Conventional Vs Islamic Trade Finance PDF Free

Conventional Vs Islamic Trade Finance PDF Free

Uploaded by

JAS 0313Copyright:

Available Formats

Conventional Vs Islamic Trade Finance PDF Free

Conventional Vs Islamic Trade Finance PDF Free

Uploaded by

JAS 0313Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Conventional Vs Islamic Trade Finance PDF Free

Conventional Vs Islamic Trade Finance PDF Free

Uploaded by

JAS 0313Copyright:

Available Formats

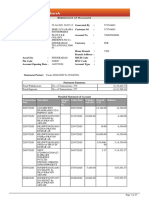

CONVENTIONAL VS ISLAMIC TRADE FINANCE

WAKALAH

CONVENTIONAL LETTER OF CREDIT

ISLAMIC LETTER OF CREDIT

Agency Agency

Transit interest No transit interest

Upon negotiation – foreign based Compensation is claimed for late

interest payment

Standard remittance days interest

Penalty is charged for late payment

MURABAHAH

TRUST RECEIPT

ISLAMIC LETTER OF CREDIT

Based on simple interest basis Based on murabahah principle

Payment of principal plus interest Mark-up deferred payment sales

upon maturity (tail end) Buying and selling

Interest may be varied after issuance Payment tail-end

of the trust receipt. The customer may Profit fixed

end up paying more when the interest Budget is simpler

rate increases-uncertain profit

Budget may not be accurate

BANKER ACCEPTANCE ISLAMIC ACCEPTED BILL

Based on discounting Purchase & Import

The customer pays the interest plus Based on murabahah and bay al dayn

accepts commission upfront either by principles for purchase and import

the bank debiting customer’s current Mark-up deferred payment sales and

account or utilising overdraft facility sales of debt

Budget may not be accurate Full financing to the exact amount

Payment at tail-end

Islamic accepted bill draft drawn on

the customer, Islamic bank is the

drawer and customer is acceptance

Sales & Import

Based on bay al dayn principle or

sale of debt

Payment at tail-end

The Islamic bank is the acceptor and

the customer, the drawer

ISLAMIC

EXPORT CREDIT FINANCING

EXPORT CREDIT FINANCING

Purchases foreign bill at a discount ECR-i Pre Shipment

Overhead finances Based on murabahah and bay al dayn

Roll over on CP principles

Involves interest Finances the customer on a cost plus

mark-up basis

Discounts the bill with Exim Bank on

Bai al dayn basis or sales of debt

Does not finance overhead

No roll-over for CP

ECR-i Post Shipment

Bay al dayn concept or sale of debt

Discounting basis

CONVENTIONAL

ISLAMIC BANK GUARANTEE

LETTER OF GUARANTEE

Charges commission Based on kafalah (suretyship) or a

hybrid concept of al wakalah bi al

istithmar (investment agency) and

kafalah (suretyship)

Charges commission on pro-rata basis

or changes an agency fee for

managing the funds

You might also like

- Maf653 MindmapDocument1 pageMaf653 MindmapAniisa AthirahNo ratings yet

- Conventional Vs Islamic Trade FinanceDocument2 pagesConventional Vs Islamic Trade FinanceQyla HusnaNo ratings yet

- Difas-2011-Ist-Pr 02-WilsonDocument12 pagesDifas-2011-Ist-Pr 02-WilsonWana MaliNo ratings yet

- Bank IslamDocument41 pagesBank Islamaim_nainaNo ratings yet

- Sources of FundsDocument26 pagesSources of FundsTahir DestaNo ratings yet

- C7-Islamic Trade Financing InstrumentsDocument5 pagesC7-Islamic Trade Financing Instrumentsnurainilmi2001No ratings yet

- Islamic Banking Products Vs Conventional Banking ProductsDocument6 pagesIslamic Banking Products Vs Conventional Banking Productsdontsnd888No ratings yet

- 2017 Mitsubishi Mirage 97704Document6 pages2017 Mitsubishi Mirage 97704Van OpenianoNo ratings yet

- If-1Document27 pagesIf-1Asad MemonNo ratings yet

- Credit Financing in Islamic Financial in PDFDocument2 pagesCredit Financing in Islamic Financial in PDFasadfNo ratings yet

- Islamic Finance PresentationDocument21 pagesIslamic Finance PresentationZINEB YDIRNo ratings yet

- Important Lending Regulations: Credmfi/FincredDocument11 pagesImportant Lending Regulations: Credmfi/FincredNina CruzNo ratings yet

- INBT 211Document5 pagesINBT 211iftinay8197antNo ratings yet

- Wealth KFS INPC FinanceDocument4 pagesWealth KFS INPC FinanceAtta Ur RahmanNo ratings yet

- Difference and Similarities in Islamic ADocument16 pagesDifference and Similarities in Islamic ASayed Sharif HashimiNo ratings yet

- Uib2612 1730 Lecture 2Document62 pagesUib2612 1730 Lecture 2huiminlim0626No ratings yet

- Credit Operations in PakistanDocument157 pagesCredit Operations in PakistanAdnan Adil HussainNo ratings yet

- Fin 370 Chapter 1Document24 pagesFin 370 Chapter 1my chimchimNo ratings yet

- Islamic Capital Market: SukukDocument10 pagesIslamic Capital Market: SukukShafik AliNo ratings yet

- Chapter 25: Step by Step Murabaha Financing: Bank ClientDocument3 pagesChapter 25: Step by Step Murabaha Financing: Bank ClientAlton JurahNo ratings yet

- Al-Wadeah Principal and It's Feature Al-Wadeah Principal and It's FeatureDocument8 pagesAl-Wadeah Principal and It's Feature Al-Wadeah Principal and It's Featurevivekananda RoyNo ratings yet

- An Introduction To Islamic Banking & Finance ProductsDocument15 pagesAn Introduction To Islamic Banking & Finance Productsim_sNo ratings yet

- Islamic Retail Financing ProductsDocument79 pagesIslamic Retail Financing ProductsAishiterru Gurl'sNo ratings yet

- Presented To:: Islamic FinanceDocument31 pagesPresented To:: Islamic FinanceRizwan Bin RafiqNo ratings yet

- Bank GuaranteeDocument17 pagesBank Guaranteevimal kumar dwivedi100% (1)

- Chapter 6 - Islamic Home LoansDocument7 pagesChapter 6 - Islamic Home LoansVIDHYA A P PANIRSELVAM UnknownNo ratings yet

- Islamic Banking Slides - Copy BWDocument13 pagesIslamic Banking Slides - Copy BWAbder AlamiNo ratings yet

- IFCP - Class 4Document16 pagesIFCP - Class 4Jamal NasirNo ratings yet

- Letter of Credit FaqsDocument8 pagesLetter of Credit FaqsMohamed AbdelbasetNo ratings yet

- Working CapitalDocument11 pagesWorking Capitalharshshah2160No ratings yet

- Loan ReceivablesDocument4 pagesLoan ReceivablesEyra MercadejasNo ratings yet

- Letter of Credit AmityDocument33 pagesLetter of Credit AmitySudhir Kochhar Fema AuthorNo ratings yet

- Factoring AND Forfaitin GDocument35 pagesFactoring AND Forfaitin GChinmayee ChoudhuryNo ratings yet

- Difference Between Conventional and Islamic Products AssetDocument9 pagesDifference Between Conventional and Islamic Products AssetTahir DestaNo ratings yet

- Chapter 8 - BOCDocument4 pagesChapter 8 - BOCAramina Cabigting BocNo ratings yet

- UNIt 1 BODocument38 pagesUNIt 1 BORakshitha. A GedamNo ratings yet

- Lecture 5 - Banker AcceptancesDocument14 pagesLecture 5 - Banker AcceptancesYvonne100% (2)

- Difference Between Islamic Banking & Conventional BankingDocument3 pagesDifference Between Islamic Banking & Conventional BankingMuhammad BurhanNo ratings yet

- Islamic Banking: Presented by Lakshmi and ShameemDocument21 pagesIslamic Banking: Presented by Lakshmi and ShameemvidyaposhakNo ratings yet

- Week 4 Topic 1 Aqad and Sources of FundsDocument41 pagesWeek 4 Topic 1 Aqad and Sources of Funds2 Ashlih Al TsabatNo ratings yet

- SecuritisationDocument31 pagesSecuritisationAbhishek MalikNo ratings yet

- ASB-i Application Form 100620Document25 pagesASB-i Application Form 100620nur hazwaniNo ratings yet

- Module 5 - Substantive Test of CashDocument6 pagesModule 5 - Substantive Test of CashJesievelle Villafuerte NapaoNo ratings yet

- Islamic Banking and Investment by ML. Shoayb JoosubDocument26 pagesIslamic Banking and Investment by ML. Shoayb JoosubroytanladiasanNo ratings yet

- M.A. S3 Module 2 - Part 2Document5 pagesM.A. S3 Module 2 - Part 242 Abhishek Paul M ssNo ratings yet

- MurabahaisbfDocument18 pagesMurabahaisbfHaider RazaNo ratings yet

- Strategic FinanceDocument15 pagesStrategic FinanceSawaira QureshiNo ratings yet

- SBF270 - Chapter 3 Murabaha and Tawarruq - UpdatedDocument35 pagesSBF270 - Chapter 3 Murabaha and Tawarruq - Updatedalaamabood6No ratings yet

- Reviewer in Business FinanceDocument3 pagesReviewer in Business FinancebaekhyunNo ratings yet

- Islamic Financial System Principles and Operations PDF 401 500Document100 pagesIslamic Financial System Principles and Operations PDF 401 500Asdelina R100% (1)

- Collatrerals Moveable & ImmoveablesDocument223 pagesCollatrerals Moveable & ImmoveablesAdnan Adil HussainNo ratings yet

- A Quick Guide To Credit Linked Notes, (CLN)Document2 pagesA Quick Guide To Credit Linked Notes, (CLN)Keval ShahNo ratings yet

- Money and BankingpptDocument19 pagesMoney and BankingpptSania ZaheerNo ratings yet

- Group 2 - Cash TransferDocument34 pagesGroup 2 - Cash TransferCiocon JewelynNo ratings yet

- Short-Term Financing ReviewerDocument3 pagesShort-Term Financing ReviewerSeleenaNo ratings yet

- Islamic Banking and Finance A#5Document6 pagesIslamic Banking and Finance A#5Abdul Wahid KhanNo ratings yet

- 8th Mode of FinancingDocument30 pages8th Mode of FinancingYaseen IqbalNo ratings yet

- PRESENTATION Imu503 ATIKAH (Autosaved)Document9 pagesPRESENTATION Imu503 ATIKAH (Autosaved)ATIKAH NABILAH YUSRINo ratings yet

- Home Plan: PurchaseDocument16 pagesHome Plan: PurchaseYasin1231 AhmedNo ratings yet

- DepreciationDocument10 pagesDepreciationJAS 0313No ratings yet

- Lipo FifoDocument4 pagesLipo FifoJAS 0313No ratings yet

- NI Act Cheque, Endorsement, CrossingDocument6 pagesNI Act Cheque, Endorsement, CrossingJAS 0313No ratings yet

- Islamic Values and Principles in The Organization: A Review of LiteratureDocument7 pagesIslamic Values and Principles in The Organization: A Review of LiteratureJAS 0313No ratings yet

- Vdocument - in - Ship Security Plan Web View Ship Security Plan For MV Aoekarla Prepared byDocument114 pagesVdocument - in - Ship Security Plan Web View Ship Security Plan For MV Aoekarla Prepared byEge SertNo ratings yet

- Computer Science MCQs Practice Test 1 PDFDocument4 pagesComputer Science MCQs Practice Test 1 PDFPriyanka Paul0% (1)

- The Most Important Thing Uncommon Sense For The Thoughtful Investor by Howard MarksDocument13 pagesThe Most Important Thing Uncommon Sense For The Thoughtful Investor by Howard MarksVladimir OlefirenkoNo ratings yet

- EEFM PracticeDocument4 pagesEEFM PracticePhoenixRoboNo ratings yet

- Lakme's Positioning in Terms of Personality and Self Concept: LakmeDocument11 pagesLakme's Positioning in Terms of Personality and Self Concept: Lakme9427590749100% (3)

- 2.battery SizingDocument14 pages2.battery SizingPrabhash Verma0% (1)

- CnPilot Enterprise Wi Fi Access Points 4.2 Hardware and Installation GuideDocument44 pagesCnPilot Enterprise Wi Fi Access Points 4.2 Hardware and Installation GuidesuhendraNo ratings yet

- Solid Waste Management BudgetDocument43 pagesSolid Waste Management BudgetWilfredo Gabata SinoyNo ratings yet

- PR210 (MS-1222) Part NumberDocument34 pagesPR210 (MS-1222) Part Numberwirelesssoul100% (1)

- Java Servlets 110317050338 Phpapp01 PDFDocument57 pagesJava Servlets 110317050338 Phpapp01 PDFsakshamNo ratings yet

- Abra Mining - Iacgr 2020Document65 pagesAbra Mining - Iacgr 2020Nichole John UsonNo ratings yet

- Transaction Date Narration Cheque / Ref No. Value Date Withdra Wal (DR) Deposit (CR) BalanceDocument27 pagesTransaction Date Narration Cheque / Ref No. Value Date Withdra Wal (DR) Deposit (CR) BalancePravin kumar aenamNo ratings yet

- Doctrine: The Lawyer's Oath Is NOT A Mere Ceremony or Formality For Practicing Law. Every Lawyer ShouldDocument1 pageDoctrine: The Lawyer's Oath Is NOT A Mere Ceremony or Formality For Practicing Law. Every Lawyer ShoulddadcansancioNo ratings yet

- F-SM6R-DM1A-A22-L1: Product DatasheetDocument2 pagesF-SM6R-DM1A-A22-L1: Product DatasheetEzraKitrieGunawanNo ratings yet

- Personnel Safety: Working With PerliteDocument2 pagesPersonnel Safety: Working With Perlitehosein100% (1)

- ESMC2018 Technical Program Web 0 PDFDocument291 pagesESMC2018 Technical Program Web 0 PDFSenthilkumar VNo ratings yet

- Difference Between Dyke and Sill - Difference BetweenDocument1 pageDifference Between Dyke and Sill - Difference BetweenMbewēNo ratings yet

- Project SynopsysDocument4 pagesProject Synopsyspratham mishraNo ratings yet

- Impact of Macroeconomic Policies To The Unemployment Situation in The PhilippinesDocument7 pagesImpact of Macroeconomic Policies To The Unemployment Situation in The Philippineskenah suzzane angNo ratings yet

- Design Calculation: Hindustan Construction Co. LTDDocument13 pagesDesign Calculation: Hindustan Construction Co. LTDSharat SahaNo ratings yet

- Detailed StatementDocument19 pagesDetailed StatementPushpendra ChauhanNo ratings yet

- Harris-Todaro Migration ModelDocument2 pagesHarris-Todaro Migration ModelSamira Islam100% (1)

- ProjectsDocument10 pagesProjectsm sherNo ratings yet

- Witney Town Council Budget Info 2023 To 2024Document4 pagesWitney Town Council Budget Info 2023 To 2024cristianburlacu1995No ratings yet

- VLSI Design Automation of A Montgomery Multiplier Using Astro by ...Document24 pagesVLSI Design Automation of A Montgomery Multiplier Using Astro by ...Ramya ScNo ratings yet

- Ductile Iron Castings: Standard Specification ForDocument6 pagesDuctile Iron Castings: Standard Specification ForLuis F. LoachamínNo ratings yet

- B 3 D 3 B 5Document16 pagesB 3 D 3 B 5Fausto Tito100% (1)

- Letter of IntentDocument2 pagesLetter of IntentRic Napus0% (1)

- Project Report Submitted in Partial Fulfillment of The Requirement of Bachelor of Business Administration (Banking and Insurance)Document5 pagesProject Report Submitted in Partial Fulfillment of The Requirement of Bachelor of Business Administration (Banking and Insurance)Rohit SolankiNo ratings yet

- MR Alexis Cell Conde San Antonio ST., Brgy. Paya 01 6811 GiporlosDocument1 pageMR Alexis Cell Conde San Antonio ST., Brgy. Paya 01 6811 GiporlosAlexis Cell A. CondeNo ratings yet