Trends in Portfolio Management Services of Axis Bank, Icici and HDFC Bank

Uploaded by

Pratik GuravTrends in Portfolio Management Services of Axis Bank, Icici and HDFC Bank

Uploaded by

Pratik GuravSee discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/309783726

" TRENDS IN PORTFOLIO MANAGEMENT SERVICES OF AXIS BANK, ICICI AND

HDFC BANK "

Article · August 2012

CITATIONS READS

0 3,178

3 authors, including:

Pawan Kumar

Lovely Professional University

24 PUBLICATIONS 60 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Online Shopping buying behaviour among Indian Consumers View project

Research Paper View project

All content following this page was uploaded by Pawan Kumar on 09 November 2016.

The user has requested enhancement of the downloaded file.

IJRIME Volume1Issue4 ISSN-2249- 1619

“TRENDS IN PORTFOLIO MANAGEMENT SERVICES OF AXIS BANK,

ICICI AND HDFC BANK”

Ms Gazal Aggarwal*

Mr. Pawan Kumar **

ABSTRACT

This paper aims to make a comparison of Portfolio management services in Axis, HDFC &

ICICI Banks in terms of progress and reforms they have made for the proper utilization of

people’s hard earned income. The comparison of these shows that banks dependence on

traditional activities has decrease during the period under consideration. In this paper different

components of Portfolio Management Services like Real Estate, Insurance and Investment in

Securities are taken into account. Earning scenario of all the banks has been studied and the

differences are probed into briefly. The analysis of the contents of portfolio Management

Services are done through statistical tools like growth rate, trend value and compound growth

rates. It has been widely debated that that ICICI Bank has a better experience of PMS activity as

compare to other two banks. There is no doubt that PMS Activities helps investors to plan the

investment of their resources with a high level of competency in recent years.

Keywords: PMS, NII, Ratio, Averages, Percentage, Interest Earned, Interest Expanded,

Exponential,

*Asst. Prof. Vidya Sagar College of Mgt. & Tech., Patiala

**Asst. Prof. Vidya Sagar College of Mgt. & Tech, Patiala

International Journal of Research in IT, Management and Engineering

www.gjmr.org

167

IJRIME Volume1Issue4 ISSN-2249- 1619

INTRODUCTION

Trends in Portfolio Management Services of Axis, HDFC & ICICI Banks in India

The last three decades of 20th century witnessed the emergence of a number of issues that spared

debates and discussions among economists1. Financial sector is the major area of macro

economy that has received renewed focus in the recent areas. Within the broad ambit of the

financial sector, the banking sector has been the cynosure of academia.

The traditional face of banking is also undergoing change from that of mere intermediator to the

one of a provider of quick, cast, effective, and customer Centric services. Therefore, banking

sector is passing through a challenging, yet exciting, times and India is no exception to that rule.

By 1969, it had become evident that the commercial banking system did not satisfactory play its

role in the overall development of the nation. Funds coming from masses were being misused to

meet the vested interest of big industrialists and business men who controlled banks and used

these funds to build their own private empire. So, this lop sided pattern of credit disbursal and

the spate of banks failures during 1960’s forced the government to resort to nationalization of

banks2. Fourteen banks in 1969 with deposits of Rs. 50 crore and more were nationalized. In

June 1980, 6 more banks with deposits of more than Rs. 200 crore were nationalised. But with

the merger of New bank of India with Punjab National Bank on September 6, 1983, the number

of nationalised banks now stands at 27 out of which 8 are from State Bank of India and its group

(i.e. other state associated banks) and the rest 19 comprises other public sector banks.

The Indian Banking system progressed by leaps and bounds after nationalisaton3. Banking in

India recorded an unparallel achievement in spreading banking habit to rural and semi urban

areas.

Private sector banks are those banks in which majority of stake are hold by private individuals

and not by the government. Private sector banks came into existence to supplement the

performance of Public sector banks and serve the needs of the economy better. As the public

sector banks were merely in the hands of the government, banks had no incentive to make profits

and improve the financial health. Nationalized killed competition and stifled competition in

banking. Banks operated in regulatory environment with administered rate of interest structure,

quantitative restrictions on credit flows, high reserve requirements and significant proportion of

lend able resources going to the priority and government sectors. This resulted in low levels of

investment and growth, decline in productivity and erosion of profitability of banking sector.

International Journal of Research in IT, Management and Engineering

www.gjmr.org

168

IJRIME Volume1Issue4 ISSN-2249- 1619

Thus, Narasimham Committee I (1991) which recommended the free entry of new banks in the

financial market provided they confirm the minimum startup capital and other requirements by

the permission of Reserve Bank of India. Private banking in India was practiced since the

beginning of banking system in India. The first Private Bank in India to receive an in principle

approval from the Reserve Bank of India was Housing Development Finance Corporation

Limited, to set up a bank in the private sector banks in India as part of the RBI's liberalisation of

the Indian Banking Industry. It was incorporated in August 1994 as HDFC Bank Limited with

registered office in Mumbai and commenced operations as Scheduled Commercial Bank in

January 1995. ING Vysya, yet another Private Bank of India was incorporated in the year 1930.

Bangalore has a pride of place for having the first branch inception in the year 1934. With

successive years of patronage and constantly setting new standards in banking, ING Vysya Bank

has many credits to its account. . IDBI ranks the tenth largest development bank in the world as

Private Banks in India and has promoted world class institutions in India.

These also took place rapid growth in deposit mobilisation by banks. As such, switching from

pure commercial pursuits to social commitments was the essence of era of nationalisation. But,

inspite of all these achievements, the baking sector performed poorly as regards their

productivity and efficiency.

The committee suggested that banks would have to minimize their risk and for this, banks should

not dependent only upon conventional sources of income. Rather they should try to shift towards

non traditional sources like PMS and off Balance Sheet Activities. Hence, recommendations of

the verma committee aimed at resource mobilisation by banks.

Portfolio Management Services (PMS) refer to the science and art of taking decisions

regarding investment policy and mix, aligning investments and objectives, asset allocation for

institutions and individuals, and balancing performance and risk. This specialized service offers

numerous customized investment strategies for capitalizing market opportunities.

Portfolio Management Services (PMS) is a sophisticated investment vehicle that offers a

customized investing into stocks, fixed income products, cash, other structured products and

mutual funds units, real estate etc. to meet specific investment objectives. Though, PMS is

International Journal of Research in IT, Management and Engineering

www.gjmr.org

169

IJRIME Volume1Issue4 ISSN-2249- 1619

managed by a professional financial managers, it has potential to address the personal

preferences tailored into the investment portfolio giving the freedom and flexibility required for

achieving the financial goals. Portfolio Management Services are very essential in the present

world as getting more and more complex, with number of exotic financial instruments

increasing. With all these complexities, building and then managing portfolio on your own can

be a herculean task. Other than that, you may not have extensive knowledge about all the

investment alternatives. This is where your portfolio manager comes into help and makes

managing your portfolio easy.

PMS activities are of three types

A. Insurance

B. Investments in India

C. Real Estate

Insurance can be defined as the process of reimbursing or protecting a person from contingent

risk of losses through financial means, in return for relatively small, regular payments to the

insuring body or insurance company. Insurance can range from life to medical to general

(residential, commercial property, natural incidents, burglary, etc)

Insurance is further divided under different heads:-

a) LIC

b) GIC

B) Investments in India

Following are the details of investments services which are another type of PMS activities

provided by banks.

1) Commercial paper

2) Bonds

3) Mutual Fund

4) Joint Venture

5) Certificate of Deposits

6) Government securities

International Journal of Research in IT, Management and Engineering

www.gjmr.org

170

IJRIME Volume1Issue4 ISSN-2249- 1619

C) Real estate is a broad term that refers to:

• Residential new homes and existing (resale) homes,

• Commercial shopping centers and offices,

• Industrial and manufacturing buildings and property,

• Vacant land and farms.

Hence, financial innovation reflected in growing portfolio management services of banks, is

considered one of the most significant developments of past few years. Through the increased

use of portfolio management services, there has been a notable shift towards capital market

instruments. Inspite of its growing popularity in all over the world, portfolio management

services have gained credence in the Indian context also. Recent initiatives by the government

and the Securities and Exchange Board of India (SEBI) are expected to go a long way towards

streamlining portfolio management services in India.

The present study was undertaken with a view to studying the trends and growth rate of income

from portfolio management services of banks.

Specifically, the study aims at

1. Working out the trends in spread (net interest income) and income from PMS (Portfolio

Management Services) of Axis, HDFC and ICICI banks over the period under

consideration.

2. Analysis the growth of components of PMS Activities (real estate, insurance and

investments) of Axis, HDFC and ICICI banks in India.

3. Examining the average rate of change of different forms of PMS activities of Axis,

HDFC and ICICI banks over the period under study.

Period of the study

The period of the study is from 2005 to 2010. The selection of the study period was dictated by

the availability of the requisite data in the Insurance Regulatory and Development Authority

(IRDA) website, namely, www.irda.gov.in

Data Sources

International Journal of Research in IT, Management and Engineering

www.gjmr.org

171

IJRIME Volume1Issue4 ISSN-2249- 1619

The data used in the study pertain to Private sector bank in India mainly, Axis, HDFC and ICICI

Bank. The data on the amount of spread and PMS components were obtained from the website

namely:-www.irda.gov.in.,

Website of Axisbank, www.axisbank.com

Wbsite of HDFC Bank, www.hdfcbank.com

Website of ICICI Bank, www.icicibank.com

Statistical Tools

In the present study, simple statistical tools like ratios, averages and percentages have been used.

Further, the growth rates were also estimated using the exponential formula.

γt = Aβt eµt …………..(1)

The equation (1) in logarithmic linear form appears as follow:-

Log γt = Log A+ t. Log β + µ t …………….(2)

Where γt is the value of dependent variable in period t.

β is the parameter to be estimated in period t and µt is disturbance term.

The compound growth rate were worked out as

r = Antilog (β^- 1) x100

Here β is the essential value of the regression coefficient in equation (2).

Some Concepts

Following are some of the variables used in the present study:

1 Interest earned

2 Interest expanded

3 Spread or net interest income

4 PMS

Trends in growth of income of Axis, HDFC and ICICI Bank

In this paper an attempt has been made to analyze growth trends, spreads and Portfolio

Management Services of the private sector banks in India. These banks have been categorized

into three:

a) Axis Bank

b) HDFC Bank

International Journal of Research in IT, Management and Engineering

www.gjmr.org

172

IJRIME Volume1Issue4 ISSN-2249- 1619

c) ICICI Bank

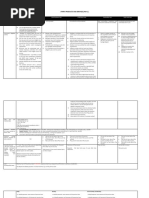

Section 1

Private Sector Banks Net Interest Income Portfolio Management

(Spread) Services

2006 2010 2006 2010

Axis Bank 47.46 35.76 55.17 24.45

HDFC Bank 43.19 13.01 51.58 9.11

ICICI Bank 66.18 -3.01 43.44 6.60

Table 1: Percentage share in net income

Table 1 shows the percentage share of net income i.e. spread and of Portfolio Management

Services in net income of the private sector banks mainly axis bank, HDFC Bank, ICICI Bank. It

may be seen from the table that ICICI has redesigned its operations in such a manner that their

net interest income (spread) as a proportion of their income declined where as that of income

from PMS rose over the period 2005-10

The table also depicts that Axis bank generates more income from traditional sources as compare

to PMS. The percentage rate of growth in net interest income increases from 47.76 percent to

64.98 percent. While in case of PMS there is downward percentage growth i.e. 55.17 percent to

24.45 percent.

In the case of HDFC, net interest income trends decline from 43.19 percent to 13.10 percent

.while in PMS it performs better from 51.58 percent growth rate to 57.15 percent growth rate.

Thus it broadly follows that except Axis bank, HDFC and ICICI Bank dependent more on PMS

for generating additional incomes. This mark a shift from their dependence on traditional sources

of income to non traditional sources, as has been suggested by several committees.

SECTION II

Growth rate of components of PMS of Axis, HDFC and ICICI Bank

In this section, an attempt has been made to study the components of PMS of each of the broadly

categorised private sector bank i.e. Axis, HDFC and ICICI bank.

International Journal of Research in IT, Management and Engineering

www.gjmr.org

173

IJRIME Volume1Issue4 ISSN-2249- 1619

Period Investments in Insurance Real Estate Total Income

(1stApril-31st India (2) (3) (4)=1+2+3

March) (1)

2005 1504802 4687 158370 1667859

2006 2152735 8336 426942 2588013

(43.06) (77.85) (169.59) (55.17)

2007 2633529 14297 1120999 3768825

(22.23) (71.5) (162.56) (45.62)

2008 3309653 28068 1520205 4857926

(25.67) (96.32) (35.61) (28.90)

2009 4554174 42873 1919074 6516121

(37.60) (52.74) (26.24) (34.14)

2010 5529640 116053 2463839 8109532

(21.42) (170.69) (28.39) (24.45)

Growth Rate 16.98*** 5.39*** 16.98*** 7.33***

Table 2: An analysis of components of portfolio management services of Axis Bank during

2005-2010

(Amount i n Lakh)

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year

AXIS BANK

Table 2 shows the average annual percentage rate of change and the growth rate of various

components of PMS of Axis Bank for the specified period from 2005-2010.

It may be seen from the table that average annual increase in PMS grew from 25.17 percent in

2006 to 45.62 percent in 2007.for the period 2005-2010 as a whole the compound growth rate

was found 7.33 percent.

International Journal of Research in IT, Management and Engineering

www.gjmr.org

174

IJRIME Volume1Issue4 ISSN-2249- 1619

Of these, average annual percentage rate of change of insurance continuously increased from

77.85 percent during 2006 to 170.69 percent in 2010.It grew at the compound growth rate of

15.77 percent per annum.

Investments in India, on the other hand increased from Rs. 1504802 in 2005 to Rs.5529640 in

2010.over the period 2005-10, it grew at the compound rate of 17 percent per annum

Real Estate, on the other hand declined by 35.61 percent in 2008, but rose by 169.59 percent

over the period 2005-10. It grew at the compound growth rate of 16.98 percent per annum. On

the whole, when compared to other components of PMS, it grew in each subsequent year

comparatively at a much higher rate.

Period (Ist Investments in Insurance Real Estate Total Income

April -31st India (2) (3) (4)=1+2+3

March) (1)

2005 1934981 31043 270255 2236279

---- ---- ---- ----

2006 2639396 66947 483453 3389796

(46.74) (115.66) (78.89) (51.28)

2007 3056480 118444 732012 3906936

(7.65) (76.92) (51.41) (15.26)

2008 4939332 198844 1015704 6153880

(61.60) (67.88) (38.76) (57.51)

2009 5881754 227972 1847380 7957106

(19.08) (14.65) (81.88) (29.30)

2010 5860762 292206 2529308 8682276

(-0.36) (28.18) (36.90) (9.11)

International Journal of Research in IT, Management and Engineering

www.gjmr.org

175

IJRIME Volume1Issue4 ISSN-2249- 1619

Growth Rate 12.76*** 22.86*** 15.29*** 10.69***

Table3: An analysis of components of portfolio management services of HDFC Bank during

2005-2010

(Amount in Lakh)

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year

HDFC BANK

Table 3 shows that average rate of increase in PMS grew from 51.28 percent in 2006 to 57.51

percent in 2008.in both the years the ratio of increase for other private sector banks under study

higher than that of Axis Bank and ICICI bank. For the period 2005-2010 as a whole the

compound growth rate of PMS of HDFC Bank(10.69%) was found much higher as compared to

that of Axis bank (7.33%)

Of these, Insurance of HDFC Bank too continuously increased from Rs. 31043 lakh in 2005 to

Rs. 292206 lakh in 2010 and the compound growth of this component during 2005-10 was found

to be 22.28 percent which is higher than the other components of PMS of HDFC Bank.

Average annual percentage rate of change of Investments in India in case of HDFC Bank varied

between 46.74 percent in 2006 and by 61.60 percent in 2008. The compound growth rate of this

component during the 2005-10 was found to be 12.76%

Real estate, another component of PMS varied between 78.89 percent in 2006 and by 81.88

percent in 2009. The compound growth rate of this component during 2005-10 was found to be

15.29%. Which is much more than the compound growth of investments in India of HDFC Bank.

Period (Ist Investments in Insurance Real Estate Total Income

april – 31st India (2) (3) (4)=1+2+3

March) (1)

2005 5284958 101021 3755510 9141489

---- ---- ---- ----

International Journal of Research in IT, Management and Engineering

www.gjmr.org

176

IJRIME Volume1Issue4 ISSN-2249- 1619

2006 7609980 186272 5216500 13112752

(43.99) (84.39) (41.56) (43.44)

2007 8675402 348520 7971680 16995602

(14.00) (87.10) (49.94) (29.16)

2008 10511637 589457 8130200 19231114

(29.17) (69.13) (1.99) (13.15)

2009 9347838 673459 7680300 17701597

(-11.07) (14.25) (-5.53) (-7.95)

2010 11755285 727060 6387070 18869415

(25.75) (7.96) (-16.83) (6.60)

Growth Rate 87.18*** 15.03*** 11.14*** 11.42***

Table4: An analysis of components of portfolio management services of ICICI Bank during

2005-2010

(Amount in Rs. Lakh)

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year.

ICICI BANK

Table 4 shows that Average Annual percent rate of change of PMS in case of ICICI continuously

declined from 43.44 percent in 2006 to 2009 (-7.95 percent). However in 2010 it went on

upward and percentage rate of change of PMS increased from negative -7.95percent to 6.60

percent. For the period 2005-10 as a whole the compound growth rate of PMS of ICICI bank was

found much higher as compared to that of Axis bank and HDFC Bank i.e. 11.42 percent.

Out of real estate, its average annual percentage continuously decreased from 2007 to til 2010.As

investments in India is concerned its performance is far much better than other two components

International Journal of Research in IT, Management and Engineering

www.gjmr.org

177

IJRIME Volume1Issue4 ISSN-2249- 1619

of PMS activity. Its compound growth rate 87.18 percent .As insurance is concerned, it increases

from Rs. 101021 lakh to Rs. 727060 lakh from 2005 to 2010.

Section III Average rate of change of components of all the banks together

Period (Ist April to Axis Bank HDFC Bank ICICI Bank

31st March)

2005 ------ -------- -----

2006 77.85 115.66 84.39

2007 71.57 76.92 87.10

2008 96.32 67.88 69.13

2009 52.74 14.65 14.25

2010 170.69 22.18 7.96

Growth Rate 5.39*** 22.86*** 15.03***

Table5: Average rate of change of Insurance of all the banks under study

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year.

Period (Ist April to Axis Bank HDFC Bank ICICI Bank

31st March)

2005 -------- ------- ---------

2006 43.06 46.74 43.99

2007 22.33 7.65 14

2008 25.67 61.60 29.17

2009 37.60 19.08 -11.07

International Journal of Research in IT, Management and Engineering

www.gjmr.org

178

IJRIME Volume1Issue4 ISSN-2249- 1619

2010 21.42 -0.36 25.75

Growth Rate 17*** 12.76 *** 87.18***

Tabl6: Average rate of change of Investments of all the banks under study

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year.

Period ( Ist April to Axis Bank HDFC Bank ICICI Bank

31st march)

2005 ----- ----- ------

2006 169.16 78.89 41.56

2007 162.56 51.41 49.94

2008 35.61 38.76 1.99

2009 26.24 81.88 -5.53

2010 28.39 36.99 -16.83

Growth Rate 16.98*** 15.29*** 11.14***

Table 7: Average rate of change of Real Estate of all the banks under study

Note: 1. *** significant at one percent level

2. Figures in brackets represents percentage rate of change over the previous year.

The table 5,6,7 reveals that out of the components of Portfolio Management Services, the

insurance component registered highest compound growth in HDFC Bank with 22.86 percent as

International Journal of Research in IT, Management and Engineering

www.gjmr.org

179

IJRIME Volume1Issue4 ISSN-2249- 1619

compare to Axis and ICICI Bank, which registered 5.38 percent and 15.03 percent compound

growth respectively. The second component of PMS ,i.e. the investments in India, the ICICI

bank has registered highest compound growth i.e. 87.18 percent as compared to Axis and HDFC

Bank, whose compound growth rate was 17 percent and 12.76 percent respectively.

Further the table reveals that out of the component of PMS, the Real Estate component registered

highest compound growth in Axis bank with 16.98 percent as compared to HDFC and ICICI

Bank which registered 15.29 percent and 11.14 percent compound growth respectively.

BROAD CONCLUSIONS OF THE STUDY ARE:

(i) Various committees like Narsimham committee II, verma committee and Tarapore concluded

that banks should try to shift towards non traditional sources in order to remove their weakness

and become viable.

(ii) The literature on the subject reviewed indicates that portfolio management services have

come to occupy a prominent place in the profit and loss of the banks, helping investors to plan

the investment of their resources with a high level of competency, reducing the number of

superfluous and loss making investment.

(iii) An analysis of trends in percentage share of spread (i.e. net interest income) and portfolio

management services in total income comprising of both spread and PMS of the three banks on

portfolio management services has increased for generating additional incomes during the recent

past.

(iv) A study of average rate of change of different form of income of Axis, HDFC, ICICI bank

reveals that these banks registered a higher growth rate of other income

(v) While examining the growth of components of portfolio management services of Axis,

HDFC and ICICI Bank, it was found that Axis bank has registered highest compound growth in

real estate, where as HDFC has registered highest compound growth in insurance, while ICICI

has registered highest compound growth in Investments in India.

(vi) ICICI Bank seem to have perform better than as compare to Axis bank and HDFC bank .out

of the various components of PMS activity, overall compound growth rate of ICICI bank on

various transactions have registered the highest among all other two banks.

Thus in the end we can say that emergence of PMS activity on these banks have grown

dramatically over the period under study.

International Journal of Research in IT, Management and Engineering

www.gjmr.org

180

IJRIME Volume1Issue4 ISSN-2249- 1619

LIMITATIONS OF THE STUDY

Since there are number of Banks available in the financial market, but I have chosen only three,

due to time constraint. The reliability of the finding is 50% significant because we do not take

into account all other private sector banks. Their earnings from PMS can be more than the ICICI,

HDFC and Axis bank.

BIBLIOGRAPHY

[1] Aggarwal,Bhagwati (1981), Commercial banking in India after Nationalisation – A Study of

their Policies and Progress, classical, New Delhi.

[2] Chakrabarty, K.C. (1990), Banking in the 1990s, Himalaya Publishing House, Bombay.

Desai,Vasant (1991), Indian Banking – Nature and Problems, Himalaya Publishing House,

Bombay.

[3] Dhar, P.K. (2002), Indian Economy its Growing Dimensions, Kalyani Publications, New Delhi

Dutt Ruddar, Sundram K.P.M. (2004), Indian Economy, S. Chand & Company, New Delhi

[4] Tarapore S.S (2000), Issues in Financial Sector, UBSPD, New Delhi.

[5] Gupta, S.B. (1982), Monetary Economics – Institutions, Theory and Policy, S. Chand and

Company, New Delhi.

[6] Gupta S.P., (2006), Statistical Methods, Sultan Chand & Sons, New Delhi

[7] Paul R.R. and S.L. Bhardwaj (1989), Money Banking and International Trade, Kalyani

Publications, New Delhi.

[8] Rangarajan, C. (1998), Indian Economy : Essay in Money and Finance, UBSPD, New Delhi.

[9] Tarapore S.S. (2001), Monetary Management and Institutional Reforms, UBSPD, New Delhi.

[10] Tarapore S.S. (2001), Report on Capital account Convertibility with Comments and

Reactions, Anupam Publications, New Delhi.

[11] Angadi, V.B. (1986), “Policy Constraints and Banks profit variability”, Economics and

Political Weekly, Vol. 21, No. 24, June. Ghosh D.N. (1999), “Verma Committee Report on

Weak Public Sector Banks” , Economic and Political Weekly, Aug. 2001, Vol. XVI.

[12] Joshi P.N. (2001), “Leadership in Banking”, Economics and Political Weekly, Aug. 2001,

Vol. XVI.

[13] Mohan Ram T.T. (2002), “Deregulation and Performance of Public Sector bank”,

Economic and Political Weekly, Feb. 2-8, vol. XXXVII, No. 5.

International Journal of Research in IT, Management and Engineering

www.gjmr.org

181

IJRIME Volume1Issue4 ISSN-2249- 1619

[14] Tarapore S.S. (2000), “Malaise of Indian Financial System : Need for Reforms,” Economics

and Political Weekly, Aug 2000, Vol. XXVIII.

[15] RBI, Reserve Bank of India Bulletins, various issues.

[16] Reserve Bank of India: Report on Trend and Progress of Banking in India, Various Issues.

[17] Narsimhan M (1998), The Committee on banking Sector Reforms, Nabhi Publications

(1998), New Delhi.

[18] Benvensite, B (1987), “Securitisation with recourse : An Instrument That offers Uninsured

Bank Depositiors Sequential Claims”, Journal of banking and Finance, 11, pp. 403-424.

[19] Boot, Thakur and Berper (1991), “Risk-based capital insurance Reforms”, Journal of

banking and Finance, 16, pp. 847-874.

[20] Deshmukh, G. (1983), “Interest rate uncertainty and the Financial Intermediary’s choice of

exposure”, Journal of Finance 3-8, pp. 141-147.

[21] Duan, jin- Chuan and Sealey, CW (1997), “Determination of Bank’s Deposit insurance

liabilities: Exagenous versus managerial influences,” Research in Finance, vol.15 pp. 252-274.

[22] Jalan B, (2000), “Agenda for banking in the New Milllenium”,Reserve Bank of India

bulletin, RBI

[23] Narsimham M (1991), “Report of the committee on the Financial System : Summary” RBI

Bulletin, February 1992, vol. XLVIL.

[24] Rangarajan C. (1997), “Financial Sector Reforms, The Indian Experience”, RBI Bulletin,

july (1977).

[25] Seshadhari, .J.I.H, “Trend and Pattern of Bank Profitability.” Financial Express, October

6,1979.

[26] Tarapore S.S. (2000), “Twist and Turns in Banking Sector Reforms”, Business Standard, 11

Nov.,2000.

[27] Tejinder Singh (2002), “A study of weak Public Sector Banks in India”, M.Sc. Thesis

submitted to Punjab School of Economics, Guru Nanak Dev University (2002), Amritsar.

[28] Verma M.S. (1998), “ Challenges to the Baking Industry”, The Journal of Indian Institute

of bankers , Oct-Dec.,1998.

[29] www.123india.com

[30] www.axisbank.com

[31] www.articlesnatch.com

International Journal of Research in IT, Management and Engineering

www.gjmr.org

182

IJRIME Volume1Issue4 ISSN-2249- 1619

[32] www.bankersindia.com

[33] www.banknetindia.com

[34] www.banktech.com

[35] www.google.com

[36] www.hdfcbank.com

[37] www.icicibank.com

[38] www.icicipruamc.com

[39] www.iciciprulife.com

[40] www.icraindia.com

[41] www.irda.gov.in

[42] www.rbi.org.in

[43] www.wikipedia.com

International Journal of Research in IT, Management and Engineering

www.gjmr.org

183

View publication stats

You might also like

- Banking Industry With Respect To SBI BANKNo ratings yetBanking Industry With Respect To SBI BANK47 pages

- Trends in Portfolio Management Services of Axis Bank, Icici and HDFC BankNo ratings yetTrends in Portfolio Management Services of Axis Bank, Icici and HDFC Bank18 pages

- A Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstNo ratings yetA Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector Bankst18 pages

- The Indian Banking Sector: Recent Developments, Growth and ProspectsNo ratings yetThe Indian Banking Sector: Recent Developments, Growth and Prospects17 pages

- ICICI BANK - Rural Finance Provided by ICICI BankNo ratings yetICICI BANK - Rural Finance Provided by ICICI Bank41 pages

- Financial Analysis of Banking Industry With Special Refference in Icici BankNo ratings yetFinancial Analysis of Banking Industry With Special Refference in Icici Bank135 pages

- A Study On Non-Performing Assets (NPA) of Public and Private Sector Banks in IndianNo ratings yetA Study On Non-Performing Assets (NPA) of Public and Private Sector Banks in Indian8 pages

- Emerging Issues in Indian Banking SectorNo ratings yetEmerging Issues in Indian Banking Sector31 pages

- Industry Analysis - Banking: SIBM BangaloreNo ratings yetIndustry Analysis - Banking: SIBM Bangalore20 pages

- An Introduction To The Banking Sector in IndiaNo ratings yetAn Introduction To The Banking Sector in India69 pages

- Banking Sector Refers To The Industry or The Section of The Economy Devoted To The ProperNo ratings yetBanking Sector Refers To The Industry or The Section of The Economy Devoted To The Proper5 pages

- ICICI Bank - Working Capital Management - AmityNo ratings yetICICI Bank - Working Capital Management - Amity75 pages

- Performance Analysis of Public Sector Banks in India: March 2015No ratings yetPerformance Analysis of Public Sector Banks in India: March 201512 pages

- Chapter-1 Introduction 1.1 Introduction About The Sector100% (2)Chapter-1 Introduction 1.1 Introduction About The Sector60 pages

- Industry Status & IDBI Bank's Interface Industry IntroductionNo ratings yetIndustry Status & IDBI Bank's Interface Industry Introduction5 pages

- Structure of Management in The Banking SectorNo ratings yetStructure of Management in The Banking Sector16 pages

- Performance Comparison of Private Sector Banks With The Public Sector Banks in IndiaNo ratings yetPerformance Comparison of Private Sector Banks With The Public Sector Banks in India8 pages

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Performace Evaluation of Selected Banking Companies in India: A StudyNo ratings yetPerformace Evaluation of Selected Banking Companies in India: A Study25 pages

- The Growth in The Indian Banking Industry Has Been More Qualitative Than Quantitative and It Is Expected To Remain The Same in The Coming YearsNo ratings yetThe Growth in The Indian Banking Industry Has Been More Qualitative Than Quantitative and It Is Expected To Remain The Same in The Coming Years3 pages

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of LendingNo ratings yet

- Ey New Accounting Standards and Interpretations Pbe 31 Mar 2022 FinalNo ratings yetEy New Accounting Standards and Interpretations Pbe 31 Mar 2022 Final13 pages

- Application Form: General Information: Selection Criteria For AccommodationNo ratings yetApplication Form: General Information: Selection Criteria For Accommodation5 pages

- LPMPC Products and Services - Part 1 - As of Octob 3No ratings yetLPMPC Products and Services - Part 1 - As of Octob 38 pages

- Market Factors That Impact Health Care - EditedNo ratings yetMarket Factors That Impact Health Care - Edited5 pages

- New India Mediclaim Policy Premium Chart-1No ratings yetNew India Mediclaim Policy Premium Chart-12 pages

- Ba5012 Security Analysis and Portfolio ManagementNo ratings yetBa5012 Security Analysis and Portfolio Management13 pages

- Bill Preparation and Submission - User Manual - Part 4 - March2016No ratings yetBill Preparation and Submission - User Manual - Part 4 - March201689 pages

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportNo ratings yetIFRS 17 Assets For Acquisition Cash Flows: Explanatory Report34 pages

- Mrs. Gomathi Govindarajan - . No 1/79 2 ND Street Bharathi Nagar Palavakkam Mylapore TAMIL NADU India 600041 9840No ratings yetMrs. Gomathi Govindarajan - . No 1/79 2 ND Street Bharathi Nagar Palavakkam Mylapore TAMIL NADU India 600041 98409 pages

- Lung Center of The Philippines Executive Summary 2020No ratings yetLung Center of The Philippines Executive Summary 20207 pages

- Trends in Portfolio Management Services of Axis Bank, Icici and HDFC BankTrends in Portfolio Management Services of Axis Bank, Icici and HDFC Bank

- A Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector BankstA Study On Comparative Analysis of Non-Performing Assets in Selected Private Sector Bankst

- The Indian Banking Sector: Recent Developments, Growth and ProspectsThe Indian Banking Sector: Recent Developments, Growth and Prospects

- Financial Analysis of Banking Industry With Special Refference in Icici BankFinancial Analysis of Banking Industry With Special Refference in Icici Bank

- A Study On Non-Performing Assets (NPA) of Public and Private Sector Banks in IndianA Study On Non-Performing Assets (NPA) of Public and Private Sector Banks in Indian

- Banking Sector Refers To The Industry or The Section of The Economy Devoted To The ProperBanking Sector Refers To The Industry or The Section of The Economy Devoted To The Proper

- Performance Analysis of Public Sector Banks in India: March 2015Performance Analysis of Public Sector Banks in India: March 2015

- Chapter-1 Introduction 1.1 Introduction About The SectorChapter-1 Introduction 1.1 Introduction About The Sector

- Industry Status & IDBI Bank's Interface Industry IntroductionIndustry Status & IDBI Bank's Interface Industry Introduction

- Performance Comparison of Private Sector Banks With The Public Sector Banks in IndiaPerformance Comparison of Private Sector Banks With The Public Sector Banks in India

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)

- Performace Evaluation of Selected Banking Companies in India: A StudyPerformace Evaluation of Selected Banking Companies in India: A Study

- The Growth in The Indian Banking Industry Has Been More Qualitative Than Quantitative and It Is Expected To Remain The Same in The Coming YearsThe Growth in The Indian Banking Industry Has Been More Qualitative Than Quantitative and It Is Expected To Remain The Same in The Coming Years

- Banking India: Accepting Deposits for the Purpose of LendingFrom EverandBanking India: Accepting Deposits for the Purpose of Lending

- Ey New Accounting Standards and Interpretations Pbe 31 Mar 2022 FinalEy New Accounting Standards and Interpretations Pbe 31 Mar 2022 Final

- Application Form: General Information: Selection Criteria For AccommodationApplication Form: General Information: Selection Criteria For Accommodation

- LPMPC Products and Services - Part 1 - As of Octob 3LPMPC Products and Services - Part 1 - As of Octob 3

- Bill Preparation and Submission - User Manual - Part 4 - March2016Bill Preparation and Submission - User Manual - Part 4 - March2016

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportIFRS 17 Assets For Acquisition Cash Flows: Explanatory Report

- Mrs. Gomathi Govindarajan - . No 1/79 2 ND Street Bharathi Nagar Palavakkam Mylapore TAMIL NADU India 600041 9840Mrs. Gomathi Govindarajan - . No 1/79 2 ND Street Bharathi Nagar Palavakkam Mylapore TAMIL NADU India 600041 9840

- Lung Center of The Philippines Executive Summary 2020Lung Center of The Philippines Executive Summary 2020