Group Assignment 2014

Group Assignment 2014

Uploaded by

Samuel AberaCopyright:

Available Formats

Group Assignment 2014

Group Assignment 2014

Uploaded by

Samuel AberaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Group Assignment 2014

Group Assignment 2014

Uploaded by

Samuel AberaCopyright:

Available Formats

Group Assignment For Regular Students

Bahir Dar University

College of Business and Economics

Accounting and Finance Department

Work out the following questions, show all the necessary steps

1. Matlock Plc uses a perpetual inventory system. Its beginning inventory consists of 50

units that cost €34 each. During June, the company purchased 150 units at €34 each,

returned 6 units for credit, and sold 125 units at €50 each.

Instruction

Journalize the June transactions.

2. In your audit of Garza Company, you find that a physical inventory on December 31,

2019, showed merchandise with a cost of $441,000 was on hand at that date. You also

discover the following items were all excluded from the $441,000.

a. Merchandise of $61,000 which is held by Garza on consignment. The consignor is

the Bontemps Company.

b. Merchandise costing $33,000 which was shipped by Garza f.o.b. destination to a

customer on December 31, 2019. The customer was expected to receive the

merchandise on January 6, 2020.

c. Merchandise costing $46,000 which was shipped by Garza f.o.b. shipping point to

a customer on December 29, 2019. The customer was scheduled to receive the

merchandise on January 2, 2020.

d. Merchandise costing $73,000 shipped by a vendor f.o.b. destination on December

30, 2019, and received by Garza on January 4, 2020.

e. Merchandise costing $51,000 shipped by a vendor f.o.b. shipping point on

December 31, 2019, and received by Garza on January 5, 2020.

Instructions

Based on the above information, calculate the amount that should appear on Garza's statement of

financial position at December 31, 2019, for inventory.

Prepared By Hunegnaw A Page 1

Group Assignment For Regular Students

3. Walya Plc is a multiproduct firm. The following is information concerning one of its

Date Transaction Quantity Price/cost products, the

1/1 Beginning Inventory 1000 $.12 Mattress.

2/4 Purchase 2000 18

2/20 Sales 2500 30

4/2 Purchase 3000 23

11/4 Sales 2200 33

Instructions

Compute cost of goods sold, assuming Walya Plc uses:

a. Periodic system, FIFO cost flow.

b. Perpetual system, FIFO cost flow.

c. Periodic system, weighted-average cost flow.

d. Perpetual system, moving-average cost flow.

4. Astaire ASA uses the gross profit method to estimate inventory for monthly reporting

purposes. Presented below is information for the month of May.

Inventory, May 1 € 160,000

Purchases (gross) 640,000

Freight-in 30,000

Sales 1,000,000

Sales returns 70,000

Purchase discounts 12,000

Instructions

a. Compute the estimated inventory at May 31, assuming that the gross profit is 25% of

sales.

b. Compute the estimated inventory at May 31, assuming that the gross profit is 25% of

cost.

Prepared By Hunegnaw A Page 2

Group Assignment For Regular Students

5. Yintang Group has negotiated the purchase of a new piece of automatic

equipment at a price of $7,000 plus tradein, f.o.b. factory. Yintang paid

$7,000 cash and traded in used equipment. The used equipment had

originally cost $62,000; it had a book value of $42,000 and a secondhand

fair value of $45,800, as indicated by recent transactions involving similar

equipment. Freight and installation charges for the new equipment required a

cash payment of $1,100.

Instructions

a) Prepare the general journal entry to record this transaction, assuming that the

exchange has commercial substance.

b) Assuming the same facts as in (a) except that fair value information for the

assets exchanged is not determinable; prepare the general journal entry to

record this transaction.

Prepared By Hunegnaw A Page 3

You might also like

- Inventory 2 (Theories & Problems) With AnswersDocument11 pagesInventory 2 (Theories & Problems) With AnswersUzziehllah Ratuita100% (3)

- CH 06Document8 pagesCH 06Tien Thanh DangNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- CE On Inventories T3 AY1920 PDFDocument9 pagesCE On Inventories T3 AY1920 PDFshiplusNo ratings yet

- Inventories QuestionnaireDocument9 pagesInventories QuestionnaireKristine JavierNo ratings yet

- FoA II-Individual AssignmentDocument6 pagesFoA II-Individual Assignmentmedhane negaNo ratings yet

- INVENTORIESDocument5 pagesINVENTORIESEdrick Devilla Dimayuga100% (2)

- Quiz#2 Problem Solving InventoryDocument3 pagesQuiz#2 Problem Solving InventoryMyles Ninon LazoNo ratings yet

- Dysas - Fin Acc - 3rdDocument5 pagesDysas - Fin Acc - 3rdJao FloresNo ratings yet

- Intacc Q2Document4 pagesIntacc Q2Juliana Reign RuedaNo ratings yet

- Far First Set ADocument8 pagesFar First Set APaula Villarubia100% (1)

- F FAR PBFPBOCT19.pdf 93604515Document16 pagesF FAR PBFPBOCT19.pdf 93604515Athena AthenaNo ratings yet

- 3311 CH 8 REVIEWDocument5 pages3311 CH 8 REVIEWVernon Dwanye LewisNo ratings yet

- Activity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)Document8 pagesActivity 2: COST ACCOUNTING AND COST CONTROL (Select The Letter of The Best Answer)kakimog738No ratings yet

- Exam 3 - C5&6.2019V1Document3 pagesExam 3 - C5&6.2019V1ReineNo ratings yet

- Intermediate Accounting Practice HandoutsDocument8 pagesIntermediate Accounting Practice HandoutspolxrixNo ratings yet

- MidDocument4 pagesMidFroilan Arlando BandulaNo ratings yet

- Inventories and Cost FlowDocument5 pagesInventories and Cost Flowalford sery CammayoNo ratings yet

- Quiz 5 - Ques AnsDocument11 pagesQuiz 5 - Ques Anshtamanh05.personalNo ratings yet

- Chang Converted MergedDocument8 pagesChang Converted MergedEbAd ZuberiNo ratings yet

- Acct2202 - Hand in Assignment October 2024Document8 pagesAcct2202 - Hand in Assignment October 2024abduramantofik5No ratings yet

- Financial AccountingDocument10 pagesFinancial AccountingMi NguyenNo ratings yet

- POA1-Assignment - Chapter 5 - QDocument5 pagesPOA1-Assignment - Chapter 5 - QAuora Bianca100% (1)

- Q2FT InventoriesDocument2 pagesQ2FT Inventoriesfrancis dungcaNo ratings yet

- P1 Day3 RM 2020Document5 pagesP1 Day3 RM 2020P De GuzmanNo ratings yet

- BHMH2101 - Reinforcement Ex Ch6 Q (Revised)Document3 pagesBHMH2101 - Reinforcement Ex Ch6 Q (Revised)52rvjhmsmdNo ratings yet

- Lebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Document14 pagesLebanese Association of Certified Public Accountants - IFRS July Exam 2016 Multiple Choice (30%) Use The Following Information For Questions 1 and 2Kololiko 123No ratings yet

- Quiz - InventoriesDocument8 pagesQuiz - InventoriesChristian QuintansNo ratings yet

- IFRS 15 Revenue MathsDocument2 pagesIFRS 15 Revenue MathsTanvir PrantoNo ratings yet

- Inventory, Biological & InvestmentDocument4 pagesInventory, Biological & InvestmentShaira BugayongNo ratings yet

- Intermediate Accounting 1: Following? A. PAS 1 B. PAS 2 C. Pas 7 D. PAS 8Document20 pagesIntermediate Accounting 1: Following? A. PAS 1 B. PAS 2 C. Pas 7 D. PAS 8Ginoong OsoNo ratings yet

- Bài tập inventoryDocument6 pagesBài tập inventoryHoàng Bảo TrâmNo ratings yet

- 27 Assignment InventoriesDocument7 pages27 Assignment Inventoriesleonardonocaprio616No ratings yet

- Chapter 7 InventoriesDocument8 pagesChapter 7 InventoriesChanelNo ratings yet

- Cash and Cash EquivalentsDocument5 pagesCash and Cash EquivalentsFelsie Jane PenasoNo ratings yet

- Tugas Lab 6 - Merchandising InventoryDocument2 pagesTugas Lab 6 - Merchandising InventoryRandomly StoreNo ratings yet

- Mock Quiz 3 FAR InvestmentSecutities X InventoriesDocument11 pagesMock Quiz 3 FAR InvestmentSecutities X InventoriesMARISA SYLVIA CAALIMNo ratings yet

- Merchadising MOCK QUIZDocument5 pagesMerchadising MOCK QUIZCarl Dhaniel Garcia SalenNo ratings yet

- Intermediate Accounting 1 Assessment ExaminationDocument20 pagesIntermediate Accounting 1 Assessment ExaminationKrissa Mae Longos100% (1)

- Quiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresDocument8 pagesQuiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresCassandra MarieNo ratings yet

- 6 This Will Help You Be BetterDocument65 pages6 This Will Help You Be Betteryes yesnoNo ratings yet

- MidtermDocument5 pagesMidtermNo NameNo ratings yet

- Chapter 7 Millan AnswersDocument33 pagesChapter 7 Millan AnswersCristine AcocosNo ratings yet

- Sheet (8) Intermediate Accounting: InventoriesDocument12 pagesSheet (8) Intermediate Accounting: Inventoriesmagdy kamelNo ratings yet

- AcFn - 2012-Worksheet - Ch01Document5 pagesAcFn - 2012-Worksheet - Ch01Andualem ZenebeNo ratings yet

- 3 Prefinals Exam Intermediate Accounting IA Bloc 3Document3 pages3 Prefinals Exam Intermediate Accounting IA Bloc 3Lourence Lee ServidadNo ratings yet

- Quiz 3 - InventoriesDocument4 pagesQuiz 3 - InventoriesJohn BanasNo ratings yet

- FAR-4105 INVENTORIES - Part 2Document3 pagesFAR-4105 INVENTORIES - Part 2music niNo ratings yet

- ACCT3000 Optional Multiple Choice QuestionsDocument10 pagesACCT3000 Optional Multiple Choice QuestionsFaizanNo ratings yet

- Audit of Inventories and Cost of Goods SoldDocument9 pagesAudit of Inventories and Cost of Goods SoldDita Indah0% (1)

- Chapter 8 InventoryDocument11 pagesChapter 8 Inventorymarwan2004acctNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- ACCY 201 Exam 2 Study GuideDocument42 pagesACCY 201 Exam 2 Study GuideKelly WilliamsNo ratings yet

- Final Preboard-FAR-with AnswersDocument11 pagesFinal Preboard-FAR-with AnswersLuisito CorreaNo ratings yet

- Inventories, Inventories Estimation and Investment in AssociateDocument7 pagesInventories, Inventories Estimation and Investment in Associatethaz.roco.auNo ratings yet

- Far Quiz Nov. 20, 2020Document7 pagesFar Quiz Nov. 20, 2020Yanna AlquisolaNo ratings yet

- Inv 4-7Document21 pagesInv 4-7lynguyen2996No ratings yet

- Final Exam Revision - Set 2Document2 pagesFinal Exam Revision - Set 2Tran Pham Quoc ThuyNo ratings yet

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- PST FM 2015 2023Document92 pagesPST FM 2015 2023PhilipNo ratings yet

- Green Modern Analysis of Results PresentationDocument12 pagesGreen Modern Analysis of Results PresentationGautamNo ratings yet

- IH NotesDocument2 pagesIH NotesSuryansh AggarwalNo ratings yet

- BSB119 Practice MCQAnswers OneDocument2 pagesBSB119 Practice MCQAnswers OneBrianChristopherNo ratings yet

- Module 3 Buying and Selling For Students Copy 1Document35 pagesModule 3 Buying and Selling For Students Copy 1Alexander GuevarraNo ratings yet

- DELETEDBusiness Studies 2020-21Document2 pagesDELETEDBusiness Studies 2020-21Siddhi JainNo ratings yet

- 2008 GDJ Transportation and Logistics in Supply ChainsDocument43 pages2008 GDJ Transportation and Logistics in Supply Chainsbodeks dexNo ratings yet

- Inflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsDocument2 pagesInflation. Interest Rates. Balance of Payments. Government Intervention. Other FactorsEmmanuelle RojasNo ratings yet

- Chapter Six - MacroeconomicsDocument66 pagesChapter Six - MacroeconomicsAlazar MebratuNo ratings yet

- Lesson 2. Monetary StandardDocument14 pagesLesson 2. Monetary StandardLAROA, Mychell D.No ratings yet

- Promoting The Small BusinessDocument9 pagesPromoting The Small BusinessJovielyn M. MontealtoNo ratings yet

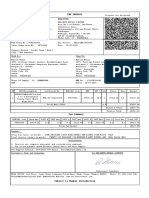

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)PV VimalNo ratings yet

- Munro5@chass - Utoronto.ca John - Munro@utoronto - CaDocument45 pagesMunro5@chass - Utoronto.ca John - Munro@utoronto - CakimjimNo ratings yet

- Government Budget and The EconomyDocument8 pagesGovernment Budget and The EconomyAryan Rawat100% (1)

- Module-1 Contemporary WorldDocument7 pagesModule-1 Contemporary WorldRaniel Galindo0% (1)

- Port and Maritime Supply ChainDocument150 pagesPort and Maritime Supply ChainMastika GebrehiewotNo ratings yet

- Principle of Macro-Economics Mcq'sDocument6 pagesPrinciple of Macro-Economics Mcq'sSafiullah mirzaNo ratings yet

- Basic Crypto Currency TradingDocument34 pagesBasic Crypto Currency TradingANo ratings yet

- Dynamic Changes in Comparative Advantage - Japan 'Flying Geese' Model and Its Implications For ChinaDocument15 pagesDynamic Changes in Comparative Advantage - Japan 'Flying Geese' Model and Its Implications For ChinaGaNikoModdilaniNo ratings yet

- Contemp Activity 3&4Document4 pagesContemp Activity 3&4Mickaella MercurioNo ratings yet

- NIKE (Case Study)Document31 pagesNIKE (Case Study)Nguyen Ngoc Hai Son (K17 HCM)No ratings yet

- Hard FurnishDocument6 pagesHard Furnishmanish kumarNo ratings yet

- Cash Flow Statement Important QuestionsDocument20 pagesCash Flow Statement Important QuestionsSatinder SinghNo ratings yet

- Wpiea2023270 Print PDFDocument51 pagesWpiea2023270 Print PDFArindam ChakrabortyNo ratings yet

- BREIT Monthly Performance - February 2020Document26 pagesBREIT Monthly Performance - February 2020MAYANK AGGARWALNo ratings yet

- InvoiceDocument1 pageInvoiceVeerappan MuthuramanNo ratings yet

- Aditya Birla Fashion and Retail Limited: Disc - Amt Disc% Item - Name Ean - Code HSN QTY MRP Net - Amt Tax - Rate TaxDocument2 pagesAditya Birla Fashion and Retail Limited: Disc - Amt Disc% Item - Name Ean - Code HSN QTY MRP Net - Amt Tax - Rate TaxSanti KhanNo ratings yet

- The East India CompanyDocument4 pagesThe East India CompanyEkta KhatriNo ratings yet

- Finance Report enDocument1 pageFinance Report enPhương Linh VũNo ratings yet

- Relatorio Doing Business 2020 - Brasil (1) 81Document1 pageRelatorio Doing Business 2020 - Brasil (1) 81Love GuroNo ratings yet