Exam Notes

Exam Notes

Uploaded by

Even JayCopyright:

Available Formats

Exam Notes

Exam Notes

Uploaded by

Even JayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Exam Notes

Exam Notes

Uploaded by

Even JayCopyright:

Available Formats

Exam Notes

Chapter 9: INVESTMENTS

• Financial asset is cash, equity instrument of another entity, contractual right to receive cash or

to exchange financial instrument under favorable conditions.

• Financial instrument is recognized only when the entity becomes a party to the contractual

provisions of the instrument.

• Financial assets are classified based on both:

(a) the entity's business model for managing financial assets; and

(b) the entity's contractual cash flow characteristics of the financial asset.

• The classifications of financial assets are:

1. FVPL

2. FVOCI (election)

3. FVOCI (mandatory)

4. Amortized cost.

• A financial asset that is held under a "hold to collect" business model and qualifies under the

"SPPI" test is classified as subsequently measured at amortized cost.

• A financial asset that is held under a "hold to collect and sell" business model and qualifies

under the "SPPI" test is classified as subsequently measured at FVOCI (mandatory). A financial

asset that is not held under a "hold to collect" or "hold to collect and sell" business model is

classified as subsequently measured at FVPL.

• Exceptions:

1. Option to designate financial assets to be measured at FVPL if doing so significantly reduces or

eliminates "accounting mismatch."

2. Election to measure investments in equity securities that are not held for trading at FVOCI.

• Fair value is measured based on the market price in the principal market (if one exists) or in the

most advantageous market (in the absence of a principal market).

• The market price used in measuring fair value is not adjusted for any transaction costs, but is

adjusted for any transport costs.

• Hierarchy of fair value inputs:

(a) Level 1 inputs - quoted prices in active input “most reliable”

(b) Level 2 inputs - prices derived from observable data

(c) Level 3 inputs - unobservable inputs

Chapter 10: INVESTMENTS IN DEBT SECURITIES

• Amortized cost and FVOCI debt securities are initially measured at fair value plus transaction

costs.

Discount Carrying amt. is less than Face amt.; EIR> NIR

Premium Carrying amt. is more than Face amt.; EIR <NIR

• The interest income on debt securities measured at amortized cost or FVOCI is calculated using

the effective interest method.

Interest income = Present value x Effective interest rate (EIR)

Interest receivable = Face amount x Nominal interest rate (NIR)

• Any accrued interest that is:

included in the purchase price of bonds is excluded from the initial measurement of the

investment.

included in the sale price of bonds is excluded from the measurement of the gain or loss on the

sale of investment.

• The periodic cash flows of serial bonds include collections of both interest and principal.

• The cash flows of zero coupon bonds are due only at maturity.

These include both principal and compounded interest.

Fair value of FVOCI debt securities at reporting date xx

Amortized cost of FVOCI at reporting date xx

Cumulative balance of gain (loss) at reporting date xx

Cumulative balance of gain (loss) at reporting date xx

Cumulative bal. of gain (loss) at previous reporting date xx

Unrealized gain (loss) recognized in OCI for the year xx

Net selling price of FVOCI debt securities xx

Amortized cost of FVOCI at date of sale xx

Gain (loss) on sale/ Reclassification adjustment to P/L xx

Chapter 11: ADDITIONAL CONCEPTS

• Under the trade date accounting, a financial asset that is purchased is recognized (and financial

asset that is sold is derecognized) on the trade date, i.e., the date of commitment to purchase or

to sell.

• An entity accounts for the fair value change between the trade date and the settlement date for

a purchased financial asset but not for a financial asset sold.

• Reclassification of financial assets is permitted only when the entity changes its business model

for managing financial assets. Reclassification is applied prospectively on reclassification date,

which is the first day of the first reporting period following the change in business model.

• Only debt-type financial assets can be reclassified. Equity instruments cannot be reclassified.

• Reclassifications are accounted for at the reclassification date Fair value, except for a

reclassification from EVOCI to AC Whereby the reclassification date fair value is adjusted for the

Cumulative gain or loss previously recognized in OCI.

• The impairment requirements of PFRS 9 apply only to financial assets measured at amortized

cost or FVOCI (mandatory), i.e., debt-type financial assets only.

• Only cash and property dividends can be recognized as dividend revenue (equal to the cash

received/receivable for cash dividend and fair value of the non-cash asset for property dividend).

• When shares are purchased dividend-on, the purchased dividend is excluded from the purchase

price when computing for the initial measurement of the investment. There is no Accounting

problem for shares purchased ex-dividend.

• Stock rights are accounted for separately at fair value when the related shares become ex-right.

T/P Value of 1 Right= FV of share rights on - Subscription Rights

No. of rights needed to purchase 1 share + 1

Chapter 12: OTHER LONG-TERM INVESTMENTS

• On initial recognition, cash surrender value is allocated over the required holding period. The

amount allocated to the current period is treated as a reduction of insurance expense; the

remainder is credited to retained earnings.

• Subsequent increases in the cash surrender value and dividends received are recognized as

deduction from insurance expense.

• The cash surrender value is updated when the key employee dies during the year. The gain on

life insurance settlement is 'squeezed' from the entry below:

Cash xx

Cash surrender value xx

Insurance expense / Prepaid insurance xx

Gain on life insurance (squeeze) xx

Chapter 13: BASIC DERIVATIVES

• A derivative is a financial instrument or other contract that derives its value from the changes in

value of some other underlying asset or other instrument.

• The characteristics of a derivative are:

(a) its value changes in response to the change in an underlying;

(b) it requires no initial net investment or only a very minimal initial net investment; and

(c) it is settled at a future date.

• Underlying - a specified price, rate, or other variable, including a scheduled event that may or

may not occur..

• Notional amount - a specified unit of measure (e.g., number of currency units, number of

shares, bushels, pounds, etc.).

• Derivatives are obtained either as (a) hedging instrument to hedge some kind of risk or (b) non-

hedging instrument (e.g., for speculation).

• Examples of derivatives:

a. Forward contract - an agreement between two parties to exchange a specified amount of a

commodity, security, or foreign currency at a specified date in the future at a pre agreed price.

b. Futures contract - similar to forward contact but is traded on an exchange.

c. Option - a contract that gives the holder the right, but not the obligation, to buy (call option) or

sell (put option) an asset at a specified price any time during a specified period in the future.

d. Swap - a contract in which two parties agree to exchange payments in the future based on the

movement of some agreed-upon price or rate.

• Derivatives are measured at fair value. Changes in the fair value of a derivative that is not

designated as a hedging instrument are recognized in profit or loss.

Chapter 14: INVESTMENT IN ASSOCIATES

• An associate is an entity over which the investor h significant influence.

• Significant influence is the power to participate in the financial and operating policy decisions

of the investee but is not control or joint control over those policies. Significant influence is

presumed to exist when ownership interest is 20% or more.

• Under the equity method, the investment in an associate is initially recognized at cost and

subsequently adjusted for the investor's share in the changes in equity of the associate, such as

(a) profit or loss,

(b) other comprehensive income, and

(c) results of discontinued operations.

• When an associate has cumulative preference shares, the investor computes its share in profit

or loss after deducting one-year dividends on those shares, whether declared or not.

• The investor's share in the depreciation of an undervaluation of asset is a deduction to both the

investment income (share in profit of associate) and the investment in associate account. Share in

losses of associate is recognized up to the amount of the "interest in the associate."

• After the investor's interest in the associate is reduced to zero, additional losses are recognized

only for the following:

(a)legal or constructive obligations; or

(b) payments made on behalf of the associate. Other losses are not recognized.

• If the associate subsequently reports profits, the investor resumes recognizing its share in those

profits only after its share in the profits equals the share in the losses not recognized.

Chapter 15: PPE 1

• PPE are (a) tangible assets, (b) used in business, and (c) long term in nature.

• The capitalization of costs of a PPE ceases when the PPE is in the location and condition

necessary for it to be capable of operating in the manner intended by management.

• The lump-sum acquisition cost of two or more PPE is allocated to the individual assets based on

their relative fair values at the date of acquisition. The same accounting treatment is applied

whether the entity's management intends or does not intend to use one or more of the acquired

assets.

• The accounting treatment for demolition costs parallels the purpose for the demolition. For

example, if an old building is demolished to make way for the construction of a new building, the

demolition costs (net of any proceeds from sale of salvaged materials from the demolition) are

capitalized as cost of the new building.

• An entity determines the cost of a self-constructed asset using the same principles as for a

purchased asset. Accordingly, the cost does not include: internal profits or savings, cost

inefficiencies (e.g., losses on wasted resources and uninsured hazards), and income from

incidental operations.

Chapter 16: PPE 2

• Subsequent to initial recognition, an entity chooses either the cost model or the revaluation

model as its accounting policy and applies that policy to an entire class of PPE.

• Depreciation is the systematic allocation of the depreciable amount of an asset over its

estimated useful life. Each significant part of an item of PPE is depreciated separately.

• Depreciation begins when the asset is available for use and ceases when the asset is

derecognized, classified as "held for sale," or becomes fully depreciated.

• An asset is fully depreciated when its carrying amount is zero or equal to the residual value.

• Assets that are idle, temporarily taken out of use or retired from active use, or abandoned are

continued to be depreciated.

• SYD denominator = Life x [(Life + 1) / 2]

• DDB rate = 2 divided by life

• Composite Life DC / A; while A / TC Composite Rate. = Where: DC is 'depreciable cost', another

term for depreciable amount; A is annual depreciation; and TC is Total cost. The mnemonic is

pronounced as: "dee-ka-ah tee-see; left right." No gain or loss is recognized when one asset in

the group is disposed of or replaced.

• Leasehold improvement is depreciated over the shorter of its

(a) useful life and the

(b) remaining lease term.

• Changes in depreciation method, useful life, or residual value are changes in accounting

estimate that are accounted for prospectively.

• Revaluation surplus = Fair value less Carrying amount Revaluation may be recorded using the

proportional or elimination method.

• If the revalued asset is depreciable, a portion of the revaluation surplus may be transferred

periodically to retained earnings.

• Gain or loss on disposal = Net proceeds less Carrying amount

Chapter 17: DEPLETION OF MINERAL RESOURCES

• Exploration and evaluation expenditures start to be incurred after the legal right to explore an

area is obtained and ceases when the existence of reserves is in fact established.

• Exploration and evaluation expenditures are either recognized as asset or expense depending

on the entity's chosen accounting policy - which is based entirely on management's judgment.

• If the entity chooses to recognize exploration and evaluation expenditures as asset, it shall

initially measure the asset at cost and subsequently measure it using either the cost model or the

revaluation model. An entity may subsequently change its accounting policy if the change makes

the financial statements more relevant and no less reliable, or more reliable and no less relevant.

• Exploration and evaluation assets are initially recognized as a separate class of assets. When the

existence of mineral resources is established, the exploration and evaluation assets are

reclassified to other assets (e.g., as part of the cost of the mine).

• The cost of a natural resource includes:

(a) purchase cost, direct costs, and decommissioning and restoration costs for which the

entity has incurred a present obligation,

(b) exploration and evaluation costs to the extent that they are capitalized in accordance

with the entity' accounting policy, and

(c) intangible development costs.

• Depletion is computed using the units-of-production method.

• Tangible development costs are not included as cost of a natural resource but rather capitalized

as equipment and depreciated separately.

• Liquidating dividends are those declared in excess of the balance of retained earnings.

Liquidating dividends are return of capital rather than return on capital.

Chapter 18: GOVERNMENT GRANTS

• Government grants are recognized when there is reasonable assurance that

(a) the attached conditions will be satisfied and

(b) the grants will be received. The mere receipt of a grant is not a conclusive evidence of the

satisfaction of the attached conditions.

• A government grant is recognized as income as the related expense for which the grant was

intended to compensate is incurred. (MATCHING - no expense, no income')

• A grant related to a depreciable asset is recognized as income as the asset is depreciated.

• A grant related to a non-depreciable asset (land) is recognized as income as the depreciable

asset built on the land is depreciated.

• A grant received as compensation for expenses already incurred or as immediate financial

support is recognized immediately as income.

• Grants related to assets are grants conditioned on the acquisition of long-term assets. Other

grants are considered grants related to income.

• Grants are measured at fair value. Alternatively, non monetary grants may be measured at

nominal amount.

• Grants are presented in the financial statements (except statement of cash flows) either by

gross presentation or net presentation.

• Forgivable loans and the benefit of loans at below-market interest rate are considered

government grants.

• The repayment, of a government grant is accounted for prospectively.

• The following are not government grants:

(1) Tax benefits,

(2) Free technical or marketing advice,

(3) Provision of guarantees,

(4) Government procurement policy that is responsible for a portion of the entity's sales, and

(5) Public improvements that benefit the entire community.

Chapter 19: BORROWING COSTS

• Borrowing costs that are directly attributable to the acquisition, construction or production of a

qualifying asset are capitalized. Other borrowing costs are expensed.

• Borrowing may include:

(a) interest expense calculated using the effective interest method;

(b) finance charges on finance leases;

(c) exchange differences.

• Qualifying asset is an asset that necessarily takes a substantial period of time to get ready for its

intended use or sale. It may be an

(a) inventory,

(b) PPE,

(c) investment property measured at cost, or

(d) intangible asset.

• The following are not qualifying assets:

(a) assets produced over a short period of time,

(b) assets that are ready for their intended use or sale,

(c) assets produced routinely and in large quantities and

(d) assets measured at fair value.

• The capitalization of borrowing costs starts when the entity

(a) incurs expenditures for the asset,

(b) incurs borrowing costs, and

(c) necessary activities are being undertaken.

• Capitalization of borrowing costs is suspended during extended periods of suspension of active

development of a qualifying asset.

• The capitalization of borrowing costs ceases when the qualifying asset is substantially

completed.

• Only avoidable borrowing costs are eligible for capitalization.

• Capitalizable borrowing cost on specific borrowing = (interest expense less investment income)

• Capitalizable borrowing cost on general borrowing = (average expenditure x capitalization rate)

• Capitalization rate = Total interest expense on general borrowings divided by Total general

borrowings

• Qualifying assets are not segregated from other assets in the financial statements.

Chapter 20: INVESTMENT PROPERTY

• Biological asset is a living animal or plant.

• Agricultural produce are harvested products from biological assets before any processing.

• Harvesting from unmanaged sources is not agricultural activity.

• Biological assets and agricultural produce are recognized when the following are present:

(a) control;

(b) probable future economic benefits; and

(c) fair value or cost can be measured reliably.

• Biological asset is initially and subsequently measured at fair value less costs to sell.

• Agricultural produce is initially measured at fair value less costs to sell at the point of harvest

and subsequently measured under PAS 2 Inventories or other applicable standard.

• Costs to sell include

(a) commissions to brokers,

(b) levies by regulatory agencies and commodity exchanges, and

(c) transfer taxes and duties.

• Transport costs are not costs to sell; they are deducted from the market price when measuring

fair value.

• Gains and losses from changes in FVLCS of biological assets and FVLCS of agricultural produce at

the point of harvest are recognized in profit or loss.

• If the fair value cannot be measured reliably on initial recognition, the biological asset is

measured at cost less accumulated depreciation and accumulated impairment loss.

• Land used in agricultural activity is classified as PPE.

• An unconditional government grant related to a biological asset measured at FVLCS is

recognized in profit or loss when the e government grant becomes receivable.

Chapter 21: AGRICULTURE

• Investment Property is land and/or building held to earn rentals or for capital appreciation or

both.

• The portions of a property that is partly being rented out and partly owner-occupied are

accounted for separately if the portions can be sold separately (or leased out separately under a

finance lease). If not, the entire property is classified as either investment property or PPE,

whichever portion is more significant.

• If ancillary services provided to occupants are insignificant, the property is classified as

investment property.

• A property that is leased between members of a group is classified as PPE in the group's

consolidated financial statements.

• Investment property is initially measured at cost.

• Investment property is subsequently measured using either the cost model or the fair value

model.

• An investment property that is measured under the cost model is accounted for using PAS 16

(PPE).

• An investment property that is measured under the fair value model is remeasured to fair value

at the end of each reporting period. Changes in fair value are recognized in profit or loss. The

investment property is not depreciated.

• Regardless of which model is used, an entity is required to determine the fair value of an

investment property.

• Transfers to or from investment property are made only when there is a change in use.

• When an investment property is derecognized (e.g., disposed of), the difference between the

net disposal proceeds, if any, and the carrying amount is recognized as gain or loss in profit | or

loss.

Chapter 22: INTANGIBLE ASSETS

• Intangible assets are identifiable non-monetary assets without physical substance.

• Essential elements:

(1) Identifiability (separable or arises from contractual or other legal rights);

(2) Control; and

(3) Future economic benefits.

• Intangible assets are initially measured at cost. The measurement of cost depends on the

intangible asset's mode of acquisition.

• Internal generation:

1. Research cost - recognized as expense.

2. Development cost - capitalized only if all of the conditions under PAS 38 are met.

• If it is not clear whether an expenditure is a research or a development cost, it is treated as a

research cost.

• Reinstatement of costs already expensed is prohibited.

• Internally generated brands, mastheads, publishing titles, customer lists, goodwill and similar

items are not recognized as intangible assets.

•Subsequent expenditures on recognized intangible assets are generally expensed, unless they

meet the definition of an intangible asset and the recognition criteria.

• Intangible assets are subsequently measured using the cost model or the revaluation model.

The revaluation model is applicable only when the intangible asset has an active market.

Amortization:

1. Indefinite useful life - not amortized but tested for

2. Finite useful life - amortized using the straight line method impairment at least annually using

PAS 36.

(unless another method better reflects the consumption of the economic benefits from the asset)

over the shorter of the asset's useful life and legal life, if any. The residual value is assumed to be

zero, unless the entity has the ability to sell the asset at the end of its useful life.

Chapter 23: IMPAIRMENT OF ASSETS

• An asset is impaired if its carrying amount exceeds its recoverable amount. The excess

represents the impairment loss.

• Recoverable amount is the higher of an asset's (a) fair value less costs of disposal and its (b)

value in use.

• An asset is tested for impairment only when an indication of impairment exists, except for

certain intangible assets that are required to be tested for impairment at least annually.

• It is not always necessary to compute both the FVLCD and the VIU. If any one of them exceeds

the carrying amount, the asset is not impaired and the other one need not be computed. If the

FVLCD cannot be determined, the VIU is used as the recoverable amount. If the asset is held for

disposal, its recoverable amount is the FVLCD.

•Value in use is the present value of estimated future cash flows expected to arise from the

continuing use of an asset (or CGU) and from its disposal at the end of its useful life.

• Impairment loss is recognized in profit or loss, unless it represents a revaluation decrease.

• After impairment, subsequent depreciation (amortization) is based on the asset's recoverable

amount.

• If an asset's recoverable amount can be determined reliably, it is tested for impairment on its

own. If its recoverable amount cannot be determined reliably, the CGU to which that asset

belongs is the one tested for impairment.

• For purposes of impairment, goodwill and corporate assets are allocated to CGUS.

• The impairment loss on a CGU is allocated first to any goodwill in the CGU. The excess is

allocated to the other assets of the CGU pro rata based on their carrying amounts.

• The reversal of impairment loss shall not result to a carrying amount in excess of the asset's

would-be carrying amount had no impairment loss been recognized in prior periods.

• Impairment loss on goodwill is never reversed.

You might also like

- Chapter 12 Financial Statement Analysis - BobadillaDocument26 pagesChapter 12 Financial Statement Analysis - BobadillaJohn Rey Enriquez100% (4)

- Imo MC 2.07Document101 pagesImo MC 2.07Santoso WahyudiNo ratings yet

- PAS 39 Financial Instruments Recognition and MeasurementsDocument51 pagesPAS 39 Financial Instruments Recognition and MeasurementsSherry Mae Malabago93% (14)

- PWC Oil and Gas Handbook - Final Sept 2013Document171 pagesPWC Oil and Gas Handbook - Final Sept 2013Faisal MehmoodNo ratings yet

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Philippine Accounting Standards 38 (Intangible Assets2)Document72 pagesPhilippine Accounting Standards 38 (Intangible Assets2)Princess Edreah NuñalNo ratings yet

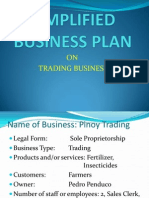

- Simplified Business Plan SampleDocument28 pagesSimplified Business Plan SampleZandie Garcia100% (2)

- Chap 6Document54 pagesChap 6Jose Martin Castillo Patiño100% (1)

- Chapter 10 Investments in Debt SecuritiesDocument24 pagesChapter 10 Investments in Debt SecuritiesChristian Jade Lumasag NavaNo ratings yet

- Chapter 11 Investments Additional Concepts LectureDocument13 pagesChapter 11 Investments Additional Concepts Lecturesantillan.arnaldo.duranNo ratings yet

- InvestmentDocument39 pagesInvestmentJames R JunioNo ratings yet

- Financial Accounting and Reporting - InvestmentsDocument10 pagesFinancial Accounting and Reporting - InvestmentsLuisitoNo ratings yet

- Financial Instrument - (NEW)Document11 pagesFinancial Instrument - (NEW)AS Gaming100% (1)

- Probiotec Annual Report 2022 6Document8 pagesProbiotec Annual Report 2022 6楊敬宇No ratings yet

- Financial Assets at Fair Value NotesDocument3 pagesFinancial Assets at Fair Value NotesJames R JunioNo ratings yet

- Pas 32Document34 pagesPas 32Iris SarigumbaNo ratings yet

- Audit of InvestmentDocument70 pagesAudit of InvestmentJoanne RomaNo ratings yet

- Probiotec Annual Report 2021 6Document8 pagesProbiotec Annual Report 2021 6楊敬宇No ratings yet

- Financial Instrument v.03Document49 pagesFinancial Instrument v.03ashaheen2704No ratings yet

- Accounting For InvestmentsDocument7 pagesAccounting For InvestmentsPaolo Immanuel OlanoNo ratings yet

- FA To Investment Property-DiscussionDocument7 pagesFA To Investment Property-DiscussionMary Rose Castillo AguadoNo ratings yet

- Classification of Financial InstrumentsDocument18 pagesClassification of Financial InstrumentsElena Hernandez100% (2)

- Financial InstrumentsDocument40 pagesFinancial InstrumentsArvind KumarNo ratings yet

- Financial Instruments IFRS 9Document38 pagesFinancial Instruments IFRS 9m7md.nagaNo ratings yet

- Topic 3 - Financial Instruments - A232Document106 pagesTopic 3 - Financial Instruments - A232thanusri0103No ratings yet

- Fas133 FASB Derivatives Hedge Accounting RulesDocument22 pagesFas133 FASB Derivatives Hedge Accounting Rulesswinki3100% (1)

- Financial Instruments by Sir AB JanjuaDocument14 pagesFinancial Instruments by Sir AB JanjuaMian Sajjad100% (1)

- Ifrs 9 PresentationDocument26 pagesIfrs 9 PresentationJean Damascene HakizimanaNo ratings yet

- Forex and Treasury Management - BLR 2019Document74 pagesForex and Treasury Management - BLR 2019Arif AhmedNo ratings yet

- Measurement BasesDocument21 pagesMeasurement BasessurfistasafonsoeliseuNo ratings yet

- Financial Instruments 9Document28 pagesFinancial Instruments 9ryooou08No ratings yet

- IntAcc1.3LN Investments in Debt Equity InstrumentsDocument4 pagesIntAcc1.3LN Investments in Debt Equity InstrumentsJohn AlbateraNo ratings yet

- Intermediate Acc NotesDocument6 pagesIntermediate Acc NotesLuh CheeseNo ratings yet

- IFRS 9 (Recognition, Classification and Measurement) - Class NotesDocument5 pagesIFRS 9 (Recognition, Classification and Measurement) - Class NotesRana gNo ratings yet

- Financial Instrument NotesDocument53 pagesFinancial Instrument NotesKhadija HasanNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Section 11Document30 pagesSection 11Abata BageyuNo ratings yet

- Lecture Notes On Revaluation and ImpairmentDocument6 pagesLecture Notes On Revaluation and Impairmentjudel ArielNo ratings yet

- Lecture Notes On Revaluation and Impairment PDFDocument6 pagesLecture Notes On Revaluation and Impairment PDFjudel ArielNo ratings yet

- Accounting For Financial InstrumentsDocument40 pagesAccounting For Financial Instrumentssandun chamikaNo ratings yet

- Financial Instrument Ind As 32, I N D A S 1 0 7, INDAS109Document24 pagesFinancial Instrument Ind As 32, I N D A S 1 0 7, INDAS109rvsiddharth054No ratings yet

- 19 - Us Gaap Vs Indian GaapDocument5 pages19 - Us Gaap Vs Indian GaapDeepti SinghNo ratings yet

- Acc003 Summary IA3 C01 Small EntitiesDocument8 pagesAcc003 Summary IA3 C01 Small EntitiesMonique VillaNo ratings yet

- Module 4Document20 pagesModule 4Althea mary kate MorenoNo ratings yet

- PFRS 8&9Document8 pagesPFRS 8&9Queenie BuisanNo ratings yet

- Intacc 1Document12 pagesIntacc 1Mycka Joy HernandezNo ratings yet

- PFRS 9Document6 pagesPFRS 9Beverly UrbaseNo ratings yet

- Lecture Notes On Trade and Other Receivables PDFDocument5 pagesLecture Notes On Trade and Other Receivables PDFjudel ArielNo ratings yet

- Lecture Notes On Trade and Other ReceivablesDocument5 pagesLecture Notes On Trade and Other Receivablesjudel ArielNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Session 8 (22nd Oct)Document122 pagesSession 8 (22nd Oct)zf8dkk8fnzNo ratings yet

- Accounting Revision Notes (CA Companions)Document8 pagesAccounting Revision Notes (CA Companions)Habib Ullah KhanNo ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Final SummaryDocument6 pagesFinal SummaryAkanksha singhNo ratings yet

- What Are The Characteristics of A Bond Investment? AnswerDocument4 pagesWhat Are The Characteristics of A Bond Investment? AnswerAllysa Jane FajilagmagoNo ratings yet

- IAS 32 - NotesDocument30 pagesIAS 32 - NotesJyNo ratings yet

- Bond InvestmentDocument2 pagesBond InvestmentPat RFNo ratings yet

- Pfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsDocument6 pagesPfrs 9 Financial Instruments Summary Financial Assets Financial Liabilities and Equity InstrumentsSHARON SAMSONNo ratings yet

- FAFV and Amortized CostDocument64 pagesFAFV and Amortized CostMiccah Jade CastilloNo ratings yet

- Investment AccountsDocument10 pagesInvestment AccountsMani kandan.GNo ratings yet

- SAMALA - DISCUSSION 4 (Audit of Stockholder's Equity, Share Based Payment & Book Value and Earnings Per Share)Document6 pagesSAMALA - DISCUSSION 4 (Audit of Stockholder's Equity, Share Based Payment & Book Value and Earnings Per Share)Jessalyn DaneNo ratings yet

- FAR IFRS StandardsDocument11 pagesFAR IFRS Standardsyfarhana2002No ratings yet

- Ifrs at A Glance: IAS 39 Financial InstrumentsDocument8 pagesIfrs at A Glance: IAS 39 Financial InstrumentsvivekchokshiNo ratings yet

- Cfas Chapter 23-26 NotesDocument12 pagesCfas Chapter 23-26 Noteskhyzhirell028No ratings yet

- Antibodies Ready For PrintingDocument113 pagesAntibodies Ready For PrintingEven JayNo ratings yet

- Lesson PlanDocument5 pagesLesson PlanEven JayNo ratings yet

- MATH 6.4 SLRP For Meaning Making OutpuDocument9 pagesMATH 6.4 SLRP For Meaning Making OutpuEven JayNo ratings yet

- MATH 2.1 SLRP Template (OUTPUT)Document2 pagesMATH 2.1 SLRP Template (OUTPUT)Even JayNo ratings yet

- ET11 Module6Document6 pagesET11 Module6Even JayNo ratings yet

- ET11 Module5Document11 pagesET11 Module5Even JayNo ratings yet

- MATHEMATICS 7 LP 2nd QuarterDocument4 pagesMATHEMATICS 7 LP 2nd QuarterEven JayNo ratings yet

- MAPEH 7 LP 2nd QuarterDocument5 pagesMAPEH 7 LP 2nd QuarterEven JayNo ratings yet

- g12 Handout 2quarter HOPE4Document5 pagesg12 Handout 2quarter HOPE4Even JayNo ratings yet

- CIDAM Sir Domz SampleDocument13 pagesCIDAM Sir Domz SampleEven JayNo ratings yet

- Handout567 G12 HOPE4Document11 pagesHandout567 G12 HOPE4Even JayNo ratings yet

- Chapter 16 Non Profit OrganizationsDocument62 pagesChapter 16 Non Profit OrganizationsJanine LerumNo ratings yet

- Business Plan On Pizza CornerDocument24 pagesBusiness Plan On Pizza CornerTanin RahmanNo ratings yet

- Chapter 8 QuizDocument3 pagesChapter 8 QuizTriet Nguyen0% (1)

- Prepaid Expenses and Deferred Charges 1. Proper Authorization To IncurDocument4 pagesPrepaid Expenses and Deferred Charges 1. Proper Authorization To IncurJasmine Iris BautistaNo ratings yet

- 2 - Bank Financial StatementDocument36 pages2 - Bank Financial StatementTiến ĐứcNo ratings yet

- RTP - CAP - III - Gr-I - Dec - 2022 (2) - 3-29Document27 pagesRTP - CAP - III - Gr-I - Dec - 2022 (2) - 3-29Mahesh PokharelNo ratings yet

- Unit-I Mba-C105Document48 pagesUnit-I Mba-C105Jeevesh ViswambharanNo ratings yet

- Developing An Business Model: EffectiveDocument34 pagesDeveloping An Business Model: Effectiveghufran almazNo ratings yet

- Ipsas 6 Consolidated and 3Document36 pagesIpsas 6 Consolidated and 3EmmaNo ratings yet

- Demo Soletrader 31 Dec 2018 Accounts PDFDocument15 pagesDemo Soletrader 31 Dec 2018 Accounts PDFRainbow Construction LtdNo ratings yet

- MBA Local Compnay Presentation - Financial - AccountingDocument7 pagesMBA Local Compnay Presentation - Financial - AccountingAliza RizviNo ratings yet

- 274-B-A-A-C (2683)Document10 pages274-B-A-A-C (2683)Ahmed Awais100% (4)

- Ain T No Stoppin' Us! - Score - B Tenor SaxophoneDocument1 pageAin T No Stoppin' Us! - Score - B Tenor SaxophoneDana Díaz AcostaNo ratings yet

- ACCT1101 Lecture 1Document3 pagesACCT1101 Lecture 1Eli FalzunNo ratings yet

- A Level Paper2Document18 pagesA Level Paper2amna abbasNo ratings yet

- Profitability AnalysisDocument63 pagesProfitability Analysishr. infotechnogenplNo ratings yet

- Mercury Mining Investment LTD - Audited Reports For 2022Document16 pagesMercury Mining Investment LTD - Audited Reports For 2022tankodanjumacNo ratings yet

- Afa 5Document5 pagesAfa 5akash raymondNo ratings yet

- Maruti SuzukiDocument20 pagesMaruti Suzukiproperty.lords1No ratings yet

- Stabat Mater - Emanuele DastorgaDocument9 pagesStabat Mater - Emanuele DastorgacathynitaNo ratings yet

- Finance 101 Cheat SheetDocument1 pageFinance 101 Cheat SheetMinyu LvNo ratings yet

- Chapter 3 Multiple ChoicesDocument16 pagesChapter 3 Multiple ChoicesNayeon LimNo ratings yet

- Home Office Branch and Agency AccountingDocument5 pagesHome Office Branch and Agency AccountingMaria Angelica SergoteNo ratings yet

- Analysis of Financial StatementDocument51 pagesAnalysis of Financial StatementSumit Rp100% (4)

- Babylon Produce - 2013 3rd PlaceDocument43 pagesBabylon Produce - 2013 3rd PlacedewanibipinNo ratings yet