1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

Uploaded by

Ashly MateoCopyright:

Available Formats

1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

Uploaded by

Ashly MateoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

1701Q Quarterly Income Tax Return: For Individuals, Estates and Trusts

Uploaded by

Ashly MateoCopyright:

Available Formats

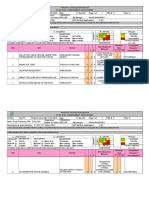

BIR Form No.

1701Qv2018 Page 1 of 1

BIR Form No.

1701Q Quarterly Income Tax Return

January 2018 (ENCS)

Page 2

for Individuals, Estates and Trusts

TIN Taxpayer/Filer's Last Name

185 506 872 000 FAJARDO

PART V - COMPUTATION OF TAX DUE (DO NOT enter Centavos; 49 Centavos or less drop down; 50 or more round up)

Declaration this Quarter A) Taxpayer/Filer B) Spouse

If graduated rate, fill in items 36 to 46; if 8%, fill in items 47 to 54

Schedule I - For Graduated IT Rate

36 Sales/Revenues/Receipts/Fees (net of sales returns, allowances and discounts) 36A 3,000,000.00 36B 0.00

37 Less: Cost of Sales/Services (applicable only if availing Itemized Deductions) 37A 1,800,000.00 37B 0.00

38 Gross Income/(Loss) from Operation (Item 36 Less Item 37) 38A 1,200,000.00 38B 0.00

Less: Allowable Deductions

39 Total Allowable Itemized Deductions 39A 550,000.00 39B 0.00

OR

40 Optional Standard Deduction (OSD) (40% of Item 36) 40A 0.00 40B 0.00

41 Net Income/(Loss) This Quarter (Item 38 Less Either Item 39 OR 40) 41A 650,000.00 41B 0.00

Add: 42 Taxable Income/(Loss) Previous Quarter/s 42A 0.00 42B 0.00

43 Non-Operating Income (specify) 43A 0.00 43B 0.00

44 Amount Received/Share in Income by a Partner from General Professional Partnership (GPP) 44A 0.00 44B 0.00

45 Total Taxable Income/(Loss) To Date (Sum of Items 41 to 44) 45A 650,000.00 45B 0.00

46 Tax Due (Item 45 x Applicable Tax Rate based on Tax Table below)(To

(To Part

Part III,

III, Item

Item 26)

26) 46A 92,500.00 46B 0.00

Schedule II - For 8% IT Rate

47 Sales/Revenues/Receipts/Fees (net of sales returns, allowances and discounts) 47A 0.00 47B 0.00

48 Add: Non-Operating Income (specify) 48A 0.00 48B 0.00

49 Total Income for the quarter (Sum of Items 47 and 48) 49A 0.00 49B 0.00

50 Add: Total Taxable Income/(Loss) Previous Quarter (Item 51 of previous quarter) 50A 0.00 50B 0.00

51 Cumulative Taxable Income/(Loss) as of This Quarter (Sum of Items 49 and 50) 51A 0.00 51B 0.00

52 Less:Allowable reduction from gross sales/receipts and other non-operating income of purely self-employed

individuals and/or professionals in the amount of P250,000 52A 0.00 52B 0.00

53 Taxable Income/(Loss) To Date (Items 51 Less Item 52) 53A 0.00 53B 0.00

54 Tax Due (Item 53 x 8% Tax Rate)(To

(To Part

Part III,

III, Item

Item 26)

26) 54A 0.00 54B 0.00

Schedule III - Tax Credits/Payments

55 Prior Year's Excess Credits 55A 0.00 55B 0.00

56 Tax Payment/s for the Previous Quarter/s 56A 73,750.00 56B 0.00

57 Creditable Tax Withheld for the Previous Quarter/s 57A 0.00 57B 0.00

58 Creditable Tax Withheld per BIR Form No. 2307 for this Quarter 58A 0.00 58B 0.00

59 Tax Paid in Return Previously Filed, if this is an Amended Return 59A 0.00 59B 0.00

60 Foreign Tax Credits, if applicable 60A 0.00 60B 0.00

61 Other Tax Credits/Payments (specify) 61A 0.00 61B 0.00

62 Total Tax Credits/Payments (Sum of Items 55 to 61)(To

(To Part

Part III,

III, Item

Item 27)

27) 62A 73,750.00 62B 0.00

63 Tax Payable/(Overpayment) (Item 46 or 54, Less Item 62)(To

(To Part

Part III,

III, Item

Item 28)

28) 63A 18,750.00 63B 0.00

Schedule IV - Penalties

64 Surcharge 64A 0.00 64B 0.00

65 Interest 65A 0.00 65B 0.00

66 Compromise 66A 0.00 66B 0.00

67 Total Penalties (Sum of Items 64 to 66)(To

(To Part

Part III,

III, Item

Item 29)

29) 67A 0.00 67B 0.00

68 Total Amount Payable/(Overpayment) (Sum of Items 63 and 67)(To

(To Part

Part III,

III, Item

Item 30)

30) 68A 18,750.00 68B 0.00

TABLE 1 - Tax Rates (effective January 1, 2018 to December 31, 2022) TABLE 2 - Tax Rates (effective January 1, 2023 and onwards)

If Taxable Income is: Tax Due is: If Taxable Income is: Tax Due is:

Not over P250,000 0% Not over P250,000 0%

Over P250,000 but not over P400,000 20% of the excess over P250,000 Over P250,000 but not over P400,000 15% of the excess over P250,000

Over P400,000 but not over P800,000 P30,000 + 25% of the excess over P400,000 Over P400,000 but not over P800,000 22,500 + 20% of the excess over P400,000

Over P800,000 but not over P2,000,000 P130,000 + 30% of the excess over P800,000 Over P800,000 but not over P2,000,000 102,500 + 25% of the excess over P800,000

Over P2,000,000 but not over P8,000,000 P490,000 + 32% of the excess over P2,000,000 Over P2,000,000 but not over P8,000,000 402,500 + 30% of the excess over P2,000,000

Over P8,000,000 P2,410,000 + 35% of the excess over P8,000,000 Over P8,000,000 P2,202,500 + 35% of the excess over P8,000,000

file:///C:/Users/Acer/AppData/Local/Temp/%7BEB187139-EEFB-462C-90BC-D44A17... 19/01/2023

You might also like

- List of Companies PDFDocument22 pagesList of Companies PDFAnaoj2891% (11)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013Document12 pagesPhilippines New Annual Income Tax Return Form 01 IAF JUNE 2013Danilla Navarro VelasquezNo ratings yet

- 1701Q Page 2Document1 page1701Q Page 2John ApeladoNo ratings yet

- War - Room 1701q 1st Quarter 2024 Pt2Document1 pageWar - Room 1701q 1st Quarter 2024 Pt2Edison Guevarra BaringNo ratings yet

- 1701Q-2nd FINALDocument1 page1701Q-2nd FINALLoufelleJoiceCaseñasNo ratings yet

- BIR Form Page 2Document1 pageBIR Form Page 2Mark De JesusNo ratings yet

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDocument3 pages1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsLLYOD FRANCIS LAYLAYNo ratings yet

- 02D. QTRLY ITR (8%) Pg2Document1 page02D. QTRLY ITR (8%) Pg2marivel c divinoNo ratings yet

- 1701a - Page 2Document1 page1701a - Page 2Sygee BotantanNo ratings yet

- Bf MikaylaDocument1 pageBf Mikaylaesguerranelia25No ratings yet

- Maderazo 2Document1 pageMaderazo 2madervi1947No ratings yet

- 1701A Annual Income Tax Return: (Add More... )Document1 page1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNo ratings yet

- pg2Document1 pagepg2Paulo BelenNo ratings yet

- BIR Form 1702-RTDocument1 pageBIR Form 1702-RTGil DelenaNo ratings yet

- eFPS Home - Efiling and Payment System PDFDocument2 pageseFPS Home - Efiling and Payment System PDFRegs AccountingTaxNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- EXIS INC - Financial Report 2022Document25 pagesEXIS INC - Financial Report 2022JohnfreNo ratings yet

- Common Size and Comparative Statements Format of Statement of Profit and LossDocument18 pagesCommon Size and Comparative Statements Format of Statement of Profit and LosssatyaNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- Deductions TaxationDocument4 pagesDeductions Taxationramosinducil05No ratings yet

- Quarterly Income Tax Return: Schedule 1Document3 pagesQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNo ratings yet

- DoneDocument3 pagesDoneJam DiolazoNo ratings yet

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Document4 pagesIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaNo ratings yet

- 1701-2023-Charito P2Document1 page1701-2023-Charito P2markposadas.0831No ratings yet

- 4pg Itr SmiiDocument3 pages4pg Itr SmiiRic Dela CruzNo ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument1 page1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNo ratings yet

- TAX First Preboard B96 - Solutions - 240805 - 093539Document9 pagesTAX First Preboard B96 - Solutions - 240805 - 093539sugammi.7137No ratings yet

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDocument2 pages1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaNo ratings yet

- CPA Review School of The Philippines Manila First Pre-Board Solutions TaxationDocument8 pagesCPA Review School of The Philippines Manila First Pre-Board Solutions TaxationLive LoveNo ratings yet

- Act370 Tax Form SowasifDocument16 pagesAct370 Tax Form SowasifAbuboker MahadyNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Different Variants of ProfitsDocument1 pageDifferent Variants of Profitshhimanshumba23No ratings yet

- (A715df5e 0954 4777 A1Document1 page(A715df5e 0954 4777 A1John Aries Paz SarteNo ratings yet

- CHRIS 4Document2 pagesCHRIS 4Joseph Arg CasasNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- Castillo - Income Statement and Cost ControlDocument2 pagesCastillo - Income Statement and Cost ControlAndriel JophineNo ratings yet

- Year Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes NoDocument5 pagesYear Ended Calendar Fiscal (MM/YYYY) Quarter 1st 2nd 3rd 4th Return Period (MM/DD/YYYY) From: To: Yes Noarchell gabicaNo ratings yet

- Employee Informa On: 22856 Joseph Mathew Officer Kozhikode/ MalaparambaDocument1 pageEmployee Informa On: 22856 Joseph Mathew Officer Kozhikode/ Malaparambadilna dvdNo ratings yet

- Astradigital Inc BIRForm 1702RT-page 4Document1 pageAstradigital Inc BIRForm 1702RT-page 4MARIA CRISTINA DE PAZNo ratings yet

- Feb 2024 PayslipDocument1 pageFeb 2024 PayslipDevanand0206No ratings yet

- 0622 - 2550Q - Lola Tina NewDocument3 pages0622 - 2550Q - Lola Tina NewKaren RodriguezNo ratings yet

- Yes NoDocument3 pagesYes Noyrrej tadgolNo ratings yet

- BD0164 SalarySlipwithTaxDetailsDocument1 pageBD0164 SalarySlipwithTaxDetailskb5452520No ratings yet

- Asurion Hong Kong Limited ROHQDocument2 pagesAsurion Hong Kong Limited ROHQcooltonic (cooltonic)No ratings yet

- Page 4Document1 pagePage 4Carol MNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsayanbhargav3No ratings yet

- PAT (Carried To BS) 49.60: Financial Accounting - A Managerial Orientation - GW-1 Page 3 of 4Document1 pagePAT (Carried To BS) 49.60: Financial Accounting - A Managerial Orientation - GW-1 Page 3 of 4akanksha chauhanNo ratings yet

- 20092010form16 004355Document3 pages20092010form16 004355Hemen BrahmaNo ratings yet

- GSTR 1Document5 pagesGSTR 1nambi.kumaresanNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsashvel65No ratings yet

- Apr 2024 PayslipDocument1 pageApr 2024 PayslipDevanand0206No ratings yet

- Yes NoDocument3 pagesYes NoNia AtalinNo ratings yet

- Rahul SinghDocument2 pagesRahul SinghRahul kumar singhNo ratings yet

- Tax Computation 12 2023Document3 pagesTax Computation 12 2023Rajib ChowdhuryNo ratings yet

- Budgétisation - CREATIA TECHDocument1 pageBudgétisation - CREATIA TECHHicham FraouiNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Sept 2023Document1 pageSept 2023mahantayya021291No ratings yet

- 12 December 2550Q'19Document3 pages12 December 2550Q'19RóndoNo ratings yet

- Launch Jasper ReportDocument2 pagesLaunch Jasper ReportmttarvNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- PARTNERSHIPDocument3 pagesPARTNERSHIPAshly MateoNo ratings yet

- ADCOM - Oral CommunicationDocument7 pagesADCOM - Oral CommunicationAshly MateoNo ratings yet

- Law ReviewerDocument7 pagesLaw ReviewerAshly MateoNo ratings yet

- International Trade and BusinessDocument1 pageInternational Trade and BusinessAshly MateoNo ratings yet

- Week 3 Course Material For Income TaxationDocument11 pagesWeek 3 Course Material For Income TaxationAshly MateoNo ratings yet

- Etech 2020 L3 - 918200701Document40 pagesEtech 2020 L3 - 918200701Ashly MateoNo ratings yet

- Etech 2020 L2 - 1195868801Document24 pagesEtech 2020 L2 - 1195868801Ashly MateoNo ratings yet

- Wika at Panitikan OrientationDocument34 pagesWika at Panitikan OrientationAshly MateoNo ratings yet

- BSA1Document2 pagesBSA1Ashly MateoNo ratings yet

- Consent Form - JPIA NightDocument1 pageConsent Form - JPIA NightAshly MateoNo ratings yet

- How Etnocentrism and Xenocentrism Affect The View of A Person Towards Other CultureDocument1 pageHow Etnocentrism and Xenocentrism Affect The View of A Person Towards Other CultureAshly MateoNo ratings yet

- Classifications of ContractsDocument11 pagesClassifications of ContractsAshly MateoNo ratings yet

- Orca Share Media1611720377264 6760045225244014693Document7 pagesOrca Share Media1611720377264 6760045225244014693Ashly MateoNo ratings yet

- Week 4 Course Material For Income TaxationDocument12 pagesWeek 4 Course Material For Income TaxationAshly MateoNo ratings yet

- CONTRACTSDocument68 pagesCONTRACTSAshly MateoNo ratings yet

- Chapter 2Document2 pagesChapter 2Ashly MateoNo ratings yet

- Module 1 Mathematics in Our World (Part 1)Document30 pagesModule 1 Mathematics in Our World (Part 1)Ashly MateoNo ratings yet

- Chapter 2 Aquatic ActivitiesDocument5 pagesChapter 2 Aquatic ActivitiesAshly Mateo100% (1)

- Week 2 - Types of EntrepreneurDocument18 pagesWeek 2 - Types of EntrepreneurAshly MateoNo ratings yet

- Research Instrument FinalDocument2 pagesResearch Instrument FinalAshly MateoNo ratings yet

- Validation Letter FinalDocument3 pagesValidation Letter FinalAshly MateoNo ratings yet

- PHYSCI Chapter 6 Household Products and Personal Care ProductsDocument38 pagesPHYSCI Chapter 6 Household Products and Personal Care ProductsAshly MateoNo ratings yet

- Rosenberg SelfDocument2 pagesRosenberg SelfAshly MateoNo ratings yet

- RRL TableDocument20 pagesRRL TableAshly MateoNo ratings yet

- Gas-Volume Conversion Device PTZ-BOX 3.0: Manual Specifications Technical Description Mounting Instructions ConfigurationDocument120 pagesGas-Volume Conversion Device PTZ-BOX 3.0: Manual Specifications Technical Description Mounting Instructions ConfigurationanupamNo ratings yet

- Donald Ogman, Government MemoDocument38 pagesDonald Ogman, Government MemomtuccittoNo ratings yet

- Full Download (Ebook PDF) Hole's Essentials of Human Anatomy & Physiology 14th Edition PDFDocument41 pagesFull Download (Ebook PDF) Hole's Essentials of Human Anatomy & Physiology 14th Edition PDFgastalmauta60% (5)

- (Secretary, Society) : ScienceDocument3 pages(Secretary, Society) : SciencePragadeeshNo ratings yet

- 95bisdwf 2000 HTDocument1 page95bisdwf 2000 HTBùi Hắc HảiNo ratings yet

- Grundfos VLC VLSC IomDocument16 pagesGrundfos VLC VLSC Iomvalentin.hernandezNo ratings yet

- Good Manufacturing Practice (GMP) For Food: Maximising Growth Through AssuranceDocument4 pagesGood Manufacturing Practice (GMP) For Food: Maximising Growth Through AssuranceSyaza Izzah Athirah SpaieeNo ratings yet

- G2M RTPCR (Oncology)Document7 pagesG2M RTPCR (Oncology)clave.ntx22No ratings yet

- Retail Technology: A Competitive Tool For Customer Service: S.Ramesh Babu, P.Ramesh Babu, Dr.M.S.NarayanaDocument7 pagesRetail Technology: A Competitive Tool For Customer Service: S.Ramesh Babu, P.Ramesh Babu, Dr.M.S.NarayanaIjesat JournalNo ratings yet

- Pour Point and Cloud PointDocument4 pagesPour Point and Cloud PointJustine Marbie MayaoNo ratings yet

- Lay Down Drill PipeDocument2 pagesLay Down Drill PipeAbdul Hameed OmarNo ratings yet

- Standing GuardDocument24 pagesStanding Guardtutorial 001No ratings yet

- Bus Eng Prelims 126Document2 pagesBus Eng Prelims 126veronica_celestialNo ratings yet

- IAS Core Practical CP - 1Document26 pagesIAS Core Practical CP - 1Bassant AbdesalamNo ratings yet

- University of KeralaDocument6 pagesUniversity of KeralaChristy TCNo ratings yet

- Lockout Tagout ProcedureDocument6 pagesLockout Tagout Procedurejuda823100% (1)

- 1-Upper GI Malignancy (Moodle)Document31 pages1-Upper GI Malignancy (Moodle)Abdulrahman NanakaliNo ratings yet

- Hypothesis Testing T TestDocument13 pagesHypothesis Testing T TestJhaydiel JacutanNo ratings yet

- Query Optimization: Practice ExercisesDocument4 pagesQuery Optimization: Practice ExercisesDivyanshu BoseNo ratings yet

- "Decade of Adoption Focus Fails To Reduce Shelter Killing," Animal People July/August 2009Document3 pages"Decade of Adoption Focus Fails To Reduce Shelter Killing," Animal People July/August 2009DogsBite.org100% (1)

- Notch Chapter 7Document132 pagesNotch Chapter 7mre2006No ratings yet

- Financial Modeling Advanced BrochureDocument8 pagesFinancial Modeling Advanced BrochureLisha AvtaniNo ratings yet

- Isbn Icosi 2020Document430 pagesIsbn Icosi 2020Mohammad AlfianNo ratings yet

- Stem Creator Manual EnglishDocument53 pagesStem Creator Manual EnglishanderNo ratings yet

- A Simple Procedure For Design Spray DryerDocument7 pagesA Simple Procedure For Design Spray DryerArielNo ratings yet

- Action Plan For Coorective ActionDocument2 pagesAction Plan For Coorective ActionRabbanNo ratings yet

- Kraft Australia HoldingsDocument9 pagesKraft Australia HoldingsVarun GuptaNo ratings yet

- Boq ElectricalDocument22 pagesBoq Electricaleng_hosNo ratings yet

- Memory Allocation in Operating SystemsDocument37 pagesMemory Allocation in Operating SystemsmazharNo ratings yet