Axis Business Cycle Fund NFO-LEAFLET

Axis Business Cycle Fund NFO-LEAFLET

Uploaded by

amarnathb2001Copyright:

Available Formats

Axis Business Cycle Fund NFO-LEAFLET

Axis Business Cycle Fund NFO-LEAFLET

Uploaded by

amarnathb2001Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Axis Business Cycle Fund NFO-LEAFLET

Axis Business Cycle Fund NFO-LEAFLET

Uploaded by

amarnathb2001Copyright:

Available Formats

NFO Opens: February 02nd, 2023

NFO Closes: February 16th, 2023

Investing - A Game of Identification

Right place, right time critical to investing success

Shareholder

Economic External Value

Capacity Factors

Capital

Availability

Economic Cycle Sector Cycle

(to identify cycles Pricing (To Identify sectors

in Macro Efficiency with own cycles

driven sectors) DRIVEN by Industry

specific factors)

Consumer

Sentiment Capacity

Government

Demand Utilization

Action

Dynamics

Identify A Portfolio of Companies with Favourable Business Cycle Tailwinds

Business Cycle Investing

A Case for Conviction Driven Investing

Need For High Conviction

Forward Looking Investing Sell Discipline

• Meaningful allocation to

• Focus on Medium term • Restructure portfolios

sectors basis research

Growth triggers once industry cycle

indicators

plays out

• Identify opportunities to

• Always Plan for

benefit from earnings • Transition to new

Contingency - Nothing

upgrades and/or portfolio basis a

goes to Plan. Plan to

valuation re-rating changing business cycle

diversify

Investment Approach

Our Approach to Business Cycle Investing

Economic Cycle Sector Cycle

(Macro Factors) (Industry Specific Factors)

Growth and inflation Industry analysis

Monetary and Fiscal policy Company position

Regulatory changes Competitive advantage

Capex and consumer spending Growth prospects

Top down approach + Bottom up approach = Hybrid approach to investing

Looking for cyclical opportunities with a medium term view

Sector selection will be based on nature of sectors

Fund Facts

Name Fund Manager Benchmark

Axis Business Mr. Ashish Naik NIFTY 500 TRI

Cycles Fund & Mr. Hitesh Das

(for Foreign Securities)

Category Minimum Application NFO Period

nd th

Thematic ` 5,000 and in multiples of ` 1 thereafter February 02 - 16 , 2023

For detailed Investment strategy please refer SID/KIM of the Scheme available on the website.

Fund Benchmark Distributed by:

AXIS BUSINESS CYCLES FUND

(An open ended equity scheme following business cycles based investing theme)

Benchmark: Nifty 500 TRI

This product is suitable for investors who are seeking* Moderate

Moderately

High Moderate

Moderately

High

• Capital appreciation over long term

Low to Low to

Moderate High High

Moderate

• An equity scheme investing in equity & equity related securities with focus on riding Low Very High Low Very High

business cycles through dynamic allocation between various sectors and stocks at RISKOMETER RISKOMETER

different stages of business cycles in the economy Investors understand that their principal

will be at very high risk Nifty 500 TRI

*Investors should consult their financial advisers if in doubt about whether the product is

suitable for them.

The product labelling assigned during the New Fund Offer is based on internal assessment of the Scheme Characteristics or model portfolio and the same may

vary post NFO when actual investments are made.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to ` 1 lakh).

Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Ltd. is not liable or responsible

for any loss or shortfall resulting from the operation of the schemes.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

You might also like

- 2024 - Tax Slayer MethodDocument67 pages2024 - Tax Slayer Methodtechnicaldepartment4893% (14)

- Sample Skateboard Market Analysis and Segment Forecasts To 2025Document47 pagesSample Skateboard Market Analysis and Segment Forecasts To 2025Stefu RajNo ratings yet

- Swing TradingDocument14 pagesSwing TradingAzmi Mahamad100% (2)

- GE and Shell's MatrixDocument38 pagesGE and Shell's MatrixSparsh SaxenaNo ratings yet

- Mussie Beyene Asst. Professor: Capital Budgeting and Corporate StrategyDocument24 pagesMussie Beyene Asst. Professor: Capital Budgeting and Corporate StrategyeferemNo ratings yet

- Creditcardrush JSONDocument31 pagesCreditcardrush JSONmacroniess khanNo ratings yet

- Icici Prudential Pms Pipe Strategy: Our Philosophy ForgrowthDocument31 pagesIcici Prudential Pms Pipe Strategy: Our Philosophy Forgrowthpiyush pushkarNo ratings yet

- Corporate Finance Lesson 3Document43 pagesCorporate Finance Lesson 3antonius adi prasetyaNo ratings yet

- Management ProjectDocument21 pagesManagement ProjectShivam KapoorNo ratings yet

- WH Tis ?: Fundamental Analysis A Fundamental AnalysisDocument7 pagesWH Tis ?: Fundamental Analysis A Fundamental AnalysisAbhinandan ChatterjeeNo ratings yet

- Class NotesDocument77 pagesClass NotesSphamandla MakalimaNo ratings yet

- Campus Presentation FY 25 - 2.1Document12 pagesCampus Presentation FY 25 - 2.1abhinavpadi2001No ratings yet

- Lesson 8 Corporate DiversificationDocument14 pagesLesson 8 Corporate DiversificationNazia SyedNo ratings yet

- BSL Pms Cep June 2016Document39 pagesBSL Pms Cep June 2016savan kalakarNo ratings yet

- ICICI Securities - MBA - 2024Document17 pagesICICI Securities - MBA - 20240399shubhankarNo ratings yet

- M&ADocument151 pagesM&APallavi Prasad100% (1)

- Union Innovation Opportunities FundDocument25 pagesUnion Innovation Opportunities Fundberendra9No ratings yet

- Girik Multicap Growth Equity Strategy - Aug 2023Document13 pagesGirik Multicap Growth Equity Strategy - Aug 2023Biren PatelNo ratings yet

- Strategy Models Strategy ModelsDocument35 pagesStrategy Models Strategy Modelsbapan_84No ratings yet

- Prudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)Document2 pagesPrudent Investing: Invest in Mirae Asset Prudence Fund (MAPF)api-349453187No ratings yet

- Cross-Border M&A Valuation - Issues: Jayasimha P Director - Investment BankingDocument17 pagesCross-Border M&A Valuation - Issues: Jayasimha P Director - Investment Bankingmansavi bihaniNo ratings yet

- Applying Financial Statement Analysis: Comprehensive Case - Campbell SoupDocument9 pagesApplying Financial Statement Analysis: Comprehensive Case - Campbell SoupLheegar TanNo ratings yet

- Capital Market - Thematic Report - 28 Nov 22Document123 pagesCapital Market - Thematic Report - 28 Nov 22bharat.divineNo ratings yet

- Process: For Institutional One-On-One Use OnlyDocument16 pagesProcess: For Institutional One-On-One Use OnlyABermNo ratings yet

- Advanced Financial Modeling: Mergers and Acquisitions (M&A)Document38 pagesAdvanced Financial Modeling: Mergers and Acquisitions (M&A)Akshay SharmaNo ratings yet

- English - Kotak Bluechip Fund LeafletDocument2 pagesEnglish - Kotak Bluechip Fund LeafletAMAN SHARMANo ratings yet

- BusinessValuationModelingCoursePresentation 200527 140843Document93 pagesBusinessValuationModelingCoursePresentation 200527 140843Maruthi Sabbani100% (4)

- Procurement Hot Skills - CIPs London PresentationDocument31 pagesProcurement Hot Skills - CIPs London Presentationrgrao85No ratings yet

- Capital Budgeting Net Present Value and Other Investment RulesDocument32 pagesCapital Budgeting Net Present Value and Other Investment RulesSushant YattamNo ratings yet

- BlueOceanStrategy - v1.0 - 2021-ShareDocument49 pagesBlueOceanStrategy - v1.0 - 2021-ShareAdithya MNo ratings yet

- Best Practices For AIFMs Valuation FunctionsDocument13 pagesBest Practices For AIFMs Valuation FunctionsMarco A. Lantermo100% (1)

- Comprehensive CaseDocument39 pagesComprehensive CasePratiwi NingsihNo ratings yet

- MBA 290 Strategic AnalysisDocument110 pagesMBA 290 Strategic AnalysisLynette TangNo ratings yet

- Acquisitions and Selling A Business: Corporate Financial Strategy 4th Edition DR Ruth BenderDocument19 pagesAcquisitions and Selling A Business: Corporate Financial Strategy 4th Edition DR Ruth BenderAin roseNo ratings yet

- Policy TermDocument4 pagesPolicy TermPratim SanyalNo ratings yet

- FSA 01 Overview of FSADocument14 pagesFSA 01 Overview of FSA239919990522No ratings yet

- Understanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Document17 pagesUnderstanding Private Equity.: 70 W. Chippewa Street, Suite 500, Buffalo, NY 14202 716.566.2900Dharmik SolankiNo ratings yet

- Environmental Assessment Preparing For New VentureDocument22 pagesEnvironmental Assessment Preparing For New VentureAftab AhmedNo ratings yet

- Introduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonDocument13 pagesIntroduction To Financial Statement Analysis: by Prof Arun Kumar Agarwal, ACA, ACS IBS, GurgaonPRACHI DASNo ratings yet

- BSE Update December 2022Document43 pagesBSE Update December 2022OPTIONS TRADING20No ratings yet

- Financial AnalysisDocument28 pagesFinancial AnalysisDr.Shaifali GargNo ratings yet

- Ccba Finance WayDocument12 pagesCcba Finance WayTehone TeketelewNo ratings yet

- Mitsubishi Corporation: Midterm Corporate Strategy 2018Document10 pagesMitsubishi Corporation: Midterm Corporate Strategy 2018Sourav ChhabraNo ratings yet

- Narnolia IAP Product Note (Approved For Client Level Circulation) - May 2024Document14 pagesNarnolia IAP Product Note (Approved For Client Level Circulation) - May 2024Bull FlairNo ratings yet

- Tata Ethical Fund March 2021Document18 pagesTata Ethical Fund March 2021Capitus L. L. PNo ratings yet

- Week 10 LectureDocument19 pagesWeek 10 Lecturejiejialing08No ratings yet

- W2 WCorporateDocument14 pagesW2 WCorporateWay2 WealthNo ratings yet

- Basic Corporate Finance Concepts: Joint Venture & AcquisitionDocument29 pagesBasic Corporate Finance Concepts: Joint Venture & AcquisitionSalil SheikhNo ratings yet

- ICICI Securities Ltd. Campus Placement - FY 24Document15 pagesICICI Securities Ltd. Campus Placement - FY 24Ritik vermaNo ratings yet

- Capstone Partners Financial Technology Payments MA Coverage Report March 2022Document31 pagesCapstone Partners Financial Technology Payments MA Coverage Report March 2022Juan Nicolás BarretoNo ratings yet

- Preserve & Prosper With Jama Wealth Aug2020Document26 pagesPreserve & Prosper With Jama Wealth Aug2020mithilgada7002No ratings yet

- Chapter - 01 - Introduction - To - M - and - A NhanDocument39 pagesChapter - 01 - Introduction - To - M - and - A NhanQuỳnh Trần Thị ThúyNo ratings yet

- 2PM ProjectIdeasDocument4 pages2PM ProjectIdeasapi-3837252No ratings yet

- Ambit - IIM Calcutta Job Description FormDocument2 pagesAmbit - IIM Calcutta Job Description Formdeepakcool208No ratings yet

- ST03 Strategic Practices - Session 5 VEDocument28 pagesST03 Strategic Practices - Session 5 VEraphael.religioso15No ratings yet

- Company Details - ICICI Securities - IMI New DelhiDocument11 pagesCompany Details - ICICI Securities - IMI New DelhiShivangi BhasinNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument42 pagesInvesting and Financing Decisions and The Balance SheetSap 155155No ratings yet

- Session 6 - Managing & Processing Equity IssuesDocument71 pagesSession 6 - Managing & Processing Equity IssuesNakul AroraNo ratings yet

- Digital Final PPT Saved1Document14 pagesDigital Final PPT Saved1k.vermaNo ratings yet

- Alternate Funding Solution For Life Insurers?: Paul CaputoDocument16 pagesAlternate Funding Solution For Life Insurers?: Paul CaputorobcannonNo ratings yet

- The Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesFrom EverandThe Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesNo ratings yet

- WDI Business Card Page2Document1 pageWDI Business Card Page2amarnathb2001No ratings yet

- Leadership Quote 5Document1 pageLeadership Quote 5amarnathb2001No ratings yet

- WDI Business Card Page1Document1 pageWDI Business Card Page1amarnathb2001No ratings yet

- Panaimara Sirappu NotesDocument3 pagesPanaimara Sirappu Notesamarnathb2001No ratings yet

- Babu CardDocument1 pageBabu Cardamarnathb2001No ratings yet

- Imo Class#1 Seta 2019Document8 pagesImo Class#1 Seta 2019amarnathb2001100% (1)

- Empty Vessels Make NoiseDocument1 pageEmpty Vessels Make Noiseamarnathb2001No ratings yet

- NSO Class#1 SetA 2019Document8 pagesNSO Class#1 SetA 2019amarnathb200175% (4)

- Imo Class#1 Setb 2017Document8 pagesImo Class#1 Setb 2017amarnathb2001No ratings yet

- IMO Class#3 SetA 2019Document8 pagesIMO Class#3 SetA 2019amarnathb2001100% (4)

- NSO Class#3 SetA 2019Document8 pagesNSO Class#3 SetA 2019amarnathb2001No ratings yet

- 58 - A - Shekhar - DPC Ii JournalDocument69 pages58 - A - Shekhar - DPC Ii JournalShekhar PanseNo ratings yet

- HTMedia Result UpdatedDocument12 pagesHTMedia Result UpdatedAngel BrokingNo ratings yet

- Extinguishing An Obligations Payment and CompensationDocument28 pagesExtinguishing An Obligations Payment and CompensationMhariecriszReazoNo ratings yet

- Chapter Exercises 1Document7 pagesChapter Exercises 1Mark John Ortile BrusasNo ratings yet

- BBest QSSLAP Crypto - 5 TampaDocument45 pagesBBest QSSLAP Crypto - 5 TampaMuthuram RNo ratings yet

- FP&A HandbookDocument40 pagesFP&A HandbookFaraz50% (2)

- PDF September Ict Notespdf - CompressDocument14 pagesPDF September Ict Notespdf - CompressSagar BhandariNo ratings yet

- Ibs Selayang 1 31/03/22Document2 pagesIbs Selayang 1 31/03/22miraNo ratings yet

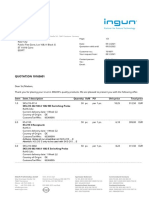

- Quotation 10165601Document3 pagesQuotation 10165601mmNo ratings yet

- Chapter 11 International Finance - Types of FDIDocument13 pagesChapter 11 International Finance - Types of FDIjagritiNo ratings yet

- Ed Koch and The Rebuilding of New York City - Jonathan SofferDocument17 pagesEd Koch and The Rebuilding of New York City - Jonathan SofferColumbia University PressNo ratings yet

- Payments Standardss-InitiationDocument349 pagesPayments Standardss-InitiationpurushotamsaNo ratings yet

- Finact 3 Prelims 2019-2020Document5 pagesFinact 3 Prelims 2019-2020Kenneth Lim OlayaNo ratings yet

- QA - RBA CLOSURE AUDIT-đã XoayDocument7 pagesQA - RBA CLOSURE AUDIT-đã XoayQuỳnh VõNo ratings yet

- The Kerala Agricultural Income Tax ActDocument93 pagesThe Kerala Agricultural Income Tax ActuppaimapplaNo ratings yet

- R Money Sip Presentation by Ravish Roshandelhi 1223401016149009 9Document19 pagesR Money Sip Presentation by Ravish Roshandelhi 1223401016149009 9Yukti KhoslaNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- Accounting For Branches and Combined FSDocument112 pagesAccounting For Branches and Combined FSEcka Tubay100% (1)

- FR 2021Document165 pagesFR 2021Bunny KanungoNo ratings yet

- Case Study 2: Portfolio Selection 1 Decision VariablesDocument2 pagesCase Study 2: Portfolio Selection 1 Decision VariablesZaima LizaNo ratings yet

- M02 Gitman50803X 14 MF C02Document51 pagesM02 Gitman50803X 14 MF C02louise carinoNo ratings yet

- Dividend Policy Determinants: An Investigation of The Influences of Stakeholder TheoryDocument18 pagesDividend Policy Determinants: An Investigation of The Influences of Stakeholder Theorywedaje2003No ratings yet

- Spicejet: Credit Rating AnalysisDocument9 pagesSpicejet: Credit Rating Analysissatyakidutta007No ratings yet

- Business Research Report: The Minimization of Credit Card System Issues in HBL & Standard Chartered BankDocument41 pagesBusiness Research Report: The Minimization of Credit Card System Issues in HBL & Standard Chartered BankFawad IftikharNo ratings yet

- PR - Carrefour Sales Q3 2022Document15 pagesPR - Carrefour Sales Q3 2022FaIIen0nENo ratings yet

- Learn and Go This New Formula of Cost of Equity:: JMD TUTORIAL'S-Question BankDocument12 pagesLearn and Go This New Formula of Cost of Equity:: JMD TUTORIAL'S-Question BankSnehal PatelNo ratings yet