GSTR3B 37adcfs8516j1zp 012018

GSTR3B 37adcfs8516j1zp 012018

Uploaded by

ravi kiranCopyright:

Available Formats

GSTR3B 37adcfs8516j1zp 012018

GSTR3B 37adcfs8516j1zp 012018

Uploaded by

ravi kiranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

GSTR3B 37adcfs8516j1zp 012018

GSTR3B 37adcfs8516j1zp 012018

Uploaded by

ravi kiranCopyright:

Available Formats

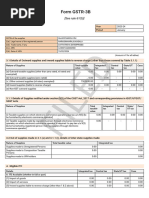

Form GSTR-3B

[See rule 61(5)]

Year 2017-18

Period January

1. GSTIN 37ADCFS8516J1ZP

2(a). Legal name of the registered person SRI KRISHNA BIKES

2(b). Trade name, if any SRI KRISHNA BIKES

2(c). ARN AA3701182988997

2(d). Date of ARN 05/04/2018

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

4996011.00

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

699442.00

-

-

-

0.00

tax

699442.00

-

-

-

0.00

0.00

0.00

0.00

-

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 0.00 0.00 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 812396.00 1890.00 1890.00 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 1250.00 1250.00 -

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

699442.00

699442.00

0.00

0.00

Integrated

tax

697552.00

433399.00

-

-

0.00

ED

Central

tax

1890.00

-

-

-

0.00

State/UT

tax

-

1890.00

-

-

0.00

Cess

-

-

0.00

-

cash

0.00

0.00

264153.00

0.00

0.00

cash

-

0.00

0.00

0.00

0.00

cash

-

1250.00

1250.00

FIL

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

January 2018 0.00 699442.00 699442.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 05/04/2018 Name of Authorized Signatory

Designation /Status

You might also like

- GSTR3B 37adcfs8516j1zp 022019Document2 pagesGSTR3B 37adcfs8516j1zp 022019ravi kiranNo ratings yet

- GSTR3B 37adcfs8516j1zp 032020Document2 pagesGSTR3B 37adcfs8516j1zp 032020ravi kiranNo ratings yet

- GSTR3B 36axcpk6922a1zu 012024Document3 pagesGSTR3B 36axcpk6922a1zu 012024Abhishek BhomiaNo ratings yet

- GSTR3B 01bropg6451k1zp 032023Document2 pagesGSTR3B 01bropg6451k1zp 032023Ishtiyaq RatherNo ratings yet

- GSTR3B 36axcpk6922a1zu 122023Document3 pagesGSTR3B 36axcpk6922a1zu 122023Abhishek BhomiaNo ratings yet

- 3 GSTR-3B - Jun 21-22Document2 pages3 GSTR-3B - Jun 21-22ArbindraNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 07biypk7555f1zl 032023Document3 pagesGSTR3B 07biypk7555f1zl 032023Shubham JindalNo ratings yet

- GSTR3B 52022Document2 pagesGSTR3B 52022Logesh Waran KmlNo ratings yet

- GSTR3B 36axcpk6922a1zu 112023Document3 pagesGSTR3B 36axcpk6922a1zu 112023Abhishek BhomiaNo ratings yet

- GSTR3B 36aigpy2941j1zs 102020Document2 pagesGSTR3B 36aigpy2941j1zs 102020Md YounusNo ratings yet

- GSTR3B 32aaecl5263f1zr 082022Document2 pagesGSTR3B 32aaecl5263f1zr 082022gmonisha.finnestNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B_23BHSPP5666F1ZV_122023Document3 pagesGSTR3B_23BHSPP5666F1ZV_122023Shubham PanchvediNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_022024Document3 pagesGSTR3B_23BHSPP5666F1ZV_022024Shubham PanchvediNo ratings yet

- GSTRDocument3 pagesGSTRfliz1889No ratings yet

- 11 GSTR-3B - Feb 21-22Document2 pages11 GSTR-3B - Feb 21-22ArbindraNo ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- GSTR3B_37ELMPR7367L1ZZ_022024Document3 pagesGSTR3B_37ELMPR7367L1ZZ_022024NH RCNo ratings yet

- GSTR3B 36axcpk6922a1zu 032024Document3 pagesGSTR3B 36axcpk6922a1zu 032024Abhishek BhomiaNo ratings yet

- Apr June 3Document2 pagesApr June 3ROHAN AGGARWALNo ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_012024Document3 pagesGSTR3B_23BHSPP5666F1ZV_012024Shubham PanchvediNo ratings yet

- GSTR3B 33NQFPS6897K1ZN 102024Document3 pagesGSTR3B 33NQFPS6897K1ZN 102024avaratha97No ratings yet

- GSTR3B 36adlfs7862g1zi 062024Document3 pagesGSTR3B 36adlfs7862g1zi 062024krma.chandrikaNo ratings yet

- GSTR3B_07EZIPS7293J1ZG_122022Document3 pagesGSTR3B_07EZIPS7293J1ZG_122022Sanjay SinghNo ratings yet

- 10 GSTR-3B - Jan 21-22Document2 pages10 GSTR-3B - Jan 21-22ArbindraNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 19bahph8899e1z2 052022Document3 pagesGSTR3B 19bahph8899e1z2 052022Pawan KanuNo ratings yet

- GSTR3B 01bropg6451k1zp 062023Document2 pagesGSTR3B 01bropg6451k1zp 062023Ishtiyaq RatherNo ratings yet

- GSTR3B 36adlfs7862g1zi 052024Document3 pagesGSTR3B 36adlfs7862g1zi 052024krma.chandrikaNo ratings yet

- GSTR3B 36adlfs7862g1zi 072024Document3 pagesGSTR3B 36adlfs7862g1zi 072024krma.chandrikaNo ratings yet

- GSTR3B 33NQFPS6897K1ZN 092024Document3 pagesGSTR3B 33NQFPS6897K1ZN 092024avaratha97No ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_032024Document3 pagesGSTR3B_23BHSPP5666F1ZV_032024Shubham PanchvediNo ratings yet

- GSTR3B 27apapd6950p1zj 052022Document2 pagesGSTR3B 27apapd6950p1zj 052022Arun NaikwadeNo ratings yet

- GSTR3B_18ASDPB5416A1ZF_052023Document3 pagesGSTR3B_18ASDPB5416A1ZF_052023Shila SarkarNo ratings yet

- GSTR3B 36adlfs7862g1zi 092024Document3 pagesGSTR3B 36adlfs7862g1zi 092024krma.chandrikaNo ratings yet

- MH GSTR3B Nov'22Document3 pagesMH GSTR3B Nov'22crmfinance.tnNo ratings yet

- MH GSTR3B Dec'22Document3 pagesMH GSTR3B Dec'22crmfinance.tnNo ratings yet

- GSTR3B 36adlfs7862g1zi 082024Document3 pagesGSTR3B 36adlfs7862g1zi 082024krma.chandrikaNo ratings yet

- GSTR3B 03jpaps1346b1za 062023Document3 pagesGSTR3B 03jpaps1346b1za 062023advocate.atul0001No ratings yet

- GSTR3B 33adrpn8340a1zn 092023Document3 pagesGSTR3B 33adrpn8340a1zn 092023LogeshwaranNo ratings yet

- GSTR3B 33aeqpy3870g1zy 112023Document3 pagesGSTR3B 33aeqpy3870g1zy 112023Durai kannuNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_062024Document3 pagesGSTR3B_23BHSPP5666F1ZV_062024Shubham PanchvediNo ratings yet

- GSTR3B 37ahvpk1100d1zo 042023Document3 pagesGSTR3B 37ahvpk1100d1zo 042023gopi xerox786No ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B_36AMDPN7643R1Z9_122023Document3 pagesGSTR3B_36AMDPN7643R1Z9_122023anuteck1No ratings yet

- GSTR3B_30BRIPA0271P1Z0_052024Document3 pagesGSTR3B_30BRIPA0271P1Z0_052024homecreditfinance784No ratings yet

- GSTR3B 03jpaps1346b1za 112023Document3 pagesGSTR3B 03jpaps1346b1za 112023advocate.atul0001No ratings yet

- GSTR3B_23BHSPP5666F1ZV_052024Document3 pagesGSTR3B_23BHSPP5666F1ZV_052024Shubham PanchvediNo ratings yet

- GSTR3B 24bedpj9895q1zi 032023Document2 pagesGSTR3B 24bedpj9895q1zi 032023hetalahir149No ratings yet

- GSTR3B 37ahvpk1100d1zo 052023Document3 pagesGSTR3B 37ahvpk1100d1zo 052023gopi xerox786No ratings yet

- GSTR3B 09gfapk9940g1z4 022024Document3 pagesGSTR3B 09gfapk9940g1z4 022024aditya999.tyagiNo ratings yet

- GSTR3B_33AXIPM2303B1Z7_052023Document3 pagesGSTR3B_33AXIPM2303B1Z7_052023kumarthiran24No ratings yet