Professional Documents

Culture Documents

1905 - Market Share Analysis - ERP Software, Worldwide, 2018

1905 - Market Share Analysis - ERP Software, Worldwide, 2018

Uploaded by

Rufus Shinra RaidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1905 - Market Share Analysis - ERP Software, Worldwide, 2018

1905 - Market Share Analysis - ERP Software, Worldwide, 2018

Uploaded by

Rufus Shinra RaidCopyright:

Available Formats

Market Share Analysis: ERP Software,

Worldwide, 2018

Published: 9 May 2019 ID: G00390945

Analyst(s): Chris Pang, Robert Anderson, John Kostoulas

The ERP software market saw an annual growth of 10% to become a $35

billion market in 2018. The continued transition toward digital business, the

maturing of SaaS applications and purchases of new ERP versions drove

end-user spending in ERP.

Key Market Findings

■ Market growth was healthy and steady. Spending was characterized by end-user organizations

making incremental ERP investments rather than “big bang,” single-vendor, full ERP suite

projects.

■ Administrative ERP (financial management systems and human capital management) grew 11%

— nearly twice as fast as operational ERP (manufacturing and operations and enterprise asset

management) at 6% annual growth.

■ ERP is fragmented compared to other mature software segments, with the top three vendors

combined holding no more than 40% market share, and the top five holding 51% market share.

Vendor Performance Highlights

■ SAP and Oracle retained their respective No. 1 and No. 2 market share positions with little

change in the overall market share.

■ Workday is the first cloud-native provider to break into the top three for vendor revenue market

share.

■ Kronos broke the billion-dollar mark in software revenue and retained its No. 7 position.

Market Share Data

Gartner’s definition of enterprise resource planning (ERP) software broadly includes the categories

of:

■ Administrative ERP, which includes financial management system (FMS) software and human

capital management (HCM) software

■ Operational ERP, which includes manufacturing and operations software and enterprise asset

management (EAM) software

These technologies can be purchased separately, in different combinations or as a complete suite.

Figure 1 shows the 2018 revenue for the top five vendors in the ERP software market.

Figure 1. Top Five ERP Software Vendor Revenue, Worldwide, 2018

Page 2 of 12 Gartner, Inc. | G00390945

Table 1 shows the top 10 ERP software vendors worldwide, ranked by total software revenue in

2018. The combined revenue contribution of the top 10 vendors in 2018 was about 63%; this was

consistent with previous year.

Table 1. Ranking of Top 10 ERP Software Vendors by Revenue, Worldwide, 2018 (Millions of Dollars)

2017 Rank 2018 Rank Vendor 2017 Revenue 2018 Revenue 2017-2018 2018 Market

Growth Share

1 1 SAP 7,072 7,709 9% 22%

2 2 Oracle 3,715 3,901 5% 11%

4 3 Workday 1,746 2,325 33% 7%

3 4 Sage 1,869 2,048 10% 6%

5 5 Infor 1,639 1,720 5% 5%

6 6 Microsoft 1,179 1,261 7% 4%

7 7 Kronos 947 1,019 8% 3%

8 8 Ultimate 802 997 24% 3%

Software

9 9 Visma 724 783 8% 2%

10 10 Yonyou 526 628 19% 2%

Other Vendors 11,968 13,061 9% 37%

Total 32,186 35,451 10% 100%

Notes: Numbers may not add to totals shown because of rounding.

Source: Gartner (May 2019)

Table 2 shows the growth of administrative ERP versus operational ERP during 2018.

Gartner, Inc. | G00390945 Page 3 of 12

Table 2. Administrative and Operational ERP, Worldwide, 2017-2018 (Millions of U.S. Dollars)

2017 Revenue 2018 Revenue 2017 Market 2018 Market Growth 2018

Share Share Year

Enterprise Asset 1,547 1,599 5% 5% 3%

Management (EAM)

Manufacturing and 5,714 6,098 18% 17% 7%

Operations

Operational ERP Total 7,261 7,696 23% 22% 6%

Financial Management 12,321 13,301 38% 38% 8%

Systems (FMS)

Human Capital 12,604 14,454 39% 41% 15%

Management (HCM)

Administrative ERP Total 24,925 27,755 77% 78% 11%

ERP Market Total 32,186 35,451 100% 100% 10%

Notes: Numbers may not add to totals shown because of rounding.

Source: Gartner (May 2019)

Overall Market Segment Performance Analysis

The ERP software market grew 10% to a global market value of $35 billion in 2018 (see “Market

Share: Enterprise Resource Planning, Worldwide, 2018”). Market growth was healthy and steady

rather than explosive because there was no major “burning platform” to promote significant and

marketwide end-user spend on ERP. Growth was driven through a combination of reasons,

including the ones listed below.

Digital Business Initiatives Trigger New ERP Investments

While not a new trend, end-user organizations continue to embrace digital business strategies.

Digital business changes the way an organization deals with customers, suppliers, partners, internal

processes, and employee engagement — all of which are supported by ERP, thus driving ERP

upgrades and/or replacements. Today, most organizations are taking a postmodern ERP approach

where investments are targeted on specific workloads, such as financial management, HR, or

manufacturing and operations, rather than a big bang, single-vendor, full suite initiative. This

certainly drove spend in new ERP solutions, but it did not result in explosive growth due to the

absence of a burning platform such as Y2K or the sunset of a major application.

Page 4 of 12 Gartner, Inc. | G00390945

Multicloud ERP Options Help Move Reluctant Customers

All the major non-cloud-native ERP providers are on multiyear journeys of moving customers to

their latest-generation ERP platforms. In many cases, these platforms are deployed via a multitenant

SaaS model. But some providers offer more flexibility through private cloud, deployment in third-

party cloud providers or even on-premises. Previously, most providers deliberately limited additional

deployment options due to the economics and complexity of doing so. But with the rise of third-

party infrastructure as a service (IaaS) offerings, this is less of an issue. ERP providers are now able

to sell to organizations that could not — or preferred not — to use multitenant SaaS ERP offerings

due to regulatory or cultural constraints.

Slow but Incremental Move to Latest Version ERP

Many of the leading non-cloud-native providers have had general availability of their next-

generation ERP applications for a number of years. But getting mainstream adoption and building

the reputation of a new product/version takes time because customers will have their own time

frames and business cases for a new or upgraded ERP. Likewise, there are still questions around

the depth of functionality in new platforms versus old platforms — especially in operational ERP.

In general, for non-cloud-native providers, live customers on new platforms (compared to previous

generation products) remain small. But the revenue impact is already hitting the top line because

customers are buying and subscribing to these new platforms and are in varying stages of rollout.

Emerging Technologies Indirectly Influence New Spend

Within the ERP market, very few providers can “sell” artificial intelligence (AI), the Internet of Things

(IoT), blockchain, augmented reality or other emerging technologies as a stand-alone SKU. Instead,

emerging technologies are being made available as an integral feature or an integration hook is

made available and/or published to make it easier to interface with third parties. Hence, the direct

revenue impact of emerging technologies is low, but it is an incentive for customers to purchase

new versions/platforms because new technologies are deliberately not made available for legacy

products.

Focus and Specialization Are Key to Growth

ERP is an established and mature software market with a history going back four decades, yet no

provider is truly dominant. SAP, for example, is the market share leader with 22% of the market, but

that still leaves 78% of the market to other providers. In the small and midsize market, the vendor

landscape remains incredibly fragmented. All major providers have increased their market

opportunity through mergers and acquisitions and new product development, but a wide portfolio

offering does not always lead to the most growth. Customers want a product that is “right” for their

requirements and a vendor they feel comfortable doing business with. This means that even in a

mature market like ERP, there is still abundant opportunity. This is demonstrated by the fact that

providers with the highest growth tended to be specialists in a particular domain, industry and/or

geographical coverage (see Table 1).

Gartner, Inc. | G00390945 Page 5 of 12

Packaging and Pricing Creativity Helps Drive Additional Revenue

All major ERP providers have teams dedicated to pricing and packaging strategies. They have to

walk a fine line of revenue optimization without appearing to be greedy. As the transition to cloud

continues, some “old” ways of finding additional revenue, such as software usage audits, remain.

But new ways are coming to light as well. This all helps to drive incremental revenue for providers.

Recent examples we have seen include:

■ Indirect usage licensing for robotic process automation (RPA) use cases; previously we saw this

mostly in connection with data extraction and consumption by third-party application providers.

■ Limited advisory/vendor consultation sold as a premium customer support subscription rather

than as a professional service.

■ Expanded user license types that enable providers to sell licenses for more of their clients’ user

base than before.

■ Additional capabilities (such as additional storage, sandbox systems, API support) that increase

the annual contract value.

Top Vendors Analyzed

SAP

SAP grew ERP software revenue by 9% (7% in home currency). SAP comfortably remains the

largest vendor with almost double the market share of the next nearest contender. SAP is

deliberately transitioning its revenue mix to being cloud-heavy instead of being dominated by

traditional license and maintenance.

During 2018, SAP further refined its vision of the Intelligent Enterprise (a future based on event-

driven, real-time business applications) to encourage more adoption of SAP S/4HANA. SAP’s vision

is designed to encourage customers to reimagine the experience which they give to their

customers, improve their internal productivity, increase innovation capacity and creating and

sustaining an engaged workforce.

To this end, SAP is still early in its journey of S/4HANA adoption (see “SAP S/4HANA Research

Roundup”). At the close of 2018, we estimate around 10,500 in total customers had licensed it, and

approximately 2,600 were in production. From the existing SAP ERP installed base, SAP continued

to make progress. Gartner estimates about 17% of the base have acquired the licenses and about

4% are in production on the platform. Overall while the percentage of customers in production

remained low, the product license switch to SAP S/4HANA did contribute significant revenue in

2018. Other ERP product lines such as SAP Business One (for small and midsize businesses) also

performed well, with around 6,000 new customers joining and a year-end customer count of 65,000.

From a cloud portfolio perspective, SAP Business ByDesign also saw continued momentum, as did

SAP Concur. SAP SuccessFactors is another key pillar within SAP’s cloud product strategy, which

finished 2018 with close to 3,000 Employee Central customers (over 30% growth). However, there

Page 6 of 12 Gartner, Inc. | G00390945

remains a sizable opportunity for more customers to migrate from the SAP’s existing on-premises-

based HCM offering to SAP SuccessFactors in the coming years.

Oracle

Oracle maintained its No. 2 position in 2018, driven by a 5% annual growth rate and maintaining

11% revenue share of the overall ERP market. It finished the year with 6,000+ Oracle ERP Cloud

customers, with approximately 60% of customers net new to Oracle. Gartner estimates that 27% of

Oracle ERP Cloud customers also bought HCM Cloud, which has been a successful driver for

growth. In core financials, ERP Cloud was bolstered by new subscription and revenue management

features and the introduction of an Accounting Hub as a gateway to financial reporting.

NetSuite, Oracle’s cloud-native ERP for small and midsize enterprises, ended the year with 16,000+

customers and an ERP revenue growth rate of 25%. Sales momentum and productivity in 2018 was

helped by its investment in SuiteSuccess. SuiteSuccess is an implementation and onboarding

approach aimed at helping customers be in production within 45 days and giving them an active

roadmap for future value delivery. NetSuite also introduced Oracle NetSuite Planning and Budgeting

to provide additional capabilities, as well as additional sales presence in Europe.

Workday

Workday ascended to the No. 3 position, driven by another strong year of sales with 33% growth in

software revenue for 2018. Workday as a cloud-native provider competes in the administrative ERP

areas of FMS and HCM. It finished the fiscal year with a customer count of 2,600+ HCM customers,

650+ financial management customers and a user count of 35 million. While Workday’s HCM

customer count is not the highest of the big three, its strategy of targeting large global customers

with its suite-based approach is working well. Key attributes that helped Workday win include the

continual evolution of its cloud-native architecture, a largely organic approach to development, and

its focus on customer satisfaction.

In 2018, Workday executed its largest acquisition to date by acquiring Adaptive Insights to improve

and accelerate its capabilities for integrated business planning. Adaptive Insights continued to be

sold as a stand-alone offering, adding another 200 customers following its acquisition. Other

significant actions in 2018 included early adopter availability of platform as a service (PaaS), and

Workday being delivered via Amazon Web Services (AWS) for customers needing data residency in

Canada and Germany. These and other enhancements allowed Workday to better compete against

larger competitors with already released platform extension capabilities and more extensive data

center operations.

Sage

Sage slipped to No. 4 in 2018 despite a 10% increase in ERP software revenue (6% in home

currency). Like many established ERP providers, Sage is transitioning its business to be more

cloud-revenue-heavy through a combination of acquiring native cloud products and cloud-enabling

selective products within its existing portfolio.

Gartner, Inc. | G00390945 Page 7 of 12

Sage’s native cloud business was helped in 2018 through having a full year of revenue contribution

from Intacct (cloud financial management), which was acquired in 2017. Sage Intacct was mainly

sold to the U.S. market, but toward the end of the year, Sage announced that the U.K. and

Australian markets would follow shortly. A significant driver of growth in 2018 has been Sage’s

cloud-connected products, where Sage 50 and Sage 200 desktop customers moved to

subscription contracts with cloud-connected functionality (thus increasing subscription revenue).

Sage Enterprise Management (Sage’s midmarket ERP suite) grew revenue by 11% through a strong

push for adding more customers with larger contract values. At year end, Sage added more than 70

new customer contracts worth more than £100,000 in software revenue.

Infor

Infor maintained its No. 5 position in 2018, underpinned by a 5% year-over-year growth rate. During

2018, Infor increased efforts on branding itself as a cloud ERP company, which it led with sales

motions tied to its CloudSuite solutions that are capable of running on multitenant AWS. By the end

of 2018, 70% of its sales revenue was subscription-based.

During the past year, Infor expanded its presence in healthcare, manufacturing, retail and the public

sector markets while increasingly differentiating itself on delivering last-mile vertical and

microvertical solutions. In other activities, Infor continued to enhance its Infor OS cloud operating

platform, including the ION messaging bus, the XML-based business object document integration

layer, the Ming.le user interface, and additional support for Amazon Web Services’ JSON-based

APIs.

Other Notable Vendors

Kronos

Kronos is an HCM software provider with a deep history and focus on workforce management

functionality. Kronos grew software revenue by 8% to more than $1 billion in 2018 and maintained

its No. 7 market share ranking. In doing so, Kronos joins the “billion dollar” club, in which the top

seven providers generate more than $1 billion in total software revenue annually (Kronos generated

total company revenue more than $1.4 billion).

Primary revenue drivers include continued sales momentum from Workforce Ready (a cloud-native

HCM and talent suite for small and midsize businesses) and adoption of Workforce Dimensions.

Workforce Dimensions is a recently released cloud-native workforce management suite and the

eventual successor to Kronos’ Workforce Central product. Kronos also generated new revenue from

the migration of on-premises license and maintenance customers to cloud licensing and

deployment options. While newer cloud-native products get most of the publicity, Kronos also

generated a substantial amount of maintenance revenue from a loyal installed base of Workforce

Central and other solutions within its portfolio.

Page 8 of 12 Gartner, Inc. | G00390945

Ultimate Software

Ultimate Software (Ultimate) is an HCM SaaS provider with almost a billion dollars in total software

revenue ($997.1 million), which represented a 24% increase in annual revenue. Ultimate continued

its customer acquisition focus on North America-based midsize and enterprise organizations, with

its customer base growing to more than 5,600 organizations and the number of people records in

the cloud expanded to more than 48 million. Ultimate maintained its customer retention rate of 96%

(same as 2017), which made it easier to grow top-line revenue.

In 2018, Ultimate grew its international operations by acquiring PeopleDoc, a key player in cloud-

based HR service delivery with offices in England, France, Germany, and the United States, and

more than 1,000 customers with users in 180 countries. Similar to 2017, Ultimate received a number

of awards for its culture, diversity and services, which helped to underline Ultimate’s image as a

positive and customer-friendly organization to do business with.

Mergers and Acquisitions

The following details some of the merger and acquisition activity that occurred in 2018 that impacts

the ERP software market. Note this is not an exhaustive list. Some acquisitions made by providers

in the ERP market have not been listed if the acquired assets are considered additive to areas other

than ERP.

■ Certify acquired Captio.

■ Cornerstone OnDemand acquired Grovo Learning and Workpop.

■ Infor acquired Vivonet.

■ Oracle acquired Iridize and DataScience.com.

■ Saba Software acquired Lumesse.

■ SAP acquired Recast.AI, Coresystems, Callidus Software and Contextor.

■ Ultimate Software acquired PeopleDoc.

■ Workday acquired Adaptive Insights, Rallyteam, SkipFlag and Stories.bi.

■ Visma acquired Raet.

Gartner Recommended Reading

Some documents may not be available as part of your current Gartner subscription.

“Market Share: Enterprise Resource Planning, Worldwide, 2018”

“Market Share: All Software Markets, Worldwide, 2018”

Gartner, Inc. | G00390945 Page 9 of 12

“Market Definitions and Methodology: Software”

“Invest Implications: ‘Market Share: All Software Markets, Worldwide, 2018’”

Evidence

Gartner’s market statistics methodology combines primary and secondary sources to produce

Market Statistics documents. Gartner surveys all major participants within the industry in the Asia/

Pacific region, EMEA, Japan, North America and Latin America. This primary research is

supplemented with additional research to verify market size, shipment totals and pricing

information. Sources of data used by Gartner include, but are not limited to, the following:

■ Interviews with manufacturers, distributors and resellers

■ Information published by major industry participants

■ Published company financial reports

■ Estimates made by reliable industry spokespersons

■ Government data or trade association data

■ Published product literature and price lists

■ Relevant economic data

■ Articles in the general and trade press

■ Reports from financial analysts

■ End-user surveys

Gartner’s market statistics data is the most accurate and meaningful available. Despite the care

taken in gathering, analyzing and categorizing the data, careful attention must be paid to definitions

and assumptions. Various companies, government agencies and trade associations may use slightly

different definitions of product categories and regional groupings, or they may include different

companies in their summaries. These differences should be kept in mind when making comparisons

between data and numbers provided by Gartner and those provided by other research

organizations.

Gartner publishes all market share research in U.S. dollars. Our methodology converts the income

statements of non-U.S. vendors into U.S. dollars using the exchange rates provided in “Market

Share: All Software Markets, Worldwide, 2018.” Consequently, the reported growth rates and

market share for non-U.S. vendors in this report reflect a combination of actual native-currency

performance and the movement of other currencies versus the U.S. dollar. Historical quarterly and

annual exchange rates are calculated from appropriate averages of monthly exchange rates

reported by the Federal Reserve Bank of New York and the Pacific Exchange Rate Service.

Page 10 of 12 Gartner, Inc. | G00390945

Additional Notes

Non-U.S.-headquartered vendors generally base and judge their annual performance in their home

currency rather the U.S. dollar. But for the purposes of comparison Gartner uses the U.S. dollar.

Gartner collects market share data for individual vendors in the vendor’s local currency. Data

reported in currencies other than the U.S. dollar is converted to U.S. dollars for the purposes of

cross-country comparisons and aggregation using average exchange rates. The impact of the

exchange rate changes can include the following:

■ Vendor growth measured in U.S. dollars may differ from the vendor growth measured in the

currency in which the vendor reports.

■ Occasionally, exchanges rate changes may have an influence on the market share positions,

where one vendor gets a beneficial effect of the exchange rate changes and another suffers an

adverse effect.

■ Changes in exchanges rates for the current year compared with the prior year mean that, when

measured in U.S. dollars, growth rates for revenue accrued in a foreign currency differ from

growth rates that are shown in U.S. dollars.

Individual Vendor Revenue Reporting

As a result of ASC606/IFRS15 adoption, which varies from vendor to vendor, Gartner has opted not

to restate financial history at the individual vendor level regardless of the method the vendor has

chosen to adopt.

We believe our approach to each vendor is the most equitable way to handle the anomalies

resulting from this industrywide change in revenue recognition standards.

Total Market Growth Reporting

We have made adjustments such that overall market growth trends are still reflected accurately.

More details regarding this approach will be detailed in the upcoming Market Definitions and

Methodology Guides for each market.

This document is published in the following Market Insights:

Software Applications Worldwide

Gartner, Inc. | G00390945 Page 11 of 12

GARTNER HEADQUARTERS

Corporate Headquarters

56 Top Gallant Road

Stamford, CT 06902-7700

USA

+1 203 964 0096

Regional Headquarters

AUSTRALIA

BRAZIL

JAPAN

UNITED KINGDOM

For a complete list of worldwide locations,

visit http://www.gartner.com/technology/about.jsp

© 2019 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner is a registered trademark of Gartner, Inc. and its affiliates. This

publication may not be reproduced or distributed in any form without Gartner's prior written permission. It consists of the opinions of

Gartner's research organization, which should not be construed as statements of fact. While the information contained in this publication

has been obtained from sources believed to be reliable, Gartner disclaims all warranties as to the accuracy, completeness or adequacy of

such information. Although Gartner research may address legal and financial issues, Gartner does not provide legal or investment advice

and its research should not be construed or used as such. Your access and use of this publication are governed by Gartner Usage Policy.

Gartner prides itself on its reputation for independence and objectivity. Its research is produced independently by its research

organization without input or influence from any third party. For further information, see "Guiding Principles on Independence and

Objectivity."

Page 12 of 12 Gartner, Inc. | G00390945

You might also like

- Pace Layered Applications Research ReportDocument13 pagesPace Layered Applications Research ReportHasso Schaap100% (1)

- The Eight Building Blocks of CRM - OverviewDocument11 pagesThe Eight Building Blocks of CRM - OverviewLu OanaNo ratings yet

- Erp Functional ArchitectureDocument12 pagesErp Functional ArchitectureKarthika SasikumarNo ratings yet

- More Sample Exam Questions-Midterm2Document6 pagesMore Sample Exam Questions-Midterm2mehdiNo ratings yet

- Application Portfolio ManagementDocument22 pagesApplication Portfolio ManagementRicardo BergerNo ratings yet

- IG1262 Software Marketplaces A New Go To Market Opportunity ForDocument36 pagesIG1262 Software Marketplaces A New Go To Market Opportunity ForHai Dang DaoNo ratings yet

- ITIL - Introducing Service Strategy PDFDocument8 pagesITIL - Introducing Service Strategy PDFUpendra VenkatNo ratings yet

- IDG 2018 Cloud Computing ResearchDocument8 pagesIDG 2018 Cloud Computing ResearchIDG_World100% (4)

- Final ProjectDocument11 pagesFinal ProjectsoumyanicNo ratings yet

- It Project On Wipro TechnologiesDocument36 pagesIt Project On Wipro Technologiessam_12_34No ratings yet

- Mirc Electronics (Onida) - Strategic AnalysisDocument30 pagesMirc Electronics (Onida) - Strategic AnalysisbhuramacNo ratings yet

- Final E-Government Strategy Implementation Report v1.12-26th FebDocument361 pagesFinal E-Government Strategy Implementation Report v1.12-26th FebYoseph BirruNo ratings yet

- Blockchain ERP Integration and ISO StandardDocument47 pagesBlockchain ERP Integration and ISO StandardNad100% (1)

- ERP ALL Full FormsDocument5 pagesERP ALL Full FormsRajdipsinh N JadejaNo ratings yet

- ERP NotesDocument27 pagesERP Notesramanvp60100% (1)

- The SAP Report 2022 Q3 1Document13 pagesThe SAP Report 2022 Q3 1Momo gueyeNo ratings yet

- Insurance Sector in IndiaDocument4 pagesInsurance Sector in IndiaYadav412No ratings yet

- Fy18 It Budget GuidanceDocument79 pagesFy18 It Budget Guidancethangave2000No ratings yet

- Field Project PresentationDocument12 pagesField Project PresentationManjiree Ingole JoshiNo ratings yet

- A Study of Promotional Strategies Adopted by Bright Vision Infotech With An Intent To Inhance Its Brand ImageDocument38 pagesA Study of Promotional Strategies Adopted by Bright Vision Infotech With An Intent To Inhance Its Brand ImageAhmad Abdul WahabNo ratings yet

- Ecommerce in Latin AmericaDocument42 pagesEcommerce in Latin AmericaLuis SantosNo ratings yet

- Infotech Case Study: Gamatronic, Our Power Your ConfidenceDocument1 pageInfotech Case Study: Gamatronic, Our Power Your ConfidenceGamatronicNo ratings yet

- Process Mapping in Successful ERP Implementations: Michael D. Okrent and Robert J. VokurkaDocument7 pagesProcess Mapping in Successful ERP Implementations: Michael D. Okrent and Robert J. VokurkaDidik HariadiNo ratings yet

- Business Case SAPDocument28 pagesBusiness Case SAPAtikaRahmawatiYuliantoputri50% (2)

- Gartner Reprint 2022Document33 pagesGartner Reprint 2022Sajan Rajagopal100% (1)

- Loyalty: Professor: Ehab Mohamed Abou AishDocument54 pagesLoyalty: Professor: Ehab Mohamed Abou AishMohamed Abo ElKomsanNo ratings yet

- Industry Analysis On Cloud ServicesDocument12 pagesIndustry Analysis On Cloud ServicesBaken D DhungyelNo ratings yet

- Enabling Business Process Management: S F B P & D MDocument6 pagesEnabling Business Process Management: S F B P & D Mvjs1730100% (1)

- Concept 081 RebadgingDocument1 pageConcept 081 Rebadgingpriyadarshini.ajithNo ratings yet

- ERP ModernisationDocument18 pagesERP ModernisationUsmanNo ratings yet

- SAP and Oracle - A Comparison On Support StandardsDocument35 pagesSAP and Oracle - A Comparison On Support StandardsBalaji_SAPNo ratings yet

- Using Benchmarking To Drive EA ProgressDocument4 pagesUsing Benchmarking To Drive EA ProgressTrivial FaltuNo ratings yet

- Case Study Challenge Lift ExercisesDocument29 pagesCase Study Challenge Lift ExercisesTrishitoNo ratings yet

- Placement Preparation Committee, Iim Indore: AnniversaryDocument10 pagesPlacement Preparation Committee, Iim Indore: AnniversaryADITI SHARMA PGP 2021-23 BatchNo ratings yet

- Sap S4hana State of The Market ReportDocument38 pagesSap S4hana State of The Market ReportKoushik BanikNo ratings yet

- SAP Road Map For RetailDocument106 pagesSAP Road Map For RetailA HNo ratings yet

- PMP Examination Preparatory Course Topic: Introduction, Project Life Cycle & OrganizationDocument51 pagesPMP Examination Preparatory Course Topic: Introduction, Project Life Cycle & OrganizationasimsquareNo ratings yet

- S/4HANA Cloud Due-Diligence Framework: SAP Best PracticesDocument3 pagesS/4HANA Cloud Due-Diligence Framework: SAP Best PracticesSSNo ratings yet

- Vodafone Sustainability ReportDocument70 pagesVodafone Sustainability ReportMahajan BharatNo ratings yet

- Service Definition Document 2022 05 12 1340Document13 pagesService Definition Document 2022 05 12 1340NaserNo ratings yet

- SAP Cloud Integration ContentDocument3 pagesSAP Cloud Integration ContentAbhijitNo ratings yet

- SAP ERP and Tally ERPDocument11 pagesSAP ERP and Tally ERPalkjjasdnNo ratings yet

- Crystalbridge - The Data Transformation Platform HarmonizeDocument5 pagesCrystalbridge - The Data Transformation Platform HarmonizeNityaNo ratings yet

- IIA Los Angeles ERP PresentationDocument38 pagesIIA Los Angeles ERP PresentationramialNo ratings yet

- Learning Journey SAP For Automotive Manufacturing IndustryDocument5 pagesLearning Journey SAP For Automotive Manufacturing IndustryvpurshotNo ratings yet

- Oracle Cloud MarketplaceDocument10 pagesOracle Cloud Marketplacebrunohf1208No ratings yet

- EY - Digital Mine 2.0 - BE Catalogue 06 Project Gov FrameworkDocument40 pagesEY - Digital Mine 2.0 - BE Catalogue 06 Project Gov Frameworkayudingwani12No ratings yet

- BPM 11g Process Monitoring and ImprovementDocument17 pagesBPM 11g Process Monitoring and Improvementrichiet2009No ratings yet

- Upgrade To Oracle E-Business Suite R12: WhitepaperDocument16 pagesUpgrade To Oracle E-Business Suite R12: WhitepaperHesham FawziNo ratings yet

- Oracle vs. SapDocument10 pagesOracle vs. SapRose Siena Simon AntioquiaNo ratings yet

- ERPDocument89 pagesERPJack AbdallahNo ratings yet

- Solution ProposalDocument36 pagesSolution Proposalscribeuser04100% (1)

- Untitled Form - Google FormsDocument3 pagesUntitled Form - Google FormsShagun PoddarNo ratings yet

- SAP FUE LicenseDocument76 pagesSAP FUE LicenseAmit ShindeNo ratings yet

- CRM VodafoneDocument33 pagesCRM VodafoneAngadNo ratings yet

- Cartus CRM RFP Template Latest 2Document19 pagesCartus CRM RFP Template Latest 2Matthew ColemanNo ratings yet

- Benefits Activity Matrix PDFDocument1 pageBenefits Activity Matrix PDFJenny RocelaNo ratings yet

- Integrated Business Planning A Complete Guide - 2020 EditionFrom EverandIntegrated Business Planning A Complete Guide - 2020 EditionNo ratings yet

- Public Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionFrom EverandPublic Cloud ERP for Small or Midsize Businesses A Complete Guide - 2019 EditionNo ratings yet

- Insurance Policy Administration Systems A Complete Guide - 2019 EditionFrom EverandInsurance Policy Administration Systems A Complete Guide - 2019 EditionNo ratings yet

- AIG Case StudyDocument1 pageAIG Case StudyVishesh ShrivastavaNo ratings yet

- Limitations of MarketingDocument11 pagesLimitations of MarketingLE JOHN AQUINONo ratings yet

- Chapter 3 Step Wise An Approach To Planning Software Projects 976242065Document31 pagesChapter 3 Step Wise An Approach To Planning Software Projects 976242065RiajiminNo ratings yet

- E Reciept5954447845112Document3 pagesE Reciept5954447845112hugofanta83No ratings yet

- Management Control Systems: Authors: Anthony and Govindarajan 12 EditionDocument31 pagesManagement Control Systems: Authors: Anthony and Govindarajan 12 EditionMohammad Sabbir Hossen SamimNo ratings yet

- Module 3 Notes.Document22 pagesModule 3 Notes.MARYAM AKBAR JUNo ratings yet

- Tata Steel - Corus Case StudyDocument24 pagesTata Steel - Corus Case StudyMegha Munshi ShahNo ratings yet

- Case Study Analysis On: Mcdonald'S Adventure in The Hotel IndustryDocument8 pagesCase Study Analysis On: Mcdonald'S Adventure in The Hotel IndustryNainish MishraNo ratings yet

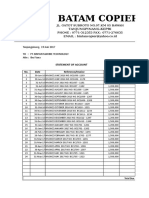

- Batam Copier: Tanjungpinang-KepriDocument5 pagesBatam Copier: Tanjungpinang-KeprirahmawatiNo ratings yet

- Data Analytics BrochureDocument3 pagesData Analytics BrochureUsman ManiNo ratings yet

- 6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFDocument5 pages6 Organizational Innovations: Total Quality Management Just-In-Time Production System PDFAryan LeeNo ratings yet

- ADS 410 Short Review (Log Book)Document9 pagesADS 410 Short Review (Log Book)AmirCPNo ratings yet

- Offer - Letter - Nishu WarwalDocument6 pagesOffer - Letter - Nishu WarwalnishuNo ratings yet

- OA ROI Case StudyDocument10 pagesOA ROI Case Studyscmarti2No ratings yet

- BGM ST Trans SecDocument235 pagesBGM ST Trans SecrajuwithualwaysNo ratings yet

- Tableau Building Blocks of A Modern Analytics PlatformDocument20 pagesTableau Building Blocks of A Modern Analytics PlatformDMS APACNo ratings yet

- Health Care: Hospital Management & Information SystemDocument8 pagesHealth Care: Hospital Management & Information Systemdakshita joshiNo ratings yet

- Unit 11 Management of Terial Resources: OD CtioDocument22 pagesUnit 11 Management of Terial Resources: OD CtioSnejina. B. AshokNo ratings yet

- Dhanush GowravDocument4 pagesDhanush GowravDhanush GowravNo ratings yet

- PNC INFRATECH - ASM ProjectDocument11 pagesPNC INFRATECH - ASM ProjectAbhijeet kohatNo ratings yet

- 1 6 QuizDocument12 pages1 6 Quizdaejina64No ratings yet

- Acquisition of Havells India LTD and Lloyd Electric's Consumer DurablesDocument10 pagesAcquisition of Havells India LTD and Lloyd Electric's Consumer DurablesAsra BadbadeNo ratings yet

- Lesson 18-19-20!21!22 Inventory ManagementDocument4 pagesLesson 18-19-20!21!22 Inventory ManagementChaqib SultanNo ratings yet

- 15 Qualities of A Good Project ManagerDocument8 pages15 Qualities of A Good Project ManagerDanilo Magallanes SampagaNo ratings yet

- Ias 23Document6 pagesIas 23faridaNo ratings yet

- Chapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsDocument79 pagesChapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsAlex Rossi100% (1)

- Tata INVOICEDocument75 pagesTata INVOICEAkhand SinghNo ratings yet

- Funamentals of Acct - II - Chapter 1 InventoriesDocument47 pagesFunamentals of Acct - II - Chapter 1 InventoriesibsaashekaNo ratings yet

- Kap 1 Workbook Se CH 1Document32 pagesKap 1 Workbook Se CH 1Zsadist20No ratings yet