Gprmo 0003

Gprmo 0003

Uploaded by

ApCopyright:

Available Formats

Gprmo 0003

Gprmo 0003

Uploaded by

ApOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Gprmo 0003

Gprmo 0003

Uploaded by

ApCopyright:

Available Formats

Last Updated on: 26 Aug 2022

High Quality Right Price

Invest in stocks that will bene it from Aatma Nirbhar Bharat

theme! (Rec amt 5-10 lakhs)

2Y CAGR

High Volatility

67.30% Since: March 20, 2020

smallcase rationale

Invests in 15-22 companies that can Multiply Your Wealth in the next 2-4 years.

Theme:

-AatmaNirbhar Bharat- Policy Formulated by PM of India to make India a "bigger

and more important part of the global economy" pursuing policies that are

e icient, competitive, resilient and being self-sustaining and self-generating.

-China Plus One- Is the business strategy to avoid investing only in China and

diversify business into other countries. Many companies are looking to diversify

their manufacturing into countries like India as a part of their de-risking strategy.

-Production Linked Incentive Scheme- Extends an incentive of 4% to 6% on

incremental sales (over the base year) of goods manufactured in India and

covered under target segments, to eligible companies, for a period of ive (5)

years

-Make in India-Initiative to encourage companies to manufacture in India and

encourage dedicated investments into manufacturing.

-Government initiatives like Anti Dumping Duty, Import Licensing

High Quality Right Price Companies

-Strong Balance Sheet and Low Debt on books.

-Good Management integrity, capability and performance track record.

-Available at Reasonable Valuations

-Multi-cap Strategy

-Announcements, Results, News of the companies are regularly researched

Created by SEBI Reg. Number Subscription Type

Green Portfolio INH100008513 Paid

Invest in this smallcase here

Methodology

De ining the universe

All the companies which will reap bene its from government

schemes such as Atmanirbhar Bharat, Import substitution, and PLI

are a part of the universe.

Research

-Green Portfolio is a SEBI Registered Portfolio Manager with -

Founders having 3 generations of investing experience.

We have a research team of over 8 members including CA's,

MBA's,

Economics Honours graduates.

-The team does screening of inancial data of all the listed

companies and selects the companies where detailed research is

to be done basis

HQRP Philosophy.

-Detailed research report is prepared basis study of Annual

Report, Quarterly Financial Statements, Company

Announcements, industry and

company news, business potential, valuations, etc.

-Daily tracking of stocks is done by studying the news items and

corporate announcements.

-Quarterly research report is prepared for each stock under

research.

-We use Ace Equity and Ace MF database to study the inancial

statements.

-On-ground research is done by interacting with the

Distributors, Employees, Customers, and Competitors on a

periodic basis to

understand the business direction.

Historical back-testing

Green Portfolio smallcases are checked for historical

outperformance to ensure that only consistently outperforming

strategies are selected.

Our team has over 30 years of successful track in creating wealth

from stocks. We use our learnings from the past to select the best

multi-bagger stocks.

We also use a disciplined approach to select stocks, re-balance

them, keep liquid money for opportunities and do staggered

buying and selling.

Constituent Screening

Our Screening is done basis "HQRP" Philosophy

Buying High-Quality Companies “HQ”

- The company should have been in business, successfully,

for a long period of time.

- The company should be pro itable.

- Debt/ equity should be below 1 times.

- Revenues should be growing.

- The Balance Sheet should be strong.

- The business should have moats, or entry barriers- i.e.

Capital, technology

- The company should be utilizing the cash generated from

the business, in the best interest of shareholders.

- No ignorance towards safety, environment and pollution

issues

- Operating margins should be above the industry average.

- The taxes paid should be near the rate prescribed by the

Government

- The company should be investing in product innovation,

R&D and brand building.

- The management integrity, capability, and history should

be good.

Buying the stocks at the right price “RP”

Buying a Company at the right price helps us maintain a margin

of safety on your investments. This helps us generate higher

capital appreciation.

We use income, market and asset approach to evaluate the

valuations of the company.

The company should be Resilient, have a High Addressable

Business Opportunity, should have high capital e iciency, have a

competitive moat, have management with integrity. While

investing, we consider ourselves as a small owner of the business

Weighting

Following parameters are considered while assigning weights to

stocks in this smallcases

-Industry Exposure

-Company Exposure

-Theme

-Potential to generate wealth

-Economy and market trends

Rebalance

This smallcase has a quarterly rebalance schedule. Once every

quarter, the research team reviews this smallcase to add or drop

stock/ETFs, if applicable

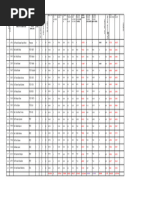

Ratios

Ratio smallcase Equity Mid & Small Cap

PE Ratio 14.19 26.74

PB Ratio 1.94 3.24

Sharpe Ratio 3.77 1.12

Dividend Yield (%) 1.19 1.70

Important Fields

Inception Date Launch Date Marketcap Category

August 8, 2018 March 20, 2020 Equity Mid & Small Cap

Review Frequency Last Reviewed Next Review On

Quarterly August 10, 2022 November 10, 2022

Market Cap Distribution

Large Cap Mid Cap Small Cap

15.18% 9.00% 75.82%

Live Data Comparison with Equity Mid & Small Cap

High Quality Right Price with Equity Mid & Small Cap

350

300

250

200

150

100

April July October 2021 April July October 2022 April July

The performance graphs & numbers are calculated using only the live data and

includes rebalances. Past performance doesn't include cost or guarantee future

returns.

Backtested Data Comparison with Equity Mid & Small Cap

High Quality Right Price with Equity Mid & Small Cap

120

110

100

90

October 2019 April July October 2020

The performance graphs & numbers are calculated using only the backtested

data. Past performance doesn't include cost or guarantee future returns.

Returns over various periods

1M Returns 3M Returns 6M Returns 1Y Returns

smallcase smallcase smallcase smallcase

6.24% 4.15% 8.88% 2.33%

Equity Mid &… Equity Mid &… Equity Mid &… Equity Mid &…

6.59% 9.07% 7.83% 10.77%

Pricing Plans

12 Months 6 Months

₹ 5,900* ₹ 3,540*

*Inclusive of all taxes applicable

How to subscribe

How to invest

De initions and Disclosures

CAGR

CAGR (compounded annual growth rate) is a useful measure of growth or

performance of a portfolio. Every year returns generated by a portfolio are

different. Let's say if a portfolio is live for 3 years and returns generated by the

portfolio are 5%, 15% & -7%, respectively in the irst, second and third year. Then

we calculate CAGR as a return number that would give the same terminal

investment value at the end of three years, as we get when the portfolio gains by

5% & 15% in the irst two years and drops by 7% in the third year. The CAGR in this

case would be 3.94%. This means that you will always end up with the same

investment value at the end of the third year, if your portfolio gains by 3.94% every

year or 5%, 15% and -7%, respectively in the irst, second and third year.

In simple words, it indicates the annual return generated by the smallcase from

the date of launch. For smallcases live for less than 1 year, absolute returns in the

applicable time period are shown. Only live data is considered for all calculations.

Returns and CAGR numbers don’t include backtested data.

P.S. - CAGR calculation methodology got updated from 25th Apr’22 on all

smallcase Platforms. Please read this post to understand the changes in detail

Volatility Label

Changing stock prices on a daily basis results in luctuating investment value of

your portfolio. If the daily change in the investment value of a portfolio is too

drastic, it means prices of stocks in the portfolio are changing very rapidly. Such

portfolios have High Volatility. Every smallcase is categorized into one of the three

volatility buckets - High Volatility, Medium Volatility and Low Volatility. This is done

by comparing smallcase volatility vs broader market volatility.

Investing in High Volatility smallcases means that change in your investment

values can be very sudden and drastic. Following table represents the logic

followed to categorize smallcases into various volatility buckets

Volatility Ratio (VR) Label

VR >= 1.3 High Volatility

0.8 <=VR< 1.3 Medium Volatility

VR < 0.8 Low Volatility

Volatility Ratio = Average annual rolling standard deviation of the smallcase

divided by the average annual rolling standard deviation of the Nifty 50 Index,

since launch of the smallcase.

Calculation of Volatility if the smallcase is less than 1 year old

If the weight of Equities in the portfolio is less than 40%, the smallcase will

be considered ‘Low Volatility’

If the weight of Equities in the portfolio is between 40% to 70%, the

smallcase will be considered ‘Medium Volatility’

If the weight of Equities in the portfolio is greater than 70%, then the weight

of large-cap stocks within the equities portion is taken into consideration

If the weight of large-cap stocks is more than 70%, the smallcase is

considered as ‘Medium Volatility’

If the weight of large-cap stocks is less than 70%, the smallcase is

considered as ‘High Volatility’

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

Segment

Stocks/ETFs belonging to a smallcase are categorized under different segments.

Weightage of a segment is calculated as sum of weights of all stocks belonging to

that segment. Suppose 4 stocks, with each having a weight of 10%, belong to the

Food Products segment. Then the weight of the Food Product segment in the

smallcase will be 40% (4*10)

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

Review

Rebalancing is the process of periodically reviewing and updating the

constituents of a smallcase. This is done to ensure that constituents in the

smallcase continue to re lect the underlying theme or strategy

Market Cap Categorization of Stocks

All the stocks listed on NSE(National Stock Exchange) are arranged in decreasing

order of Market Cap, so that the stock with the largest market cap gets 1st Rank.

Stocks ranked equal to or below 100 are categorized as Large Cap. Stocks ranked

below or equal to 250, but ranked above 100 are categorized as Mid Cap stocks.

Stocks ranked above 250 are categorized as smallcap

Market Cap Categorization of smallcases

If the sum of weights of constituent large cap stocks is greater than 50%,

then smallcase is categorized as Largecap

If the sum of weights of constituent mid cap stocks is greater than 50%, then

smallcase is categorized as Midcap

If the sum of weights of constituent small cap stocks is greater than 50%,

then smallcase is categorized as Smallcap

If the sum of weights of constituent large cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of large cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Large & Midcap

If the sum of weights of constituent small cap stocks is greater than 30%,

sum of weights of mid cap stocks are greater than 30%, and sum of weights

of small cap and mid cap stocks are greater than 80%, then smallcase is

categorized as Mid & Smallcap

If none of the above conditions are met, then smallcase is categorized as

Multicap

Marketcap category of a smallcase might be different from the above

mentioned, if the creator/manager of the smallcase speci ically de ines a

particular category

For smallcases where manager has not prescribed any weights, equal weights are

assumed for calculations.

General Investment Disclosure

Charts and performance numbers on the platform do not include any backtested

data. Please refer to the Returns Calculation Methodology to check how returns are

calculated on the platform. Data used for calculation of historical returns and

other information is provided by exchange approved third party data vendors and

has neither been audited nor validated by the Company. For smallcases where

weights are not provided by the creator, Equal weights are used to calculate all

returns, numbers and ratios on the platform.

Smallcase factsheets might include strategy backtest, if provided by the creator

of the smallcase. This is included to help users analyze performance of the

smallcase across different economic cycles and long time horizons. STPL has not

veri ied the backtest performed by the manager. We make no representations or

warranties (expressed or implied) to any recipient on the contents of the backtest.

Any information included in the backtest, should never be construed as our

representation or endorsement for the same. STPL is not involved in the generation

of the backtest and are not responsible for the contents of the same, nor do we

verify the accuracy of the same. We do not have control over the backtest

performed by the creator/manager of the smallcase and neither do we play a

determinative role in any calculation of the same.

"Back-testing" is the application of a quantitative model to historical market data

to generate hypothetical performance during a prior period. Use of back-tested

data has inherent limitations including the following:

a. The results do not re lect the results of actual trading or the effect of material

economic and market conditions on the decision-making process, but were

achieved by means of retrospective application, which may have been

designed with the bene it of hindsight.

b. Calculation of such back-tested performance data is based on assumptions

integral to the model which may or may not be testable and are therefore

subject to losses.

c. Actual performance may differ signi icantly from back-tested performance.

Back-tested results are not adjusted to re lect the reinvestment of dividends

and other income and, except where otherwise indicated, do not include the

effect of back-tested transaction costs.

d. Back-tested returns do not represent actual returns and should not be

interpreted as an indication of such.

e. Please note that past performance does not guarantee future returns.

All information present in this document and related material is to help investors

in their decision making process and shall not be considered as a

recommendation or solicitation of an investment or investment strategy. Investors

are responsible for their investment decisions and are responsible to validate all

the information used to make the investment decision. Investor should understand

that his/her investment decision is based on personal investment needs and risk

tolerance, and information available in this document and related material is one

among many other things that should be considered while making an investment

decision.

Stock and ETF investments are subject to market risks, read all related documents

carefully. Investors should consult their inancial advisors if in doubt about

whether the product is suitable for them.

Please visit Green Portfolio for detailed disclosures, terms and conditions.

You might also like

- Final 6 - Venture Capital, Going PublicNo ratings yetFinal 6 - Venture Capital, Going Public33 pages

- Company Profile: 9Kczr-Wlm - Bq7We-Mailchimp PasswordNo ratings yetCompany Profile: 9Kczr-Wlm - Bq7We-Mailchimp Password6 pages

- Saral Gyan Stocks Past Performance 050113No ratings yetSaral Gyan Stocks Past Performance 05011313 pages

- Financial Plan For Wipro Company Limited-DIMANo ratings yetFinancial Plan For Wipro Company Limited-DIMA14 pages

- Venture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, Mos0% (1)Venture Capital: Noel J. Maquiling, Mba Car, Micb, CFMP, Mos18 pages

- Sessions 2 and 3 - Equity Valuation - in Session - Section ENo ratings yetSessions 2 and 3 - Equity Valuation - in Session - Section E88 pages

- Sessions 2 and 3 - Equity Valuation - in Session - Section ENo ratings yetSessions 2 and 3 - Equity Valuation - in Session - Section E88 pages

- Not All Moats Are Created Equal (5!30!2017)No ratings yetNot All Moats Are Created Equal (5!30!2017)47 pages

- Tamim Fund Global High Conviction - Summary 2021No ratings yetTamim Fund Global High Conviction - Summary 20213 pages

- Adaptasset: Automatic Investment ManagementNo ratings yetAdaptasset: Automatic Investment Management19 pages

- Competitive Advantage and Capital Allocation - Dorsey Asset Management 1No ratings yetCompetitive Advantage and Capital Allocation - Dorsey Asset Management 130 pages

- Project Report ON: Portfolio Management in Karvy Stock Broking LimitedNo ratings yetProject Report ON: Portfolio Management in Karvy Stock Broking Limited6 pages

- DIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)From EverandDIVIDEND INVESTING: Maximizing Returns while Minimizing Risk through Selective Stock Selection and Diversification (2023 Guide for Beginners)No ratings yet

- Business Opportunity Thinking: Building a Sustainable, Diversified BusinessFrom EverandBusiness Opportunity Thinking: Building a Sustainable, Diversified BusinessNo ratings yet

- Data Dukung NS Dan Catatan Atas Laporan KeuanganNo ratings yetData Dukung NS Dan Catatan Atas Laporan Keuangan57 pages

- Tips My Story and My Life As An Actress The Kali Archiv100% (1)Tips My Story and My Life As An Actress The Kali Archiv150 pages

- Listening Comprehension Test: For 10 Form StudentsNo ratings yetListening Comprehension Test: For 10 Form Students2 pages

- The Difference of Strategic and Tactic Marketing To Planning in Their Key Terms of Objectives and Its Processes100% (1)The Difference of Strategic and Tactic Marketing To Planning in Their Key Terms of Objectives and Its Processes21 pages

- Parenting Time Guidelines Indiana - What Is The 6 Rule in Indiana?No ratings yetParenting Time Guidelines Indiana - What Is The 6 Rule in Indiana?6 pages

- Terrence G. Austin: 5925 South Natoma, Chicago, IL 60638No ratings yetTerrence G. Austin: 5925 South Natoma, Chicago, IL 606382 pages

- Int. Reader and Study Guide NoRestrictionNo ratings yetInt. Reader and Study Guide NoRestriction423 pages

- Failure Is The State or Condition of Not Meeting A Desirable or Intended ObjectiveNo ratings yetFailure Is The State or Condition of Not Meeting A Desirable or Intended Objective9 pages

- Relevant Sanskrit Shlokas With Meaning in Hindi & English - ReSanskritNo ratings yetRelevant Sanskrit Shlokas With Meaning in Hindi & English - ReSanskrit91 pages

- Professional Responsibility: Sample TestNo ratings yetProfessional Responsibility: Sample Test10 pages

- F - Office of Risk Management - Fin CTRL & Operational Risk Management Unit-Undergraduate Intern (No ratings yetF - Office of Risk Management - Fin CTRL & Operational Risk Management Unit-Undergraduate Intern (4 pages