Normal costing = DM + DL + OH(applied)

Cost Accounting AAUCC 2009 Page 5 of 16

Example 1 (Actual Job Costing Systems in Manufacturing Firms)

Robinson Company uses a job costing system with two direct cost categories (DMs and

Direct manufacturing OH) and one manufacturing cost OH pool. The company allocates

manufacturing OH costs using direct manufacturing labor hours. The year 2003 budget and

actual results are given below

Budget for Year 3 Actual results for Year 3

Mfg OH $1,120,000 $1,215,000

DL cost 500,000 550,000

DL hrs 28,000 27,000

Machine hrs 10,000 11,000

The job-cost sheet for job WPP 298 lists the following:

DMs used --------------------- $4,606

DL cost ---------------------- 1,579

DL hrs --------------------- 88

Required: Determine the cost of Job WPP 298 using actual costing

Solution

The real part of the computation starts from step 5 .

Step 5. FOH allocation rate?

Actual FOH rate = Actual OH = $1,215,000 = $45 per DL hr

Actual allocation base 27,000

Step 6. Compute OH cost allocated to the Job

FOH allocated = Actual rate x Actual quantity

to Job wpp298 $45 x 88 DL hrs

= $3,960

Step 7. Compute total cost of the Job

Cost of Job wpp298:

DMs ---------------------- $4606

DL cost ---------------- 1579

FOH ---------------- 3960

Total cost of the Job $10,145

Time Period Used To Compute Indirect-Cost Rates

- Most manufacturers use an annual period as a basis for determining FOH rates. A shorter

period for averaging costs is not satisfactory.

- There are two reasons for using longer periods to calculate indirect cost rates.

a) The numerator reason (indirect-cost pool)

Cost Accounting AAUCC 2009 Page 6 of 16

- A shorter period for averaging costs is not satisfactory because wide variation can occur in

the amount of FOH costs from periods to period as a result of seasonal and nonseasonal

costs.

• Seasonal costs - for example heating costs, air conditioning costs in hot seasons, which

are part of FOH costs, are incurred only during the cold season and hot season

(months). So if monthly rate is used this cost will be charged to only units produced in

these seasons.

• Nonseasonal costs - for example repair costs may be extremely high in certain months of

the year and low in others. The fact that the repair costs were actually incurred in

certain months does not mean that products manufactured during that time should bear

all repair costs. The same is true for costs of vacation pay and holiday pay.

2. The denominator reason (quantity of the allocation base)

- The need to spread monthly fixed indirect costs over fluctuation levels of monthly output

(allocation base)(the denominator).

E.g. Assume an OH rate based on direct labor hours. If depreciation for a month is

$20,000 and expected direct labor hours that month are 40,000 hours. The OH rate

includes an amount equal to 50 cents per DL hrs for depreciation. However, if

expected DL hrs are 80,000 in the following month, the OH rate for that month will

include 25 cents per DL hr for depreciation.

The calculation of monthly indirect cost rate is affected by the number of workdays in

a month.

Pooling all indirect costs together over the course of a full year and calculating a single

annual indirect cost rate helps to smooth the effect of the above problems on the cost of a

specific cost object.

Normal Costing: Normal Job Costing Systems in Manufacturing Firms

- Now you know an annual OH rate is preferable to OH rates calculated on a weekly or

monthly basis for the above reasons. What does this mean to a company that uses actual

costing? This means to know the actual cost of its product (job), the company will have to

wait until the end of the year.

- However, mgt cannot wait until the end of the year, or even until the end of the month, to

find out how much a particular job costs. Cost data are most useful when they are

immediately (timely) available.

- The cost accountant is usually expected to report the total cost of a job as soon as it is

finished. At this time the actual total OH costs are not available, as they would be at the end

of a fiscal period. As a solution predetermined (POR) or budgeted OH rates are calculated

for each cost pool at the beginning of a fiscal year, and OH costs are allocated to jobs as

work progresses.

- A POR is an estimate of the amount of OH expense that a company will incur for every unit

of some activity (called a cost driver) that is consumed.

- Using the budgeted OH (OH application) rate gives rise to Normal costing.

- Normalizing applies the same amount of overhead to jobs during the year, regardless of when

jobs were worked on or when overhead was incurred during the year.

Example 2 Refer to example 1 and compute the cost of Job WPP 298 using Normal costing

Cost Accounting AAUCC 2009 Page 7 of 16

Solution

The real part of the computation starts from step 5

Step 5 FOH allocation rate?

Budgeted FOH rate = Budgeted OH = $ 1,120,000 =$40/DL hr

Budgeted alloc. base 28000hrs

Step 6. FOH allocated (applied) to Job Wpp 298?

FOH allocated = budgeted FOH rate × actual quantity

$40 × 88hrs $3,520

Step 7. Cost of Job Wpp298?

DM 40606

DL 1579

FOH 3520

$9705

Explanation of Transactions (Cost Flows)- Perpetual System Assumed

- One of the jobs started and completed by Robinson Company during the month of February,

Year 3 was job WPP 298. But other jobs were also being made during the same month even

if we were concerned with job WPP 298. All the transactions relating to manufacturing and

nonmanufacturing activities in February, Year 3 for several jobs is given below:

a) Purchases of materials (direct and indirect) on credit $89,000

Journal entry: Materials control ------------- 89,000

Accounts payable control ------------- 89,000

Both have the word control because they are general ledger accounts.

b) Materials sent to the manufacturing plant floor: DMs $81,000 and Indirect materials

$4000

Journal entry: WIP control ------------------81,000

Mfg OH control ------------- 4000

Materials control -------------------- 85,000

The cost of RMs sent to the mfg plant and remaining in store can be determined using

the different cost flow assumptions-SI, FIFO, LIFO, WA. The LCM method should

also be applied to value RM inventory.

c) Total mfg payroll for February: direct $39000 ; indirect,$15000

Journal entry: WIP control ------------------39,000

Mfg OH control ------------- 15000

Materials control -------------------- 54,000

Cost Accounting AAUCC 2009 Page 8 of 16

Note that total factory payroll may be charged to the factory payroll clearing account

until enough information is available to distribute these costs to the work in process

and factory overhead accounts.

Factory Payroll Clearing xx

Wages & Salaries Payable xx

Withholding Accounts xx

To record the factory payroll.

Wages & Salaries Payable xx

Cash xx

To record the payment of the factory payroll

Factory Overhead Control xx

Factory Payroll Clearing xx

To record the indirect labor costs.

Work in Process Control xx

Factory Payroll Clearing xx

To record the direct labor costs

d) Payment of total mfg payroll for februry,$54,000

Journal entry: Wages payable control --------- 54,000

Cash control ------------------------ 54,000

e) Additional mfg OH costs incurred during February, $75,000. These costs consist of

engineering and supervisory salaries, $44000; plant utilities and repairs, $4000; plant

depreciation, $18000; and plant issurance, $2000.

Journal entry: Mfg OH control ----------------- 75,000

Salaries payable control ----------------- 44,000

A/P control ----------------------------- 11,000

Accumulated depreciation control ------ 18,000

Prepaid Insurance control ----------------- 2000

f) Allocation of manufacturing OH to Jobs, $80,000

We assume 2,000 actual DL hrs were used for all jobs in February Year 3

$40 × 2,000 hrs = $80,000

From the 2,000 hours Job WPP 298 used 88 hours only. So OH cost allocated to it will be:

88 hrs × $40 = $3,520

Overhead cost computed is entered in the Manufacturing Overhead Applied section of the

individual job cost sheet

Manufacturing overhead is applied to Work-in Process using the predetermined rate. The

offsetting credit entry is to the Manufacturing Overhead allocated account.

Journal entry: WIP control ----------------80,000

Cost Accounting AAUCC 2009 Page 9 of 16

Mfg OH allocated -----------------80,000

When predetermine OH rates are used, OH is applied at the end of the period or at

completion of production, whichever is earlier.

FOH can be recorded either in a separate accounts for actual and applied OH or in a single

account. If actual and applied accounts are separate, the applied account is a contra account

to the actual OH account and is closed against it at year-end. Both are temporary accounts.

g) Completion and transfer to finished goods of 12 individual jobs, $188,800. Job no.

298 was one of the jobs completed in February at a cost of $9705

Journal entry: Finished Goods Control ----------188,800

WIP Control ------------------ 188,800

Job order-cost sheet for completed jobs are removed from the WIP subsidiary ledger and

become the subsidiary ledger for the finished goods inventory control account.

h) Cost of goods sold, $180,000. Job 298 was one of the jobs sold and delivered to

customers in February.

Journal Entry: COGS ----------------------- 180,000

Finished goods --------- 180,000

i) Marketing and customer service payroll and advertising costs accrued for February :

Mktg dept. salaries ----- $35000

Advertising costs ------- 10,000

Customer-service costs -- 15000

$60,000

Journal entries:

Mktg and advertising costs ------ 45,000

Customer service costs ------------ 15,000

Salaries payable ------------ 50,000

A/P control ------------------ 10,000

Nonmanufacturing Costs and Job Costing

- In chapter two we pointed out that companies use product costs for different purposes.

- For external reporting purpose product costs include only manufacturing costs. But for

pricing, product-mix, and cost management decisions product costs include

nonmanufacturing costs such as marketing and customer service costs. For the latter purpose

we can trace direct nonmanufacturing costs to the job and use a budgeted cost rate to allocate

indirect nonmanufacturing costs to the job. This is the same approach to job costing we

followed for manufacturing costs.

- By assigning both manufacturing costs and nonmanufacturing cost to jobs, we can compare

all costs of the different jobs against the revenues they generate and evaluate their

contribution to the overall profit.

Cost Accounting AAUCC 2009 Page 10 of 16

Budgeted Indirect Costs and End-Of Period Adjustments: The Three Approaches In

Accounting for Underallocated And Overallocated Mfg OH

- Though budgeted rates have advantages of obtaining timely cost of products, it is likely to be

inaccurate because they are based on estimates. So inevitably, FOH costs applied to the Work

in Process account and actual FOH costs incurred during a particular period will differ.

- The difference between actual overhead for the period, and estimated overhead for the period

is called the Overhead Variance.

If Estimated (applied) < Actual:

Overhead is Underapplied (meaning the actual overhead costs for the period exceed the

amount of overhead added to jobs.)

If Estimated (applied) > Actual:

Overhead is Overapplied (meaning the amount of overhead applied to jobs is greater

than the actual overhead incurred by the company.)

- Two separate Mfg OH accounts and their related balance in our example are as follows:

Mfg OH Control Mfg OH Applied

Dec.31 Dec.31, Year 3

Year 3 1,215,000 $1,080,000

The $135000 difference (1,215,000 – 1,080,000) net credit is underapplied amount.

Why are Actual and Applied Overhead Costs Different?

- The reasons actual and applied overhead costs are different are frequently separated into two

categories.

1) The numerator reason-- The actual quantities used and actual prices paid for the

various indirect resources are different from the prices and quantities estimated or

budgeted for the overhead rate calculation. This causes the spending variance (or

Budget Variance)

Inefficient use and control of FOH (Inefficiency in production) or inability to

accurately forecast overhead costs (poor estimation of the budget may be the reasons

for this. For example, overestimating of factory overhead will result in overapplied OH.

Overapplied OH can also result when actual overhead costs are lower than expected.

2) The denominator reason- The actual level of activity is different from the activity

level used to calculate the overhead rates. This causes the production volume variance

(Overhead Activity Variance).

For example, overestimating the activity base used in the denominator of the

predetermined rate will result in underapplied OH. Underestimating the cost allocation

base will result in overapplied overhead.

Cost Accounting AAUCC 2009 Page 11 of 16

- Accumulation of a larger underapplied balance is more serious than a trend in the opposite

direction any may indicate: inefficiency in production methods, excessive expenditures or a

combination of factors.

- Small underapplied overhead balance would also seem to indicate that the cost allocation

base (cost driver) was a good one.

Disposition Of Under/Overapplied FOH Balance

- At the end of each month the amount of overapplied OH/underaplied OH is transferred to the

following month, being reported in the interim balance sheet in deferred charge if

underapplied under prepaid expenses. And any overapplied balance as deferred credit or in

the interim income statement as a line item below COGS. An underapplied balance in one

period will be offset by overapplied by another month.

- But as this balance is applicable to the operations of the year just ended, the balance will not

appear on the end-of-year balance sheet. The ending balances in Mfg OH Control and Mfg

OH allocated are temporary accounts which should be closed at the end of the year.

- Three approaches to close the under/overapplied OH balance:

i) The adjusted allocation-rate

ii) The proration approach and

iii) The write-off to COGS(Immediate write-off)

i) Adjusted Allocation-Rate Approach

- Restates all OH entries in the general ledger and subsidiary ledgers using actual cost rates

rather than budgeted cost rates.

- The effect is that job-cost sheets(records), the inventory accounts(except RM inventory), and cost

of goods sold are accurately stated with respect to actual overhead.

- This means of disposing of variances is costly but has the advantage of improving the analysis of

product profitability. But the improvements in information technology and decreases in its cost

have made this method more appealing.

Adjustment = Actual FOH - Applied FOH = Actual OH rate - Budgeted OH rate

FOH applied Budgeted OH rate

. = 1,215,000 - 1,080,000 = $45 - $40

1,080,000 $40

= 0.125 or 12.5%

Actual OH exceeds the FOH applied by 12.5%

Now return to our example job No. 298

Under normal costing the Mfg OH allocated to the job is $3,520 .

Adjustment: (1 + 0.125) $3520 = $3,960

So the adjusted amount of Mfg OH allocated to job No.298 equals $3,960. Note that under

actual costing, mfg OH allocated on this job is $3,960

ii) Proration Approach

Cost Accounting AAUCC 2009 Page 12 of 16

- This involves allocation of the balance among WIP, Finished goods and COGS accounts on

the basis of the total amount of applied FOH included in those accounts at the end of the

year.

- Note that the proration approach does not adjust individual job-cost records (sheets)

- Material inventories are not included in this proration.

E.g Assume actual results for Year 3:

A/C balance Mfg OH

before proration included

WIP Control $50,000 $16,200

FDG Control 75,000 31,320

COGS 2,375,000 1,032,480

$2,500,000 $1,080,000

The proration of the underapplied FOH is done as follows:

Account A/C bal. before Mfg OH % of total × Underapplied = Amount

proration included Mfg OH Mfg OH protrated

WIP Control $50,000 $16,200 1.50% × $135000 $2,025

FDG Control 75,000 31,320 2.90% × $135000 3,915

COGS 2,375,000 1,032,480 95.60% × $135000 129,060

Total $2,500,000 $1,080,000 100% $135,000

Journal entry to record the proration and close the underallocated OH:

WIP Control ------------------------ 2,025

Finished goods Control ----------- 3,915

COGS ------------------------------- 129,060

Mfg OH allocated ----------------- 1,080,000

Mfg OH Control --------------- 1,215,000

Account balance after proration(adjustment) :

WIP Control = $50,000 + $2,025 = $52,025

FDG Control = $75,000 + $3,915 = $78915

COGS = $2,375,000 + $129,060 $2,504,060

- If FOH had been overallocated, the four accounts would have been decreased (credited)

instead of increased.

- The above journal entry restates the Year 3 ending balances for WIP, Finished goods, and

COGS to what they would have been, if actual indirect-cost rates had been used rather than

budgeted indirect-costs rates. This method reports the same ending balance in the general

ledger as the adjusted allocation-rate approach.

- Some companies prorate based on the total ending account balances in work in process,

finished goods, and cost of goods sold. But this method gives the same result as the previous

proration only if the proportions of FOH costs to total costs, and therefore direct costs, are

the same in WIP, FDG, and COGS accounts which is rarely true. But its use is justified as

Cost Accounting AAUCC 2009 Page 13 of 16

being less complex way of approximating the more accurate results from using indirect costs

allocated particularly when the FOH applied component in each account is not readily

available.

iii) Write-off to COGS

- This is the simplest approach. Any over/underapplied FOH cost is written off as an

adjustment to COGS as long as the difference is not material.

- If OH has been underapplied, less OH was charged to production than was incurred.

Therefore, COGS is understated, and the amount of the understated OH is added to COGS on

the income statement.

- If OH has been overapplied, the opposite is true and COGS is overstated, and the amount of

overstated OH is subtracted from COGS.

Journal Entry:

COGS ---------------------- 135,000

Mfg OH applied --------- 1,080,000

Mfg OH control ----- 1,215,000

The companies two Mfg OH accounts are closed with the difference between them included

in COGS.

Choice Among Approaches

- Which of these three approaches is the best one to use? In making this decision, managers

should be guided by how the resulting information will be used.

- If mangers intend to develop the most accurate record of individual job costs for profitability

analysis purposes, the adjusted allocation-rate approach is preferred. If the purpose is

confined to reporting the most accurate inventory and cost of goods sold figures in the

financial statements, proration based on the manufacturing overhead-allocated components in

the ending balances should be used because it adjusts balances to what they would have been

under actual costing.

- If the amount of undrallocated or overallocated is small- in comparison to total operating

income or some other measuring of materiality- the write-off to COGS approach yields a

good approximation to more accurate, but more complex, approaches. In this case the use of

this approach is justified by the cost benefit approach.

Multiple Overhead Cost Pools

- A plant-wide overhead rate is a single overhead rate used throughout all departments of a

company. If all production departments in a manufacturing business have the same mix of

labor and machine, and all jobs require the same amount of work in a given department, then

it is appropriate to use a single, plant-wide overhead rate.

- However, if some departments are machine intensive and some are labor intensive, then the

amount of overhead applied will not approximate the overhead used in all departments. If we

use DL hours as the activity base in a labor intensive department, this will give a good result

but if we use DL hours in a machine intensive environment that has few labor hours actually

worked, the result will be very unsatisfactory. Machine-intensive departments typically use a

Cost Accounting AAUCC 2009 Page 14 of 16

lot of overhead cost but if there are few labor hours and the rate is applied on the basis of DL

hours, little overhead will be applied.

- Even if all departments are labor intensive, the amount of labor time required for each job

might vary from one department to another. This could still result in imprecise application of

OH costs to a given job if a single labor based plant-wide rate was used for all departments.

- By using separate departmental overhead rates, the OH applied can be tailored to the specific

needs of a particular job. This will lead to more precise costing of products, which can be

critical if the business has to bid for jobs. But remember an important point: cost-benefit

guideline. The benefit of having this system to have more accurate information should

exceed the costing system adopted.

Example:

ABC Company uses Job costing system. The plant has a machining department and an

assembly department. It has two direct cost categories(DMs and Direct mfg labor) and two

mfg OH cost pools( the machining department OH, allocated to jobs based on actual

machine hours, and the assembly department OH, allocated to jobs based on actual direct

mfg labor cost

Budgeted amounts for the year:

Machining Assembly

Mfg OH ------------------------------ $48,000 $360,000

Direct mfg labor cost ---------------- 350,00 720,000

Direct mfg labor hrs ----------------- 50,000 80,000

Machine hrs ----------------------- 100,000 35,000

During October, the job cost sheet for job No.160 listed the following:

Machining Assembly

DMs used --------------- $12,000 $ 20,000

DL cost used ------------- 1400 4860

DL hrs --------------------- 200 540

Machine hrs -------------- 2000 700

The actual results for the year were as follows:

Machining Assembly

Mfg OH --------------- $390,000 $330,000

DL cost----------------- 300,000 750,000

DL hrs ------------------ 37500 78,125

Machine hrs -------------- 78,000 30,000

Required: Compute the cost of Job No. 160 using actual costing and normal costing

Solution: Actual Costing

The real part of the computation starts from step 5

Cost Accounting AAUCC 2009 Page 15 of 16

Step 5. Actual FOH allocation rate?

Machining Assembly

Actual FOH rate = Actual OH = $390,000 $330,000

Actual allocation base 78,000hrs $750,000

= $5/DL hr 44%

Step 6 and 7. FOH cost allocated to the Job and total cost of the Job

Product Machining Assembly

Job No.160:

DM $12,000 $20,000

DL 14,000 4,860

FOH (actual)

($5 ×2000hrs) 10,000

(44%×4,860) 2138.40

Total $23,400 $26,998.40

Total cost of the job is $23,400 + $26,998.40 = $50,398.40

Solution: Normal Costing

Step 5. Budgeted FOH allocation rate?

Machining Assembly

Budgeted FOH rate = Budgeted OH = $ 480,000 $360,000

Budgeted alloc. base 100,000hrs $720,000

= $4.80/hr 50%

Step 6 and 7. FOH cost allocated to the Job and total cost of the Job

Product Machining Assembly Total

Job No.160:

DM $12,000 $20,000 $32,000

DL 1,400 4,860 6,260

FOH (actual)

($4.8 x2000hrs) 9,600

(50%x4860) 2,430 12,030

Total $23,000 $27290 $50,290

Note that the general ledger would contain FOH Control and FOH allocated amount for each

cost pool under normal costing not actual costing. End of period adjustments for

under/overallocated OH costs would be made separately for each cost pool.

Note also that the disposal of any under/overallocated overhead in each department is made

in a similar fashion as discussed previously but separately for each department

Cost Accounting AAUCC 2009 Page 16 of 16

You might also like

- 06 REO BASIC HO-MAS VarianceDocument11 pages06 REO BASIC HO-MAS VarianceMichelle Angelaine Manalang100% (1)

- Private Money Presentation 2019Document21 pagesPrivate Money Presentation 2019asegurado100% (3)

- CH 17Document6 pagesCH 17Rabie HarounNo ratings yet

- Job Order Costing TheoryDocument3 pagesJob Order Costing TheoryMiscaCruzNo ratings yet

- 201 1ST Ass With AnswersDocument19 pages201 1ST Ass With AnswersLyn AbudaNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- Project Technical AnalysisDocument111 pagesProject Technical AnalysisalemayehuNo ratings yet

- Accounting For BranchesDocument53 pagesAccounting For Branchesalemayehu100% (2)

- Ex. Chapter 8Document11 pagesEx. Chapter 8ren 76No ratings yet

- A Pino Aud Prob QuizDocument14 pagesA Pino Aud Prob QuizJandave ApinoNo ratings yet

- Abnormal and Normal LossesDocument1 pageAbnormal and Normal LossesChristian Clyde Zacal ChingNo ratings yet

- Job Order CostingDocument43 pagesJob Order CostingNefvi Desqi AndrianiNo ratings yet

- Cost Accounting Finals - GONZALESDocument21 pagesCost Accounting Finals - GONZALESAdolph Christian GonzalesNo ratings yet

- Chapter 10 Process CostingDocument31 pagesChapter 10 Process CostingKrizel Dixie ParraNo ratings yet

- Chapter 7 - AnswerDocument17 pagesChapter 7 - AnsweragnesNo ratings yet

- Unit 8: Accounting For Spoilage, Reworked Units and Scrap ContentDocument26 pagesUnit 8: Accounting For Spoilage, Reworked Units and Scrap Contentዝምታ ተሻለ0% (1)

- Ch.12 FOH Carter.14thDocument40 pagesCh.12 FOH Carter.14thMuhammad Aijaz KhanNo ratings yet

- I. Answers To Questions: Cost Accounting and Control - Solutions Manual Cost Terms, Concepts and ClassificationsDocument18 pagesI. Answers To Questions: Cost Accounting and Control - Solutions Manual Cost Terms, Concepts and ClassificationsYannah HidalgoNo ratings yet

- Learning Curve: Management ScienceDocument7 pagesLearning Curve: Management Sciencegiezele ballatanNo ratings yet

- Chapter 007Document143 pagesChapter 007Ganessa Roland67% (3)

- Activity Based Costing-AssignmentDocument3 pagesActivity Based Costing-Assignmentmamasita25No ratings yet

- Problem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostDocument4 pagesProblem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostJune Maylyn MarzoNo ratings yet

- Process Costing Exercise With AnswersDocument9 pagesProcess Costing Exercise With AnswersAubrey Blancas100% (1)

- Exam I - Review - AnswersDocument13 pagesExam I - Review - AnswersJayson Hoang100% (1)

- Unit 7: Joint and By-Product Costing SystemDocument8 pagesUnit 7: Joint and By-Product Costing SystemCielo PulmaNo ratings yet

- Cost CH 3Document20 pagesCost CH 3Yonas AyeleNo ratings yet

- MGMT 027 Connect 04 HWDocument7 pagesMGMT 027 Connect 04 HWSidra Khan100% (1)

- JakeDocument5 pagesJakeEvan JordanNo ratings yet

- Part I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs DDocument9 pagesPart I: Choose The Best Answer From A Given Alternatives: B) Administrative Costs Dsamuel debebe100% (1)

- Cost Accounting and Cost Management 1 Accounting For Factory OverheadDocument19 pagesCost Accounting and Cost Management 1 Accounting For Factory OverheadJamaica David100% (1)

- Cost AccountingDocument23 pagesCost AccountingxorelliNo ratings yet

- Accounting For Production Losses in A Job Order Costing SystemDocument7 pagesAccounting For Production Losses in A Job Order Costing Systemfirestorm riveraNo ratings yet

- Accounting 7 07 Cost Acctg Cost ManagementDocument7 pagesAccounting 7 07 Cost Acctg Cost ManagementAvegail MagtuboNo ratings yet

- Chapter 6 Just in Time and Bacflush AccountingDocument17 pagesChapter 6 Just in Time and Bacflush AccountingだみNo ratings yet

- (Solved) Pablo Co. Produces Two Types of Products - Product RR and Product... - Course HeroDocument1 page(Solved) Pablo Co. Produces Two Types of Products - Product RR and Product... - Course HeroLanceNo ratings yet

- Test Bank-Cost Concepts, Job Order, Materials, Service CostsDocument100 pagesTest Bank-Cost Concepts, Job Order, Materials, Service CostsKatrina Peralta FabianNo ratings yet

- Job Order CostingDocument8 pagesJob Order CostingAndrea Nicole MASANGKAYNo ratings yet

- Process and Job Order TheoriesDocument12 pagesProcess and Job Order TheoriesAngelica ManaoisNo ratings yet

- Ch. 4 Yield Variances-NoteDocument11 pagesCh. 4 Yield Variances-Notesolomon adamuNo ratings yet

- Chapter 5 Job Order Costing: Multiple ChoiceDocument16 pagesChapter 5 Job Order Costing: Multiple ChoiceRandy AsnorNo ratings yet

- Absorption and Variable Costing Act3Document2 pagesAbsorption and Variable Costing Act3Gill Riguera100% (1)

- Cost Acctg. - HO#9Document5 pagesCost Acctg. - HO#9JOSE COTONER0% (1)

- Review Questions, Exercises and ProblemsDocument5 pagesReview Questions, Exercises and ProblemsChen HaoNo ratings yet

- ACT23 Exam FinalsDocument9 pagesACT23 Exam FinalsLim JugyeongNo ratings yet

- Cost Accounting 2014Document94 pagesCost Accounting 2014Rona Lei AlmazanNo ratings yet

- FIFO and Weighted Average Costing - REVIEWER QuestionsDocument27 pagesFIFO and Weighted Average Costing - REVIEWER QuestionsDanna VargasNo ratings yet

- Standard Costing - Answer KeyDocument6 pagesStandard Costing - Answer KeyRoselyn LumbaoNo ratings yet

- ACCRETION and EVAPORATION LOSSDocument17 pagesACCRETION and EVAPORATION LOSSVon Andrei MedinaNo ratings yet

- Cost AccountingDocument9 pagesCost AccountingCyndy VillapandoNo ratings yet

- Quiz 1Document8 pagesQuiz 1alileekaeNo ratings yet

- Lecture-8.2 Job Order Costing (Theory With Problem)Document13 pagesLecture-8.2 Job Order Costing (Theory With Problem)Nazmul-Hassan Sumon100% (2)

- Cost Accounting and Control Lecture NotesDocument11 pagesCost Accounting and Control Lecture NotesAnalyn LafradezNo ratings yet

- Chapter 6 Activity Based CostingDocument20 pagesChapter 6 Activity Based CostingSVPSNo ratings yet

- Variance Analyis - ProblemsDocument9 pagesVariance Analyis - ProblemsstillwinmsNo ratings yet

- 12 Factory Overhead - Planned, Actual - AppliedDocument13 pages12 Factory Overhead - Planned, Actual - AppliedAANo ratings yet

- Questions: Multiple Choices (Theoretical)Document6 pagesQuestions: Multiple Choices (Theoretical)Renz Alconera100% (3)

- Chapter 17 - Inventory and Production Management: True/FalseDocument31 pagesChapter 17 - Inventory and Production Management: True/FalseJc AdanNo ratings yet

- Cost Accounting Quiz 3Document10 pagesCost Accounting Quiz 3Saeym SegoviaNo ratings yet

- Procurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Document7 pagesProcurement and Inventory Management Partial Assignment On Inventory Management Uqba Imtiaz 20171-22152Aqba ImtiazNo ratings yet

- Job Order Costing Problems and SolutionsDocument14 pagesJob Order Costing Problems and SolutionsErika GuillermoNo ratings yet

- Standard CostingDocument3 pagesStandard CostingAleah MarieNo ratings yet

- Bacostmx-3tay2021-Finals Quiz 1Document6 pagesBacostmx-3tay2021-Finals Quiz 1Marjorie NepomucenoNo ratings yet

- Chapter 7 - Accounting For Joint and by ProductsDocument8 pagesChapter 7 - Accounting For Joint and by ProductsJoey LazarteNo ratings yet

- Accounting For Materials QuestionsDocument2 pagesAccounting For Materials QuestionsMîñåk ŞhïïNo ratings yet

- Ca51014 AssignmentDocument9 pagesCa51014 AssignmentRhn SbdNo ratings yet

- Chapter 3 Costing Methods The Costing of Resource OutputsDocument27 pagesChapter 3 Costing Methods The Costing of Resource Outputsahmedmuhabaw98No ratings yet

- Unit 2 Financial Statement AnalysisDocument17 pagesUnit 2 Financial Statement AnalysisalemayehuNo ratings yet

- Example 1: SolutionDocument7 pagesExample 1: SolutionalemayehuNo ratings yet

- Introduction To CompDocument47 pagesIntroduction To CompalemayehuNo ratings yet

- Cost Allocation: Joint-Products & Byproducts: Chapter SixDocument13 pagesCost Allocation: Joint-Products & Byproducts: Chapter SixalemayehuNo ratings yet

- 86th Report - Findings AG 07 2009Document218 pages86th Report - Findings AG 07 2009alemayehuNo ratings yet

- Chapter Five Microsoft WordDocument18 pagesChapter Five Microsoft WordalemayehuNo ratings yet

- Accounting For The Payroll System: Ethiopian Context PayrollDocument13 pagesAccounting For The Payroll System: Ethiopian Context Payrollalemayehu67% (6)

- 4 5890947838631740850Document2 pages4 5890947838631740850alemayehuNo ratings yet

- Accounting For The Payroll System in An Ethiopian ContextDocument11 pagesAccounting For The Payroll System in An Ethiopian Contextalemayehu100% (2)

- Accounting For Inventory ch2Document15 pagesAccounting For Inventory ch2alemayehu100% (1)

- Illustration 2: InstructionDocument2 pagesIllustration 2: InstructionalemayehuNo ratings yet

- What Is ConstitutionDocument16 pagesWhat Is ConstitutionalemayehuNo ratings yet

- Citizen and CitizenshipDocument11 pagesCitizen and CitizenshipalemayehuNo ratings yet

- Chapter-Four: The Law of SalesDocument7 pagesChapter-Four: The Law of SalesalemayehuNo ratings yet

- CH 1Document11 pagesCH 1alemayehuNo ratings yet

- Advanced Financial Accounting (Acfn3151)Document2 pagesAdvanced Financial Accounting (Acfn3151)alemayehu80% (5)

- Manual 3 Federal Accounting System Chapter 11. Monthly ReportsDocument38 pagesManual 3 Federal Accounting System Chapter 11. Monthly ReportsalemayehuNo ratings yet

- Develop A Research ProposalDocument44 pagesDevelop A Research ProposalalemayehuNo ratings yet

- History of The Project: Tions and Related Exposure DraftsDocument15 pagesHistory of The Project: Tions and Related Exposure DraftsalemayehuNo ratings yet

- 69 Ad2b22d5Document67 pages69 Ad2b22d5Terence Sze Zheng YangNo ratings yet

- Financial Anaysis of ProjectDocument48 pagesFinancial Anaysis of ProjectalemayehuNo ratings yet

- Business Combinations : Ifrs 3Document45 pagesBusiness Combinations : Ifrs 3alemayehu100% (1)

- An Overview of Business ProcessDocument22 pagesAn Overview of Business Processalemayehu100% (1)

- Chapter-Five: Agency ContractDocument10 pagesChapter-Five: Agency ContractalemayehuNo ratings yet

- Business Law By: Seyoum Teka Chapter One: Introduction To LawDocument162 pagesBusiness Law By: Seyoum Teka Chapter One: Introduction To LawalemayehuNo ratings yet

- Accounting For Cosignment and InstallementDocument26 pagesAccounting For Cosignment and InstallementalemayehuNo ratings yet

- Accounting Information Systems: An Overview: Addis Ababa University School of CommerceDocument20 pagesAccounting Information Systems: An Overview: Addis Ababa University School of Commercealemayehu100% (2)

- Banking U5Document4 pagesBanking U5alemayehuNo ratings yet

- ElasticityDocument51 pagesElasticityShahidUmar100% (1)

- PPSC Comerece Lecture Past PaperDocument1 pagePPSC Comerece Lecture Past PaperSalman AliNo ratings yet

- 2021-22 International Accounting MaterialsDocument59 pages2021-22 International Accounting MaterialsLamis ShalabiNo ratings yet

- MBA Decision Report-Group 1Document17 pagesMBA Decision Report-Group 1DhrutiMishraNo ratings yet

- ACC2 MARKSDocument9 pagesACC2 MARKSmanumanohara1316No ratings yet

- CIR v. AcesiteDocument4 pagesCIR v. AcesiteTheresa BuaquenNo ratings yet

- Sales Tax JudgementDocument13 pagesSales Tax JudgementRayudu VVSNo ratings yet

- Traders Hideout MalaccesDocument1 pageTraders Hideout MalaccesDanaeus Avaris CadmusNo ratings yet

- Rights of An Unpaid SellerDocument4 pagesRights of An Unpaid SellerchinnuaparnaNo ratings yet

- TATA MotorsDocument48 pagesTATA MotorsAshvinNo ratings yet

- Sop NCRDocument56 pagesSop NCRabhijitroy333No ratings yet

- The Four Financial StatementsDocument9 pagesThe Four Financial Statementssangeethadurjati100% (1)

- Chapter 10 - Teacher's Manual - Afar Part 1Document20 pagesChapter 10 - Teacher's Manual - Afar Part 1Angelic67% (3)

- Fiscal Policy in IndiaDocument41 pagesFiscal Policy in IndiaNeeraj Kumar100% (3)

- Chapter 3 Cost ClassificationDocument39 pagesChapter 3 Cost ClassificationIbrahim Sameer100% (1)

- Bank of KhyberDocument63 pagesBank of KhyberSalman Khaliq BajwaNo ratings yet

- DOJ Letter With ExhibitsDocument104 pagesDOJ Letter With ExhibitsTexas_Land_CompanyNo ratings yet

- 1) Cebu Portland Cement v. CTA, L-29059, 15 Dec 1987, 156 SCRA 535 (Lifeblood of The Government)Document9 pages1) Cebu Portland Cement v. CTA, L-29059, 15 Dec 1987, 156 SCRA 535 (Lifeblood of The Government)Guiller C. MagsumbolNo ratings yet

- Cta 00 CV 05378 D 1997sep01 RefDocument8 pagesCta 00 CV 05378 D 1997sep01 RefStephany PolinarNo ratings yet

- Notes On Ppe GG BC Wa IaDocument12 pagesNotes On Ppe GG BC Wa IaCleo GreyNo ratings yet

- Income Tax Act GopikaDocument20 pagesIncome Tax Act Gopikaapi-277928355No ratings yet

- WP - Insurance & Financial Advisor News 072008Document28 pagesWP - Insurance & Financial Advisor News 072008ACELitigationWatchNo ratings yet

- Accounts MCQ & AnsDocument8 pagesAccounts MCQ & AnsDr. MURALI KRISHNA VELAVETI0% (1)

- Pavani - HRMDocument14 pagesPavani - HRMzakuan79No ratings yet

- JWT China Summarywewe3wDocument10 pagesJWT China Summarywewe3wtajalaNo ratings yet

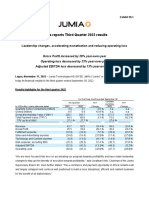

- JMIA Q3 22 ER 17.11.22 VFDocument20 pagesJMIA Q3 22 ER 17.11.22 VFSparta ElnNo ratings yet