Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

Harsh GandhiCopyright:

Available Formats

Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

Harsh GandhiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Life Insurance Premium Receipt: Personal Details

Life Insurance Premium Receipt: Personal Details

Uploaded by

Harsh GandhiCopyright:

Available Formats

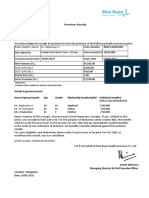

Date: 01-Apr-2021

ReceiptNo.:139785312APR202101

Life Insurance Premium Receipt

Duration For Which the Premium is Received: 01-04-2021 to 31-MAR-2022

Personal Details

Policy Number: 139785312 Current residential state: Maharashtra

Policyholder Name: Mr. Lalit Gandhi Mobile No. 7887894371

Commuinication Address: F-301 ROHAN KRITIKA Landline no. Please inform us for regular updates

SINHAGAD ROAD Life Insured Name: MR. LALIT GANDHI

Pune – 411030 AJPPG1259H

PAN Number:

E-Mail: LALITGANDHI@ICLOUD.COM

Policy Details

Plan Name: Max Life Online Term Plan PlusMax Life Waiver Of Premium Plus Rider CO - 104N092V02

Policy Term 20 Years Premium Payment Frequency Monthly

Date of Commencement 1-APR-2021 Date of Maturity 31-MAR-2041

Last Premium Due Date 1-APR-2021 Next Due Date 31-MAR-2022

Reinstatement Interest (incl. GST) ` 0.00 Model Premium (incl. GST) ` 1,50,000.00

Total Sum Assured of base plan and term

Total Premium Received (incl. GST)* ` 1,50,000.00 ` 1,00,00,000.00

rider (if any)

Coverfox Insurance Brokin

Agent's Name Agent's Contact No. 18002005522

Head Office

GST Details

Coverage Type SAC Code GST (INR) GSTIN 27AACCM3201E1Z3

Base 997132 ` 194.83 GST Regd. State Maharashtra

Rider 997132 ` 10.28 Affix

Re1

Reinstatement Interest ` 0.00

revenue

Total ` 205.11 stamp

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premium paid would

be eligible for deduction as per the provision of Income Tax Act, 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due to changes in

legislation or government notification. *Applicable Taxes, Cesses and Levies, as per prevailing laws, shall be borne by you. *For GST purposes,this premium receipt is Tax

Invoice.Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%. In case of unit linked product

GST is applicable on charges.

Authorised signatory

PRM20

You might also like

- Premium ReceiptDocument1 pagePremium ReceiptVivekanand Gupta0% (2)

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Deepthi Medical Insurance 2022-2023Document1 pageDeepthi Medical Insurance 2022-2023Prakash BattalaNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptkarthink123100% (1)

- Offer Letter 2024-03-04Document10 pagesOffer Letter 2024-03-04Gautam JaiswalNo ratings yet

- Renewal Premium ReceiptDocument1 pageRenewal Premium ReceiptShunta ShuntaNo ratings yet

- Medical Insurance ParentsDocument1 pageMedical Insurance Parentsraghuveer9303No ratings yet

- PremiumDocument2 pagesPremiumapsec0% (2)

- PDFDocument5 pagesPDFSandip SelokarNo ratings yet

- Pooja Policy Self 80 DDocument2 pagesPooja Policy Self 80 Dcagopalofficebackup100% (1)

- Medical InsuranceDocument1 pageMedical Insurancerellu prasadNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- Premium ReceiptDocument2 pagesPremium ReceiptPulkit KarnawatNo ratings yet

- HDFC Standard Life Insurance SacDocument1 pageHDFC Standard Life Insurance SacMADANMOHANREDDYNo ratings yet

- Nitin PDFDocument1 pageNitin PDFBALAJI NAIK MudavatuNo ratings yet

- Receiptsreceipts 04032011 25203Document1 pageReceiptsreceipts 04032011 25203Deepak KumarNo ratings yet

- Group C - Basix CaseDocument8 pagesGroup C - Basix Casermd1990No ratings yet

- 80D CertificateDocument2 pages80D CertificateYogy YNo ratings yet

- Max Bupa Health Insurance Company LimitedDocument1 pageMax Bupa Health Insurance Company LimitedNiklesh ChandakNo ratings yet

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- Star Health PolicyDocument5 pagesStar Health PolicyTripathy RadhakrishnaNo ratings yet

- MediclaimDocument3 pagesMediclaimPrajwal ShettyNo ratings yet

- Mediclaim 1Document1 pageMediclaim 1Arnab RoyNo ratings yet

- HDFC ERGO General Insurance Company LimitedDocument5 pagesHDFC ERGO General Insurance Company LimitedChiranjib PatraNo ratings yet

- ELSS Tax ReceiptDocument1 pageELSS Tax ReceiptPawan Bang100% (1)

- MEDCLAIM - Docx 80 DDocument1 pageMEDCLAIM - Docx 80 DNani krishnaNo ratings yet

- Medical Receipt Premium PDFDocument1 pageMedical Receipt Premium PDFe2arvindNo ratings yet

- PPF e Receipt PDFDocument1 pagePPF e Receipt PDFManoj KumarNo ratings yet

- 80D - Medical Premium Receipt - SelfDocument1 page80D - Medical Premium Receipt - SelfJagdish Saini0% (1)

- Health Insurance Premium Receipt: Personal DetailsDocument1 pageHealth Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- 090003e88105430f SONIADocument3 pages090003e88105430f SONIAKoushik DuttaNo ratings yet

- 13 18 0038121 00 PDFDocument7 pages13 18 0038121 00 PDFRaoul JhaNo ratings yet

- 2825100207112402000Document4 pages2825100207112402000bipin012No ratings yet

- Medical Insurance Certificate Max BupaDocument1 pageMedical Insurance Certificate Max BupaBinod DashNo ratings yet

- Characteristics of Employee BenefitsDocument4 pagesCharacteristics of Employee BenefitsMaitreyee Paralkar-VichareNo ratings yet

- Pdic 20 QuestionsDocument6 pagesPdic 20 Questionsjeams vidal100% (1)

- Premium ReceiptsDocument1 pagePremium Receiptsani dNo ratings yet

- RenewalReceipt 502-7066983 PolicyRenewalDocument2 pagesRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNo ratings yet

- Mediclaim Premium Receipt 2018Document1 pageMediclaim Premium Receipt 2018faizahamed111100% (1)

- HDFC Health Insurance PolicyDocument4 pagesHDFC Health Insurance PolicyrahulpahadeNo ratings yet

- FHP H0225594Document2 pagesFHP H0225594Raghavendra KamathNo ratings yet

- ParentHealthInsurance2023 2024Document1 pageParentHealthInsurance2023 2024Amarnath MalliahyagariNo ratings yet

- Premium Paid Certificate: Date: 14-SEP-20 16Document1 pagePremium Paid Certificate: Date: 14-SEP-20 16Koushik DuttaNo ratings yet

- CP PremiumReceipt 50373436 10164963 2506101435563556Document1 pageCP PremiumReceipt 50373436 10164963 2506101435563556TEENTUX100% (2)

- Medical Certifate (80D)Document2 pagesMedical Certifate (80D)chanchal kanojiaNo ratings yet

- Health Insurance ParentsDocument1 pageHealth Insurance ParentscagopalofficebackupNo ratings yet

- Sam Park DocumentDocument4 pagesSam Park DocumentShahadNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatya0% (1)

- 80CDocument3 pages80CRajesh AdluriNo ratings yet

- Premium Paid AcknowledgementDocument1 pagePremium Paid AcknowledgementDhruv PrakashNo ratings yet

- Medical InsuranceDocument1 pageMedical InsuranceMasood Ahmad100% (1)

- Birla Premium Paid Certificate 2020Document2 pagesBirla Premium Paid Certificate 2020SindhuNo ratings yet

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Tata Aig MedicalDocument2 pagesTata Aig MedicalTridib BhattacharyaNo ratings yet

- 80 D Religare Health Insurace Premium Receipt Rs.21347Document7 pages80 D Religare Health Insurace Premium Receipt Rs.21347Shree Sai Enterprise100% (1)

- Receipt DocDocument1 pageReceipt Doccharchit123No ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNo ratings yet

- Health InsuranceDocument1 pageHealth InsuranceSiddharth ElangoNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- WeHnMa1 - CA0l Agenda AandB CWC Puri 2 PDFDocument320 pagesWeHnMa1 - CA0l Agenda AandB CWC Puri 2 PDFRavi SrivastavaNo ratings yet

- NEBOSH IGC1 Past Exam Paper March 2012Document3 pagesNEBOSH IGC1 Past Exam Paper March 2012Seleni100% (1)

- Questionnaire - Crime Insurance (04 (1) .06.07)Document3 pagesQuestionnaire - Crime Insurance (04 (1) .06.07)yash3233No ratings yet

- Brain Pool Program GuidelinesDocument22 pagesBrain Pool Program GuidelinesgabyNo ratings yet

- Buried in Debt - Mahmoud ArtilDocument65 pagesBuried in Debt - Mahmoud ArtilMahmoud Artil100% (1)

- Oracle Fusion Accounting Hub Calculation Engine FahDocument4 pagesOracle Fusion Accounting Hub Calculation Engine FahSaurabh ModiNo ratings yet

- EFSA Guidelines On Outsourcing Requirements For Supervised EntitiesDocument17 pagesEFSA Guidelines On Outsourcing Requirements For Supervised EntitiesarvoboxNo ratings yet

- American Home Assurance Company, Petitioner, vs. Tantuco ENTERPRISES, INC., RespondentDocument8 pagesAmerican Home Assurance Company, Petitioner, vs. Tantuco ENTERPRISES, INC., RespondentHarvey Leo RomanoNo ratings yet

- Auto Insurance Quotes For Young DriversDocument10 pagesAuto Insurance Quotes For Young DriversScott HoltNo ratings yet

- InvoiceDocument2 pagesInvoiceIruleswar IrulesNo ratings yet

- Top 100 Pension Schemes 2010Document44 pagesTop 100 Pension Schemes 2010graciaguoNo ratings yet

- Insurance Regulatory Development Authority of India (IRDAI)Document13 pagesInsurance Regulatory Development Authority of India (IRDAI)Karthi KeyanNo ratings yet

- Articles of Incorporation Stock CorpDocument5 pagesArticles of Incorporation Stock CorpaubreydaclisNo ratings yet

- Uberrima Fides in Marine Insurance Contract Fairness Commercial Suitability and Possible ReformsDocument27 pagesUberrima Fides in Marine Insurance Contract Fairness Commercial Suitability and Possible ReformsDileep ChowdaryNo ratings yet

- Marketing of Financial Services Provided By": Dr. D. Y. Patil Vidyapeeth, PuneDocument114 pagesMarketing of Financial Services Provided By": Dr. D. Y. Patil Vidyapeeth, Punesiddharth_sr21No ratings yet

- Hmo Enrollment - Premium Deduction Schedule: Pay-Out Date Premium Payment CoverageDocument1 pageHmo Enrollment - Premium Deduction Schedule: Pay-Out Date Premium Payment CoveragePatrisha Mari KerrNo ratings yet

- Purpose Codes IndiaDocument5 pagesPurpose Codes IndiaseychellesblueNo ratings yet

- Star Cancer Care Brochure PlatinumDocument10 pagesStar Cancer Care Brochure Platinumamal j rajtNo ratings yet

- Tentative CatalogueBGR20220901182Document23 pagesTentative CatalogueBGR20220901182Vasanth rNo ratings yet

- Maharashtra State Electricity Distibution Co. LTD.: NA NADocument17 pagesMaharashtra State Electricity Distibution Co. LTD.: NA NAÄñîRûddhâ JâdHäv ÂjNo ratings yet

- 11 TaguigCity2013 Part4 AnnexesDocument108 pages11 TaguigCity2013 Part4 AnnexesRoselle SNo ratings yet

- Summer Training CertificateDocument1 pageSummer Training CertificateuditasinhaNo ratings yet

- To, Shriram Life Insurance Company Limited.: Customer Mandate Cum Declaration Form For New BusinessDocument1 pageTo, Shriram Life Insurance Company Limited.: Customer Mandate Cum Declaration Form For New Businessdharam singhNo ratings yet

- Site Preparation or LevelingDocument4 pagesSite Preparation or LevelingsuhailfarhaanNo ratings yet

- RCBC vs. CA, 289 Scra 292Document9 pagesRCBC vs. CA, 289 Scra 292Kimberly SendinNo ratings yet

- Agri 1Document82 pagesAgri 1SherwinCababatNo ratings yet