Health Insurance Premium Receipt: Personal Details

Health Insurance Premium Receipt: Personal Details

Uploaded by

Ranjith BCopyright:

Available Formats

Health Insurance Premium Receipt: Personal Details

Health Insurance Premium Receipt: Personal Details

Uploaded by

Ranjith BOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Health Insurance Premium Receipt: Personal Details

Health Insurance Premium Receipt: Personal Details

Uploaded by

Ranjith BCopyright:

Available Formats

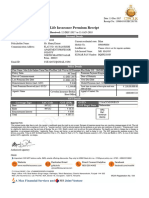

Date: 13-Dec-2021

Receipt No.: 145664876 DEC211213

Health Insurance Premium

Receipt

Duration For Which the Premium is Received: 13-DEC-2021 to 13-DEC-2022

Personal Details

Policy Number: 28394783

Current residential state: Bihar

Policyholder Name: Raj Communication

Mobile No. 8986490886

Address: House#419, 13th Main

Landline no. Please inform us for regular updates

MC Layout, Vijayanagara

Life Insured Name: MR. Vijay Kumar

Bengaluru

Karnataka - 560040 PAN Number: BQJPK5050N

2018032388.pdf

Email ID:

Policy Details

Plan Name: Max Life Online Term Plan PlusMax Life Waiver Of Premium Plus Rider CO - 104N092V02

Policy Term 36 Years Premium Payment Frequency Yearly

Date of Commencement 13-DEC-2021 Date of Maturity 12-DEC-2057

Last Premium Due Date 13-DEC-2021 Next Due Date 12-JAN-2018

Reinstatement Interest (incl. GST) 0.00 Model Premium (incl. GST) 1,344.60

Total Premium Received (incl. GST)* 1,344.60 Total Sum Assured of base plan and term 1,00,00,000.00

rider (if any)

Agent's Name Coverfox Insurance Brokin Agent's Contact No.

18002005522

Head Office

GST Details

Coverage Type SAC Code GST (INR) GSTIN 27AACCM3201E1Z3

Base 997132 194.83 GST Regd. State Maharashtra

Rider 997132 10.28

Affix

Reinstatement Interest 0.00 Re1

Total 205.11 revenue

stamp

Important Note:

*For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us. *Amount received would be adjusted against the due premium as per terms and conditions of the policy. *Premium paid would

be eligible for deduction as per the provision of Income Tax Act, 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due to changes in

legislation or government notification. *Applicable Taxes, Cesses and Levies, as per prevailing laws, shall be borne by you. *For GST purposes,this premium receipt is Tax

Invoice.Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%; Single Premium Annuity is 10%; Term and Health is 100%. In case of unit linked

product GST is applicable on charges.

Authorised signatory

PRM20

You might also like

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRITIKANo ratings yet

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- BIR Form 1601-EDocument2 pagesBIR Form 1601-EJerel John Calanao67% (3)

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash Lamani100% (1)

- Value Added Tax (VAT) Number Registration / ApplicationDocument4 pagesValue Added Tax (VAT) Number Registration / ApplicationLedger Domains LLCNo ratings yet

- Term Insurance Premium Receipt: Personal DetailsDocument1 pageTerm Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptChandPari AkulNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailschanam bedantaNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Life Insurance Premium ReceiptDocument1 pageLife Insurance Premium ReceiptVijayNo ratings yet

- Circi: InsuranceDocument1 pageCirci: InsuranceapplerajivNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/08/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/08/2023Yogesh DeshmukhNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

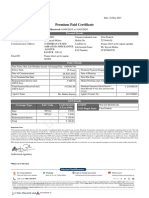

- Premium Paid Certificate: 50,00,000.00 2,561.78 28-JAN-2024 To 27-FEB-2024 28-FEB-2024Document1 pagePremium Paid Certificate: 50,00,000.00 2,561.78 28-JAN-2024 To 27-FEB-2024 28-FEB-2024Venkey DemattiNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Zprmrnot 22891511 4720686 PDFDocument1 pageZprmrnot 22891511 4720686 PDFVishwambhara DasaNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- Insurance 1premiumDocument1 pageInsurance 1premiumBharathNo ratings yet

- Mahamadabrar Mahamadhanif Malek RN 24-25Document2 pagesMahamadabrar Mahamadhanif Malek RN 24-25ayanmaniyar2204No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Mh43av0575 Utkarsha SharmaDocument2 pagesMh43av0575 Utkarsha SharmaJainam AjmeraNo ratings yet

- Policy NN012203163316 PrintNewDocument22 pagesPolicy NN012203163316 PrintNewPrabhakar bhaleraoNo ratings yet

- LIPCReport Premiumreceipt 20240724074909408 C241206964Document1 pageLIPCReport Premiumreceipt 20240724074909408 C241206964nirupam.samantha123No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- LIPCReport Premiumreceipt 20240724075007825 C241206964Document1 pageLIPCReport Premiumreceipt 20240724075007825 C241206964nirupam.samantha123No ratings yet

- Consolidatedreceipt PDFDocument1 pageConsolidatedreceipt PDFSuyash MishraNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Saw G Payment ReceiptDocument1 pageSaw G Payment ReceiptrinkukjanNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- Premium Paid Certificate: 11,27,500.00 1,04,806.26 07-MAR-2024 To 06-MAR-2025 07-MAR-2025Document1 pagePremium Paid Certificate: 11,27,500.00 1,04,806.26 07-MAR-2024 To 06-MAR-2025 07-MAR-2025tomarneptuneNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsnirupam.samantha123No ratings yet

- Zprmnotc 23280183 15838155Document1 pageZprmnotc 23280183 15838155devabhutada111coolNo ratings yet

- Consolidated ReceiptDocument2 pagesConsolidated Receiptdigital.arun999No ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Fastag Number DeclarationDocument2 pagesFastag Number DeclarationAKSHAY GAIKWADNo ratings yet

- Zprmrnot 22868079 21565386Document1 pageZprmrnot 22868079 21565386krishandeeptiNo ratings yet

- Premium Receipt: 1,80,00,000.00 1,884.50 25-MAR-2023 To 24-APR-2023 25-APR-2023Document1 pagePremium Receipt: 1,80,00,000.00 1,884.50 25-MAR-2023 To 24-APR-2023 25-APR-2023metem12409No ratings yet

- Zprmrnot - 24596389 - 25915509 2Document1 pageZprmrnot - 24596389 - 25915509 2cryptoraj2501No ratings yet

- GPA PolicyDocument10 pagesGPA Policyparas INSURANCENo ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsAmit KumarNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 42 Implementation of Tds in Tallyerp 9Document171 pages42 Implementation of Tds in Tallyerp 9P VenkatesanNo ratings yet

- Sample 1673514368545Document2 pagesSample 1673514368545Sonm NegiNo ratings yet

- Bearing The Burden of DSTDocument6 pagesBearing The Burden of DSTdignaNo ratings yet

- IT Statement 20-21Document2 pagesIT Statement 20-21Santhosh KumarNo ratings yet

- National Development Company V CIR (1987)Document2 pagesNational Development Company V CIR (1987)BernadetteGaleraNo ratings yet

- Glossary of French Banking Terms French English CommentsDocument2 pagesGlossary of French Banking Terms French English CommentsKhob ThaiNo ratings yet

- Invoice Book3Document1 pageInvoice Book3in2dblue.oceanNo ratings yet

- Account Statement For Account:0820001500005003: Branch DetailsDocument28 pagesAccount Statement For Account:0820001500005003: Branch DetailsAnmol DeepNo ratings yet

- InvoiceDocument1 pageInvoicedixofov340No ratings yet

- Account Summary Contact UsDocument5 pagesAccount Summary Contact UsBryce AntonioNo ratings yet

- Welcome to RHB Bank at 20 May 2024, Jasonpibg (Reviewer & Authorizer) (2)Document2 pagesWelcome to RHB Bank at 20 May 2024, Jasonpibg (Reviewer & Authorizer) (2)CHEW CHUN HOW MoeNo ratings yet

- Chapter 8Document10 pagesChapter 8Thùy Vân NguyễnNo ratings yet

- Bharat Heavy Electricals Limited: 06290981 Shivam GuptaDocument1 pageBharat Heavy Electricals Limited: 06290981 Shivam GuptaMr. Shivam GuptaNo ratings yet

- February 2023 NewsLetterDocument23 pagesFebruary 2023 NewsLetterSabrina CanoNo ratings yet

- BR100 - AppSetup - AP - 1.0-KULDocument58 pagesBR100 - AppSetup - AP - 1.0-KULPrathap ChandrappaNo ratings yet

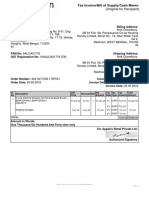

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)AB Block01No ratings yet

- Solved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFDocument1 pageSolved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFAnbu jaromiaNo ratings yet

- 9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListDocument4 pages9f71ccd9 Acfa 4d7d 85f1 Eda40ddd6c3a ListAllan Ramirez RadilloNo ratings yet

- Checks ManagementDocument3 pagesChecks ManagementnorthepirNo ratings yet

- Consolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Document8 pagesConsolidated 2018 Forms 1099 and Details: Robinhood (650) 940-2700Renjie XuNo ratings yet

- Accounting T Codes91011245389659Document18 pagesAccounting T Codes91011245389659Jayanth MaydipalleNo ratings yet

- HR QueriesDocument6 pagesHR Queriesfrancy_rajNo ratings yet

- Iesco Online Bill PDFDocument2 pagesIesco Online Bill PDFAdnan Munir100% (1)

- AFP General Insurance v. CIRDocument19 pagesAFP General Insurance v. CIRUlyssesNo ratings yet

- Overview of Vietnam Tax SystemDocument13 pagesOverview of Vietnam Tax SystemNhung HồngNo ratings yet

- Monthly Statement: This Month's SummaryDocument4 pagesMonthly Statement: This Month's SummarySanjeev KumarNo ratings yet

- Home Budget PlannerDocument137 pagesHome Budget Plannerjiguparmar1516No ratings yet