Summary of Al STD - Imp

Summary of Al STD - Imp

Uploaded by

amitsinghslideshareCopyright:

Available Formats

Summary of Al STD - Imp

Summary of Al STD - Imp

Uploaded by

amitsinghslideshareOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Summary of Al STD - Imp

Summary of Al STD - Imp

Uploaded by

amitsinghslideshareCopyright:

Available Formats

lOMoARcPSD|5011990

IAS summaries - Summary notes of IAS and IFRS

Financial Reporting 1 (The University of Warwick)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Financial Reporting

International Accounting Standards

International Accounting Standards (IASs) were issued by the antecedent International Accounting

Standards Council (IASC), and endorsed and amended by the International Accounting Standards

Board (IASB). The IASB will also reissue standards in this series where it considers it appropriate.

IAS 1-Presentation of financial statements

Objective of IAS 1

The objective of IAS 1 (2007) is to prescribe the basis for presentation of general purpose financial

statements, to ensure comparability both with the entity's financial statements of previous periods

and with the financial statements of other entities. IAS 1 sets out the overall requirements for the

presentation of financial statements, guidelines for their structure and minimum requirements for

their content. [IAS 1.1] Standards for recognising, measuring, and disclosing specific transactions are

addressed in other Standards and Interpretations. [IAS 1.3]

Scope

IAS 1 applies to all general purpose financial statements that are prepared and presented in

accordance with International Financial Reporting Standards (IFRSs). [IAS 1.2]

General purpose financial statements are those intended to serve users who are not in a position to

require financial reports tailored to their particular information needs. [IAS 1.7]

Objective of financial statements

The objective of general purpose financial statements is to provide information about the financial

position, financial performance, and cash flows of an entity that is useful to a wide range of users in

making economic decisions. To meet that objective, financial statements provide information about

an entity's: [IAS 1.9]

assets

liabilities

equity income and expenses,

including gains and losses contributions by and distributions to owners (in their capacity as

owners)

cash flows.

That information, along with other information in the notes, assists users of financial statements in

predicting the entity's future cash flows and, in particular, their timing and certainty.

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 2-Inventories

Objective of IAS 2

The objective of IAS 2 is to prescribe the accounting treatment for inventories. It provides guidance

for determining the cost of inventories and for subsequently recognising an expense, including any

write-down to net realisable value. It also provides guidance on the cost formulas that are used to

assign costs to inventories.

Scope

Inventories include assets held for sale in the ordinary course of business (finished goods), assets in

the production process for sale in the ordinary course of business (work in process), and materials

and supplies that are consumed in production (raw materials). [IAS 2.6]

However, IAS 2 excludes certain inventories from its scope: [IAS 2.2]

1. work in process arising under construction contracts (see IAS 11 Construction Contracts)

2. financial instruments (see IAS 39 Financial Instruments: Recognition and Measurement)

3. biological assets related to agricultural activity and agricultural produce at the point of

harvest (see IAS 41 Agriculture).

Also, while the following are within the scope of the standard, IAS 2 does not apply to the

measurement of inventories held by: [IAS 2.3]

producers of agricultural and forest products, agricultural produce after harvest, and

minerals and mineral products, to the extent that they are measured at net realisable value

(above or below cost) in accordance with well-established practices in those industries.

When such inventories are measured at net realisable value, changes in that value are

recognised in profit or loss in the period of the change

commodity brokers and dealers who measure their inventories at fair value less costs to sell.

When such inventories are measured at fair value less costs to sell, changes in fair value less

costs to sell are recognised in profit or loss in the period of the change.

Inventories are required to be stated at the lower of cost and net realisable value (NRV).

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 7-Statement of Cash flows

https://www.iasplus.com/en-gb/standards/ias/ias7

Objective of IAS 7

The objective of IAS 7 is to require the presentation of information about the historical changes in

cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash

flows during the period according to operating, investing, and financing activities.

Fundamental principle in IAS 7

All entities that prepare financial statements in conformity with IFRSs are required to present a

statement of cash flows. [IAS 7.1]

The statement of cash flows analyses changes in cash and cash equivalents during a period. Cash and

cash equivalents comprise cash on hand and demand deposits, together with short-term, highly

liquid investments that are readily convertible to a known amount of cash, and that are subject to an

insignificant risk of changes in value. Guidance notes indicate that an investment normally meets the

definition of a cash equivalent when it has a maturity of three months or less from the date of

acquisition. Equity investments are normally excluded, unless they are in substance a cash

equivalent (e.g. preferred shares acquired within three months of their specified redemption date).

Bank overdrafts which are repayable on demand and which form an integral part of an entity's cash

management are also included as a component of cash and cash equivalents. [IAS 7.7-8]

Presentation of the Statement of Cash Flows

Cash flows must be analysed between operating, investing and financing activities. [IAS 7.10]

Key principles specified by IAS 7 for the preparation of a statement of cash flows are as follows:

operating activities are the main revenue-producing activities of the entity that are not

investing or financing activities, so operating cash flows include cash received from

customers and cash paid to suppliers and employees [IAS 7.14]

investing activities are the acquisition and disposal of long-term assets and other

investments that are not considered to be cash equivalents [IAS 7.6]

financing activities are activities that alter the equity capital and borrowing structure of the

entity [IAS 7.6]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 8- Accounting policies, changes in accounting estimates and errors

IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors is applied in selecting and

applying accounting policies, accounting for changes in estimates and reflecting corrections of prior

period errors.

The standard requires compliance with any specific IFRS applying to a transaction, event or

condition, and provides guidance on developing accounting policies for other items that result in

relevant and reliable information. Changes in accounting policies and corrections of errors are

generally retrospectively accounted for, whereas changes in accounting estimates are generally

accounted for on a prospective basis.

An entity is permitted to change an accounting policy only if the change:

is required by a standard or interpretation; or

results in the financial statements providing reliable and more relevant information about

the effects of transactions, other events or conditions on the entity's financial position,

financial performance, or cash flows. [IAS 8.14]

Note that changes in accounting policies do not include applying an accounting policy to a kind of

transaction or event that did not occur previously or were immaterial. [IAS 8.16]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 14- Segment reporting

IAS 14 Segment Reporting requires reporting of financial information by business or geographical

area. It requires disclosures for 'primary' and 'secondary' segment reporting formats, with the

primary format based on whether the entity's risks and returns are affected predominantly by the

products and services it produces or by the fact that it operates in different geographical areas.

Objective of IAS 14

The objective of IAS 14 (Revised 1997) is to establish principles for reporting financial information by

line of business and by geographical area. It applies to entities whose equity or debt securities are

publicly traded and to entities in the process of issuing securities to the public. In addition, any entity

voluntarily providing segment information should comply with the requirements of the Standard.

Applicability

IAS 14 must be applied by entities whose debt or equity securities are publicly traded and those in

the process of issuing such securities in public securities markets. [IAS 14.3]

If an entity that is not publicly traded chooses to report segment information and claims that its

financial statements conform to IFRSs, then it must follow IAS 14 in full. [IAS 14.5]

Segment information need not be presented in the separate financial statements of a (a) parent, (b)

subsidiary, (c) equity method associate, or (d) equity method joint venture that are presented in the

same report as the consolidated statements. [IAS 14.6-7]

Key definitions

Business segment: a component of an entity that (a) provides a single product or service or a group

of related products and services and (b) that is subject to risks and returns that are different from

those of other business segments. [IAS 14.9]

Geographical segment: a component of an entity that (a) provides products and services within a

particular economic environment and (b) that is subject to risks and returns that are different from

those of components operating in other economic environments. [IAS 14.9]

Reportable segment: a business segment or geographical segment for which IAS 14 requires

segment information to be reported. [IAS 14.9]

Segment revenue: revenue, including intersegment revenue, that is directly attributable or

reasonably allocable to a segment. Includes interest and dividend income and related securities

gains only if the segment is a financial segment (bank, insurance company, etc.). [IAS 14.16]

Segment expenses: expenses, including expenses relating to intersegment transactions, that (a)

result from operating activities and (b) are directly attributable or reasonably allocable to a segment.

Includes interest expense and related securities losses only if the segment is a financial segment

(bank, insurance company, etc.). Segment expenses do not include:

interest

losses on sales of investments or debt extinguishments

losses on investments accounted for by the equity method

income taxes

general corporate administrative and head-office expenses that relate to the entity as a

whole [IAS 14.16]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Segment result: segment revenue minus segment expenses, before deducting minority interest. [IAS

14.16]

Segment assets and segment liabilities: those operating assets (liabilities) that are directly

attributable or reasonably allocable to a segment. [IAS 14.16]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 16-Property, plant and equipment

Objective of IAS 16

The objective of IAS 16 is to prescribe the accounting treatment for property, plant, and equipment.

The principal issues are the recognition of assets, the determination of their carrying amounts, and

the depreciation charges and impairment losses to be recognised in relation to them.

Scope

IAS 16 applies to the accounting for property, plant and equipment, except where another standards

requires or permits differing accounting treatments, for example:

assets classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale

and Discontinued Operations

biological assets related to agricultural activity accounted for under IAS 41 Agriculture

exploration and evaluation assets recognised in accordance with IFRS 6

Exploration for and Evaluation of Mineral Resources

mineral rights and mineral reserves such as oil, natural gas and similar non-regenerative

resources.

The standard does apply to property, plant, and equipment used to develop or maintain the last

three categories of assets. [IAS 16.3]

The cost model in IAS 16 also applies to investment property accounted for using the cost model

under IAS 40 Investment Property. [IAS 16.5]

The standard does apply to bearer plants but it does not apply to the produce on bearer plants. [IAS

16.3]

Recognition

Items of property, plant, and equipment should be recognised as assets when it is probable that:

[IAS 16.7]

it is probable that the future economic benefits associated with the asset will flow to the

entity, and

the cost of the asset can be measured reliably.

This recognition principle is applied to all property, plant, and equipment costs at the time they are

incurred. These costs include costs incurred initially to acquire or construct an item of property,

plant and equipment and costs incurred subsequently to add to, replace part of, or service it.

IAS 16 does not prescribe the unit of measure for recognition – what constitutes an item of property,

plant, and equipment. [IAS 16.9] Note, however, that if the cost model is used (see below) each part

of an item of property, plant, and equipment with a cost that is significant in relation to the total

cost of the item must be depreciated separately. [IAS 16.43]

IAS 16 recognises that parts of some items of property, plant, and equipment may require

replacement at regular intervals. The carrying amount of an item of property, plant, and equipment

will include the cost of replacing the part of such an item when that cost is incurred if the

recognition criteria (future benefits and measurement reliability) are met. The carrying amount of

those parts that are replaced is derecognised in accordance with the derecognition provisions of IAS

16.67-72. [IAS 16.13]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Also, continued operation of an item of property, plant, and equipment (for example, an aircraft)

may require regular major inspections for faults regardless of whether parts of the item are

replaced. When each major inspection is performed, its cost is recognised in the carrying amount of

the item of property, plant, and equipment as a replacement if the recognition criteria are satisfied.

If necessary, the estimated cost of a future similar inspection may be used as an indication of what

the cost of the existing inspection component was when the item was acquired or constructed. [IAS

16.14]

Initial measurement

An item of property, plant and equipment should initially be recorded at cost. [IAS 16.15] Cost

includes all costs necessary to bring the asset to working condition for its intended use. This would

include not only its original purchase price but also costs of site preparation, delivery and handling,

installation, related professional fees for architects and engineers, and the estimated cost of

dismantling and removing the asset and restoring the site (see IAS 37 Provisions, Contingent

Liabilities and Contingent Assets). [IAS 16.16-17]

If payment for an item of property, plant, and equipment is deferred, interest at a market rate must

be recognised or imputed. [IAS 16.23]

If an asset is acquired in exchange for another asset (whether similar or dissimilar in nature), the cost

will be measured at the fair value unless (a) the exchange transaction lacks commercial substance or

(b) the fair value of neither the asset received nor the asset given up is reliably measurable. If the

acquired item is not measured at fair value, its cost is measured at the carrying amount of the asset

given up. [IAS 16.24]

Measurement subsequent to initial recognition

IAS 16 permits two accounting models:

Cost model. The asset is carried at cost less accumulated depreciation and impairment. [IAS 16.30]

Revaluation model. The asset is carried at a revalued amount, being its fair value at the date of

revaluation less subsequent depreciation and impairment, provided that fair value can be measured

reliably. [IAS 16.31]

The revaluation model

Under the revaluation model, revaluations should be carried out regularly, so that the carrying

amount of an asset does not differ materially from its fair value at the balance sheet date. [IAS

16.31]

If an item is revalued, the entire class of assets to which that asset belongs should be revalued. [IAS

16.36]

Revalued assets are depreciated in the same way as under the cost model (see below).

If a revaluation results in an increase in value, it should be credited to other comprehensive income

and accumulated in equity under the heading "revaluation surplus" unless it represents the reversal

of a revaluation decrease of the same asset previously recognised as an expense, in which case it

should be recognised in profit or loss. [IAS 16.39]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

A decrease arising as a result of a revaluation should be recognised as an expense to the extent that

it exceeds any amount previously credited to the revaluation surplus relating to the same asset. [IAS

16.40]

When a revalued asset is disposed of, any revaluation surplus may be transferred directly to retained

earnings, or it may be left in equity under the heading revaluation surplus. The transfer to retained

earnings should not be made through profit or loss. [IAS 16.41]

Depreciation (cost and revaluation models)

For all depreciable assets:

The depreciable amount (cost less residual value) should be allocated on a systematic basis over the

asset's useful life [IAS 16.50].

The residual value and the useful life of an asset should be reviewed at least at each financial year-

end and, if expectations differ from previous estimates, any change is accounted for prospectively as

a change in estimate under IAS 8. [IAS 16.51]

The depreciation method used should reflect the pattern in which the asset's economic benefits are

consumed by the entity [IAS 16.60]; a depreciation method that is based on revenue that is

generated by an activity that includes the use of an asset is not appropriate. [IAS 16.62A]

The depreciation method should be reviewed at least annually and, if the pattern of consumption of

benefits has changed, the depreciation method should be changed prospectively as a change in

estimate under IAS 8. [IAS 16.61] Expected future reductions in selling prices could be indicative of a

higher rate of consumption of the future economic benefits embodied in an asset. [IAS 16.56]

Depreciation should be charged to profit or loss, unless it is included in the carrying amount of

another asset [IAS 16.48].

Depreciation begins when the asset is available for use and continues until the asset is derecognised,

even if it is idle. [IAS 16.55]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 18- Revenue

IAS 18 Revenue outlines the accounting requirements for when to recognise revenue from the sale

of goods, rendering of services, and for interest, royalties and dividends. Revenue is measured at the

fair value of the consideration received or receivable and recognised when prescribed conditions are

met, which depend on the nature of the revenue.

Objective of IAS 18

The objective of IAS 18 is to prescribe the accounting treatment for revenue arising from certain

types of transactions and events.

Key definition

Revenue: the gross inflow of economic benefits (cash, receivables, other assets) arising from the

ordinary operating activities of an entity (such as sales of goods, sales of services, interest, royalties,

and dividends). [IAS 18.7]

Measurement of revenue

Revenue should be measured at the fair value of the consideration received or receivable. [IAS 18.9]

An exchange for goods or services of a similar nature and value is not regarded as a transaction that

generates revenue. However, exchanges for dissimilar items are regarded as generating revenue.

[IAS 18.12]

If the inflow of cash or cash equivalents is deferred, the fair value of the consideration receivable is

less than the nominal amount of cash and cash equivalents to be received, and discounting is

appropriate. This would occur, for instance, if the seller is providing interest-free credit to the buyer

or is charging a below-market rate of interest. Interest must be imputed based on market rates. [IAS

18.11]

Recognition of revenue

Recognition, as defined in the IASB Framework, means incorporating an item that meets the

definition of revenue (above) in the income statement when it meets the following criteria:

it is probable that any future economic benefit associated with the item of revenue will flow

to the entity, and

the amount of revenue can be measured with reliability

IAS 18 provides guidance for recognising the following specific categories of revenue:

Sale of goods

Revenue arising from the sale of goods should be recognised when all of the following criteria have

been satisfied: [IAS 18.14]

the seller has transferred to the buyer the significant risks and rewards of ownership

the seller retains neither continuing managerial involvement to the degree usually

associated with ownership nor effective control over the goods sold

the amount of revenue can be measured reliably

it is probable that the economic benefits associated with the transaction will flow to the

seller, and

the costs incurred or to be incurred in respect of the transaction can be measured reliably

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Rendering of services

For revenue arising from the rendering of services, provided that all of the following criteria are met,

revenue should be recognised by reference to the stage of completion of the transaction at the

balance sheet date (the percentage-of-completion method): [IAS 18.20]

the amount of revenue can be measured reliably;

it is probable that the economic benefits will flow to the seller;

the stage of completion at the balance sheet date can be measured reliably;

and the costs incurred, or to be incurred, in respect of the transaction can be measured

reliably.

When the above criteria are not met, revenue arising from the rendering of services should be

recognised only to the extent of the expenses recognised that are recoverable (a "cost-recovery

approach". [IAS 18.26]

Interest, royalties, and dividends

For interest, royalties and dividends, provided that it is probable that the economic benefits will flow

to the enterprise and the amount of revenue can be measured reliably, revenue should be

recognised as follows: [IAS 18.29-30]

interest: using the effective interest method as set out in IAS 39

royalties: on an accruals basis in accordance with the substance of the relevant agreement

dividends: when the shareholder's right to receive payment is established

Disclosure [IAS 18.35]

accounting policy for recognising revenue

amount of each of the following types of revenue:

o sale of goods

o rendering of services

o interest

o royalties

o dividends

o within each of the above categories, the amount of revenue from exchanges of

goods or services

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 35-Discontinuing Operations (superseded)

Objective of IAS 35

The objective of IAS 35 is to establish principles for reporting information about discontinuing

activities (as defined), thereby enhancing the ability of users of financial statements to make

projections of an enterprise's cash flows, earnings-generating capacity and financial position, by

segregating information about discontinuing activities from information about continuing

operations. The Standard does not establish any recognition or measurement principles in relation

to discontinuing operations – these are dealt with under other IAS. In particular, IAS 35 provides

guidance on how to apply IAS 36 Impairment of Assets and IAS 37 Provisions, Contingent Liabilities

and Contingent Assets to a discontinuing operation. [IAS 35.17-19]

Discontinuing operation defined

Discontinuing operation: A relatively large component of a business enterprise – such as a business

or geographical segment under IAS 14 Segment Reporting – that the enterprise, pursuant to a single

plan, either is disposing of substantially in its entirety or is terminating through abandonment or

piecemeal sale. [IAS 35.2] A restructuring, transaction or event that does not meet the definition of a

discontinuing operation should not be called a discontinuing operation. [IAS 35.43]

When to disclose

Disclosures begin after the earlier of the following:

the company has entered into an agreement to sell substantially all of the assets of the

discontinuing operation; or

its board of directors or other similar governing body has both approved and announced the

planned discontinuance. [IAS 35.16]

The disclosures are required if a plan for disposal is both approved and publicly announced after the

end of the financial reporting period but before the financial statements for that period are

approved. A board decision after year-end, by itself, is not enough. [IAS 35.29]

What to disclose

The following must be disclosed: [IAS 35.27 and IAS 35.31]

a description of the discontinuing operation;

the business or geographical segment(s) in which it is reported in accordance with IAS 14;

the date that the plan for discontinuance was announced;

the timing of expected completion, if known or determinable;

the carrying amounts of the total assets and the total liabilities to be disposed of;

the amounts of revenue, expenses, and pre-tax operating profit or loss attributable to the

discontinuing operation, and (separately) related income tax expense;

the amount of gain or loss recognised on the disposal of assets or settlement of liabilities

attributable to the discontinuing operation, and related income tax expense;

the net cash flows attributable to the operating, investing, and financing activities of the

discontinuing operation; and

the net selling prices received or expected from the sale of those net assets for which the

enterprise has entered into one or more binding sale agreements, and the expected timing

thereof, and the carrying amounts of those net assets.

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

How to disclose

The disclosures may be, but need not be, shown on the face of the financial statements. Only the

gain or loss on actual disposal of assets and settlement of liabilities must be on the face of the

income statement. [IAS 35.39] IAS 35 does not prescribe a particular format for the disclosures.

Among the acceptable ways:

Separate columns in the financial statements for continuing and discontinuing operations

One column but separate sections (with subtotals) for continuing and discontinuing

operations within that single column

One or more separate line items for discontinuing operations on the face of the financial

statements with detailed disclosures about discontinuing operations in the notes (but the

line-item disclosure requirements of IAS 1 Presentation of Financial Statements must still be

met).

In periods after the discontinuance is first approved and announced, and before it is completed, the

financial statements must update the prior disclosures, including a description of any significant

changes in the amount or timing of cash flows relating to the assets and liabilities to be disposed of

or settled and the causes of those changes. [IAS 35.33]

The disclosures continue until completion of the disposal, though there may be cash payments still

to come. [IAS 35.35-36]

Comparative information presented in financial statements prepared after initial disclosure must be

restated to segregate the continuing and discontinuing assets, liabilities, income, expenses, and cash

flows. This helps in trend analysis and forecasting. [IAS 35.45]

IAS 35 applies to only to those corporate restructurings that meet the definition of a discontinuing

operation. But many so-called restructurings are of a smaller scope than an IAS 35 discontinuing

operation, such as plant closings, product discontinuances, and sales of subsidiaries while the

company remains in the same line of business. IAS 37 on provisions specifies the accounting and

disclosures for restructurings.

The specified disclosures are required to be presented separately for each discontinuing operation.

[IAS 35.38]

Income and expenses relating to discontinuing operations should not be presented as extraordinary

items. [IAS 35.41]

Notes to an interim financial report should disclose information about discontinuing operations. [IAS

35.47]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

IAS 36- Impairment of Assets

IAS 36 Impairment of Assets seeks to ensure that an entity's assets are not carried at more than their

recoverable amount (i.e. the higher of fair value less costs of disposal and value in use). With the

exception of goodwill and certain intangible assets for which an annual impairment test is required,

entities are required to conduct impairment tests where there is an indication of impairment of an

asset, and the test may be conducted for a 'cash-generating unit' where an asset does not generate

cash inflows that are largely independent of those from other assets.

Objective of IAS 36

To ensure that assets are carried at no more than their recoverable amount, and to define how

recoverable amount is determined.

Scope

IAS 36 applies to all assets except: [IAS 36.2]

inventories (see IAS 2)

assets arising from construction contracts (see IAS 11)

deferred tax assets (see IAS 12)

assets arising from employee benefits (see IAS 19)

financial assets (see IAS 39)

investment property carried at fair value (see IAS 40)

agricultural assets carried at fair value (see IAS 41)

insurance contract assets (see IFRS 4)

non-current assets held for sale (see IFRS 5)

Therefore, IAS 36 applies to (among other assets):

land

buildings

machinery and equipment

investment property carried at cost

intangible assets

goodwill

investments in subsidiaries, associates, and joint ventures carried at cost

assets carried at revalued amounts under IAS 16 and IAS 38

Key definitions [IAS 36.6]

Impairment loss: the amount by which the carrying amount of an asset or cash-generating unit

exceeds its recoverable amount

Carrying amount: the amount at which an asset is recognised in the balance sheet after deducting

accumulated depreciation and accumulated impairment losses

Recoverable amount: the higher of an asset's fair value less costs of disposal* (sometimes called net

selling price) and its value in use

Fair value: the price that would be received to sell an asset or paid to transfer a liability in an orderly

transaction between market participants at the measurement date (see IFRS 13 Fair Value

Measurement.

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Value in use: the present value of the future cash flows expected to be derived from an asset or

cash-generating unit

Identifying an asset that may be impaired

At the end of each reporting period, an entity is required to assess whether there is any indication

that an asset may be impaired (i.e. its carrying amount may be higher than its recoverable amount).

IAS 36 has a list of external and internal indicators of impairment. If there is an indication that an

asset may be impaired, then the asset's recoverable amount must be calculated. [IAS 36.9]

The recoverable amounts of the following types of intangible assets are measured annually whether

or not there is any indication that it may be impaired. In some cases, the most recent detailed

calculation of recoverable amount made in a preceding period may be used in the impairment test

for that asset in the current period: [IAS 36.10]

an intangible asset with an indefinite useful life

an intangible asset not yet available for use

goodwill acquired in a business combination

Indications of impairment [IAS 36.12]

External sources:

market value declines

negative changes in technology, markets, economy, or laws

increases in market interest rates

net assets of the company higher than market capitalisation

Internal sources:

obsolescence or physical damage

asset is idle, part of a restructuring or held for disposal

worse economic performance than expected

for investments in subsidiaries, joint ventures or associates, the carrying amount is higher

than the carrying amount of the investee's assets, or a dividend exceeds the total

comprehensive income of the investee

Determining recoverable amount

If fair value less costs of disposal or value in use is more than carrying amount, it is not

necessary to calculate the other amount. The asset is not impaired. [IAS 36.19]

If fair value less costs of disposal cannot be determined, then recoverable amount is value in

use. [IAS 36.20]

For assets to be disposed of, recoverable amount is fair value less costs of disposal. [IAS

36.21]

Fair value less costs of disposal

Fair value is determined in accordance with IFRS 13

Fair Value Measurement Costs of disposal are the direct added costs only (not existing costs

or overhead). [IAS 36.28]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Value in use

The calculation of value in use should reflect the following elements: [IAS 36.30]

an estimate of the future cash flows the entity expects to derive from the asset

expectations about possible variations in the amount or timing of those future cash flows

the time value of money, represented by the current market risk-free rate of interest

the price for bearing the uncertainty inherent in the asset

other factors, such as illiquidity, that market participants would reflect in pricing the future

cash flows the entity expects to derive from the asset

Cash flow projections should be based on reasonable and supportable assumptions, the most recent

budgets and forecasts, and extrapolation for periods beyond budgeted projections. [IAS 36.33] IAS

36 presumes that budgets and forecasts should not go beyond five years; for periods after five years,

extrapolate from the earlier budgets. [IAS 36.35] Management should assess the reasonableness of

its assumptions by examining the causes of differences between past cash flow projections and

actual cash flows. [IAS 36.34]

Cash flow projections should relate to the asset in its current condition – future restructurings to

which the entity is not committed and expenditures to improve or enhance the asset's performance

should not be anticipated. [IAS 36.44]

Estimates of future cash flows should not include cash inflows or outflows from financing activities,

or income tax receipts or payments. [IAS 36.50]

Discount rate

In measuring value in use, the discount rate used should be the pre-tax rate that reflects current

market assessments of the time value of money and the risks specific to the asset. [IAS 36.55]

The discount rate should not reflect risks for which future cash flows have been adjusted and should

equal the rate of return that investors would require if they were to choose an investment that

would generate cash flows equivalent to those expected from the asset. [IAS 36.56]

For impairment of an individual asset or portfolio of assets, the discount rate is the rate the entity

would pay in a current market transaction to borrow money to buy that specific asset or portfolio.

If a market-determined asset-specific rate is not available, a surrogate must be used that reflects the

time value of money over the asset's life as well as country risk, currency risk, price risk, and cash

flow risk. The following would normally be considered: [IAS 36.57]

the entity's own weighted average cost of capital the entity's incremental borrowing rate other

market borrowing rates.

Recognition of an impairment loss

An impairment loss is recognised whenever recoverable amount is below carrying amount.

[IAS 36.59]

The impairment loss is recognised as an expense (unless it relates to a revalued asset where

the impairment loss is treated as a revaluation decrease). [IAS 36.60]

Adjust depreciation for future periods. [IAS 36.63]

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Cash-generating units

Recoverable amount should be determined for the individual asset, if possible. [IAS 36.66]

If it is not possible to determine the recoverable amount (fair value less costs of disposal and value

in use) for the individual asset, then determine recoverable amount for the asset's cash-generating

unit (CGU). [IAS 36.66] The CGU is the smallest identifiable group of assets that generates cash

inflows that are largely independent of the cash inflows from other assets or groups of assets. [IAS

36.6]

Impairment of goodwill

Goodwill should be tested for impairment annually. [IAS 36.96]

To test for impairment, goodwill must be allocated to each of the acquirer's cash-generating units, or

groups of cash-generating units, that are expected to benefit from the synergies of the combination,

irrespective of whether other assets or liabilities of the acquiree are assigned to those units or

groups of units. Each unit or group of units to which the goodwill is so allocated shall: [IAS 36.80]

represent the lowest level within the entity at which the goodwill is monitored for internal

management purposes; and

not be larger than an operating segment determined in accordance with IFRS 8 Operating

Segments.

A cash-generating unit to which goodwill has been allocated shall be tested for impairment at least

annually by comparing the carrying amount of the unit, including the goodwill, with the recoverable

amount of the unit: [IAS 36.90]

If the recoverable amount of the unit exceeds the carrying amount of the unit, the unit and

the goodwill allocated to that unit is not impaired

If the carrying amount of the unit exceeds the recoverable amount of the unit, the entity

must recognise an impairment loss.

The impairment loss is allocated to reduce the carrying amount of the assets of the unit (group of

units) in the following order: [IAS 36.104]

first, reduce the carrying amount of any goodwill allocated to the cash-generating unit

(group of units); and

then, reduce the carrying amounts of the other assets of the unit (group of units) pro rata on

the basis.

The carrying amount of an asset should not be reduced below the highest of: [IAS 36.105]

its fair value less costs of disposal (if measurable)

its value in use (if measurable)

zero.

If the preceding rule is applied, further allocation of the impairment loss is made pro rata to the

other assets of the unit (group of units).

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

Reversal of an impairment loss

Same approach as for the identification of impaired assets: assess at each balance sheet date

whether there is an indication that an impairment loss may have decreased. If so, calculate

recoverable amount. [IAS 36.110]

No reversal for unwinding of discount. [IAS 36.116]

The increased carrying amount due to reversal should not be more than what the

depreciated historical cost would have been if the impairment had not been recognised. [IAS

36.117]

Reversal of an impairment loss is recognised in the profit or loss unless it relates to a

revalued asset [IAS 36.119]

Adjust depreciation for future periods. [IAS 36.121]

Reversal of an impairment loss for goodwill is prohibited. [IAS 36.124]

Disclosure

Disclosure by class of assets: [IAS 36.126]

impairment losses recognised in profit or loss

impairment losses reversed in profit or loss

which line item(s) of the statement of comprehensive income

impairment losses on revalued assets recognised in other comprehensive income

impairment losses on revalued assets reversed in other comprehensive income

Disclosure by reportable segment: [IAS 36.129]

impairment losses recognised

impairment losses reversed

Other disclosures:

If an individual impairment loss (reversal) is material disclose: [IAS 36.130]

events and circumstances resulting in the impairment loss

amount of the loss or reversal

individual asset: nature and segment to which it relates

cash generating unit: description, amount of impairment loss (reversal) by class of assets and

segment

if recoverable amount is fair value less costs of disposal, the level of the fair value hierarchy

(from IFRS 13 Fair Value Measurement) within which the fair value measurement is

categorised, the valuation techniques used to measure fair value less costs of disposal and

the key assumptions used in the measurement of fair value measurements categorised

within 'Level 2' and 'Level 3' of the fair value hierarchy*

if recoverable amount has been determined on the basis of value in use, or on the basis of

fair value less costs of disposal using a present value technique*, disclose the discount rate

* Amendments introduced by Recoverable Amount Disclosures for Non-Financial Assets, effective

for annual periods beginning on or after 1 January 2014.

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

lOMoARcPSD|5011990

If impairment losses recognised (reversed) are material in aggregate to the financial statements as a

whole, disclose: [IAS 36.131]

main classes of assets affected

main events and circumstances

Downloaded by AMIT SINGH (amitsingh4245@gmail.com)

You might also like

- A. External Financial Reporting Decisions NotesDocument146 pagesA. External Financial Reporting Decisions Notesamitsinghslideshare100% (3)

- (Intersections) Arthur J. DiFuria, Walter Melion - Ekphrastic Image-Making in Early Modern Europe, 1500-1700. 79-Brill (2021)Document884 pages(Intersections) Arthur J. DiFuria, Walter Melion - Ekphrastic Image-Making in Early Modern Europe, 1500-1700. 79-Brill (2021)analauraiNo ratings yet

- Gym ShorthandDocument3 pagesGym ShorthandMar100% (3)

- List of IFRS Corresponding To The Ind AS: S No. Ifrs/ IAS Indian Accounting Standard NameDocument4 pagesList of IFRS Corresponding To The Ind AS: S No. Ifrs/ IAS Indian Accounting Standard Nameamitsinghslideshare100% (1)

- Accounting Standards ProjectDocument6 pagesAccounting Standards ProjectPuneet ChawlaNo ratings yet

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- US CMA - Part 1 TerminologyDocument127 pagesUS CMA - Part 1 TerminologyamitsinghslideshareNo ratings yet

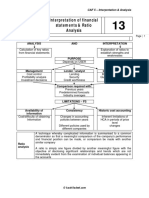

- Interpretation of Financial Statements & Ratio AnalysisDocument35 pagesInterpretation of Financial Statements & Ratio Analysisamitsinghslideshare67% (3)

- International Public Sector Accounting Standards (IPSAS)Document40 pagesInternational Public Sector Accounting Standards (IPSAS)budsy.lambaNo ratings yet

- ICAP TRsDocument45 pagesICAP TRsSyed Azhar Abbas0% (1)

- Wa0033.Document38 pagesWa0033.Baqar BaigNo ratings yet

- IFRS - IntroductionDocument16 pagesIFRS - IntroductionAnonymous rkZNo8No ratings yet

- Objective of PAS 1Document7 pagesObjective of PAS 1kristelle0marisseNo ratings yet

- List of International Financial Reporting Standards in 2022 Updated - 62f2074aDocument18 pagesList of International Financial Reporting Standards in 2022 Updated - 62f2074aCA Naveen Kumar BalanNo ratings yet

- Auditing PASDocument59 pagesAuditing PASjulie anne mae mendozaNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument6 pagesIas 1 Presentation of Financial Statementsa_michalczyk800% (2)

- Indian Accounting Standards (Ind As)Document33 pagesIndian Accounting Standards (Ind As)sandeshNo ratings yet

- Indian and International Accounting StandardsDocument13 pagesIndian and International Accounting StandardsBhanu PrakashNo ratings yet

- Philippine Accounting Standards 1 Presentation of Financial StatementsDocument10 pagesPhilippine Accounting Standards 1 Presentation of Financial StatementsJBNo ratings yet

- Ias 1Document6 pagesIas 1Ruth Job L. SalamancaNo ratings yet

- International Public Sector Accounting Standards BoardDocument10 pagesInternational Public Sector Accounting Standards Boardashique.graspNo ratings yet

- Notes 3Document12 pagesNotes 3sjayceelynNo ratings yet

- Objective of PAS 1Document8 pagesObjective of PAS 1ROB101512No ratings yet

- Accounting StandardDocument8 pagesAccounting StandardGaurav NanwaniNo ratings yet

- NUWAMANYA PATIENCE-IAS and IFRS-1Document20 pagesNUWAMANYA PATIENCE-IAS and IFRS-1MUSINGUZI IVANNo ratings yet

- Pas 1Document11 pagesPas 1yvetooot50% (4)

- unit-2-FAADocument12 pagesunit-2-FAASaloniNo ratings yet

- IAS 1 - Presentation of Financial StatementsDocument12 pagesIAS 1 - Presentation of Financial StatementsnadeemNo ratings yet

- IPSAS overviewDocument98 pagesIPSAS overviewraopaoahmedabadNo ratings yet

- List of Accounting Standards (As 1 - 32) of ICAI (Download PDF Copy) - CA ClubDocument7 pagesList of Accounting Standards (As 1 - 32) of ICAI (Download PDF Copy) - CA ClubMahipal GadhaviNo ratings yet

- Ias 1Document10 pagesIas 1Pangem100% (1)

- Explanation Financial StatementsDocument3 pagesExplanation Financial StatementsitsmekuskusumaNo ratings yet

- Ipsas 4Document19 pagesIpsas 4fuffun6No ratings yet

- Current Applicable International Accounting Standard (IAS) Under IASBDocument11 pagesCurrent Applicable International Accounting Standard (IAS) Under IASBEZEKIEL100% (1)

- 5th SEM ADVANCED ACCOUNTING MATERIAL - pdf298Document29 pages5th SEM ADVANCED ACCOUNTING MATERIAL - pdf298Dhanush KumarNo ratings yet

- 5 601a Assignment 6 PDFDocument11 pages5 601a Assignment 6 PDFItti SinghNo ratings yet

- Summary of Ias 1Document8 pagesSummary of Ias 1g0025No ratings yet

- 1Document62 pages1ShuvO DeYNo ratings yet

- Topic-8 Difference Between Indian Accounting Standards and IfrsDocument69 pagesTopic-8 Difference Between Indian Accounting Standards and IfrsPahul Walia83% (6)

- Acct 2014 - Ias 1Document23 pagesAcct 2014 - Ias 1Nicholas WilliamsNo ratings yet

- Summary of Ias 1Document10 pagesSummary of Ias 1eloi94No ratings yet

- IAS 1 - Presentation of Financial StatementsDocument8 pagesIAS 1 - Presentation of Financial StatementsCaia VelazquezNo ratings yet

- IasDocument62 pagesIasHAKUNA MATATANo ratings yet

- Ca10 0120Document16 pagesCa10 0120Amit KumarNo ratings yet

- U4Tjr_IFRSDocument8 pagesU4Tjr_IFRSkarkera20No ratings yet

- IAS 1 Preparation of FS PDFDocument12 pagesIAS 1 Preparation of FS PDFJohn Carlo SantianoNo ratings yet

- Expo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsDocument26 pagesExpo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsratiNo ratings yet

- Introduction To IFRSDocument13 pagesIntroduction To IFRSgovindsekharNo ratings yet

- Summary of IASDocument10 pagesSummary of IASSongs WorldNo ratings yet

- Ias Updated CompletedDocument92 pagesIas Updated CompletedTahir_Sartaj_1148No ratings yet

- Ca IfrsDocument7 pagesCa IfrsyogeshNo ratings yet

- Pas 1,2,16Document17 pagesPas 1,2,16Cristopherson PerezNo ratings yet

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977Viswanathan SrkNo ratings yet

- Presentation of Financial Statements:: International Accounting Standards IAS 1Document19 pagesPresentation of Financial Statements:: International Accounting Standards IAS 1Barif khanNo ratings yet

- Accounting Standards Board (ASB) in 1977Document15 pagesAccounting Standards Board (ASB) in 1977ashish kumar jhaNo ratings yet

- Summaries of International Accounting StandardsDocument69 pagesSummaries of International Accounting StandardsneelumshahzaadiNo ratings yet

- Conceptual Framework For Financial Reporting 2018Document5 pagesConceptual Framework For Financial Reporting 2018aprildion riveraNo ratings yet

- List of ICAI's Mandatory Accounting Standards (AS 1 29)Document3 pagesList of ICAI's Mandatory Accounting Standards (AS 1 29)Nishant bhardwaj100% (1)

- Summaries of International Accounting StandardsDocument68 pagesSummaries of International Accounting Standardsrakhee karNo ratings yet

- Group 47 Assignment Acc306Document18 pagesGroup 47 Assignment Acc306Nathanael MudohNo ratings yet

- Apuntes principiDocument38 pagesApuntes principiMarcos Sanz MielgoNo ratings yet

- Objective of IAS 1Document12 pagesObjective of IAS 1Emman P. ArimbuyutanNo ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 21-24From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 21-24No ratings yet

- Codification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23From EverandCodification of Statements on Standards for Accounting and Review Services: Numbers 1 - 23No ratings yet

- DipIFR TextbookDocument379 pagesDipIFR TextbookamitsinghslideshareNo ratings yet

- Ratio AnalysisDocument81 pagesRatio Analysisamitsinghslideshare100% (2)

- Arithmetic Functions of EXCEL: The SUM Function: To Add A Column or A Row of Numbers Follow The Steps BelowDocument3 pagesArithmetic Functions of EXCEL: The SUM Function: To Add A Column or A Row of Numbers Follow The Steps BelowamitsinghslideshareNo ratings yet

- IMADocument30 pagesIMANataraj RamachandranNo ratings yet

- 2014 MCQ Part 1-76Document27 pages2014 MCQ Part 1-76amitsinghslideshareNo ratings yet

- Indas 27 SFSDocument2 pagesIndas 27 SFSamitsinghslideshareNo ratings yet

- Question 3: Ias 8 Policies, Estimates & ErrorsDocument2 pagesQuestion 3: Ias 8 Policies, Estimates & ErrorsamitsinghslideshareNo ratings yet

- IFRS 15 (CAF5 S18) : Part (A) (05) Part (B)Document1 pageIFRS 15 (CAF5 S18) : Part (A) (05) Part (B)amitsinghslideshareNo ratings yet

- Consolidation Notes Consolidated Statement of Cash FlowsDocument10 pagesConsolidation Notes Consolidated Statement of Cash FlowsamitsinghslideshareNo ratings yet

- Question 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantDocument3 pagesQuestion 2: Ias 7 Statements of Cash Flows: The Following Information Is RelevantamitsinghslideshareNo ratings yet

- IAS 24 Related Party Disclosures (ICAP C6 S07) : Page 1 of 3Document3 pagesIAS 24 Related Party Disclosures (ICAP C6 S07) : Page 1 of 3amitsinghslideshareNo ratings yet

- Overview of IAS 19Document9 pagesOverview of IAS 19amitsinghslideshareNo ratings yet

- Question 1: Ifrs 9 - Financial InstrumentsDocument2 pagesQuestion 1: Ifrs 9 - Financial InstrumentsamitsinghslideshareNo ratings yet

- Question 5: Ifrs 9 - Financial InstrumentsDocument2 pagesQuestion 5: Ifrs 9 - Financial InstrumentsamitsinghslideshareNo ratings yet

- Question 2: Ifrs 9 - Financial InstrumentsDocument2 pagesQuestion 2: Ifrs 9 - Financial InstrumentsamitsinghslideshareNo ratings yet

- Ifrs 2 Share Based PaymentsDocument10 pagesIfrs 2 Share Based PaymentsamitsinghslideshareNo ratings yet

- 12 IAS 7 Statement of Cash FlowsDocument60 pages12 IAS 7 Statement of Cash Flowsamitsinghslideshare100% (1)

- Ifrs 15: Revenue From Contracts With CustomersDocument53 pagesIfrs 15: Revenue From Contracts With Customersamitsinghslideshare100% (1)

- Statement of Changes in Equity: Caf 5 - Ias 1Document24 pagesStatement of Changes in Equity: Caf 5 - Ias 1amitsinghslideshare100% (1)

- Cyber Security & Cybercrime Strategies Sri Lankan ExperienceDocument14 pagesCyber Security & Cybercrime Strategies Sri Lankan ExperienceNirosha RathnayakeNo ratings yet

- Silicones and PhosphazenesDocument13 pagesSilicones and Phosphazenesaanchal pathakNo ratings yet

- Department of Education: District/School Mid-Year Assessment and Inset For School Heads and TeachersDocument9 pagesDepartment of Education: District/School Mid-Year Assessment and Inset For School Heads and Teacherschinx camralNo ratings yet

- Vata Dosha in Ayurveda - Ayur Times PDFDocument15 pagesVata Dosha in Ayurveda - Ayur Times PDFAnand GNo ratings yet

- Instant download College Accounting Chapters 1 12 11th Edition Tracie L. Nobles pdf all chapterDocument44 pagesInstant download College Accounting Chapters 1 12 11th Edition Tracie L. Nobles pdf all chapterarianiheewon100% (1)

- Atienza vs. BOM and SiosonDocument2 pagesAtienza vs. BOM and SiosonCaitlin KintanarNo ratings yet

- Cross Elasticity of DemandDocument2 pagesCross Elasticity of DemandSushil Kapoor100% (1)

- Solicitation LetterDocument3 pagesSolicitation LetterDione Klarisse GuevaraNo ratings yet

- Xeno LinguistsDocument2 pagesXeno Linguistsyavewa3885No ratings yet

- Raghav SharmaDocument2 pagesRaghav Sharmashivay bhatejaNo ratings yet

- Risk Assessment in Public-Private Partnership Infrastructure Projects Empirical Comparison Between Ghana and Hong KongDocument22 pagesRisk Assessment in Public-Private Partnership Infrastructure Projects Empirical Comparison Between Ghana and Hong KongAndrey SamoilovNo ratings yet

- Female Sex Offenders A Challenge To Certain Paradigms Meta Analysis PDFDocument9 pagesFemale Sex Offenders A Challenge To Certain Paradigms Meta Analysis PDFPatricia Elaine JordanNo ratings yet

- Presented By: "Market Potential of MDF (Medium Density Fibreboard) in Kanpur and Surrondings"Document25 pagesPresented By: "Market Potential of MDF (Medium Density Fibreboard) in Kanpur and Surrondings"Ajay Bahadur VermaNo ratings yet

- Coms325 Notes 6Document4 pagesComs325 Notes 6kimNo ratings yet

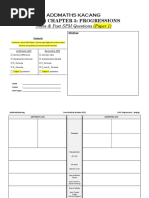

- 01 F4C5 Progressions AMKacangDocument7 pages01 F4C5 Progressions AMKacangZulkarnain IrsyadNo ratings yet

- 6 1 200 Ipecacuanha-Root - (Ipecacuanhae-Radix)Document2 pages6 1 200 Ipecacuanha-Root - (Ipecacuanhae-Radix)Fitry Ana UtamNo ratings yet

- Scoring RubricDocument1 pageScoring Rubricapi-191675997No ratings yet

- Power of The DogDocument19 pagesPower of The DogCosimo Dell'OrtoNo ratings yet

- LKPD Descriptive TextDocument6 pagesLKPD Descriptive TextFakhri MukaromahNo ratings yet

- Siqueira Et Al 2024 - 2Document21 pagesSiqueira Et Al 2024 - 2vitorsouzavianasilvaNo ratings yet

- SQL Lite Create, DeleteDocument26 pagesSQL Lite Create, Deleteekosup442No ratings yet

- By MuetDocument4 pagesBy MuetNur AsyuraNo ratings yet

- Ali Ibn Abu TalibDocument3 pagesAli Ibn Abu TalibAreef OustaadNo ratings yet

- Epic Mahabharata CharactersDocument1 pageEpic Mahabharata CharactersAlthea Kenz Cacal DelosoNo ratings yet

- Wilfred Owen ExposureDocument3 pagesWilfred Owen ExposureTreesa VarugheseNo ratings yet

- 5-6 - Storage Dan Warehousing - 1Document34 pages5-6 - Storage Dan Warehousing - 1SITI WATSIQOHNo ratings yet

- Ground Improvement Techniques: Sneha P. Hirkane, N. G. Gore, P. J. SalunkeDocument3 pagesGround Improvement Techniques: Sneha P. Hirkane, N. G. Gore, P. J. SalunkevinodykrNo ratings yet

- Template For Literary Analysis of FictionDocument8 pagesTemplate For Literary Analysis of FictionTequila Mone' Robinson100% (1)