Img 169

Img 169

Uploaded by

mjppjdcCopyright:

Available Formats

Img 169

Img 169

Uploaded by

mjppjdcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Img 169

Img 169

Uploaded by

mjppjdcCopyright:

Available Formats

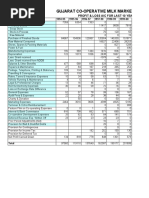

1HTG Income Statement, HTG LMH 1HTG January 31, 2011

Period: 1 2 3 4 5 6 7 8 9 10 11 12

Month: Oct Nov Dec Jan Fefa Mar Apr May June July Aug Sept YTD

Currency: LC LC LC LC LC LC LC LC LC LC LC LC LC

Avq Exert Rate: 39,47 39,63 39,50 39,62 .

Sales - MT

Flour 1-12 1 949 2485 3483 2685 10602

Feed 1-14 59 76 134

Wheat 1-1 5 529 737 468 274 2007

Total MTs Sold: 2478 3222 4010 3034 12744

Flour Sales 1-12 42 703 767 54 977 000 76 759 424 62192297 236632488

Feed Sales 1-14 616996 193660 820 860 1 035 980 2667496

Wheat Sales 1-16 3103574 4 339 632 2 745 907 1618825 11807938

Total Sales 46424337 59 510 292 80326191 64847102 251107922

Cost of Flour Sales 1-12 40 621 683 52 330 490 73 467 927 57471 178 223 891 277

Cost of Feed Sales 1-14 729541 188746 983 835 1 312 554 3214677

Cost of Wheat Sales 1-15 2763615 3 867 964 2 491 380 1 460 974 10583933

Total Cost of Sales 44114839 56 387 200 76 943 141 60244706 237689886

(GainVLoss on Inventory (Quak »

(GainVLoss on Property (Quake ) (69 792 975) (330 909 080) (400 702 055)

Business Interuption

Total (Ga[n)/Loss Quake . . (69 792 975) (330 909 080) (400 702 01)5)

Flour Gross Margin 2 082 064 2646510 3 291 497 4721 119 12741211

Feed Gross Margin (112545) 4914 (162975) (276 574) (547181)

Wheat Gross Margin 339 959 471 668 254527 157851 1 224 005

Total Gross Margin ' 2309498 3 123 092 73176025 335511476 . ' - . . - - - 414120091

SG&A Expenses I-80 21 678 484 20416477 25 421 721 28 849 072 96365754

Operating Income (19 368 986) (17 293 385) 47 754 304 306 662 404 317754337

Other Income (Expense) I -80 572 176 383 161 2 559 920 (998613) 2516644

Income before Taxes (18796810) (16910224) 50314224 305663791

Income Tax Provision I-90

(18796810) (16910224) 50314224 305 663 791 320270981

Income Before Trans Loss

(129350) 1 451 668 1 488 452 1 185971 3996741

Translation Gain (Loss)

324267722

Net Income

STATISTICAL INFORMATION

22035,36 23 166.43 22319,47

Conversion Margin per MT 21 907.73 22125,73

35,3% 0,0% 0,0% 0.0% 0,0% 0,0% 0,0% 0,0% 0,0% 175.0%

Gross Margin % M% 5,711 539,5%

50,8% 37,1% 33,1% 46,4% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 40.7%

SG&A Expense % of Salss

Income Before Tax % of Sates -44,0% -30,8% S5,5% 491,5% 0,0% 0,0% 0.0% 0,0% 0.0% 0,0% 0,0% 0,0% 135.3%

Income Tax % of Sales

Translation Adj. % of Sales -0,3% 2,6% 1,9% 1.9% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 0,0% 1,7%

-44,3% -28,1% 87,5% 493,4% o'o% 0,0% 0,0% 0,0% 0,0% 0.0% 0,0% 0,0% 137,0%

Net Inc. After Trans. % of Sales

CASH FLOWS

324237722

Above (18926160) (15456556) 61 802 676 306849762

1 315319 (4 39G BQ9) 439433

Depreciation A-90 2203529 1317453

(63 678 882) (54 6C7 099) (270114519)

Capital Expendrturee A-90 (18501 601) (113066938)

S4S92B36

Cath Flows

Print l*h>. 02030011

2 HTG Balance Sheet. HTG LMH 2HTC January 31, 20 1 1 I

Period: 1 2 3 4 5 6 7 8 9 10 11 12

Month: Oct Nov Dec Jan Feb Mar Apr May June July Aug Sept

Closing Exch Rate: 40,10 40,15 39,88 40,34 0,00 0,00 0,00 0,00 0,00 0,00 0,00 0,0

ASSETS

Cash - LC A-5 20304104 29262075 29 330 177 20416985

Cash USD A-5 256 396 903 114647078 145 690 530 65 630 065

Term Deposits A-5

Total Cash 276 701 007 143909153 175 020 707 86047050

Trade Receivable A-10 1 276 977 610753 231 903 12 2 68 3 4 . . . . . .

Less Allowance for Bad Debt A-10

Net Trade Receivables 1 276 977 610 753 231 903 1 226 834

Receivables -Non-Consol Affiliate 999914 993 250 10 0 4 5 7 2 . . . . . .

Other Receivables A-10 25 768 285 20 582 035 13 103 068 7418870

Total Receivables 27 045 262 22 192 702 14 328 221 9650275

Inventory

Wheat in Silos or bulk A-20 37 256 482 33 176 454 30 971 006 29136879

Wheat packed 1-15 58253 492 057 359449 187092

Wheat Flour 1-12 186172810 146114625 89 766 675 30 484 742

Millfeed 1-12.1

Spares A-80

Other Inventory A-80 42 397 228 47725166 39 645 862 41 474 849

Total Inventory 265 884 772 227 508 302 160742992 101 283 562

Prepaid Expenses 139975324 202915198 135412816 130009784 - . . . . . . .

Total Current Assets 709 606 365 596 525 355 485 504 736 326 990 672

Property, Plant & Equipment A-90 894286418 1 088 272 935 1 171 951 817 1226818916

Less: Accumulated Depreciation A-90 (145 581 873) (146899326) (148214645) (143817776) - . . . . . . .

Total Fixed Assets 748 704 546 941 373 610 1 023 737 172 1 083 001 140

Other Non Current Assets A-90 915 189 915189 915 189 915189

Total Noncurrent Assets 749 619 735 942 288 799 1 024 652 361 1 083 916 329

Total Assets 1 459 226 100 1538814154 1510157097 1410907001

LIABILITIES AND EQUITY:

Bank Indebtedness .-10 - - - - -

Trade Accounts Payable L-10 210280968 130516889 105 029 659 71 872 249 -

Intercompany Payables L-20 12 500 161 185301791 133405676 31 381 252 -

Accrued Payroll Liabilities L-10 4 867 735 5 534 723 2 397 399 2 673 264 -

Accrued Liabilities USD .-10 304 963 333 305383452 303 165 313 35924718 .

Accrued Liabilities Taxes L-10 6 435 422 6 435 422 6435422 5 758 573 -

Dividend Payable L-10 - - - - -

Accrued Liabilities HTG L-10 11232678 12154630 14433707 11157261 -

Total Current Liabilities 550 280 298 645 326 908 564 867 175 158 767 317 .

Long Term Debt L-30 - - - - -

Total LT Liabilities • - - - -

Total Liabilities 550 280 298 645 326 908 564867175 158767317 .

STOCKHOLDER'S EQUITY

Common Stock Issued 218571425 218 571 425 218 571 425 218571425 -

Reserves - Asset Revaluation 109285713 109285713 109 285 713 109285713 -

Dividends - - . . .

Retained Earnings 600014824 600 014 824 600 014 824 600 014 824 -

Current Year Earnings (18796810) (35 707 034) 14 607 190 320 270 981 -

Current Year Trans Gain (Loss) (129350) 1 322 318 2 810 770 3 996 741 -

Total Earnings 581 088 664 565 630 108 617432784 924 282 546 •

Total Stockholder's Equity 908 945 802 893 487 246 945 289 922 1 252 139 684 .

Total Liabilities and Equity 1 459 226 100 1538814154 1510157097 1 410 907 001 -

STATISTICS

Current Ratio 0,55 0,26 0,34 0,60 .

Quick Ratio 0,55 0,26 0,34 0,80 .

Receivable Turnover {Annualized) 661,25 1 418,07 1 088,87 605,56 -

* of Days 0,55 0,26 0,34 0,60

Inventory Turnover {Annualized) 42.82 25,09 23,77 28,39

Asset Turnover (Annualized) 7,80 3,71 2,53 2,04

You might also like

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Gregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASEDocument11 pagesGregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASE83jjmack100% (3)

- Bank of America Short Sale FormsDocument7 pagesBank of America Short Sale FormsPetra NorrisNo ratings yet

- BKN Milk UnionDocument1 pageBKN Milk UnionPrashant SinghNo ratings yet

- Production Sales May 2024Document4 pagesProduction Sales May 2024msaadiqNo ratings yet

- Petroleum Planning & Analysis Cell: NotesDocument19 pagesPetroleum Planning & Analysis Cell: NotesVignesh Faque JockeeyNo ratings yet

- JST ICU Tender Document - Buildings Tender Document (Main Bill)Document21 pagesJST ICU Tender Document - Buildings Tender Document (Main Bill)Charly MNNo ratings yet

- Ten YearDocument1 pageTen Yearvikkyjan19No ratings yet

- Maharashtra State Electricity Distribution Company LTD.: LT Demand ( ) LT Collection ( )Document5 pagesMaharashtra State Electricity Distribution Company LTD.: LT Demand ( ) LT Collection ( )msedcl msedclNo ratings yet

- GCMMF Balance Sheet 1994 To 2009Document37 pagesGCMMF Balance Sheet 1994 To 2009Tapankhamar100% (1)

- VIP AnalysisDocument5 pagesVIP AnalysisVivek SinghNo ratings yet

- Enhanced Comprehensive Local Integration Program (E-CLIP) : UpdatesDocument15 pagesEnhanced Comprehensive Local Integration Program (E-CLIP) : UpdatesYann LauanNo ratings yet

- NRLM Total SHGS 2014-15Document2 pagesNRLM Total SHGS 2014-15Sunder RajagopalanNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document58 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538member2 mtriNo ratings yet

- Round 0: Software Prediction Cust. Survey Adj. To Cust. Score MKT ShareDocument19 pagesRound 0: Software Prediction Cust. Survey Adj. To Cust. Score MKT ShareJasleen Kaur (Ms)No ratings yet

- Bill 2Document1 pageBill 2Abhishek SinghNo ratings yet

- BSC02 DashboardDocument34 pagesBSC02 Dashboardsohail.akh1979No ratings yet

- Fpregion 5Document2 pagesFpregion 5Edsel Alfred OtaoNo ratings yet

- SDHD XLXDocument8 pagesSDHD XLXVarad VinherkarNo ratings yet

- CaseDocument10 pagesCasejgiujwNo ratings yet

- Daily Monitoring ReportDocument37 pagesDaily Monitoring ReportJahan JebNo ratings yet

- 202112-Financial and Operational Result tcm202-42841Document1 page202112-Financial and Operational Result tcm202-42841Thu BuiNo ratings yet

- Godrej ConsumerDocument7 pagesGodrej ConsumermuralyyNo ratings yet

- Trisco Daily Production SummaryDocument4 pagesTrisco Daily Production Summaryhenrymerchant07No ratings yet

- Latihan Audit AR Dan Sales (IGSM)Document1 pageLatihan Audit AR Dan Sales (IGSM)Desinta PutriNo ratings yet

- 05.31_JMontecer.foi_2022 No of CoopsDocument2 pages05.31_JMontecer.foi_2022 No of CoopsGedrick Angelo AlipongaNo ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsNano WibowoNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document76 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Dammar JoshiNo ratings yet

- Solution KPITDocument28 pagesSolution KPITsuryasandeepc111No ratings yet

- Total Load and Clear Load DistributionDocument9 pagesTotal Load and Clear Load DistributionRaviTeja BhamidiNo ratings yet

- Sambalpur - Yearly Progress Report New 1Document2 pagesSambalpur - Yearly Progress Report New 1Prashant SinghNo ratings yet

- FSAV Group 07 Sales ForecastDocument18 pagesFSAV Group 07 Sales ForecastMINSAFE Fin-26thNo ratings yet

- Annexure 2-Projected ValueDocument4 pagesAnnexure 2-Projected ValueK.Uma SankarNo ratings yet

- Narayana HrudayaDocument9 pagesNarayana HrudayaDeepa ChNo ratings yet

- Pp Daywise Production Report-AugDocument5 pagesPp Daywise Production Report-AugAnkit Singh RathoreNo ratings yet

- BOP_MBSDocument29 pagesBOP_MBSsojibhossain206No ratings yet

- SonyDocument5 pagesSonyViet AnhNo ratings yet

- Daily Production Report - 1 Date 2018/09/01Document5 pagesDaily Production Report - 1 Date 2018/09/01Ng MeriedNo ratings yet

- System Wide 1st SemDocument3 pagesSystem Wide 1st SemPerpetual DALTA OfficialNo ratings yet

- Profit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)Document8 pagesProfit and Loss Account: Budget 2007-2008: (Rs. in Lakhs)grimm312No ratings yet

- Inventory Ageing Sept24Document1 pageInventory Ageing Sept24noumanNo ratings yet

- MID DAY REPORT (Daily) (Autosaved) Latest 5 AprilDocument35 pagesMID DAY REPORT (Daily) (Autosaved) Latest 5 AprilSing IskingaNo ratings yet

- October DSR Chinhat WorkshopDocument91 pagesOctober DSR Chinhat WorkshopjivanimishraNo ratings yet

- Production Sales February 2024Document4 pagesProduction Sales February 2024arslsaadNo ratings yet

- Balance Sheet: Rs CR Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24Document1 pageBalance Sheet: Rs CR Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Mar-20 Mar-21 Mar-22 Mar-23 Mar-24Dipin VinayakNo ratings yet

- ProjectionsDocument13 pagesProjectionsBerkshire Hathway coldNo ratings yet

- NRLM Total SHGS 2015-16Document2 pagesNRLM Total SHGS 2015-16Sunder RajagopalanNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document15 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538axzc sNo ratings yet

- Weighted Numeric Reach - CLASS FINALDocument4 pagesWeighted Numeric Reach - CLASS FINALumangjeetNo ratings yet

- Reliance_Industry financial reportDocument2 pagesReliance_Industry financial reportAshutosh DwivediNo ratings yet

- F235025 - Ali Irtaza - Bsba23 - It in Business Lab QuizDocument23 pagesF235025 - Ali Irtaza - Bsba23 - It in Business Lab QuizaliNo ratings yet

- Tuga Offering HDocument2 pagesTuga Offering HImran RosyadiNo ratings yet

- Admn. Expenses BudgetDocument3 pagesAdmn. Expenses BudgetTR BBOLLONo ratings yet

- Silt Data Jun-Sep 2017 & 2018Document3 pagesSilt Data Jun-Sep 2017 & 2018Xen Operation DPHNo ratings yet

- 3Q13 - WebcastDocument12 pages3Q13 - WebcastUsiminas_RINo ratings yet

- KPIT Cummins: TemplateDocument15 pagesKPIT Cummins: Templatekajal malhotraNo ratings yet

- Nepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538Document59 pagesNepal Stock Exchange Limited: Singhadurbar Plaza, Kathmandu, Nepal. Phone: 977-1-4250758,4250735, Fax: 977-1-4262538sagar gurungNo ratings yet

- Total Auto POLREG Jember 2017 2015 2016 Total Jan Feb Mar Apr May Jun Jul Aug Nama Perusahaan Daihatsu 1419 1439 1050 118 145 157 121 129 119 136 125Document1 pageTotal Auto POLREG Jember 2017 2015 2016 Total Jan Feb Mar Apr May Jun Jul Aug Nama Perusahaan Daihatsu 1419 1439 1050 118 145 157 121 129 119 136 125Ukhti NajwaNo ratings yet

- TBA 5 size - Order DetailsDocument4 pagesTBA 5 size - Order DetailsPhương Thơ NguyễnNo ratings yet

- Gfs Triwulanan 2015 2018 UpdateDocument5 pagesGfs Triwulanan 2015 2018 UpdateNabilah GaluhNo ratings yet

- Zomato 2021 - RawdataDocument31 pagesZomato 2021 - RawdatathinkestanNo ratings yet

- Final Thesis g3Document87 pagesFinal Thesis g3Aleandro NierreNo ratings yet

- ZODADocument5 pagesZODAzoda.ltdNo ratings yet

- Luxembourg Makes It SimpleDocument3 pagesLuxembourg Makes It SimpleBianci Sentini VirinNo ratings yet

- ChinaDocument17 pagesChinasn07860No ratings yet

- ICICI Bank Accepts Chanda Kochhar's Request For Early RetirementDocument1 pageICICI Bank Accepts Chanda Kochhar's Request For Early RetirementNDTVNo ratings yet

- New Microsoft Excel WorksheetDocument35 pagesNew Microsoft Excel WorksheetSownthra PalanisamyNo ratings yet

- IDFC FIRST - Bank - Annual - Report - 2019 PDFDocument292 pagesIDFC FIRST - Bank - Annual - Report - 2019 PDFJay KoliNo ratings yet

- Chapter-6 Data Analysis and InterpretationDocument25 pagesChapter-6 Data Analysis and InterpretationMubeenNo ratings yet

- Lembar Kerja Try Out-Laporan Keuangan Sesi 1Document13 pagesLembar Kerja Try Out-Laporan Keuangan Sesi 1Arif RamadhaniNo ratings yet

- 1001Document4 pages1001Nikolaos KalantzisNo ratings yet

- Financial AffidavitDocument1 pageFinancial Affidavitprakritikofficial11No ratings yet

- 3206_21062024103239_unlockedDocument12 pages3206_21062024103239_unlockedMainpal YadavNo ratings yet

- Result Presentation 3Q24Document12 pagesResult Presentation 3Q24augusto.vgcNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Audit of Investments May 2028Document8 pagesAudit of Investments May 2028kmarisseeNo ratings yet

- Chapter - 5 - Insurance Intermediaries1568157534206075349Document34 pagesChapter - 5 - Insurance Intermediaries1568157534206075349Mahima MaharjanNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisAli Gokhan Kocan100% (1)

- Reviewer in CfasDocument25 pagesReviewer in CfasCherry Rose LadicaNo ratings yet

- FINAl sUPER 18Document47 pagesFINAl sUPER 18purshotamg01No ratings yet

- About: Prudential PLCDocument8 pagesAbout: Prudential PLCMillton LucanoNo ratings yet

- The Cost of Capital: Answers To End-Of-Chapter QuestionsDocument21 pagesThe Cost of Capital: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- Cash Flow Statement Xtra Qns Raja Ma'am RecDocument8 pagesCash Flow Statement Xtra Qns Raja Ma'am RecReedhima SrivastavaNo ratings yet

- Required: Compute The Cash and Cash Equivalents That Should Be Shown in The Statement of Financial PositionDocument1 pageRequired: Compute The Cash and Cash Equivalents That Should Be Shown in The Statement of Financial PositionGlenn Orlan Morales BarriosNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- DocumentDocument26 pagesDocumentLorraine Miralles33% (3)

- Account Statement 919497397475 UnlockedDocument21 pagesAccount Statement 919497397475 UnlockedsanafkattakkalNo ratings yet

- CH 14 Ex 9 1011Document7 pagesCH 14 Ex 9 1011tirol.d.cjNo ratings yet

- Taxation and DepreciationDocument62 pagesTaxation and Depreciationrobel popNo ratings yet