PL M17 Financial Management

PL M17 Financial Management

Uploaded by

IQBAL MAHMUDCopyright:

Available Formats

PL M17 Financial Management

PL M17 Financial Management

Uploaded by

IQBAL MAHMUDCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

PL M17 Financial Management

PL M17 Financial Management

Uploaded by

IQBAL MAHMUDCopyright:

Available Formats

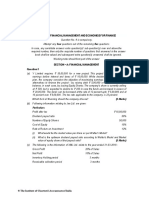

PROFESSIONAL LEVEL EXAMINATION

TUESDAY 14 MARCH 2017

(2½ hours)

FINANCIAL MANAGEMENT

This paper consists of three questions (100 marks).

1. Ensure your candidate details are on the front of your answer booklet. You will be given

time to sign, date and print your name on the answer booklet, and to enter your

candidate number on this question paper. You may not write anything else until the

exam starts.

2. Answer each question in black ballpoint pen only.

3. Answers to each question must begin on a new page and must be clearly numbered

Use both sides of the paper in your answer booklet.

4. The examiner will take account of the way in which answers are presented.

5. When the assessment is declared closed, you must stop writing immediately. If you

continue to write (even completing your candidate details on a continuation booklet), it

will be classed as misconduct.

A Formulae Sheet and Discount Tables are provided with this examination paper.

IMPORTANT

Question papers contain confidential You MUST enter your candidate number in this

information and must NOT be removed box.

from the examination hall.

DO NOT TURN OVER UNTIL YOU

ARE INSTRUCTED TO BEGIN WORK

Copyright © ICAEW 2017. All rights reserved. Page 1 of 9

BLANK PAGE

Copyright © ICAEW 2017. All rights reserved. Page 2 of 9

1. You should assume that the current date is 28 February 2017

Sentry Underwood plc (Sentry) is a large, listed UK drinks manufacturer. Sentry’s recent

profitability has deteriorated because of increased competition and a volatile consumer

market. As a result, Sentry’s board is considering a major change in the company’s trading

strategy which will cost £20 million to implement. The board has decided that this investment

will be funded either via a rights issue or an issue of debentures. Jenna Helier is Sentry’s

finance director and she is an ICAEW Chartered Accountant. Sentry’s other directors have

asked her to provide information to help them decide on the source of funding for the new

investment.

Extracts from Sentry’s most recent management accounts are shown below:

Income Statement for the year to 28 February 2017

£’000

Sales 78,500

Variable costs (56,520)

Fixed costs (13,850)

Profit before interest 8,130

Debenture interest (1,421)

Profit before tax 6,709

Taxation at 17% (1,141)

Profit after tax 5,568

Dividends proposed (3,000)

Retained profit 2,568

Balance Sheet at 28 February 2017

£’000

Ordinary share capital (£1 shares) 12,500

Retained profits 11,286

23,786

7% debentures (redeemable July 2019 to December 2020) 20,300

44,086

The market values of Sentry’s ordinary shares and debentures on 28 February 2017 are:

Ordinary shares £3.44 (cum div)

7% debentures £111% (cum int)

The £20 million required would be raised on 1 March 2017 by either:

1. A rights issue at £2.50 per ordinary share or

2. An issue of 8% debentures at par, redeemable in 2023

You have been asked by the directors to assume the following for the year to 28 February

2018:

Sales will increase by 20%

The contribution to sales ratio will remain unchanged

Fixed costs will increase by £2 million pa

The current level of dividends per share will be maintained

Corporation tax will remain at 17%

Copyright © ICAEW 2017. All rights reserved. Page 3 of 9

At last week’s board meeting the following comments were made by two of Sentry’s other

directors:

Matthew Girvan: “We could decrease the amount of new capital that we have to raise by

reducing the annual dividend. Our payout ratio has been excessive for a

number of years now. Why not halve it?”

Roger Smyth: “We need to be very careful with this issue of shares or debentures.

There’s a danger that our earnings per share (EPS) figure will be diluted,

which could cause a fall in our share price. To avoid any problem with

our share price, I suggest it would be better to tell our shareholders that

we expect sales to increase by 30%-35% next year, rather than the 20%

we are forecasting.”

Requirements

1.1 For both the rights issue and the debenture issue, prepare forecast income

statements for Sentry for the year to 28 February 2018. (6 marks)

1.2 For both the rights issue and the debenture issue, calculate Sentry’s forecast

EPS figure for the year to 28 February 2018 and

Gearing ratio (book value of long-term borrowings/long-term funds) as at

28 February 2018. (6 marks)

1.3 For the rights issue only, calculate the increase in annual sales required for the year

to 28 February 2018 in order that Sentry’s EPS figure remains the same as in the

current year. (6 marks)

1.4 Making reference to your calculations in 1.1, 1.2 and 1.3 above, discuss the

implications for Sentry’s shareholders of the company using a rights issue or a

debenture issue to fund its proposed £20 million investment. (8 marks)

1.5 Discuss Matthew Girvan’s proposal that dividends should be cut, making reference to

relevant theories. (6 marks)

1.6 Discuss the ethical issues for Jenna Helier that would be caused by Roger Smyth’s

suggestion. (3 marks)

Total: 35 marks

Copyright © ICAEW 2017. All rights reserved. Page 4 of 9

2. White Rock plc (White), a UK listed company, manufactures a range of cosmetics at three

factories: lipsticks (London), mascara (Newcastle) and foundation products (Manchester).

White’s financial year end is 31 March.

At its most recent board meeting the following matters were discussed:

(1) Closure of the London factory.

(2) Investment priorities at the Manchester factory.

(3) The impact of (1) and (2) above on White’s share price.

2.1 Closure of the London factory

The cosmetics industry is very competitive and products can quickly become unfashionable.

Falling demand for White’s lipsticks and the high costs of operating in London have meant

that the company’s directors have decided to close the London factory. Instead, White will

manufacture a smaller range of lipsticks at its Newcastle factory which currently only makes

mascara, but does have spare capacity. Manufacture of this smaller range of lipsticks would

commence in Newcastle as soon as the London factory is closed. White’s directors are

unsure whether to close the London factory on 31 March 2017 or on 31 March 2019, when its

lease expires.

You work in White’s finance team and have been asked to provide information to aid the

directors’ decision on the date of the factory closure. Information to support your task is

shown below:

Sales and contribution

London Newcastle

factory factory

Estimated lipstick sales (all at 31 March 2017 prices)

Year to 31 March 2018 £7.2m £1.3m

Year to 31 March 2019 £5.5m £1.5m

Contribution to sales ratio 60% 65%

Leases

The London factory lease costs £1.8 million pa and expires on 31 March 2019. The annual

lease cost is fixed and is payable on 1 April. If the factory is closed on 31 March 2017 then

White would pay a tax allowable cancellation charge of £3 million on that date to cancel the

lease. The Newcastle factory lease costs a fixed £0.8 million pa which is payable on 1 April.

Other fixed costs

London Newcastle

factory factory

Factory-wide fixed costs pa (at 31 March 2017 prices) £1.4m £1.2m

Allocated head office costs pa (at 31 March 2017 prices) £1.6m £1.3m

Working capital

The London factory has a working capital balance on 31 March 2017 of £0.8 million. White’s

policy is that at the start of each financial year, there should be working capital in place that is

equivalent to 10% of the estimated sales for that year.

Copyright © ICAEW 2017. All rights reserved. Page 5 of 9

Tax allowable London factory closure payments

Closure payments if closure is on 31 March 2017 £1.6m

Closure payments if closure is on 31 March 2019 (at 31 March 2019 prices) £2.3m

London factory machinery

Machinery tax written down value at 1 April 2016 £3.1m

Resale value of machinery at 31 March 2017 £1.7m

Resale value of machinery at 31 March 2019 (at 31 March 2019 prices) £0.6m

The factory machinery attracts 18% (reducing balance) capital allowances in the year of

expenditure and in every subsequent year of ownership by the company, except the final

year. In the final year, the difference between the machinery’s written down value for tax

purposes and its disposal proceeds will be treated by the company either as a:

balancing allowance, if the disposal proceeds are less than the tax written down value,

or

balancing charge, if the disposal proceeds are more than the tax written down value.

Inflation rates (applicable to all sales and costs unless otherwise indicated)

Year to 31 March 2018 2%

Year to 31 March 2019 3%

Other information

Corporation tax will be payable at the rate of 17% for the foreseeable future and tax will be

payable in the same year as the cash flows to which it relates.

Unless indicated otherwise, assume that all cash flows occur at the end of the relevant year.

White uses a money cost of capital of 11% for investment appraisal purposes.

Requirements

(a) Calculate the relevant money cash flows associated with closing the London factory on:

(1) 31 March 2017

(2) 31 March 2019

and use these to calculate the net present value at 31 March 2017 of each of these

possible closure dates.

In both of these calculations you should ignore any opportunity cash flows associated

with the alternative closure date. (21 marks)

(b) Advise White’s directors as to the preferred closure date of the London factory.

(1 mark)

Copyright © ICAEW 2017. All rights reserved. Page 6 of 9

2.2 Investment priorities at the Manchester factory

The Manchester factory has a capital expenditure budget of £15 million for the financial year

to 31 March 2018. White’s board needs to choose which of the available projects would

maximise shareholder wealth. Details of the four projects available are shown below:

Project 1 2 3 4

£’000 £’000 £’000 £’000

Investment required 6,000 4,500 4,700 3,850

Net Present Value 621 563 869 622

Requirement

Prepare calculations showing the combination of projects that will maximise White’s

shareholders’ wealth if the four projects are assumed to be either (1) divisible or

(2) indivisible. (6 marks)

2.3 White’s managing director has stated that once the London closure date and the Manchester

investment plans are announced to the stock market, White’s share price will adjust to reflect

this information accurately. However, the finance director has pointed out that there are

behavioural factors that may mean that this is not the case.

Requirement

Explain the key principles underlying the Efficient Market Hypothesis and how behavioural

factors question the validity of that hypothesis. (7 marks)

Total 35 marks

Copyright © ICAEW 2017. All rights reserved. Page 7 of 9

3. You should assume that the current date is 31 March 2017

ST Leonard Foods (STL) is a UK frozen food company. It buys raw vegetables and fish from

its suppliers and, following processing and freezing, sells them to its customers.

You work in STL’s finance team and have been asked to prepare calculations that will help

STL’s management decide on the best strategy with regard to these two issues:

Issue 1 - foreign exchange rate hedging

Earlier this year STL’s management signed a contract worth €1,750,000 with one of its

Spanish suppliers and the goods arrived at STL last week. In addition, it has agreed to sell

€600,000 worth of frozen goods to a new customer, a French hypermarket, and these goods

will be despatched to France in ten days’ time.

Both of these contracts are due to be settled in three months’ time on 30 June 2017. STL’s

management is keen to explore whether it is worth hedging against movements in the value

of the euro between now and then. Four possible strategies are under consideration by the

board:

Do not hedge

Use an over-the-counter (OTC) currency option

Use a money market hedge

Use a forward contract

The following data has been collected at the close of business on 31 March 2017:

Spot rate (€/£) 1.2652 – 1.2744

Euro interest rate (lending) 2.2% pa

Euro interest rate (borrowing) 3.4% pa

Sterling interest rate (lending) 4.2% pa

Sterling interest rate (borrowing) 4.6% pa

Three-month OTC call option on € – exercise price 1.2540/£

Three-month OTC put option on € – exercise price 1.2650/£

Three month forward contract premium (€/£) 0.0058 – 0.0042

Cost of relevant OTC option £0.70 per €100 converted

Arrangement fee for forward contract £5,500

Issue 2 - interest rate hedging

STL has recently signed a contract with its bank to borrow £4.2 million on 1 July 2017 to help

fund the construction of a new factory. The loan is for three years at an interest rate of

LIBOR + 1% pa. STL’s management is concerned that interest rates will rise before 1 July

and wishes to explore whether it should hedge its borrowing cost. Its bank has offered STL a

Forward Rate Agreement (FRA) at 5.8% pa or an option at 5.2% pa plus a premium of 0.5%

of the sum borrowed.

Copyright © ICAEW 2017. All rights reserved. Page 8 of 9

Requirements

3.1 For Issue 1, show the net sterling payment for the four possible strategies under

consideration, assuming that on 30 June 2017 the spot exchange rate will be:

(a) €1.1875 – 1.1960/£

(b) €1.2745 – 1.2860/£

(11 marks)

3.2 For Issue 1, with reference to your calculations in 3.1 above, advise STL’s board

whether it should hedge against movements in the value of the euro. (8 marks)

3.3 For Issue 2, assuming that on 1 July 2017 LIBOR will be:

(a) 4% pa

(b) 6% pa

calculate the annual interest rate payment if STL chooses an FRA, an option or no

hedging instrument and advise STL’s management as to its best strategy. (7 marks)

3.4 Explain briefly how FRAs differ from interest rate futures. (4 marks)

Total: 30 marks

Copyright © ICAEW 2017. All rights reserved. Page 9 of 9

You might also like

- Marketing Made Simple WorkbookDocument51 pagesMarketing Made Simple Workbookdjan constant92% (12)

- Summary of Business - Strategy - Application - Level - Question - Bank - With Immediate AnswersDocument221 pagesSummary of Business - Strategy - Application - Level - Question - Bank - With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Case 3Document13 pagesCase 3Prezi Toli100% (1)

- Midlands State University Faculty of CommerceDocument9 pagesMidlands State University Faculty of CommerceOscar MakonoNo ratings yet

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- DG300Document18 pagesDG300654321No ratings yet

- CFALevel1 Sample QuestionsDocument58 pagesCFALevel1 Sample QuestionsManoj UpretiNo ratings yet

- 9706_s18_qp_33Document16 pages9706_s18_qp_33FarHan AquariusNo ratings yet

- 6-Month Report Final 2018Document2 pages6-Month Report Final 2018BernewsAdminNo ratings yet

- APC Nov 2017 Specimen Examples CompleteDocument67 pagesAPC Nov 2017 Specimen Examples CompleteSafwaan DanielsNo ratings yet

- PL FM S17 WebDocument7 pagesPL FM S17 WebIQBAL MAHMUDNo ratings yet

- 4 Financial Management Questions Nov Dec 2019 PL PDFDocument5 pages4 Financial Management Questions Nov Dec 2019 PL PDFShahriar ShihabNo ratings yet

- 9706_s18_qp_22Document16 pages9706_s18_qp_22mannanpursnaniNo ratings yet

- FM (Q.) - 30-04-23 eDocument6 pagesFM (Q.) - 30-04-23 eVishal Kumar 5504No ratings yet

- QUESTION 01 (Account Q. Section C)Document3 pagesQUESTION 01 (Account Q. Section C)prince falakuNo ratings yet

- CPA Ireland-Financial-Accounting-April-2018Document19 pagesCPA Ireland-Financial-Accounting-April-2018Mwenda MongweNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- 2017 AND Prelim 4E5N P2Document12 pages2017 AND Prelim 4E5N P2kristintan888No ratings yet

- 3.business Plan Divident and Grought QB 41-54Document12 pages3.business Plan Divident and Grought QB 41-54miradvance studyNo ratings yet

- ACC 423 Final Exam GuideDocument11 pagesACC 423 Final Exam Guideapjk510No ratings yet

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarNo ratings yet

- Ac3059 Za 2019Document44 pagesAc3059 Za 2019kishwarya01No ratings yet

- Sample Midterm QuestionDocument3 pagesSample Midterm QuestionAleema RokaiyaNo ratings yet

- Af QP - CFSDocument4 pagesAf QP - CFSaman KumarNo ratings yet

- PL Financial Accounting and Reporting IFRS Exam June 2019Document10 pagesPL Financial Accounting and Reporting IFRS Exam June 2019scottNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument13 pagesCambridge International Advanced Subsidiary and Advanced LevelAR RafiNo ratings yet

- Advanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzeDocument20 pagesAdvanced Financial Management May 2019 Past Paper and Suggested Answers ZvqqzekaragujsNo ratings yet

- PG Dip Man - Fin Man - Jan 2018 ExamDocument5 pagesPG Dip Man - Fin Man - Jan 2018 Examolwethu.mtyobile5No ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Sample PYQ (1) (2)Document7 pagesSample PYQ (1) (2)Tong En TehNo ratings yet

- November 2007 Examinations: © The Chartered Institute of Management Accountants 2007Document36 pagesNovember 2007 Examinations: © The Chartered Institute of Management Accountants 2007magnetbox8No ratings yet

- ACC-Sept-QP & Memo-2019-Gr10Document23 pagesACC-Sept-QP & Memo-2019-Gr10Tawanda QuintonNo ratings yet

- Ef Assessment 2Document5 pagesEf Assessment 2Charbel HatemNo ratings yet

- PL S18 FM WebDocument7 pagesPL S18 FM WebIQBAL MAHMUDNo ratings yet

- Compile Numerical and Theory of Financial Derivatives CourseDocument14 pagesCompile Numerical and Theory of Financial Derivatives CourseTalha HassanNo ratings yet

- Accounting For Specialized InstituitionsDocument4 pagesAccounting For Specialized InstituitionsTitus Clement100% (1)

- Financial MarketDocument81 pagesFinancial MarketBijay AgrawalNo ratings yet

- Dividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)Document23 pagesDividend Concepts & Theories: Year EPS (X LTD.) DPS (X LTD.) Eps (Y LTD.) Dps (Y LTD.) Mps (X LTD.)amiNo ratings yet

- ACC208 - JUL - 2016 - Exam Paper - 1484707193403Document9 pagesACC208 - JUL - 2016 - Exam Paper - 1484707193403weddingNo ratings yet

- Fin Man 1BDocument12 pagesFin Man 1BMelissa KleinNo ratings yet

- GFM Mock QuestionsDocument13 pagesGFM Mock QuestionsBhanu TejaNo ratings yet

- Asia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationDocument5 pagesAsia-Pacific International University: Second Semester 2020-2021 - Midterm ExaminationNicolas ErnestoNo ratings yet

- Final Paper 2Document258 pagesFinal Paper 2chandresh0% (1)

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Previous Question PaperDocument22 pagesPrevious Question PaperrahulrajpunniyankavuNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- Dividend PolicyDocument8 pagesDividend PolicySumit PandeyNo ratings yet

- Accounting Level 3/ Series 4 2008 (3001)Document19 pagesAccounting Level 3/ Series 4 2008 (3001)Hein Linn Kyaw100% (1)

- Seventeenth Edition: Implementing Strategies: Finance and Accounting IssuesDocument22 pagesSeventeenth Edition: Implementing Strategies: Finance and Accounting IssuesGrace GunawanNo ratings yet

- FIAM8411 EaDocument11 pagesFIAM8411 EaPuseletsoNo ratings yet

- Suggested Answers 2017Document33 pagesSuggested Answers 2017Ram UpendraNo ratings yet

- Additional Sums MF FM24 - 1041897Document4 pagesAdditional Sums MF FM24 - 1041897Dipika MalpaniNo ratings yet

- Acc 2021 T1 Week 7 Ratios Audit Governance ENG MEMODocument4 pagesAcc 2021 T1 Week 7 Ratios Audit Governance ENG MEMOnqobilemosia592No ratings yet

- Five Bonus Share Companies: A Project Report ONDocument11 pagesFive Bonus Share Companies: A Project Report ONShubham agarwalNo ratings yet

- CF&RM QPDocument7 pagesCF&RM QPBijay AgrawalNo ratings yet

- Fina 1027 - May 2017 - ExamDocument12 pagesFina 1027 - May 2017 - ExamJiaFengNo ratings yet

- As 20 Earning Per ShareDocument18 pagesAs 20 Earning Per ShareNishant Jha Mcom 2No ratings yet

- 00 Assignment 2 QuestionnaireDocument6 pages00 Assignment 2 QuestionnaireBharat KoiralaNo ratings yet

- Week 10 & 11 Accounting RatioDocument12 pagesWeek 10 & 11 Accounting RatiotzeyyusdzaNo ratings yet

- It Governance TechnologyDocument5 pagesIt Governance TechnologyIQBAL MAHMUDNo ratings yet

- It Governance Technology-Chapter 01Document4 pagesIt Governance Technology-Chapter 01IQBAL MAHMUDNo ratings yet

- Summary of Business Strategy Application Level - Self Test With Immediate AnswerDocument177 pagesSummary of Business Strategy Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Summary of Business Strategy Application Level Interactive Questions With Immediate AnswerDocument118 pagesSummary of Business Strategy Application Level Interactive Questions With Immediate AnswerIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Worked ExampleDocument22 pagesSummary of Audit & Assurance Application Level - Worked ExampleIQBAL MAHMUDNo ratings yet

- Chapter-06 (Most Important)Document23 pagesChapter-06 (Most Important)IQBAL MAHMUDNo ratings yet

- Question - Analysis Audit and Assurance Application LevelDocument28 pagesQuestion - Analysis Audit and Assurance Application LevelIQBAL MAHMUDNo ratings yet

- Summary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersDocument46 pagesSummary of Audit & Assurance Application Level - Interactive Questions With Immediate AnswersIQBAL MAHMUDNo ratings yet

- Solution Tax Question (Application Level)Document6 pagesSolution Tax Question (Application Level)IQBAL MAHMUDNo ratings yet

- Ca Ipcc - ItDocument82 pagesCa Ipcc - ItIQBAL MAHMUDNo ratings yet

- Order #0002396: Professional - BST Item ListDocument1 pageOrder #0002396: Professional - BST Item ListIQBAL MAHMUDNo ratings yet

- PL FM M16 Exam PaperDocument7 pagesPL FM M16 Exam PaperIQBAL MAHMUDNo ratings yet

- PL FM D17 Student Mark PlanDocument11 pagesPL FM D17 Student Mark PlanIQBAL MAHMUDNo ratings yet

- Capitalization Table Definition - InvestopediaDocument3 pagesCapitalization Table Definition - InvestopediaBob KaneNo ratings yet

- RFBT 8715 - Other Special LawsDocument24 pagesRFBT 8715 - Other Special LawsAvocado HunterNo ratings yet

- Testbank - Multinational Business Finance - Chapter 12Document15 pagesTestbank - Multinational Business Finance - Chapter 12Uyen Nhi NguyenNo ratings yet

- Questions Folder - 2024Document22 pagesQuestions Folder - 2024Shumail AkhundNo ratings yet

- All Slides - Delhi Algo Traders ConferenceDocument129 pagesAll Slides - Delhi Algo Traders ConferencenithyaprasathNo ratings yet

- Lesson-1-Fair-Value-DefinedDocument8 pagesLesson-1-Fair-Value-DefinedishtiaqNo ratings yet

- Oblicon ReviewerDocument89 pagesOblicon ReviewerJen MoloNo ratings yet

- In The Books of ATITHI: Name PRN No. Division BatchDocument10 pagesIn The Books of ATITHI: Name PRN No. Division BatchAnanya ChoudharyNo ratings yet

- BU283 Fall 17 Spring PDFDocument24 pagesBU283 Fall 17 Spring PDFfallenstatusNo ratings yet

- LC Guptha Committee On DerivativesDocument2 pagesLC Guptha Committee On DerivativesGopalRavi100% (1)

- FCCB (Assignment)Document10 pagesFCCB (Assignment)loveaute15No ratings yet

- I BD 20130821Document45 pagesI BD 20130821cphanhuyNo ratings yet

- Group 7 - Metallgesellschaft's Hedging DebacleDocument13 pagesGroup 7 - Metallgesellschaft's Hedging DebacleAbhi SangwanNo ratings yet

- BillDocument11 pagesBillRahul SharmaNo ratings yet

- ABA Comments To NVCA Term SheetDocument28 pagesABA Comments To NVCA Term Sheetcah2009aNo ratings yet

- Ewealth Insurance - BrochureDocument16 pagesEwealth Insurance - BrochurerajendranrajendranNo ratings yet

- Assume Call Prices Are Right in NSE Option Chain. Verify If Put Call Parity HoldsDocument6 pagesAssume Call Prices Are Right in NSE Option Chain. Verify If Put Call Parity HoldsAnirudh DuttaNo ratings yet

- Hybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument36 pagesHybrid Financing:: Preferred Stock, Leasing, Warrants, and ConvertiblesAhsanNo ratings yet

- Vault-Finance Interview QuestionsDocument22 pagesVault-Finance Interview QuestionsSandeep Chowdhury100% (1)

- SS 14 Mindmaps DerivativesDocument36 pagesSS 14 Mindmaps Derivativeshaoyuting426No ratings yet

- Mba Project On Derivatives EditDocument49 pagesMba Project On Derivatives EditmanivamshiNo ratings yet

- SAPM 1st Internal Assessment Test QPDocument2 pagesSAPM 1st Internal Assessment Test QPVasantha NaikNo ratings yet

- Techniques of Asset/liability Management: Futures, Options, and SwapsDocument43 pagesTechniques of Asset/liability Management: Futures, Options, and SwapsSushmita BarlaNo ratings yet

- Parking Garage Case PaperDocument10 pagesParking Garage Case Papernisarg_No ratings yet

- BIS Working Papers: No 952 Passive Funds Affect Prices: Evidence From The Most ETF-dominated Asset ClassesDocument67 pagesBIS Working Papers: No 952 Passive Funds Affect Prices: Evidence From The Most ETF-dominated Asset Classes5ty5No ratings yet

- Asm657 W1 - 1Document22 pagesAsm657 W1 - 1NuradillasyhahiraNo ratings yet

- Option Pricing Numerical MethodsDocument135 pagesOption Pricing Numerical MethodsmiguelangelnicolasNo ratings yet