Secondary Market

Secondary Market

Uploaded by

Kanchan GuptaCopyright:

Available Formats

Secondary Market

Secondary Market

Uploaded by

Kanchan GuptaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Secondary Market

Secondary Market

Uploaded by

Kanchan GuptaCopyright:

Available Formats

The secondary market, also called aftermarket, is the financial market where previously issued securities and financial

instruments such as stock, bonds, options, and futures are bought and sold. With primary issuances of securities or financial instruments, or the primary market, investors purchase these securities directly from issuers such as corporations issuing shares in an IPO or private placement, or directly from the federal government in the case of treasuries. After the initial issuance, investors can purchase from other investors in the secondary market. The secondary market for a variety of assets can vary from loans to stocks, from fragmented to centralized, and from illiquid to very liquid. The major stock exchanges are the most visible example of liquid secondary markets - in this case, for stocks of publicly traded companies. Exchanges such as the New York Stock Exchange, Nasdaq and the American Stock Exchange provide a centralized, liquid secondary market for the investors who own stocks that trade on those exchanges. Most bonds and structured products trade over the counter, or by phoning the bond desk of ones broker-dealer. Loans sometimes trade online using a Loan Exchange.

Functions

Secondary marketing is vital to an efficient and modern capital market. In the secondary market, securities are sold by and transferred from one investor or speculator to another. It is therefore important that the secondary market be highly liquid (originally, the only way to create this liquidity was for investors and speculators to meet at a fixed place regularly; this is how stock exchanges originated. As a general rule, the greater the number of investors that participate in a given marketplace, and the greater the centralization of that marketplace, the more liquid the market. Fundamentally, secondary markets mesh the investor's preference for liquidity (i.e., the investor's desire not to tie up his or her money for a long period of time, in case the investor needs it to deal with unforeseen circumstances) with the capital user's preference to be able to use the capital for an extended period of time. Accurate share price allocates scarce capital more efficiently when new projects are financed through a new primary market offering, but accuracy may also matter in the secondary market because: 1) price accuracy can reduce the agency costs of management, and make hostile takeover a less risky proposition and thus move capital into the hands of better managers, and 2) accurate share price aids the efficient allocation of debt finance whether debt offerings or institutional borrowing.

An intelligent investor in common stocks will do better in the secondary market than he will do buying new issues. The reason has to do with the way prices are set in each instance. The secondary market, which is periodically ruled by mass folly, is constantly setting a "clearing" price. No matter how foolish that price may be, it's what counts for

the holder of a stock or bond who needs or wishes to sell, of whom there are always going to be a few at any moment. In many instances, shares worth x in business value have sold in the market for 1/2 x or less. The new-issue market, on the other hand, is ruled by controlling stockholders and corporations, who can usually select the timing of offerings or, if the market looks unfavorable, can avoid an offering altogether. Understandably, these sellers are not going to offer any bargains, either by way of a public offering or in a negotiated transaction: It's rare you'll find x for 1/2 x here. Indeed, in the case of common-stock offerings, selling shareholders are often motivated to unload only when they feel the market is overpaying.

In April 2010, Bank of America sold a $1.9 billion portfolio of private equity fund interests to AXA Private Equity, representing one of the largest private equity secondary market transactions to date. The transaction involved a mature portfolio as approximately 60% of commitments had already been called down. It consisted of 90% buyout funds, of which 30% were considered large funds. In July 2010, Lexington Partners purchased of a portfolio of Citigroups proprietary investments in its funds of funds, mezzanine funds, feeder funds and co-investment funds. StepStone Group took over the management of funds. Public Sector Pension Investment Board sold over $1 billion of private equity fund stakes to CPP Investment Board in October 2010. It originally brought around $2 billion of fund interests to the market, but eventually decided to remove the least funded commitments included in the offering. Cogent Partners acted as intermediary for the transaction.

The secondary market known as stock market or stock exchange plays an equally important role in mobilising long-term funds by providing the necessary liquidity to holdings in shares and debentures. It provides a place where these securities can be encashed without any difficulty and delay. It is an organised market where shares, and debentures are traded regularly with high degree of transparency and security. In fact, an active secondary market facilitates the growth of primary market as the investors in the primary market are assured of a continuous market for liquidity of their holdings. The major players in the primary market are merchant bankers, mutual funds, financial institutions, and the individual investors; and in the secondary market you have all these and the stockbrokers who are members of the stock exchange who facilitate the trading. After having a brief idea about the primary market and secondary market let see the difference between them. 18.5 DISTINCTION BETWEEN PRIMARY MARKET AND SECONDARY MARKET The main points of distinction between the primary market and secondary market are as follows: 1. Function : While the main function of primary market is to raise long-term funds through fresh issue of securities, the main function of secondary market is to provide

continuous and ready market for the existing long-term securities. 2. Participants: While the major players in the primary market are financial institutions, mutual funds, underwriters and individual investors, the major players in secondary market are all of these and the stockbrokers who are members of the stock exchange. 3. Listing Requirement: While only those securities can be dealt within the secondary market, which have been approved for the purpose (listed), there is no such requirement in case of primary market. 4. Determination of prices: In case of primary market, the prices are determined by the management with due compliance with SEBI requirement for new issue of securities. But in case of secondary market, the price of the securities is determined by forces of demand and supply of the market and keeps on fluctuating

As indicated above, stock exchange is the term commonly used for a secondary market, which provide a place where different types of existing securities such as shares, debentures and bonds, government securities can be bought and sold on a regular basis. A stock exchange is generally organised as an association, a society or a company with a limited number of members. It is open only to these members who act as brokers for the buyers and sellers. The Securities Contract (Regulation) Act has defined stock exchange as an association, organisation or body of individuals, whether incorporated or not, established for the purpose of assisting, regulating and controlling business of buying, selling and dealing in securities. The main characteristics of a stock exchange are: 1. It is an organised market. 2. It provides a place where existing and approved securities can be bought and sold easily. 3. In a stock exchange, transactions take place between its members or their authorised agents. 4. All transactions are regulated by rules and by laws of the concerned stock exchange. 5. It makes complete information available to public in regard to prices and volume of transactions taking place every day. It may be noted that all securities are not permitted to be traded on a recognised stock exchange. It is allowed only in those securities (called listed securities) that have been duly approved for the purpose by the stock exchange authorities. The method of trading nowadays, however, is quite simple on account of the availability of on-line trading facility with the help of computers. It is also quite fast as it takes just a few minutes to strike a deal through the brokers who may be available close by. Similarly, on account of the system of scrip-less trading and rolling settlement, the delivery of securities and the payment of amount involved also take very little time, say, 2 days. FUNCTIONS OF A STOCK EXCHANGE The functions of stock exchange can be enumerated as follows: 1. Provides ready and continuous market: By providing a place where listed securities can be bought and sold regularly and conveniently, a stock exchange ensures a ready and continuous market for various shares, debentures, bonds and government securities. This lends a high degree of liquidity to holdings in these securities as the investor can encash their holdings as and when they want. 2. Provides information about prices and sales: A stock exchange maintains complete record of all transactions taking place in different securities every day and supplies regular information on their prices and sales volumes to press and other

media. In fact, now-a-days, you can get information about minute to minute movement in prices of selected shares on TV channels like CNBC, Zee News, NDTV and Headlines Today. This enables the investors in taking quick decisions on purchase and sale of securities in which they are interested. Not only that, such information helps them in ascertaining the trend in prices and the worth of their holdings. This enables them to seek bank loans, if required. 3. Provides safety to dealings and investment: Transactions on the stock exchange are conducted only amongst its members with adequate transparency and in strict conformity to its rules and regulations which include the procedure and timings of delivery and payment to be followed. This provides a high degree of safety to dealings at the stock exchange. There is little risk of loss on account of non-payment or nondelivery. Securities and Exchange Board of India (SEBI) also regulates the business in stock exchanges in India and the working of the stock brokers. Not only that, a stock exchange allows trading only in securities that have been listed with it; and for listing any security, it satisfies itself about the genuineness and soundness of the company and provides for disclosure of certain information on regular basis. Though this may not guarantee the soundness and profitability of the company, it does provide some assurance on their genuineness and enables them to keep track of their progress. 4. Helps in mobilisation of savings and capital formation: Efficient functioning of stock market creates a conducive climate for an active and growing primary market. Good performance and outlook for shares in the stock exchanges imparts buoyancy to the new issue market, which helps in mobilising savings for investment in industrial and commercial establishments. Not only that, the stock exchanges provide liquidity and profitability to dealings and investments in shares and debentures. It also educates people on where and how to invest their savings to get a fair return. This encourages the habit of saving, investment and risk-taking among the common people. Thus it helps mobilising surplus savings for investment in corporate and government securities and contributes to capital formation. 5. Barometer of economic and business conditions: Stock exchanges reflect the changing conditions of economic health of a country, as the shares prices are highly sensitive to changing economic, social and political conditions. It is observed that during the periods of economic prosperity, the share prices tend to rise. Conversely, prices tend to fall when there is economic stagnation and the business activities slow down as a result of depressions. Thus, the intensity of trading at stock exchanges and the corresponding rise on fall in the prices of securities reflects the investors assessment of the economic and business conditions in a country, and acts as the barometer which indicates the general conditions of the atmosphere of business. 6. Better Allocation of funds: As a result of stock market transactions, funds flow from the less profitable to more profitable enterprises and they avail of the greater potential for growth. Financial resources of the economy are thus better allocated.

ADVANTAGES OF STOCK EXCHANGES

(a) To the Companies (i) The companies whose securities have been listed on a stock exchange enjoy a better goodwill and credit-standing than other companies because they are supposed to be financially sound. (ii) The market for their securities is enlarged as the investors all over the world become aware of such securities and have an opportunity to invest (iii) As a result of enhanced goodwill and higher demand, the value of their securities increases and their bargaining power in collective ventures, mergers, etc. is enhanced. (iv) The companies have the convenience to decide upon the size, price and timing of the issue. (b) To the Investors: (i) The investors enjoy the ready availability of facility and convenience of buying

and selling the securities at will and at an opportune time. (ii) Because of the assured safety in dealings at the stock exchange the investors are free from any anxiety about the delivery and payment problems. (iii) Availability of regular information on prices of securities traded at the stock exchanges helps them in deciding on the timing of their purchase and sale. (iv) It becomes easier for them to raise loans from banks against their holdings in securities traded at the stock exchange because banks prefer them as collateral on account of their liquidity and convenient valuation. (c) To the Society (i) The availability of lucrative avenues of investment and the liquidity thereof induces people to save and invest in long-term securities. This leads to increased capital formation in the country. (ii) The facility for convenient purchase and sale of securities at the stock exchange provides support to new issue market. This helps in promotion and expansion of industrial activity, which in turn contributes, to increase in the rate of industrial growth. (iii) The Stock exchanges facilitate realisation of financial resources to more profitable and growing industrial units where investors can easily increase their investment substantially. (iv) The volume of activity at the stock exchanges and the movement of share prices reflect the changing economic health. Senior Secondary Notes 76 MODULE -4 Business Finance (v) Since government securities are also traded at the stock exchanges, the government borrowing is highly facilitated. The bonds issued by governments, electricity boards, municipal corporations and public sector undertakings (PSUs) are found to be on offer quite frequently and are generally successful. LIMITATIONS OF STOCK EXCHANGES Like any other institutions, the stock exchanges too have their limitations. One of the common evils associated with stock exchange operations is the excessive speculation. You know that speculation implies buying or selling securities to take advantage of price differential at different times. The speculators generally do not take or give delivery and pay or receive full payment. They settle their transactions just by paying the difference in prices. Normally, speculation is considered a healthy practice and is necessary for successful operation of stock exchange activity. But, when it becomes excessive, it leads to wide fluctuations in prices and various malpractices by the vested interests. In the process, genuine investors suffer and are driven out of the market. Another shortcoming of stock exchange operations is that security prices may fluctuate due to unpredictable political, social and economic factors as well as on account of rumours spread by interested parties. This makes it difficult to assess the movement of prices in future and build appropriate strategies for investment in securities. However, these days good amount of vigilance is exercised by stock exchange authorities and SEBI to control activities at the stock exchange and ensure their healthy functioning, about which you will study later.

18.8 SPECULATION IN STOCK EXCHANGES The buyers and sellers at the stock exchange undertake two types of operations, one for speculation and the other for investment. Those who buy securities primarily to earn a regular income from such investment and possibly make some long-term gain on account

of price rise in future are called investors. They take delivery of the securities and make full payment of the price. Such transactions are called investment transactions. But, when the securities are bought with the sole object of selling them in future at higher prices or these are sold now with the intention of buying at a lower price in future, are called speculation transactions. The main objective of such transactions is to take advantage of price differential at different times. The stock exchange also provides for settlement of such transactions even by receiving or paying, as the case may be, just the difference in prices. For example, Rashmi bought 200 shares of Moser Baer Ltd. at Rs. 210 per share and sold them at Rs. 235 per share. He does not take and give delivery of the shares but settles the transactions by receiving the difference in prices amounting to Rs. 5,000 minus brokerage. In another case, Mohit bought 200 shares of Seshasayee Papers Ltd. at Rs. 87 per share and sold them at Rs. 69 per share. He settles these transactions by simply paying the difference amounting to Rs. 3600 plus brokerage. However, now-a-days stock exchanges have a system of rolling settlement. Such facility is limited only to transactions of purchase and sale made on the same day, as no carry forward is allowed. 25x200 = 5000 18x200 = 3600 Business Studies 77 Notes MODULE -4 Business Finance Rolling Settlement: Earlier trading in the stock exchange was held face-to-face (called pit-trading) without the use of computers and the advanced computer software as it is today. In those times, transactions were settled (i.e., actual delivery of shares, through share certificates, by the seller and payment of money by the buyer) in the stock exchange, only on a fixed day of the week, say on a Saturday, or a Wednesday irrespective of which day of the week the shares were bought and sold. This was called Fixed Settlement. Today, with the electronic / computer based system of recording and carrying out of share transactions, stock exchanges go in for rolling settlement. That means, transaction are settled after a fixed number of days of the transaction rather than on a particular day of the week. For example, if a stock exchange goes in for T+2 days of rolling settlement, the transaction is settled within two working days of occurring of the transaction, T being the day of the transaction. In T+7 days of rolling settlement, the transaction is settled on the 7th day after the transaction. This is facilitated through electronic transfer of shares, through Dematerialised Account or Demat Account i.e., the share does not have a physical form of a paper document, but is a computerised record of a person holding a share, and through transfer of money electronically or through cheques payment is settled. Though speculation and investment are different in some respects, in practice it is difficult to say who is a genuine investor and who is a pure speculator. Sometimes even a person who has purchased the shares as a long-term investment may suddenly decide to sell to reap the benefit if the price of the share goes up too high or do it to avoid heavy loss if the prices starts declining steeply. But he cannot be called a speculator because his basic intention has been to invest. It is only when a persons basic intention is to take advantage of a change in prices, and not to invest, then the transaction may be termed as speculation. In strict technical terms, however, the transaction is regarded as speculative only if it is settled by receiving or paying the difference in prices without involving the delivery of securities. It is so because, in practice, it is quite difficult to ascertain the intention. Some people regard speculation as nothing but gambling and consider it as an evil. But it

is not true because while speculation is based on foresight and hard calculation, gambling is a kind of blind and reckless activity involving high degree of chance element. No only that, speculation is a legal activity duly recognised as a prerequisite for the success of stock exchange operations while gambling is regarded as an evil and a punishable activity. However, reckless speculation may take the form of gambling and should be avoided.

BULLS AND BEARS A bull market is associated with increasing investor confidence, and increased investing in anticipation of future price increases (capital gains). A bullish trend in the stock market often begins before the general economy shows clear signs of recovery.

Examples

A global bull market occurred in the 1980s and 1990s when the U.S. and many other stock markets rose

Bear market

A bear market is a general decline in the stock market over a period of time. It is a transition from high investor optimism to widespread investor fear and pessimism. According to The Vanguard Group, "While theres no agreed-upon definition of a bear market, one generally accepted measure is a price decline of 20% or more over at least a two-month period." It is sometimes referred to as "The Heifer Market" due to the paradox with the above subject.

Examples

A bear market followed the Wall Street Crash of 1929 and erased 89% (from 386 to 40) of the Dow Jones Industrial Average's market capitalization by July 1932, marking the start of the Great Depression. After regaining nearly 50% of its losses, a longer bear market from 1937 to 1942 occurred in which the market was again cut in half. Another long-term bear market occurred from about 1973 to 1982, encompassing the 1970s energy crisis and the high unemployment of the early 1980s. Yet another bear market occurred between March 2000 and October 2002. The most recent examples occurred between October 2007 and March 2009.

Secondary market trend

Secondary trends are short-term changes in price direction within a primary trend. The duration is a few weeks or a few months. One type of secondary market trend is called a market correction. A correction is a short term price decline of 5% to 20% or so. A correction is a downward movement that is not large enough to be a bear market (ex post).

Another type of secondary trend is called a bear market rally (sometimes called "sucker's rally" or "dead cat bounce") which consist of a market price increase of only 10% or 20% and then the prevailing, bear market trend resumes. Bear market rallies occurred in the Dow Jones index after the 1929 stock market crash leading down to the market bottom in 1932, and throughout the late 1960s and early 1970s. The Japanese Nikkei 225 has been typified by a number of bear market rallies since the late 1980s while experiencing an overall long-term downward trend.

HARSHAD MEHTA SCAM Through the second half of 1991 Mehta had earned the sobriquet of the Big Bull, because he was said to have started the bull run. On April 23, 1992, journalist Sucheta Dalal exposed Mehta's illegal methods in a column in The Times of India. Mehta was dipping illegally into the banking system to finance his buying. The authors explain: The crucial mechanism through which the scam was effected was the ready forward (RF) deal. The RF is in essence a secured short-term (typically 15day) loan from one bank to another. Crudely put, the bank lends against government securities just as a pawnbroker lends against jeweller. The borrowing bank actually sells the securities to the lending bank and buys them back at the end of the period of the loan, typically at a slightly higher price. It was this ready forward deal that Mehta and his accomplices used with great success to channel money from the banking system. A typical ready forward deal involved two banks brought together by a broker in lieu of a commission. The broker handles neither the cash nor the securities, though that wasnt the case in the lead-up to the scam. In this settlement process, deliveries of securities and payments were made through the broker. That is, the seller handed over the securities to the broker, who passed them to the buyer, while the buyer gave the cheque to the broker, who then made the payment to the seller. In this settlement process, the buyer and the seller might not even know whom they had traded with, either being known only to the broker. This the brokers could manage primarily because by now they had become market makers and had started trading on their account. To keep up a semblance of legality, they pretended to be undertaking the transactions on behalf of a bank. Another instrument used was the bank receipt (BR). In a ready forward deal, securities were not moved back and forth in actuality. Instead, the borrower, i.e., the seller of securities, gave the buyer of the securities a BR. As the authors write, a BR confirms the sale of securities. It acts as a receipt for the money received by the selling bank. Hence the name - bank receipt. It promises to deliver the securities to the buyer. It also states that in the mean time, the seller holds the securities in trust of the buyer. Having figured out his scheme, Mehta needed banks which issued fake BRs, or BRs not backed by any government securities. Two small and little known banks - the Bank of Karad (BOK) and the Metropolitan Co-operative Bank (MCB) - came in handy for this purpose. These banks were willing to

issue BRs as and when required, for a fee, the authors point out. Once these fake BRs were issued, they were passed on to other banks and the banks in turn gave money to Mehta, assuming that they were lending against government securities when this was not really the case. This money was used to drive up the prices of stocks in the stock market. When time came to return the money, the shares were sold for a profit and the BR was retired. The money due to the bank was returned. The game went on as long as the stock prices kept going up, and no one had a clue about Mehtas modus operandi. Once the scam was exposed, though, a lot of banks were left holding BRs which did not have any value - the banking system had been swindled of a whopping Rs 4,000 crore.

Secondary Market Instruments Futures options are an excellent way to trade the futures markets. Many new traders start by trading futures options instead of straight futures contracts. There is generally less risk and volatility when using options instead of futures. Actually, many professional traders only trade options. What are Futures Options? An option is the right, not the obligation, to buy or sell a futures contract at a designated strike price. For trading purposes, you buy options to bet on the price of a futures contract to go higher or lower. There are two main types of options - calls and puts. Calls You would buy a call option if you believe the underlying futures price will move higher. For example, if you expect corn futures to move higher, you will want to buy a corn call option. Puts You would buy a put option if you believe the underlying futures price will move lower. For example, if you expect soybean futures to move lower, you will want to buy a soybean put option. Premium You are obviously going to have to pay some kind of price when you buy an option. The term used for the price of an option is premium. You can think of the pricing of options as a bet. The bigger the long shot, the less expensive they will be. Oppositely, the more sure the bet is, the more expensive it will be. Contract Months (Time) Options have an expiration date, which means they only last for a certain period of time. When you buy an option, you cannot hold it forever. For example, a December corn call expires in late November. You will need to close the position before expiration. Generally, the more time you have on an option, the more expensive it will be. Strike Price This is the price at which you could buy or sell the underlying futures contract. For example, a December $3.50 corn call allows you to buy a December futures contract at $3.50 anytime before the option expires. Most traders do not convert options, they just close the option position and take the profits.

Example of Buying an Option: Lets say you expect the price of gold futures to move higher over the next 3-6 months. It is currently January, so you would probably buy an August gold call to give yourself enough time. Gold is currently trading at $590 per ounce. You expect the price to climb to $640 within 6 months. You purchase: 1 August $600 gold call at $15

1 = number of options you are buying August = Month of option contract $600 = strike price Gold = underlying futures contract Call = type of option (bet on price moving higher) $15 = premium ($1,500 is the price to buy - 100 ounces of gold x $15 = $1,500)

Stocks and Bonds What does it mean to own stock? Basically it means that a stock holder has a share in the company it holds stock in. In a sense the stockholders own a piece of the company that it has stock in. Stock shares are traded, bought and sold at a stock exchange such as the New York Stock Exchange which is the best known, but by no means the only stock exchange. Stocks are a type of security, Securities are instruments giving to their legal holders rights to money or other property. Securities include stocks, bonds, notes, mortgages, How does one get to own stock? Usually stock is obtained through a stock broker. Let's say you wish to own a piece of Toys R Us or Coca-Cola. You would call a stock broker and he would tell you how much a share in the company would be. He would then place an order for the stock for you. When the stock is purchased, the broker would keep a stock certificate that shows that you are the legal owner of the stock until you choose to sell it. What are the advantages of owning stock? One is that it allows the stock owner to share in the profits of a company. These profits come in the form of dividends, which are allocated according to how much stock one holds in the company. Of course one of the disadvantages is that one can lose money if a stock's price goes down. What makes stock prices go up and down? There are many reasons: how much profit or loss a company has, the time of year, good or bad publicity about the company, how the economy is doing in general, etc.. There are several different kinds of stock. Preferred stock is a type of stock in which the stockholder gets a certain percentage of dividends each year based on the profits of the company. Common stockholders get dividends based on the remainder of the profits after preferred stockholders have been paid their dividends. Another way to purchase stocks is through mutual funds. A mutual fund is an investment company that continually offers new shares and buys existing shares back at the request of the shareholder and uses its capital to invest in diversified securities of other companies. An investor puts money into a mutual fund and then the company invests the money on behalf of the investors. What are bonds and how do they differ from stocks? A bond is a certificate of debt issued by a government or corporation guaranteeing payment of the original investment plus interest by a specified future date. Basically one is making a loan to the government or corporation and gets paid a sum of money in the future for letting the government or corporation borrow the money. Bonds are one way the government raises money besides taxes

ECONOMY Rank

STOCK EXCHANGE Market Trade

Economy

Stock Exchange

Capitalization (USD Billions)

Value (USD Billions)

United States Europe

NYSE Euronext

15,970

19,813

United States Europe

NASDAQ OMX

4,931

13,439

Japan United Kingdom

Tokyo Stock Exchange

3,827

3,787

London Stock Exchange Shanghai Stock Exchange Hong Kong Stock Exchange Toronto Stock Exchange

3,613

2,741

China

2,717

4,496

Hong Kong Canada

2,711

1,496

2,170

1,368

India

Bombay Stock Exchange National Stock Exchange of India

1,631

258

India

1,596

801

ROLE OF SEBI

As part of economic reforms programme started in June 1991, the Government of India initiated several capital market reforms, which included the abolition of the office of the Controller of Capital Issues (CCI) and granting statutory recognition to Securities Exchange Board of India (SEBI) in 1992 for: (a) protecting the interest of investors in securities; (b) promoting the development of securities market; (c) regulating the securities market; and (d) matters connected there with or incidental thereto. SEBI has been vested with necessary powers concerning various aspects of capital market such as: (i) regulating the business in stock exchanges and any other securities market; (ii) registering and regulating the working of various intermediaries and mutual funds; (iii) promoting and regulating self regulatory organisations;

(iv) promoting investors education and training of intermediaries; (v) prohibiting insider trading and unfair trade practices; (vi) regulating substantial acquisition of shares and take over of companies; (vii) calling for information, undertaking inspection, conducting inquiries and audit of stock exchanges, and intermediaries and self regulation organisations in the stock market; and (viii) performing such functions and exercising such powers under the provisions of the Capital Issues (Control) Act, 1947 and the Securities Contracts (Regulation) Act, 1956 as may be delegated to it by the Central Government. As part of its efforts to protect investors interests, SEBI has initiated many primary market reforms, which include improved disclosure standards in public issue documents, introduction of prudential norms and simplification of issue procedures. Companies are now required to disclose all material facts and risk factors associated with their projects while making public issue. All issue documents are to be vetted by SEBI to ensure that the disclosures are not only adequate but also authentic and accurate. SEBI has also introduced a code of advertisement for public issues for ensuring fair and truthful disclosures. Merchant bankers and all mutual funds including UTI have been brought under the regulatory framework of SEBI. A code of conduct has been issued specifying a high degree of responsibility towards investors in respect of pricing and premium fixation of issues. To reduce cost of issue, underwriting of issues has been made optional subject to the condition that the issue is not under-subscribed. In case the issue is under-subscribed i.e., it was not able to collect 90% of the amount offered to the public, the entire amount would be refunded to the investors. The practice of preferential allotment of shares to promoters at prices unrelated to the prevailing market prices has been stopped and private placements have been made more restrictive. All primary issues have now to be made through depository mode. The initial public offers (IPOs) can go for book building for which the price band and issue size have to be disclosed. Companies with dematerialised shares can alter the par value as and when they so desire. As for measures in the secondary market, it should be noted that all statutory powers to regulate stock exchanges under the Securities Contracts (Regulation) Act have now been vested with SEBI through the passage of securities law (Amendment) Act in 1995. SEBI has duly notified rules and a code of conduct to regulate the activities of intermediaries in the securities market and then registration in the securities market and then registration with SEBI is made compulsory. It has issued guidelines for composition of the governing bodies of stock exchanges so as to include more public representatives. Corporate membership has also been introduced at the stock exchanges. It has notified the regulations on insider trading to protect and preserve the integrity of stock markets and issued guidelines for mergers and acquisitions. SEBI has constantly reviewed the traditional trading systems of Indian stock exchanges and tried to simplify the procedure, achieve transparency in transactions and reduce their costs. To prevent excessive speculations and volatility in the market, it has done away with badla system, and introduced rolling settlement and trading in derivatives. All stock exchanges have been advised to set-up clearing corporation /settlement guarantee fund to ensure timely settlements. SEBI organises training programmes

for intermediaries in the securities market and conferences for investor education all over the country from time to time.

You might also like

- Perceptual MappingDocument31 pagesPerceptual MappingPooja PoddarNo ratings yet

- Self Regulation in Capital MarketsDocument12 pagesSelf Regulation in Capital MarketsFrancis Njihia Kaburu0% (1)

- Money MarketDocument37 pagesMoney MarketShaishav BhesaniaNo ratings yet

- Ethical Issue in BusinessDocument6 pagesEthical Issue in BusinessJudil BanastaoNo ratings yet

- Exchange Rate Management SystemsDocument3 pagesExchange Rate Management SystemsMonalisa PadhyNo ratings yet

- Revision 1 ST TermDocument33 pagesRevision 1 ST Term_dinashNo ratings yet

- Features of Money MarketDocument3 pagesFeatures of Money MarketAnurita MajumdarNo ratings yet

- Good Governance (Chapter 4)Document7 pagesGood Governance (Chapter 4)Bobby GuetanNo ratings yet

- Assignment 2 - Recruitment in A Changing Internal Labor MarketDocument8 pagesAssignment 2 - Recruitment in A Changing Internal Labor MarketMeriem DaoudiNo ratings yet

- Functions of InsuranceDocument1 pageFunctions of InsuranceJenifer MaryNo ratings yet

- System Design in POM 1Document11 pagesSystem Design in POM 1John Patrick Lazaro AndresNo ratings yet

- Chapter 1 - Review of Accounting ProcessDocument13 pagesChapter 1 - Review of Accounting ProcessJam100% (1)

- What Is TaxationDocument2 pagesWhat Is TaxationJason AmpongNo ratings yet

- Chapter 11: The Capital MarketDocument5 pagesChapter 11: The Capital MarketMike RajasNo ratings yet

- Explain The Relationship Between Risk and ReturnDocument2 pagesExplain The Relationship Between Risk and ReturnKristine Claire PangandoyonNo ratings yet

- Investement Analysis and Portfolio Management Chapter 5Document15 pagesInvestement Analysis and Portfolio Management Chapter 5Oumer ShaffiNo ratings yet

- Security Valuation: Meaning and FactorsDocument7 pagesSecurity Valuation: Meaning and FactorsRohit BajpaiNo ratings yet

- LESSON 1 Financial MarketDocument7 pagesLESSON 1 Financial MarketJames Deo CruzNo ratings yet

- Difference Between A Functional Manager and A Project ManagerDocument7 pagesDifference Between A Functional Manager and A Project ManageriftikharNo ratings yet

- Financial Management - Chapter 9Document17 pagesFinancial Management - Chapter 9mechidreamNo ratings yet

- Explain What Corruption IsDocument6 pagesExplain What Corruption IsMelody BTOB100% (1)

- M1 - Introduction To Valuation HandoutDocument6 pagesM1 - Introduction To Valuation HandoutPrince LeeNo ratings yet

- Geceth Module ViDocument15 pagesGeceth Module ViChristopher Apani100% (1)

- Differences Between Ordinary and Preference SharesDocument2 pagesDifferences Between Ordinary and Preference SharesrabiatussalehaNo ratings yet

- Pure CompetitionDocument7 pagesPure CompetitionEricka TorresNo ratings yet

- MFI Unit 01Document13 pagesMFI Unit 01Shreejan PandeyNo ratings yet

- Twenty-Three Investment CompaniesDocument17 pagesTwenty-Three Investment CompaniesMahendra SinghNo ratings yet

- Performance Evaluation SystemDocument8 pagesPerformance Evaluation SystemMhyr Pielago CambaNo ratings yet

- Master in Business Administration Mba 308 - Financial ManagementDocument5 pagesMaster in Business Administration Mba 308 - Financial ManagementJhaydiel JacutanNo ratings yet

- Tuto BAVDocument12 pagesTuto BAVVivianNo ratings yet

- FM 02-Financial Markets and Institutions The Process of Capital AllocationDocument3 pagesFM 02-Financial Markets and Institutions The Process of Capital AllocationJPIA Scholastica DLSPNo ratings yet

- Module Two: Theories of International Trade: Part OneDocument16 pagesModule Two: Theories of International Trade: Part OneitsmenatoyNo ratings yet

- Activity 7Document2 pagesActivity 7Alejandro Missael ZavalaNo ratings yet

- BM JcoDocument4 pagesBM JcoHannah GarciaNo ratings yet

- Ability To Pay TheoryDocument1 pageAbility To Pay TheoryMuhammadFiazNo ratings yet

- Foreign Banks: Ben Mathews T4 MbaDocument11 pagesForeign Banks: Ben Mathews T4 MbaBen MathewsNo ratings yet

- GE8 - Ethics (First Assignment)Document8 pagesGE8 - Ethics (First Assignment)Francine Alyssa GaliciaNo ratings yet

- Chapter 8 Lecture NotesDocument7 pagesChapter 8 Lecture NotesnightdazeNo ratings yet

- Types of Monetary StandardsDocument7 pagesTypes of Monetary StandardsMadel UreraNo ratings yet

- Unit III Manufacturing ConcernDocument12 pagesUnit III Manufacturing ConcernAlezandra SantelicesNo ratings yet

- A, B, C - Specialised Accounting - 1Document12 pagesA, B, C - Specialised Accounting - 1محمود احمدNo ratings yet

- Risk Return Trade OffDocument13 pagesRisk Return Trade OffNeelabh KumarNo ratings yet

- Global BusinessDocument2 pagesGlobal BusinessJerica DacanayNo ratings yet

- Foreign Exchange and Foreign Exchange MarketDocument28 pagesForeign Exchange and Foreign Exchange MarketKubalyenda SilajiNo ratings yet

- Notes On Consumer BehaviorDocument45 pagesNotes On Consumer Behaviorswati kandpalNo ratings yet

- Chapter 7 Sources of Short Term CapitalDocument30 pagesChapter 7 Sources of Short Term CapitalAlkhris AustriaNo ratings yet

- FINMNN1 Chapter 4 Short Term Financial PlanningDocument16 pagesFINMNN1 Chapter 4 Short Term Financial Planningkissmoon732No ratings yet

- What Is Financial Statement AnalysisDocument4 pagesWhat Is Financial Statement AnalysisDivvy JhaNo ratings yet

- What Are The Two Major Perceptions of Time, and How Does Each Affect International Business? AnswerDocument2 pagesWhat Are The Two Major Perceptions of Time, and How Does Each Affect International Business? AnswerVikram KumarNo ratings yet

- Chapter 1 Capital MarketsDocument7 pagesChapter 1 Capital MarketssayNo ratings yet

- Managing Retailing, Wholesaling and LogisticsDocument27 pagesManaging Retailing, Wholesaling and LogisticsMary Rose Virtucio100% (1)

- Law of Supply and DemandDocument2 pagesLaw of Supply and DemandDONNA MAE FUENTESNo ratings yet

- Lesson 3 Part 1 Internal and External InstitutionsDocument22 pagesLesson 3 Part 1 Internal and External InstitutionsDeanne GuintoNo ratings yet

- Accounting For Corporation FinalDocument34 pagesAccounting For Corporation FinalHarold Kent MendozaNo ratings yet

- ECC2Document2 pagesECC2Dana IsabelleNo ratings yet

- Session 4 Money and Monetary PolicyDocument50 pagesSession 4 Money and Monetary PolicyBiswajit PrustyNo ratings yet

- Recognizing A Firm's Intellectual Assets: Moving Beyond A Firm's Tangible ResourcesDocument38 pagesRecognizing A Firm's Intellectual Assets: Moving Beyond A Firm's Tangible ResourcesshuvoertizaNo ratings yet

- Lesson: 7 Cost of CapitalDocument22 pagesLesson: 7 Cost of CapitalEshaan ChadhaNo ratings yet

- Accounting: Basic Terminologies in AccountingDocument24 pagesAccounting: Basic Terminologies in AccountingRoshan JhaNo ratings yet

- Fundamental Analysis in SAPMDocument6 pagesFundamental Analysis in SAPMRoshan VargheseNo ratings yet

- Financial Market TopicDocument31 pagesFinancial Market TopicGautam MahtoNo ratings yet

- STRG - Capacity MGTDocument20 pagesSTRG - Capacity MGTKanchan GuptaNo ratings yet

- Legal Environment of Business: Principle of Insurance, & IRDA, "Should Insurer Compensate Loss From Riots?"Document33 pagesLegal Environment of Business: Principle of Insurance, & IRDA, "Should Insurer Compensate Loss From Riots?"Kanchan GuptaNo ratings yet

- Relation Between PDTN & CostsDocument2 pagesRelation Between PDTN & CostsKanchan GuptaNo ratings yet

- Turnaround ManagemenDocument81 pagesTurnaround ManagemenKanchan GuptaNo ratings yet

- Taj HRM Case On TPPDocument15 pagesTaj HRM Case On TPPKanchan Gupta0% (1)

- Managerial Economics: Utility TheoryDocument45 pagesManagerial Economics: Utility TheoryKanchan GuptaNo ratings yet

- A Cleaner Today... A Better TomorrowDocument3 pagesA Cleaner Today... A Better TomorrowKanchan GuptaNo ratings yet

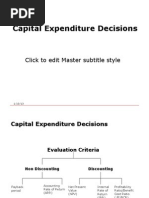

- Capital Exp Decisions1Document24 pagesCapital Exp Decisions1Kanchan GuptaNo ratings yet

- Doston SeDocument3 pagesDoston SeKanchan GuptaNo ratings yet

- Leadership Ethics: Prof. Aparna KanchanDocument28 pagesLeadership Ethics: Prof. Aparna KanchanKanchan GuptaNo ratings yet

- I Lie Awake at Night See Things in Black and White With LyricsDocument3 pagesI Lie Awake at Night See Things in Black and White With LyricsKanchan GuptaNo ratings yet

- Exam Schedule Sem-IDocument1 pageExam Schedule Sem-IKanchan GuptaNo ratings yet

- Customer Satisfaction On VodafoneDocument86 pagesCustomer Satisfaction On VodafoneKanchan GuptaNo ratings yet

- CourseDocument17 pagesCourseKushwahaBrijeshNo ratings yet

- Hedging Performance of Protective Puts and Covered Calls Portfolio: A Study of NSE NIFTY OptionsDocument27 pagesHedging Performance of Protective Puts and Covered Calls Portfolio: A Study of NSE NIFTY OptionsRahul PinnamaneniNo ratings yet

- Applying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured EntitiesDocument24 pagesApplying IFRS: IFRS 12 - Example Disclosures For Interests in Unconsolidated Structured Entitiesnicolai aquino0% (1)

- Finance 1 Case Study Sample 2013Document7 pagesFinance 1 Case Study Sample 2013giorgiaNo ratings yet

- Abhishek Lahiri ResumeDocument4 pagesAbhishek Lahiri ResumejaspreetsaroraNo ratings yet

- Implementation of The Recommendations of Sodhani CommitteeDocument2 pagesImplementation of The Recommendations of Sodhani Committeekrissh_87No ratings yet

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- 4 Term Structure Theory of Interest RateDocument2 pages4 Term Structure Theory of Interest RateHusnul IradatiNo ratings yet

- BSE - (Bombay Stock Exchange)Document15 pagesBSE - (Bombay Stock Exchange)Karanpreet SinghNo ratings yet

- Perception of Derivatives at SMC Investment Project ReportDocument108 pagesPerception of Derivatives at SMC Investment Project ReportBabasab Patil (Karrisatte)No ratings yet

- AGEAS DistributionDocument13 pagesAGEAS Distributionarnab.for.ever9439No ratings yet

- Testbank - Chapter 19Document2 pagesTestbank - Chapter 19naztig_017No ratings yet

- Seminar 3 - SolutionsDocument13 pagesSeminar 3 - SolutionsDavidBudinasNo ratings yet

- Andhra BankDocument1 pageAndhra BankNagur PrasadNo ratings yet

- Case Study-IcmrDocument7 pagesCase Study-IcmrAsif ShaikNo ratings yet

- Financial Markets MmsDocument202 pagesFinancial Markets MmsJigar ModyNo ratings yet

- Crude Oil - Gold DataDocument33 pagesCrude Oil - Gold DataJocelyn TanNo ratings yet

- Tanishq - Retail StrategiesDocument19 pagesTanishq - Retail StrategiesGurleen KaurNo ratings yet

- Unit 1 - Principles of MarketingDocument29 pagesUnit 1 - Principles of MarketingDuval Pearson100% (1)

- SWOTDocument4 pagesSWOTvinneNo ratings yet

- Depository ServicesDocument15 pagesDepository ServicesNaga Mani MeruguNo ratings yet

- International Accounting Chap 006Document39 pagesInternational Accounting Chap 006ChuckNo ratings yet

- Letter ShareholdersDocument7 pagesLetter ShareholdersRich0087No ratings yet

- ch011 IndDocument16 pagesch011 IndAry Setyastu Jatmika DwihartantaNo ratings yet

- The Evolution of Relationship MarketingDocument9 pagesThe Evolution of Relationship MarketingPagla HowaNo ratings yet

- A Study of Consumer Behaviour in Relation To Insurance Products in IDBI Federal Life Insurance CoDocument9 pagesA Study of Consumer Behaviour in Relation To Insurance Products in IDBI Federal Life Insurance CoAshu AgarwalNo ratings yet

- Pricing Issues in Channel ManagementDocument8 pagesPricing Issues in Channel Managementavi6192No ratings yet

- OS at Hedge EquitiesDocument46 pagesOS at Hedge EquitiesEby JoseNo ratings yet