0 ratings0% found this document useful (0 votes)

Fabm2 Quiz

Fabm2 Quiz

Uploaded by

Xin LouDior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

Fabm2 Quiz

Fabm2 Quiz

Uploaded by

Xin Lou0 ratings0% found this document useful (0 votes)

Dior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Dior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

Fabm2 Quiz

Fabm2 Quiz

Uploaded by

Xin LouDior Clothing Corporation's cash flow statement for 2009 and 2008 is to be prepared using the indirect method. The balance sheets as of March 31, 2009 and 2008 are provided, along with additional information regarding provision for tax, sale of fixed assets, dividends paid, and issuance of new debentures.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1/ 2

FABM2

CASH FLOW STATEMENT QUIZ FABM2

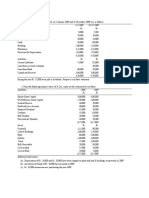

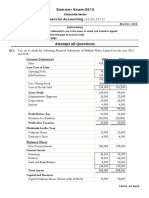

From the particulars given ahead prepare the cash flow statement as per AS-3 (Revised) using the CASH FLOW STATEMENT QUIZ

indirect method: From the particulars given ahead prepare the cash flow statement as per AS-3 (Revised) using the

Dior Clothing Corporation indirect method:

Balance Sheets As At 31 March, ..... Dior Clothing Corporation

Liabilities 2009 2008 Balance Sheets As At 31 March, .....

Equity Share Capital Php 80,000 Php 55,000 Liabilities 2009 2008

10% Preference Share Capital 20,000 25,000 Equity Share Capital Php 80,000 Php 55,000

General Reserve 7,600 4,000 10% Preference Share Capital 20,000 25,000

Profit & Loss Account 2,400 2,000 General Reserve 7,600 4,000

15% Debentures 14,000 12,000 Profit & Loss Account 2,400 2,000

Creditors 22,000 24,000 15% Debentures 14,000 12,000

Proposed Dividend 8,000 10,000 Creditors 22,000 24,000

Provision for Taxation 8,400 6,000 Proposed Dividend 8,000 10,000

1,62,400 1,38,000 Provision for Taxation 8,400 6,000

Assets 2009 2008 1,62,400 1,38,000

Fixed Assets 80,000 82,000 Assets 2009 2008

Less: Accumulated Depreciation 30,000 22,000 Fixed Assets 80,000 82,000

50,000 60,000 Less: Accumulated Depreciation 30,000 22,000

Stock 70,000 60,000 50,000 60,000

Debtors 34,400 15,000 Stock 70,000 60,000

Cash 7,000 2,400 Debtors 34,400 15,000

Prepaid Expenses 1,000 600 Cash 7,000 2,400

1,62,400 1,38,000 Prepaid Expenses 1,000 600

1,62,400 1,38,000

Additional Information:

(a) Provision for tax made Rs. 9,400. Additional Information:

(b) Fixed assets costing Rs. 20,000 (accumulated depreciation till the date of sale on them Rs. 6,000) (a) Provision for tax made Rs. 9,400.

were sold for Rs. 10,000. (b) Fixed assets costing Rs. 20,000 (accumulated depreciation till the date of sale on them Rs. 6,000)

(c) Interim dividend paid during the year Rs. 9,000. The proposed dividend of last year was declared were sold for Rs. 10,000.

and paid during the year. Ignore corporate dividend tax. (c) Interim dividend paid during the year Rs. 9,000. The proposed dividend of last year was declared

(d) New debentures were issued on 31 March 2009. and paid during the year. Ignore corporate dividend tax.

(d) New debentures were issued on 31 March 2009.

You might also like

- Answer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current AssetsNo ratings yetAnswer: Amazon Ltd. 2009 2008 Increase (Decrease) Working Capital Increase Decrease Current Assets2 pages

- Attempt All Questions: Summer Exam-2015No ratings yetAttempt All Questions: Summer Exam-201525 pages

- 4QQMN501 - Comprehending The Statement of Cash FlowsNo ratings yet4QQMN501 - Comprehending The Statement of Cash Flows3 pages

- DB6 - Worksheet & FS Prep For Merchandising BusinessNo ratings yetDB6 - Worksheet & FS Prep For Merchandising Business4 pages

- Journalizing Transaction (Ezekiel Lapitan)No ratings yetJournalizing Transaction (Ezekiel Lapitan)3 pages

- Master of Business Administration (M.B.A.) Semester-I (Outcome Based C.B.C.S.) Examination Financial Reporting Statements and Analysis Paper-5No ratings yetMaster of Business Administration (M.B.A.) Semester-I (Outcome Based C.B.C.S.) Examination Financial Reporting Statements and Analysis Paper-58 pages

- BCA202 FINANCIAL ACCOUNTING II wk 12& 13No ratings yetBCA202 FINANCIAL ACCOUNTING II wk 12& 135 pages

- Assignment in Financial Accounting: Jane B. Evangelista Bsba-2B0% (1)Assignment in Financial Accounting: Jane B. Evangelista Bsba-2B4 pages

- Anne Mariel Gomez & Gem Yao-Raneses MGT 213 - WYNo ratings yetAnne Mariel Gomez & Gem Yao-Raneses MGT 213 - WY2 pages

- IGCSE Accounting 0452: Unit No 4: Accounting ProceduresNo ratings yetIGCSE Accounting 0452: Unit No 4: Accounting Procedures7 pages

- Dabur India - Working Capital and Cost ManagementNo ratings yetDabur India - Working Capital and Cost Management15 pages

- 1458118002cbse Pariksha Accountancy I For 17 March ExamNo ratings yet1458118002cbse Pariksha Accountancy I For 17 March Exam11 pages

- Top Accounting Interview Questions With Answers UpdatedNo ratings yetTop Accounting Interview Questions With Answers Updated26 pages

- Calculating Variance DirectLabor Materials OverheadNo ratings yetCalculating Variance DirectLabor Materials Overhead29 pages

- Cooperative Auditing and Accounting - Basic CourseNo ratings yetCooperative Auditing and Accounting - Basic Course34 pages

- Adjusting Entries: Asistensi Pengantar Akuntansi I100% (1)Adjusting Entries: Asistensi Pengantar Akuntansi I4 pages

- L2 General Purpose Financial StatementsNo ratings yetL2 General Purpose Financial Statements10 pages

- Accounting & English Mcqs in Nts Test Www-Ntsforums-Com100% (1)Accounting & English Mcqs in Nts Test Www-Ntsforums-Com5 pages

- Bajaj Electricals Q1FY24 Result Update Centrum 11082023No ratings yetBajaj Electricals Q1FY24 Result Update Centrum 1108202310 pages

- 2024 Prelim Examination - FAR - (FOR PRINTING)No ratings yet2024 Prelim Examination - FAR - (FOR PRINTING)3 pages

- Chapter-9 Accounting for Not for Profit Organization VQeKPMNo ratings yetChapter-9 Accounting for Not for Profit Organization VQeKPM6 pages