GSTR3B_09AEOFS1902H1ZV_062022

GSTR3B_09AEOFS1902H1ZV_062022

Uploaded by

saransh.garg01Copyright:

Available Formats

GSTR3B_09AEOFS1902H1ZV_062022

GSTR3B_09AEOFS1902H1ZV_062022

Uploaded by

saransh.garg01Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

GSTR3B_09AEOFS1902H1ZV_062022

GSTR3B_09AEOFS1902H1ZV_062022

Uploaded by

saransh.garg01Copyright:

Available Formats

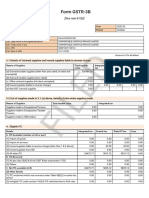

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period June

1. GSTIN 09AEOFS1902H1ZV

2(a). Legal name of the registered person SUNIL KUMAR AND SONS

2(b). Trade name, if any SUNIL KUMAR AND SONS

2(c). ARN AB090622895068N

2(d). Date of ARN 20/07/2022

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

445317.13

0.00

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

tax

6679.76

-

-

-

0.00

tax

6679.76

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

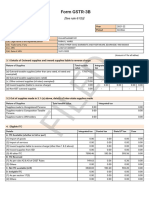

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 11228.38 11228.38 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 0.00 11228.38 11228.38 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

6680.00

6680.00

0.00

0.00

Integrated

tax

-

0.00

0.00

0.00

ED

Central

tax

6680.00

-

-

-

0.00

State/UT

tax

-

6680.00

-

-

0.00

Cess

-

-

0.00

-

cash

0.00

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

FIL

tax

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

June 2022 0.00 6680.00 6680.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 20/07/2022 Name of Authorized Signatory

AYUSH RASTOGI

Designation /Status

PARTNER

You might also like

- Fund. How To Finance An Independent Film.Document11 pagesFund. How To Finance An Independent Film.Buffalo 8100% (17)

- Acc 111 Merged CompleteDocument162 pagesAcc 111 Merged CompleteRhina Antolin DomingoNo ratings yet

- Introduction To Business Forecasting and Predictive AnalyticsDocument25 pagesIntroduction To Business Forecasting and Predictive AnalyticsHarsh Bhat0% (1)

- Financial Accounting and Reporting - Problems ReviewDocument5 pagesFinancial Accounting and Reporting - Problems ReviewARIS100% (1)

- Wolfe 1955Document20 pagesWolfe 1955Shashank KumarNo ratings yet

- GSTR3B 27apapd6950p1zj 052022Document2 pagesGSTR3B 27apapd6950p1zj 052022Arun NaikwadeNo ratings yet

- GSTR3B 24bedpj9895q1zi 062022Document2 pagesGSTR3B 24bedpj9895q1zi 062022hetalahir149No ratings yet

- GSTR3B 36aoupg4539a1zx 062022Document2 pagesGSTR3B 36aoupg4539a1zx 062022abhi ramNo ratings yet

- GSTR3B 36aoupg4539a1zx 042022Document2 pagesGSTR3B 36aoupg4539a1zx 042022abhi ramNo ratings yet

- GSTR3B 33BMFPM8633P1ZH 032022Document2 pagesGSTR3B 33BMFPM8633P1ZH 032022rajasudhannesanNo ratings yet

- GSTR3B 24bedpj9895q1zi 032023Document2 pagesGSTR3B 24bedpj9895q1zi 032023hetalahir149No ratings yet

- GSTR3B 36bmypp9150m1zx 072022Document2 pagesGSTR3B 36bmypp9150m1zx 072022RAJESH DNo ratings yet

- GSTR3B 21aywpa7472l1zz 062022Document2 pagesGSTR3B 21aywpa7472l1zz 062022prateek gangwaniNo ratings yet

- GSTR3B 24cgupp8826r1z3 012024Document3 pagesGSTR3B 24cgupp8826r1z3 012024HEMANT PARMARNo ratings yet

- Apr June 3Document2 pagesApr June 3ROHAN AGGARWALNo ratings yet

- GSTR3B_29AALCA9924D1ZE_062022Document2 pagesGSTR3B_29AALCA9924D1ZE_062022priya.loansdepartmentNo ratings yet

- GSTR3B 33amzpr4644q1zw 062023Document3 pagesGSTR3B 33amzpr4644q1zw 062023rajasudhannesanNo ratings yet

- GSTR3B_33AAXFB1925C1ZN_042024Document3 pagesGSTR3B_33AAXFB1925C1ZN_042024Bindu KhariwalNo ratings yet

- GSTR3B 29aaicc9487a1zb 012023Document2 pagesGSTR3B 29aaicc9487a1zb 012023krishswat7912No ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 36aigpy2941j1zs 102020Document2 pagesGSTR3B 36aigpy2941j1zs 102020Md YounusNo ratings yet

- GSTR3B 32aaecl5263f1zr 082022Document2 pagesGSTR3B 32aaecl5263f1zr 082022gmonisha.finnestNo ratings yet

- GSTR3B 23howps0374q1zt 092021Document2 pagesGSTR3B 23howps0374q1zt 092021ArbindraNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 33aeqpy3870g1zy 062023Document3 pagesGSTR3B 33aeqpy3870g1zy 062023Durai kannuNo ratings yet

- GSTR3B 21aywpa7472l1zz 052022Document2 pagesGSTR3B 21aywpa7472l1zz 052022prateek gangwaniNo ratings yet

- 1 GSTR-3B - Apr 22-23Document2 pages1 GSTR-3B - Apr 22-23ArbindraNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 18aiqpm6346m1zf 032022Document2 pagesGSTR3B 18aiqpm6346m1zf 032022IMRADUL HUSSAINNo ratings yet

- GSTR3B 33aeqpy3870g1zy 112023Document3 pagesGSTR3B 33aeqpy3870g1zy 112023Durai kannuNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_062024Document3 pagesGSTR3B_23BHSPP5666F1ZV_062024Shubham PanchvediNo ratings yet

- GSTR3B_37AAECE1023G1Z4_012023 (1)Document3 pagesGSTR3B_37AAECE1023G1Z4_012023 (1)Suresh KumarNo ratings yet

- GSTR3B 21aachs0767c1zm 032023Document3 pagesGSTR3B 21aachs0767c1zm 032023Subrat Kumar RanaNo ratings yet

- GSTR3B_07EZIPS7293J1ZG_122022Document3 pagesGSTR3B_07EZIPS7293J1ZG_122022Sanjay SinghNo ratings yet

- GSTR3B 18agppi9704c1za 022023Document3 pagesGSTR3B 18agppi9704c1za 022023ABDUL KHALIKNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 27BCGPS7468K1ZR 092022Document3 pagesGSTR3B 27BCGPS7468K1ZR 092022Aman JaiswalNo ratings yet

- GSTR3B 32almph4268c1zc 122021Document2 pagesGSTR3B 32almph4268c1zc 122021efile.hco3No ratings yet

- GSTR3B_29BBTPD2910B1ZX_022022Document2 pagesGSTR3B_29BBTPD2910B1ZX_022022hemapriya.finnestNo ratings yet

- GSTR3B 36aoupg4539a1zx 052022Document2 pagesGSTR3B 36aoupg4539a1zx 052022abhi ramNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 082022Document3 pagesGSTR3B 27BCGPS7468K1ZR 082022Aman JaiswalNo ratings yet

- GSTR3B_23BHSPP5666F1ZV_022024Document3 pagesGSTR3B_23BHSPP5666F1ZV_022024Shubham PanchvediNo ratings yet

- GSTR3B 09abwpb8808n1zt 052022 PDFDocument2 pagesGSTR3B 09abwpb8808n1zt 052022 PDFManeesh VermaNo ratings yet

- GSTR3B 29aafcb8099q1zk 112023Document3 pagesGSTR3B 29aafcb8099q1zk 112023priya.loansdepartmentNo ratings yet

- Aprli 22 GSTR3BDocument2 pagesAprli 22 GSTR3Bkishan bhalodiyaNo ratings yet

- 1 GSTR-3B - Apr 21-22Document2 pages1 GSTR-3B - Apr 21-22ArbindraNo ratings yet

- GSTR3B 33aaspd2745f2zu 012024Document3 pagesGSTR3B 33aaspd2745f2zu 012024goodandgoodproductsNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3Bkrishswat7912No ratings yet

- GSTR3B 01bropg6451k1zp 092023Document2 pagesGSTR3B 01bropg6451k1zp 092023Ishtiyaq RatherNo ratings yet

- RecordstatementDocument18 pagesRecordstatementSanthoshNo ratings yet

- GSTR3B 33NQFPS6897K1ZN 102024Document3 pagesGSTR3B 33NQFPS6897K1ZN 102024avaratha97No ratings yet

- GSTR3B_23BHSPP5666F1ZV_082024Document3 pagesGSTR3B_23BHSPP5666F1ZV_082024Shubham PanchvediNo ratings yet

- GSTR3B 09aqrpb2108b1zb 072022Document2 pagesGSTR3B 09aqrpb2108b1zb 072022Aishvary GuptaNo ratings yet

- $RHYXUCEDocument2 pages$RHYXUCEakxerox47No ratings yet

- GSTR3B 09aqdpj6516d2z0 062024Document3 pagesGSTR3B 09aqdpj6516d2z0 062024taxationadvmayank1996No ratings yet

- Jan 23-24Document3 pagesJan 23-24crmfinance.tnNo ratings yet

- GSTR3B 29jeipk8186j1zi 022023Document3 pagesGSTR3B 29jeipk8186j1zi 022023meghanaaradhya1912No ratings yet

- 8 GSTR-3B - Nov 21-22Document2 pages8 GSTR-3B - Nov 21-22ArbindraNo ratings yet

- GSTR3B_33DDTPS9872R2ZY_112024Document3 pagesGSTR3B_33DDTPS9872R2ZY_112024dontamil.1989No ratings yet

- GSTR3B 20BCMPS7511M1ZB 112021Document2 pagesGSTR3B 20BCMPS7511M1ZB 112021kumarapoorv088No ratings yet

- GSTR3B 33NQFPS6897K1ZN 092024Document3 pagesGSTR3B 33NQFPS6897K1ZN 092024avaratha97No ratings yet

- GSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Document3 pagesGSTR3B - 08bhupa6318m2zt - 092022 July To Sep 2022Rahul SharmaNo ratings yet

- GSTR3B 01bropg6451k1zp 062023Document2 pagesGSTR3B 01bropg6451k1zp 062023Ishtiyaq RatherNo ratings yet

- DTCKNP23-2414 (1)Document2 pagesDTCKNP23-2414 (1)saransh.garg01No ratings yet

- Tax_Invoice_Gas_Patna_Axenic_Final_28Sept2023.docxDocument1 pageTax_Invoice_Gas_Patna_Axenic_Final_28Sept2023.docxsaransh.garg01No ratings yet

- CERTIFICATE_MSME_OBTUSE (1)Document2 pagesCERTIFICATE_MSME_OBTUSE (1)saransh.garg01No ratings yet

- JITENDRA DEVA 21-22Document4 pagesJITENDRA DEVA 21-22saransh.garg01No ratings yet

- Ganpati Trading Co. Gst CertificateDocument3 pagesGanpati Trading Co. Gst Certificatesaransh.garg01No ratings yet

- Calander and VoucherDocument2 pagesCalander and Vouchersaransh.garg01No ratings yet

- SHOPDECK PROPOSALDocument11 pagesSHOPDECK PROPOSALsaransh.garg01No ratings yet

- Dear Partner__We are excited to share the Payouts for the month of October 2024.__All the details are shared in the link below__https___payouts.basichomeloan.com_2024_Payout_Oct_2024.pdf__For more details please contact your RM.__BASICDocument15 pagesDear Partner__We are excited to share the Payouts for the month of October 2024.__All the details are shared in the link below__https___payouts.basichomeloan.com_2024_Payout_Oct_2024.pdf__For more details please contact your RM.__BASICsaransh.garg01No ratings yet

- document (2)Document2 pagesdocument (2)saransh.garg01No ratings yet

- Label AmazonDocument1 pageLabel Amazonsaransh.garg01No ratings yet

- GSTR 3bDocument3 pagesGSTR 3bsaransh.garg01No ratings yet

- FARHANA MSMEDocument2 pagesFARHANA MSMEsaransh.garg01No ratings yet

- Ragni Salary Slip July24Document1 pageRagni Salary Slip July24saransh.garg01No ratings yet

- Invoicing Case Level Details DataDocument5 pagesInvoicing Case Level Details Datasaransh.garg01No ratings yet

- ESO11 - 34 Social DevelopmentDocument16 pagesESO11 - 34 Social DevelopmentshanujssNo ratings yet

- The Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskDocument37 pagesThe Cost of Capital: Sources of Capital Component Costs Wacc Adjusting For Flotation Costs Adjusting For RiskMohammed MiftahNo ratings yet

- Course Outline Marketing ManagementDocument4 pagesCourse Outline Marketing ManagementLALISA ABDISSANo ratings yet

- CSEC POA June 2014 P1 PDFDocument12 pagesCSEC POA June 2014 P1 PDFjunior subhanNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal GhoshNo ratings yet

- Understanding Supply Chain Due Diligence - TauliaDocument3 pagesUnderstanding Supply Chain Due Diligence - TauliaNajaraNo ratings yet

- Madhur Dairy, Gandhinagar: V.M. Patel College of Management StudiesDocument70 pagesMadhur Dairy, Gandhinagar: V.M. Patel College of Management StudiesAditypatel451_548818100% (1)

- MF GlobalDocument101 pagesMF GlobalDealBookNo ratings yet

- E3sconf Netid2021 02032Document7 pagesE3sconf Netid2021 02032prabathnilanNo ratings yet

- Annual Review 2006-2007 ContentsDocument38 pagesAnnual Review 2006-2007 ContentskarasandraNo ratings yet

- Statement of Account For 4020cdiv599236: Bajaj Finance LimitedDocument3 pagesStatement of Account For 4020cdiv599236: Bajaj Finance LimitedRudrali HitechNo ratings yet

- Bio Sketch Jiban K. Mukhopadhyay Is at Present Consultant, Corporate Economics &Document5 pagesBio Sketch Jiban K. Mukhopadhyay Is at Present Consultant, Corporate Economics &shadab0123No ratings yet

- Basic Concepts About The Business PlanDocument27 pagesBasic Concepts About The Business PlanLuzvai Dela ConchaNo ratings yet

- BM Chapter 4Document102 pagesBM Chapter 4hoailt20404cNo ratings yet

- FY2021 Recommended Budget in Brief (Final)Document64 pagesFY2021 Recommended Budget in Brief (Final)mwickerACTNo ratings yet

- Advanced Accounting Part 2 Dayag 2015 Chapter 14Document29 pagesAdvanced Accounting Part 2 Dayag 2015 Chapter 14jayson100% (2)

- RBI Reference Rate For USDocument1 pageRBI Reference Rate For USDebojit NathNo ratings yet

- Quote 09708 PDFDocument1 pageQuote 09708 PDFRecordTrac - City of OaklandNo ratings yet

- The Secret CurrencyDocument12 pagesThe Secret CurrencyDavid de LafuenteNo ratings yet

- Mukesh Dhirubhai AmbaniDocument13 pagesMukesh Dhirubhai AmbanimanikNo ratings yet

- Starbucks: Delivering Customer Service: SummaryDocument1 pageStarbucks: Delivering Customer Service: SummaryZoha KamalNo ratings yet

- Supply Chain ScorecardDocument4 pagesSupply Chain ScorecardbumbiazarkaNo ratings yet

- Franchise Setup ChecklistDocument6 pagesFranchise Setup ChecklistLiam de JesusNo ratings yet

- Class 11 Business Studies Sample Paper Set 12Document8 pagesClass 11 Business Studies Sample Paper Set 12Artham ResourcesNo ratings yet

- Metronet SMP FinalDocument15 pagesMetronet SMP Finalapi-541792317No ratings yet