Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Imthe OneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Imthe OneCopyright:

Available Formats

CMU

Enrichment Learning Activity

Name: John Carlo C. Tolentino Date: February 15 2022

Year and Section: BSMA - 3A Instructor: Mr. Jefferson Cruz

Module #: 7 Topic: Consolidated Financial Statement -

part 4

Directions: ANSWER PROBLEM 1MULTIPLE CHOICE ON YOUR BOOK NOS. 1-8 pp 358-360 (Show your solutions)

1. In Owen’s December 31, 1993 consolidated balance sheet, what amount should be reported as total retained

earnings? 1,240,000

If the investment in the subsidiary is determined using the equity method, the consolidated retained earnings are

the same as the parent's retained earnings.

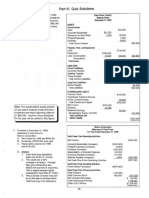

2. What should Dallas report as earnings from subsidiary, in its 1991 income statement? 16,000

Share in profit of subsidiary= 20,000*80%= 16,000

Retained earnings- Subsidiary

January 1 1991 36,000

Dividends 5,000 Profit (squeeze) 20,000

51,000

3. How much is the acquisition cost of the investment on January 1 1991? 120,000

Dividends received= 5,000*80%= 4,000

Investment in subsidiary

Initial cost 120,000

Share in profit of subsidiary 16,000 Dividends received 4,000

Share in the amortization of

undervaluation of assets -

December 31 1991 132,000

4. How much is the goodwill on the business combination? 40,000

Consideration Transferred 120,000

Non-controlling interest in the acquire (100,000*20%) 20,000

Previously held equity interest in the acquiree -

Total 140,000

Fair value of net identifiable assets acquired (100,000)

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

Goodwill at acquisition date 40,000

Accumulated impairment losses since acquisition date -

Goodwill, net-current year

40,000

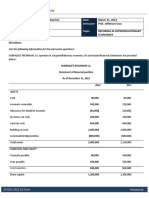

5. How much is the non-controlling interest in the net asset of Style on December 31,1991? 23,000

115,000*20%= 23,000

6. How much is the consolidated retained earnings on December 31, 1991? 139,750

Consolidated retained earnings is equal to parent’s retained earnings

7. How much is the total assets in the consolidated statement of financial position as of December 31, 1991?

293,000

Other assets (138,000+115,000) 253,000

Goodwill 40,000

Total Asset 293,000

Common stock (Parent only) 50,000

Additional paid-in capital (Parent only) 80,250

Retained earnings (Parent only) 139,750

Equity attributable to owners of the parent 270,000

Non-controlling interest 23,000

Total equity 293,000

8. What amount of equity attributable to the owners of the parent should be reported in the Dallas December

31, 1991 consolidated balance sheet? 270,000

SY2021-2022 1st Term Homework

You might also like

- Answers - Activity 2.4 2.5 and 3.1Document38 pagesAnswers - Activity 2.4 2.5 and 3.1Tine Vasiana Duerme83% (6)

- Class Problems CH 4Document9 pagesClass Problems CH 4Eduardo Negrete100% (2)

- Accounting For Business Combinations Second Grading ExaminationDocument21 pagesAccounting For Business Combinations Second Grading ExaminationMjoyce A. Bruan86% (29)

- Sol. Man. Chapter 4 Consol. Fs Part 1Document37 pagesSol. Man. Chapter 4 Consol. Fs Part 1itsmenatoy43% (7)

- Partnership FormatDocument2 pagesPartnership FormatGlenn Taduran100% (2)

- E 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Document10 pagesE 4-8 (APPENDIX B) Journal Entries and Computations (Cost and Equity Methods)Lusiana Purnama SariNo ratings yet

- BUS 1102 Learning Journal Unit 1Document3 pagesBUS 1102 Learning Journal Unit 1kangwa stephen100% (1)

- UVA F 1356 EurolandDocument12 pagesUVA F 1356 EurolandPriscila MatulaitisNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument2 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Consolidation of Financial Statement - Miscellaneous TopicsDocument42 pagesConsolidation of Financial Statement - Miscellaneous TopicsJen KerlyNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- Exercise Ni ValewDocument4 pagesExercise Ni ValewALMA MORENANo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Intercompany DividendsDocument6 pagesIntercompany DividendsClauie BarsNo ratings yet

- Consolidation/Group Accounts: Example 18: Disposal of SubsidiaryDocument4 pagesConsolidation/Group Accounts: Example 18: Disposal of SubsidiaryMuhammad Sarfraz AsmatNo ratings yet

- Principles of Consolidated Financial Statements Test Your Understanding 1Document17 pagesPrinciples of Consolidated Financial Statements Test Your Understanding 1sandeep gyawaliNo ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- E5 8, E5 11, P5 3, P5 6Document12 pagesE5 8, E5 11, P5 3, P5 6CellinejosephineNo ratings yet

- Consolidated Financial Statement-Part 3Document6 pagesConsolidated Financial Statement-Part 3JINKY TOLENTINONo ratings yet

- Earnings Is Equal To The Parent's Retained EarningsDocument16 pagesEarnings Is Equal To The Parent's Retained EarningsMelanie AmpoonNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Acctg 305 Midterm Quiz 1 (With Answers)Document4 pagesAcctg 305 Midterm Quiz 1 (With Answers)Michelle Joyce KuizonNo ratings yet

- Group 6 (Ia Ii)Document8 pagesGroup 6 (Ia Ii)LexNo ratings yet

- Consolidated SOFP ExamplesDocument10 pagesConsolidated SOFP ExamplesKopanang LeokanaNo ratings yet

- Name: Mukarram Ali Siddiqui (18020) Topic: Financial Statements On CorporationDocument4 pagesName: Mukarram Ali Siddiqui (18020) Topic: Financial Statements On CorporationAreeba NaeemNo ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- Intermediate Accounting IIDocument10 pagesIntermediate Accounting IILexNo ratings yet

- Module 5Document11 pagesModule 5Jacqueline OrtegaNo ratings yet

- ABC - Homework 02 - JaguinesDocument5 pagesABC - Homework 02 - JaguinesHannah Mae JaguinesNo ratings yet

- Business Combinations Midterm 2023 For LMSDocument4 pagesBusiness Combinations Midterm 2023 For LMSSarah Del teodoroNo ratings yet

- FAOMA Part 3 Quiz Complete SolutionsDocument3 pagesFAOMA Part 3 Quiz Complete SolutionsMary De JesusNo ratings yet

- Final RequirementDocument18 pagesFinal RequirementZandra GonzalesNo ratings yet

- The Examiner's Answers F2 - Financial Management March 2013: Section ADocument18 pagesThe Examiner's Answers F2 - Financial Management March 2013: Section Amd salehinNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Fabm 2. Final ExamDocument3 pagesFabm 2. Final ExamSHIERY MAE FALCONITINNo ratings yet

- TEML10ACTIVITY 38 2nd CDocument3 pagesTEML10ACTIVITY 38 2nd CJennilyn SolimanNo ratings yet

- Accounting For Business Combinations ExaminationDocument20 pagesAccounting For Business Combinations ExaminationJanella Umieh De UngriaNo ratings yet

- Consolidation at Subsequent DateDocument7 pagesConsolidation at Subsequent DateJulie Mae Caling MalitNo ratings yet

- BUSI 1004 B - Week 2Document3 pagesBUSI 1004 B - Week 2AlexNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Consolidated Financial Statements 1 SolDocument18 pagesConsolidated Financial Statements 1 SolChristine Dela Rosa Carolino100% (1)

- Chapter 16 - Teacher's Manual - Aa Part 2Document18 pagesChapter 16 - Teacher's Manual - Aa Part 2IsyongNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Chapter 4 - Consolidated Financial Statements (Part 1)Document32 pagesChapter 4 - Consolidated Financial Statements (Part 1)Philip RososNo ratings yet

- Assignment 1 Fall 2017Document3 pagesAssignment 1 Fall 2017YaseenTamerNo ratings yet

- Consolidated Statement of Financial Position Q & ADocument5 pagesConsolidated Statement of Financial Position Q & Ajohnzacharia33No ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Review of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)Document12 pagesReview of Financial Statements and Its Analysis: Rheena B. Delos Santos BSBA-1A (FM2)RHIAN B.No ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document11 pagesChapter 6 - Consolidated Financial Statements (Part 3)Kim GarciaNo ratings yet

- Akuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADocument8 pagesAkuntansi Keuangan 1 TUGAS E5.11, E5.12, E5.15 DAN E5.16 Kelas ADedep0% (1)

- FINANCIAL POSITON Week 1 or To Week 2 StudentDocument5 pagesFINANCIAL POSITON Week 1 or To Week 2 StudentStefhanie DiazNo ratings yet

- 14 Consolidated FS Pt1 PDFDocument2 pages14 Consolidated FS Pt1 PDFRiselle Ann Sanchez53% (15)

- De Jesus, Zephaniah - (Finals)Document4 pagesDe Jesus, Zephaniah - (Finals)Zephaniah De JesusNo ratings yet

- Consolidated Financial Statement Classroom Discussion Part 2Document6 pagesConsolidated Financial Statement Classroom Discussion Part 2Sunshine KhuletzNo ratings yet

- Practice For Test 3 - Copy (1) EbiDocument9 pagesPractice For Test 3 - Copy (1) EbireynaldohizkiaNo ratings yet

- Step 1: Analysis of The Subsidiary's Net AssetsDocument10 pagesStep 1: Analysis of The Subsidiary's Net AssetsJulie Mae Caling MalitNo ratings yet

- Consolidation FP ExampleDocument4 pagesConsolidation FP ExampleHasif YusofNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- 04 Homework (Ramirez)Document4 pages04 Homework (Ramirez)Imthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- John Carlo C. Tolentino March 3, 2022 Bsma-3A Mr. Jefferson Cruz 3Document5 pagesJohn Carlo C. Tolentino March 3, 2022 Bsma-3A Mr. Jefferson Cruz 3Imthe OneNo ratings yet

- Condominium Subcontractor CDC Holdings Corporation Ramirez CondominiumDocument3 pagesCondominium Subcontractor CDC Holdings Corporation Ramirez CondominiumImthe OneNo ratings yet

- A Contract of Sale May Be Absolute or ConditionalDocument5 pagesA Contract of Sale May Be Absolute or ConditionalImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Navotas Polytechnic College Bs HRM ACTIVITY 1.6 (20pts)Document2 pagesNavotas Polytechnic College Bs HRM ACTIVITY 1.6 (20pts)Imthe OneNo ratings yet

- Chapter 2 Notes PayableDocument13 pagesChapter 2 Notes PayableImthe OneNo ratings yet

- Competitive Analysis: Porter's Five-Forces Model: Rivalry Among Competing FirmsDocument3 pagesCompetitive Analysis: Porter's Five-Forces Model: Rivalry Among Competing FirmsImthe OneNo ratings yet

- Quiz 1Document3 pagesQuiz 1Imthe OneNo ratings yet

- The Impact of Corporate Governance On Financial RiDocument9 pagesThe Impact of Corporate Governance On Financial RiImthe OneNo ratings yet

- Delay Sanction RulesDocument2 pagesDelay Sanction RulesImthe OneNo ratings yet

- Guerta Term Paper - Ethical Issues and Problem of Our EconomyDocument2 pagesGuerta Term Paper - Ethical Issues and Problem of Our EconomyImthe OneNo ratings yet

- Starbuck Corporate GovernanceDocument26 pagesStarbuck Corporate GovernanceImthe One100% (1)

- Group 7 Activity BMWs Competitive AnalysisDocument2 pagesGroup 7 Activity BMWs Competitive AnalysisImthe OneNo ratings yet

- Internal Control BasicsDocument29 pagesInternal Control BasicsImthe OneNo ratings yet

- Financial AnalysisDocument32 pagesFinancial AnalysisMustafa MahmoodNo ratings yet

- Is Systematic Value Investing Dead 51520Document41 pagesIs Systematic Value Investing Dead 51520Kostas IordanidisNo ratings yet

- Tax ReviewerDocument10 pagesTax ReviewerChristian ZanoriaNo ratings yet

- Airline Finance 5th EdnDocument48 pagesAirline Finance 5th EdnCornelio SwaiNo ratings yet

- JHL Financial Statement Year Ended 31st December 2017Document1 pageJHL Financial Statement Year Ended 31st December 2017douglasNo ratings yet

- Capital Market Instruments Are Basically Either Equity (Stock) Securities or Debt (Bond)Document2 pagesCapital Market Instruments Are Basically Either Equity (Stock) Securities or Debt (Bond)maryaniNo ratings yet

- Framework For The Preparation and Presentation of Financial StatementsDocument6 pagesFramework For The Preparation and Presentation of Financial Statementsg0025No ratings yet

- List of Accounting StandardsDocument3 pagesList of Accounting StandardsManish MohantyNo ratings yet

- CPA Exam REG - S-Corporation Taxation.Document2 pagesCPA Exam REG - S-Corporation Taxation.Manny MarroquinNo ratings yet

- Impactof Capitalstructureon Financial PerformanceanditsdeterminantsDocument11 pagesImpactof Capitalstructureon Financial PerformanceanditsdeterminantsLehar GabaNo ratings yet

- IPSAS PSAS ComparisonDocument7 pagesIPSAS PSAS Comparisonwr KheruNo ratings yet

- Module 6 Investment PropertyDocument9 pagesModule 6 Investment Propertytite ko'y malakeNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationNicoleNo ratings yet

- Offering Circular 25 January 2008 - Liberty ACQDocument157 pagesOffering Circular 25 January 2008 - Liberty ACQGag PafNo ratings yet

- Accountancy and Auditing-2020Document5 pagesAccountancy and Auditing-2020Bakhita MaryamNo ratings yet

- SER Plagiarism ReportDocument5 pagesSER Plagiarism ReportmayankNo ratings yet

- CV - Roimond Immanuel NewDocument1 pageCV - Roimond Immanuel NewPamela NuraniNo ratings yet

- Financial Planning and Forecasting From Brigham & EhrhardtDocument52 pagesFinancial Planning and Forecasting From Brigham & EhrhardtAsif KhanNo ratings yet

- CA. Sarthak Jain: CARO, 2020Document3 pagesCA. Sarthak Jain: CARO, 2020Kushagra BurmanNo ratings yet

- British American TobaccoDocument30 pagesBritish American TobaccoFahim YusufNo ratings yet

- Target CostingDocument2 pagesTarget CostingMuhammad FaizanNo ratings yet

- Gbca Presentation On Aif - Aug 2021Document23 pagesGbca Presentation On Aif - Aug 2021Sri RamNo ratings yet

- Functions of Stock ExchangesDocument5 pagesFunctions of Stock Exchangesgkvimal nathanNo ratings yet

- Evaluating Distressed SecuritiesDocument12 pagesEvaluating Distressed Securitieslazaros-apostolidis1179No ratings yet

- PDF 1Document151 pagesPDF 1Nana GandaNo ratings yet

- ABM 1 Adjustments and WorksheetDocument4 pagesABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Checklist - InventoriesDocument12 pagesChecklist - InventoriesdasharathdhageNo ratings yet

- Sa 1 0107Document18 pagesSa 1 0107api-3749988100% (2)