GSTR3B 36aoupg4539a1zx 062022

GSTR3B 36aoupg4539a1zx 062022

Uploaded by

abhi ramCopyright:

Available Formats

GSTR3B 36aoupg4539a1zx 062022

GSTR3B 36aoupg4539a1zx 062022

Uploaded by

abhi ramOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

GSTR3B 36aoupg4539a1zx 062022

GSTR3B 36aoupg4539a1zx 062022

Uploaded by

abhi ramCopyright:

Available Formats

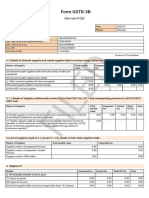

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period June

1. GSTIN 36AOUPG4539A1ZX

2(a). Legal name of the registered person SHIVA KUMAR GUNNALA

2(b). Trade name, if any GUNNALA SHIVA KUMAR

2(c). ARN AA3606224263469

2(d). Date of ARN 18/07/2022

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

378970.00

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

15521.09

-

-

-

0.00

tax

15521.09

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 10132.50 20937.47 20937.47 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 10132.50 20937.47 20937.47 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 597.68

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

15521.00

15521.00

0.00

0.00

Integrated

tax

-

0.00

10133.00

0.00

ED

Central

tax

5388.00

-

-

-

0.00

State/UT

tax

-

15521.00

-

-

0.00

Cess

-

-

0.00

-

cash

0.00

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

FIL

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

June 2022 0.00 15521.00 15521.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 18/07/2022 Name of Authorized Signatory

GUNNALA KUMAR

Designation /Status

PROPRIETOR

You might also like

- PODocument4 pagesPOA vyasNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 27bjlpa8487j1zm 092022Document2 pagesGSTR3B 27bjlpa8487j1zm 092022SHAIKH MOINNo ratings yet

- GSTR3B 33BMFPM8633P1ZH 032022Document2 pagesGSTR3B 33BMFPM8633P1ZH 032022rajasudhannesanNo ratings yet

- GSTR3B_29AALCA9924D1ZE_062022Document2 pagesGSTR3B_29AALCA9924D1ZE_062022priya.loansdepartmentNo ratings yet

- GSTR3B 36aoupg4539a1zx 042022Document2 pagesGSTR3B 36aoupg4539a1zx 042022abhi ramNo ratings yet

- GSTR3B 29aajcb9687j2zp 122022Document3 pagesGSTR3B 29aajcb9687j2zp 122022nithinganesh174No ratings yet

- GSTR3B 19bahph8899e1z2 022023Document3 pagesGSTR3B 19bahph8899e1z2 022023Pawan KanuNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- GSTR3B 33alapv4527e1za 012020Document2 pagesGSTR3B 33alapv4527e1za 012020hakkim satharNo ratings yet

- GSTR3B 19bahph8899e1z2 122022Document3 pagesGSTR3B 19bahph8899e1z2 122022Pawan KanuNo ratings yet

- Recordstatement 2Document18 pagesRecordstatement 2SanthoshNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_122023Document3 pagesGSTR3B_23BHSPP5666F1ZV_122023Shubham PanchvediNo ratings yet

- GSTR3B 29jeipk8186j1zi 022023Document3 pagesGSTR3B 29jeipk8186j1zi 022023meghanaaradhya1912No ratings yet

- GSTR3B_23BHSPP5666F1ZV_022024Document3 pagesGSTR3B_23BHSPP5666F1ZV_022024Shubham PanchvediNo ratings yet

- GSTR3B 27axipg6899g1zv 082019Document2 pagesGSTR3B 27axipg6899g1zv 082019pritish.gordeNo ratings yet

- GSTR3B 29jeipk8186j1zi 012023Document3 pagesGSTR3B 29jeipk8186j1zi 012023meghanaaradhya1912No ratings yet

- GSTR3B_18ASDPB5416A1ZF_052023Document3 pagesGSTR3B_18ASDPB5416A1ZF_052023Shila SarkarNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- Apr June 3Document2 pagesApr June 3ROHAN AGGARWALNo ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 36axcpk6922a1zu 122023Document3 pagesGSTR3B 36axcpk6922a1zu 122023Abhishek BhomiaNo ratings yet

- GSTR3B 36axcpk6922a1zu 112023Document3 pagesGSTR3B 36axcpk6922a1zu 112023Abhishek BhomiaNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 122022 Oct To Dec 2022Rahul SharmaNo ratings yet

- GSTR3B_37ELMPR7367L1ZZ_022024Document3 pagesGSTR3B_37ELMPR7367L1ZZ_022024NH RCNo ratings yet

- GSTR3B 33anppm7249d1zt 052023Document3 pagesGSTR3B 33anppm7249d1zt 052023Logesh Waran KmlNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B_23BHSPP5666F1ZV_012024Document3 pagesGSTR3B_23BHSPP5666F1ZV_012024Shubham PanchvediNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- GSTR3B 36aoupg4539a1zx 052022Document2 pagesGSTR3B 36aoupg4539a1zx 052022abhi ramNo ratings yet

- GSTR3B 19azwpd2404n1zx 062023Document3 pagesGSTR3B 19azwpd2404n1zx 062023ho.ubiquityNo ratings yet

- GSTR3B_19BTTPM3572N1ZN_092024 (1)Document3 pagesGSTR3B_19BTTPM3572N1ZN_092024 (1)nidhigoyal2591No ratings yet

- GSTR3B 32aaecl5263f1zr 082022Document2 pagesGSTR3B 32aaecl5263f1zr 082022gmonisha.finnestNo ratings yet

- GSTRDocument3 pagesGSTRfliz1889No ratings yet

- GSTR3B_09AEOFS1902H1ZV_062022Document2 pagesGSTR3B_09AEOFS1902H1ZV_062022saransh.garg01No ratings yet

- GSTR3B_18ASDPB5416A1ZF_082023Document3 pagesGSTR3B_18ASDPB5416A1ZF_082023Shila SarkarNo ratings yet

- GSTR3B 03jpaps1346b1za 112023Document3 pagesGSTR3B 03jpaps1346b1za 112023advocate.atul0001No ratings yet

- GSTR3B 24bedpj9895q1zi 032023Document2 pagesGSTR3B 24bedpj9895q1zi 032023hetalahir149No ratings yet

- GSTR3B 07ahepk2148n1z5 052023Document3 pagesGSTR3B 07ahepk2148n1z5 052023PKCL027 Rishabh JainNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 33aespt6851j1zr 092023Document3 pagesGSTR3B 33aespt6851j1zr 092023Vignesh KrishnamoorthyNo ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- 1 GSTR-3B - Apr 22-23Document2 pages1 GSTR-3B - Apr 22-23ArbindraNo ratings yet

- GSTR3B 19azwpd2404n1zx 042023Document3 pagesGSTR3B 19azwpd2404n1zx 042023ho.ubiquityNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_032024Document3 pagesGSTR3B_23BHSPP5666F1ZV_032024Shubham PanchvediNo ratings yet

- GSTR3B 10cespr1366g1ze 012023Document3 pagesGSTR3B 10cespr1366g1ze 012023Mega GuideNo ratings yet

- GSTR3B_33EJFPD0998Q1ZN_072023Document3 pagesGSTR3B_33EJFPD0998Q1ZN_072023kannan. srinivasanNo ratings yet

- GSTR3B 36aigpy2941j1zs 102020Document2 pagesGSTR3B 36aigpy2941j1zs 102020Md YounusNo ratings yet

- GSTR3B 33NQFPS6897K1ZN 092024Document3 pagesGSTR3B 33NQFPS6897K1ZN 092024avaratha97No ratings yet

- GSTR3B 07ahepk2148n1z5 112022Document3 pagesGSTR3B 07ahepk2148n1z5 112022Rishabh Naresh JainNo ratings yet

- GSTR3B_33AXIPM2303B1Z7_072023Document3 pagesGSTR3B_33AXIPM2303B1Z7_072023kumarthiran24No ratings yet

- GSTR3B 03jpaps1346b1za 062023Document3 pagesGSTR3B 03jpaps1346b1za 062023advocate.atul0001No ratings yet

- GSTR3B 29aafcb8099q1zk 112023Document3 pagesGSTR3B 29aafcb8099q1zk 112023priya.loansdepartmentNo ratings yet

- GSTR3B_29BBTPD2910B1ZX_022022Document2 pagesGSTR3B_29BBTPD2910B1ZX_022022hemapriya.finnestNo ratings yet

- GSTR3B 33NQFPS6897K1ZN 102024Document3 pagesGSTR3B 33NQFPS6897K1ZN 102024avaratha97No ratings yet

- GSTR3B 33aeqpy3870g1zy 082023Document3 pagesGSTR3B 33aeqpy3870g1zy 082023Durai kannuNo ratings yet

- GSTR3B 09abwpb8808n1zt 052022 PDFDocument2 pagesGSTR3B 09abwpb8808n1zt 052022 PDFManeesh VermaNo ratings yet

- GSTR3B 37ahvpk1100d1zo 042023Document3 pagesGSTR3B 37ahvpk1100d1zo 042023gopi xerox786No ratings yet

- GSTR3B 06effpm8326p1zs 102023Document3 pagesGSTR3B 06effpm8326p1zs 102023Prahlad JhaNo ratings yet

- Bank SbiDocument15 pagesBank Sbiabhi ramNo ratings yet

- Vijetha July Pay SlipDocument1 pageVijetha July Pay Slipabhi ramNo ratings yet

- ApplicationDocument6 pagesApplicationabhi ramNo ratings yet

- GasDocument2 pagesGasabhi ramNo ratings yet

- Rental Agreement 1Document6 pagesRental Agreement 1abhi ramNo ratings yet

- Minimum Balance RequestDocument1 pageMinimum Balance Requestabhi ramNo ratings yet

- Onex I 230956Document2 pagesOnex I 230956chunduharikrishnaNo ratings yet

- CGST 16 (2) (C)Document31 pagesCGST 16 (2) (C)noorensaba01No ratings yet

- IRCTC Retiring Room at MMCTDocument1 pageIRCTC Retiring Room at MMCTomkar daveNo ratings yet

- Goods and Service TaxDocument3 pagesGoods and Service TaxPoornima PoornimaNo ratings yet

- Career Objective: Accountant (R2R/GL Domain) 02/2021 - Till Present Achievements/TasksDocument3 pagesCareer Objective: Accountant (R2R/GL Domain) 02/2021 - Till Present Achievements/TasksDipanwita SahaNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument4 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decisionssee5b2 elsedNo ratings yet

- Impact of GST On FMCG and Automobile SectorDocument43 pagesImpact of GST On FMCG and Automobile SectorappuggouthamgNo ratings yet

- Od 431721674755760100Document3 pagesOd 431721674755760100martinluther saluNo ratings yet

- Risk-Weighted Assets - Meaning, Formula, Examples, How To Calculate ItDocument12 pagesRisk-Weighted Assets - Meaning, Formula, Examples, How To Calculate ItDZ Stock Cfd FXNo ratings yet

- (INV0004) Oracle Inventory How To Setup Shortage Parameter and Notifications - Oracle Apps SCM Functional GuideDocument5 pages(INV0004) Oracle Inventory How To Setup Shortage Parameter and Notifications - Oracle Apps SCM Functional GuideAKSHAY PALEKARNo ratings yet

- Electronic Reservation Slip (ERS) : 2743379717 14033/JAMMU MAIL Ac 3 Tier Sleeper (3A)Document2 pagesElectronic Reservation Slip (ERS) : 2743379717 14033/JAMMU MAIL Ac 3 Tier Sleeper (3A)Neeraj ThapliyalNo ratings yet

- GST E-Invoices FAQDocument4 pagesGST E-Invoices FAQGarvitNo ratings yet

- Inter Gist of GST PDFDocument14 pagesInter Gist of GST PDFshivam kharivale 55No ratings yet

- Electronic Reservation Slip (ERS) : 8314205215 19307/INDB CDG EXP Sleeper Class (SL)Document3 pagesElectronic Reservation Slip (ERS) : 8314205215 19307/INDB CDG EXP Sleeper Class (SL)gt0896587No ratings yet

- Theory and Practice of GSTDocument2 pagesTheory and Practice of GSTneha khanNo ratings yet

- Anita Yadav Vs GodrejDocument9 pagesAnita Yadav Vs GodrejNishantvermaNo ratings yet

- Revision Notes & Question May 2024 - CA Aman AgarwalDocument159 pagesRevision Notes & Question May 2024 - CA Aman Agarwalmayankpantgg.14No ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/ 05/2018Hima VeeramachaneniNo ratings yet

- Company Unit 02-Sept - 2021Document12 pagesCompany Unit 02-Sept - 2021cubadesignstud0% (1)

- Invoice: 2871046 Apr 09, 2022 5060490567 Apr 08, 2022 999316Document1 pageInvoice: 2871046 Apr 09, 2022 5060490567 Apr 08, 2022 999316korada.vizagNo ratings yet

- InvoiceDocument1 pageInvoicesajid mahfuzNo ratings yet

- InvoiceDocument1 pageInvoicedarkstarverygoodfighterNo ratings yet

- Tax Invoice - 23-24 0326 - 13 - 01 - 24Document4 pagesTax Invoice - 23-24 0326 - 13 - 01 - 24sanjibbhuyan1985No ratings yet

- Assignment-1 - GSTDocument2 pagesAssignment-1 - GSTanchattopadhyay2008No ratings yet

- GST Definition, Types, Registration Process Bajaj Finance 2Document1 pageGST Definition, Types, Registration Process Bajaj Finance 2Raman PalNo ratings yet

- Gmail - Invoice - SLEC4411952, Purchased On - 2022-09-09Document2 pagesGmail - Invoice - SLEC4411952, Purchased On - 2022-09-09Anoop JangraNo ratings yet

- Sept 18 LtaDocument1 pageSept 18 LtaSidharth SNo ratings yet

- Itt Filter MediaDocument41 pagesItt Filter MediaANIMESH JAINNo ratings yet

- Boarding PassDocument5 pagesBoarding Passsanapatel5878No ratings yet