Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Imthe OneCopyright:

Available Formats

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Imthe OneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: Topic

Uploaded by

Imthe OneCopyright:

Available Formats

CMU

Enrichment Learning Activity

Name: Eugene EJ C. Ramirez Date: March 31, 2022

Year and Section: 3rd - BSMA Instructor Prof. Jefferson Cruz

:

Module #: 1 Topic: REPORING IN HYPERINFLATIONARY

ECONOMIES

Directions:

Use the following information for the next seven questions:

SOBRIQUET NICKNAME Co. operates in a hyperinflationary economy. Its unrestated financial statements are provided

below:

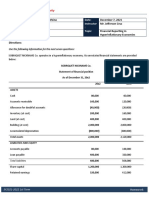

SOBRIQUET NICKNAME Co.

Statement of financial position

As of December 31, 20x2

20x2 20x1

ASSETS

Cash 80,000 60,000

Accounts receivable 160,000 120,000

Allowance for doubtful accounts (40,000) (20,000)

Inventory (at cost) 200,000 160,000

Land (at cost) 400,000 400,000

Building (at cost) 2,000,000 2,000,000

Accumulated depreciation (800,000) (600,000)

Total assets 2,000,000 2,120,000

LIABILITIES AND EQUITY

Accounts payable 80,000 188,000

Loan payable 400,000 320,000

Total liabilities 480,000 508,000

Share capital 1,200,000 1,200,000

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

Retained earnings 320,000 412,000

Total equity 1,520,000 1,612,000

Total liabilities and equity 2,000,000 2,120,000

SOBRIQUET NICKNAME Co.

Statement of profit or loss and other comprehensive income

For the year ended December 31, 20x2

Sales 1,600,000

Cost of sales:

Inventory, January 1 160,000

Purchases 1,200,000

Total goods available for sale 1,360,000

Inventory, December 31 (200,000) (1,160,000)

Gross income 440,000

Depreciation expense (200,000)

Distribution costs (140,000)

Bad debts expense (20,000)

Finance cost (40,000)

Profit before tax 40,000

Income tax expense (12,000)

Profit for the year 28,000

Other comprehensive income -

Total comprehensive income for the year 28,000

Additional information:

The land and building were acquired on April 1, 20x0.

The share capital was issued on March 1, 20x0.

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

Sales, purchases, and expenses (except interest expense) were incurred evenly during the year.

Interest expense was recognized and paid on December 31, 20x2.

Dividends of ₱120,000 were declared and paid on December 31, 20x2.

Selected values of general price indices (CPI) are shown below:

March 1, 20x0……………………………………………...100

April 1, 20x0………………………………………………..100

Average for 20x1…………………………………………..110

December 31, 20x1…………………..………….…………120

Average for 20x2…………………………………………..125

December 31, 20x2………………………………………….140

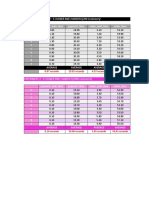

1. How much is the restated total assets in the 20x1 comparative statement of financial position?

20x1 Restated

Cash 70,000

AR 140,000

Allowance for doubt. Acc. (23,333)

Inventory (at cost) 203,636

Land (at cost) 560,000

Building (at cost) 2,800,000

Accu. Dep. (840,000)

TOTAL ASSETS: 2,910,303

2. How much is the restated total liabilities in the 20x1 comparative statement of financial position?

20x1

Accounts Payable 219,333

Loans Payable 373,333

TOTAL LIABILITIES: 592,667

3. How much is the restated total assets in the 20x2 statement of financial position?

20x2 Restated

Cash 80,000

AR 160,000

Allowance for doubt. Acc. (40,000)

Inventory (at cost) 244,000

Land (at cost) 560,000

Building (at cost) 2,800,000

Accu. Dep. (1,120,000)

TOTAL ASSETS: 2,644,000

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

4. How much is the restated total liabilities in the 20x2 statement of financial position?

20x2

Accounts Payable 80,000

Loans Payable 400,000

TOTAL LIABILITIES: 480,000

5. How much is the restated profit?

Restated

Sales 1,792,000

Cost of sales:

Inv. Jan, 1 203,636

Purchases 1,344,000

Total goods available for sale 1,547,636

Inv. Dec, 31 (244,000) (1,323,636)

Gross income 468,364

Dep. Expense (280,000)

Distribution costs (156,800)

Bad debts expense ( 20,000)

Finance Cost (40,000)

Gain on net monetary position 28,240

Profit before tax (196)

Income tax expense (13,440)

Profit for the year (13,636)

Other Comprehensive income -

Total comprehensive income for the yr. (13,636)

6. How much is the gain (loss) on net monetary position (purchasing power gain or loss)?

Gain on net monetary position 28,240

7. How much is the restated retained earnings on December 31, 20x2?

20x2

Retained Earnings 504,000

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

The next two items are based on the following information:

Rice Wholesaling Corp. accounts for inventory on a FIFO basis. There were 8,000 units in inventory on January 1, 20x3.

Costs were incurred and goods purchased as follows during 20x3:

20x3 Historical costs Units purchased Units sold

1st qtr. 410,000 7,000 7,500

2nd qtr. 550,000 8,500 7,300

3rd qtr. 425,000 6,500 8,200

4th qtr. 630,000 9,000 7,000

Totals 2,015,000 31,000 30,000

Rice estimates that the current cost per unit of inventory was ₱57 at January 1, 20x3, and ₱71 at December 31, 20x3.

8. How much is the December 31, 20x3 inventory restated to current cost?

Beginning inventory – units 8,000

Units purchased 31,000

Total goods available for sale – units 39,000

Units sold 30,000

Ending inventory in units 9,000

Current cost per unit 71

Ending inventory - current cost 639,000

9. How much is the 20x3 cost of goods sold restated to current cost?

Units sold 30,000

Average current cost [(71 + 57) ÷ 2] 64

Cost of sales - current cost 1,920,000

SY2021-2022 1st Term Homework

CMU

Enrichment Learning Activity

10. Fair Value, Inc., paid ₱1,200,000 in December 20x7 for certain of its inventory. In December 20x8, one half of the

inventory was sold for ₱1,000,000 when the replacement cost of the original inventory was ₱1,400,000. Ignoring

income taxes, what amount should be shown as the total gain resulting from the above facts in a current value

accounting income statement for 20x8?

Sales 1,000,000

Historical cost of portion sold (1,200,000 x 1/2) (600,000)

Realized gain 400,000

Current cost of unsold portion (1,400,000 x 1/2) 700,000

Historical cost of portion unsold (1,200,000 x 1/2) (600,000)

Unrealized gain 100,000

Total gain 500,000

SY2021-2022 1st Term Homework

You might also like

- Bar Exam Questions On Preliminary AttachmentDocument20 pagesBar Exam Questions On Preliminary AttachmentKim Ecarma100% (2)

- Refinery Planning and Optimation Using Linear ProgrammingDocument11 pagesRefinery Planning and Optimation Using Linear ProgrammingSenthil Kumar100% (3)

- Motivation LetterDocument2 pagesMotivation Lettersanjeev86% (22)

- Astm B532Document2 pagesAstm B532tam daoNo ratings yet

- ACG3141 Chap 14 PDFDocument35 pagesACG3141 Chap 14 PDFLexter Dave C EstoqueNo ratings yet

- ABC FX Summer 22 23Document16 pagesABC FX Summer 22 23Patricia EsplagoNo ratings yet

- Problem 7-1: True or False False: Fact PatternDocument23 pagesProblem 7-1: True or False False: Fact PatternMichael Brian TorresNo ratings yet

- Assignment About Liquidation ValueDocument1 pageAssignment About Liquidation ValueNiezel MirandaNo ratings yet

- Accounting For Business Combinations (PRE7) - FINALSDocument3 pagesAccounting For Business Combinations (PRE7) - FINALSMay P. HuitNo ratings yet

- Quiz Chapter 4 Consol. Fs Part 1Document7 pagesQuiz Chapter 4 Consol. Fs Part 1Avril Denise NavarroNo ratings yet

- This Question Has Been Answered: Find Study ResourcesDocument1 pageThis Question Has Been Answered: Find Study ResourcesWayne Casanova100% (1)

- BusinessCombi (Chapter 5)Document18 pagesBusinessCombi (Chapter 5)richmond naragNo ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Assignment For Accounting Policies, Estimate and Errors: Problem 3Document3 pagesAssignment For Accounting Policies, Estimate and Errors: Problem 3Fria Mae Aycardo AbellanoNo ratings yet

- Theory Reviewer Buscomb ConsoDocument13 pagesTheory Reviewer Buscomb ConsoRoselyn AmpoNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- Chapter 11Document9 pagesChapter 11Em-em ValNo ratings yet

- ADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FDocument2 pagesADVANCED ACCOUNTING 1 - Chapter 8: Accounting For Franchise Operations - Franchisor James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- Final Examination: Total Points EcodevDocument14 pagesFinal Examination: Total Points EcodevEllen BuenafeNo ratings yet

- Solution Manual Special Transactions Millan Chapter 3 2021 - CompressDocument24 pagesSolution Manual Special Transactions Millan Chapter 3 2021 - Compressriri04700No ratings yet

- Solman Chap10 Shareholders Equity - CompressDocument18 pagesSolman Chap10 Shareholders Equity - CompressDump DumpNo ratings yet

- Chapter 23 The Effects of Changes in Foreign Exchange Rates Afar Part 2Document20 pagesChapter 23 The Effects of Changes in Foreign Exchange Rates Afar Part 2Kathrina RoxasNo ratings yet

- Module 8Document2 pagesModule 8Jacqueline OrtegaNo ratings yet

- Afar302 A - PF 1Document4 pagesAfar302 A - PF 1Nicole TeruelNo ratings yet

- Solved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course HeroDocument5 pagesSolved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course Herojau chiNo ratings yet

- Accounting For Special Transactions p1 - CompressDocument10 pagesAccounting For Special Transactions p1 - CompressALINA, Jhon Czery C.0% (1)

- Chapter 28 LeaseDocument56 pagesChapter 28 LeaseFel Salazar JapsNo ratings yet

- ACC 139 MCQ Sas 1-24Document35 pagesACC 139 MCQ Sas 1-24MaricrisNo ratings yet

- Unit 1 Audit of Property PLant and EquipmentDocument5 pagesUnit 1 Audit of Property PLant and EquipmentJustin SolanoNo ratings yet

- Prelim Exam Set 1Document10 pagesPrelim Exam Set 1kristelNo ratings yet

- Activity #3 Separate and Consolidated FS - Date of AcquisitionDocument4 pagesActivity #3 Separate and Consolidated FS - Date of AcquisitionLorelie I. RamiroNo ratings yet

- Chapter 20 Consolidated Fs Part 4 Afar Part 2Document22 pagesChapter 20 Consolidated Fs Part 4 Afar Part 2trishaNo ratings yet

- Problem 1: Auditing and Assurance PrinciplesDocument3 pagesProblem 1: Auditing and Assurance PrinciplesMitch MinglanaNo ratings yet

- Mantuhac, Anthony BSA-3Document3 pagesMantuhac, Anthony BSA-3Anthony Tunying MantuhacNo ratings yet

- p3 Acc 110 ReviewerDocument12 pagesp3 Acc 110 ReviewerRona Amor MundaNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Corporate Liquidation & Reorganization T&FDocument2 pagesCorporate Liquidation & Reorganization T&FLugh Tuatha DeNo ratings yet

- Problem 7-1: True or False False: Fact PatternDocument6 pagesProblem 7-1: True or False False: Fact Patternrichmond naragNo ratings yet

- Tandem Activity GE Allowable DeductionsDocument6 pagesTandem Activity GE Allowable DeductionsErin CruzNo ratings yet

- TG Chapter 7Document8 pagesTG Chapter 7Faith EsguerraNo ratings yet

- This Study Resource Was Shared Via: Miscellaneous TopicsDocument2 pagesThis Study Resource Was Shared Via: Miscellaneous TopicsRochelle HullezaNo ratings yet

- ? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingDocument6 pages? IA3 SIM Answers Week 12-13 ULO123 Hyperinflation & Current Cost AccountingJeric TorionNo ratings yet

- Use The Following Information For The Next Four QuestionsDocument1 pageUse The Following Information For The Next Four QuestionsTine Vasiana DuermeNo ratings yet

- Cae08 - Activity Chapter 2Document4 pagesCae08 - Activity Chapter 2Jr VillariezNo ratings yet

- Chapter 4 Partnership Liquidation 2021 EditionDocument25 pagesChapter 4 Partnership Liquidation 2021 Editionregine bacabagNo ratings yet

- Grace-AST Module 4Document2 pagesGrace-AST Module 4Devine Grace A. MaghinayNo ratings yet

- Aa 3Document4 pagesAa 3Unknown 01No ratings yet

- Consignment and Franchise Assignment ILAGANDocument4 pagesConsignment and Franchise Assignment ILAGANAsdfghjkl LkjhgfdsaNo ratings yet

- PAS 40-Biological Assets and Agricultural Produce: Key DefinitionsDocument5 pagesPAS 40-Biological Assets and Agricultural Produce: Key DefinitionsAngel Anne Gonzales ClaritoNo ratings yet

- Quiz 1 in Ia3Document6 pagesQuiz 1 in Ia3Dorothy NadelaNo ratings yet

- LS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditDocument6 pagesLS 2.90 - PSA 320 Materiality in The Planning and Performing An AuditSkye Lee100% (1)

- Quiz 2 Version 1 SolutionDocument6 pagesQuiz 2 Version 1 SolutionEych MendozaNo ratings yet

- Intermediate Accounting 3 - January 24, 2023, F2F DiscussionDocument8 pagesIntermediate Accounting 3 - January 24, 2023, F2F DiscussionZhaira Kim CantosNo ratings yet

- Chapter 10Document9 pagesChapter 10Patrick Earl T. PintacNo ratings yet

- Chapter 15 - AnswerDocument18 pagesChapter 15 - AnswerCrisalie BocoboNo ratings yet

- COST ACCOUNTING 1 8 Final Allocation of Joint CostsDocument15 pagesCOST ACCOUNTING 1 8 Final Allocation of Joint CostsZoe MendozaNo ratings yet

- Chapter 43 - Statement of Cash FlowsDocument13 pagesChapter 43 - Statement of Cash FlowsRoxan PacsayNo ratings yet

- Review of Accounting CycleDocument2 pagesReview of Accounting CycleAnnie RapanutNo ratings yet

- Audit Theory Escala Key AnswersDocument1 pageAudit Theory Escala Key AnswersLein MallariNo ratings yet

- Chap 5 Escala With AnswerDocument10 pagesChap 5 Escala With Answerkris mNo ratings yet

- ACC 139 SAS Day 17 EXAM JLDDocument20 pagesACC 139 SAS Day 17 EXAM JLDmarili ZarateNo ratings yet

- At 1 With AnswersDocument7 pagesAt 1 With AnswersKeren Joyce RojasNo ratings yet

- 01 Homework - Urbino Bsa - 4aDocument8 pages01 Homework - Urbino Bsa - 4aVeralou UrbinoNo ratings yet

- Use The Following Information For The Next Seven Questions:: Total LiabilitiesDocument7 pagesUse The Following Information For The Next Seven Questions:: Total LiabilitiesRoss John JimenezNo ratings yet

- 04 Homework (Ramirez)Document4 pages04 Homework (Ramirez)Imthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument1 pageEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument2 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- John Carlo C. Tolentino March 3, 2022 Bsma-3A Mr. Jefferson Cruz 3Document5 pagesJohn Carlo C. Tolentino March 3, 2022 Bsma-3A Mr. Jefferson Cruz 3Imthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument5 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Condominium Subcontractor CDC Holdings Corporation Ramirez CondominiumDocument3 pagesCondominium Subcontractor CDC Holdings Corporation Ramirez CondominiumImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument3 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Chapter 2 Notes PayableDocument13 pagesChapter 2 Notes PayableImthe OneNo ratings yet

- A Contract of Sale May Be Absolute or ConditionalDocument5 pagesA Contract of Sale May Be Absolute or ConditionalImthe OneNo ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument2 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Navotas Polytechnic College Bs HRM ACTIVITY 1.6 (20pts)Document2 pagesNavotas Polytechnic College Bs HRM ACTIVITY 1.6 (20pts)Imthe OneNo ratings yet

- Competitive Analysis: Porter's Five-Forces Model: Rivalry Among Competing FirmsDocument3 pagesCompetitive Analysis: Porter's Five-Forces Model: Rivalry Among Competing FirmsImthe OneNo ratings yet

- Guerta Term Paper - Ethical Issues and Problem of Our EconomyDocument2 pagesGuerta Term Paper - Ethical Issues and Problem of Our EconomyImthe OneNo ratings yet

- Quiz 1Document3 pagesQuiz 1Imthe OneNo ratings yet

- Delay Sanction RulesDocument2 pagesDelay Sanction RulesImthe OneNo ratings yet

- Homework Chapter 8Document3 pagesHomework Chapter 8Imthe OneNo ratings yet

- The Impact of Corporate Governance On Financial RiDocument9 pagesThe Impact of Corporate Governance On Financial RiImthe OneNo ratings yet

- Starbuck Corporate GovernanceDocument26 pagesStarbuck Corporate GovernanceImthe One100% (1)

- Internal Control BasicsDocument29 pagesInternal Control BasicsImthe OneNo ratings yet

- Group 7 Activity BMWs Competitive AnalysisDocument2 pagesGroup 7 Activity BMWs Competitive AnalysisImthe OneNo ratings yet

- Summaries To The LectureDocument2 pagesSummaries To The LectureImthe OneNo ratings yet

- Biswajit Nayak Article On Wearable DevicesDocument9 pagesBiswajit Nayak Article On Wearable DevicesVamsi Pratap KNo ratings yet

- IEAM Vs Peterson & Almsteier Full Peterson ComplaintDocument60 pagesIEAM Vs Peterson & Almsteier Full Peterson ComplaintFuzzy PandaNo ratings yet

- Class Exercises - Trial BalanceDocument2 pagesClass Exercises - Trial BalanceDEEPANo ratings yet

- Chapter 7 Leveraging Secondary Brand Associations To Build Brand EquityDocument14 pagesChapter 7 Leveraging Secondary Brand Associations To Build Brand Equitywintoday0195% (21)

- Hard Choices Needed On Proposed North Peace Leisure FacilityDocument5 pagesHard Choices Needed On Proposed North Peace Leisure FacilityTom SummerNo ratings yet

- Lovely Professional University, Phagwara: INSTRUCTIONAL PLAN (For Lectures)Document5 pagesLovely Professional University, Phagwara: INSTRUCTIONAL PLAN (For Lectures)arvindsippuNo ratings yet

- Previous Experiment: 3 Cashier and 4 Barista (200 Customers)Document2 pagesPrevious Experiment: 3 Cashier and 4 Barista (200 Customers)Christine Mae CionNo ratings yet

- 14 ReferencesDocument25 pages14 ReferencesDrHemant Shastry75% (4)

- Chapters 1-4Document5 pagesChapters 1-4ceejarchivescirca2024No ratings yet

- Mini Magazine - Issue 316 July 2021Document100 pagesMini Magazine - Issue 316 July 2021seadognetNo ratings yet

- Ent300 - Case Study (Individual Assignment)Document29 pagesEnt300 - Case Study (Individual Assignment)nur syakiraNo ratings yet

- Supply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument47 pagesSupply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyAlaa Al HarbiNo ratings yet

- Business Partnership ProposalDocument2 pagesBusiness Partnership ProposalRico EdureseNo ratings yet

- WWW - ILOE.ae WWW - ILOE.aeDocument2 pagesWWW - ILOE.ae WWW - ILOE.aedeepan85No ratings yet

- Acct 4220 Additional Review Questions For Final ExamDocument5 pagesAcct 4220 Additional Review Questions For Final ExamrakutenmeeshoNo ratings yet

- Digital Marketing Techniques - 40079661 v2Document28 pagesDigital Marketing Techniques - 40079661 v2EreakpoNo ratings yet

- Logistic & SCM QB TybmsDocument13 pagesLogistic & SCM QB TybmsRinky VekariaNo ratings yet

- 1.1 Nikon Corporation: 1.1.1 Company OverviewDocument3 pages1.1 Nikon Corporation: 1.1.1 Company OverviewSwati AgrawalNo ratings yet

- Fia Formula 1 Financial Regulations - Issue 21 - 2024-07-31 0Document52 pagesFia Formula 1 Financial Regulations - Issue 21 - 2024-07-31 0jaydenrburrowsNo ratings yet

- Na BR 1168 Hybrid Agv Vna 4Document4 pagesNa BR 1168 Hybrid Agv Vna 4Marco BaptistaNo ratings yet

- Availability of Essential Supplies & EquipmentDocument2 pagesAvailability of Essential Supplies & EquipmentLovelydePerioNo ratings yet

- MOTORTECH ProductGuide2013 PDFDocument196 pagesMOTORTECH ProductGuide2013 PDFFrancisco Mosquera Lopez100% (1)

- 1043 Rose Oil Drop LabelDocument2 pages1043 Rose Oil Drop LabelAli MalekiNo ratings yet

- Process of Design-Module1Document47 pagesProcess of Design-Module1alphain69100% (1)

- Project Integration Management Pmbok 5th Edition PPT File v1.1Document71 pagesProject Integration Management Pmbok 5th Edition PPT File v1.1Danlami ChieNo ratings yet

- Covert Product Selling PrinciplesDocument15 pagesCovert Product Selling PrinciplesWenn BanaagNo ratings yet