Santhiya Analysis

Santhiya Analysis

Uploaded by

Ajay PandianCopyright:

Available Formats

Santhiya Analysis

Santhiya Analysis

Uploaded by

Ajay PandianCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Santhiya Analysis

Santhiya Analysis

Uploaded by

Ajay PandianCopyright:

Available Formats

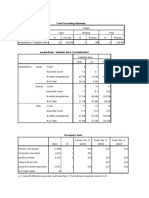

Correlation

Symmetric Measures

Asymp. Std.

Value Errora Approx. Tb Approx. Sig.

Interval by Interval Pearson's R .583 .083 4.966 .000c

Ordinal by Ordinal Spearman Correlation .596 .090 5.143 .000c

N of Valid Cases 50

a. Not assuming the null hypothesis.

b. Using the asymptotic standard error assuming the null hypothesis.

c. Based on normal approximation.

Regression:

Coefficientsa

Standardized

Unstandardized Coefficients Coefficients

Model B Std. Error Beta t Sig.

1 (Constant) 1.265 .463 2.733 .052

Distributions of households

.029 .171 .086 .172 .872

by monthly income

a. Dependent Variable: online shopping saves time and money as compare to traditional shopping

Chi-square

Chi-Square Tests

Asymp. Sig. (2-

Value df sided)

a

Pearson Chi-Square 21.881 20 .347

Likelihood Ratio 25.356 20 .188

Linear-by-Linear Association 4.091 1 .043

N of Valid Cases 50

a. 27 cells (90.0%) have expected count less than 5. The minimum

expected count is .06.

One sample:

One-Sample Test

Test Value = 0

95% Confidence Interval of the

Difference

t df Sig. (2-tailed) Mean Difference Lower Upper

Distributions of households by

13.232 49 .000 2.64000 2.2391 3.0409

Asset value

Micro finance loan can be

8.216 6 .000 2.14286 1.5047 2.7811

obtained within short duration

Reliability:

Reliability Statistics

Cronbach's

Alpha N of Items

.819 21

You might also like

- Robotics Book Unit 1 & 2Document33 pagesRobotics Book Unit 1 & 2arun193905No ratings yet

- PGP09168 At&tDocument11 pagesPGP09168 At&tReshma MajumderNo ratings yet

- Clearinghouse: Sally Soprano Part 1Document1 pageClearinghouse: Sally Soprano Part 1djaaaamNo ratings yet

- COMM 1715-Proofreading and Editing Assignment #1 - 5%Document3 pagesCOMM 1715-Proofreading and Editing Assignment #1 - 5%api-535571884100% (1)

- Analisis Hipotesis: 1. Variabel X, Kepuasan Karyawan Dengan MotivasiDocument3 pagesAnalisis Hipotesis: 1. Variabel X, Kepuasan Karyawan Dengan Motivasiandreas hendraNo ratings yet

- Analisis Hipotesis: 1. Variabel X, Kepuasan Karyawan Dengan MotivasiDocument3 pagesAnalisis Hipotesis: 1. Variabel X, Kepuasan Karyawan Dengan Motivasiandreas hendraNo ratings yet

- Symmetric Measures: Crosstab Biaya ProyekDocument8 pagesSymmetric Measures: Crosstab Biaya ProyekTRI DAMAYANTI -No ratings yet

- Uji AnnisaDocument2 pagesUji AnnisaMuhammad Bintang satrioNo ratings yet

- 49 .0000000 .46948270 .329 .296 - .329 1.041 .228 A. Test Distribution Is Normal. B. Calculated From DataDocument4 pages49 .0000000 .46948270 .329 .296 - .329 1.041 .228 A. Test Distribution Is Normal. B. Calculated From DataBayu PrasetyoNo ratings yet

- R Linear 0.961 R Quadratic 0.989 R2 Cubic 0.991Document7 pagesR Linear 0.961 R Quadratic 0.989 R2 Cubic 0.991Sasini PethumikaNo ratings yet

- Lampiran BaruDocument1 pageLampiran BaruAbdul MajidNo ratings yet

- Statistik Deskriptif: Descriptive StatisticsDocument4 pagesStatistik Deskriptif: Descriptive StatisticszhafiraNo ratings yet

- Model SummaryDocument5 pagesModel SummarySid Ra RajpootNo ratings yet

- Pertemuan 12 (Tugas 12)Document4 pagesPertemuan 12 (Tugas 12)OziNo ratings yet

- Nixon S. Gaviloria 9Document5 pagesNixon S. Gaviloria 9Ronel SingsonNo ratings yet

- Crosstabs: Crosstabs /tables V1 V2 by Y /format Avalue Tables /statistics Chisq Corr Risk /cells Count /count Round CellDocument4 pagesCrosstabs: Crosstabs /tables V1 V2 by Y /format Avalue Tables /statistics Chisq Corr Risk /cells Count /count Round CellPanjiNurprasetyaAdiNo ratings yet

- Coefficients: Dari Nilai Signfikansi Yang Tidak Ada Signifikan Berarti Tidak Ada HeterokesdatisDocument11 pagesCoefficients: Dari Nilai Signfikansi Yang Tidak Ada Signifikan Berarti Tidak Ada HeterokesdatisKemal Budi MNo ratings yet

- BIOSTATSDocument9 pagesBIOSTATSSharif KavumaNo ratings yet

- كاي تربيع امنهDocument26 pagesكاي تربيع امنهhasemNo ratings yet

- Output Data SpssDocument3 pagesOutput Data SpssLalla ClawNo ratings yet

- Yunike 202010050Document2 pagesYunike 202010050Honami IchinoseNo ratings yet

- Analisis Data FixDocument3 pagesAnalisis Data FixkartinijumaingNo ratings yet

- Uji Nonparametrik test KolmogorovDocument2 pagesUji Nonparametrik test KolmogorovaslanraitaNo ratings yet

- CrosstabsDocument3 pagesCrosstabsOdelie KerinciNo ratings yet

- IpoteDocument12 pagesIpoteMihaela IzmanNo ratings yet

- Lampiran Output Spss Regresi AnisaDocument2 pagesLampiran Output Spss Regresi Anisanindy KNo ratings yet

- Crosstabs: Case Processing SummaryDocument3 pagesCrosstabs: Case Processing SummaryYudi NinalNo ratings yet

- Tugas AccountingDocument3 pagesTugas AccountingFera YolandaNo ratings yet

- Lampiran 3: Regresi Persamaan 1Document7 pagesLampiran 3: Regresi Persamaan 1julisimarmataNo ratings yet

- Hasil SPSSDocument2 pagesHasil SPSSQinta Ni'mah AmaliaNo ratings yet

- LAMPIRANDocument3 pagesLAMPIRANSepri KencanaNo ratings yet

- Chi - Square Test Case Processing SummaryDocument5 pagesChi - Square Test Case Processing Summaryk eswariNo ratings yet

- Case Processing SummaryDocument1 pageCase Processing SummaryHilda 'ida' Apriyani SNo ratings yet

- Hasil Spss FixDocument15 pagesHasil Spss FixandarNo ratings yet

- Statistik UjiDocument5 pagesStatistik UjiSuka NovelNo ratings yet

- Explore: Case Processing SummaryDocument8 pagesExplore: Case Processing SummarymereetikaNo ratings yet

- Hasil Olahan DataDocument4 pagesHasil Olahan DataneeadiaNo ratings yet

- Lampiran Uji Validitas: Case Processing Summary Model SummaryDocument13 pagesLampiran Uji Validitas: Case Processing Summary Model SummaryMasdaNo ratings yet

- Praktikum Hipotesis KorelatifDocument4 pagesPraktikum Hipotesis KorelatifepiyakkNo ratings yet

- New File SpssDocument4 pagesNew File Spssmohammad111ameen45No ratings yet

- Hasil Analisis Penelitian TatiDocument4 pagesHasil Analisis Penelitian TatiBill Brenton Raynherzh MandalaNo ratings yet

- UJI HOMOGEN DAN UJI HIPOTESISDocument1 pageUJI HOMOGEN DAN UJI HIPOTESISnuasystaNo ratings yet

- Mann-Whitney Test: RanksDocument14 pagesMann-Whitney Test: RanksISMARIANTONo ratings yet

- Output Olah Data Dengan Mba DiahDocument7 pagesOutput Olah Data Dengan Mba DiahYora SakiNo ratings yet

- Crosstabs: Case Processing SummaryDocument4 pagesCrosstabs: Case Processing SummaryBerlau AndayuNo ratings yet

- Uji ValitditasDocument4 pagesUji ValitditasThomas Brilian DanikaNo ratings yet

- Tabel Hasil Olah Data LagiDocument4 pagesTabel Hasil Olah Data LagiAmelya YunusNo ratings yet

- Model Variables Entered Variables Removed Method 1Document3 pagesModel Variables Entered Variables Removed Method 1Fizah HafizahNo ratings yet

- Uji SpssDocument2 pagesUji SpssRizky HamdaniNo ratings yet

- HdhsgwhajDocument5 pagesHdhsgwhajwirda zuljannahNo ratings yet

- Dipa AnsDocument9 pagesDipa AnsDipanwita SamantaNo ratings yet

- CoefficientsaDocument2 pagesCoefficientsaNurcahyonoNo ratings yet

- Case Processing SummaryDocument2 pagesCase Processing SummaryMichelleAugustineNo ratings yet

- SULFIANIDocument3 pagesSULFIANIIka FitrianiNo ratings yet

- AppendicesDocument9 pagesAppendicesMuhammad Ikhwanudin AL-FarisNo ratings yet

- DIMTOTDocument3 pagesDIMTOTReifan 395No ratings yet

- Hasil Uji Statistik Uji Normalitas (Npar Tests)Document3 pagesHasil Uji Statistik Uji Normalitas (Npar Tests)zain arifNo ratings yet

- Nama: Deny Setyawan Nim: 1602010214 Matkul: Komputer Analisis Data / LDocument21 pagesNama: Deny Setyawan Nim: 1602010214 Matkul: Komputer Analisis Data / LhendriNo ratings yet

- BR Research Paper-pages-DeletedDocument31 pagesBR Research Paper-pages-DeletedArchit JindalNo ratings yet

- Tia Sopiah - CKR0190120 - Keperawatan CDocument4 pagesTia Sopiah - CKR0190120 - Keperawatan CTedi SetiawanNo ratings yet

- Chi Square ResultsDocument3 pagesChi Square ResultsvaibhavNo ratings yet

- Lampiran Hasil Statistik 1. Hubungan Pengetahuan Terhadap Angka Kejadian Demam BerdarahDocument5 pagesLampiran Hasil Statistik 1. Hubungan Pengetahuan Terhadap Angka Kejadian Demam Berdarahaan sofyanudinNo ratings yet

- Rural Innovation Project Ajai05Document9 pagesRural Innovation Project Ajai05Ajay PandianNo ratings yet

- ProjectDocument3 pagesProjectAjay PandianNo ratings yet

- Rural Innovation Project AjayDocument56 pagesRural Innovation Project AjayAjay PandianNo ratings yet

- Project Letter 24Document1 pageProject Letter 24Ajay PandianNo ratings yet

- Rip Front PagesDocument9 pagesRip Front PagesAjay PandianNo ratings yet

- ToolsDocument1 pageToolsAjay PandianNo ratings yet

- SpssDocument24 pagesSpssAjay PandianNo ratings yet

- ProjectDocument3 pagesProjectAjay PandianNo ratings yet

- Project 23mba339Document4 pagesProject 23mba339Ajay PandianNo ratings yet

- 23mba339 RIP ProjectDocument59 pages23mba339 RIP ProjectAjay PandianNo ratings yet

- 23mba336 - Rahulrip - 1 (1) (1) finalLLLLDocument67 pages23mba336 - Rahulrip - 1 (1) (1) finalLLLLAjay PandianNo ratings yet

- 23mba336 RipDocument48 pages23mba336 RipAjay PandianNo ratings yet

- A Review of Hand Gesture and Sign Language Recognition TechniquesDocument23 pagesA Review of Hand Gesture and Sign Language Recognition Techniquessabbirmusfique1No ratings yet

- Project 12 ReportDocument17 pagesProject 12 ReportPHƯỚC DƯƠNG THANHNo ratings yet

- Contoh Tes AceptDocument28 pagesContoh Tes AceptNisa Nisa100% (2)

- Working Module Diss 11Document31 pagesWorking Module Diss 11Elle Segovia SungaNo ratings yet

- Geodetic Scope of WorkDocument24 pagesGeodetic Scope of WorkKris Aileen CortezNo ratings yet

- Alma 26Document13 pagesAlma 26Yassef Helicoidal AntunezNo ratings yet

- Academic Writing 2023Document1 pageAcademic Writing 2023A. Imamul GazaliNo ratings yet

- Professionals and Practitioners in Social Work: Humss7Document9 pagesProfessionals and Practitioners in Social Work: Humss7Sha CalsesNo ratings yet

- BUSM3310 (HRM) - Summative AssessmentDocument7 pagesBUSM3310 (HRM) - Summative AssessmentKim NguyenNo ratings yet

- AEPS PYQsDocument36 pagesAEPS PYQsNishant LambatNo ratings yet

- Certificate in Library and Information Science (Clis) : Term End Examination, December, 2020Document24 pagesCertificate in Library and Information Science (Clis) : Term End Examination, December, 2020Poonam UJSNo ratings yet

- Analisis Faktor Penghambat Skripsi Mahasiswa Jurusan Pendidikan Guru Sekolah Dasar Universitas Wijaya Kusuma SurabayaDocument14 pagesAnalisis Faktor Penghambat Skripsi Mahasiswa Jurusan Pendidikan Guru Sekolah Dasar Universitas Wijaya Kusuma SurabayaNafa RihhaNo ratings yet

- Brazed Plate Heat Exchanger Serie-CSP-CSPIDocument29 pagesBrazed Plate Heat Exchanger Serie-CSP-CSPIСергей КолесниковNo ratings yet

- Rocborne: Introducing TheDocument11 pagesRocborne: Introducing TheGala Alonso Puente100% (2)

- A Day in The Life of A Water MoleculeDocument2 pagesA Day in The Life of A Water MoleculeDeborahNo ratings yet

- How Chemical Engineering Will Drive The 21st CenturyDocument71 pagesHow Chemical Engineering Will Drive The 21st CenturyAjeya Bandyopadhyay100% (1)

- Homework Problem Set #3: 1. Endrun Construction CompanyDocument2 pagesHomework Problem Set #3: 1. Endrun Construction CompanyAaryamanNo ratings yet

- Heerwagen Et Al 1995 Environmental Design Work and Well Being Managing Occupational Stress Through Changes in TheDocument11 pagesHeerwagen Et Al 1995 Environmental Design Work and Well Being Managing Occupational Stress Through Changes in TheMalini MallickNo ratings yet

- 2016-436 IA Guidance Part 1 061418 (081-159)Document79 pages2016-436 IA Guidance Part 1 061418 (081-159)JosephmsNo ratings yet

- Lecture Notes: Cell Biology (Biomedical Laboratory Science Students)Document82 pagesLecture Notes: Cell Biology (Biomedical Laboratory Science Students)Abdullahi MuhammadNo ratings yet

- SI0240Document12 pagesSI0240Kavi SaikrishnaNo ratings yet

- Differential Calculus: Differentiation. Geometrically, The Derivative at A Point Is TheDocument10 pagesDifferential Calculus: Differentiation. Geometrically, The Derivative at A Point Is TheNirmal BhowmickNo ratings yet

- агылшынDocument163 pagesагылшынthe boyz best boyzNo ratings yet

- 04 v4n2 00057Document13 pages04 v4n2 00057Mauricio Moyano CastilloNo ratings yet

- Be First Year Engineering Semester 1 2023 May Engineering Physics I Phy1rev 2019c SchemeDocument1 pageBe First Year Engineering Semester 1 2023 May Engineering Physics I Phy1rev 2019c SchemeKaushal S SuwarNo ratings yet

- Astm C 191Document7 pagesAstm C 191shankar parajuliNo ratings yet

- Nfpa List PDFDocument7 pagesNfpa List PDFJurnalNo ratings yet