BBBBB

BBBBB

Uploaded by

Alvira FajriCopyright:

Available Formats

BBBBB

BBBBB

Uploaded by

Alvira FajriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

BBBBB

BBBBB

Uploaded by

Alvira FajriCopyright:

Available Formats

JAWABAN UAS 2018 FATA 2018

FINANCIAL ACCOUNTING TEACHING ASSISTANTS 2018

JAWABAN UAS AKUNTANSI KEUANGAN II 2018

Part I: True/False

1. False. The first step in revenue recognition process is to identify the contract.

2. True.

3. True. Deferred tax asset represents the increase in taxes refundable (or saved) in future

years as a result of deductible temporary differences existing at the end of the current

year.

4. False. Under the loss carryback approach, companies must apply the loss to the earlier

year first and then to the second year.

5. True.

6. True. If the classification error is found in the same period, an entry must be made to

reclassify the accounts.

7. False. The company reconciles net income to net cash flow from operating activities

when using the indirect method only.

8. False. Under the accrual basis of accounting, net income is not the same as net cash flow

from operating activities, because it only represents cash-based income from operating

activities.

9. True.

10. False. Companies must recognize the entire expected loss on an unprofitable contract in

the current period under both the percentage-of-completion method and the cost-

recovery method. (18-42)

Part II: Multiple Choice

1. D

2. D (18-30)

3. D. $1,500,000 + ($90,000 / 30%) = $1,800,000

4. A. $800,000 x 28% = $224,000

5. D.

6. A. $800,000 x (1 – 0.3) = $560,000

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

7. A. $37,500 x (1 – 0.3) = $26,250

8. B. (24-9)

9. D (18-31)

10. B

Part III: Theory

1.

a) Temporary difference. This is because for income tax purposes, the revenue recognition

is only deferred until cash is collected (timing difference).

b) Permanent difference. This is because the difference in pretax income and taxable

income will never reverse. U.S tax laws allow a company that owns stock in another

corporation to deduct 80% of the dividends it receives from that company. Taxes will not

be paid on those dividends deducted. However, this amount will not be deducted for

financial reporting purposes.

c) Temporary difference. Assuming the estimated warranty amount is valid, this will be a

temporary difference because eventually total amount deducted for accounting and tax

purposes will be the same over the three-year period (timing difference).

2.

a) Disclosed in the notes to financial statements as contingent liability. This is because the

likelihood of the event is unknown whether or not it is possible or probable and the

amount of settlement cannot be estimated.

b) Discontinued operations should not only be reported in the income statement, but also

disclosed in the notes to financial statements. Menurut PSAK 58: Aset Tidak Lancar

yang Dimiliki untuk Dijual dan Operasi yang Dihentikan, dalam penyajian operasi yang

dihentikan, entitas harus mengungkapkan:

Suatu jumlah tunggal dalam laporan laba rugi komprehensif atas laba/rugi setelah

pajak dari operasi yang dihentikan dan dan yang diakui dalam mengukur nilai

wajar aset terkait operasi yang dihentikan

Analisis terhadap jumlah tunggal terhadap pendapatan, beban, laba/rugi sebelum

pajak, beban pajak penghasilan dll

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

Arus kas neto yang dapat diatribusikan ke aktivitas operasi, investasi, dan

pendanaan terkait operasi yang dihentikan

Jumlah penghasilan dari operasi yang dilanjutkan dan yang dihentikan yang dapat

diatribusikan pada pemilik induk perusahaan

c) Disclosed in the notes to financial statements as contingent asset. Since the exact amount

of a potential gain is not known, it is not recorded in the financial statements. However, it

could be disclosed in the notes of a financial statements as the amount is significant.

Part IV: Essay

1.

A) 1. Since the change is in accounting estimate, so it must be implemented prospectively.

The change in estimates was done in 2016, so the company does not have to reduce the

2015 net income. In order to fix this mistake, the company should reverse the reduction

by adding $20,000 back to the 2015 net income.

2. Change in inventory method from average to FIFO is a change in accounting policy,

which should be implemented retrospectively. Since the change was done in 2018,

therefore the company must also adjust the effects of this change to the financial

statements of previous years.

3. a) The overstatement of inventory is an accounting error which should be

implemented retrospectively. The error was for 2017 ending inventory, and was

discovered in 2018, so both the 2017 and 2018 financial statements should be restated.

b) The tax settlement was correctly treated.

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

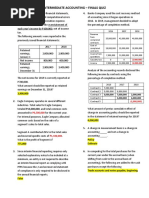

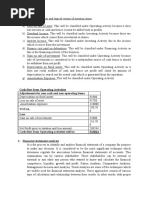

B)

2015 2016 2017 2018

Net Income (unadjusted) 280,000 320,000 410,000 552,000

1. BDE adjustment (20,000)

2. Inventory method adjustment 30,000 10,000 20,000 (32,000)

3. a) Inventory overstatement error (28,000) 28,000

Net Income (adjusted) 290,000 330,000 402,000 548,000

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

SOAL TAMBAHAN

1. Grill Master Company sells total outdoor grilling solutions, providing gas and charcoal grills,

accessories, and installation services for custom patio grilling stations.

Instructions

Respond to the requirements related to the following independent revenue arrangements for Grill

Master products and services.

(a) Grill Master offers contract GM205, which is comprised of a free-standing gas grill for small

patio use plus installation to a customer’s gas line for a total price £800. On a standalone basis,

the grill sells for £700 (cost £425), and Grill Master estimates that the fair value of the

installation service (based on cost-plus estimation) is £150. Grill Master signed 10 GM205

contracts on April 20, 2015, and customers paid the contract price in cash. The grills were

delivered and installed on May 15, 2015. Prepare journal entries for Grill Master for GM205 in

April and May 2015.

(b) A local shire is planning major renovations in its parks during 2015 and enters into a contract

with Grill Master to purchase 400 durable, easy maintenance, standard charcoal grills during

2015. The grills are priced at £200 each (with a cost of £160 each), and Grill Master provides a

6% volume discount if the shire purchases at least 300 grills during 2015. On April 17, 2015,

Grill Master delivered and received payment for 280 grills. Based on prior experience with the

shire’s renovation projects, the delivery of this many grills makes it certain that the shire will

meet the discount threshold. Prepare the journal entries for Grill Master for grills sold on April

17, 2015.

(c) Grill Master sells its specialty combination gas/wood-fired grills to local restaurants. Each

grill is sold for £1,000 (cost £550) on credit with terms 3/30, net/90. Prepare the journal entries

for the sale of 20 grills on September 1, 2015, and upon payment, assuming the customer paid on

(1) September 25, 2015, and (2) October 15, 2015. Assume the company records sales net.

(d) On October 1, 2015, Grill Master sold one of its super deluxe combination gas/charcoal grills

to a local builder. The builder plans to install it in one of its “Parade of Homes” houses. Grill

Master accepted a 3-year, zero-interest-bearing note with face amount of £5,324. The grill has an

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

inventory cost of £2,700. An interest rate of 10% is an appropriate market rate of interest for this

customer. Prepare the journal entries on October 1, 2015, and December 31, 2015.

Solutions:

a. Revenue Allocation

$ 700

Grill = x $ 800=$ 658.82353 /unit

$ 850

= $ 658.82353 x 10 unit=$ 6,688.2353

$ 150

Installation = x $ 800=$ 141.17647 /unit

$ 850

= $ 141.17647 x 10 unit=$ 1,411.7647

Journal Entries

Apr 20, 2019 Cash ($800 x 10 units) $ 8,000

Unearned Sales Revenue (Grill) $6,588.2353

Unearned Service Revenue (Installation) $1,411.7647

Cost of Goods Sold ($425 x 10 units) $4,250

Inventory $4,250

May 15, 2019 Unearned Sales Revenue (Grill) $6,588.2353

Unearned Sales Revenue (Installation) $1,411.7647

Sales Revenue (Grill) $6,588.2353

Sales Revenue (Installation) $1,411.7647

b. Journal Entries

Apr 17, 2019 Cash $ 52,640

Sales Revenue $52,640

(280*$200-(6%*280*$200))

Cost of Goods Sold $44,800

Inventory $44,800

(280*$160)

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

c. Journal Entries

Sept 1, 2019 Accounts Receivable $19,400

Sales Revenue $19,400

(20*$1000 – (3%*20*$1,000))

Cost of Goods Sold $11,000

Inventory $11,000

(20*$550)

(1) if paid on September 25, 2019 (within discount period)

Sept 25, 2019 Cash $ 19,400

Accounts Receivable $19,400

(2) if paid on October 15, 2019 (no within discount period)

Oct 15, 2019 Cash $ 20,000

Accounts Receivable $19,400

Sales Discount Fortfeid $ 600

d. Journal Entries

Oct 1,2019 Notes Receivable $5,324

Sales Revenue $5,324

Cost of Goods Sold $2,700

Inventory $2,700

Dec 31, 2019 Notes Receivable $133.1

3 $133.1

Interest Revenue ( x 10 % x $ 5,324 ¿

12

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

JAWABAN UAS 2018 FATA 2018

2. SAK adalah suatu kerangka dalam prosedur pembuatan laporan keuangan agar terjadi

keseragaman dalam penyajian laporan keuangan. Standar akuntansi diperlukan untuk

memudahkan penyusunan laporan keuangan dan memudahkan penggunanya untuk

menginterpretasikan dan membandingkan laporan keuangan entitas yang berbeda-beda. SAK

dibuat oleh DSAK. SAK terdiri dari SAK umum berbasis IFRS, SAK Entitas Tanpa

Akuntabilitas Publik (ETAP), SAK Syariah, dan SAK Entitas Mikro Kecil Menengah (EMKM).

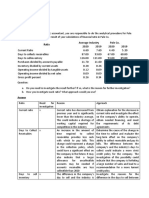

3. Perbedaan PSAK dan SAK ETAP

No. Elemen PSAK SAK ETAP

1. Laporan laba rugi Terdiri dari laporan laba rugi Hanya laporan laba rugi

komprehensif

2. Laporan arus kas Terdapat metode direct dan Hanya menggunakan

indirect metode indirect

3. Laporan keuangan Diatur dalam PSAK 65 Tidak diatur

konsolidasi dan terpisah

4. Investasi pada perusahaan Menggunakan metode biaya, Hanya menggunakan

asosiasi dan entitas anak metode ekuitas, dan metode nilai metode ekuitas

wajar

5. Properti investasi Menggunakan model nilai wajar Hanya menggunakan

dan model biaya model biaya

6. Biaya pinjaman Dapat dikapitalisasi Langsung dibebankan

7. Penurunan nilai aset terdapat aturan terkait Tidak diatur impairment

impairment pada goodwill pada goodwill

DANENDRA – MARGARETA – TITAN – WINONA FATA 2018

You might also like

- CHECKLIST OF DOCUMENTS For HOADocument5 pagesCHECKLIST OF DOCUMENTS For HOAJfm A Dazlac100% (10)

- Cases Inhouse ClassDocument5 pagesCases Inhouse ClassKevin DeswandaNo ratings yet

- 1 15 2022.PayStubSJ99Document1 page1 15 2022.PayStubSJ99troymc101No ratings yet

- The Big Picture: Brief ExercisesDocument13 pagesThe Big Picture: Brief ExercisesRacel Agonia0% (1)

- Quiz Midterm - Answer KeyDocument11 pagesQuiz Midterm - Answer KeyGloria BeltranNo ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- AP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document10 pagesAP-200Q (Quizzer - Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Bernadette Panican100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- AP Module 01 - Accounting Changes and ErrorsDocument10 pagesAP Module 01 - Accounting Changes and ErrorsjasfNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- E22-6 (LO 2) Accounting Changes-DepreciationDocument6 pagesE22-6 (LO 2) Accounting Changes-DepreciationRiana DeztianiNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- 3657 - Commerce - COMM-CT-302 - 3rd Sem - L - 2Document2 pages3657 - Commerce - COMM-CT-302 - 3rd Sem - L - 2Guru DattNo ratings yet

- Sol Installment SalesDocument16 pagesSol Installment SalesMaria Beatrice100% (1)

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- Installment SalesDocument3 pagesInstallment SalesIryne Kim PalatanNo ratings yet

- 02 Audit of Expenditure and Disbursements Cycle (Cont.)Document4 pages02 Audit of Expenditure and Disbursements Cycle (Cont.)Becky GonzagaNo ratings yet

- DepreciationDocument3 pagesDepreciationSumanth KumarNo ratings yet

- Accounting ErrorssDocument5 pagesAccounting ErrorssJuvilynNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Tutorial Set 2Document5 pagesTutorial Set 2djfiashideNo ratings yet

- Quiz 1. Special Revenue RecognitionDocument6 pagesQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.No ratings yet

- Basic Accounting Practice Problems 2Document1 pageBasic Accounting Practice Problems 2elagoluckylou.cmuNo ratings yet

- LEVEL 2 Online Quiz - Questions SET ADocument8 pagesLEVEL 2 Online Quiz - Questions SET AVincent Larrie MoldezNo ratings yet

- Ia3 Finals QuizDocument7 pagesIa3 Finals QuizJalyn Jalando-onNo ratings yet

- BEP Revision pdfDocument3 pagesBEP Revision pdfcarmeltsoupouNo ratings yet

- Balance Sheet Errors: Problem 1Document2 pagesBalance Sheet Errors: Problem 1Alyana SandiegoNo ratings yet

- Chapter 9Document7 pagesChapter 9jeanNo ratings yet

- Buscom Lecture-3Document4 pagesBuscom Lecture-3Dai SyNo ratings yet

- 助教課講義 Ch.4Document12 pages助教課講義 Ch.45213adamNo ratings yet

- Week 4 Tutorial QuestionsDocument5 pagesWeek 4 Tutorial QuestionsDe CemNo ratings yet

- AC15 Quiz 2Document6 pagesAC15 Quiz 2Kristine Esplana Toralde100% (1)

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Erika Larinay100% (1)

- Financial Accounting Question SetDocument24 pagesFinancial Accounting Question SetAlireza KafaeiNo ratings yet

- FINALS QUIZ Fin3Document11 pagesFINALS QUIZ Fin3Angela MartiresNo ratings yet

- Chapter 10Document8 pagesChapter 10Coursehero PremiumNo ratings yet

- 93 - Final PB MASDocument12 pages93 - Final PB MASEliny CruzNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- 29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2Document10 pages29 Ke-toan-quoc-te-2 201109 Đề-01 Cky3 CLC 13h30 10.09.2021-2uthanh2209No ratings yet

- FR 2021 Paper PrelimDocument10 pagesFR 2021 Paper PrelimshashalalaxiangNo ratings yet

- No.2 FA Assignment 3 Amato FIXDocument3 pagesNo.2 FA Assignment 3 Amato FIXKevin DeswandaNo ratings yet

- PDF Intermediate Accounting Volume 3 ValixDocument4 pagesPDF Intermediate Accounting Volume 3 ValixJosh Cruz CosNo ratings yet

- Last 3 Topics ExerciseDocument18 pagesLast 3 Topics Exercisepeiyu.ouyang31No ratings yet

- 8506 - Installment Sales - 113910598Document4 pages8506 - Installment Sales - 113910598Ryan CornistaNo ratings yet

- Glainier Industríal CorporationDocument43 pagesGlainier Industríal CorporationGraceila CalopeNo ratings yet

- SolutionQuestionnaireUNIT 3 - 2020Document5 pagesSolutionQuestionnaireUNIT 3 - 2020LiNo ratings yet

- Acc 3013 - Fwa Revision QuestionsDocument12 pagesAcc 3013 - Fwa Revision Questionsfalnuaimi001No ratings yet

- Acp - Acc417 Case Study 1Document6 pagesAcp - Acc417 Case Study 1Faker MejiaNo ratings yet

- AP Audit of Non-Current Liabilities Part 2Document2 pagesAP Audit of Non-Current Liabilities Part 2bangtansonyeondaNo ratings yet

- Project Question: Financial Management 1ADocument4 pagesProject Question: Financial Management 1AHashimRazaNo ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- CPA 1 Financial Accounting-1Document8 pagesCPA 1 Financial Accounting-1LYNETTE NYAKAISIKINo ratings yet

- Testbank - Error Correction Answer KeyDocument1 pageTestbank - Error Correction Answer KeyDawn Rei DangkiwNo ratings yet

- Error Correction Problem 1: Lord Gen A. Rilloraza, CPADocument5 pagesError Correction Problem 1: Lord Gen A. Rilloraza, CPAMae-shane SagayoNo ratings yet

- 2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFDocument25 pages2019.1.19 20 Aud Prob Error Correction Cash Inventory Non Financial Assets Equity PDFMae-shane SagayoNo ratings yet

- Intermediate Accounting Volume 3 ValixDocument4 pagesIntermediate Accounting Volume 3 ValixVyonne Ariane EdiongNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- MAS Final Preboard QuestionsDocument12 pagesMAS Final Preboard QuestionsVillanueva, Mariella De VeraNo ratings yet

- Act1104 Quiz No. 3 Problem 1Document6 pagesAct1104 Quiz No. 3 Problem 1DyenNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Sumber Skripsi - Investigation of Thai Listed Firms Financial Distress Using Macro & MicroDocument23 pagesSumber Skripsi - Investigation of Thai Listed Firms Financial Distress Using Macro & MicroAlvira FajriNo ratings yet

- Paper: SSRN-id900284Document37 pagesPaper: SSRN-id900284Alvira FajriNo ratings yet

- Q3 - Keynesian - Supply - Shocks - and - Hayekian - Secondary - DefDocument19 pagesQ3 - Keynesian - Supply - Shocks - and - Hayekian - Secondary - DefAlvira FajriNo ratings yet

- Sumber Skripsi - A Revision of Altman Z-Score Model and A Comparative Analysis of Turkish Companies' Financial Distress PredictionDocument19 pagesSumber Skripsi - A Revision of Altman Z-Score Model and A Comparative Analysis of Turkish Companies' Financial Distress PredictionAlvira FajriNo ratings yet

- 2018 - PENGARUH CORPORATE GOVERNANCE, RASIO KEUANGAN, UKURAN PERUSAHAAN DAN MAKROEKONOMI TERHADAP FINANCIAL DISTRESS - Sinta 3Document16 pages2018 - PENGARUH CORPORATE GOVERNANCE, RASIO KEUANGAN, UKURAN PERUSAHAAN DAN MAKROEKONOMI TERHADAP FINANCIAL DISTRESS - Sinta 3Alvira FajriNo ratings yet

- 2019 - The Impact of Macroeconomic Factors On Firms' Profitability - Index Scimago Q4Document6 pages2019 - The Impact of Macroeconomic Factors On Firms' Profitability - Index Scimago Q4Alvira FajriNo ratings yet

- FD Makro 5Document19 pagesFD Makro 5Alvira FajriNo ratings yet

- Adbi wp1251Document30 pagesAdbi wp1251Alvira FajriNo ratings yet

- FD Makro 8Document17 pagesFD Makro 8Alvira FajriNo ratings yet

- Ujian Tengah SemesterDocument9 pagesUjian Tengah SemesterAlvira FajriNo ratings yet

- Silahkan Kerjakan Soal Ini Dengan Baik Dan Pastikan Tidak Ada Pertanyaan Yang Terlewat Agar Anda Mendapatkan Hasil Yang MaksimalDocument4 pagesSilahkan Kerjakan Soal Ini Dengan Baik Dan Pastikan Tidak Ada Pertanyaan Yang Terlewat Agar Anda Mendapatkan Hasil Yang MaksimalAlvira FajriNo ratings yet

- FD Makro 7Document18 pagesFD Makro 7Alvira FajriNo ratings yet

- Soal & Jawab Audit - Review Bu DeviDocument8 pagesSoal & Jawab Audit - Review Bu DeviAlvira FajriNo ratings yet

- CASES (Choose 2 of 3 Questions, You May Answer The Questions in Bahasa Indonesia)Document2 pagesCASES (Choose 2 of 3 Questions, You May Answer The Questions in Bahasa Indonesia)Alvira FajriNo ratings yet

- 12 SSDDDDocument3 pages12 SSDDDAlvira FajriNo ratings yet

- Lab 3 Stock InvestmentDocument4 pagesLab 3 Stock InvestmentAlvira FajriNo ratings yet

- Latihan Target CostingDocument7 pagesLatihan Target CostingAlvira FajriNo ratings yet

- Tugas Dan Jawaban Lab 9 - Changes in Ownership EquityDocument5 pagesTugas Dan Jawaban Lab 9 - Changes in Ownership EquityAlvira FajriNo ratings yet

- P 7-15 Common Stock Value: All Growth ModelsDocument8 pagesP 7-15 Common Stock Value: All Growth ModelsAlvira FajriNo ratings yet

- Final Exam Preparation Auditing II: Condition Yang Terjadi Dan Mempengaruhi Akun-Akun Sebelum TanggalDocument5 pagesFinal Exam Preparation Auditing II: Condition Yang Terjadi Dan Mempengaruhi Akun-Akun Sebelum TanggalAlvira FajriNo ratings yet

- Responsibility Centers: Revenue and Expense CentersDocument2 pagesResponsibility Centers: Revenue and Expense CentersAlvira FajriNo ratings yet

- Materi Lab 8 - Intercompany Profit Transactions - BondsDocument5 pagesMateri Lab 8 - Intercompany Profit Transactions - BondsAlvira FajriNo ratings yet

- Tugas Lab 5 - Consolidated Techniques and ProceduresDocument2 pagesTugas Lab 5 - Consolidated Techniques and ProceduresAlvira FajriNo ratings yet

- Exercise Accruals Adjusting EntriesDocument3 pagesExercise Accruals Adjusting EntriesNatalie Irish VillanuevaNo ratings yet

- MIDTERM Long Quiz - Theories Answer KeyDocument2 pagesMIDTERM Long Quiz - Theories Answer KeyKristine NunagNo ratings yet

- BIR ITR 2306 - CastilloDocument1 pageBIR ITR 2306 - CastilloBernadine CastilloNo ratings yet

- The People's Guide To The 2022 BudgetDocument4 pagesThe People's Guide To The 2022 BudgetCityPress100% (1)

- Accounting For Income TaxationDocument8 pagesAccounting For Income Taxationangelian bagadiongNo ratings yet

- BIR RULING NO. 154-93: King, Capuchino, Tan and AssociatesDocument2 pagesBIR RULING NO. 154-93: King, Capuchino, Tan and Associatesrian.lee.b.tiangcoNo ratings yet

- Methods and Techniques of CostingDocument63 pagesMethods and Techniques of CostingVansh BhatiaNo ratings yet

- Xi Accounting Set 2Document6 pagesXi Accounting Set 2aashirwad2076No ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- Template For Accounting Cycle Review ProblemDocument24 pagesTemplate For Accounting Cycle Review ProblemCacieNo ratings yet

- Lecture 1 Advanced Corportate ReportingDocument100 pagesLecture 1 Advanced Corportate ReportingMohammedNo ratings yet

- Formula SheetDocument5 pagesFormula SheetherculesNo ratings yet

- IntxDocument6 pagesIntxSophia KeratinNo ratings yet

- Tax-Interview RGSGDocument1 pageTax-Interview RGSGthenabeelcmaNo ratings yet

- Module-5-Transcript-Federal-Taxation-I-Individuals-Employees-and-Sole-ProprietorsDocument69 pagesModule-5-Transcript-Federal-Taxation-I-Individuals-Employees-and-Sole-ProprietorsZubair BalochNo ratings yet

- LN 1 Cross Border ActivitiesDocument18 pagesLN 1 Cross Border ActivitiesMinWei1107No ratings yet

- Cardekho: Salary Slip For The Month of December - 2021Document2 pagesCardekho: Salary Slip For The Month of December - 2021Røcky DêêpåkNo ratings yet

- Balance Cash HoldingsDocument34 pagesBalance Cash HoldingsSurafelNo ratings yet

- Fundamentals of AccountingDocument32 pagesFundamentals of AccountingJoshua Jay JesuroNo ratings yet

- Workshop 5 QuestionsDocument3 pagesWorkshop 5 QuestionsJingwen YangNo ratings yet

- Financial Accounting & AnalysisDocument6 pagesFinancial Accounting & AnalysisAmandeep SinghNo ratings yet

- AFM Dividend Policy Swetha Ma'AmDocument5 pagesAFM Dividend Policy Swetha Ma'AmNavya KNo ratings yet

- Special Audit in GSTDocument2 pagesSpecial Audit in GSTGautamNo ratings yet

- Budget & AccountingDocument41 pagesBudget & AccountingazharNo ratings yet

- MamtaDocument17 pagesMamtaRoma BhatiaNo ratings yet

- Taxation Under Spanish and Americans.Document2 pagesTaxation Under Spanish and Americans.Gwyneth Klaire GeliNo ratings yet

- Post Assessment Long Quiz 2 Attempt ReviewDocument35 pagesPost Assessment Long Quiz 2 Attempt ReviewanonymousNo ratings yet