PS Jul-23 MP

PS Jul-23 MP

Uploaded by

myphotosfetCopyright:

Available Formats

PS Jul-23 MP

PS Jul-23 MP

Uploaded by

myphotosfetOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

PS Jul-23 MP

PS Jul-23 MP

Uploaded by

myphotosfetCopyright:

Available Formats

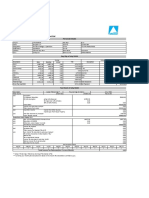

BIC CELLO INDIA PVT LTD

Regd. Off. : Plot No.711/1,2,3,4, Somnath Road, Dabhel, Daman -396210 (U.T.)

Corp. Off. : C-1/702, G-1/701, G-2/702, 7Th Floor, Lotus Corporate Park, Western Express Highway, Goregaon (East),

Mumbai 400 063

Payslip for the Month of : JULY 2023

Employee Code 891132 Bank Name STATE BANK OF INDIA Paid Days 4.00

Name MIHIR NILESHBHAI PANCHAL Bank Account No. 37268914245 LOP Days 0.00

Date of Joining 01-Jul-2022 PF No. Arrear Days 0.00

Location UAN 101849168426 Days in Month 31.00

Department MANUFACTURING PAN CELPN8586B

Designation Senior Executive - Manufacturing Excellence ESI No.

Gender Male Level Non Level (1.2)

Earning Entitled Paid Arrear YTD Deduction Deduction Arrear YTD

(Excl. Arrear) Amount

Basic 14000.00 1806.00 0.00 43806.00 PF 578.00 0.00 5978.00

House Rent Allowance 5600.00 723.00 0.00 17523.00 Other Deductions 60.00 0.00 1400.00

Leave Travel Allowance 1400.00 181.00 0.00 4381.00

Education Allowance 200.00 26.00 0.00 626.00

Supplementary Allowance 21743.25 2806.00 0.00 68035.00

Total Earnings 42,943.25 5,542.00 0.00 134,371.00 Total Deductions 638.00 0.00 7,378.00

Net Pay : 4,904.00

Indian rupee Four Thousand(s) Nine Hundred Four Only

YTD figures are from April

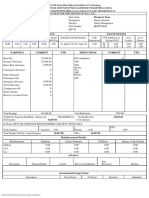

Details of Leave

Leave Type Opening Balance Credit Availed Closing Balance

CL 1.51 1.17 0.00 2.68

FH 2.00 0.00 1.00 1.00

LOP -1.98 0.00 0.00 -1.98

PL 3.72 1.34 1.00 4.06

Income Tax Calculation HRA Exemption

Particulars Till date Projected Taxable Amount Note: HRA exemption = Least of Columns 1,2,3

Basic 43806.00 43806.00 Months Basic Rent Metro HRA Rent Less 40/50% of HRA

Paid Paid (Y/N) 10% Basic Basic Exemp.

House Rent Allowance 17523.00 17523.00

(1) (2) (3)

Leave Travel Allowance 4381.00 4381.00

Apr 23 14000 N 5600 0 0

Education Allowance 626.00 626.00

May 23 14000 N 5600 0 0

Supplementary Allowance 68035.00 68035.00

Jun 23 14000 N 5600 0 0

Gross Salary 134371.00

Jul 23 1806 N 723 0 0

Less: EXEMPTION U/S 10 Total 0

Standard deduction u/s 50000.00 Tax Deducted Breakup

Sec 16(i)

Particulars Amount

Salary income after 84371.00

deduction u/s 16 Apr ,2023

May ,2023

DEDUCTIONS U/S 80C

Jun ,2023

DEDUCTIONS U/S CHAPTER VI A Jul ,2023

Total Income 84370.00

Tax Deducted - Current

Month

Balance - Tax payable /

refundable

* Computer generated salary slip. Signature not required

You might also like

- Info Sys Salary SlipDocument2 pagesInfo Sys Salary SlipGurpreetS Myvisa100% (1)

- Lmurillo Benefit LetterDocument2 pagesLmurillo Benefit Letterloretta005100% (1)

- EmployeeData OctDocument2 pagesEmployeeData OctAnkit SinghNo ratings yet

- Salary & Reliving LetterDocument6 pagesSalary & Reliving LetterYash ShettyNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKP0% (1)

- FNF 02 I33514 Ankit ShuklaDocument3 pagesFNF 02 I33514 Ankit ShuklaAnkit ShuklaNo ratings yet

- Naresh PayslipDocument1 pageNaresh PayslipBADI APPALARAJUNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Jan18 PDFDocument1 pageJan18 PDFomkassNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsSaurav JagtapNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- May 2024Document1 pageMay 2024Neeraj GNo ratings yet

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiNo ratings yet

- Tata Business Support Services LTD: 00110283 KhushbuDocument1 pageTata Business Support Services LTD: 00110283 KhushbuKhushbu SinghNo ratings yet

- Gerpl 997Document1 pageGerpl 997gk3439516No ratings yet

- Mar-2022Document1 pageMar-2022jyotishprasad21No ratings yet

- Employer2 9065 Payslip Dec2021Document1 pageEmployer2 9065 Payslip Dec2021phaniteja.sattiNo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- Employee DataDocument1 pageEmployee DataomkassNo ratings yet

- Payslip 2022 2023 8 kmbl178207 KTKBANKTDocument1 pagePayslip 2022 2023 8 kmbl178207 KTKBANKTjaymehta0808No ratings yet

- September Sal SlipDocument1 pageSeptember Sal Sliptmkn8cmpkgNo ratings yet

- Payslip March 2023Document1 pagePayslip March 2023kaushalNo ratings yet

- Employee DataDocument2 pagesEmployee DataAnkit KumarNo ratings yet

- Salary September2023Document2 pagesSalary September2023depiha5135No ratings yet

- Salary Slipwith Tax DetailsDocument1 pageSalary Slipwith Tax Detailsdipak923434No ratings yet

- JAN Payslip India-UnlockedDocument2 pagesJAN Payslip India-Unlockedbskapoor68No ratings yet

- September PayslipDocument1 pageSeptember Payslipxyz abcdNo ratings yet

- Salary Slip DetailsDocument1 pageSalary Slip Detailss.k.ranga235No ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- INTERG_Feb 2024Document1 pageINTERG_Feb 2024rohitrpoojariNo ratings yet

- 1st Floor, T19 Towers, MG Road, Secunderabad-500003: Payslip For The Month Of: JUNE 2024Document1 page1st Floor, T19 Towers, MG Road, Secunderabad-500003: Payslip For The Month Of: JUNE 2024srinivas rao kNo ratings yet

- Tushar Saini (MOB2314) - Sep23payslipDocument1 pageTushar Saini (MOB2314) - Sep23payslipvikasdixit95200No ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Jul 192017Document1 pageJul 192017Anonymous qqE8o5QNo ratings yet

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairNo ratings yet

- May 2023-2024Document1 pageMay 2023-2024bhartiyapaisaofficialNo ratings yet

- Salary SlipDocument1 pageSalary SlipPhagun BehlNo ratings yet

- Micro Payslip - May, 2022 (Emp Code00111500)Document1 pageMicro Payslip - May, 2022 (Emp Code00111500)chagusahoo170No ratings yet

- Salary SlipDocument1 pageSalary Sliparpan.dev08No ratings yet

- Oct 23Document2 pagesOct 23VIKAS TIWARINo ratings yet

- Previewfileservlet 43Document1 pagePreviewfileservlet 43sunilshinde7644No ratings yet

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaNo ratings yet

- Employee DataDocument1 pageEmployee DataSyed Abu TalibNo ratings yet

- Aug Sal SlipDocument1 pageAug Sal Sliptmkn8cmpkgNo ratings yet

- Payslip 2022 2023 11 kmbl178207 KTKBANKTDocument1 pagePayslip 2022 2023 11 kmbl178207 KTKBANKTjaymehta0808No ratings yet

- INTERG_Dec 2023Document1 pageINTERG_Dec 2023rohitrpoojariNo ratings yet

- Employee DataDocument2 pagesEmployee DataJitender singhNo ratings yet

- SAN Complex, #4, Williams Road, Cantonment, Trichy, Tamil Nadu, 620001Document2 pagesSAN Complex, #4, Williams Road, Cantonment, Trichy, Tamil Nadu, 620001Sahana yogesvaranNo ratings yet

- May Salary PDFDocument1 pageMay Salary PDFomkassNo ratings yet

- Payslip 2023 2024 8 100000000701882 IGSLDocument1 pagePayslip 2023 2024 8 100000000701882 IGSL164152.rkNo ratings yet

- Payslip 1 PDFDocument1 pagePayslip 1 PDFkrishnaNo ratings yet

- Dec-2023 Salary SlipDocument1 pageDec-2023 Salary SlipsalimNo ratings yet

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarNo ratings yet

- DOC-20241130-WA0021.Document1 pageDOC-20241130-WA0021.arunarya588No ratings yet

- Sandy Jan PayslipDocument1 pageSandy Jan PayslipJoginderNo ratings yet

- PayEmpSalarySlip Mar PDFDocument1 pagePayEmpSalarySlip Mar PDFBharat DevareNo ratings yet

- 100000000420152Document1 page100000000420152Sandeep SranNo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- Payslip 5 2024Document1 pagePayslip 5 2024subratkumarbhole41No ratings yet

- Gsis Acquired Assets For DispositionDocument13 pagesGsis Acquired Assets For DispositionMary Grace BalmoresNo ratings yet

- Large Taxpayer Unit (Ltu) : Concept ofDocument3 pagesLarge Taxpayer Unit (Ltu) : Concept ofswami_ratanNo ratings yet

- INCTAX Chapter 8 Lecture NotesDocument4 pagesINCTAX Chapter 8 Lecture NotesJoshua LisingNo ratings yet

- Estate Tax PayableDocument8 pagesEstate Tax PayableHazel Jane Esclamada100% (2)

- Barangay Budget Preparation Forms LiquiciaDocument3 pagesBarangay Budget Preparation Forms LiquiciaMaria RinaNo ratings yet

- Circular Flow in Three Sector ModelDocument4 pagesCircular Flow in Three Sector ModelSantosh ChhetriNo ratings yet

- Nambiar Builders Private Limited Nambiar Builders Private Limited 04-48-58Document1 pageNambiar Builders Private Limited Nambiar Builders Private Limited 04-48-58praveen praveenNo ratings yet

- Z June 2018 Module 2.06 (Suggested Solutions)Document20 pagesZ June 2018 Module 2.06 (Suggested Solutions)M Nasir ArifNo ratings yet

- A Critical Review On The Tax Structure of BangladeshDocument17 pagesA Critical Review On The Tax Structure of Bangladeshkhan arif mahmudNo ratings yet

- Sold By: Tax InvoiceDocument2 pagesSold By: Tax Invoice41-Julian EbinesarNo ratings yet

- Greenfield V MeerDocument3 pagesGreenfield V MeerGertrude ArquilloNo ratings yet

- CPA Taxation by Ampongan - Principles of TaxationDocument43 pagesCPA Taxation by Ampongan - Principles of TaxationVictor Tuco100% (2)

- ITAD BIR Ruling 008-19 PE - Rep OfficeDocument14 pagesITAD BIR Ruling 008-19 PE - Rep OfficeKathyrn Ang-ZarateNo ratings yet

- Rick Berg's 2011 Q4 FEC FilingDocument184 pagesRick Berg's 2011 Q4 FEC FilingNorthDakotaWayNo ratings yet

- Salary Pay SlipDocument3 pagesSalary Pay SlipSendhilNo ratings yet

- SSS Maternity Benefits Commitment and Undertaking Form - V1.2 - 05162023 3 1Document2 pagesSSS Maternity Benefits Commitment and Undertaking Form - V1.2 - 05162023 3 1mrs.jannettedgNo ratings yet

- Subject To FBT Subject To Basic Tax Exempt: - Fringe BenefitsDocument3 pagesSubject To FBT Subject To Basic Tax Exempt: - Fringe BenefitsAriane GaleraNo ratings yet

- 06 Quiz 1Document1 page06 Quiz 1Angelo MorenoNo ratings yet

- Tan Koon Aik PayslipDocument3 pagesTan Koon Aik PayslipDaniel GuanNo ratings yet

- My Pay SlipDocument1 pageMy Pay Slipعلي سعيد سعودNo ratings yet

- Invoice IAB89077 2023 09 01Document1 pageInvoice IAB89077 2023 09 01LSMartinNo ratings yet

- Corporate Tax Planning: Tax Evasion and AvoidanceDocument8 pagesCorporate Tax Planning: Tax Evasion and AvoidanceShainaNo ratings yet

- 2014 Bar Questions On Taxation Gen Pri and IncomeDocument4 pages2014 Bar Questions On Taxation Gen Pri and IncomeSheena PalmaresNo ratings yet

- Form No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )Document2 pagesForm No. 2E Naya Saral Naya Saral Its - 2E: (See Second Proviso To Rule 12 (1) (B) (Iii) )NeethinathanNo ratings yet

- Income Tax For Corporations, PartnershipsDocument22 pagesIncome Tax For Corporations, PartnershipsKimberly parciaNo ratings yet

- Taxation Law: Answers To Bar Examination QuestionsDocument125 pagesTaxation Law: Answers To Bar Examination QuestionsAnonymous bioCvBieYNo ratings yet

- 0217 Form NewDocument2 pages0217 Form NewJuanbon Padadawan100% (3)

- Pay Statement: June 2019 Aspin Pharma Pvt. LTDDocument1 pagePay Statement: June 2019 Aspin Pharma Pvt. LTDAman AnsariNo ratings yet

- INTX211 OverviewDocument1 pageINTX211 OverviewJemima FernandezNo ratings yet