0 ratings0% found this document useful (0 votes)

27 viewsTechnical Analysis: A Comprehensive Course London Time

Technical Analysis: A Comprehensive Course London Time

Uploaded by

Edward XuThis document outlines the modules and content covered in a comprehensive technical analysis course. Module 1 introduces technical analysis, including its history and criticisms. It also covers the basics of technical analysis like different chart types, trends, support and resistance. Module 2 focuses on graphical tools, including candlestick patterns. Module 3 discusses mathematical tools used in technical analysis, such as momentum, trend, volatility, and oscillator indicators. The course concludes with insights on additional technical analysis concepts and a case study.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Technical Analysis: A Comprehensive Course London Time

Technical Analysis: A Comprehensive Course London Time

Uploaded by

Edward Xu0 ratings0% found this document useful (0 votes)

27 views3 pagesThis document outlines the modules and content covered in a comprehensive technical analysis course. Module 1 introduces technical analysis, including its history and criticisms. It also covers the basics of technical analysis like different chart types, trends, support and resistance. Module 2 focuses on graphical tools, including candlestick patterns. Module 3 discusses mathematical tools used in technical analysis, such as momentum, trend, volatility, and oscillator indicators. The course concludes with insights on additional technical analysis concepts and a case study.

Original Title

Technical Analysis Course Agenda 2021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

This document outlines the modules and content covered in a comprehensive technical analysis course. Module 1 introduces technical analysis, including its history and criticisms. It also covers the basics of technical analysis like different chart types, trends, support and resistance. Module 2 focuses on graphical tools, including candlestick patterns. Module 3 discusses mathematical tools used in technical analysis, such as momentum, trend, volatility, and oscillator indicators. The course concludes with insights on additional technical analysis concepts and a case study.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

27 views3 pagesTechnical Analysis: A Comprehensive Course London Time

Technical Analysis: A Comprehensive Course London Time

Uploaded by

Edward XuThis document outlines the modules and content covered in a comprehensive technical analysis course. Module 1 introduces technical analysis, including its history and criticisms. It also covers the basics of technical analysis like different chart types, trends, support and resistance. Module 2 focuses on graphical tools, including candlestick patterns. Module 3 discusses mathematical tools used in technical analysis, such as momentum, trend, volatility, and oscillator indicators. The course concludes with insights on additional technical analysis concepts and a case study.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

TECHNICAL ANALYSIS: A COMPREHENSIVE COURSE

London time

MODULE 1

10:00 Welcome and Introduction to the course

10:05 Technical Analysis (TA) – Theory and Context

The history of technical analysis

Fundamental vs Technical Analysis vs Behavioural Finance

Criticism of technical analysis

o self-fulfilling prophecy

o It is too subjective

o Random Walk Theory

o Efficient market hypothesis

o Other common misconceptions about TA

ICIS Technical Analysis report

ICIS Methodology

11:35 Break

11:45 The basics of technical analysis

Charting types

o Candlestick

o Candle Volume

o Heikin Ashi

o Renko

o Three-line break

o Point and Figure

o Kagi

o Equi-Volume

o Bar

o Line

Arithmetic vs logarithmic charting

Trends, Trendlines, Gaps, Support/Resistance

Dow Theory (market phases)

13:50 Interactive Q&A

14:00 End of day one

MODULE 2:

10.00 Graphical tools – Part 1

Introduction to graphicals

Large candle patterns

o Coils

o Parallels

o Arcs

o Others

12:10 Break

12:20 Graphical tools – Part 2

Small candle patterns

o One-candle patterns

o Two-candle patterns

o Three-candle patterns

13:30 Interactive Q&A

13:45 End of day two

MODULE 3:

10:00 Mathematical tools

Momentum tools

o Introduction

o ROC

o MACD

o Williams %R

Trend tools

o SAR

o Moving Averages

o DM/ DI

o ADX /ADXR

o Ichimoku

o Coppock

o MA envelope and channels

Volatility tools

o ATR

o Bollinger bands

Volume tools

o OBV

o Bars

o VWAP

Oscillators

o Stochastics

o CCI

o RSI

11:30 Interactive Q&A

11:40 Break

11:50 ICIS insights

Fibonacci Extension and Retracement

Elliott wave

Correlation matrix

Backtesting

External factors

13:20 Interactive Q&A

13:30 Case study

13:55 Final remarks

14:00 End of the course

You might also like

- Gujarat Technological University: W.E.F. AY 2020-21Document3 pagesGujarat Technological University: W.E.F. AY 2020-21AADITYA SHAHNo ratings yet

- Wavelet TransformDocument3 pagesWavelet Transformmitul patelNo ratings yet

- Department of Electrical Engineering Faculty of Engineering & TechnologyDocument22 pagesDepartment of Electrical Engineering Faculty of Engineering & TechnologyZeeshan GujjarNo ratings yet

- Digital Concepts: 1.1 Definition of An Analogue QuantityDocument6 pagesDigital Concepts: 1.1 Definition of An Analogue QuantityKiran DNo ratings yet

- Electronic Measurements CoDocument5 pagesElectronic Measurements Coavi agarrwalNo ratings yet

- Cpu CaDocument6 pagesCpu CaHari YeligetiNo ratings yet

- ECON F213 MathstatDocument3 pagesECON F213 MathstatSrikar RenikindhiNo ratings yet

- MEL G623 Advanced VLSI Design Course Handout: SECOND SEMESTER 2021-2022Document7 pagesMEL G623 Advanced VLSI Design Course Handout: SECOND SEMESTER 2021-2022SARITA GAJANAN BIJAWENo ratings yet

- Annexa Prime Trading CoursesDocument11 pagesAnnexa Prime Trading CoursesFatima FX100% (1)

- EE405 - Digital ElectronicsDocument3 pagesEE405 - Digital ElectronicsTakudzwa MNo ratings yet

- 00 TE 242 - Syllabus - N - ScheduleDocument2 pages00 TE 242 - Syllabus - N - ScheduleMoses IsmailNo ratings yet

- Cours de Chromatographie UFAZ Commented Version Part 1Document43 pagesCours de Chromatographie UFAZ Commented Version Part 1Rafig MammadzadehNo ratings yet

- Crypto For Beginners: Technical Analysis CourseDocument49 pagesCrypto For Beginners: Technical Analysis CourseCryptoWealthAcademyNo ratings yet

- CMT Reading ListDocument8 pagesCMT Reading ListftbearNo ratings yet

- Digital ElectronicsDocument4 pagesDigital Electronicskimajam628No ratings yet

- Digital System Design 1 - Chapter 1 SlideDocument44 pagesDigital System Design 1 - Chapter 1 Slide42200405No ratings yet

- Bec402 - PCS - All in OneDocument108 pagesBec402 - PCS - All in Onerameshgroup306No ratings yet

- 45 StatisticsDocument7 pages45 StatisticsMridul MaheshwariNo ratings yet

- Digital Logic Design Lab Manual Fall 20 Semester Version 4Document78 pagesDigital Logic Design Lab Manual Fall 20 Semester Version 4Abdul HaseebNo ratings yet

- Trade Pattern Tutorial PDFDocument24 pagesTrade Pattern Tutorial PDFKiran Krishna33% (3)

- Prerequisites Course Objectives: Department of Technical Education Board of Technical Examinations, BengaluruDocument9 pagesPrerequisites Course Objectives: Department of Technical Education Board of Technical Examinations, BengaluruRakshithNo ratings yet

- CFDDocument2 pagesCFDSumit BhanushaliNo ratings yet

- Technical Analysis ElearnDocument44 pagesTechnical Analysis ElearnRavi Tomar100% (4)

- Non Destructive Evaluation QPDocument1 pageNon Destructive Evaluation QPrajyalakshmi_mechNo ratings yet

- LDPC ConstrDocument51 pagesLDPC Constrsravan padalaNo ratings yet

- MM Notes PDFDocument106 pagesMM Notes PDFChhagan kharolNo ratings yet

- On The Analysis and Application of LDPC Codes: Olgica Milenkovic University of Colorado, BoulderDocument51 pagesOn The Analysis and Application of LDPC Codes: Olgica Milenkovic University of Colorado, BouldersushanthsrkrNo ratings yet

- Me8501-Metrology and Measurements - by Learnengineering - inDocument106 pagesMe8501-Metrology and Measurements - by Learnengineering - inAbimanyu SankarapandianNo ratings yet

- 15CS32 SyllabusDocument2 pages15CS32 SyllabuspramelaNo ratings yet

- Signal and SystemDocument3 pagesSignal and SystemHodec SsecNo ratings yet

- ProbabilityandstaticsDocument207 pagesProbabilityandstaticsSheebaNo ratings yet

- Technical Analysis PDFdrive 1Document17 pagesTechnical Analysis PDFdrive 120mayis20No ratings yet

- Technical AnalysisDocument183 pagesTechnical Analysisbagya100% (1)

- Robotics (MSS, MCC) - CD01Document4 pagesRobotics (MSS, MCC) - CD01lalaNo ratings yet

- Exam Pattern & Syllabous For Various Posts Advertised Against Vacancy Notice No. 04-2023Document24 pagesExam Pattern & Syllabous For Various Posts Advertised Against Vacancy Notice No. 04-2023Anupam KhandelwalNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityadamNo ratings yet

- Gujarat Technological University Instrumentation & Control EngineeringDocument3 pagesGujarat Technological University Instrumentation & Control Engineeringgecg ICNo ratings yet

- 19MT10704 - High Voltage DC TransmissionDocument2 pages19MT10704 - High Voltage DC TransmissionNmg KumarNo ratings yet

- Electronics and Communication Engineering: Course PlanDocument4 pagesElectronics and Communication Engineering: Course PlandeevNo ratings yet

- Instrumentation Outline Fall 22Document4 pagesInstrumentation Outline Fall 22numikhan.eeNo ratings yet

- Oswaal CBSE Class 12th Syllabus Applied Mathematics For 2022-23 ExamDocument9 pagesOswaal CBSE Class 12th Syllabus Applied Mathematics For 2022-23 ExamYashasvi VatsNo ratings yet

- Chapter1 Introduction Digital ElectronicsDocument37 pagesChapter1 Introduction Digital ElectronicsfjburgosfNo ratings yet

- CIS-111: Digital Logic Design: by Dr. Javaid Khurshid Dcis, PieasDocument38 pagesCIS-111: Digital Logic Design: by Dr. Javaid Khurshid Dcis, PieasAbdul RafayNo ratings yet

- De&mp Unit - 3Document29 pagesDe&mp Unit - 3Mahesh BabuNo ratings yet

- Course CurriculumDocument3 pagesCourse CurriculumKannan 20No ratings yet

- Digital Design Course SyllabusDocument2 pagesDigital Design Course SyllabusDahlia ZamoraNo ratings yet

- ENG 8101 - Statics Introduction and REVIEW: Professor: Esmaeil MahdaviDocument26 pagesENG 8101 - Statics Introduction and REVIEW: Professor: Esmaeil MahdaviZainebAl-FaeslyNo ratings yet

- CS Ece Engg113.02 Mayuga - G - Recto - K S 2022 1Document6 pagesCS Ece Engg113.02 Mayuga - G - Recto - K S 2022 1just888justNo ratings yet

- Medical Electronics SylaDocument129 pagesMedical Electronics SylaKirthana GowdaNo ratings yet

- Basic Electronics SyllabusDocument4 pagesBasic Electronics Syllabushimanshu.joshiNo ratings yet

- 1ET1040506 Sensors and Transducers Open ElectiveDocument2 pages1ET1040506 Sensors and Transducers Open ElectivePatel SarkarNo ratings yet

- Department of Technical EducationDocument17 pagesDepartment of Technical EducationPiya SharmaNo ratings yet

- 2 Pu Phy - Most Imp Problems-1Document31 pages2 Pu Phy - Most Imp Problems-1stanley15347No ratings yet

- Maths 4 Course PlanDocument5 pagesMaths 4 Course PlanShryNo ratings yet

- Ec101 Course Plan 2017-2018Document5 pagesEc101 Course Plan 2017-2018hareeshNo ratings yet

- Schaum's Easy Outline of Introduction to Mathematical EconomicsFrom EverandSchaum's Easy Outline of Introduction to Mathematical EconomicsRating: 4 out of 5 stars4/5 (1)

- Short-Memory Linear Processes and Econometric ApplicationsFrom EverandShort-Memory Linear Processes and Econometric ApplicationsNo ratings yet

- $400 Daily SpammingDocument14 pages$400 Daily SpammingEdward Xu100% (5)

- CCT Ebook How To Time Forex Trades V4 Aka James EdwardDocument27 pagesCCT Ebook How To Time Forex Trades V4 Aka James EdwardEdward Xu100% (1)

- Kamus Candlestick OKDocument2 pagesKamus Candlestick OKMd YusofNo ratings yet

- Poram Standard Specifications For Processed Palm OilDocument2 pagesPoram Standard Specifications For Processed Palm OilEdward XuNo ratings yet

- BTC Madness 1.1 PDFDocument7 pagesBTC Madness 1.1 PDFEdward Xu100% (3)

- 9 Biggest LiesDocument6 pages9 Biggest LiesEdward Xu100% (1)

- Ed Burke - TutorialsDocument115 pagesEd Burke - TutorialsEdward Xu100% (2)

- Pre-Midterm Exam 1 - 63Document14 pagesPre-Midterm Exam 1 - 63Khaimook ChanunthidaNo ratings yet

- Aswath Damodaran Financial Statement AnalysisDocument18 pagesAswath Damodaran Financial Statement Analysisshamapant7955100% (2)

- Fourth Quarter Test in 5Document30 pagesFourth Quarter Test in 5Ephril De RomaNo ratings yet

- Stock Market Efficiency & Stock ValuationDocument23 pagesStock Market Efficiency & Stock ValuationKaila SalemNo ratings yet

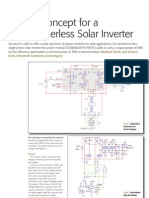

- Design Concept of Transformerless Solar InverterDocument3 pagesDesign Concept of Transformerless Solar InverterdragonjahirshaNo ratings yet

- Guidelines For Water Quality ManagementDocument96 pagesGuidelines For Water Quality ManagementKleah Cuizon100% (1)

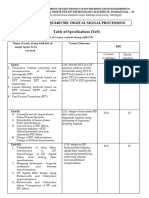

- Standards For Use With V8I and SSCDocument5 pagesStandards For Use With V8I and SSCbilisuma sebokaNo ratings yet

- Life of Rasikananda PrabhuDocument6 pagesLife of Rasikananda PrabhuYash RajNo ratings yet

- Post Result InformationDocument2 pagesPost Result InformationJohanNo ratings yet

- Rawls and Nozick PDFDocument13 pagesRawls and Nozick PDFAndrey BurinNo ratings yet

- LLB-1, Manaal Kazmi10-03-12Document6 pagesLLB-1, Manaal Kazmi10-03-12Manaal KazmiNo ratings yet

- 6сынып English Plus.3 тоқDocument63 pages6сынып English Plus.3 тоқДильшат БейсекеноваNo ratings yet

- FortiAnalyzer 7.2.1 Administration GuideDocument398 pagesFortiAnalyzer 7.2.1 Administration Guidelahidu lakshanNo ratings yet

- Effect of Budgetary Process On Financial Performance Case Study of Selected Savings and Credit Cooperative Societies in Hoima District, UgandaDocument9 pagesEffect of Budgetary Process On Financial Performance Case Study of Selected Savings and Credit Cooperative Societies in Hoima District, UgandaInternational Journal of Innovative Science and Research Technology100% (1)

- Foreign Investment in India: Trend and PatternDocument64 pagesForeign Investment in India: Trend and PatternitsmehaNo ratings yet

- Paired Sample T-Test: StepsDocument2 pagesPaired Sample T-Test: StepsGoogle GamesNo ratings yet

- Cable Tray PriceList 1st APRIL 2021Document1 pageCable Tray PriceList 1st APRIL 2021Swarzina Elios SwargiaryNo ratings yet

- LAS Science 9 Week 2Document4 pagesLAS Science 9 Week 2JULIE CADORESNo ratings yet

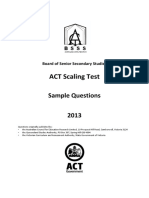

- ACT Scaling Test: Sample QuestionsDocument68 pagesACT Scaling Test: Sample Questionsinder191No ratings yet

- List With The Most Used Suffixes and PrefixesDocument4 pagesList With The Most Used Suffixes and PrefixesBianca MarinaNo ratings yet

- Coursework 3 IgcseDocument7 pagesCoursework 3 Igcsef5e28dkq100% (2)

- African CeramicsDocument5 pagesAfrican CeramicsBlack CatNo ratings yet

- Chapter 3 - Sets - ExerciseDocument69 pagesChapter 3 - Sets - ExerciseRachael Wong100% (2)

- Clinical Field Experience B Schoolwide Budgetary NeedsDocument6 pagesClinical Field Experience B Schoolwide Budgetary Needsapi-475628377No ratings yet

- NoMemoryAbstractionDocument15 pagesNoMemoryAbstractionDanh VôNo ratings yet

- Free Is The Future of BusinessDocument14 pagesFree Is The Future of BusinessNoel Saji PaulNo ratings yet

- Importance of Accurate Modeling Input and Assumptions in 3D Finite Element Analysis of Tall BuildingsDocument6 pagesImportance of Accurate Modeling Input and Assumptions in 3D Finite Element Analysis of Tall BuildingsMohamedNo ratings yet

- MOOC Guidelines - 18-19Document3 pagesMOOC Guidelines - 18-19Siva YellampalliNo ratings yet

- RNS300 Line CodesDocument9 pagesRNS300 Line CodesxxNo ratings yet

- Virtual Reality in HR Management As A Condition of Innovative Changes in A CompanyDocument4 pagesVirtual Reality in HR Management As A Condition of Innovative Changes in A Companydinu4u4everNo ratings yet