IA Activity 6 Ass

IA Activity 6 Ass

Uploaded by

WeStan LegendsCopyright:

Available Formats

IA Activity 6 Ass

IA Activity 6 Ass

Uploaded by

WeStan LegendsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

IA Activity 6 Ass

IA Activity 6 Ass

Uploaded by

WeStan LegendsCopyright:

Available Formats

Activity 6 – Chapter 23 Property, Plant and Equipment

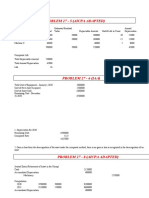

Problem 23-4 (IAA)

Prepare journal entries to record the machinery acquisitions and related interest.

Anson Company

Journal Entries

1. Acquisition:

Machinery P3,000,000

Accounts payable P3,000,000

Payment:

Accounts payable 3,000,000

Purchase discount loss (3,000,000 x 0.10) 300,000

Cash 3,000,000

Machinery 300,000

Loss on retirement of old Machine 50,000

Spare parts inventory 150,000

Cash 200,000

2. Acquisition:

Machinery P4,700,000

Interest Expense 800,000

Cash 500,000

Notes payable 5,000,000

Payment:

Notes Payable 5,000,000

Cash 5,000,000

3. Acquisition:

Machinery (500,000 x 3.17) 1,585,000

Discount on note payable 415,000

Note payable 2,000,000

Payment at the end of the year:

Note Payable 500,000

Cash 500,000

Interest Expense (1,585,000 x 10%) 158,500

Discount on note payable 158,500

4. Acquisition:

Machinery (2,000,000 x 0.68) 1,360,000

Discount on note payable 640,000

Note payable 2,000,000

Interest:

Interest Expense (10% x 1,360,000) 136,000

Discount on note Payable 136,000

Problem 23-8 (AICPA Adapted)

Prepare journal entries to record the exchange transaction.

Mellow Company

Journal Entries

Equipment – new 1,400,000

Accumulated Depreciation 600,000

Equipment – old 1,000,000

Cash 980,000

Gain in exchange 20,000

Problem 23-10 (IAA)

Compute the cost of finished goods and building.

1. Total Finished goods Building

Direct labor 6,000,000 4,200,000 1,800,000

Materials 7,000,000 3,000,000 4,000,000

Overhead 2,000,000 2,000,000 -

15,000,000 9,200,000 5,800,000

2. Total Finished goods Building

Direct labor 6,000,000 4,200,000 1,800,000

Materials 7,000,000 3,000,000 4,000,000

Overhead 2,000,000 - -

135/180 x 2,000,000 1,500,000

45/180 x 2,000,000 500,000

15,000,000 8,700,000 6,300,000

3. Total Finished goods Building

Direct labor 6,000,000 4,200,000 1,800,000

Materials 7,000,000 3,000,000 4,000,000

Overhead 2,000,000 - -

42/60 x 2,000,000 1,400,000

18/60 x 2,000,000 600,000

15,000,000 8,600,000 6,400,000

Problem 23-11 (IAA)

a. Calculate the cost of the machinery, assuming that manufacturing activities are to be

charged with overhead at the rate experienced in the prior year.

Materials P500,000

Direct Labor 1,000,000

*Overhead 600,000

Cost of Machinery P2,100,000

Overhead P3,600,000

Charged to finished goods (75% x 4,000,000) (3,000,000)

*Charged to machinery P600,000

b. Calculate the cost of the machinery if manufacturing and construction activities are to

be charged with overhead at the same rate.

Materials P500,000

*Direct Labor 1,000,000

Overhead (1/5 x 3,600,000) 720,000

Cost of Machinery P2,200,000

Finished Goods P4,000,000 (4/5)

*Machinery 1,000,000 (1/5)

Direct Labor P5,000,000

Problem 23-15 (AICPA Adapted)

1. What amount should be recorded as initial cost of the machine?

P200,000 x 5.712 = d. P1,142,400

2. What amount should be recorded as discount on note payable on December 31,

2021?

P200,000 x 8 payments P1,600,000

Less: Initial cost (1,142,400)

Discount on note payable - December 31, 2021 b. P457,600

3. What amount should be recorded as interest expense for 2022?

Initial cost P1,142,400

Noninterest bearing note P200,000

Carrying value of the notes – Dec. 31, 2021 P942,400

Multiply by 0.11

Interest expense – 2022 b. P103,664

4. What is the carrying amount of note payable on December 31, 2022?

Noninterest bearing note P200,000

Less: Interest expense (P103,664)

Amount applied to principal P96,336

Carrying value of the notes – Dec. 31, 2021 P942,400

Less: Amount applied to principal (P96,336)

Carrying value of the notes – Dec. 31, 2022 b. P846,064

Problem 23-28 Multiple choice (PAS 16)

1. d

2. b

3. d

4. a

5. d

Problem 23-29 Multiple choice (IAA)

1. b

2. a

3. a

4. c

5. b

Problem 23-30 Multiple choice (AICPA Adapted)

1. d

2. a

3. b

4. a

5. c

You might also like

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola50% (6)

- 8e Ch3 Mini Case MaterialityDocument8 pages8e Ch3 Mini Case MaterialityAnonymous Ul3litq0% (9)

- Assignment-3 1Document3 pagesAssignment-3 1WeStan LegendsNo ratings yet

- Cost AccountingDocument12 pagesCost AccountingCamille G.No ratings yet

- Intermediate Accounting 1 Valix Chapter 17Document2 pagesIntermediate Accounting 1 Valix Chapter 17Captain Shield100% (1)

- Module 4: Unit 1 Exercise 1. Answer The Following QuestionsDocument2 pagesModule 4: Unit 1 Exercise 1. Answer The Following QuestionsWeStan LegendsNo ratings yet

- Cash To Accrual Basis, Single Entry and Error CorrectionDocument7 pagesCash To Accrual Basis, Single Entry and Error CorrectionHasmin Saripada AmpatuaNo ratings yet

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 Answersbebe_cute06XDNo ratings yet

- Shane CompanyDocument1 pageShane CompanyRhitzelynn Ann BarredoNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Sacrosanct Company Problem 26 - 5 (INTACCS Problem)Document1 pageSacrosanct Company Problem 26 - 5 (INTACCS Problem)Ya NaNo ratings yet

- Chapter 13 - Gross Profit MethodDocument2 pagesChapter 13 - Gross Profit MethodBena CubillasNo ratings yet

- Defined Benefit Plan (Exercises With Answers)Document3 pagesDefined Benefit Plan (Exercises With Answers)Jennifer AdvientoNo ratings yet

- 30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixDocument3 pages30 5 To 30 6 Depletion Intermediate Accounting Volume 1 2021 Edition ValixAway To PonderNo ratings yet

- FinAcc 3 QuizzesDocument9 pagesFinAcc 3 QuizzesStella SabaoanNo ratings yet

- GROUP2 AE105 Chp.11 14Document26 pagesGROUP2 AE105 Chp.11 14Isabelle CandelariaNo ratings yet

- Group Activity Mina HanDocument4 pagesGroup Activity Mina HanLevi's DishwasherNo ratings yet

- Installment Sales - DiscussionDocument5 pagesInstallment Sales - DiscussionJustine SorizoNo ratings yet

- Reference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixDocument3 pagesReference: Financial Accounting - 2 by Conrado T. Valix and Christian ValixMie CuarteroNo ratings yet

- Seatwork - Module 1Document5 pagesSeatwork - Module 1Alyanna Alcantara100% (1)

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Chapter 7 - Compound Financial Instrument (FAR6)Document5 pagesChapter 7 - Compound Financial Instrument (FAR6)Honeylet SigesmundoNo ratings yet

- Borrowing Cost Sample ProblemsDocument8 pagesBorrowing Cost Sample Problemslet me live in peaceNo ratings yet

- Note Receivable Part 2Document7 pagesNote Receivable Part 2Carlo VillanNo ratings yet

- Land Building Machinery ProblemsDocument13 pagesLand Building Machinery ProblemsJomerNo ratings yet

- IA 1 Valix 2020 Ver. Problem 27-5 - Problem 27-7Document2 pagesIA 1 Valix 2020 Ver. Problem 27-5 - Problem 27-7Ariean Joy DequiñaNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Bonds Payable: Intermediate Accounting 2Document38 pagesBonds Payable: Intermediate Accounting 2Rolando Verano TanNo ratings yet

- Assign 1 Answer Valuation of Contributions of Partners Millan 2021Document4 pagesAssign 1 Answer Valuation of Contributions of Partners Millan 2021mhikeedelantarNo ratings yet

- 4.3 - Research and Development CostDocument3 pages4.3 - Research and Development CostKaryl FailmaNo ratings yet

- Chap16 ProblemsDocument20 pagesChap16 ProblemsYen YenNo ratings yet

- Cfas Chapter 16 4Document3 pagesCfas Chapter 16 4Iana Jane BuronNo ratings yet

- Drill - ReceivablesDocument7 pagesDrill - ReceivablesMark Domingo MendozaNo ratings yet

- 7 3 BuenaventuraDocument2 pages7 3 BuenaventuraAnonnNo ratings yet

- This Study Resource Was: Operating Lease and LeasebackDocument7 pagesThis Study Resource Was: Operating Lease and LeasebackMarcus MonocayNo ratings yet

- Chapter 20Document5 pagesChapter 20Xynith Nicole RamosNo ratings yet

- Assessment Task 1-1Document10 pagesAssessment Task 1-1hahahahaNo ratings yet

- Chapter 15 (CFAS)Document2 pagesChapter 15 (CFAS)Vince Pereda100% (1)

- Problem 2 8Document6 pagesProblem 2 8Carl Jaime Dela CruzNo ratings yet

- Answer Value 800000Document1 pageAnswer Value 800000Kath LeynesNo ratings yet

- Flexible Company Debit Credit 2020Document1 pageFlexible Company Debit Credit 2020AnonnNo ratings yet

- IA 1 Valix 2020 Ver. Problem 28Document6 pagesIA 1 Valix 2020 Ver. Problem 28Ariean Joy DequiñaNo ratings yet

- IA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Document5 pagesIA 1 Valix 2020 Ver. Problem 26-6 - Problem 26-7Ariean Joy DequiñaNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Chapter 16 30 Valix Practical Accounting 2011Document492 pagesChapter 16 30 Valix Practical Accounting 2011Joselito S. MalaluanNo ratings yet

- Assignment No. 1 - Leases - Cunanan & ManlangitDocument7 pagesAssignment No. 1 - Leases - Cunanan & ManlangitCunanan, Malakhai JeuNo ratings yet

- Problem 4-9Document2 pagesProblem 4-9maryaniNo ratings yet

- Saint Louis CollegeDocument55 pagesSaint Louis CollegeKonrad Lorenz Madriaga UychocoNo ratings yet

- IA 1 Valix 2020 Ver. Problem 29Document3 pagesIA 1 Valix 2020 Ver. Problem 29Ariean Joy DequiñaNo ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- Audit of LiabilitiesDocument54 pagesAudit of LiabilitiesWerpa PetmaluNo ratings yet

- 13 Acctg Ed 1 - Loan ReceivableDocument17 pages13 Acctg Ed 1 - Loan ReceivableNath BongalonNo ratings yet

- Name: - Score: - Year/Course/Section: - ScheduleDocument10 pagesName: - Score: - Year/Course/Section: - ScheduleYukiNo ratings yet

- Actual Amount P900,000 BDocument3 pagesActual Amount P900,000 BFerb CruzadaNo ratings yet

- Lesson 3A Investments: ContentsDocument19 pagesLesson 3A Investments: ContentsSimon PeterNo ratings yet

- Group Work - Inventory Cost Flow and LCNRV: AnswerDocument5 pagesGroup Work - Inventory Cost Flow and LCNRV: AnswerKawhileonard LeonardNo ratings yet

- c2 Premium Liability Lets Get It PDFDocument15 pagesc2 Premium Liability Lets Get It PDFCris VillarNo ratings yet

- Chap 12,13, and 14Document6 pagesChap 12,13, and 14Mary Claudette UnabiaNo ratings yet

- IA 2 - Valix 2019Document216 pagesIA 2 - Valix 2019Renier Bautista Jr.No ratings yet

- Chapter 17Document6 pagesChapter 17GONZALES, MICA ANGEL A.No ratings yet

- Intacc 3 Leases FinalsDocument9 pagesIntacc 3 Leases FinalsDarryl AgustinNo ratings yet

- Multiple Choice Problems 9Document15 pagesMultiple Choice Problems 9Dieter LudwigNo ratings yet

- Problem 23Document2 pagesProblem 23alyNo ratings yet

- Pastoral SocietiesDocument2 pagesPastoral SocietiesWeStan LegendsNo ratings yet

- RPH AssignmentDocument5 pagesRPH AssignmentWeStan LegendsNo ratings yet

- Assignment5.1 CBMEC Chapter5Document2 pagesAssignment5.1 CBMEC Chapter5WeStan LegendsNo ratings yet

- Fin Mar Chapter 1 EssayDocument1 pageFin Mar Chapter 1 EssayWeStan LegendsNo ratings yet

- Assignment 1.1 PMDocument1 pageAssignment 1.1 PMWeStan LegendsNo ratings yet

- Stat AnalysisDocument1 pageStat AnalysisWeStan LegendsNo ratings yet

- Cbmec-4 1Document2 pagesCbmec-4 1WeStan LegendsNo ratings yet

- Assignment 2.1 OMDocument2 pagesAssignment 2.1 OMWeStan LegendsNo ratings yet

- Stat Analysis 1Document1 pageStat Analysis 1WeStan LegendsNo ratings yet

- Activity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)Document6 pagesActivity 5 - Chapter 22 Investment Property (Cash Surrender Value) Problem 22-2 (IFRS)WeStan LegendsNo ratings yet

- Summary Organizational CultureDocument3 pagesSummary Organizational CultureWeStan LegendsNo ratings yet

- SummarizationConflict and StressDocument12 pagesSummarizationConflict and StressWeStan LegendsNo ratings yet

- 1 The Nature and Scope of Organizational BehaviorDocument7 pages1 The Nature and Scope of Organizational BehaviorWeStan LegendsNo ratings yet

- Ia Activity 4Document23 pagesIa Activity 4WeStan LegendsNo ratings yet

- Business Process ReengineeringDocument2 pagesBusiness Process ReengineeringWeStan LegendsNo ratings yet

- MMW Assignment 4.5Document1 pageMMW Assignment 4.5WeStan LegendsNo ratings yet

- Litratures of The WorldDocument22 pagesLitratures of The WorldWeStan LegendsNo ratings yet

- Introduction and Review of Basic Concepts ExercisesDocument6 pagesIntroduction and Review of Basic Concepts ExercisesWeStan LegendsNo ratings yet

- Behavioral Principles of InnovationDocument1 pageBehavioral Principles of InnovationWeStan LegendsNo ratings yet

- MMW Assignment 4.6Document2 pagesMMW Assignment 4.6WeStan LegendsNo ratings yet

- CH - 10 - Acquisition and Disposition of Property, Plant, and EquipmentDocument62 pagesCH - 10 - Acquisition and Disposition of Property, Plant, and EquipmentSamiHadadNo ratings yet

- IAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionDocument41 pagesIAS 16 (CAF5 S18) : (I) (Ii) (Iii) - Rs. in MillionShameel IrshadNo ratings yet

- PPE and BORROWING COSTDocument21 pagesPPE and BORROWING COSTmeemisuNo ratings yet

- NEF Application Form 28nov2022Document9 pagesNEF Application Form 28nov2022NicolasNo ratings yet

- IE Chapter 3 - ProjectDocument56 pagesIE Chapter 3 - Project10-12A1- Nguyễn Chí HiếuNo ratings yet

- WWW Papertyari Com Sebi Grade ADocument12 pagesWWW Papertyari Com Sebi Grade ANihal JamadarNo ratings yet

- Vertical Format Final Accounts - SolutionsDocument6 pagesVertical Format Final Accounts - SolutionsASHIFNo ratings yet

- Budget Planning or Preparation Process: SAP FM BCS Business BlueprintDocument22 pagesBudget Planning or Preparation Process: SAP FM BCS Business BlueprintÖmerFarukTekin100% (1)

- NKR Engineering (Private) Limited - June 2020Document19 pagesNKR Engineering (Private) Limited - June 2020Mustafa hadiNo ratings yet

- BUS310 TMA Spring 2020Document12 pagesBUS310 TMA Spring 2020Ola Doueh100% (1)

- IAS 16 and IAS 38 - Analysis 1Document10 pagesIAS 16 and IAS 38 - Analysis 1Lin AungNo ratings yet

- Reviewer On Ch. 6 7 8 AISDocument18 pagesReviewer On Ch. 6 7 8 AISYan FranciaNo ratings yet

- ICAEW QB2024 Accounting Scenario DangKhoaDocument21 pagesICAEW QB2024 Accounting Scenario DangKhoaminhphuc0177No ratings yet

- IAS16 Defines Property, Plant and Equipment As "Tangible Items ThatDocument35 pagesIAS16 Defines Property, Plant and Equipment As "Tangible Items ThatMo HachimNo ratings yet

- Download Full Fetal Cardiovascular Imaging A Disease Based Approach 1st Edition Jack Rychik PDF All ChaptersDocument77 pagesDownload Full Fetal Cardiovascular Imaging A Disease Based Approach 1st Edition Jack Rychik PDF All ChaptersgurjitdelrueNo ratings yet

- New Fixed AssetsDocument6 pagesNew Fixed AssetsRupert Parsons100% (4)

- SAP CodeDocument56 pagesSAP Code1799No ratings yet

- Chapter 10 - SlidesDocument38 pagesChapter 10 - Slidesernest gyapongNo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- Government GrantsDocument9 pagesGovernment Grantssorin8488100% (1)

- Selamat Sempurna TBK - Billingual - Des 31 2019 - ReleasedDocument141 pagesSelamat Sempurna TBK - Billingual - Des 31 2019 - ReleasedRangga Ardiansya PutraNo ratings yet

- Accounting Revision Notes (0452)Document38 pagesAccounting Revision Notes (0452)MissAditi KNo ratings yet

- Fixed Assets Manual PDFDocument33 pagesFixed Assets Manual PDFArup DattaNo ratings yet

- Se O Nly: Work Sheet ADocument6 pagesSe O Nly: Work Sheet Asanjay blakeNo ratings yet

- Answers To Olivia CompanyDocument34 pagesAnswers To Olivia CompanyRIZLE SOGRADIELNo ratings yet

- Accounting Grade 12 For LessonDocument8 pagesAccounting Grade 12 For LessonKgothatso ArnanzaNo ratings yet

- Business PlanDocument34 pagesBusiness PlanAli Mudenyo MwinyiNo ratings yet