SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

Uploaded by

DIVYANSHU SHEKHARCopyright:

Available Formats

SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

Uploaded by

DIVYANSHU SHEKHAROriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

SVKM's Narsee Monjee Institute of Management Studies Name of School - SBM, Bangalore

Uploaded by

DIVYANSHU SHEKHARCopyright:

Available Formats

SVKM’s Narsee Monjee Institute of Management Studies

Name of School – SBM, Bangalore

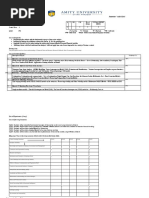

Program: MBA Trimester VI

Course/Module : Financial Analytics Module Code:

Teaching Scheme Evaluation Scheme

Lecture Practical Term End

Tutorial Internal Continuous

(Hours (Hours Examinations (TEE)

(Hours per Credit Assessment (ICA)

per per (Marks- 40)

week) (Marks - 60)

week) week) in Question Paper)

Marks Scaled to Marks Scaled to

-3- - - 3

-60- -40-

Pre-requisite:

Business Forecasting

Statistics I & II

Investment Analysis & Portfolio Management

Derivatives

Recent years have witnessed a growing need for econometric methods in financial research and practice.

As a result, econometric methods in finance have become one of the most active areas of research. This

course intends to cover econometric techniques that are required for empirical finance, with an emphasis

on Time Series Analysis, Panel Data Analysis, and Cross-sectional Data Analysis. It would cover the

application part of all the econometric models covered in the course with the help of financial data

analysis on a statistical software EViews/ R/ STATA.

Objectives:

Provide comprehensive knowledge to do empirical work in financial research and practice.

Outcomes: After completion of the course, students would be able to :

1. Acquire working knowledge of Financial Time Series data.

2. Acquire working knowledge of Financial Panel data.

3. Acquire working knowledge of Cross-sectional data.

4. Know how to access data sources and prepare data for econometric analysis.

5. Perform basic programming using the statistical software package EVIEWS/ R/ STATA.

6. Apply econometric concepts and techniques in professional assignments to real financial data.

Detailed Syllabus: ( per session plan )

Session Description Duration

in Hours

1 What Role does Econometrics play in Finance? 1.5

Apply Methodology of Econometrics;

Define the types of Econometrics tools

What is the connection between Econometrics, Statistics, and Finance?

2 Dummy Variable Regression Models 1.5

Apply dummy variables

Apply ANOVA Models with 2 qualitative variables;

Apply ANCOVA models

3 Relaxing the Assumptions of the Classical Model: Multicollinearity 1.5

SVKM’s Narsee Monjee Institute of Management Studies

Name of School – SBM, Bangalore

Evaluate multicollinearity;

Estimation in the presence of perfect multicollinearity;

Estimation in the presence of high but imperfect multicollinearity

4 Relaxing the Assumptions of the Classical Model: Heteroscedasticity 1.5

Evaluate heteroscedasticity;

Apply OLS estimation in the presence of heteroscedasticity;

Apply Method of Generalized Least Squares (GLS)

5 Relaxing the Assumptions of the Classical Model: Autocorrelation 1.5

Evaluate autocorrelation;

Apply OLS estimation in the presence of autocorrelation;

Evaluate the BLUE estimator in the presence of autocorrelation

6 Model specification and diagnostic testing 1.5

Evaluate model selection criteria;

Evaluate Types of specification errors;

Resolve Consequences of model specification errors

7-8 Nonlinear Regression Models 3

Apply Estimation of nonlinear regression models

Find alternate approaches to estimating nonlinear regression models

9-10 Qualitative Response Regression Models 3

Evaluate qualitative response models;

Apply Linear Probability Model (LPM)

Applications of LPM

Logit Model

11-13 Panel Data Regression Models 4.5

Apply the Fixed effect model

Apply the Random effect model

Evaluate selection between fixed effect and random effect model; various

diagnostic tests;

Applications of panel data from corporate finance literature

14-15 Dynamic Econometric Models 3

Evaluate the role of time or lag in Economics;

The reasons for lags;

Estimation of Distributed-Lag Models.

Estimation of Autoregressive Models

16-17 Simultaneous-Equation Models 3

Evaluate Simultaneous-Equation Models

Applications of Simultaneous-Equation Models

18 Artificial Intelligence & Neural Networks 1.5

Artificial intelligence & neural networks application in finance

19-20 Group Presentations on Given Projects 3

Collecting panel data and applying Fixed Effect Model and Random Effect

Model and finding the suitable model;

Collecting cross-sectional data and applying Qualitative Response Regression

Models;

Collecting time series data and applying Dynamic Econometric Models;

Collecting time series data and applying Simultaneous-Equation Models;

SVKM’s Narsee Monjee Institute of Management Studies

Name of School – SBM, Bangalore

Collecting time series data and applying Nonlinear Regression Models

Total 30

Text Books:

Basic Econometrics, 5e, Damodar N Gujarati., D. Porter & S Gunakesar, McGraw Hill Publication,

2012[Gujarati]

Reference Books:

Introductory Econometrics for Finance, 3e, Chris Brooks, Cambridge University Press, 2014 [Brooks]

Introductory Econometrics,4e, Jeffery M. Woolridge, Cengage Learning,[Woolridge], 2009

Any other information :

Total Marks of Internal Continuous Assessment (ICA) : 60 Marks

Distribution of ICA Marks :

Description of ICA Marks

Class Participation 20

Presentation 20

Project Report 20

Term-End Exam 40

Total Marks : 100

_________ ____________

Signature Signature

(Prepared by Concerned Faculty/HOD) (Approved by Dean)

You might also like

- Divyanshu Shekhar Interest CertificateDocument1 pageDivyanshu Shekhar Interest CertificateDIVYANSHU SHEKHAR100% (2)

- MEM 506 OR & Simulation SyllabusDocument6 pagesMEM 506 OR & Simulation SyllabusElectronNo ratings yet

- Case Study - Sales Trainee UpdatedDocument2 pagesCase Study - Sales Trainee UpdatedDIVYANSHU SHEKHAR100% (1)

- Thomas Edison PPDocument12 pagesThomas Edison PPMohamed Ali EzzeddineNo ratings yet

- Bms Syllabus Sem 3. Cvs WarriorsDocument34 pagesBms Syllabus Sem 3. Cvs WarriorsUtkarsh ChauhanNo ratings yet

- Revised BMS III SEM Common Syllabi TemplateDocument41 pagesRevised BMS III SEM Common Syllabi Templatebhavya.22048No ratings yet

- BMS Syllabus 3rd semesterDocument34 pagesBMS Syllabus 3rd semesterganeshnda69No ratings yet

- Bms 3rd Sem FinalDocument39 pagesBms 3rd Sem FinalTejas NandanNo ratings yet

- SyllabusDocument56 pagesSyllabusGautamNo ratings yet

- 1642155466SHF QT FULL PDFDocument40 pages1642155466SHF QT FULL PDFRaghav NaagarNo ratings yet

- 4941 Download FYBBIDocument28 pages4941 Download FYBBIkarengoodjobNo ratings yet

- New SyllabusDocument4 pagesNew SyllabusApoorv SharmaNo ratings yet

- Epbabi Iim RanchiDocument6 pagesEpbabi Iim RanchiDarshan MaldeNo ratings yet

- Notice - Workshop 2015Document7 pagesNotice - Workshop 2015Anna Mae M. TorresNo ratings yet

- Econmet Syllabus 3T 2017-2018 V24Document7 pagesEconmet Syllabus 3T 2017-2018 V24Richard LeightonNo ratings yet

- Business Statistics Syllabus NEPDocument3 pagesBusiness Statistics Syllabus NEPHimanshuNo ratings yet

- POR Module 1Document36 pagesPOR Module 1Suresh NarayananNo ratings yet

- BCOM (H) SEM 3 SYLLABIDocument10 pagesBCOM (H) SEM 3 SYLLABIwofoya4367No ratings yet

- 4539286Document3 pages4539286venkat naiduNo ratings yet

- STATISTICS AND ECONOMETRICS - 2024 - 5 - University of SurreyDocument3 pagesSTATISTICS AND ECONOMETRICS - 2024 - 5 - University of SurreyZeyu KangNo ratings yet

- Financial Modelling PDFDocument5 pagesFinancial Modelling PDFPuneet MalhotraNo ratings yet

- Eco No Metrics Course OutlineDocument2 pagesEco No Metrics Course Outlinebhagavath012No ratings yet

- BFIA 2nd SEM COREDocument6 pagesBFIA 2nd SEM COREChetan SinghNo ratings yet

- 100000S01I InvestigacionOperativaDocument6 pages100000S01I InvestigacionOperativavelezbrenda988No ratings yet

- Quantitative Techniques - TRIM I PGDM (Executive)Document2 pagesQuantitative Techniques - TRIM I PGDM (Executive)Mamuni PandaNo ratings yet

- IPM StatisticalMethods Term1Document4 pagesIPM StatisticalMethods Term1dhruv mahashayNo ratings yet

- 22 Trim 6 ODS - Operations and Supply Chain AnalyticsDocument3 pages22 Trim 6 ODS - Operations and Supply Chain Analytics27vxjtfbh8No ratings yet

- Sem2 4Document7 pagesSem2 4Pavan Kumar SNo ratings yet

- 8 Trim 6 FIN - Strategic Financial ManagementDocument2 pages8 Trim 6 FIN - Strategic Financial Management27vxjtfbh8No ratings yet

- IIMB CourseSyllabus QM101.1xDocument8 pagesIIMB CourseSyllabus QM101.1xkPrasad8No ratings yet

- 8c48aq T APP MGT IDocument2 pages8c48aq T APP MGT INiket SinhaNo ratings yet

- 01it0702 Software TestingDocument4 pages01it0702 Software TestingMfleh MflehNo ratings yet

- Semester_4Document16 pagesSemester_4sangoi_vipulNo ratings yet

- Course Syllabus Grading PolicyDocument9 pagesCourse Syllabus Grading PolicyVipul sethNo ratings yet

- MaturityModelArchitect-AToolforMaturityAssessmentSupportDocument11 pagesMaturityModelArchitect-AToolforMaturityAssessmentSupportbarnikrt24No ratings yet

- Managerial Accounting: Standard MBA ProgramDocument33 pagesManagerial Accounting: Standard MBA ProgramAnne KawNo ratings yet

- Quantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPDocument41 pagesQuantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPEngMohamedReyadHelesy100% (1)

- Module 1 SPMFDocument32 pagesModule 1 SPMFSriyaNo ratings yet

- BCM4C04 - Quantitative Techniques For BusinessDocument155 pagesBCM4C04 - Quantitative Techniques For Businessvarshasubru19No ratings yet

- ForecastingDocument33 pagesForecastingG Murtaza Dars100% (1)

- Sem III_SYBCOM_Operations Management_24_25Document4 pagesSem III_SYBCOM_Operations Management_24_25hrsuga28No ratings yet

- Introduction C359 v12011Document18 pagesIntroduction C359 v12011Chumba MusekeNo ratings yet

- Bcom P 3rd Sem Syllabus 2023Document10 pagesBcom P 3rd Sem Syllabus 2023-Dekay -No ratings yet

- UNIT-1: Importance and Scope of Operations ResearchDocument60 pagesUNIT-1: Importance and Scope of Operations Researchkishu085No ratings yet

- Sem 3 SyllabusDocument11 pagesSem 3 Syllabusvedantuttam05No ratings yet

- ProgrammeDocument69 pagesProgrammethemysteryofmind69No ratings yet

- Seminar Proposal For SHSJ ADC Dan Elemia Ver 1.0Document57 pagesSeminar Proposal For SHSJ ADC Dan Elemia Ver 1.0Charlton S.InaoNo ratings yet

- BOOKFE Kalot14Document217 pagesBOOKFE Kalot14AhmedNo ratings yet

- Bms 2nd Sem FinalDocument17 pagesBms 2nd Sem FinalTejas NandanNo ratings yet

- Pakistan Institute of Public Finance Accountants: Pipfa Syllabus 2019 Local Fund Audit Department PunjabDocument70 pagesPakistan Institute of Public Finance Accountants: Pipfa Syllabus 2019 Local Fund Audit Department PunjabMoazam KhanNo ratings yet

- Compiled Lecture in Engineering Economy PDFDocument78 pagesCompiled Lecture in Engineering Economy PDFLJ dela PazNo ratings yet

- Economics Iind-SemDocument14 pagesEconomics Iind-Semdasr05858No ratings yet

- Models of Curriculum EvaluationDocument30 pagesModels of Curriculum EvaluationJaymar MagtibayNo ratings yet

- CSM Book 2018 PDFDocument210 pagesCSM Book 2018 PDFDeval SrivastavaNo ratings yet

- SPICE Investigating Measurement Scales and Aggregation Methods in SPICEDocument12 pagesSPICE Investigating Measurement Scales and Aggregation Methods in SPICESam GvmxdxNo ratings yet

- E-Note 20895 Content Document 20240607120458PMDocument202 pagesE-Note 20895 Content Document 20240607120458PMisseihyoudou609No ratings yet

- Semester 3 SyllabusDocument9 pagesSemester 3 Syllabusshubhamehra04No ratings yet

- Sample Plan1Document6 pagesSample Plan1htjritNo ratings yet

- Eco No Metrics Course OutlineDocument6 pagesEco No Metrics Course OutlineAli FarooqNo ratings yet

- Semester: IV Subject Name: Software Engineering Subject Code: 09CE0402Document8 pagesSemester: IV Subject Name: Software Engineering Subject Code: 09CE0402aNo ratings yet

- Quantatative Methods SylDocument7 pagesQuantatative Methods SylThảo Bùi PhươngNo ratings yet

- Softsyll CompressDocument23 pagesSoftsyll CompressGagan V hallurNo ratings yet

- Biographical Overview and Analysis - Pulkit JainDocument5 pagesBiographical Overview and Analysis - Pulkit JainDIVYANSHU SHEKHARNo ratings yet

- Sr. No Candidate Name ResponseDocument3 pagesSr. No Candidate Name ResponseDIVYANSHU SHEKHARNo ratings yet

- Operations Dossier 2021Document56 pagesOperations Dossier 2021DIVYANSHU SHEKHAR0% (1)

- IT Companies BFSIDocument42 pagesIT Companies BFSIDIVYANSHU SHEKHAR0% (1)

- Pet Problems? Forget Them.: First PetsDocument14 pagesPet Problems? Forget Them.: First PetsDIVYANSHU SHEKHARNo ratings yet

- Academics: Divyanshu ShekharDocument2 pagesAcademics: Divyanshu ShekharDIVYANSHU SHEKHARNo ratings yet

- Finance Sector NADocument4 pagesFinance Sector NADIVYANSHU SHEKHARNo ratings yet

- CertificateDocument1 pageCertificateDIVYANSHU SHEKHARNo ratings yet

- Mid Term Exam 2021 OctoberDocument4 pagesMid Term Exam 2021 OctoberDIVYANSHU SHEKHARNo ratings yet

- Cancelled Meetings Status - Mumbai PuneDocument39 pagesCancelled Meetings Status - Mumbai PuneDIVYANSHU SHEKHARNo ratings yet

- SVKM's NMIMS, Bangalore Campus Post Graduate Diploma in Management (PGDM) Academic Year 2020-21 Serial No Trimester Subject Name CreditsDocument4 pagesSVKM's NMIMS, Bangalore Campus Post Graduate Diploma in Management (PGDM) Academic Year 2020-21 Serial No Trimester Subject Name CreditsDIVYANSHU SHEKHARNo ratings yet

- Tata Imagination Challenge 2021 TAS PPI (Pre-Placement Interview) GuidelinesDocument2 pagesTata Imagination Challenge 2021 TAS PPI (Pre-Placement Interview) GuidelinesDIVYANSHU SHEKHARNo ratings yet

- 1 Consultancy Corporate Executive Board HR Round: S.No. Sector Company RoundDocument9 pages1 Consultancy Corporate Executive Board HR Round: S.No. Sector Company RoundDIVYANSHU SHEKHARNo ratings yet

- Master of Business Administration: Narsee Monjee Institute of Management StudiesDocument3 pagesMaster of Business Administration: Narsee Monjee Institute of Management StudiesDIVYANSHU SHEKHARNo ratings yet

- Perspectai Assessment Faq'S: Support@Perspect - AiDocument1 pagePerspectai Assessment Faq'S: Support@Perspect - AiDIVYANSHU SHEKHARNo ratings yet

- Green Supply Chain ManagementDocument5 pagesGreen Supply Chain ManagementDIVYANSHU SHEKHARNo ratings yet

- Backend Team - PAN IndiaDocument6 pagesBackend Team - PAN IndiaDIVYANSHU SHEKHARNo ratings yet

- Enterprenuership Innovation Ver-2Document8 pagesEnterprenuership Innovation Ver-2DIVYANSHU SHEKHARNo ratings yet

- Operations & Supply Chain AnalyticsDocument4 pagesOperations & Supply Chain AnalyticsDIVYANSHU SHEKHAR100% (1)

- Návod K Použití CZDocument36 pagesNávod K Použití CZAivlis SokuytNo ratings yet

- Heirs of Tan Eng Kee v. CA, G.R. No. 126881Document14 pagesHeirs of Tan Eng Kee v. CA, G.R. No. 126881Krister VallenteNo ratings yet

- FortiOS-Upgradepath 5.0.5Document9 pagesFortiOS-Upgradepath 5.0.5canonpixmats6050No ratings yet

- A Search For Alternative Solvent To Hexane During Neem Oil ExtractionDocument5 pagesA Search For Alternative Solvent To Hexane During Neem Oil ExtractiontramiNo ratings yet

- Interfacing With VirtualizationDocument10 pagesInterfacing With VirtualizationBrothers MailNo ratings yet

- Auto Bond Information SheetDocument2 pagesAuto Bond Information SheetChrome6494% (16)

- DIP UnnaoDocument18 pagesDIP UnnaoDeepak KumarNo ratings yet

- WB140-2 S - N 140F11531-Up - REAR AXLE (5 - 8)Document2 pagesWB140-2 S - N 140F11531-Up - REAR AXLE (5 - 8)masanegraNo ratings yet

- Outgoing Wire Transfer Request FormDocument4 pagesOutgoing Wire Transfer Request Formron okalNo ratings yet

- Tutorial: Basant Namdeo Iips, DavvDocument24 pagesTutorial: Basant Namdeo Iips, DavvMadhvi JainNo ratings yet

- Multiple Reactions: o Selectivity and Yield o Reactions in SeriesDocument55 pagesMultiple Reactions: o Selectivity and Yield o Reactions in SeriesSyasya FaqihahNo ratings yet

- Abhijit Chakraborti: Profile SummaryDocument4 pagesAbhijit Chakraborti: Profile SummaryHRD CORP CONSULTANCYNo ratings yet

- East Vs West Cultural DifferencesDocument2 pagesEast Vs West Cultural DifferencesJawid WakmanNo ratings yet

- Insurance Fraud (Legal Methods Project)Document27 pagesInsurance Fraud (Legal Methods Project)Anjali GurumoorthyNo ratings yet

- EVT ITCC DeliveryModelDocument15 pagesEVT ITCC DeliveryModelabhi_cat16No ratings yet

- Cause of Action For Conversion of PropertyDocument3 pagesCause of Action For Conversion of PropertyGee Penn100% (2)

- Katalog MadelaDocument6 pagesKatalog MadelaBintang AlkausarNo ratings yet

- Activity DesignDocument2 pagesActivity DesignJeffrey SalinasNo ratings yet

- 2nd Semester Sylabus Pondicherry UniversityDocument6 pages2nd Semester Sylabus Pondicherry UniversityirinmichaelNo ratings yet

- Top 20 C# Interview Questions and AnswersDocument47 pagesTop 20 C# Interview Questions and AnswersAJIT SAMALNo ratings yet

- Thayer The Philippines - Securing National SovereigntyDocument3 pagesThayer The Philippines - Securing National SovereigntyCarlyle Alan ThayerNo ratings yet

- Class 12 Competency Based Question - Computer Science Chap 8 (2024-25)Document25 pagesClass 12 Competency Based Question - Computer Science Chap 8 (2024-25)haarithali123321No ratings yet

- Benefits Paid On Death During Service: Monthly BenefitDocument6 pagesBenefits Paid On Death During Service: Monthly BenefitfebjamilNo ratings yet

- ELTE3.4 DBS3900 Operation and Maintenance V1.0Document66 pagesELTE3.4 DBS3900 Operation and Maintenance V1.0Olivier RachoinNo ratings yet

- MABE Syllabus 2016-17 NewDocument91 pagesMABE Syllabus 2016-17 Newamir755No ratings yet

- 8501-00-1620 Rev D EnglishDocument98 pages8501-00-1620 Rev D EnglishRecep TorunNo ratings yet

- MBA Organisational Behaviour - Company AnalysisDocument13 pagesMBA Organisational Behaviour - Company AnalysisMohammad Faizal AbdullahNo ratings yet