Amara Raja Batteries Limited

Amara Raja Batteries Limited

Uploaded by

Nani AnugaCopyright:

Available Formats

Amara Raja Batteries Limited

Amara Raja Batteries Limited

Uploaded by

Nani AnugaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Amara Raja Batteries Limited

Amara Raja Batteries Limited

Uploaded by

Nani AnugaCopyright:

Available Formats

Amara Raja Batteries Limited

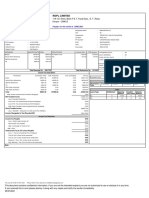

Pay Slip for the month of August 2022

All amounts are in INR

Emp Code : 1006258 District. : Chittoor

Emp Name : Mahesh Babu. A IFSC Code : SBIN0016429

Designation : Deputy Engineer - Q.A 32845188982 (STATE BANK OF

Bank A/c No. :

Grade : SE1 INDIA)

Gender : M PAN : DJDPM1916G

DOB : 25 Jul 1989 PF No. : AP/25873/8191

Payable Days : 31.00 PF UAN. : 100496380542

LWP : 0.00 ESI No. : 5038240695

A r r e a r D a y ( s ): 0.00 Division : ASBU

Working Location : Nunegundlapalli

G r o u p D a t e o f J o i n i n g: 04 May 2015

SASNo : 5020000701489

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Basic Pay 11845.00 11845.00 0.00 11845.00PF 1800.00

House Rent Allowance 8498.00 8498.00 0.00 8498.00PROF. TAX 200.00

Education Allowance 600.00 600.00 0.00 600.00Employee SAS 889.00

Performance Allowance 7385.00 7385.00 0.00 7385.00Employee Benevolent Fund 15.00

Monthly Adv Bonus 1496.00 1496.00 0.00 1496.00Bus Token Deduction 250.00

Cafeteria 58.00

GROSS EARNINGS 29824.00 29824.00 0.00 29824.00 GROSS DEDUCTIONS 3212.00

Net Pay : 26612.00 (TWENTY SIX THOUSAND SIX HUNDRED TWELVE ONLY)

Income Tax Worksheet for the Period April 2022 - March 2023

*You have opted for Old Tax Regime

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation( N o n - M e t r o )

Basic Pay 142140.00 0.00 142140.00 Investments u/s 80C Rent Paid 0.00

House Rent Allowance 101976.00 0.00 101976.00 Provident Fund 21600.00 From: 01/04/2022

Education Allowance 7200.00 0.00 7200.00 Approved Superannuation Fund 10638.00 To: 31/03/2023

Performance Allowance 88621.00 0.00 88621.00 1. Actual HRA 101976.00

Monthly Adv Bonus 17952.00 0.00 17952.00 2. 40% or 50% of Basic 56856.00

PF in excess of 12% 4545.00 0.00 4545.00 3. Rent - 10% Basic 0.00

Least of above is exempt 0.00

Taxable HRA 101976.00

Gross 362434.00 0.00 362434.00 Total Investments u/s 80C 32238.00

Tax Working U/S 80C 32238.00 T D S D e d u c t e d M o n t h l y

Standard Deduction 50000.00 80D 4099.00 M o n t h Amount

Previous Employer Taxable Income 0.00 T o t a l D e d U n d e r C h a p t e r V I - A 36337.00 April-2022 0.00

Previous Employer Professional Tax 0 May-2022 0.00

Professional Tax 2400 Perq Detail June-2022 0.00

Under Chapter VI-A 36337.00 PF in excess of 12% 4545.00 July-2022 0.00

Any Other Income 0.00 Total 4545.00 August-2022 0.00

Taxable Income 273697.00 Tax Deducted on Perq. 0.00

Total Tax 1185.00 Total 0.00

Tax Rebate u/s 87a 1185.00

Surcharge 0.00

Tax Due 0.00

Health and Education Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax per month 0.00

Tax on Non-Recurring Earnings 0.00

Tax Deduction for this month 0.00 Total Any Other Income

*Respective amounts payable to AR Township / ARES / ARIPL / CCS / IFFCO Tokio General Insurance

Disclaimer: This is a system generated payslip, does not require any signature.

You might also like

- Pay Slip - 604316 - Jul-23Document1 pagePay Slip - 604316 - Jul-23ArchanaNo ratings yet

- May PayslipDocument1 pageMay Payslipkuna gowthamkumarNo ratings yet

- PaysliP SaDocument1 pagePaysliP SagokulvaratharajanNo ratings yet

- Shin Soman Salslip 0922Document1 pageShin Soman Salslip 0922Shin S SomanNo ratings yet

- DellDocument1 pageDellNaresh Kumar Yadav (nari)No ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument2 pagesPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- PayslipDocument1 pagePayslipAnonymous QYeq3h37No ratings yet

- Kotak Mahindra Bank LTD: Full and Final SettlementDocument2 pagesKotak Mahindra Bank LTD: Full and Final SettlementvasssssssSNo ratings yet

- Payslip 2023 2024 4 h112231215 KNOAH - 230506 - 200245Document2 pagesPayslip 2023 2024 4 h112231215 KNOAH - 230506 - 200245SRIANJANNo ratings yet

- Payslip Dec 2022Document1 pagePayslip Dec 2022VickySaravananNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviNo ratings yet

- Sahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Document1 pageSahrudaya Health Care Private Limited: Pay Slip For The Month of May-2022Rohit raagNo ratings yet

- Task 1 of Financial Management AssignmentDocument26 pagesTask 1 of Financial Management AssignmentWong Hui HuiNo ratings yet

- 498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDDocument1 page498186: Vamsi Krishna Nadella: BSCPL Infrastructure LTDvamsiNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthNo ratings yet

- Payslip ModelDocument1 pagePayslip ModelKarthikeyan KarthikeyanNo ratings yet

- Samasta Microfinance Limited: Earnings DeductionsDocument1 pageSamasta Microfinance Limited: Earnings DeductionsDhirendraNo ratings yet

- Comparative Analysis of Engro Fertilizers Limited & Fauji Fertilizers Company LimitedDocument34 pagesComparative Analysis of Engro Fertilizers Limited & Fauji Fertilizers Company LimitedShahzaib SubhaniNo ratings yet

- Evidencia 5 Summary Export Import Theory V2Document8 pagesEvidencia 5 Summary Export Import Theory V2Sandra Milena100% (3)

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAkhila ChinniNo ratings yet

- SalarySlip 5876095Document1 pageSalarySlip 5876095Larry WackoffNo ratings yet

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Pay SlipDocument1 pagePay SlipLakshman Samanth ReddyNo ratings yet

- Payslip March 2024Document1 pagePayslip March 2024rajusingh05071992No ratings yet

- C243340 SalarySlipIncludeDocument1 pageC243340 SalarySlipIncludebenq78786No ratings yet

- Yogesh Salary Slip Fab - March 22Document2 pagesYogesh Salary Slip Fab - March 22avisinghoo7No ratings yet

- PaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Document1 pagePaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Karan Mahalle PatilNo ratings yet

- Pay Period 01.01.2014 To 31.01.2014: Income Tax ComputationDocument1 pagePay Period 01.01.2014 To 31.01.2014: Income Tax ComputationSumit ChakrabortyNo ratings yet

- PaySlip 6 2023Document1 pagePaySlip 6 2023Ashutosh mishraNo ratings yet

- Global Edge Software Limited: Payslip For The Month of December - 2018Document1 pageGlobal Edge Software Limited: Payslip For The Month of December - 2018Manoj SahooNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAshok KumarNo ratings yet

- Payslip October 2023Document1 pagePayslip October 2023rajusingh05071992No ratings yet

- Jocata Financial Advisory & Technology Pay Slip: Attendance Details ValueDocument1 pageJocata Financial Advisory & Technology Pay Slip: Attendance Details ValueAshuNo ratings yet

- PDFReports PDFDocument1 pagePDFReports PDFTuhin ChakrabortyNo ratings yet

- Hardik PaySlipDocument1 pageHardik PaySlipnokia6No ratings yet

- PaySlip1 OctDocument1 pagePaySlip1 Octjesten jadeNo ratings yet

- "Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaDocument3 pages"Maxim Infrastructure LTD." Old Nlunicipal Jail IndiaAmanNo ratings yet

- ReportDocument1 pageReportGarima AgrawalNo ratings yet

- Pay Slip July-2019Document1 pagePay Slip July-2019Malli SAPNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRMaaz Uddin Siddiqui0% (1)

- D114003jul2020 PDFDocument1 pageD114003jul2020 PDFRajarshiRoyNo ratings yet

- Feb-2023Document1 pageFeb-2023Rny buriaNo ratings yet

- Copy (2) of PayslipDocument1 pageCopy (2) of PayslipHiren JethwaNo ratings yet

- Intex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020Document1 pageIntex Technologies (I) LTD.: D-18/2 Okhla Industrial Area, Phase-II, New Delhi-110020rakeshsingh9811No ratings yet

- Fidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Document2 pagesFidelis Corporate Solutions Private Limited: Payslip For The Month of May 2022Dominic angelesNo ratings yet

- Salary SlipDocument1 pageSalary SlipPranav Kumar100% (1)

- EazeWorkPaySlip86723 Salslip 1017Document1 pageEazeWorkPaySlip86723 Salslip 1017Dhiraj LokhandeNo ratings yet

- Payslip - 2023 06 28Document1 pagePayslip - 2023 06 28ttamilpNo ratings yet

- Salary SlipDocument1 pageSalary SlipSanjay SolankiNo ratings yet

- April PayslipDocument2 pagesApril Payslipanushka aroraNo ratings yet

- Dec 2022Document1 pageDec 2022n1234567890987654321No ratings yet

- Salary SlipDocument1 pageSalary SlipManish KumarNo ratings yet

- 1033553563Document1 page1033553563Virendra Nalawde100% (1)

- Payslip For The Month of September-2021: Personal InformationDocument1 pagePayslip For The Month of September-2021: Personal InformationDeep KoleyNo ratings yet

- PayslipDocument1 pagePayslipBaren RoyNo ratings yet

- JUN - 2023 PayslipDocument1 pageJUN - 2023 Payslipgpsexy7No ratings yet

- Payslip 4 2022Document1 pagePayslip 4 2022Sunil B R SunilshettyNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsSaurav JagtapNo ratings yet

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsIndian LegendNo ratings yet

- RSPL Limited: Payslip For The Month of JUNE 2021Document1 pageRSPL Limited: Payslip For The Month of JUNE 2021Manju ManjappaNo ratings yet

- Jun 23Document1 pageJun 23Asif KhanNo ratings yet

- Com 5 CDocument2 pagesCom 5 CShamima AkterNo ratings yet

- Which Index Options Should You Sell?: Roni Israelov Harsha TummalaDocument35 pagesWhich Index Options Should You Sell?: Roni Israelov Harsha TummalaZachary PorgessNo ratings yet

- Tristar Case Sol.Document4 pagesTristar Case Sol.Niketa JaiswalNo ratings yet

- Folleto Sena DANIELA VARGASDocument2 pagesFolleto Sena DANIELA VARGASDaniela VargasNo ratings yet

- School EOEDocument1 pageSchool EOEMark James S. SaliringNo ratings yet

- BudgetDocument1 pageBudgetPhyoben S OdyuoNo ratings yet

- Steps To Life Ministries Farm No 738/11 Mumbwa RD Lusaka West Lusaka 0000Document1 pageSteps To Life Ministries Farm No 738/11 Mumbwa RD Lusaka West Lusaka 0000henry MwesaNo ratings yet

- Ed Perez Has Always Wanted To Run His Own RestaurantDocument1 pageEd Perez Has Always Wanted To Run His Own RestaurantAmit PandeyNo ratings yet

- Modelling and Pricing Cyber InsuranceDocument53 pagesModelling and Pricing Cyber InsuranceFurqoon黒七No ratings yet

- Case Analysis of Mechanical Drying Equipment: Submitted To: Prof. KK VohraDocument6 pagesCase Analysis of Mechanical Drying Equipment: Submitted To: Prof. KK VohraGunjan Shah100% (1)

- Landmark Whitepaper: Conditions and Policies Needed To Create and Sustain High Performing SchoolsDocument20 pagesLandmark Whitepaper: Conditions and Policies Needed To Create and Sustain High Performing SchoolsTed Fujimoto100% (2)

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- General Socio-Economic & Banking AwarenessDocument4 pagesGeneral Socio-Economic & Banking AwarenessKapil MalikNo ratings yet

- Monetary Policy RBI.Document28 pagesMonetary Policy RBI.santoshys50% (2)

- SBI Education Loan For Abroad Education-Documents ChecklistDocument3 pagesSBI Education Loan For Abroad Education-Documents ChecklistAditya jaswalNo ratings yet

- Valuation of Stcoks in The FMCG SectorDocument60 pagesValuation of Stcoks in The FMCG SectorLAKHAN TRIVEDINo ratings yet

- 4 Chap 1 Audit An Overview RevDocument29 pages4 Chap 1 Audit An Overview RevJoen SinamagNo ratings yet

- Performance Evaluation of Trading Strategies in Multi-Agent Systems - Case of A-TraderDocument6 pagesPerformance Evaluation of Trading Strategies in Multi-Agent Systems - Case of A-TraderKostas IordanidisNo ratings yet

- Financial Statement Analysis of Zomato (1)Document19 pagesFinancial Statement Analysis of Zomato (1)24mba.naveenkumar.pNo ratings yet

- A Review of Blockchain in Fintech: Taxonomy, Challenges, and Future DirectionsDocument52 pagesA Review of Blockchain in Fintech: Taxonomy, Challenges, and Future DirectionsHiếu Nguyễn MinhNo ratings yet

- Unit - V Banking and Insurance Law Study NotesDocument4 pagesUnit - V Banking and Insurance Law Study NotesSekar M KPRCAS-Commerce100% (1)

- Chapter 1 Assignment InsuranceDocument15 pagesChapter 1 Assignment InsurancePratik SapkotaNo ratings yet

- Chandragiri 071-072 ProvsionalDocument9 pagesChandragiri 071-072 ProvsionalBright Tone Music InstituteNo ratings yet

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- DBBL BankDocument59 pagesDBBL BankMd Rafiul IslamNo ratings yet

- MTZ PresentationDocument19 pagesMTZ PresentationUrtaBaasanjargalNo ratings yet

- Handout On General Awarness - 2Document118 pagesHandout On General Awarness - 2Swathi PriyaNo ratings yet