De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

Uploaded by

Rodwin DeunaCopyright:

Available Formats

De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

Uploaded by

Rodwin DeunaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

De La Salle Lipa: DLSL CPA Board Operation - Auditing Problem Page 1 of 4

Uploaded by

Rodwin DeunaCopyright:

Available Formats

DE LA SALLE LIPA

College of Business, Economics, Accountancy and Management

Accountancy Department

2nd Semester A.Y. 2012-2013

Auditing Problem

AUDIT OF INVENTORY

I. Components of Inventory

Problem 1. The following items are included in the Inventory Account of CANON Inc.:

Finished goods held by customer on “sale or return” arrangement P 100,000

Raw materials held by CANON on “sale on approval or trial” arrangement 200,000

Raw materials held by CANON on “consignment” 50,000

Finished goods held by customer on “consignment” 150,000

Finished goods held by customer on “sale on approval or trial” arrangement 20,000

Raw materials held by CANON on “sale or return” arrangement 30,000

Finished goods on display in CANON’s retail store 40,000

Finished goods on CANON’s warehouse which is specifically segregated per sale contract 10,000

Raw Materials in transit, FOB Destination 30,000

Finished goods in transit, FOB Shipping Point 20,000

Raw Materials in transit, FOB Shipping Point 60,000

Finished goods in transit, FOB Destination 80,000

Finished Goods in the CANON’s warehouse 10,000

Finished Goods in the loading dock of CANON 20,000

Work-in-process in the CANON’s warehouse 30,000

Raw Materials in the receiving department, invoice not yet received 20,000

Finished Goods in the shipping department 40,000

Finished Goods on counter for sale 50,000

Unexpired insurance on inventories 100,000

Office supplies 10,000

Advertising catalogs and shipping cartons 25,000

Required: What is the total amount that should be included in Inventory Account?

II. Inventory Cost Components

Problem 2. Sharp Inc. is engaged in manufacturing and selling appliances in the Philippines. The manufacturer uses

perpetual inventory system and net method in its purchases. Moreover, the entity implemented Just-in-Time Cost

Accounting in its production. During the 2011, Sharp Inc. incurred the following expenditures in the production of its

product:

List or Catalog Price of purchased materials P1,000,000

Trade discount and rebates 200,000

Purchase discounts not taken 100,000

Foreign exchange differences arising from acquisition 100,000

Creditable value added tax 120,000

Nonrefundable import duties 100,000

Brokerage commission 200,000

Freight and insurance of materials 300,000

Other handling costs 200,000

Fixed factory overhead 100,000

Variable administrative overhead 200,000

Direct Labor 300,000

Variable factory overhead 400,000

Normal amount of production waste 200,000

Abnormal amount of production waste 100.000

Variable administrative overhead 200,000

After-sales warranty cost 200,000

Distribution cost 100,000

Storage cost of finished goods 200,000

Salary of inventory clerk 300,000

Salary of sales staff 400,000

Required: What is the total costs of Inventory?

DLSL CPA Board Operation – Auditing Problem

Page 1 of 4

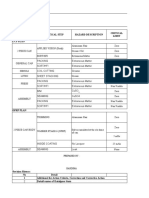

III. FIFO, Weighted Average & Moving Average

Problem 3. On the month of December 2011, the following transactions occurred in one of the branches of Panda Inc.:

Date Transaction Unit Cost Unit Total Cost

December 1 Beginning Balance P5.00 1,000 P 5,000

5 Purchase 6.00 2,000 12,000

10 Purchase 8.00 3,000 24,000

11 Purchase Return 6.00 (1,000) (6,000)

15 Purchase 9.00 2,000 18,000

16 Sales (5,000)

20 Sales Return 2,000

21 Purchase 10.00 3,000 30,000

22 Sales 1,000

23 Purchase 11,000 1,000 11,000

30 Purchase return 10.00 (1,000) 10,000

Required: Determine the following for the month of December 2011:

Assumption FIFO Weighted Average Moving Average

1. TGAS __________ __________ __________

2. Cost of Sales __________ __________ __________

3. Cost of Ending Inventory __________ __________ __________

IV. Lower of Cost or Net Realizable Value

Problem 4. Avida Inc. is engaged in real estate business. On December 31, 2011, Avida provided the following data

concerning its different types of inventories:

Product Cost Estimated Normal Profit Cost to Cost to

Selling Price % based on SP Complete Sell

Condominium P1,000,000 P2,000,000 20% P500,000 P300,000

House and Lot 2,000,000 3,000,000 30% 600,000 800,000

Resort House 3,000,000 4,000,000 10% 700,000 400,000

Land 2,000,000 2,500,000 10% 250,000 100,000

Required: Determine the following for the year ended December 31,2011:

____________1. Total Net Realizable Value of Inventory

____________2. Total Amount to be presented in the Statement of Financial Position on December 31,2011

____________3. Loss on Inventory Writedown on 2011

V. Gross Profit Method

Problem 5. On December 30,2011, the warehouse of Silver Inc. was razed by a fire. As a result, all merchandise

inventories in the warehouse were destroyed except for a necklace. The necklace was sold on December 31,2011 for

P200,000. The following data are obtained from the accounting records of Silver Inc as of December 30,2011:

Inventory Beginning P1,500,000

Purchases 5,000,000

Freight – In 500,000

Purchase return 300,000

Purchase discount 400,000

Purchase allowance 400,000

Total Sales as of December 30,2011 6,000,000

Sales return 1,000,000

Sales discount 500,000

Sales allowance 500,000

Required: Determine the following:

Assumption 20% based on Sale 20% based on Cost

1. TGAS ________________ ________________

2. Gross Profit as of December 30,2011 ________________ ________________

3. Cost of Sales as of December 30,2011 ________________ ________________

4. Ending Inventory as of December 30,2011 ________________ ________________

5. Loss on Fire ________________ ________________

DLSL CPA Board Operation – Auditing Problem

Page 2 of 4

6. Adjusted Gross Profit as of Dec. 31,2011 ________________ ________________

7. Adjusted Cost of Sales as of Dec. 31,2011 ________________ ________________

VI. Retail Inventory Method

Problem 6. The following data are provided by Bench Inc. for the year ended December 31,2011:

Cost Retail

Beginning Inventory P500,000 P800,000

Purchases 2,000,000 2,500,000

Freight In 200,000

Purchase return (100,000) (120,000)

Purchase allowance (50,000)

Purchase discount (50,000)

Department transfer in 200,000 240,000

Department transfer out (150,000) (200,000)

Mark up 200,000

Mark down (100,000)

Mark up cancellation (100,000)

Mark down cancellation 50,000

Sales 1,500,000

Sales discount (100,000)

Sales return (200,000)

Sales allowance (100,000)

Normal shortage 100,000

Employee discount 200,000

Required: Determine the following:

Assumption: Average Retail Approach FIFO Retail Approach

1. TGAS at Retail ________________ ________________

2. TGAS at Cost ________________ ________________

3. Cost Ratio ________________ ________________

4. Ending Inventory at Retail ________________ ________________

5. Ending Inventory at Cost ________________ ________________

6. Cost of Sales ________________ ________________

VII. Biological Assets

Problem 7. The Farm Inc. is engaged in poultry business. On January 1,2011, the following data are provided concerning

the pigs of The Farm:

Biological Asset Fair Value less Cost to Sell

100 pigs (1-year old) P2,000

On July 1,2011, The Farm purchased 200 pigs (6 months – old) for P1,500 each. On October 1,2011, 300 pigs were born

and the fair value less cost to sell on such date of new born is P1,000.

The active market provided the fair value less cost to sell of the pigs on December 31,2011:

Biological Asset Fair Value less Cost to Sell

New Born P1,200

3-month Old 1,400

6-month Old 1,800

1-year Old 2,200

2-year Old 2,500

Required: Determine the following:

____________1. Biological Asset on December 31,2011

____________2. Total Gain or (Loss) on Changes in Fair Value less Cost to Sell in Profit or Loss

____________3. Gain or (Loss) arising from price change

____________4. Gain or (Loss) arising from physical change

DLSL CPA Board Operation – Auditing Problem

Page 3 of 4

VIII. Purchase, Sale & Inventory Cut-off

Problem 8. MLB Inc. is a merchandiser of baseballs. All purchases and sales of MLB are on account. The following

information was obtained from the company’s accounting records for the year ended December 31,2011:

Inventory at December 31, 2011 (based on physical count in MLB’s warehouse

at cost on December 30,2011) P12,000,000

Net Purchases 13,000,000

Accounts Payable 11,000,000

Net Sales 15,000,000

Accounts Receivable 14,000,000

Net Income 12,500,000

The following data were found during your audit:

a. Goods were in transit costing P100,000 from a supplier on December 30,2011 with shipping term of FOB

Destination. Further testing revealed that the purchase had been recorded on December 31,2011 because the

invoice was sent on such date.

b. Goods were in transit with selling price of P200,000 to a customer on December 29,2011 with shipping term of

FOB Destination. The goods arrived to customer on January 1,2012. The sale is recorded by MLB on December

31,2011. (The mark-up is 20% based on sale)

c. Goods costing P50,000 was held on consignment on December 30,2011 and included in the physical inventory

count. MLB recorded this transaction as a purchase on December 31,2011.

d. Goods were in transit costing P150,000 from a supplier on December 29,2011 with shipping term FOB Shipping

point. The goods arrived to MLB on December 31,2011. The purchase was recorded by MLB on January 2,2012

when the invoice arrived.

e. Goods in were transit with selling price of P240,000 to a customer on January 1,2012. The goods arrived to the

customer on January 2,2012. The shipping term is FOB Shipping Point. The sale was recorded by MLB on

December 31,2011 when the sales invoice was sent to the customer. (The mark-up is 20% based on sale)

f. Goods costing P250,000 was out on consignment with a customer on December 30,2011. This is recorded as

sales on account for P300,000.

g. Goods costing P150,000 on December 30,2011 was found to be defective. They are included in the physical

inventory count and expected to be returned on December 31,2011.

h. Goods were in transit costing P400,000 from a supplier on December 31,2011 with shipping term FOB Shipping

Point. Further testing revealed that the purchase had been recorded on December 31,2011 because the invoice

was sent on such date.

i. Good were in transit with selling price of P100,000 to a customer on December 31,2011. The goods were shipped

on December 31,2011 with shipping term of FOB shipping point. (The mark-up is 30% based on sale). The sale is

recorded by MLB on January 1,2012 when the invoice was sent to the customer.

j. MLB received goods costing P200,000 on December 31,2011. The shipping term is FOB-destination and MLB

recorded the purchase on January 1,2012 when the invoice was received.

k. Goods were shipped to a customer on December 29,2011 with selling price of P200,000. The shipping term is

FOB-destination and the goods arrived to the customer on January 1,2012. The sale was recorded by MLB on

December 31,2011. (The mark-up is 30% based on sale)

l. Goods costing P150,000 were shipped on January 1,2012 from a supplier. The goods were received by MLB on

January 2,2012 and the shipping term is FOB Shipping Point. The purchase was recorded by MLB on December

31,2011 when the invoice was received.

m. Goods costing P300,000 were shipped on December 28,2011 from a supplier. The goods were received by MLB

on January 1,2012 with shipping term FOB shipping point. The purchase was recorded by MLB on December

31,2011 when the invoice was received.

n. Goods costing P240,000 were shipped on December 28,2011 to a customer. The goods were received by the

customer on January 1,2012 with shipping term FOB destination. The sale was recorded by MLB on December

31,2011 when the invoice was sent. (The mark-up is 20% based on sale)

Required: Based on the result of your audit, determine the adjusted balance of the following as of December 31,2011:

____________1. Accounts Receivable

____________2. Accounts Payable

____________3. Net Purchases

DLSL CPA Board Operation – Auditing Problem

Page 4 of 4

____________4. Net Sales

____________5. Inventory

____________6. Net Income

DLSL CPA Board Operation – Auditing Problem

Page 5 of 4

You might also like

- Motivation Letter - RUAS-Supply Chain ManagementDocument2 pagesMotivation Letter - RUAS-Supply Chain ManagementNahid80% (5)

- Diebold Nixdorf DN250A - Part ListDocument5 pagesDiebold Nixdorf DN250A - Part ListrredondoNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Audit of InvDocument19 pagesAudit of InvMae-shane SagayoNo ratings yet

- Audit of Inventories (Done)Document19 pagesAudit of Inventories (Done)Hasmin Saripada Ampatua100% (1)

- Chapter 16 30 Valix Practical Accounting 2011Document429 pagesChapter 16 30 Valix Practical Accounting 2011Charlene De PedroNo ratings yet

- Toy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitDocument12 pagesToy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitShiela EscobarNo ratings yet

- AP InventoriesDocument7 pagesAP InventorieswingNo ratings yet

- Parcor Quiz Manufacturing Operations ProblemDocument1 pageParcor Quiz Manufacturing Operations ProblemArman Dizon100% (1)

- NVENTORY PROBLEM Problem 1 20Document13 pagesNVENTORY PROBLEM Problem 1 20SamihaNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- 03 - HO - Statement of Comprehensive IncomeDocument3 pages03 - HO - Statement of Comprehensive IncomeYoung MetroNo ratings yet

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- KEY Seatwork 4.2 InventoryDocument6 pagesKEY Seatwork 4.2 Inventorykingchez2304No ratings yet

- Statement of Comprehensive IncomeDocument3 pagesStatement of Comprehensive IncomeHaidee Flavier SabidoNo ratings yet

- Statement of Comprehensive Income ProblemsDocument2 pagesStatement of Comprehensive Income ProblemsDarlyn Dalida San PedroNo ratings yet

- Activity-No.-13Document2 pagesActivity-No.-13Alexandra RoqueNo ratings yet

- Integrated Accounting AssignmentDocument4 pagesIntegrated Accounting Assignmentjustinmajok8No ratings yet

- Inventory Sample ExerciseDocument13 pagesInventory Sample ExercisejangjangNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- PAS 2 - Inventories Problem 1 Decide Whether The Item Is Included As Part of Inventories As of December 31, 2019Document2 pagesPAS 2 - Inventories Problem 1 Decide Whether The Item Is Included As Part of Inventories As of December 31, 2019Shaira MaguddayaoNo ratings yet

- Actg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizDocument4 pagesActg 431 Quiz Week 7 Practical Accounting I (Part II) Inventories QuizMarilou Arcillas PanisalesNo ratings yet

- Acco For InventoriesDocument8 pagesAcco For InventoriesPatricia CNo ratings yet

- Inventories (Problems)Document6 pagesInventories (Problems)IAN PADAYOGDOGNo ratings yet

- Statement of Comprehensive Income - ExerciseDocument2 pagesStatement of Comprehensive Income - ExerciseMary Kate OrobiaNo ratings yet

- Conceptual Frameworks & Accounting Standards: (Handwritten)Document1 pageConceptual Frameworks & Accounting Standards: (Handwritten)Mikaella SaduralNo ratings yet

- Ascuncion InventoriesDocument22 pagesAscuncion InventoriesKendrew SujideNo ratings yet

- Final Exam IA ReviewerDocument67 pagesFinal Exam IA ReviewerShem CasimiroNo ratings yet

- Module 2Document11 pagesModule 2Deanne LumakangNo ratings yet

- Problem 1Document3 pagesProblem 1Cinderella Ladyong0% (2)

- Ie 516 Chapter 3 2021 Revised NewrDocument26 pagesIe 516 Chapter 3 2021 Revised NewrFarooq AlhamdanyNo ratings yet

- P1 Day1 RM2020Document5 pagesP1 Day1 RM2020P De GuzmanNo ratings yet

- COST SHEET OnlineDocument13 pagesCOST SHEET OnlineSoumendra RoyNo ratings yet

- Inventory Sample Exercise - 2Document8 pagesInventory Sample Exercise - 2jangjangNo ratings yet

- Problem Solving Updates in Philippine Accounting and Financial Reporting StandardsDocument5 pagesProblem Solving Updates in Philippine Accounting and Financial Reporting StandardsgnlynNo ratings yet

- BBD Company - Answer KeyDocument5 pagesBBD Company - Answer KeyMuriel MahanludNo ratings yet

- EC 1 - Acctg Cycle Part 2 Sample ProblemsDocument1 pageEC 1 - Acctg Cycle Part 2 Sample ProblemsChelay EscarezNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- Integrated Accounting Assignment - Docx.1Document5 pagesIntegrated Accounting Assignment - Docx.1justinmajok8No ratings yet

- Cost Sheet 1Document4 pagesCost Sheet 1Bhavya GroverNo ratings yet

- INVENTORY PROBLEMS AND CONCEPTS QUE and ANSDocument11 pagesINVENTORY PROBLEMS AND CONCEPTS QUE and ANSMALICDEM, CharizNo ratings yet

- acctng-1-Quiz-FS Begino, Vanessa Jamila DDocument4 pagesacctng-1-Quiz-FS Begino, Vanessa Jamila DVanessa JamilaNo ratings yet

- Shipments To Branch Above CostDocument4 pagesShipments To Branch Above CostJohnmichael Coroza0% (1)

- Group Work AssignmentDocument20 pagesGroup Work AssignmentDennis MunaiNo ratings yet

- Sir Mac Book SolmanDocument10 pagesSir Mac Book SolmanJAY AUBREY PINEDANo ratings yet

- Cost and Management Accounting - Internal Backlog Assignment QuestionsDocument3 pagesCost and Management Accounting - Internal Backlog Assignment QuestionsVaidehi MirajkarNo ratings yet

- 2- PERFORMANCE TASK 2Document2 pages2- PERFORMANCE TASK 2hdgsvdbnfNo ratings yet

- Accounting 1b FTX 2024 (FM3) 2SDocument5 pagesAccounting 1b FTX 2024 (FM3) 2Slou-924No ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- ASSESSMENT INVENTORIESDocument3 pagesASSESSMENT INVENTORIESRojun Kristufer MedenillaNo ratings yet

- InventoryDocument3 pagesInventorymarinelle101005No ratings yet

- (LAB) Activity - Preparation of Financial Statements Using SpreadsheetDocument3 pages(LAB) Activity - Preparation of Financial Statements Using SpreadsheetJUVEN LOGAGAY0% (1)

- Assignments QuestionDocument8 pagesAssignments Questionmuhammad qasim0% (1)

- Chapter 10 Answer Key True or FalseDocument8 pagesChapter 10 Answer Key True or FalseArn KylaNo ratings yet

- Financial PositionDocument4 pagesFinancial PositionBeth Diaz Laurente100% (2)

- Acctg 112Document3 pagesAcctg 112Rathew Cassey PencilNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Stock Market Simulation Game TemplateDocument20 pagesStock Market Simulation Game TemplateJesierine GarciaNo ratings yet

- Beti 2Document2 pagesBeti 2nile.azgyNo ratings yet

- Managing A Lean-Agile Leadership Transformation in A Traditional OrganizationDocument128 pagesManaging A Lean-Agile Leadership Transformation in A Traditional OrganizationAiouaz OthmenNo ratings yet

- HB 205-2004 OHS Risk Management HandbookDocument5 pagesHB 205-2004 OHS Risk Management HandbookSAI Global - APACNo ratings yet

- Excel Inventory Sheet TemplateDocument3 pagesExcel Inventory Sheet TemplateArief HutasuhutNo ratings yet

- Marketing Strategy For B2BDocument8 pagesMarketing Strategy For B2B2qzrkmxfn2No ratings yet

- SSRN 4657674Document24 pagesSSRN 4657674NO NAMENo ratings yet

- Resume Balaji Venkat Esha Chut Hara ManDocument1 pageResume Balaji Venkat Esha Chut Hara ManBhuvanesh M.PNo ratings yet

- Exercise 1 - IF and VlookupsDocument9 pagesExercise 1 - IF and Vlookupsjanegrace.hernandezNo ratings yet

- Commonalities and Differences Between Service andDocument9 pagesCommonalities and Differences Between Service andBui Le Thuy Trang (FE FIC HN)No ratings yet

- Schbang Theta Creds Deck 2023Document64 pagesSchbang Theta Creds Deck 2023Aditi AgrawalNo ratings yet

- The Advertising Report 2024 1708137205Document64 pagesThe Advertising Report 2024 1708137205navinscribdNo ratings yet

- TAGOLOAN Community College: Entrepreneurial Management 2Document2 pagesTAGOLOAN Community College: Entrepreneurial Management 2mariegold mortola fabelaNo ratings yet

- Team Building EmsDocument33 pagesTeam Building EmsBrhanemeskel MekonnenNo ratings yet

- Total Recordable Injury and Incident Rate: Winda Trijayanthi UtamaDocument7 pagesTotal Recordable Injury and Incident Rate: Winda Trijayanthi UtamaBook BoomNo ratings yet

- HP 0.4 CCP Oprp PlanDocument5 pagesHP 0.4 CCP Oprp PlanFahal Abdi WijayaNo ratings yet

- Technical TQL Log - R0Document4 pagesTechnical TQL Log - R0Jonathan ThimotyNo ratings yet

- Agile HomeworkDocument21 pagesAgile HomeworkLing SunNo ratings yet

- The Jaipur Jewellery Show-CompressedDocument12 pagesThe Jaipur Jewellery Show-Compressed7889628078ksNo ratings yet

- QTS Dailam Exw Us-Sgn 1540LBSDocument1 pageQTS Dailam Exw Us-Sgn 1540LBSBa Duy NguyenNo ratings yet

- Strategic ManagementDocument10 pagesStrategic ManagementVinod JakharNo ratings yet

- BPL 1 FinanceDocument48 pagesBPL 1 Financehakan.dinlerNo ratings yet

- Exercise Problems Materials PDFDocument3 pagesExercise Problems Materials PDFHardin LavistreNo ratings yet

- BSBPMG630 Task 2.1 - Assessor - S ChecklistDocument6 pagesBSBPMG630 Task 2.1 - Assessor - S ChecklisthenriquemorcegoNo ratings yet

- Venminder - Due Diligence Checklist For Low Moderate and High Risk VendorsDocument2 pagesVenminder - Due Diligence Checklist For Low Moderate and High Risk VendorsNico MateuNo ratings yet

- Kumar2015 Military Hospital Jhansi India 2014Document4 pagesKumar2015 Military Hospital Jhansi India 2014Endless LoveNo ratings yet

- Inv 235400128388bDocument1 pageInv 235400128388bdjasasumatera29No ratings yet

- Track Shipment Status - Consignment Status - DTDC IndiaDocument1 pageTrack Shipment Status - Consignment Status - DTDC IndiaAshwini KumarNo ratings yet