Module 3

Uploaded by

ThelmaModule 3

Uploaded by

ThelmaModule 3

Constructing Financial Statements

and Analyzing Transactions

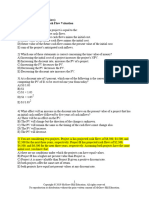

Learning Objectives – coverage by question

Multiple Essay

True/False Exercises Problems

Choice Questions

LO1 Analyze

and record

transactions

using the

1-6 1-8 1-4 1-4 1-2

financial

statement

effects

template.

LO2 Prepare

and explain

accounting

1-2

adjustments

7-12 9-16 4-9 & 1,3

and their

5

financial

statement

effects.

LO3 Explain

and construct

13 17-19 9-10 6 1,4

the trial

balance.

LO4

Construct

financial

- 20-21 11-13 6-8 1,5

statements

from the trial

balance.

LO5 Describe

the closing 14-15 22-25 14 9-10 1,6

process

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-1

Module 3: Constructing Financial Statements and Analyzing Transactions

True/False

Topic: Financial statement effects template

LO: 1

1. The financial statement effects template captures the effects of transactions on all four

financial statements.

Answer: True

Rationale: The balance sheet accounts are all on the right side of the template and the income

statement accounts on the left. In addition, the cash column provides the statement of cash flows,

and the two equity columns can be used to construct the statement of shareholders’ equity.

Topic: Journal Entries

LO: 1

2. Assets, expenses and dividends increase with debits.

Answer: True

Rationale: Assets increase with debits and equity decreases with debits. Therefore, expenses

and dividends decrease equity – they are debits.

Topic: Journal Entries

LO: 1

3. Increases are recorded on the left side of asset T-accounts and on the right side of liability T-

accounts.

Answer: True

Rationale: Debits increase assets and credits increase liabilities.

Topic: Financial statement effects of transactions

LO: 1

4. When shareholders contribute capital to a company, earned capital increases because the

company has earned the shareholders’ trust and their investments.

Answer: False

Rationale: When shareholders contribute capital to a company, contributed, not earned, capital

increases.

Topic: Financial statement effects of transactions

LO: 1

5. Revenues and expenses affect the income statement but not the balance sheet.

Answer: False

Rationale: Revenue and expense recognition increases retained earnings on the balance sheet.

Cambridge Business Publishers, ©2010

3-2 Financial Accounting for MBAs, 4th Edition

Topic: Financial statement effects of transactions

LO: 1

6. Revenue is typically recorded as earned when cash is received because that is when the

company can measure the revenue objectively.

Answer: False

Rationale: Revenue is recorded when it is earned regardless of when cash is received.

Topic: Financial statement effects of transactions

LO: 2

7. Expenses that are paid in advance are held on the balance sheet until the end of the

accounting period when they are transferred to the income statement with accounting

adjustments.

Answer: False

Rationale: Expenses paid in advance include prepaid insurance, inventory and fixed assets. All

of these items end up on the income statement when they are used up, not necessarily at the end

of the accounting period.

Topic: Accrual Accounting

LO: 2

8. Accrual accounting recognizes revenues only when cash is received and expenses only when

cash is paid.

Answer: False

Rationale: Accrual accounting refers to the recognition of revenue when earned and the

matching of expenses when incurred. The recognition of revenues and expenses does not,

necessarily, relate to the receipt or payment of cash.

Topic: Accrual Accounting

LO: 2

9. The journal entry for recording sales revenue that has been earned is to debit accounts

receivable if cash will be received later, or debit unearned revenue if cash was received in

advance.

Answer: True

Rationale: If cash is received later, the debit is to accounts receivable. If the cash is received

before revenue is earned then the appropriate debit is to unearned revenue.

Topic: Accounting Adjustments

LO: 2

10. The journal entry for recording cost of sales is to debit cost of sales expense and credit the

inventory account.

Answer: True

Rationale: The journal entry for recording cost of sales is to debit cost of sales expense and

credit inventory. When the cash is paid for the inventory does not affect the expense.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-3

Topic: Accounting Adjustments

LO: 2

11. Accounting scandals happen when managers abuse the accounting adjustment process.

Answer: False

Rationale: Accounting scandals can happen with improperly recorded transactions or with

improper accounting adjustments. As well, even if managers abuse the adjustment process, it is

not the case that a scandal always ensues.

Topic: Accounting Adjustments

LO: 2

12. Companies make adjustments to more accurately reflect items on the income statement and

the balance sheet.

Answer: True

Rationale: Adjustments ensure that performance and position are accurately portrayed in the

financial statements.

Topic: Trial Balance

LO: 3

13. Companies typically prepare two trial balances – one after recording all the transactions and

one after recording all the accounting adjustments.

Answer: True

Rationale: An unadjusted and an adjusted trial balance are both part of the accounting cycle.

Topic: Closing Accounts

LO: 5

14. A company closes all of its accounts in order to zero out the balances so that next period

starts with a fresh slate.

Answer: False

Rationale: A company closes its temporary accounts only. Balance sheet accounts are never

closed out – they have cumulative balances.

Topic: Closing Accounts

LO: 5

15. To close revenue accounts, a company must debit Retained Earnings because Revenue has

a credit balance and debits must equal credits.

Answer: False

Rationale: Revenue does have a credit balance. Therefore, to close Revenue, the company

debits Revenue and credits Retained earnings.

Cambridge Business Publishers, ©2010

3-4 Financial Accounting for MBAs, 4th Edition

Multiple Choice

Topic: Financial statement effects – Sales on account

LO: 1

1. Sales on account would produce what effect on the balance sheet?

a. Increase Revenue

b. Increase non-cash assets (Accounts receivable)

c. Decrease non-cash assets (Inventory)

d. a and b

e. a and b and c

Answer: b

Rationale: Revenue is not on the balance sheet (answer a is incorrect). Inventory is not always

decreased – think of service revenue (answer b is incorrect).

Topic: Financial statement effects – Collection of a receivable

LO: 1

2. Cash collected on accounts receivable would produce what effect on the balance sheet?

a. Increase liabilities and decrease equity

b. Decrease liabilities and increase equity

c. Increase assets and decrease assets

d. Decrease assets and decrease liabilities

e. None of the above

Answer: c

Rationale: Cash collected on accounts receivable produces an increase in cash and a decrease

in accounts receivable, both asset accounts. There is no impact on profit and on equity.

Topic: Financial statement effects – Inventory purchase

LO: 1

3. How would a purchase $100 of inventory on credit affect the income statement?

a. It would increase liabilities by $100

b. It would decrease liabilities by $100

c. It would increase non-cash assets by $100

d. Both a and c

e. None of the above

Answer: e

Rationale: There is no income statement effect of an inventory purchase.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-5

Topic: Financial statement effects – Inventory purchase

LO: 1

4. During fiscal 2007, Kenneth Cole Productions recorded inventory purchases on credit of

$289.2 million. The financial statement effect of these purchase transactions, would be a (an):

a. Increase liabilities (Accounts payable) by $289.2 million

b. Decrease cash by $289.2 million

c. Increase expenses (Cost of goods sold) by $289.2 million

d. Decrease non-cash assets (Inventory) by $289.2 million

e. Both a and d

Answer: a

Rationale: Purchases do not involve cash or expenses (b and c are incorrect). Non-cash assets

increase not decrease (d is incorrect).

Topic: Financial statement effects – Cost of goods sold – Numerical calculation required

LO: 1

5. During fiscal 2007, Kenneth Cole Productions recorded inventory purchases on credit of

$289.2 million. Inventory at the start of the year was $46.3 million and at the end of the year was

$48 million. Which of the following describes how these transactions would be entered on the

financial statement effects template?

a. Increase liabilities (Accounts payable) by $287.5 million

b. Increase expenses (Cost of goods sold) by $289.2 million

c. Increase expenses (Cost of goods sold) by $287.5 million

d. Decrease non-cash assets (Inventory) by $1.7 million

e. Both a and c

Answer: c

Rationale: Cost of goods sold is purchases less the increase in inventory = $287.5 (c is correct)

Liabilities increase by $289.2 when the inventory was purchased (not $287.5) so a is incorrect.

Inventory decreases during the year by $1.7million but not because of a transaction being

entered (d is incorrect).

Cambridge Business Publishers, ©2010

3-6 Financial Accounting for MBAs, 4th Edition

Topic: Financial statement effects – Accounts receivable collection

LO: 1

6. During fiscal 2007, E. I. DuPont de Nemours and Company recorded cash of $28,893 million

from customers for accounts receivable collections. Which of the following financial statement

effects template entries captures this transaction?

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+28,893

-28,893

a. +28,893

(AR)

= (Retained +28,893 – = +28,893

earnings)

-28,893

b. +28,893

(AR)

= – =

+28,893

+28,893

c. (AR)

= (Retained +28,893 – = +28,893

earnings)

+28,893

d. -28,893

(AR)

=

Answer: b

Rationale: Collecting cash from customers increases cash and decreases accounts receivable.

There is no income statement effect.

Topic: Financial statement effects of equity transactions – Numerical calculations required.

LO: 1

7. During fiscal 2008, Black & Decker Corporation reported Net income of $293.6 million and paid

dividends of $101.8 million. Which of the following describes how these transactions would affect

Black and Decker’s equity accounts? (in millions)

a. Increase contributed capital by $293.6 and decrease earned capital by $101.8

b. Decrease contributed capital by $101.8 and increase earned capital by $293.6

c. Increase contributed capital by $191.8

d. Increase earned capital by $191.8

e. None of the above

Answer: d

Rationale: Net income increases earned capital and dividends decrease earned capital. The net

effect is an increase to earned capital.

Topic: Financial statement effects of equity transactions – Numerical calculations required.

LO: 1

8. Kay’s Bakery, Inc. began operations in October 2009. The owner contributed cash of $5,000

and a delivery truck with fair value of $7,000 to the company. Which of the following describes

how these transactions would affect the company’s equity accounts? (in millions)

a. Increase contributed capital by $12,000

b. Increase earned capital by $12,000

c. Increase contributed capital by $5,000 and earned capital by $7,000

c. Increase earned capital by $5,000 and contributed capital by $7,000

e. None of the above

Answer: a

Rationale: Cash and equipment have both been contributed by the owner – this represents

contributed capital.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-7

Topic: Accounting adjustment – Accrue wages

LO: 2

9. An accrual of wages expense would have what effect on the balance sheet?

a. Decrease liabilities and increase equity

b. Increase assets and increase liabilities

c. Increase liabilities and decrease equity

d. Decrease assets and decrease liabilities

e. None of the above

Answer: c

Rationale: An accrual of wages expense increase wages payable (a liability) and decreases

retained earnings, resulting from the decrease in net income.

Topic: Accounting adjustments – Cost of goods sold – Numerical calculation required

LO: 2

10. At the end of fiscal 2009, Brady’s Greenhouse counted inventory and determined that

inventories of $14,290 were on hand. The 2009 unadjusted trial balance showed a balance in the

Inventory account of $15,000. Inventory at the start of the year was $17,220. Which of the

following accounting adjustments should Brady’s Greenhouse record?

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

-710

-710 +710

a. (Inventory)

= (Retained – (COGS)

= -710

earnings)

-2,220

-2,220 +2,220

b. (Inventory)

= (Retained – (COGS) = -2,220

earnings)

-2,930

-2,930 +2,930

c. (Inventory)

= (Retained – (COGS) = -2,930

earnings)

d. No

accounting

=

adjustment is

required.

Answer: a

Rationale: Unadjusted balance of $15,000 must be decreased to actual inventory on hand of

$14,290. This requires a decrease to inventory and an increase in COGS.

Cambridge Business Publishers, ©2010

3-8 Financial Accounting for MBAs, 4th Edition

Topic: Accounting adjustment – Supplies inventory – Numerical calculations required

LO: 2

11. During its first three months of operations, Kay’s Bakery, Inc. purchased supplies such as

plates, napkins, bags, and cutlery for $1,500 and recorded this as an expense. Supplies on hand

at the end of the first quarter, amount to $400. To prepare financial statement for the first quarter,

the company must record which of the following accounting adjustments?

a. Increase Supplies expense by $400 and decrease Supplies inventory by $400

b. Increase Supplies expense by $1,100 and decrease Supplies inventory by $1,100

c. Increase Supplies inventory by $400 and decrease Supplies expense by $400

d. Increase Supplies inventory by $1,100 and decrease Supplies expense by $1,100

e. None of the above

Answer: c

Rationale: Supplies on hand are $400, these must be recorded with an increase to supplies

inventory of $400.

Topic: Recognition of costs as expense

LO: 2

12. As inventory and PPE assets on the balance sheet are consumed, they are reflected:

a. As a revenue on the income statement

b. As an expense on the income statement.

c. As a cash flow outflow on the Statement of Cash flows.

d. Both b and c

e. Assets are never consumed.

Answer: b

Rationale: As assets are consumed (used up), their cost is transferred into the income statement

as an expense. The cash outflow occurred when the assets were originally purchased and not

when they are used up.

Topic: Accounting adjustment for depreciation expense

LO: 2

13. A company records an adjusting journal entry to record $15,000 depreciation expense.

Which of the following describes the entry?

a. Debit Property Plant and Equipment and Credit Depreciation expense

b. Debit Depreciation expense and Credit Property Plant and Equipment

c. Debit Property Plant and Equipment and Credit Cash

d. Debit Depreciation expense and Credit Cash

Answer: b

Rationale: Depreciation is an expense which decreases retained earnings – it is a debit. Property

plant and equipment is being used up and thus its balance is decreasing on the balance sheet – it

requires a credit.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-9

Topic: Accounting adjustments

LO: 2

14. Which account is least likely to appear in an accounting adjustment?

a. Interest expense

b. Cost of goods sold

c. Cash

d. Sales

Answer: c

Rationale: Cash is hardly ever in need of adjustment. An exception occurs when there has been a

fraud and cash is missing. Then, the cash account needs to be adjusted to reflect its lower

balance.

Topic: Calculating net income from transactions – Numerical calculations required

LO: 2

15. During the month of March 2010, Weaver World, a tax-preparation service, had the following

transactions.

Billed $74,000 in revenues on credit

Received $41,000 from customers’ accounts receivable

Incurred expenses of $33,500 but only paid $19,425 cash for these expenses

Prepaid $5,555 for computer services to be used next month

What was the company’s accrual basis net income for the month?

a. $16,020

b. $10,465

c. $40,500

d. none of the above

Answer: c.

Rationale:

Revenues (earned) $74,000

Expenses (incurred) $33,500

Net income $40,500

Topic: Calculating operating cash flow from transactions – Numerical calculations required

LO: 2

16. During the month of March 2010, Weaver World, a tax-preparation service, had the following

transactions.

Billed $74,000 in revenues on credit

Received $41,000 from customers’ accounts receivable

Incurred expenses of $33,500 but only paid $19,425 cash for these expenses

Prepaid $5,555 for computer services to be used next month

What was the company’s net cash flow from operations for the month?

a. $16,020

b. $10,465

c. $74,000

d. none of the above

Answer: a

Rationale:

Revenues (cash receipts) $41,000

Expenses ($19,425+$5,555) $24,980

Cash from operating activities $16,020

Cambridge Business Publishers, ©2010

3-10 Financial Accounting for MBAs, 4th Edition

Topic: Trial balance components

LO: 3

17. Which of the following would not be included in a trial balance?

a. Net income

b. Accounts receivable

c. Contributed Capital

d. Depreciation expense

e. None of the above – they are all included on the trial balance.

Answer: a

Rationale: Net income is not an account, it is a sum of all income and expense accounts.

Therefore, it would not appear on a trial balance.

Topic: Trial balance

LO: 3

18. The unadjusted trial balance for Fitness World for December 31, 2008 reported Supplies

inventory of $530. The adjusted trial balance reported Supplies inventory of $0. Which of the

following is a plausible explanation for this difference?

a. The Supplies inventory account was closed so that next period’s account will begin afresh.

b. Supplies inventory should never appear on a trial balance, so the error was fixed.

c. Supplies expense had not been properly recorded during the period.

d. Supplies had been erroneously excluded from the unadjusted trial balance, so they were

added.

e. None of the above.

Answer: c

Rationale: Supplies had been used up during the period and an accounting adjustment was

required to reflect that fact.

Topic: Trial balance

LO: 3

19. Companies prepare unadjusted trial balances:

a. To detect transactions that were posted to the wrong accounts.

b. To ensure that debits = credits in each account.

c. To help prepare financial statements

d. To detect all accounting errors

e. Both c and d

Answer: c

Rationale: a is incorrect because posting to an incorrect account will still yield a trial balance that

balances. B is incorrect because each account only has one balance, either debit or credit and

the two do not need to match. D is incorrect because there are many accounting errors that will

not be detected by a trial balance, for example, posting the incorrect amounts or posting to

incorrect accounts.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-11

Topic: Items involved in preparing income statement from trial balance

LO: 4

20. Which of the following trial balance items would not be involved in preparing the income

statement?

a. Depreciation expense

b. Accumulated depreciation

c. Rent expense payable

d. Interest income

e. b and c.

Answer: e

Rationale: Accumulated depreciation and rent expense payable are both balance sheet accounts.

Topic: Preparing statement of cash flows

LO: 4

21. A statement of cash flows usually does not include which of the following?

a. Net income

b. Increase in accounts receivable

c. Contributed Capital

d. Depreciation expense

e. All of the above.

Answer: c

Rationale: Contributed capital is a balance sheet account and is not included in the statement of

cash flows. Changes in the contributed capital account would be included, however.

Topic: Closing entries

LO: 5

22. Which of the following accounts would not appear in a closing entry?

a. Net income

b. Depreciation expense

c. Cost of goods sold

d. Inventory

e. Both a and d

Answer: e

Rationale: Net income (answer a) is not a trial balance account so it is not closed. Inventory

(answer d) is a balance sheet (permanent) account, which is never closed. Therefore, the correct

answer is e.

Topic: Closing entries – Dividends – Numerical calculation required

LO: 5

23. During 2008, Nike Inc, reported Net income of $1,883.4 million. The company declared

dividends of 23% of Net income. The closing entry for dividends would include which of the

following?

a. Credit Dividends expense for $433.182 million

b. Credit Dividends expense for $1,450.218 million

c. Debit Net income for $1,450.218 million

d. Debit Retained earnings for $433,182

e. Both a and d

Answer: d

Rationale: Dividends are not an expense and net income is not involved in dividends.

Cambridge Business Publishers, ©2010

3-12 Financial Accounting for MBAs, 4th Edition

Topic: Closing entries

LO: 5

24. Which of the following accounts would not appear in a closing entry?

a. Interest expense

b. Accumulated depreciation

c. Cost of goods sold

d. Dividends

e. Both d and c

Answer: b

Rationale: Accumulated depreciation is a balance sheet (permanent) account, which is never

closed.

Topic: Closing entries – Inventory and Cost of goods sold

LO: 5

25. During fiscal 2007, Kenneth Cole Productions reported Cost of goods sold of $287.4 million.

Inventory at the start of the year was $46.3 million and at the end of the year was $48 million.

Which of the following describes the closing entry that the company will make for these accounts?

a. Credit inventory $1.7 million ($48 million - $46.3 million)

b. Credit inventory $48 million

c. Credit Cost of goods sold $287.4 million

d. Both a and c

e. None of the above

Answer: c

Rationale: Cost of goods sold is a temporary account that must be closed. Inventory accounts are

never closed – they are permanent accounts.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-13

Exercises

Topic: Using the Financial Statements Effects Template – Balance sheet and income statement

LO: 1

1. Record the following transactions in the financial statements effects template below.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

Purchase

$5,000 of

= – =

inventory on

credit

Sell all

inventory for

= – =

$9,000 on

account

Collect $2,000

cash for

= – =

accounts

receivable

Pay $3,000

cash toward

= – =

accounts

payable

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

Purchase

$5,000 of +5,000 +5,000

= – =

inventory on (Inventory) (AP)

credit

Sell all +9,000

inventory for +4,000

+9,000 – +5,000

(AR)

= (Retained = +4,000

$9,000 on -5,000 earnings)

(COGS)

account (Inventory)

Collect $2,000

cash for –2,000

+2,000 = – =

accounts (AR)

receivable

Pay $3,000

cash toward

–3,000 = –3,000 – =

accounts (AP))

payable

Cambridge Business Publishers, ©2010

3-14 Financial Accounting for MBAs, 4th Edition

Topic: Using the Financial Statements Effects Template – Balance sheet only

LO: 1

2. Record the following transactions in the financial statements effects template below.

a) Founder contributes $6,000 in cash in exchange for common stock

b) Obtain $9,000 short-term bank loan.

c) Purchase equipment costing $7,000 for cash

d) Purchase inventory costing $1,000 on account

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

a) = – =

b) = – =

c) = – =

d) = – =

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+6,000

a) +6,000 = (Common – =

Stock)

+9,000

b) +9,000 = (Note – =

payable)

c) -7,000 +7,000 = – =

(Equipment)

d) +1,000 = +1,000 – =

(Inventory) (AP)

Topic: Inferring transactions from reported financial statements

LO: 1

3. The 2007 income statement and balance sheet for Kohl’s Corporation shows the following

items (in thousands):

Net sales $16,473,734

Cost of merchandise sold 10,459,549

Merchandise inventories 2,855,733

Prepare the journal entries to record Net sales and Cost of goods sold for Kohls’ for 2007.

Answer:

Debit Cash 16,473,734

Credit Net sales 16,473,734

To record sales for the year (Kohl’s is a cash and carry department store, thus no credit sales.

Debit Cost of merchandise sold 10,459,549

Credit Merchandise inventories 10,459,549

To record cost of merchandise sold expense for the year.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-15

Topic: Using the Financial Statements Effects Template – Numerical calculations required

LO: 1, 2

4. Record the following transactions in the financial statements effects template below.

a) Company receives $1,000 from the sale of gift certificates.

b) Customers used $950 gift certificates. The cost of the inventory sold is $650.

c) The balance of the gift certificates expire unused.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

a) = – =

b) = – =

c) = – =

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+1,000

a) +1,000 = (Unearned – =

revenue)

-950 +300 +650

b) -600 = +950 – (Cost of

= +300

(Unearned (Retained

(Inventory) goods

revenue) earnings) sold)

-50 +50

c) = (Unearned (Retained +50 – = +50

revenue) earnings)

Cambridge Business Publishers, ©2010

3-16 Financial Accounting for MBAs, 4th Edition

Topic: Preparing accounting adjustments and closing entries – Numerical calculations required

LO: 2, 5

5. The balance sheet of Santa Fe Promotion includes the amounts shown below. Analysis of the

company’s records reveals the following transactions during 2009, the company’s first year of

operations:

Cash received from customers, recorded as service revenue $207,650

Purchase of supplies for cash, expensed $ 29,000

Cash paid for salaries, expensed $ 85,400

Analysis of the company’s balance sheet accounts reveals that at year end, supplies on hand

total $5,300, employees have earned $8,000 but have not yet been paid, and on the last day of

the fiscal year, customers paid deposits of $14,700 for future promotions (this is included in total

cash received from customers, above).

Prepare journal entries to adjust the account balances for revenue, supplies expense and salary

expense for the year end. Prepare closing entries.

Answer:

Debit Service revenue 14,700

Credit Unearned revenue 14,700

To record unearned revenue for deposits received from customers.

Debit Supplies inventory 5,300

Credit Unearned revenue 5,300

To record supplies on hand at year end.

Debit Salary expense 8,000

Credit Salaries payable 8,000

To record unpaid wages at year end.

Debit Service revenue 192,950

Credit Retained earnings 192,950

To close revenues at year end.

Debit Retained earnings 23,700

Credit Supplies expense 23,700

To close supplies expense at year end.

Debit Retained earnings 70,700

Credit Salaries expense 70,700

To close salaries expense at year end.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-17

Topic: Adjusting accounts – Numerical calculations required (More challenging, requires

decrease to expense account)

LO: 2

6. The unadjusted trial balance of Pepe’s Pizza for fiscal 2009, includes the following items:

Debit Credit

Inventory $23,900

Wages payable $ 400

Prepaid insurance 1,900

Taxes payable 0

Your analysis reveals additional information as follows:

the cost of inventory items on hand is $11,600

employee wages for the two weeks prior to year end were $3,900 and these will not be

paid until the 2010 fiscal year

the unexpired portion of the company’s insurance policy at year end was $2,300

the company’s tax accountant reports that the company will owe $27,000 for income

taxes for fiscal 2009.

Prepare journal entries for any required accounting adjustments.

Answer:

Debit Cost of goods sold 12,300

Credit Inventory 12,300

To record inventory used by year end

Debit Wages expense 3,500

Credit Salary payable 3,500

To record unpaid salaries at year end

Debit Prepaid insurance 400

Credit Insurance expense 400

To record prepaid insurance still available at year end

Debit Tax expense 27,000

Credit Taxes payable 27,000

To record taxes owing for the year.

Cambridge Business Publishers, ©2010

3-18 Financial Accounting for MBAs, 4th Edition

Topic: Adjusting accounts – Numerical calculations required (More challenging, requires

decrease to expense account)

LO: 2

7. The unadjusted trial balance of Chicken Express for December 31, 2009, includes the following

items:

Debit Credit

Prepaid rent $17,280

Accumulated depreciation - Van $2,750

Accumulated depreciation - Stoves 4,875

Gift certificates – unearned revenue 780

Your analysis reveals additional information as follows:

The company prepaid rent of $1,440 per month on June 1, 2009.

The company bought the van two years ago. The van cost $22,000 and is expected to

last eight years. The company’s policy is to record depreciation evenly over the asset’s

useful life.

When purchased four years ago, the stoves had an expected life of 10 years. The

company’s policy is to record depreciation evenly over the asset’s useful life. No

depreciation has been recorded on the stoves during fiscal 2009.

The company sells numbered gift certificates in $20 denominations. At year-end there

were 15 unredeemed gift certificates.

Prepare journal entries for any required accounting adjustments.

Answer:

Debit Rent expense 10,080

Credit Accumulated depreciation - Van 10,080

To record rent expense for seven months @ $1,440 per month.

Debit Depreciation expense 2,750

Credit Accumulated depreciation - Van 2,750

To record depreciation for the year on the van ($22,000 / 8 years = $2,750 per year).

Debit Depreciation expense 1,625

Credit Accumulated depreciation - Stoves 1,625

To record depreciation for the year on the ovens ($4,875 / 3 years to date = $1,625 per year).

Debit Gift certificates – unearned revenue 480

Credit Revenue 480

To adjust for gift certificates still outstanding = $20 × 15 = $300.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-19

Topic: Adjusting accounts – Numerical calculations required (More challenging, using T-account

to infer adjustments)

LO: 2

8. During the year ended December 31, 2008, Cabela’s, Inc. a retailer of outdoor equipment and

apparel, purchased merchandise inventory at a cost of $1,448,655 (in thousands). The following

T-account reflects information contained in the company’s 2006 and 2005 balance sheets (in

thousands). Calculate Cabela’s Cost of sales for 2008 and complete the T-account.

Inventory

2007 Balance

608,159

2008 Balance

517,657

Answer:

COGS = Beginning inventory $608,159 + purchases $1,448,655 - Ending inventory $200,877 =

1,539,157

Inventory

2007 Balance

608,159

Purchases Cost of sales

1,448,655 1,539,157

2008 Balance

517,657

Cambridge Business Publishers, ©2010

3-20 Financial Accounting for MBAs, 4th Edition

Topic: Adjusting accounts – Numerical calculations required (More challenging, using T-account

to infer adjustments)

LO: 2

9. During the year ended December 31, 2008, Cabela’s, Inc. a retailer of outdoor equipment and

apparel, purchased merchandise inventory at a cost of $1,448,655 (in thousands). Assume that

all inventory purchases were on account (on credit) and that accounts payable is only used for

inventory purchases. The following T-account reflects information contained in the company’s

2007 and 2008 balance sheets. Calculate the amount Sketchers paid in cash to its suppliers

during 2008 and complete the T-account.

Accounts Payable

2007 Bal.

281,391

2008 Bal.

189,766

Answer:

Payments on account = Beginning balance $281,391+ purchases $1,448,655 – Ending balance

$189,766 = $1,540,280

Accounts Payable

2007 Bal.

281,391

Payments Purchases

1,540,280 1,448,655

2008 Bal.

189,766

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-21

Topic: Understanding the Trial Balance

LO: 3

10. BloomFree is an organic floral shop. After its first quarter of operations, the company’s

accountant prepared the following trial balance, in alphabetical order. Indicate whether each line

on the trial balance is an income statement or balance sheet account.

Debits Credits Balance Sheet / Income Statement

Accounts payable $2,300

Accounts receivable $200

Bank loan for van 13,200

Cash 5,500

Common stock 1,000

Cost of goods sold 12,000

Delivery van 18,000

Gas for van 500

Tax expense 2,000

Insurance expense 1,000

Inventory 3,800

Prepaid insurance expense 1,000

Rent expense 1,500

Salaries expense 8,000

Sales 35,000

Taxes payable 2,000

Total $53,500 $53,500

Answer:

Debits Credits Balance Sheet / Income Statement

Accounts payable $2,300 Balance Sheet

Accounts receivable $200 Balance Sheet

Bank loan for van 13,200 Balance Sheet

Cash 5,500 Balance Sheet

Common stock 1,000 Balance Sheet

Cost of goods sold 12,000 Income Statement

Delivery van 18,000 Balance Sheet

Gas for van 500 Income Statement

Tax expense 2,000 Income Statement

Insurance expense 1,000 Income Statement

Inventory 3,800 Balance Sheet

Prepaid insurance 1,000 Balance Sheet

Rent expense 1,500 Income Statement

Salaries expense 8,000 Income Statement

Sales 35,000 Income Statement

Taxes payable 2,000 Balance Sheet

Total $53,500 $53,500

Cambridge Business Publishers, ©2010

3-22 Financial Accounting for MBAs, 4th Edition

Topic: Constructing financial statements from transaction data – Numerical calculations required

LO: 4

11. BloomFree is an organic floral shop. After its first quarter of operations, the company’s

accountant prepared the following trial balance, in alphabetical order. The accountant also tells

you that net income for the quarter was $10,000. Use the trial balance along with the net income

information to prepare a balance sheet for BloomFree.

Debits Credits

Accounts payable $2,300

Accounts receivable $200

Bank loan for van 13,200

Cash 5,500

Common stock 1,000

Cost of goods sold 12,000

Delivery van 18,000

Gas for van 500

Tax expense 2,000

Insurance expense 1,000

Inventory 3,800

Prepaid insurance 1,000

Rent expense 1,500

Salaries expense 8,000

Sales 35,000

Taxes payable 2,000

Total $53,500 $53,500

Answer:

BloomFree

Balance Sheet

Cash $5,500 Accounts payable $2,300

Accounts receivable 200 Taxes payable 2,000

Inventory 3,800 Total current liabilities 4,300

Prepaid insurance 1,000 Bank loan for van 13,200

Total current assets 10,500 Total liabilities 17,500

Delivery van 18,000 Common stock 1,000

Total assets $28,500 Retained earnings 10,000

Total equity 11,000

Total liabilities and

equity $28,500

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-23

Topic: Constructing financial statements from transaction data – Numerical calculations required

LO: 4

12. Big Green Company made $32,000 in net income during September 2009, its first month of

business. It sold its product on credit and billed its customers $60,000 for September sales. The

company collected $4,000 of these receivables in September. Company employees earned

September wages (the company’s only expense), but those are not paid until the first of October.

Complete the following financial statements for the end of September 2009.

Income Statement Balance sheet

Sales $ Cash $

Wages expense Accounts receivable

Net Income $ Total assets $

Wages payable $

Retained earnings

Total liabilities and

$

equity

Answer:

Income Statement Balance sheet

Sales $ 60,000 Cash $ 4,000

Wages expense 28,000 Accounts receivable 56,000

Net income $ 32,000 Total assets $ 60,000

Wages payable $ 28,000

Retained earnings 32,000

Total liabilities and

$ 60,000

equity

Cambridge Business Publishers, ©2010

3-24 Financial Accounting for MBAs, 4th Edition

Topic: Constructing financial statements from transaction data – Numerical calculations required

LO: 4

13. Copy Corner began operations in March with cash and common stock of $6,000. The

company made $97,000 in net income its first month. It performed print jobs for customers and

billed these customers $150,000. The company collected half of its receivables by the end of the

month. The company had cost of goods sold of $27,000 paid for in cash and $1,000 inventory left

over at the end of the month. Copy Corner employees earned wages but those are not paid until

the first of April. Complete the following statements for the end of March.

Income Statement Balance sheet

Sales $ Cash $

Cost of Sales Accounts receivable

Wages expense Inventory

Net Income $ Total assets $

Wages payable $

Retained earnings

Total liabilities and

$

equity

Answer:

Income Statement Balance sheet

Sales $150,000 Cash $53,000

Cost of Sales 27,000 Accounts receivable 75,000

Wages expense 26,000 Inventory 1,000

Net Income $97,000 Total assets $124,000

Wages payable $26,000

Common stock 6,000

Retained earnings 97,000

Total liabilities and

equity $123,000

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-25

Topic: Preparing closing entry from income statement

LO: 5

14. The 2008 income statement of Snap-On Incorporated includes the amounts shown below.

The company paid dividends of $69.7 (in millions). Prepare the closing entries for the company

for 2008.

(in millions)

Net sales 2,853.3

Cost of goods sold 1,568.7

Other operating expenses 933.1

Interest expense, net 34.3

Operating income from financial services 37.3

Income tax expense 117.8

Answer:

Debit Net sales 2,853.3

Debit Operating income from financial services 37.3

Credit Cost of goods sold 1568.7

Credit Other operating expenses 933.1

Credit Interest expense 34.3

Credit Income taxes 117.8

Credit Retained earnings 236.7

To close temporary (income statement) accounts for the year.

Debit Retained earnings 69.7

Credit Dividends 69.7

To close dividends for the year.

Cambridge Business Publishers, ©2010

3-26 Financial Accounting for MBAs, 4th Edition

Problems

Topic: Use template to record transactions and accounting adjustments – Numerical calculations

required

LO: 1, 2

1. Britt’s Bike’s began operations in May 2009 and had the following transactions.

a) Owner invested $20,000 cash and a truck worth $6,000 in exchange for stock.

b) Paid rent expense of $4,000.

c) Purchased $50,000 of bicycle inventory on credit.

d) Sold bicycles for cash of $84,500. The cost of the bikes sold was $30,000.

e) Sold and invoiced bicycles to a client for $15,900. The cost of the bikes sold was $8,000.

f) Bought promotional materials and plane tickets for Tour de France, for $15,000 in cash and

recorded the entire amount as Advertising expense.

g) Paid $4,000 in cash for supplies to do bike repairs.

h) Collected $10,000 from accounts receivable

i) Paid for bikes purchased on credit in c above

j) Paid cash dividends of $500.

k) Recorded revenue for $1,000 received from customer.

Required:

Record each transaction a) through k) in the financial statements effects template, below .

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

a) = – =

b) = – =

c) = – =

d) = – =

e) = – =

f) = – =

g) = – =

h) = – =

i) = – =

j) = – =

k) = – =

At the end of May, the following information is available.

i. At the end of May, $3,200 supplies remained on hand.

ii. Rent paid in transaction b is rent for May and June.

iii. The expenditures in transaction f relate to a major ad campaign that will occur in June during

the Tour de France.

iv. The truck is expected to be used for five years (60 months).

v. The deposit in transaction k is for a bike to be built and delivered in July.

Required:

Record any accounting adjustments required for items i. through v., in the financial statement

effects template, below.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-27

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

i. = – =

ii. = – =

iii. = – =

iv. = – =

v. = – =

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+6,000 = +26,000

a) +20,000 (Common – =

(Equipment)

Stock)

-4,000 +4,000

b) -4,000 = (Retained – (Rent = -4,000

earnings) exp.)

c) +50,000 = +50,000 – =

(Inventory) (AP)

-30,000 +54,500

d) +84,500 = (Retained +84,500 – +30,000 = +54,500

(Inventory) (COGS)

earnings)

+15,900

(AR) +7,900 +8,000 =

e) = (Retained +15,900 – +7,900

-8,000 earnings)

(COGS)

(Inventory)

-15,000 +15,000

f) -15,000 = (Retained – (Advert. = -15,000

earnings) exp.)

g) -4,000 +4,000 = – =

(Supplies)

h) +10,000 -10,000 = – =

(AR)

i) -50,000 = -50,000 – =

(AP)

j) -500 = -500 – =

(Dividend)

+1,000

k) +1,000 = (Retained +1,000 – = +1,000

earnings)

Cambridge Business Publishers, ©2010

3-28 Financial Accounting for MBAs, 4th Edition

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

-800 +800

i. = – (Supplies = -800

(Supplies)

exp.)

+2,000 +2,000 -2,000

ii. (Prepaid = (Retained – (Rent = +2,000

rent) earnings) exp.)

+15,000 +15,000 -15,000

iii. (Prepaid = (Retained – (Advert. = +15,000

advert.) earnings) exp.)

-100 -100 +100

iv. = (Retained – (Dep’n. = -100

(Truck)

earnings) exp.)

+1,000 -1,000

v. = (Unearned (Retained -1,000 – = -1,000

Revenue) earnings)

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-29

Topic: Use Journal Entries to Record Transactions – Numerical calculations required

LO: 1, 2

2. Prepare journal entries to record each of the following transactions (a through k).

Britt’s Bike’s began operations in May 2009 and had the following transactions.

a) Owner invested $20,000 cash and a truck worth $6,000 in exchange for stock.

b) Paid rent expense of $4,000.

c) Purchased $50,000 of bicycle inventory on credit.

d) Sold bicycles for cash of $84,500. The cost of the bikes sold was $30,000.

e) Sold and invoiced bicycles to a client for $15,900. The cost of the bikes sold was $8,000.

f) Bought promotional materials and plane tickets for Tour de France, for $15,000 in cash and

recorded the entire amount as Advertising expense.

g) Paid $4,000 in cash for supplies to do bike repairs.

h) Collected $10,000 from accounts receivable

i) Paid for bikes purchased on credit in c above

j) Paid cash dividends of $500.

k) Recorded revenue for $1,000 received from customer.

At the end of May, the following information is available.

Required: Prepare journal entries for any accounting adjustments required for items i. through v.

i. At the end of May, $3,200 supplies remained on hand.

ii. Rent paid in transaction b is rent for May and June.

iii. The expenditures in transaction f relate to a major ad campaign that will occur in June during

the Tour de France.

iv. The truck is expected to be used for five years (60 months).

v. The deposit in transaction k is for a bike to be built and delivered in July.

Answer:

Transaction journal entries:

a)

Debit Cash 20,000

Debit Truck (PPE) 6,000

Credit Common stock 26,000

To record initial investment by owner.

b)

Debit Rent expense 4,000

Credit Cash 4,000

To record rent paid.

c)

Debit Inventory 50,000

Credit Accounts payable 50,000

To record inventory purchased on account

d)

Debit Cash 84,500

Credit Sales 84,500

Debit Cost of goods sold 30,000

Credit Inventory 30,000

To record cash sale and cost of sale.

Cambridge Business Publishers, ©2010

3-30 Financial Accounting for MBAs, 4th Edition

e)

Debit Accounts receivable 15,900

Credit Sales 15,900

Debit Cost of goods sold 8,000

Credit Inventory 8,000

To record sale on account.

f)

Debit Advertising expense 15,000

Credit Cash 15,000

To record promotional expenses.

g)

Debit Supplies inventory 4,000

Credit Cash 4,000

To record supplies purchased.

h)

Debit Cash 10,000

Credit Accounts receivable 10,000

To record cash collected from customers.

i)

Debit Accounts payable 50,000

Credit Cash 50,000

To pay suppliers for bikes purchased earlier on account.

j)

Debit Dividends 500

Credit Cash 500

To record dividends paid to owner.

k)

Debit Cash 1,000

Credit Sales 1,000

To record cash received from customer.

Accounting adjustments:

i)

Debit Supplies expense 800

Credit Supplies 800

To record supplies used.

ii)

Debit Prepaid rent 2,000

Credit Rent expense 2,000

To record prepaid June rent.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-31

iii)

Debit Prepaid advertising 15,000

Credit Advertising expense 15,000

To record prepaid Tour de France promotional expense.

iv)

Debit Depreciation expense 100

Credit Equipment (or Accum. Depn) 100

To record depreciation expense on truck.

v)

Debit Sales 1,000

Credit Unearned revenue 1,000

To record deposit from customer.

Topic: Using the Financial Statements Effects Template – Numerical calculations required

LO: 1

3. Record the following transactions for McDouglas Pet Foods, Inc. in the financial statements

effects template below (in thousands).

a) Sell stock in company for $7,000

b) Obtain long-term bank loan of $5,000.

c) Purchase manufacturing equipment for $3,400 cash.

d) Rent manufacturing and warehousing space and pay $700 in advance for the year.

e) Manufacture $5,000 of inventory. Of the total, $4,000 was the cost of raw materials purchased

on credit. The balance was wages to manufacturing employees paid in cash.

f) Sell half of the inventory manufactured, for $5,650 on account.

g) Pay $3,500 to creditors.

h) Make loan payment of $800 of which interest is $80 and the rest is principal.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

a) = – =

b) = – =

c) = – =

d) = – =

e) = – =

f) = – =

g) = – =

h) = – =

Cambridge Business Publishers, ©2010

3-32 Financial Accounting for MBAs, 4th Edition

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+7,000

a) +7,000 = (Common – =

stock)

b) +5,000 = +5,000 – =

(Loan)

c) -3,400 +3,400 = – =

(Equipment)

d) -700 +700 = – =

(Prepaid rent)

e) -1,000 +5,000 = +4,000 – =

(Inventory) (AP)

+5,650 +2,500

(AR) +3,150 (Cost of

f) = (Retained +5,650 – = +3,150

-2,500 earnings)

goods

(Inventory) sold)

g) -3,500 = -3,500 – =

(AP)

-720 -80 +80

h) -800 = (Retained – (Interest = -80

(Loan)

earnings) expense)

Topic: Preparing journal entries to record transactions – Numerical calculations required

LO: 1

4. Prepare journal entries to record the following transactions for McDouglas Pet Foods, Inc. (in

thousands).

a) Sell stock in company for $7,000

b) Obtain long-term bank loan of $5,000.

c) Purchase manufacturing equipment for $3,400 cash.

d) Rent manufacturing and warehousing space and pay $700 in advance for the year.

e) Manufacture $5,000 of inventory. Of the total, $4,000 was the cost of raw materials purchased

on credit. The balance was wages to manufacturing employees paid in cash.

f) Sell half of the inventory manufactured, for $5,650 on account.

g) Pay $3,500 to creditors.

h) Make loan payment of $800 of which interest is $80 and the rest is principal.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-33

Answer:

a)

Debit Cash 7,000

Credit Common stock 7,000

To record owner’s contribution.

b)

Debit Cash 5,000

Credit Bank loan 5,000

To record cash received from bank.

c)

Debit Equipment (PPE) 3,400

Credit Cash 3,400

To record purchase of equipment.

d)

Debit Prepaid expenses 700

Credit Cash 700

To record rent paid in advance for the year.

e)

Debit Inventory 5,000

Credit Accounts payable 4,000

Credit Cash 1,000

To record raw materials purchased on credit and wages paid to manufacture inventory.

f)

Debit Accounts receivable 5,650

Credit Sales 5,650

Debit Cost of goods sold 2,500

Credit Inventory 2,500

To record sale on account and cost of sales.

g)

Debit Accounts payable 3,500

Credit Cash 3,500

To record payment on account.

h)

Debit Interest expense 80

Debit Bank loan 720

Credit Cash 800

To record payment of loan: interest and principal.

Cambridge Business Publishers, ©2010

3-34 Financial Accounting for MBAs, 4th Edition

Topic: Assessing Financial Statement Effects of Transactions and Adjustments – Numerical

calculations required

LO: 2

5. You have been hired by MacPeters CAD, a small engineering and drafting firm, to help prepare

a set of financial statements for the bank for the year ending October 31. You have reviewed all

the transactions for the year and find the following information that has not been recorded in the

company’s books.

1) During October, MacPeters CAD provided $1,900 of CAD services to clients who will be billed

in early November. The firm uses the account Fees Receivable to reflect amounts due but not yet

billed.

2) The firm paid $2,400 cash on October 15 for a series of radio commercials to run during

October and November. One-third of the commercials have aired by October 31st. The $2,400

payment was recorded in the Prepaid advertising account.

3) Starting October 1, all maintenance work on MacPeters CAD’s computer and printing

equipment is handled by PC Guru under an agreement whereby MacPeters CAD pays a fixed

monthly charge of $800. MacPeters CAD paid six months’ service charge of $4,800 cash in

advance on October 1, and increased its Prepaid expenses account by $4,800.

4) Starting October 16, MacPeters CAD rented 800 square feet of storage space from a

neighboring business. The monthly rent of $0.80 per square foot is due in advance on the first of

each month. Nothing was paid in October, however, because the neighbor agreed that

MacPeters CAD could pay the rent for October with the November 1 rent payment.

5) MacPeters CAD invested $10,000 cash in securities on October 1 and earned interest of $200

on these securities by October 31. No interest will be received until January.

6) Monthly depreciation on the equipment is $145. No depreciation has been recorded yet.

7) Weekly salaries for a five-day week total $6,250, payable on Fridays. October 31 of the current

year is a Tuesday.

8) A bill for work done during August and September has not yet been sent because the client is

out of the country. The bill totals $2,075.

9) MacPeters CAD has $40,000 of notes payable outstanding at October 31. Interest of $400 has

accrued on these notes by October 31, and will be paid when the notes mature in 2015.

10) MacPeters CAD received a deposit from a client for a job that will be begun in December. The

$2,000 deposit was recorded as Sales.

Required:

Prepare accounting adjustments required at October 31 using the financial statement effects

template, below.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-35

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

1)

= – =

2)

= – =

3)

= – =

4)

= – =

5)

= – =

6)

= – =

7)

= – =

8)

= – =

9)

= – =

10)

= – =

Cambridge Business Publishers, ©2010

3-36 Financial Accounting for MBAs, 4th Edition

Answer:

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+1,900 +1,900 +1,900

1) = (Retained – = +1,900

(AR) (Sales)

earnings)

-600 -600 +600

2) (Prepaid = (Retained – (Advert. = -600

advertising) earnings) exp.)

-800 -800 +800

(Maint-

3) (Prepaid = (Retained – = -800

enance

expenses) earnings)

exp)

+320 -320 +320

4) = (Retained – (Rent = -320

(AP)

earnings) exp.)

+200 +200 +200

5) = (Retained (Interest – = +100

(AR)

earnings) income)

-1,740 -1,740 +1,740

6) = (Retained – (Dep’n = -1,740

(PPE)

earnings) exp.)

+2,500 -2,500 +2,500

7) = (Wages (Retained – (Wages = -2,500

payable) earnings) exp.)

+2,075 +2,075 +2,075

8) = (Retained – = +2,075

(AR) (Sales)

earnings)

+400 -400 +400

9) = (Interest (Retained – (Interest = -400

payable) earnings) exp.)

+2,000 -2,000 -2,000 –

10) = (Unearned (Retained = -2,000

(Sales)

revenue) earnings)

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-37

Topic: Preparing trial balance and income statement from financial statement effects template –

Numerical calculations required

LO: 3, 4

6. In December 2009, Milly Newton opened an organic dry-cleaning shop. The financial statement

effects template below shows transactions for the month (a through h) and accounting

adjustments (i through iv).

Required:

a) Prepare trial balance for December 31, 2009.

b) Prepare an income statement for Milly Newton’s first month of operations.

c) Prepare a balance sheet for December 31, 2009.

Balance Sheet Income Statement

Cash Noncash Liabil- Contrib. Earned Rev- Expen- Net

Transaction + = + + – =

Asset Assets ities Capital Capital enues ses Income

+36,000 +42,000

a) +6,000 = (Common – =

(Equipment)

stock)

+1,200 -180 +180

b) -1,380 = (Retained – (Phone = -180

(Supplies)

earnings) expense)

c) +2,300 = +2,300 – =

(Equipment) (AP)

+400 +400

d) +400 = (Retained (Sales) – = +400

earnings)

+265

e) +265 = (Unearned – =

revenue)

f) -2,000 +2,000 = – =

(Equipment)

-1,500 +1,500

g) -1,500 = (Retained – (Wages = -1,500

earnings) exp.)

+2,650 +2,650

h) +2,650 = (Retained – = +2,650

(Sales)

earnings)

i) -2,100 = -2,100 – =

(AP)

-800 -800 +800

i. = (Retained – (Supplies = 8400

(Supplies)

earnings) exp.)

-1,000 -1,000 +1,000

ii. = (Retained – (Depr’n = -1,000

(Equipment)

earnings) exp.)

+50 -50 +50

iii. = (Wages (Retained – (Wages = -50

payable) earnings) exp.)

+600 -600 +600

iv. = (Rent (Retained – (Rent = -600

payable) earnings) exp.)

Cambridge Business Publishers, ©2010

3-38 Financial Accounting for MBAs, 4th Edition

Answer:

a.

Trial balance Debits Credits

Cash 2,335

Cleaning supplies 400

Equipment at cost 40,300

Accumulated depreciation 1,000

Accounts payable 200

Rent payable 600

Wages payable 50

Unearned revenue 265

Common stock 42,000

Sales 3,050

Salaries expense 1,550

Rent expense 600

Depreciation 1,000

Supplies expense 800

Phone expense 180

Totals 47,165 47,165

b.

Milly Newton Cleaners

Income Statement

For the month of December

Sales $3,050

Salaries expense 1,550

Rent expense 600

Depreciation 1,000

Supplies expense 800

Phone expense 180

Net loss -$1,080

c.

Milly Newton Cleaners

Balance Sheet

At December 31

Accounts payable and

Cash $ 2,335 accrued expenses $ 850

Cleaning supplies 400 Unearned revenue 265

Total current assets 2,735 Total current liabilities 1,115

Equipment at cost 40,300 Common stock 42,000

Less accumulated

depreciation -1,000 Retained earnings (deficit) -1,080

Equipment, net 39,300 Total equity 40,920

Total assets $42,035 Total liabilities and equity $42,035

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-39

Topic: Preparing financial statements from trial balance – Numerical calculations required

LO: 4

7. The December 27, 2008 adjusted trial balance of Cabela’s Incorporated shows the amounts

below. Prepare the company’s income statement and balance sheet for December 27, 2008.

Debits Credits

Accounts payable 189,766

Accounts receivable 213,014

Gift certificates (unredeemed) 184,834

Income tax expense 41,831

Inventories 517,657

Merchandise costs 1,540,214

Other current assets 133,439

Cash and cash equivalents 410,104

Contributed capital 272,626

Interest expense, net 22,804

Long-term liabilities 781,557

Other current liabilities 326,204

Property and equipment, net 1,121,852

Retained earnings 564,675

Selling, distribution, and administrative expenses 871,468

Total revenue 2,552,721

4,872,383 4,872,383

Cabela’s Incorporated

Income Statement

For the year ended

December 27, 2008

Total revenue $2,552,721

Merchandise costs 1,540,214

Selling, distribution, and administrative expenses 871,468

Operating income 141,039

Interest expense, net 22,804

Income before tax 118,235

Income tax expense 41,831

Net income $ 76,404

Cambridge Business Publishers, ©2010

3-40 Financial Accounting for MBAs, 4th Edition

Cabela’s Incorporated

Balance Sheet

At December 27, 2008

Cash and cash equivalents $ 410,104 Accounts payable $ 189,766

Gift certificates

Accounts receivable 213,014 (unredeemed) 184,834

Inventories 517,657 Other current liabilities 326,204

Other current assets 133,439 Current liabilities 700,804

Current assets 1,274,214 Long-term liabilities 781,557

Total liabilities 1,482,361

Property and equipment, net 1,121,852

Contributed capital 272,626

Retained earnings 641,079

Total equity 913,705

Total assets $ 2,396,066 Total liabilities and equity $ 2,396,066

Topic: Preparing financial statements from trial balance – Numerical calculations required

LO: 4

8. The adjusted trial balance for The Washington Post Company for the year ended December

31, 2008, is as follows (in alphabetical order). Use the trial balance to prepare the income

statement and balance sheet for 2008.

Debits Credits

Accounts payable 544,920

Advertising revenue 1,083,084

Cash 390,509

Circulation revenue 901,898

Contributed capital 264,027

Deferred revenue 388,007

Depreciation and amortization expense 288,131

Dividends 82,161

Education revenue 2,331,580

Long-term assets 3,806,894

Operating expenses 3,999,241

Other current assets 961,031

Other equity 14,536

Other expenses, net 29,086

Other liabilities 1,356,141

Other revenue 145,018

Retained earnings 4,333,582

Tax expense 79,400

Treasury stock 1,697,268

11,348,257 11, 348,257

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-41

Answer:

a.

The Washington Post Company

Income Statement

For the year ended

December 31, 2008

Education revenue $2,331,580

Advertising revenue 1,083,084

Circulation revenue 901,898

Other revenue 145,018

Total revenue 4,461,580

Operating expenses 3,999,241

Depreciation and amortization expense 288,131

Operating profit 174,208

Other expenses, net 29,086

Income before tax 145,122

Tax expense 79,400

Net income $ 65,722

b.

The Washington Post Company

Balance Sheet

At December 31, 2008

Cash $ 390,509 Accounts payable $ 544,920

Other current assets 961,031 Deferred revenue 388,007

Current assets 1,351,540 Current liabilities 932,927

Long-term assets 3,806,894 Other liabilities 1,356,141

Total liabilities 2,289,068

Contributed capital 264,027

Retained earnings 4,317,143

Treasury stock -1,697,268

Other equity -14,536

Total equity 2,869,366

Total assets $5,158,434 Total liabilities and equity $5,158,434

Cambridge Business Publishers, ©2010

3-42 Financial Accounting for MBAs, 4th Edition

Topic: Preparing closing entry from trial balance – Numerical calculations required

LO: 5

9. The adjusted trial balance for The Washington Post Company for the year ended December

31, 2008, is as follows (in alphabetical order). Use the trial balance to prepare the closing entry

for the year.

Debits Credits

Accounts payable 544,920

Advertising revenue 1,083,084

Cash 390,509

Circulation revenue 901,898

Contributed capital 264,027

Deferred revenue 388,007

Depreciation and amortization expense 288,131

Dividends 82,161

Education revenue 2,331,580

Long-term assets 3,806,894

Operating expenses 3,999,241

Other current assets 961,031

Other equity 14,536

Other expenses, net 29,086

Other liabilities 1,356,141

Other revenue 145,018

Retained earnings 4,333,582

Tax expense 79,400

Treasury stock 1,697,268

11,348,257 11, 348,257

Answer:

Debit Education revenue 2,331,580

Debit Advertising revenue 1,083,084

Debit Circulation revenue 901,898

Debit Other revenue 145,018

Credit Operating expenses 3,999,241

Credit Depreciation and amortization expense 288,131

Credit Other expenses, net 29,086

Credit Tax expense 79,400

Credit Retained earnings 65,722

To close income statement accounts for the year.

Debit Retained earnings 82,161

Credit Dividends 82,161

To close dividends account for the year.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-43

Topic: Preparing closing entry from income statement – Numerical calculations required (More

challenging, requires determining debits and credits for certain items and requires students to

ignore subtotals)

LO: 5

10. The 2008 income statement of The Coca-Cola Company is as follows. Prepare the closing

entry for 2008 for the income statement temporary accounts.

The Coca-Cola Company

Income statement

For the year ended December 31, 2008

Net revenues 31,944

Cost of goods sold 11,374

GROSS PROFIT 20,570

Selling, general and administrative 11,774

Other operating charges 350

OPERATING INCOME 8,446

Interest income 333

Interest expense 438

Equity income (loss) (874)

Other income (loss) (28)

INCOME BEFORE INCOME TAXES 7,439

Income taxes 1,632

NET INCOME 5,807

Answer:

Debit Net sales 31,944

Debit Interest income 333

Credit Cost of goods sold 11,374

Credit Selling, general and administrative 11,774

Credit Other operating charges 350

Credit Interest expense 438

Credit Equity loss 874

Credit Other loss 28

Credit Income taxes 1,632

Credit Retained earnings 5,807

To close income statement temporary accounts for 2008.

Cambridge Business Publishers, ©2010

3-44 Financial Accounting for MBAs, 4th Edition

Essay Questions

Topic: Accounting cycle

LO: 1, 2, 3, 4, 5

1. Describe and explain the accounting cycle.

Answer: The accounting cycle is the steps a firm takes to record its transactions and prepare

financial statements. Transactions are first recorded in the accounting records. Each of these

transactions is, generally, the result of an external transaction, such as recording a sale to a

customer or the payment of wages to employees. Once all of the transactions have been

recorded during the accounting period, the company prepares an unadjusted trial balance to

ensure that the accounts balance. Then the company adjusts the accounting records to recognize

a number of events that have occurred, but which have not yet been recorded. These might

include the recognition of wage expense and the related wages payable for those employees who

have earned wages, but have not yet been paid, or the recognition of depreciation expense for

buildings and equipment. These adjustments are made at the end of the accounting period to

properly adjust the accounting records in preparation of financial statements. Once all

adjustments are made, the company prepares another “adjusted” trial balance. As the last step,

financial statements are prepared and the temporary accounts are closed.

Topic: Balance sheet components

LO: 1

2. What are the three broad groups that make up a balance sheet? Please list and define each.

Answer:

1. Assets – investments which are expected to produce revenues, either directly when the asset

is sold or indirectly, like a manufacturing plant that produces inventories for sale or a corporate

office building that housed employees supporting revenue generating activities of the company.

2. Liabilities – Are borrowed funds (accounts payable, accrued liabilities, and obligations to

lenders or bond investors).

3. Equity – Capital that has been invested by the shareholders, either directly via the purchase of

stock (net of any repurchases of stock from its shareholders by the company) or indirectly in the

form of retained earnings that have been reinvested into the business and not paid out as

dividends.

Topic: Need for accounting adjustments

LO: 2

3. Explain what accounting adjustments are and why firms use them.

Answer: Companies make adjustments to more accurately report their financial performance and

condition.

For example, employees might not have been paid for wages earned at the end of an accounting

period. Failure to recognize this labor cost would understate the company’s total liabilities because

wages payable would be too low), and would overstate net income for the period because wages

expense would be too low). Thus, neither the balance sheet nor the income statement would be

accurate.

© Cambridge Business Publishers, 2010

Test Bank, Module 3 3-45

Topic: Trial balance

LO: 3

4. Why do firms prepare a trial balance before making accounting adjustments for the period?

Answer: A trial balance is a listing of all accounts and their balances at a point in time. To prepare

a trial balance the company lists the accounts along with their balances. The trial balance lists

debits and credits separately. The purpose of a trial balance is to prove the mathematical equality

of debits and credits, provide a useful tool to uncover any accounting errors, and help prepare the

financial statements.

Topic: Statement of cash flows

LO: 4

5. Name and describe the two methods for preparing the operating section of the cash flow

statement.

Answer: there are two methods to display net cash flows from operating activities: the direct

method and the indirect method. Under the indirect method, the basic approach is to adjust net

income to arrive at net cash flows from operating activities. This indirect method involves listing

changes in working capital accounts (by comparing the opening and ending balances). The direct

method lists all cash revenues and expenses directly. Changes in balance sheet accounts are not

involved in this method. Both methods report the same net operating cash flow, the only

difference is in presentation.

Topic: Closing temporary accounts

LO: 5

6. Describe the closing process and explain why firms engage in this process.

Answer: The closing process refers to the ‘zeroing out’ of revenue, expense, and dividend accounts

(the temporary accounts) by transferring their ending balances to retained earnings. The closing

process is typically carried out via a series of journal entries that successively zero out each revenue

and expense account, transferring those balances to retained earnings. The result is that all income

statement accounts begin the next period with zero balances. The balance sheet accounts do not

need to be similarly adjusted because their balances carry over from period to period.

Cambridge Business Publishers, ©2010

3-46 Financial Accounting for MBAs, 4th Edition

You might also like

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizNo ratings yetFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice Quiz3 pages

- Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLib0% (1)Matheson Electronics has just developed a new electronic device that it believes will have broad market appeal. The company has performed marketing and cost studies that revealed the following inform... - HomeworkLib1 page

- Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 191001163059100% (3)Financial and Managerial Accounting For Mbas 4th Edition Easton Test Bank 19100116305932 pages

- International Financial Statement AnalysisNo ratings yetInternational Financial Statement Analysis3 pages

- Chapter 24 - Professional Money Management, Alternative Assets, and Industry EthicsNo ratings yetChapter 24 - Professional Money Management, Alternative Assets, and Industry Ethics48 pages

- CH 03 Review and Discussion Problems Solutions57% (7)CH 03 Review and Discussion Problems Solutions23 pages

- Engel, Louis & Boyd, Brendan - How To Buy Stocks100% (2)Engel, Louis & Boyd, Brendan - How To Buy Stocks364 pages

- Reporting and Analyzing Intercorporate Investments: Learning Objectives - Coverage by QuestionNo ratings yetReporting and Analyzing Intercorporate Investments: Learning Objectives - Coverage by Question45 pages

- Famba 8e Test Bank Mod01 TF MC 093020 1No ratings yetFamba 8e Test Bank Mod01 TF MC 093020 116 pages

- Forecasting Financial Statements: Learning Objectives - Coverage by QuestionNo ratings yetForecasting Financial Statements: Learning Objectives - Coverage by Question53 pages

- Download full Solution Manual for Corporate Finance 11th Edition by Ross Westerfield Jaffe Jordan ISBN 0077861752 9780077861759 all chapters100% (21)Download full Solution Manual for Corporate Finance 11th Edition by Ross Westerfield Jaffe Jordan ISBN 0077861752 9780077861759 all chapters57 pages

- Bun Bakery - Finanical Improvement PlanNo ratings yetBun Bakery - Finanical Improvement Plan11 pages

- Quiz 2. Recording Transactions - Attempt Review 3No ratings yetQuiz 2. Recording Transactions - Attempt Review 311 pages