Statement of Accounts - 053243181

Statement of Accounts - 053243181

Uploaded by

Gaurav SongraCopyright:

Available Formats

Statement of Accounts - 053243181

Statement of Accounts - 053243181

Uploaded by

Gaurav SongraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Statement of Accounts - 053243181

Statement of Accounts - 053243181

Uploaded by

Gaurav SongraCopyright:

Available Formats

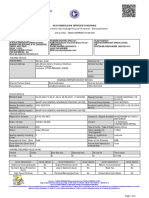

ACCOUNT STATEMENT HOME

Generated Electronically as on 08 May, 2023

GAURAV KUMAR

S O Wazir Singh 48,dhanana 1 Dhanana 52 Bhiwani,,bhiwani,bhiwani

Bhiwani

Bhiwani - 127031

708-238-9508

Summary of Loan Account

A/C No Products EMI Amount Remaining EMI(s) Principal Outstanding EMI(s) Overdue Charges Overdue

111080875 Personal Loan 2,837 11 27,763 0 0

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

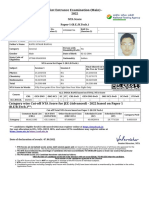

PERSONAL LOAN HOME

LOAN EMI PAYMENTS & CHARGES

A/C No 111080875 EMI Amount ` 2,837.00 Last Payment Date 01 May 2023

Loan Amount ` 30,000.00 EMI Start Month May 2023 Last Payment Amount ` 2,837.00

Net Tenure 12 Months EMI End Month April 2024 Payment Mode Others

Gross Tenure 12 Months EMI Due On 05 of every month EMI Overdue ` 0.00

STATUS Active Remaining EMI(s) 11 Bounce Charges Overdue ` 0.00

Disbursed Date 15 Apr, 2023 Penalty Charges Overdue ` 0.00

Other charges ` 0.00

Unadjusted Payments ` 0.00

PAY

Transaction Details

May 2023

Date Particular Remark Debit Credit

05-05-2023 Due For Instalment 1 - 2,837.00 0.00

05-05-2023 Amount Adjusted - 2,837.00 2,837.00

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

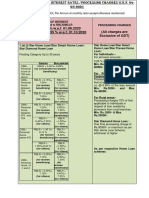

ACCOUNT STATEMENT HOME

Generated Electronically as on 08 May, 2023

Products/Type of charges Personal Loan

EMI Bounce charges per presentation* 400

Late payment/Penal charges/ Default interest/Overdue (per month) 2% of the unpaid EMI or Rs 300 whichever is higher

Cheque Swap charges (per swap)* 500

10000 within 30 days of disbursement or 1st EMI presentation whichever is

Cancellation & Rebooking charges earlier. Post 30 days or 1st EMI presentation request for cancellation will be

treated as foreclosure

Foreclosure / Prepayment charges* 5% of principle outstanding amount

Loan re scheduling charges (per re scheduling) NA

Duplicate No Objection Certificate Issuance Charges* 500

Physical Repayment Schedule * 500

Physical Statement of Account* 500

Document retrieval charges (per retrieval)* 500

Stamping Charges As per actuals

Processing fees Up to 3.5% of the total loan amount

List of Documents NA

Part Payment charges Part Payment is not allowed

Initial Money Deposit/ Application Fees (Non-refundable) NA

EBC Replacement Fee (if EBC Applicable)

Easy Buy Card Replacement Fee (If Easy Buy Card Applicable)

EBC & Push Card fee(if applicable)

EMI Pickup/ Collection Charges* 350

Admin Charges (If Applicable)

Pre EMI

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

ACCOUNT STATEMENT HOME

Generated Electronically as on 08 May, 2023

Products/Type of charges Personal Loan

Security Post Dated Cheque Waiver

Legal/Collections/ Repossession & Incidental Charges

PDD charges

Valuation Charges (If applicable)

Admin Fee (if applicable)

Other Charges (if applicable)

Valuation Charges (Used Tractor)

*Charges above are exclusive of GST

Please note

1) First Presentation will be done on the 2nd or 5th each month. Kindly ensure your account is funded with sufficient funds by 1st or 4th each month to

avoid levy of charges

2) If the EMI for the month bounces and payment against the same is not received in the same month, late payment charges will be applicable. These will

be charged every month on a recurring basis till the payment is received

3) Above charges are exclusive of GST

4) Non-payment of any of the charges levied will be reported to the Credit information company (including CIBIL) and will affect the credit score.

5) * incase a company, firm, etc. is a part of the loan structure; foreclosure charges/ penalty/levy can be levied as stated in the sanction conditions will be

Applicable.

6) Schedule of charges are subject to change as per company's discretion from time to time. The company reserves the right to introduce any new charges

or fees, as it may deem appropriate. Please visit "www.idfcfirstbank.com" to view the updated loan charges.

* To know principal outstanding for loan against property / home loans please get in touch with our customer service please call 1860-258-2000

Please note that a charge of Rs 400 will be levied against your account in case of EMI bouncing due to insufficient balance. Please maintain sufficient

balance in your account by 1st of every month to avoid EMI Bounce charges. A second attempt to recover EMI will be made 2-3 working days after the first

presentation of every month. If sufficient balance is not maintained by this second attempt, a further bounce charge of Rs 400 will be levied. Please also

note that non-payment of EMI within the calendar month will result in a penal charge of 2% of the unpaid EMI or Rs 300 whichever is higher. For any

clarifications of charges applicable to your account, consult our schedule of charges.

All charges mentioned in the statement are exclusive of GST. GST will be charged as per the applicable rules and regulations.

DISCLAIMER: This is a system generated Account Statement and does not require signature. In case of any discrepancy in this Account Statement, please

call 1860-258-2000 or visit nearest IDFC FIRST Bank branch within 10 (TEN) days from the date of last entry made in this statement, failing which, this

Account Statement will be deemed to be accepted by you (the borrower).

Visit us at Call us on Download our app

www.idfcfirstbank.com 1860-258-2000

You might also like

- SEMA Accessory Opportunity Report Top Cars and TrucksDocument86 pagesSEMA Accessory Opportunity Report Top Cars and Trucksgirish_patki100% (1)

- Air Ticket Ixl To DelDocument1 pageAir Ticket Ixl To DelNEW JERSEY ACADEMYNo ratings yet

- Foreclosure Letter - 20 - 49 - 45Document3 pagesForeclosure Letter - 20 - 49 - 45Suman KumarNo ratings yet

- Loan Foreclosure LetterDocument3 pagesLoan Foreclosure LetterBabu BNo ratings yet

- Your Reliance Communications Bill: Summary of Current Charges Amount (RS.) 1. Monthly Rental 500.00 2. Taxes 51.50Document2 pagesYour Reliance Communications Bill: Summary of Current Charges Amount (RS.) 1. Monthly Rental 500.00 2. Taxes 51.50Vel MuruganNo ratings yet

- Ict and Ict ToolDocument1 pageIct and Ict ToolJatin SinghNo ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoRajesh KumarNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryRavella VenkatakrishnaNo ratings yet

- Batch Sequence No.: वदेश मं ालय भारत सरकार Ministry of External Affairs, Government of India Online Application ReceiptDocument3 pagesBatch Sequence No.: वदेश मं ालय भारत सरकार Ministry of External Affairs, Government of India Online Application ReceiptBhadrasahi Cement Casting IndustriesNo ratings yet

- Foreclosure 12 24 05Document3 pagesForeclosure 12 24 05Sunil LaygudeNo ratings yet

- InvoiceDocument2 pagesInvoiceWinNo ratings yet

- Your Reliance Netconnect+ No. 9341894875: Madhav ManiDocument4 pagesYour Reliance Netconnect+ No. 9341894875: Madhav Maniamarjith1341No ratings yet

- PAS 7 Statement of Cash FlowsDocument10 pagesPAS 7 Statement of Cash Flowsjan petosilNo ratings yet

- (Mìü™Èþ Ë$Ï Ððþ$$™Èþ Ðþíï Ç #Ë$ Çüææÿ$ Êr$Ï (Ç Çü$ ™èþ Béèjë$ Ðþíï Èþðèþëíü Èþ Ç NÇ Ððþ$$™Èþ Væüyæþ$Ðèþ# ™óþDocument6 pages(Mìü™Èþ Ë$Ï Ððþ$$™Èþ Ðþíï Ç #Ë$ Çüææÿ$ Êr$Ï (Ç Çü$ ™èþ Béèjë$ Ðþíï Èþðèþëíü Èþ Ç NÇ Ððþ$$™Èþ Væüyæþ$Ðèþ# ™óþGurumurthy GodlaveetiNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillUgender SingarapuNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument3 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDIGITAL ZONENo ratings yet

- (Ddau Am (E: DelhiDocument5 pages(Ddau Am (E: Delhikashyap8291No ratings yet

- Jan. 01, 2023 Jan. 03, 2023: Hotel Confirmation VoucherDocument3 pagesJan. 01, 2023 Jan. 03, 2023: Hotel Confirmation VouchermugunthanNo ratings yet

- 1.11091338 - 12 Mar 2013Document5 pages1.11091338 - 12 Mar 2013Deepak KumarNo ratings yet

- Account Statement: Folio No.: 18220401 / 43Document4 pagesAccount Statement: Folio No.: 18220401 / 43Shweta RaniNo ratings yet

- Mitc - Blank-Format - SampleDocument3 pagesMitc - Blank-Format - SampleRavi yadavNo ratings yet

- Statement of Account For 405dpfip400747: Bajaj Finance LimitedDocument3 pagesStatement of Account For 405dpfip400747: Bajaj Finance Limitedletsdraw 2010No ratings yet

- Manappuram Finance Limited: SR - NoDocument5 pagesManappuram Finance Limited: SR - NoMohan PvdvrNo ratings yet

- EMS ResultDocument2 pagesEMS ResultSmeeta AralikattiNo ratings yet

- PolicySoftCopy 464137756Document3 pagesPolicySoftCopy 464137756IndyNo ratings yet

- Jee Mains AmanDocument1 pageJee Mains AmanAman BansalNo ratings yet

- Thomson Larger TV Installation and Demo: Grand Total 1000.00Document1 pageThomson Larger TV Installation and Demo: Grand Total 1000.00HARIHARAN SSNo ratings yet

- (Ddau DV© - MZ Ewëh$ Am (EDocument14 pages(Ddau DV© - MZ Ewëh$ Am (EAnonymous AiaBparZNo ratings yet

- Ëêüãüoæ Üåóüá Ñü Aýh Ìwüùüá: Summary of ChargesDocument10 pagesËêüãüoæ Üåóüá Ñü Aýh Ìwüùüá: Summary of ChargeshanumantyadavNo ratings yet

- Your Reliance Communications BillDocument2 pagesYour Reliance Communications BillRajesh UpadhyayNo ratings yet

- About BlankDocument2 pagesAbout Blankसंग्रामसिंह जाखलेकर पाटीलNo ratings yet

- Application FormDocument2 pagesApplication FormShubham JoshiNo ratings yet

- Ilovepdf Merged PDFDocument7 pagesIlovepdf Merged PDFVijay UNo ratings yet

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDocument3 pagesवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment Receiptdream onlineNo ratings yet

- Appointment RecieptDocument3 pagesAppointment Reciept7 A Anushka Mishra 26No ratings yet

- Information For StudentsDocument5 pagesInformation For StudentsRohitashwa NigamNo ratings yet

- Summary of ChargesDocument6 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- DBTR00610980722 00Document2 pagesDBTR00610980722 00zayd sheikhNo ratings yet

- Appointment RecieptDocument3 pagesAppointment RecieptSunita AgarwalNo ratings yet

- P ¡Cs¡e : Your Reliance Communications BillDocument2 pagesP ¡Cs¡e : Your Reliance Communications BillKarthick KumarNo ratings yet

- Acknowledgement 1647346050386Document4 pagesAcknowledgement 1647346050386Admin LoginNo ratings yet

- GhonjiDocument3 pagesGhonjiaraban datesNo ratings yet

- Renewal Notice - Tw-AnilagrDocument2 pagesRenewal Notice - Tw-AnilagrRakesh VermaNo ratings yet

- Published GeM Bidding 3288055 - (2) 2022 03 29 03 - 15 - 26Document7 pagesPublished GeM Bidding 3288055 - (2) 2022 03 29 03 - 15 - 26bhimdiptiNo ratings yet

- Ogl 230231660900898542Document5 pagesOgl 230231660900898542Manohar NMNo ratings yet

- Ogl 237761675670575919Document5 pagesOgl 237761675670575919Rajesh KumarNo ratings yet

- Form PDF 494190400281221Document8 pagesForm PDF 494190400281221Suprava MishraNo ratings yet

- Gaana Plus Subscription - 3 Months: Grand Total 0.00Document3 pagesGaana Plus Subscription - 3 Months: Grand Total 0.00Mahin LaskarNo ratings yet

- Account Statement: Folio No.: 20087663 / 07Document3 pagesAccount Statement: Folio No.: 20087663 / 07Prakash SayareNo ratings yet

- Aadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryDocument4 pagesAadhaar Update Form: Aadhaar Enrolment Is Free & VoluntaryRahulNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesRakesh NegiNo ratings yet

- Consolidated Premium Paid STMT 2019-2020Document1 pageConsolidated Premium Paid STMT 2019-2020CHELLASWAMY RAMASWAMYNo ratings yet

- Biodata: 1. Personal DetailsDocument2 pagesBiodata: 1. Personal DetailsPRAKASH CHAND DWIWEDINo ratings yet

- SOAL SMP KELAS 7 Semester 1 Materi Introduction-DikonversiDocument8 pagesSOAL SMP KELAS 7 Semester 1 Materi Introduction-DikonversiHilma RahmiNo ratings yet

- Subhajit BarmanDocument5 pagesSubhajit BarmanMahammad Roshan JamalNo ratings yet

- Appointment Reciept SHDocument3 pagesAppointment Reciept SHsam995995No ratings yet

- Jonel Sanchez TixDocument3 pagesJonel Sanchez TixGabrielle AlikNo ratings yet

- Summary of ChargesDocument8 pagesSummary of ChargesShailendra DwiwediNo ratings yet

- Other Sources Numerical SheetDocument5 pagesOther Sources Numerical SheetDisha GuptaNo ratings yet

- Statement of Account - 81465036 - 015941Document4 pagesStatement of Account - 81465036 - 015941krishnamondal6261No ratings yet

- CurrentDocument12 pagesCurrentAnthony CabonceNo ratings yet

- CHP 1Document22 pagesCHP 1David LiuNo ratings yet

- Demystifying Digital Lending PDFDocument44 pagesDemystifying Digital Lending PDFHitesh DhaddhaNo ratings yet

- Bank CRG ScoreSheetDocument3 pagesBank CRG ScoreSheetMd. Zubaer100% (1)

- Navigating The Loan Workout Maze - Commercial ObserverDocument1 pageNavigating The Loan Workout Maze - Commercial ObserverRobynNo ratings yet

- Assgmt1 2 ProbDocument14 pagesAssgmt1 2 ProbSyurga Fathonah0% (2)

- RA 7279 Urban Development and Housing Act (UDHA) of 1992Document15 pagesRA 7279 Urban Development and Housing Act (UDHA) of 1992RoselynGutangBartoloNo ratings yet

- Priyanka RajputDocument48 pagesPriyanka RajputNitinAgnihotriNo ratings yet

- Prospectus 375 Park AvenueDocument321 pagesProspectus 375 Park AvenueJagadeesh YathirajulaNo ratings yet

- Prudential Regulations For Corporate /commercial Banking: (Risk Management, Corporate Governance and Operations)Document269 pagesPrudential Regulations For Corporate /commercial Banking: (Risk Management, Corporate Governance and Operations)hasan_siddiqui_15No ratings yet

- Case Study 1 - Sullivan Ford Auto WorldDocument10 pagesCase Study 1 - Sullivan Ford Auto WorldDenmark David Gaspar NatanNo ratings yet

- Swati 2022Document84 pagesSwati 2022Anil kadamNo ratings yet

- Case Digest - Rehabilitation Finance Corporation V CA, Estelito Madrid, Jesus AnduizaDocument2 pagesCase Digest - Rehabilitation Finance Corporation V CA, Estelito Madrid, Jesus AnduizaEllie Yson80% (5)

- Account Executive in Denver CO Resume Patrick PurcellDocument3 pagesAccount Executive in Denver CO Resume Patrick PurcellPatrickPurcellNo ratings yet

- RBI Format ROI PCDocument8 pagesRBI Format ROI PCom vermaNo ratings yet

- Baroda Home LoanDocument31 pagesBaroda Home LoanRajkot academyNo ratings yet

- ApartmentMarketReport Jakarta 1Q2014Document11 pagesApartmentMarketReport Jakarta 1Q2014Ahmad So MadNo ratings yet

- NON ABM BusMath Midterm 9 CopiesDocument13 pagesNON ABM BusMath Midterm 9 CopiesAnthony John BrionesNo ratings yet

- Singson 99 104 Case DigestDocument6 pagesSingson 99 104 Case DigestTriciaNo ratings yet

- Banco Filipino v. CADocument7 pagesBanco Filipino v. CAJui Aquino ProvidoNo ratings yet

- HudhandbookDocument413 pagesHudhandbookjbydoNo ratings yet

- Plot Allotment Regulations, 2018Document15 pagesPlot Allotment Regulations, 2018Usama JadoonNo ratings yet

- ATP BAR Qs 1990-2015Document6 pagesATP BAR Qs 1990-2015Edcarl CagandahanNo ratings yet

- Agriland Funding: Made By:-Pinki Gaur Sapna YadavDocument9 pagesAgriland Funding: Made By:-Pinki Gaur Sapna YadavPuja GaurNo ratings yet

- Giacobbe Indictment FiledDocument32 pagesGiacobbe Indictment FiledWXXI NewsNo ratings yet

- Final Project SBI ProductDocument56 pagesFinal Project SBI Productkunal hajareNo ratings yet

- Cfap 2 CLW PKDocument128 pagesCfap 2 CLW PKTeacher HaqqiNo ratings yet

- Askri BankDocument17 pagesAskri Bankanon_772670No ratings yet

- Mortgage Calculator Excel TemplateDocument13 pagesMortgage Calculator Excel TemplateHamid MansouriNo ratings yet

- Housing LoanDocument21 pagesHousing LoanKrizia Iris De MesaNo ratings yet