0 ratings0% found this document useful (0 votes)

322 viewsAccounting For Depreciation and Disposal of Non-Current Asset

Accounting For Depreciation and Disposal of Non-Current Asset

Uploaded by

Grade 8A PATEL YASHVI VIPUL- Depreciation is an estimate of the loss in value of a non-current asset over its expected working life.

- The straight line method charges the same amount of depreciation each year, while the reducing balance method charges decreasing amounts each year as the net book value decreases.

- The net book value is the cost price minus total depreciation to date. The residual value is the value of an asset at the end of its useful life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Accounting For Depreciation and Disposal of Non-Current Asset

Accounting For Depreciation and Disposal of Non-Current Asset

Uploaded by

Grade 8A PATEL YASHVI VIPUL0 ratings0% found this document useful (0 votes)

322 views4 pages- Depreciation is an estimate of the loss in value of a non-current asset over its expected working life.

- The straight line method charges the same amount of depreciation each year, while the reducing balance method charges decreasing amounts each year as the net book value decreases.

- The net book value is the cost price minus total depreciation to date. The residual value is the value of an asset at the end of its useful life.

Original Title

Accounting for depreciation and disposal of non-current asset

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

- Depreciation is an estimate of the loss in value of a non-current asset over its expected working life.

- The straight line method charges the same amount of depreciation each year, while the reducing balance method charges decreasing amounts each year as the net book value decreases.

- The net book value is the cost price minus total depreciation to date. The residual value is the value of an asset at the end of its useful life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

322 views4 pagesAccounting For Depreciation and Disposal of Non-Current Asset

Accounting For Depreciation and Disposal of Non-Current Asset

Uploaded by

Grade 8A PATEL YASHVI VIPUL- Depreciation is an estimate of the loss in value of a non-current asset over its expected working life.

- The straight line method charges the same amount of depreciation each year, while the reducing balance method charges decreasing amounts each year as the net book value decreases.

- The net book value is the cost price minus total depreciation to date. The residual value is the value of an asset at the end of its useful life.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Accounting for depreciation and

disposal of non-current asset

• Depreciation is an estimate of the loss in the

value of a non-current asset over its expected

working life

• The straight line method of depreciation is

where the same amount of depreciation is

charged each year

• The residual value is the value of a non-

current asset at the end of its useful life

• The reducing balance method of depreciation

is where the depreciation charged each year

decreases as t is calculated in the net book

value rather that the cost

• The net b00k value of a non-current asset is

the cost price minus the total depreciation to

date

• The revaluation method of depreciation is

where the opening value of a non-current asset

are compared to determine the depreciation for

the year

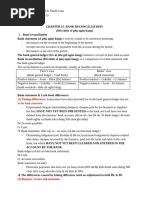

1. Name the two books of prime entry used in

1. Name the two books of prime entry used in

preparing the disposal account

Ans- 1. general journal 2. cash book

2. State two causes of depreciation of non-current

assets.

Ans- 1. Economic reasons 2. Depletion

3. Explain how charging depreciation is an

example of the application of the principle of

prudence.

Ans- Ensures that non-current assets are shown

at more realistic values in the statement of

financial position /Ensures that the profit for the

year is not overstated in the income statement

4. Suggest one reason why the loose tools are

revalued at the end of each financial year rather

than by using the straight line (fixed

instalment) or reducing (diminishing) balance

method of depreciation.

Ans- Low value items which are not easy to

depreciate separately /Not practical to keep

detailed records of such assets

5. Name one method of depreciation, other than

the straight line (equal instalment) method, and

explain how it is calculated.

Ans-

Reducing (diminishing) balance method.

Annual percentage rate is applied to the net book

value of the asset.

OR

Revaluation method.

The difference between the opening and closing

value of the asset.

OR

Revaluation method.

The difference between the opening and closing

valuations is taken and adjusted for any

purchases or disposals.

6. Suggest two reasons why the straight line

(equal instalment) method would not be a

suitable method of depreciation to apply to the

hand tools used in Jamil’s factory

Ans- 1. Do not depreciate by an equal amount

each year

2. Principle of materiality – not practical to

depreciate each item separately

7. Name the financial statement in which the

provision for depreciation appears. State in which

section it appears.

Ans- Statement of financial position-

Non-current assets

8. State how providing depreciation is an

application of the accounting principle of accruals

(matching)

Ans- The cost of the non-current asset and the

revenues arising from its use are matched in an

accounting period.

OR

The cost of the non-current asset is spread over its

useful life

You might also like

- Marathon As BusinessDocument27 pagesMarathon As Businessmm1ashanshahidNo ratings yet

- Sample Annual Report (Financial Statements of A Fictitious Real Estate Company)Document19 pagesSample Annual Report (Financial Statements of A Fictitious Real Estate Company)falculan_delsie75% (8)

- IGCSE Business Studies Essential Book Answers For Unit 3Document6 pagesIGCSE Business Studies Essential Book Answers For Unit 3emonimtiazNo ratings yet

- Introduction To Books of Prime Entry and LedgersDocument12 pagesIntroduction To Books of Prime Entry and Ledgersdianime OtakuNo ratings yet

- Firms, Cost Revenue and ObjectivesDocument8 pagesFirms, Cost Revenue and ObjectivesMamta LalwaniNo ratings yet

- 16) A Level Business Studies Unit 5 KeywordDocument8 pages16) A Level Business Studies Unit 5 KeywordCRAZYBLOBY 99No ratings yet

- Exam Style Questions Page 266Document2 pagesExam Style Questions Page 266Arounny Corwin100% (2)

- Operations Planning: Activity 21.1 (Page 395) : Sunburst BakeriesDocument15 pagesOperations Planning: Activity 21.1 (Page 395) : Sunburst BakeriesDivine Ntsonge100% (3)

- 6 Business Structure (A Level) : Multiple-Choice QuestionsDocument1 page6 Business Structure (A Level) : Multiple-Choice QuestionsKatherine PierceNo ratings yet

- IGCSE ACCOUNTING Syllabus Code: 0452 Scheme of Work Course OverviewDocument4 pagesIGCSE ACCOUNTING Syllabus Code: 0452 Scheme of Work Course OverviewAmin Mofreh100% (2)

- Recruitment, Selection and Training of Workers: Revision QuestionsDocument1 pageRecruitment, Selection and Training of Workers: Revision QuestionsBinSayeed100% (1)

- Make or Buy: Surana College, Department of MBA Chapter-5 Contact Num-9620843555 Bangalore University, BangaloreDocument6 pagesMake or Buy: Surana College, Department of MBA Chapter-5 Contact Num-9620843555 Bangalore University, Bangalorebalaji RNo ratings yet

- IGCSE Edexcel Business Studies NotesDocument17 pagesIGCSE Edexcel Business Studies NotesEllie Housen0% (1)

- Chapter 23 AnswersDocument9 pagesChapter 23 AnswersAnusree Sivasamy100% (1)

- IGCSE-OL - Bus - CH - 1 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 1 - Answers To CB ActivitiesAdrián Castillo100% (1)

- Sample Question and Answers: Business Studies 0450/0986 Worksheet 1 Business ActivityDocument3 pagesSample Question and Answers: Business Studies 0450/0986 Worksheet 1 Business ActivityAbdullah HassanNo ratings yet

- Accounting Equation Test 10Document2 pagesAccounting Equation Test 10Martha AntonNo ratings yet

- Pdfcaie Igcse Accounting 0452 Theory v2 PDFDocument24 pagesPdfcaie Igcse Accounting 0452 Theory v2 PDFrumaisaaltaf287No ratings yet

- Edexcel IGCSE Accounting AnswersDocument92 pagesEdexcel IGCSE Accounting Answerskwakwa480% (5)

- Enterprises, Business Growth and Size. IGCSE Business Studies PDFDocument22 pagesEnterprises, Business Growth and Size. IGCSE Business Studies PDFLamar100% (1)

- 9706 - m24 - QP - 32 - Acc p3 Feb March 24Document12 pages9706 - m24 - QP - 32 - Acc p3 Feb March 24Shaamikh Rilwan100% (1)

- AO2 Analysis Exercises and ActivitiesDocument9 pagesAO2 Analysis Exercises and ActivitiesBhavishka ValraniNo ratings yet

- CHAPTER 7 - Bad Debts and Doubtful DebtsDocument24 pagesCHAPTER 7 - Bad Debts and Doubtful DebtsMuhammad Adib100% (3)

- Cambridge A-Level Business - CHP 27Document15 pagesCambridge A-Level Business - CHP 27SitayeshNo ratings yet

- Capacity Utilisation and OutsourcingDocument3 pagesCapacity Utilisation and OutsourcingJared OtienoNo ratings yet

- Caie Igcse: Business STUDIES (0450)Document36 pagesCaie Igcse: Business STUDIES (0450)Victoria Sáenz-Azcúnaga100% (1)

- Business Studies IgcseDocument115 pagesBusiness Studies IgcsexNo ratings yet

- G.ix. Chapter 1.1 & 1.2 WorksheetDocument5 pagesG.ix. Chapter 1.1 & 1.2 WorksheetMangesh RahateNo ratings yet

- Caie A2 Level Business 9609 Definitions v1Document8 pagesCaie A2 Level Business 9609 Definitions v1Jude ChamindaNo ratings yet

- Cambridge International AS & A Level: AccountingDocument14 pagesCambridge International AS & A Level: AccountingFarrukhsgNo ratings yet

- TEST 1 - MarkschemeDocument3 pagesTEST 1 - MarkschemeDhrisha GadaNo ratings yet

- Cambridge Assessment International Education: Business 9609/13 May/June 2019Document12 pagesCambridge Assessment International Education: Business 9609/13 May/June 2019AbdulBasitBilalSheikhNo ratings yet

- Chapter 12 The Marketing Mix ProductDocument20 pagesChapter 12 The Marketing Mix ProductENG ZI QINGNo ratings yet

- International Gcse: Accounting (9-1)Document28 pagesInternational Gcse: Accounting (9-1)Yan Naing TunNo ratings yet

- IGCSE and O Level Business Studies Coursebook Answers PDF Franchising EmploymentDocument10 pagesIGCSE and O Level Business Studies Coursebook Answers PDF Franchising Employmentamanihorani3No ratings yet

- Revision Checklist For As Accounting 9706 FINALDocument28 pagesRevision Checklist For As Accounting 9706 FINALhopeaccaNo ratings yet

- ACCA F3 Control Accounts and Incomplete Records Questions2Document6 pagesACCA F3 Control Accounts and Incomplete Records Questions2Amos OkechNo ratings yet

- Revision 2017 PDFDocument72 pagesRevision 2017 PDFKUUNDJUAUNENo ratings yet

- Accounting FormatsDocument21 pagesAccounting FormatsAsima ZubairNo ratings yet

- Complete A Level BudgetingDocument23 pagesComplete A Level BudgetingLuqman MuhammadNo ratings yet

- 0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Document26 pages0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Divya SinghNo ratings yet

- IGCSE - Edexcel - Economics - 12. PrivatisationDocument1 pageIGCSE - Edexcel - Economics - 12. PrivatisationSahara ArfiNo ratings yet

- Economics Textbook AnswereDocument100 pagesEconomics Textbook Answereom100% (1)

- IGCSE Business Studies Note Chapter 22Document4 pagesIGCSE Business Studies Note Chapter 22emonimtiazNo ratings yet

- Chapter6 Motivation AnswersDocument3 pagesChapter6 Motivation Answersmohdportman100% (1)

- 1.1 - Business Activity - IGCSE AIDDocument1 page1.1 - Business Activity - IGCSE AIDlydia.cNo ratings yet

- IGCSE 1.5 Business Objectives and Stakeholder ObjectivesDocument30 pagesIGCSE 1.5 Business Objectives and Stakeholder Objectivesayla.kowNo ratings yet

- 9706 w11 QP 21Document12 pages9706 w11 QP 21Diksha KoossoolNo ratings yet

- IGCSE Business Chapter 02 NotesDocument4 pagesIGCSE Business Chapter 02 NotesemonimtiazNo ratings yet

- Enterprise Project Rebecca Howells 2016Document272 pagesEnterprise Project Rebecca Howells 2016Ruth MacaspacNo ratings yet

- 0 - Business 9609 A2 NotesDocument84 pages0 - Business 9609 A2 Notesiman100% (1)

- CIE IGCSE Unit 3.3 - Workers - Occupations, Earnings and The Labour Market - Miss PatelDocument19 pagesCIE IGCSE Unit 3.3 - Workers - Occupations, Earnings and The Labour Market - Miss PatelJingyao HanNo ratings yet

- 9609 Scheme of WorkDocument182 pages9609 Scheme of Workfenny soeprijadi100% (1)

- IGCSE Business 6 QuestionDocument1 pageIGCSE Business 6 QuestionVerify MeNo ratings yet

- Week 5 AS 11gr HomeworkDocument4 pagesWeek 5 AS 11gr Homeworkaisaverdieva04No ratings yet

- IGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesDocument3 pagesIGCSE-OL - Bus - CH - 5 - Answers To CB ActivitiesAdrián Castillo100% (1)

- Accounting For DepreciationDocument3 pagesAccounting For DepreciationMuskan AgrawalNo ratings yet

- Depreciation Provisions and Reserves Class 11 NotesDocument48 pagesDepreciation Provisions and Reserves Class 11 Notesjainayan8190No ratings yet

- Chapter 8 - Operating Assets: Property, Plant, and Equipment, and IntangiblesDocument9 pagesChapter 8 - Operating Assets: Property, Plant, and Equipment, and IntangiblesHareem Zoya WarsiNo ratings yet

- Abm 1Document7 pagesAbm 1Sachin ManjhiNo ratings yet

- Chapter 11Document26 pagesChapter 11ENG ZI QINGNo ratings yet

- Finance For CseDocument19 pagesFinance For Csedjhora103No ratings yet

- Problem 23 2Document5 pagesProblem 23 2Muhammad SyahbinNo ratings yet

- CCD Opening SolutionDocument14 pagesCCD Opening Solutionspectrum_4820% (5)

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Measuring and Forecasting Earnings of A CompanyDocument38 pagesMeasuring and Forecasting Earnings of A CompanySoumendra RoyNo ratings yet

- Didaw - Noncurrent AssetDocument2 pagesDidaw - Noncurrent AssetDoneagle VillaluzNo ratings yet

- PSBA - Property, Plant and EquipmentDocument13 pagesPSBA - Property, Plant and EquipmentAbdulmajed Unda MimbantasNo ratings yet

- MTH302 Final Term Solved MCQs With ReferenceDocument30 pagesMTH302 Final Term Solved MCQs With ReferenceShahid Saeed100% (1)

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Bulk Oil Clauses AnalysisDocument15 pagesBulk Oil Clauses AnalysisManoj Varrier100% (1)

- July 2014Document88 pagesJuly 2014ICCFA StaffNo ratings yet

- P1 - ReviewDocument14 pagesP1 - ReviewEvitaAyneMaliñanaTapit0% (2)

- As 10Document8 pagesAs 10krithika vasanNo ratings yet

- Loanntt@ftu - Edu.vn: (1) Timing DifferencesDocument40 pagesLoanntt@ftu - Edu.vn: (1) Timing DifferencesHaziNo ratings yet

- Ch03-Adjusting Journal Entries - Year End Procedures - 4eDocument95 pagesCh03-Adjusting Journal Entries - Year End Procedures - 4ejasonmatthew0309No ratings yet

- 03 - Tutorial 3 - Week 5Document7 pages03 - Tutorial 3 - Week 5Jason ChowNo ratings yet

- Audit Report FinalDocument606 pagesAudit Report FinalJenika JoyceNo ratings yet

- Ethiopia D2S2a Extract From The Open Safari Case Study PDFDocument1 pageEthiopia D2S2a Extract From The Open Safari Case Study PDFGere TassewNo ratings yet

- Quiz 2Document4 pagesQuiz 2zainabcomNo ratings yet

- Odipo's Business PlanDocument25 pagesOdipo's Business PlanHesbon MakoriNo ratings yet

- PPE Lecture3Document25 pagesPPE Lecture3Alvin IsmailNo ratings yet

- Kaizen Costing: A Catalyst For Change and Continuous Cost ImprovementDocument16 pagesKaizen Costing: A Catalyst For Change and Continuous Cost ImprovementnoorNo ratings yet

- Nikon 2017 Financial ResultsDocument37 pagesNikon 2017 Financial ResultsMichael ZhangNo ratings yet

- FRA Assignment 1Document23 pagesFRA Assignment 1VallabhRemaniNo ratings yet

- Advanced Excel FormulasDocument314 pagesAdvanced Excel FormulasReza NouriNo ratings yet

- Financial ReportingDocument156 pagesFinancial ReportingAkanksha singhNo ratings yet

- Mamaearth Valuation AnalysisDocument24 pagesMamaearth Valuation Analysisoriental.bento2No ratings yet

- Adjusting The Accounts: Marivic Valenzuela-Manalo Accountancy Department RVR College of BusinessDocument70 pagesAdjusting The Accounts: Marivic Valenzuela-Manalo Accountancy Department RVR College of BusinessAriana David Purugganan100% (1)

- Creating and Understanding Financial StatementsDocument11 pagesCreating and Understanding Financial StatementseleNo ratings yet